|

Report from

Europe

Rebound in UK imports of tropical wood and wooden

furniture

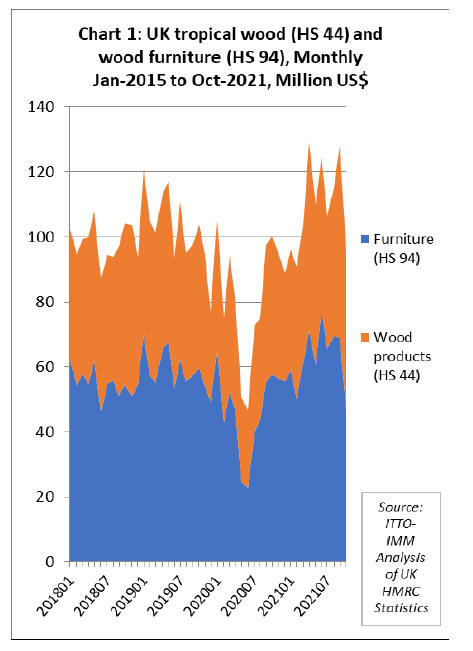

The UK imported tropical wood and wooden furniture

products with a total value of USD1.1 billion in the first

ten months of 2021, a 38% increase compared to the same

period in 2021. Import value to end October this year was

also 4% more than the same period in 2019 before onset of

the COVID pandemic.

Following the sharp increase in April this year, when

import value was at the highest monthly level since before

the financial crises of 2008-2009, imports declined only

slightly from this peak between May and October (Chart

1).

This year the UK has experienced a very robust rise in

construction sector activity and in timber trade and

consumption.

There has been a welcome rebound from the lows of last

year in the value of wood product imports from tropical

countries into the UK, and importers are benefiting from

strong sales, high prices and larger margins. The main

constraints to increased imports this year have been on the

supply side.

The latest UK Construction Products Association (CPA)

Trade Survey shows construction continued to expand

during the third quarter of this year, with private housing

and repairs, maintenance and improvement leading the

industry. Much of the activity in these sectors has been

sustained by government housing policies, an increase in

the disposable income across households in the UK, and a

homeworking trend that has been driving demand for

greater or improved outdoor and office space.

According to the Building Merchants Building Index

(BMBI), UK sales of timber were at their highest ever

level and performing better than all other building material

categories in the third quarter of 2021. Sales were 5%

higher than the previous quarter, 44% up on the same

quarter the previous year and 49% higher than the same

quarter in 2019. According to the UK Timber Trade

Federation, longer term prospects for timber demand in the

UK are good, but short term logistical issues are putting

severe strain on supply.

While UK construction activity remained robust in the

third quarter, the latest UK Office of National Statistics

data indicates that activity declined by 1.8% in October

compared to September, the sharpest fall since the initial

COVID lockdown in March 2020.

The main reason for the downturn was shortages in the

supply and sharp increases in prices of key construction

materials, including timber, due to a combination of

ongoing COVID restrictions, Brexit delays and shipping

hold-ups. The volatile price and supply environment was

hindering new business as construction companies revised

cost projections and some clients delayed decisions on

contract awards.

However, the latest IHS Markit/CIPS UK Construction

Purchase Managers Index (PMI) for November suggests

that the downturn in October was short-lived. At 55.5 in

November, up from 54.6 in October, the PMI signalled a

robust and accelerated expansion of overall construction

activity in the UK during the month (any number over 50

indicates growth).

According to Tim Moore, director at IHS Markit,

"November data highlighted a welcome combination of

faster output growth and softer price inflation across the

UK construction sector. Commercial building led the way

as recovering economic conditions ushered in new

projects, which helped compensate for the recent

slowdown in house building". Tim Moore also noted that

"input price inflation remains extremely strong by any

measure, but it has started to trend downwards after hitting

multi-decade peaks this summer.

