4.

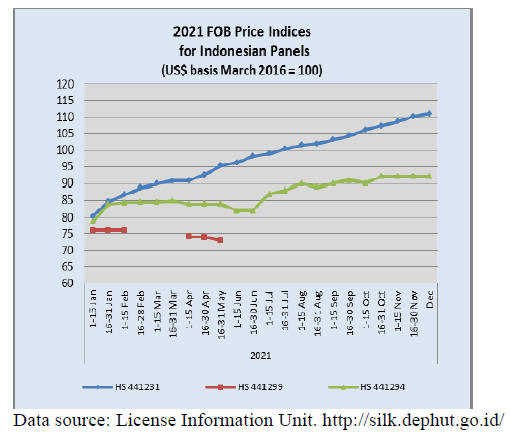

INDONESIA

Association convinced new EU

deforestation free trade

proposal will not disrupt exports

According to the Chairman of the Association of

Indonesian Forest Concession Holders (APHI), Indroyono

Soesilo, exporters of wood products believe the new draft

proposal from the European Union aimed at reducing

deforestation will not hamper Indonesia's exports.

He said Indonesian products meet the legality criteria

determined by the EU and that the products exported to

the European Union come from legal timber and are not

the product of deforestation.

The Association reports forest and wood product exports

to the EU reached US$1.24 billion as of October 2021

exceeding both 2020 and 2019 levels.

It is Indroyono understanding that the EU draft proposal

states that companies must provide geographic coordinates

showing the origin of the raw material processed for

export to the EU market.

The EU draft proposal would prohibit agricultural

commodities and their derivatives from entering the EU

market if they are produced from raw material from

deforested or degraded land.

See:

https://ekonomi.bisnis.com/read/20211126/12/1470520/eksportir-produk-kayu-yakin-kebijakan-baru-uni-eropa-tidakmengganggu.

In related news, APHI Executive Director, Purwadi

Soeprihanto, said the deforestation rate was reduced to

only 115,000 hectares last year which is very encouraging

and the Association supports a permanent moratorium on

the issuance of permits for harvesting in peatlands and

primary forests.

See:

https://www.tribunnews.com/bisnis/2021/11/30/aphideforestasi-sudah-turun-signifikan.

Prospects in the furniture and craft industries

The Indonesian Furniture and Craft Industry Association

(HIMKI) Secretary General, Heru Prasetyo, expressed

optimism on prospects for the furniture and handicraft

industry even in the face of the COVID-19 pandemic.

Between January and November 2021 production by the

furniture and craft industries expanded over 30% year on

year.

The HIMKI supports small scale furniture and crafts

enterprises through training and developing marketing

especially through participation at trade shows and

exhibitions.

See:

https://www.msn.com/id-id/ekonomi/bisnis/industri-mebel-dankerajinan-tumbuh-32-persen-himki-prospek-yang-cerah/ar-AARibvv?ocid=BingNewsSearch

Silvicultural technique accelerates merbau growth

The Ministry of Environment and Forestry (KLHK) has

released details of a silvicultural technique to accelerate

the growth of merbau. The Director General of Sustainable

Forest Management, Agus Justianto, said this innovation

was developed collaboratively to achieve sustainable

forest resource management.

He further stated that the launching of the merbau

initiative will result in an increase in the productivity of

the natural forest and sustainable management of forest

resources, especially in Papua and West Papua Provinces.

The domestic press reports that Indroyono said "Through

intensive silviculture the target for natural forest wood

productivity of 120 cubic metres per hectare with a 20-

year cycle for meranti and a 30-year cycle for merbau can

be realised.”

See:

https://infopublik.id/kategori/nasional-sosialbudaya/585601/klhk-rilis-inovasi-teknik-silin-percepatpertumbuhan-kayu-merbau

New Business approach in the forestry sector

At the 2021 National Conference of Association of

Indonesian Forest Concession Holders the Minister of

Environment and Forestry, Siti Nurbaya, expressed her

gratitude for the support of APHI members in accelerating

the reorientation of businesses in the forestry sector.

She said that the government still needs support so that

businesses can contribute to forestry development,

especially in relation to Law No. 11/2020 concerning Job

Creation.

