Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Nov

2021

Japan Yen 114.7

Reports From Japan

Another huge stimulus budget

Japan's Cabinet has approved a record Yen 36.0 trillion

supplementary budget for fiscal 2021 to put the pandemicstricken

economy on a recovery track. The government

also plans to use 6.1 trillion yen that was carried over from

the fiscal 2020 budget.

See:

https://mainichi.jp/english/articles/20211126/p2g/00m/0na/041000c

and

https://www.japantimes.co.jp/news/2021/11/19/business/stimulus-plan-record/

In related news, the government has met with employer

groups and urged them to encourage their members to

raise wages by 3% or more next spring to achieve a

virtuous cycle of growth and wealth distribution. This is

part of the Prime Minister¡¯s ¡®new capitalism¡¯ strategy. A

government panel has recommended raising the pay

welfare workers, nurses and care-givers by 3% .

See:

https://asia.nikkei.com/Politics/Japan-s-Kishida-urgescompanies-to-raise-wages-3-or-more

Economy contracts

Japan's economy contracted in the third quarter as global

supply chain disruptions hit exports and business spending

plans. The expectation is that the economy has expanded

in the final quater as virus infection rates fall But, supply

issues pose increasing risks to the economy which is

export-dependent.

The Japanese economy shrank an annualised 3% in the

second quarter following the (revised) 1.5% gain in the

first quarter. The weak GDP growth contrasts sharply with

that of other advanced economies.

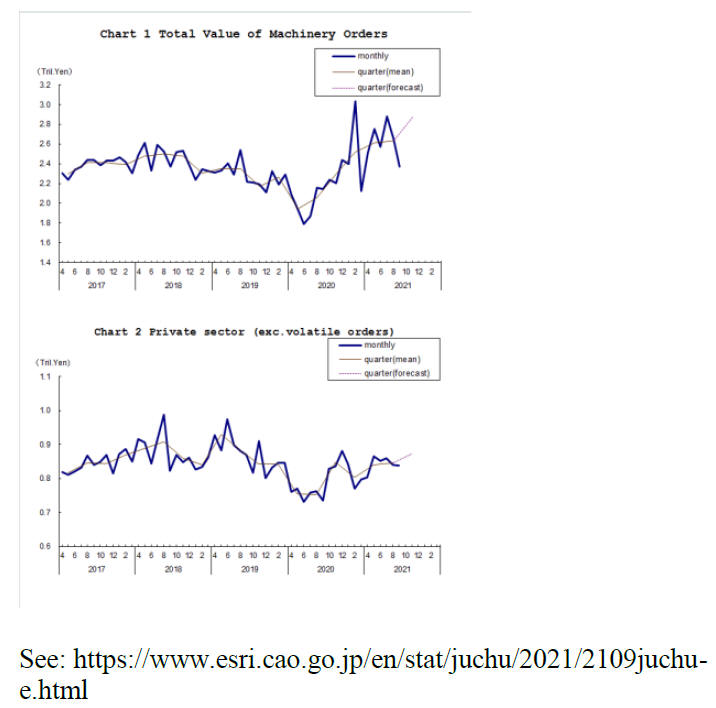

Machinery orders dip

The value of machinery orders received by the main

manufacturers operating in Japan declined by 10% in

September from the previous month. In the July-

September period it increased by just 1% compared with

the previous quarter.

In the last quarter of 2021 the value of machinery

orders

has been forecast to increase by 9% and private-sector

orders, excluding volatile ones, are expected to rise by 3%

from the previous quarter. But this was before new travel

restrictions for foreighers were introduced to try and stop

the spread of the Omicron variant.

Foreign workers to be allowed to stay

It is reported that the government is considering revising

the current legislation to allow foreign blue-collar workers

to live and work indefinitely. The current law from 2019

allows "specified skilled workers" in 14 sectors such as

farming and construction to stay for up to five years but

without their family members.

The government has been urged by the private sector to

ease these restriction. The shrinking population has

become a serious problem for companies needing workers.