The latest rise in purchasing costs was the slowest since

April, helped by a gradual turnaround in supply chain

disruption and a slight slowdown in input buying. Port

congestion and severe shortages of haulage capacity were

again the most commonly cited reasons for longer lead

times for construction products and materials."

Recovery in UK furniture imports from tropical

countries

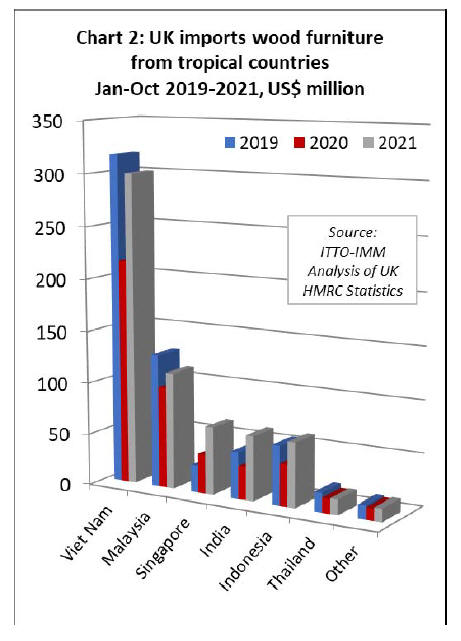

The UK imported USD630 million of tropical wooden

furniture in the first ten months of this year, 40% more

than the same period in 2020, but just 4% more than the

same period in 2019. After a slow first quarter this year,

when lockdowns once again disrupted trade, imports

strengthened considerably in the second quarter to reach

monthly highs not seen for over a decade. The pace of

imports slowed only a little in the third quarter.

Overall during the first ten months of 2021 compared to

the same period last year, UK wooden furniture imports

were up from all the leading tropical supply countries to

this market; Vietnam (+39% to USD300 million),

Malaysia (+15% to USD112 million), Singapore (+75% to

USD65 million), India (+94% to USD62 million),

Indonesia (+53% to USD62 million) and Thailand (+4% to

USD15 million).

While gains were made across the board when compared

to the depressed levels of 2020, wooden furniture import

value in the first ten months of 2021 was still trailing the

pre-pandemic 2019 level from Vietnam (-5%), Malaysia (-

12%), and Thailand (-20%).

In contrast, imports were significantly higher than in 2019

from India (+40%), Indonesia (+9%), and Singapore

(+148%).

Singapore has become more important as a supply hub due

to logistical problems elsewhere during the pandemic

(Chart 2 above).

UK tropical joinery imports exceed pre-pandemic level

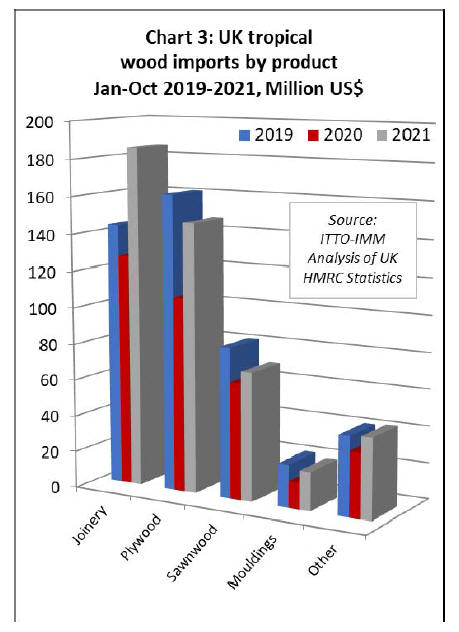

UK import value of all tropical wood products in Chapter

44 of the Harmonised System (HS) of product codes was

USD469 million in the first ten months of 2021, 35% more

than the same period last year and 3% up on the same

period in 2019.

Comparing UK import value in the first ten months of

2021 with the same period in 2020, tropical joinery was up

46% at USD186 million, tropical plywood was up 38% at

USD147 million, tropical sawnwood was up 10% at

USD70 million, and tropical mouldings/decking was up

47% at USD21 million.