In response the Chairman of APHI, Indroyono Soesilo,

stated that APHI members will continue to support the

government programmes and will encourage dialogue on

how best to configure a new competitive and sustainable

forestry business system to meet the requirements of the

Job Creation Law.

He said that one of the ways to reorient forestry business

was to harness forest ecosystem services, a concept

developed by the government.

See:

https://investor.id/national/273730/menteri-lhk-aphi-dorongaktualisasi-ekosistem-bisnis-baru-sektor-kehutanan

and

https://www.dimensinews.co.id/180091/menteri-lhk-aphipendorong-aktualisasi-ekosistem-bisnis-baru-sektorkehutanan.html

5.

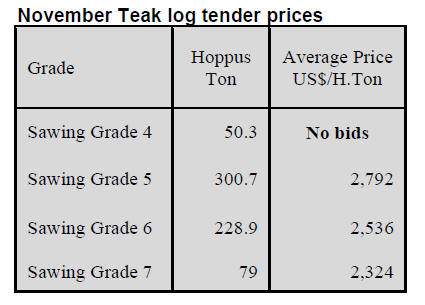

MYANMAR

Fading prospects for the timber

industry

2021 will be remembered as the year of the fading

prospect for timber industry. In contrast to other extractive

industry the entire process starting from the purchase of

logs to the delivery of products to the port is regulated and

controlled by the respective departments of the

government. Even the container has to be sealed by Forest

Department officers before leaving the factory otherwise

the container will not be allowed into the port for

shipment.

Timber exporters have been complaining against

restrictive practices but the regulators say that a relaxation

of current practices is not feasible under the current

circumstances.

In addition to the tight control of export procedures inside

the country there are also other challenges in importing

countries such as the measures adopted by the EU and the

USA against Myanma Timber Enterprise and the market

concerns on the verification of timber legality.In addition

to the various regulations the Covid control measures are

also disrupting production.

A few mills decided to close temporarily and few ceased

operations and sold-up. In most cases manufacturers had

to switch production for the local market. The export of

veneer and flooring to India, China and some

ASEAN countries is expected to continue but the export of

teak products to EU and USA will decline sharply in the

coming years.

The current administration has ordered a halt to the

export of the sawnwood as of 1 January 2023 which is

another challenge and millers and manufacturers feel that

it is the time to stop or start a new business line.

State Administration Council co-leader - the economy

is suffering

According to the online Irrawaddy News, Senior-General

Min Aung Hlaing admitted Myanmar’s economy was

suffering from the impact of Covid and the post-coup

political upheaval which has forced foreign firms to leave

and a boycott by the people of enterprises linked to the

military.

Myanmar's foreign trade deficit reached nearly US$57

million by mid-November in mini budget period of 2021-

2022 FY, according to the Ministry of Commerce.

See:https://www.irrawaddy.com/news/burma/junta-watch-coupleaders-confession-bogus-show-of-leniency-and-more.html

Statements by the UN interfere internal affairs says

Ministry

Myanmar’s Ministry of Foreign Affairs (MOFA) has been

reported as saying statements by the UN are interfering

with the judiciary and internal affairs. The statement said

everyone is equal before the court and no one is above the

law. It said unilateral criticism of the decisions of a

sovereign state's domestic jurisdiction is inappropriate and

interferes with the judiciary and internal affairs of

Myanmar.

See:

https://elevenmyanmar.com/news/statements-issued-by-theun-officials-interfere-with-judiciary-and-internal-affairs-mofa

Declaration by the High Representative Josep Borrell

on behalf of the European Union on the situation

The European Union strongly condemns this politically

motivated verdict, which constitutes another major setback

for democracy in Myanmar since the military coup on 1

February 2021.

These proceedings are a clear attempt to exclude

democratically elected leaders, including Aung San Suu

Kyi and the National League for Democracy, from the

inclusive dialogue process called for by ASEAN’s Five

Point Consensus. The European Union reiterates its full

support to the ongoing efforts by ASEAN and the ASEAN

Chair’s Special Envoy, in close cooperation with the

Special Envoy of the UN Secretary-General.

The military’s actions show complete contempt for the

will of the people, expressed clearly in the November

2020 elections.

Since 1 February, the people of Myanmar have

overwhelmingly rejected the military coup and

demonstrated their unwavering desire for a nation in

which the rule of law, human rights and democratic

processes are respected, protected and upheld.