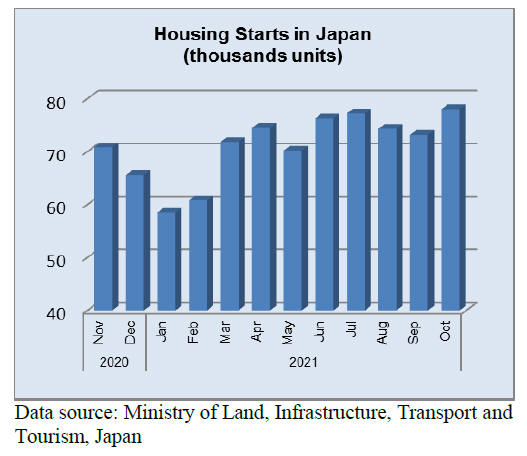

Space and more space please

Space is a bonus in Japanese homes and many newly built

homes now incorporate a feature of traditional Japanese

homes ¨C a doma - which is a room commonly used for

storage and where outside shoes can be worn.

Japanese homes always have an entrance area where

outdoor shoes can be removed before entering the living

area. Now, even more apartment buyers are asking for a

larger ¡°doma¡± in which they can walk around while

wearing footwear and store items for outdoor use. This

change is said to be related to the increase in outdoor

leisure activities but it is not likely to have any real impact

on the use of wood products in construction.

See:

https://www.asahi.com/ajw/articles/14475020

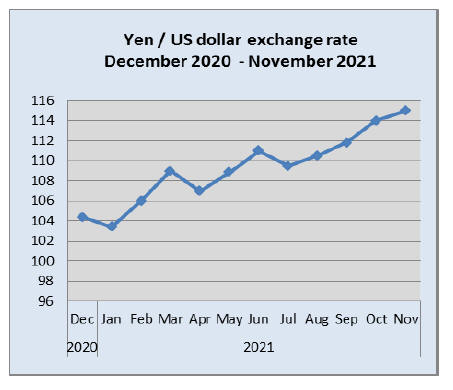

Weaker Yen, good or bad?

A weak yen, once hailed as giving exporters an advantage

in international markets, has now become headache for the

government as the rising costs of imports, especially oil, is

pushing up the cost of living. Also, as Japanese

manufacturers move off-shore the weak yen has become

less of a advantage for local exporters than it was.

The US dollar hit 115.5 yen in late November, a

level not

seen since January 2017 driven by higher US treasury

yields as well as by the broad-based strength of the dollar

due to inflation concerns and strong growth momentum.

The reappointment of Jerome Powell as Federal

Reserve

Chair reinforced the perception that US interest rates

would rise next year further weakening the yen.

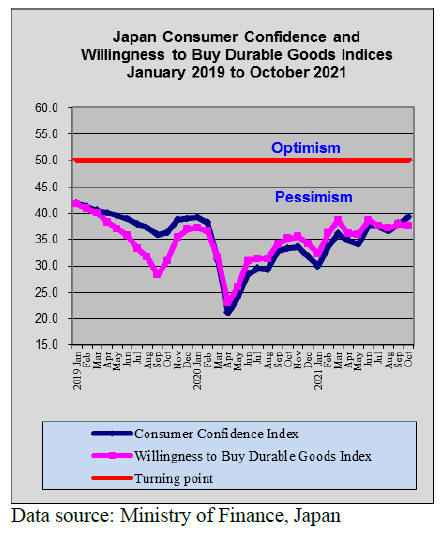

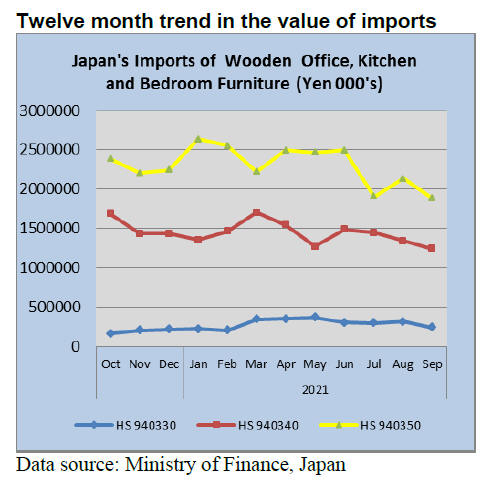

September was the low point this year for furniture

sales

Up to September, sales of wooden furniture remained

subdued as the country struggled to bring a fifth wave of

infections under control. However, recent data shows that

department store sales rose modestly in October as the

lockdown was lifted.

