|

Report from

North America

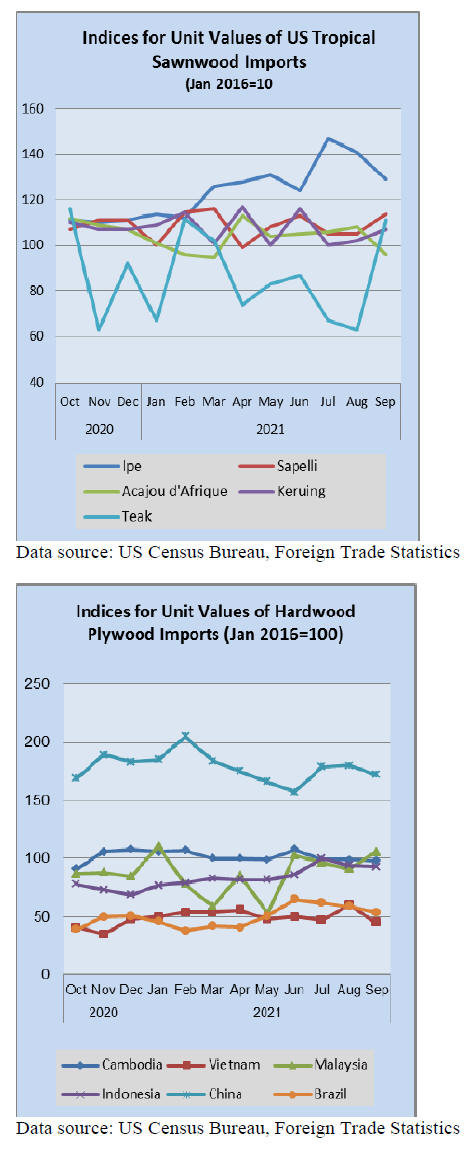

Tropical sawn hardwood imports rebound

US imports of sawn tropical hardwood rebounded in

October, rising 28% after two months of decline. Unlike

September¡¯s low numbers, the 8,198 cubic metres

imported in October is more in line with the volume we

have seen most months this year. Imports from nearly all

trading partners increased greatly in October.

Imports of Sapelli more than doubled in October and are

up 19% year to date through October while imports of

Keruing grew by 19% and are up 15% year to date.

Imports of Padauk were the highest since March and

Virola imports bounced back from a very weak

September.

Overall imports are officially down year to date by 36%,

however that is misleading since Ip¨¦ and Jatoba were

removed from the official category by the US Department

of Agriculture earlier this year. Counting Jatoba and Ip¨¦,

sawn tropical hardwood imports are up 21% so far this

year.

Hardwood plywood imports edge upward

Imports of hardwood plywood rose 3% in October. The

October import volume of 315,513 cubic metres is more

than 20% above that of October 2020. Imports from

Russia rose 41% from the previous month and are ahead

23% year to date.

Imports from Malaysia are also up 24% year to date

despite declining by 34% in October. Overall import

volume is ahead of last year by 32% through October.

Veneer imports recover

US imports of tropical hardwood veneer in October were

double that of the previous month as imports recovered

somewhat from an anemic September. Imports from China

bounced back from no recorded imports in September to a

level more than 50% higher than the previous October.

Imports from Italy also recovered strongly but were still

only about half that of October 2020. Imports from

Cameroon rose 203% but still lag year to date by 20%.

Overall imports are down 2% year to date.

Hardwood flooring imports remain strong despite

slowing

US imports of hardwood flooring retreated for the second

straight month. Yet, despite a 7% month-to-month decline,

imports remained 25% higher than that of the previous

October. Strong increases in imports from Indonesia and

Malaysia mostly made up for steep declines in imports

from Vietnam, China, and Brazil. Overall imports remain

well ahead of last year, up 38% year to date.

Imports of assembled flooring panels held steady in

October, rising by less than 1%. Imports from China rose

by 61% in October and are up 25% year to date. Imports

from Indonesia and Vietnam fell 25% and 11%,

respectively.

Imports from both countries remain up more than 50% for

the year to date. However, all year-to-date numbers should

be viewed as inflated in 2021 as the USDA added two

additional categories to the Assembled Flooring Panels

category in May.

Moulding imports rise to new high

Imports of hardwood mouldings rose 4% in October,

setting a record for 2021. Imports from Brazil rose 34%

and were more than 25% better than the previous October.

After lagging most of the year, imports from Brazil are

now up 2% over 2020 year to date.

Imports from China also rose, gaining 5% over last month

to nearly twice that of last October. However, imports

from China still trail 2020 by 45% year to date. Overall

U.S imports of hardwood mouldings are up 25% year to

date through October.