The failure so far to restore democracy, compounded by

the COVID-19 pandemic and widespread violence and

conflict, is driving the country towards a large-scale

humanitarian crisis. It is imperative that the Myanmar

military authorities allow a swift return of Myanmar to the

path of democracy.

The European Union reiterates its urgent calls for the

immediate and unconditional release of all political

prisoners as well as all those arbitrarily detained since the

coup.

See:

https://www.consilium.europa.eu/en/press/pressreleases/2021/12/06/myanmar-burma-declaration-by-the-highrepresentative-josep-borrell-on-behalf-of-the-european-union-onthe-situation/

6. INDIA

Economy shows signs

of recovery

Data from the National Statistical Office indicates the

Indian economy grew 8.4% year on year in the third

quarter of this year but this was from a very low base in

2020. The good performance was supported by increased

vaccination and a rise in agricultural output, public

spending and a revival of the services sector.

As the number of people vaccinated rises and as the

impact of the fuel duty cuts introduced by the government

take effect confidence is expected to rise spurring demand

howeve,r there is concern that once the effect start being

seen, rising higher prices and uncertainty due the new

Covid variant Omicron could slow the pace of recovery.

See:

https://indianexpress.com/article/business/economy/indiagdp-q2-results-covid-economy-7648981/

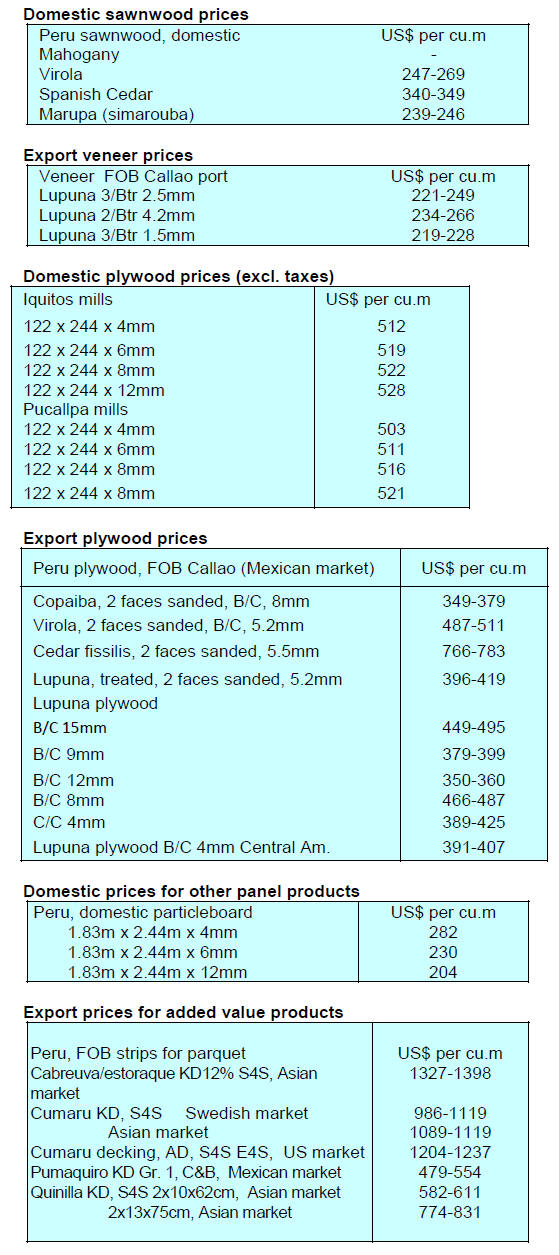

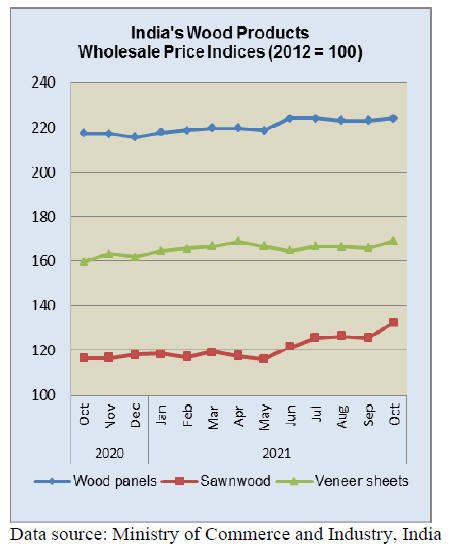

Prices for manufactured products, including wood

products rising

The Ministry of Commerce and Industry has reported the

official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for September 2021 increased to

133.8 from 133.0 in August.