Sales at furniture stores such as Nitori Holdings rose

almost 4% in October from a year earlier according to the

Japan Chain Stores Association.

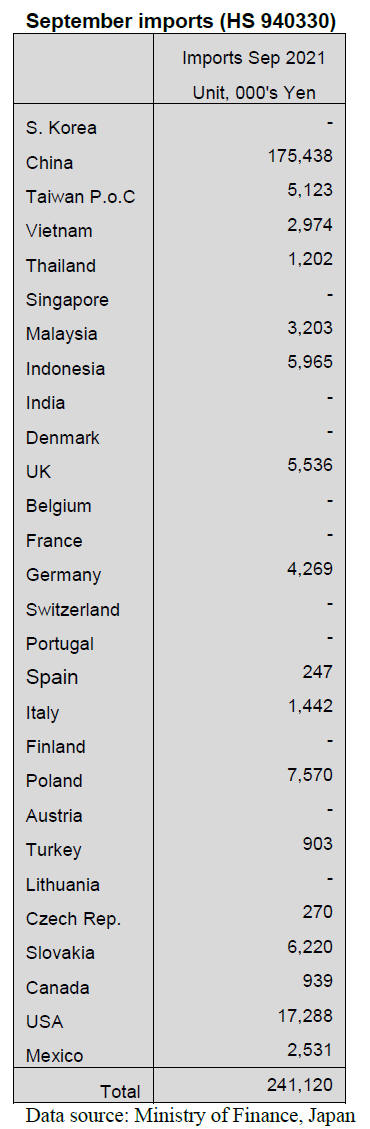

Office furniture imports (HS 940330)

The top shipper of wooden office furniture in September

this year was China whose share of imports was 73%,

down from the value of August shipments. The other

major shipper in September was the US with a 7% share, a

significant increase on the usual monthly shipments to

Japan. Most of the balance of September imports was

shipped from Taiwan P.o.C, Indonesia and Slovakia

(aprox 5% share each).

Year on year, the value of imports of wooden office

furniture (HS940330) rose over 40% in September and

compared to September 2019 there was a 32% increase in

the value of imports.

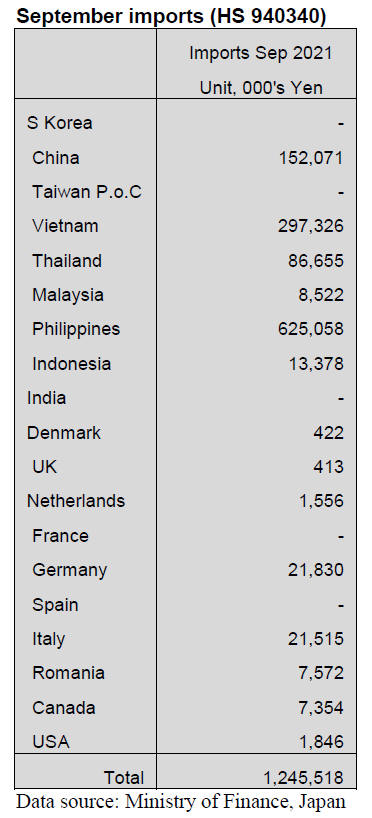

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s wooden kitchen furniture imports

continued the downward trend that began in July this year.

September imports were 7% below the value of imports in

August.

Compared to 2020 the value of imports dropped 9% and

compared to 2019 there was a 10% decline. Exporters in

Germany and Italy once again made it into the list of top

20 shippers of wooden kitchen furniture.