While import value of tropical joinery in the first ten

months of this year was also up 29% on the pre-pandemic

level in 2019, UK import value of all other HS 44 tropical

wood products was significantly behind the 2019 level,

including plywood (-9%), sawnwood (-15%), and

mouldings/decking (-9%) (Chart 3).

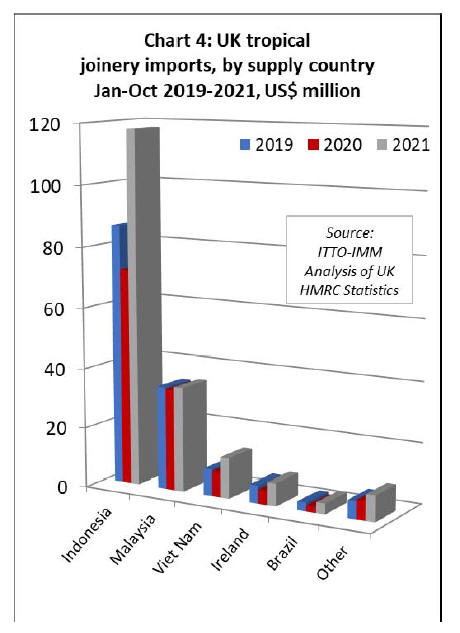

After the sharp dip in UK imports of tropical joinery

products during the first lockdown period in Q2 2020,

imports gradually built momentum until March this year

and then surged in the second quarter.

Imports from Indonesia (mainly wooden doors) continued

to rise in the third quarter but imports from Malaysia and

Vietnam (mainly laminated products for kitchen and

window applications) slowed during this period.

Joinery product imports from Indonesia were USD118

million in the first ten months of 2021, 64% more than the

same period last year and 37% up on the same period in

2019. Imports from Malaysia were USD35 million

between January and October this year, 3% more than the

same period in 2020 and 2% up on the same period in

2019.

Joinery product imports of USD13 million from Vietnam

were 62% more than in the same period in 2020 and 60%

more than the same period in 2019 (Chart 4).

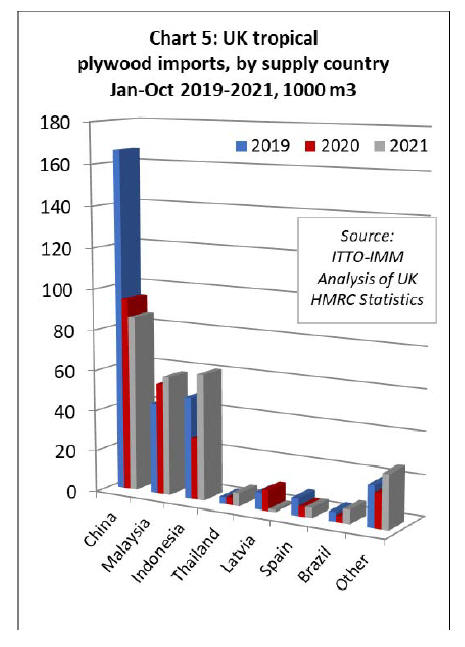

UK tropical plywood imports still at low levels

In contrast to joinery products, UK imports of tropical

hardwood plywood have remained at relatively low levels

this year. In the first ten months of 2021, the UK imported

250,900 cu.m of tropical hardwood plywood, which is

16% more than the same period in 2020 but still down

18% compared to the same period in 2019.

Imports from the UK¡¯s three largest suppliers of tropical

hardwood plywood ¨C China, Indonesia and Malaysia ¨C

have followed very different trajectories this year (Chart

5). The UK imported 85,800 cu.m of tropical hardwood

faced plywood from China in the first ten months of this

year, down 9% compared to the same period in 2020 and

48% less than the same period in 2019.