The annual rate of inflation was 12.5l) for October, 2021as

compared to 1.31% in October, 2020. The high rate of

inflation in October 2021 is primarily due to rise in prices

of mineral oils, basic metals, food products, crude

petroleum and natural gas, chemicals and chemical

products.

For manufactured products 18 groups saw price increases,

3 groups saw decreases and for one group the price

remained unchanged in October 2021 compared to

September 2021.

The increase in prices is mainly contributed by

manufacture of basic metals; chemicals and chemical

products; electrical equipment; rubber and plastics

products, textiles and wood products.

India's furniture market set to surge

According to data provided by a Bengaluru market

research firm ResSeer, pent-up and deferred demand is

forecast to drive furniture sales to new highs over the next

5 years. The report says online furniture sales will triple

and there will be an almost doubling of annual spending

on furniture.

See:

https://www.business-standard.com/article/companies/indias-furniture-home-market-to-reach-40bn-by-2026-report-121110800300_1.html

Manufacturing at 10-month high

India’s manufacturing activity grew at its fastest pace in

10 months in November as companies expanded the

sourcing of production inputs encouraged by strengthening

demand. Data released by the IHS Markit showed

Purchasing Managers’ Index (PMI) rose to 57.6 in

November from 55.9 in October. A reading above 50

indicates expansion in economic activity and a number

below that signals contraction.

Covid school closures hurts India’s ‘pencil village’

One small area in Kashmir supplies almost 90% of the

wood that is used to manufacture pencils but, because of

school closures and lockdowns demand has collapsed.

Most of the pencils in India are made from poplar timber

and in addition to supplying local demand there is a

thriving export business delivering pencils to more than

150 countries.

Due to the drop in demand and covid control measures the

owners of pencil factories reduced their workforce by

more than half. The timber suppliers and the factory

workers have to wait for demand to pick up.

See:

https://thepolicytimes.com/the-cost-of-covid-schoolclosures-effect-on-indias-pencil-village/