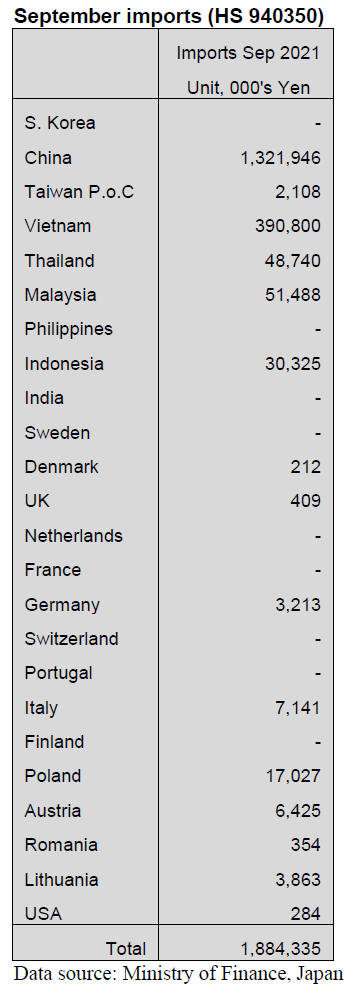

Bedroom furniture imports (HS 940350)

Since the beginning of the second quarter of this year the

value of Japan¡¯s imports of wooden bedroom furniture

have been trending lower. Year on year, September 2021

imports were some 15% below that in 2020 but just

matched the level of 2019 imports.

Month on month, September arrivals of wooden bedroom

furniture were down 11% thus resuming the downward

trend.

The top suppliers in terms of value in September were

China (70%) and Vietnan (21%). Shipmets from Vietnam

in September were down sharply due to the impact of

pandemic lockdown measures imposed in the country.

The other top shippers in September were Malaysia,

Thailand and Indonesia which together accounted for

almost 15% of the value of arrivals taking up some of the

loss from Vietnam.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Price hike of various items

Daiken Corporation (Osaka) increased the sales prices of

MDF produced in Malaysia and New Zealand since

November. This is second time of price increase followed

last April. Increase this time is more than 20% and further

increase may be necessary depending on prices of raw

materials. Increase is necessary to pass higher cost of

wood chip, adhesive and ocean freight. In particular,

adhesive prices climbed fast by increase of crude oil prices

and export restriction of urea by China so adhesive

manufacturers ask 1.4¨C 2.0 times higher prices compared

to the first quarter this year.

Daiken has two MDF plants in Malaysia with total

monthly production of 20,000 cbms and two plants in New

Zealand with total production of 35,000 cbms. The

demand is brisk so all the plants are running full.

Eidai Co., Ltd. (Osaka) announced to increase the prices

of all flooring since December 1. This is the second price

hike this year following July 1. Prices of domestic

softwood plywood, ocean freight, wooden board (MDF)

and adhesive all climbed so it needs to pass such higher

cost onto finished products.

Aica Kogyo (Nagoya) announced to increase the prices of

all the decorative board since December 21. The increase

will be 10-15% from present prices. It is facing high cost

of plywood, chemical products and energy. Particularly

plywood is becoming hard to buy and it is inevitable to

increase the prices for stable supply of the products.

South Sea (tropical) logs and lumber

After Daishin plywood quit using South Sea hardwood for

plywood manufacturing, import of South Sea hardwood

logs is almost none.

There are only two ships from PNG for the first eight

month and remaining mills now use veneer instead of logs.

With declining log production in Malaysia and chronic

high prices, there is no hope to use logs again. Lumber of

South Sea hardwood is also hard to come by because logs

are scarce in the South East Asia by rainy season so that

lumber prices are high.Chinese laminated free board

inventory is about two months in Tokyo region. Export

prices of Chinese red pine lumber and Indonesian mercusii

pine lumber are unchanged.

Domestic dealers worry about market price down by large

volume arrivals but now shipment takes more than two

weeks longer so rush arrivals are unlikely. Dealers are

selling cautiously as more demand to refurbish stores and

shops after state of emergency is lifted.