In contrast, Malaysian plywood has made gains in the UK

market this year, imports of 58,000 cu.m in the first ten

months being 7% more than the same period in 2020 and

31% up on the same period in 2020. But these gains are

being made against historically very low levels after a long

period of decline in UK imports of Malaysia plywood in

the years before 2019.

This year, UK imports of plywood from Indonesia have

also rebounded from the lows of 2020 this year, a trend

which gained momentum in the third quarter. Plywood

imports of 61,300 cu.m from Indonesia in the first ten

months of this year are 106% more than the same period in

2020 and 24% more than the same period in 2019.

As for other hardwood product groups, UK demand for

tropical hardwood plywood has been strong this year,

driven by high levels of construction activity and

shortages of competing materials. The main market

challenges have been on the supply side, notably the

considerable escalation in freight rates on Asian routes to

the UK.

A 40ft container from Malaysia or Indonesia as late as last

autumn cost US$1500-2000. By Q2 2021 UK importers

were being quoted over US$15,000 and rates have

remained at these record high levels in the second half of

the year.

This has encouraged a partial switch to breakbulk

shipments out of Southeast Asia into the UK, although this

has proved a challenging option. When the breakbulk

vessel Konya arrived into the port of London from

Malaysia in summer this year, the first such arrival for 30

years, it took weeks to discharge the cargo, partly as the

port was so busy and partly because personnel weren¡¯t

used to the work.

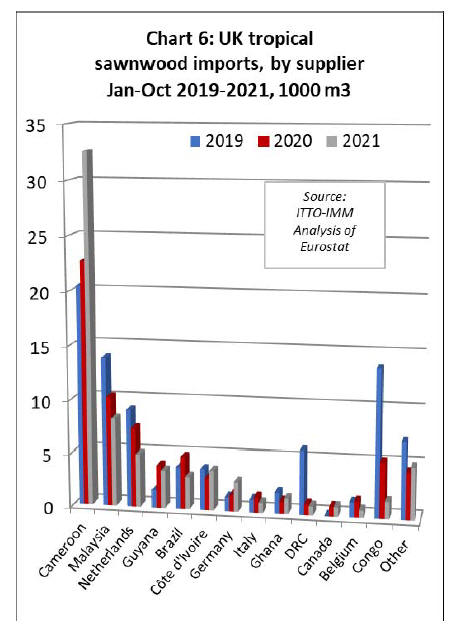

Supply issues constrain UK imports of tropical

sawnwood

After falling sharply in May and June last year, UK

imports of tropical sawnwood slowly increased during the

course of the next 12 months, but the pace of increase

began to slow again in the third quarter of 2021.

Throughout this period, the rebound in UK tropical

sawnwood imports has been impaired by significant

logistical problems on the supply side.

UK imports were 70,100 cu.m in the first ten months of

2021, just 1% more than the same period in 2020 and 18%

less than the same period in 2019. Although imports from

Cameroon, now by far the leading supplier of tropical

sawnwood to the UK, were up 44% on 2021 and up 60%

on 2019 during the ten month period, imports from nearly

all other leading tropical sawnwood supply countries have

remained weak this year (Chart 6).

The large increase in imports of sawnwood from

Cameroon this year reflects the long lead time in shipment

of contracts placed back in 2020. UK importers report that

securing supplies for hardwoods from Cameroon and other

African supply countries has continued to be very

challenging.

While iroko is currently reported by UK importers to be

more readily available, utile is described as ¡®very scarce¡¯.

There are differing views on sapele supply, with some

importers reporting they have secured sufficient volume

while others have been unable to do so.

UK imports of tropical sawnwood from Côte d'Ivoire were

3,700 cu.m in the first ten months of this year, 22% more

than the same period in 2020 but still down 4% on the

same period in 2019. The UK was previously a significant

buyer of framire from Côte d'Ivoire but UK importers

report that this species is proving increasingly difficult to

source, both due to a lack of raw material in the forest and

the challenges of obtaining assurances of legality that

satisfy UK Timber Regulation requirements.