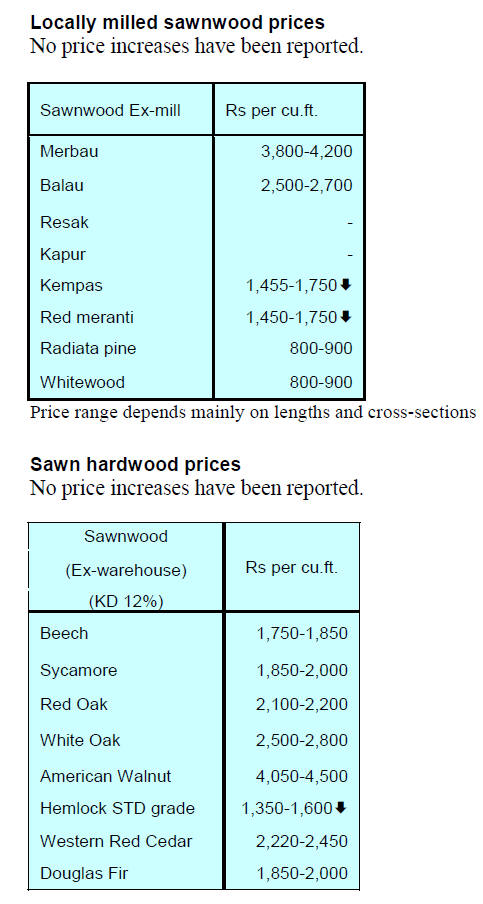

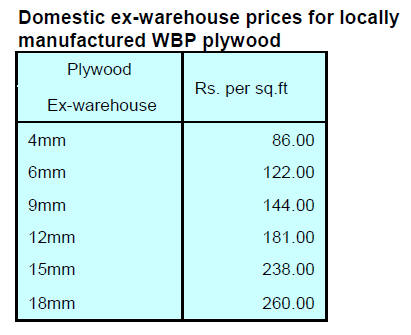

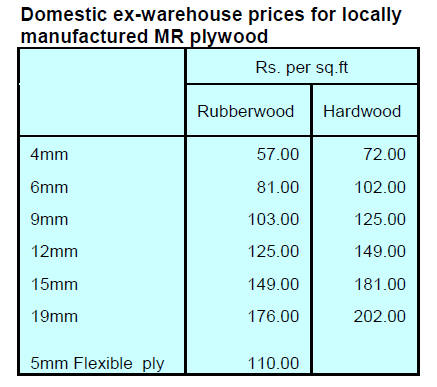

Plywood

The gradual easing of Covid restrictions and a boost to the

pace of vaccinations are helping plywood manufacturers

recover from the effects of the pandemic control measures

on the supply chain and they are anticipating resuming full

production.

After a year of financial hardship the plywood industry is

showing signs of recovery as real estate sales increase.

See:

https://timesofindia.indiatimes.com/city/kolkata/powerply/articleshow/87955005.cms

7.

VIETNAM

Trade highlights

In November 2021, Vietnam's wood and wood product

(W&WP) exports to the EU reached US$45 million, up

2.3% compared to November 2020. In the 11 months of

2021, W&WP exports to the EU market were estimated at

US$528.1 million, an increase of 16% over the same

period in 2020.

Exports of kitchen furniture in November 2021 are

estimated at US$82 million raising the total export of this

item in 11 months of 2021 to US$832.8 million, up 24%

over the same period in 2020.

Vietnam's export of rattan, bamboo and other types of

NTFPs in November 2021 reached US$70 million, up

2.5% compared to October 2021 and up 23% compared to

November 2020.

Over the 11 months of 2021 Vietnam's exports of NTFPs

of all kinds is estimated at US$771 million, an increase of

42% over the same period in 2020.

Wood enterprises speed up production to meet year-end

orders

According to the Ministry of Industry and Trade Export and

Import Department wood and wood product exports in

November reached US$1.15 billion, up 21% compared to

October 2021 but down 7% compared to November 2020.

Exports of wood products reached US$840 million, up 35%

compared to October 2021 but down 17% compared to

November 2020.

Production in Vietnam has returned to normal and

businesses operating in the wood industry are accelerating

production to keep up with signed export orders for the last

month of the year and the first half of 2022.

Export activity by the timber industry increased in October

and November 2021 although the export value is still not

equal to the same period in 2020.

Overall, the timber industry maintained good growth in the

first 11 months of 2021 thanks to the efforts of enterprises

to maintain production when the epidemic broke out in

many provinces and cities across the country. Production

recovered quickly after the easing of social distancing.

At the current growth rate it is estimated that exports of

wood and wood products will reach US$14.3 billion in

2021, up 14% compared to 2020 and completing 98.7% of

the target set for the year.

The driver of growth for the timber industry has been

wooden furniture production. Exports of wooden furniture

accounted for 68% of the total export value of wood and

wood products in the first 11 months of 2021.

See:

https://en.nhandan.vn/business/item/10873602-woodenterprises-speed-up-production-to-meet-year-end-orders.html

Rising imports of oak from EU

Vietnam's imports of oak from the EU increased in the

first 10 months of 2021 reaching 80,800 cu.m, worth

US$41.8 million, up 54% in volume and 66% in value

over the same period in 2020 and accounted for 30% of

total oak imports imported into Vietnam.

Oak a major import species

Vietnam's imports of oak in November 2021 are estimated

at 24,400 cu.m worth US$15.4 million, up 10% in volume

and 10% in value compared to October 2021. Compared to

November 2020 imports dropped 19% in volume and 7%

in value. In general, over 11 months of 2021 oak wood

imports totalled at 292,200 cu.m, worth US$164.8 million,

up 12% in volume and 33% in value over the same period

in 2020.

Price of imported oak

The price of imported of oak logs in the 10 months of

2021 averaged at US$557.5 per cu.m, an increase by 19%

over the same period in 2020.

In particular, the average price of oak logs imported from

the US increased by 24% over the same period in 2020.