Declining log exports to China

The volume of exporting logs in August is 55,879 cbms,

51.8% less than last month and 44% less than same month

in last year. This is the lowest under 100,000 cbms since

January, 2020. It seems declining more after September.

The reasons are not only price increasing of freight and a

traffic congestion at the ports but also demands in China

declined.

There are restrictions on electric power supply and change

of policy at ports in China. Therefore, there is no hope for

recovering through the end of this year. There is also

another big problem which is keeping out logs at Taicang

port of Jiangsu province, one of major ports in China.

They are restricted to accept low value logs to have more

high-value-added goods so some sawmills around Taicang

port are forced to move out of the area.

About 80 to 90% of Japanese logs unloaded at Shanghai

port or Taicang port. This situation damages a lot to Japan.

Some export agents try to send logs to inland ports of

Chang Jiang River or the southern part of Zhejiang Sheng

in China but many of cargo ships stuck waiting outside

ports so the export agents had to pay almost Yen

1,000,000 of demurrage a month.

Ocean freight used to be US$50,000 for 2,500 cbms of a

ship until last year but now it climbed to US$120,000 so

many log exporters hesitate to export logs to overseas

from Japan. There are many logs which are over 18 cm in

diameter sitting at exporting ports.

The price of export logs was around ¥11,000 (FOB, cbm)

in southern part of Kyusyu, Japan but now they are less

than ¥10,000.

Orders from China are declining as export of cedar lumber

for the U.S. market is slowing as the U.S. housing market

is weakening. Cedar lumber inventories are high on both

side of China and the U.S.A. so even if the market in the

U.S.A. rebounds, there is no chance to recover for some

time.

Cedar log export prices for China increased by US$10 on

every ship until last July then the prices peaked at

US$170-180 per cbm C&F then dropped to US$165 in

August and there are no counter orders from China.The

volume of exporting logs to China in January to July are

794,761 cbms, 28.7% more than same period of last year.

This is 30% over for the same period of last year.

In August, the pace slowed down and it would be

1,070,000 cbms for 2021. This result would be lower than

last year which was 1,157,000 cbms.

Also exporting Japanese cedar lumber to the U.S. is

declining. The volume of lumber in August was 3,543

cbms, 34.8% less than last month and 35.1% less than

same month of last year due to loss of demands, not

enough cargo ships and expensive freight. Spot price of

40¡¯ container is now around US$15,000, which was

US$4,000 last year. It can contain 45 cbms of lumber.

Climbing adhesive prices

Soaring adhesive prices are squarely impacting wooden

board cost. Supply of raw materials of adhesive such as

urea sharply dropped after electric supply is disrupted in

China so prices of adhesive climbed in Asia.

Prices of urea and methanol climbed by over 30% in one

month and the prices of melamine soared doubled in last

four months. Some overseas MDF plants shutdown

temporarily by shortage of adhesive. Manufacturers of

MDF and particleboard are hurriedly increase the sales

prices as these products need large amount of adhesive.

Raw material prices of adhesive started climbing since late

2020 so the manufacturers of MDF and particleboard

increased the sales price by 5-10% in spring of 2021.

Urea prices stayed almost unchanged at US$200 per

ton

for whole year of 2020 then it started climbing to US$350

in March, US$500 in June and over US$600 by October

2021.

Ethanol prices were less than US$200 in June 2020 then

went up to about US$400 in December 2020, US$350-380

in July and escalated over US$500 in October. Melamine

prices were US$700 in 2020 then inflated over US$3,000

in October 2021.

Urea and ethanol are both used for urea or melamine

adhesive. Some Indonesian plywood manufacturer failed

producing some items by shortage of adhesive. The largest

reason of soaring adhesive prices is supply reduction by

China, which has 40% share of urea supply in the world.

China stopped importing coal from Australia by political

reason, which is main fuel for electricity in China so

power supply failed and disrupted production of urea. Also

urea is mainly used for fertilizer in China so supply of urea

for adhesive is reduced. After all, all the wooden board

manufacturers need to increase the sales prices by soaring

adhesive prices.

|