Meanwhile, UK imports of tropical sawnwood from both

the Republic of Congo and DRC have fallen to a trickle

since the start of the pandemic. Imports from the Republic

of Congo were just 1,614 cu.m in the first ten months of

the year, down 69% and 88% compared to the same period

in 2020 and 2019 respectively. Imports from DRC were

836 cu.m during the 10 month period, which is 17% less

than in 2020 and 86% down compared to 2019.

After an extremely slow start to the year brought on by

pandemic induced production problems and extreme

shortages of containers, UK imports of tropical sawnwood

from Malaysia picked up a little during the summer with

the arrival of breakbulk shipments of Asian meranti and

keruing lumber into the UK. UK imports of Malaysian

sawnwood were 8,235 cu.m in the first ten months of

2021. That is still 19% less than the same period last year

and 41% down on the same period in 2019.

With shortages in supply from other sources, UK

importers were turning more to South America in the

opening months of this year. Imports from Brazil were

quite good in the first quarter but ground to a halt in the

second and third quarters.

By the end of the first ten months, total UK imports of

tropical sawnwood from Brazil were just 3,000 cu.m, 38%

less than the same period last year and 22% down

compared to 2020. Imports from Guyana have been

slightly more robust, at 3,500 cu.m in the first ten months

this year, 12% less than the same period in 2020 but

double the volume imported in the same period in 2019.

Indirect UK imports of tropical sawnwood from other EU

countries have fallen dramatically this year. Total UK

imports from EU countries were 11,400 cu.m in the first

ten months of 2021, 16% less than the same period last

year and 35% down on the same period in 2019.

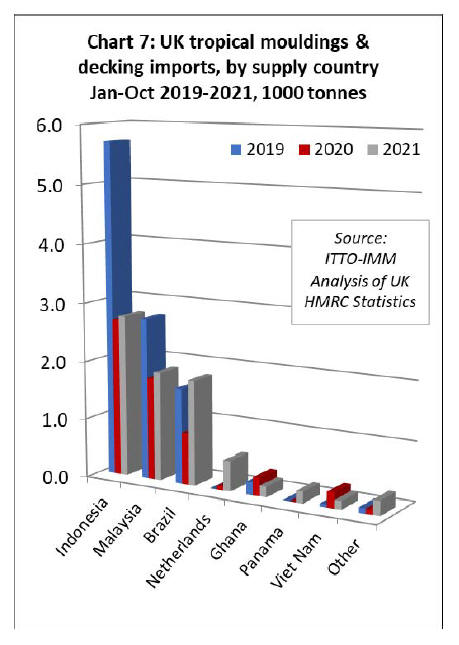

The UK imported 7,700 tonnes of tropical hardwood

mouldings/decking in the first ten months of 2021, 28%

more than the same period in 2020 but still 26% less than

the same period in 2019. The arrival of the first breakbulk

shipments into the UK this year boosted imports a little

from Indonesia, which at 2,800 tonnes in the first ten

months were 3% more than the same period in 2020, but

still down 52% compared to 2019.

Similarly, imports from Malaysia, at 1,900 tonnes, were

7% more than the same period in 2020 but 33% less than

in 2019. Imports of decking products from Brazil have

also picked up a little, at 1,800 tonnes in the first ten

months, around twice the quantity imported during the

same period last year and 11% more than in 2019 (Chart

7).

The UK market is currently suffering from severe lack of

availability of tropical hardwood decking, due both to the

freight hikes and also to suppliers preferring to sell the

limited stocks they have available to other markets. This

has encouraged some UK importers to purchase more

tropical decking from importers in the Netherlands. The

UK imported 520 tonnes of tropical hardwood decking

from the Netherlands in the first ten months of this year

when previously very little was sourced from there.

|