The price of oak logs imports from the EU increased by

8%, reaching US$516.8 per cu.m, from Ukraine the price

increased by 18% to US$581.40 per cu.m.

Volume and price of imported sawn oak

According to statistics of the General Department of

Customs in the 10 months of 2021 imports of sawn oak

reached 182,300 cu.m, worth US$111.5, up 9% in volume

and 37% in value over the same period in 2020 with the

average price of US$611 per cu.m.

Vietnam to plant extra 20,000 ha coastal forest to cope

with climate change

Vietnam will plant 20,000 ha of forests as part of a project

to protect and develop coastal forests in response to

climate change and to push green growth over the next 10

years.

It also aims to effectively promote the role and functions

of forests in coastal defence, environment protection and

coastal infrastructure systems as well as prevent

desertification and land degradation while conserving

biodiversity, reducing greenhouse gas emissions as well

as creating jobs for people in coastal areas.

According to a report of World Bank, Vietnam is highly

vulnerable to sea level rises and storms along the coast,

highlighting the critical importance of mangrove and

coastal forests.

See:

https://vietnamnews.vn/environment/1057328/viet-nam-toplant-extra-20000ha-coastal-forest-to-cope-with-climatechange.html

Cambodia, Vietnam cooperation on forest sector

Cambodia and Vietnam have expressed their commitment

to strengthen forest sector cooperation, mainly combating

the cross-border trade of timber and wild animals.

Cooperation in the field of forest management and the

prevention of deforestation and cross-border trading in

illegal timber and wildlife” were the main topics the two

parties discussed during a recent dialogue.

See:

https://www.khmertimeskh.com/50981432/cambodiavietnam-commit-to-cooperation-on-forest-sector/

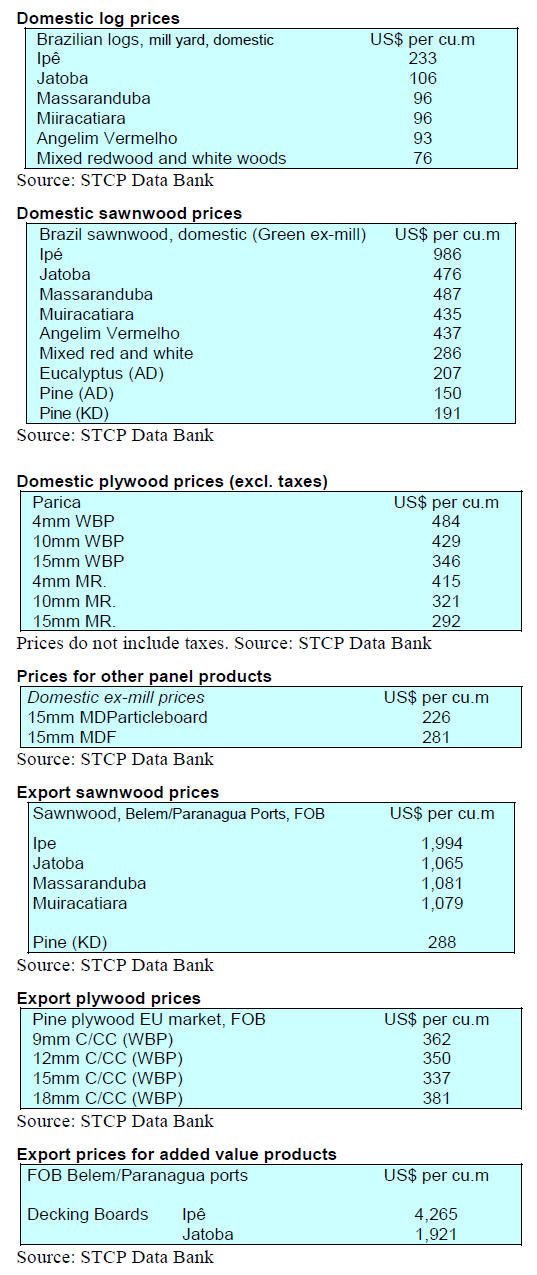

8. BRAZIL

Sustainable use of public forests

The Environment and Sustainable Development

Committee of the Chamber of Deputies has approved a

proposal which will provide for the allocation of

concessions in public forests. A draft bill (no. 5518/20)

amends several clauses of the 2006 Public Forest

Concession Law. About 20 million hectares of public

forests are said to suitable for sustainable forestry.