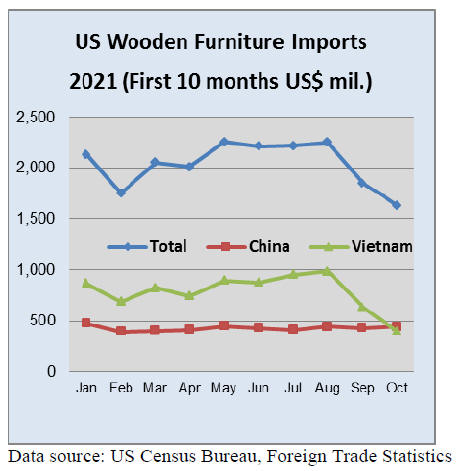

Wooden furniture imports ¨C October slowest month in

more than a year

US imports of wooden furniture tumbled again in October,

falling 11% to a level not seen since July 2020. October

imports were US$1.65 billion, well below totals that had

routinely topped US$2 billion each month for most of the

past year. Most of the recent decline has been due to

falling imports from Vietnam, which dropped 38% in

October after a similar rate of decline in September.

Despite the drop off, imports from Vietnam remain up

45% year to date due to the string of record months earlier

in the year. Overall wooden furniture imports are up 38%

year to date through October.

These numbers reflect the overall US furniture market.

New orders for residential furniture dropped 20% in

September 2021 versus September 2020, according to

Smith Leonard in its latest Furniture Insights survey.

¡°At first glance, the September 2021 results would be

alarming, but one has to look beyond the first glance,¡± said

the Smith Leonard report.

¡°New orders in September 2021 were down 20% from

September 2020, but the look beyond showed that

September 2020 orders were up 43%. So, we looked to

compare 2021 with 2019 and found that September 2021

orders were up 15% over 2019.¡± Orders were up 21% over

2020 and up 32% over the first nine months of 2019.

See:

https://www.furnituretoday.com/financial/furniture-ordersdrop-20-in-september/

Cabinet sales remain flat in October

US cabinet manufacturers reported an overall sales gain of

less than 1% in October, according to the Kitchen Cabinet

Manufacturers Association¡¯s (KCMA) monthly Trend of

Business Survey. Participating manufacturers reported

semi-custom sales rose 5.0% while stock sales went up

1.1%. Custom sales dropped 11.9%.

Compared with the previous October, overall cabinet sales

increased by 6.7%. Custom sales rose 10.4%, but semicustom

sales dipped by 0.6%. Stock sales were up 11.2%.

Sales so far this year remain healthy with overall cabinet

sales up 14.7%, custom sales up 20.1%, semi-custom sales

up 11.5%, and stock sales up 16.0%.

See:

https://www.kcma.org/news/pressreleases/October_2021_trend_of_busines_press_release

Weaker than expected jobs increase masks other good

labour news

The US economy created far fewer jobs than expected in

November, in a sign that hiring started to slow even ahead

of the new Covid threat, the Labor Department reported.

Non-farm payrolls increased by just 210,000 for the

month, yet the unemployment rate fell sharply to 4.2%

from 4.6%, even though the labor force participation rate

increased for the month to 61.8%, its highest level since

March 2020.

While the headline number was disappointing, the

household survey painted a brighter picture, with an

addition of 1.1 million jobs as the labor force increased by

594,000.

The manufacturing sector added 31,000 jobs in November.

Other sectors showing the biggest gains in November

included professional and business services (90,000),

transportation and warehousing (50,000) and construction

(31,000). Meanwhile, hiring in leisure and hospitality was

sluggish and retail lost jobs despite the traditional holiday

hiring season.

See:

https://www.bls.gov/news.release/empsit.nr0.htm

US doubles tariffs on Canadian softwood lumber

The US Commerce Department has followed through with

expected increases in anti-dumping and countervailing

duties on Canadian softwood lumber producers, placing

tariffs of 17.99% on their imports, more than twice the rate

of 8.99% during the Trump administration.

"These unjustified duties harm Canadian communities,

businesses, and workers," said Mary Ng, Canada's

Minister of International Trade, in a sharply worded

statement.

However, US lumber producers welcomed the stiffer

penalties on what they have alleged for more than a

decade was unfair competition due to government

subsidies by Canada to its mills and producers.

This conflict goes back decades and involves stumpage

fees and clean energy subsidies that the Canadian

government provides companies such as governmentoperated

electricity utilities which pass the savings along

to mills in their territories. American producers insist that

such subsidies create an unfair market advantage for their

northern neighbours.

See:

https://twitter.com/mary_ng/status/1464315252980469762

|