However, since the Public Forest concession law was

enacted in 2006 only 1 million hectares have been under

forest concession contracts.

The draft bill enables the allocation of forest concession to

legal entities for conservation, restoration and sustainable

harvesting. The concessionaire may, for example, have

access to the forest's genetic resources for the purposes of

research and development, bioprospecting and plant

collections aspects prohibited in the old public forest

concession law. Companies will also be able to explore

trade in carbon credits for the concession area.

See:

https://agenciabrasil.ebc.com.br/en/politica/noticia/2021-12/chamber-commission-expands-sustainable-use-public-forests

Domestic consumers appreciate SFM wood products

According to the Center of Producing and Exporting

Industries of the State of Mato Grosso (CIPEM) the

domestic market appreciates wood products manufactured

from sustainably managed forests. According to the Forest

Products Commercialiation and Transport System

(Sisflora/MT) sales to the domestic market by enterprises

in Mato Grosso have increased by 50% since 2020 and

there has been a corresponding decline in exports.

From 2018 to October 2021 the volume of exported fell by

23%, from 85,183 cu.m to 65,096 cu.m. According to

CIPEM prices in the domestic market have been rising and

this made the domestic market more attractive.

The state of Mato Grosso has registered an annual growth

varying between 200 and 300,000 ha. of forests under

SFM according to CIPEM. Today, Mato Grosso has 4.7

million hectares of forests under SFM and the

commitment of the State Government is to reach 6 million

hectares by 2030.

Opportunities for exporters

The Brazilian Furniture Sector Project is an initiative of

ABIMOVEL (Brazilian Association of Furniture

Industries) and Apex-Brazil (Brazilian Export and

Investment Promotion Agency) which aims to increase the

participation of the Brazilian industry in the international

market.

The second largest economy in Latin America, Mexico, is

one of the target markets for Brazilian furniture exporters.

Brazilian furniture exports to Mexico increased 89% year

on year in September 2021.

In December this year the ABIMOVEL and Apex-Brazil

project released a report to participating companies ‘Study

of Opportunities for Companies with Potential and

Exporters – Mexico Edition’ which was developed in

partnership with IEMI – Market Intelligence.

The report identifies that furniture production in Mexico is

traditionally directed to foreign markets, especially the

United States as a result over 50% of the apparent

consumption of furniture in Mexico in 2020 was supplied

by imports and this creates an opportunity for Brazilian

exporters.

See:

http://www.brazilianfurniture.org.br/en/brazilianfurniture

In related news, IEMI – Market Intelligence in partnership

with Abimóvel and ApexBrasil produced a comprehensive

assessment of the furniture industry in Brazil for the

period from 2016 to 2020. The report covers details of

manufacturing units, trends in production, consumption,

distribution, employment, investments, foreign trade and

has profiles for 720 companies in the sector.

See:

https://www.iemi.com.br/brasil-moveis-2021/

Furniture exports

Exports by the Brazilian furniture sector reached US$82.9

million in September 2021, an almost 7% increase on

August 2021. In October this year there was an increase of

11% earning US$92.3 million.

Three states in the Southern Region are the largest

furniture exporters. Together, Santa Catarina (38%), Rio

Grande do Sul (30%) and Paraná (18%) accounted for

85% of Brazilian furniture exports in 2021. Other states

that have been gaining an export share are São Paulo and

Minas Gerais.

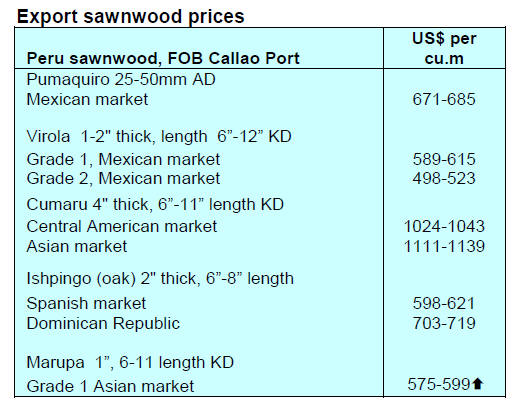

9. PERU

Wood exports represented 0.7% of

non-traditional

exports

The Association of Exporters (ADEX) has reported that

wood product exports between January and October

totalled US$97.7 million, a growth of 32% compared to

the same period last year however, compared to 2019 there

was still a decline of around 4%.

Despite the market opportunities over the ten months of

this year wood product shipments represented less than

1% of total non-traditional exports (US$13 million).

The recovery of timber shipments this year was driven

largely by demand in France and the US which increased

orders by 175% and 61%, respectively. However, the main

international market was China at US$30.2 million

accounting for 31% of the total wood product exports

followed by France US$16 million and the US with

US$11.2 million. The other markets of note were Mexico

(US$6.9 million) and the Dominican Republic (US$6.3

million).

Exports were mainly of semi-manufactured products

(US$58 million) or 59% of the total. The export of

mouldings was significant as were exports of sawnwood

(US$25.4 million). Others included construction products

(US$5.5 million), furniture and parts (US$3.5 million),

veneered wood and plywood (US$2.7 million) and other

manufactured products (US$1.2 million).

Exports of mouldings

The export of mouldings between January and September

this year totalled US$22.5 million, a significant increase

compared to 2020 (US$9.4 million) according to the

ADEX Global Business and Economics Research Center.

Data from the ADEX ‘Trade Business Intelligence

System’ shipments of mouldings in the first nine months

of this year exceeded pre-pandemic levels mainly due to

the higher demand in France which went from US$1.0

million in 2020 to US$8.1 million in 2021. Other markets

included Denmark (US$3.5 million), Belgium (US$2.2

million), the US (US$1.5 million), Mexico (US $1.3

million) and Germany (US$1.3 million). New markets

included Canada, South Africa, Martinique, Italy, Portugal

and theUnited Kingdom.

Mouldings were produced and shipped from Lima

(US$11.4 million), followed by Ucayali (US$6.2 million),

Madre de Dios (US$3.8 million), Callao (US$1.1 million)

and Tacna (US$0.3 million).

In the ADEX report ‘International panorama of molded

lumber’, it was reported that Peru was the fourth world

supplier of moulded lumber in 2020. Indonesia (61% of

the total) was the main exporter of this product, followed

by Brazil and Malaysia.

Assessing and improving community participation

A study carried out by the Forest Resources Supervision

Agency (Osinfor) in cooperation with the USAID Pro-

Bosques Project found that in only half of the forest

permits granted to native communities (CCNN) in the

Amazonian Region was there active community

participation.

While it is not certain the study authors presumed that in

the other permit areas there is a community participation

as a company or employee but that there is no evidence of

this participation.

The study, ‘Analysis on the participation of third parties in

forest activities of the CCNN’ was made on the basis of

information obtained in the Osinfor supervision reports on

623 qualifying forest permits for native communities

throughout the Amazon. These supervisions were carried

out between 2015 and 2019 and were obtained through the

Osinfor Management Information System (SIGOsfc).

In order to convey the results of the study to native

Amazonian communities the main findings of the research

were presented in the cities of Iquitos (Loreto) and

Pucallpa (Ucayali) along with proposals to empower

communities in the negotiation of forest permits.

The Forest Agenda of the Native Communities, promoted

by organisations such as Aidesep and Conap consider it

important to evaluate the formation of a free Public Forest

Regency for communities which would allow them to

have adequate technical advice when they participate in

business timber companies to ensure agreements are

balanced and do not favour one party.

Commercial forest plantations planned for nine

regions

The National Forest and Wildlife Service (SERFOR) in

the Ministry of Agrarian Development and Irrigation

reported that, within the framework of the investment

programme ‘Promotion and Sustainable Management of

Forest Production in Peru’ the management of natural

forests and the promotion of forest plantations for

commercial purposes shall be in accordance with forestry

regulations in nine Regions of Peru.

Through this programme three large investment projects

will be executed in the prioritised Departments. This

programme has been officially presented to the Regional

Governors of Loreto, Pasco and Ucayali who pledged to

support the execution of the programme to strengthen the

role of a Regional Forest and Wildlife Authority and instal

a Consultative Committee for the programme. It should be

noted that the Forestry Programme will be executed with

investments from the Peruvian State and the German

Development Bank (KWF).