4.

INDONESIA

Strengthening sengon timber network

The Ministry of Trade has plans to expand sengon

(Albizzia - lightwood) exports by facilitating business

meetings between sengon timber producers (mainly small

farmers in Central Kalimantan) as well as producers

throughout Indonesia.

At a recent meeting of stakeholders 25 sengon farmers

assisted by Fairventures Worldwide and member

companies of the Indonesia Light Wood Association

(ILWA) dicussed the ministry plans. At the same meeting

a ‘Letter of Intent’ was signed between Fairventures

Worldwide and ILWA as a commitment by both parties to

develop a lightwood value chain especially in Central

Kalimantan.

Fairventures Worldwide works in partnership with

communities and small farmers in Central Kalimantan to

take advantage of vacant land by planting fast-growing

trees such as sengon, which can provide an alternative

income for local communities. Sengon production is

sustainable in line with current market requirements.

In 2020, Indonesia's lightwood exports reached US$ 1.74

billion with Japan, the United States, South Korea, Saudi

Arabia and Taiwan as the main markets.

See:

https://infopublik.id/kategori/nasional-ekonomibisnis/582714/indonesia-berpeluang-kuasai-pasar-kayu-global

No more permits for primary and peat forest

harvesting

The policy of stopping the new permits issuance in

primary forest and peat has been shown to contribute in

reducing deforestation and forest degradation. Deputy

Minister of Environment and Forestry, Alue Dohong,

stated that the policy of terminating new permits in

primary natural forests and peat affects in drasticly

reducing in the rate of deforestation.

In an official statement Alue said "Indonesia has

succeeded in reducing the deforestation rate by 75%

compared to the previous year to 115,000 hectares in the

2019-2020 period."

See:

https://nasional.sindonews.com/read/597627/15/hentikanizin-baru-dan-perkuat-tata-kelola-hutan-gambutindonesia-turunkan-deforestasi-1636715488/10

APHI to support carbon sink target

The Association of Indonesian Forest Concessionaires

(APHI) has indicated its members are ready to support the

achievement of the target of higher carbon absorbtion than

greenhouse gas (GHG) emissions from the forest and land

use sector (Net Sink FoLU) in 2030 as decided by the

government.

To support the achievement of the FoLU Net Sink,

businesses will implement forestry multi-business

according to the Chairman of APHI, Indroyono Soesilo.

Under this multi-business scheme forest owners and

companies will not only focus on timber but also on the

utilistion of non-timber forest products and environmental

services. According to Indroyono, with a multiple forestry

businesses the value of forest will rise which will reduce

the pressure for land use conversion.

See:

https://www.antaranews.com/berita/2518245/aphi-siapdukung-pencapaian-target-net-sink-folu

Indonesian cooperation with Brazil and Congo

During discussion held at the Secretariat of the Delegation

of the Republic of Indonesia at the UNFCCC COP-26

cooperation with Brazil and the Democratic Republic of

the Congo was agreed in forest management and climate

change.

The three countries have management over a huge area of

tropical forest and it was agreed there are many areas for

collaboration according to the Deputy Minister of

Environment and Forestry, Alue Dohong. Specifically the

three countries shared ideas on each other's strengths in

climate action and forest management. They also

identified each other's capabilities that could be combined.

In this collaboration, Indonesia offered expertise in

reducing deforestation, controlling and handling forest and

land fires as well as its experience in social forest

management for communities.

Brazil has extensive experience in implementing payments

for ecosystem services (PES), managing climate funds

through the Amazon Fund as well as cooperating with

low-emission agricultural and livestock management

practices, waste management and sanitation which, said

Alue, will be valuable for Indonesia.

See;

https://www.medcom.id/nasional/politik/yKXjaVEbindonesia-kerja-sama-dengan-brasil-dan-kongo-terkaitpengelolaan-hutan

and

https://nasional.kontan.co.id/news/indonesia-brasil-dan-kongojajaki-kerja-sama-pengelolaan-hutan?page=2

Law enforcement key to curbing forest fires

Law enforcement is a potent tools to curb land and forest

fires in Indonesia according to Prof. Bambang Hero

Saharjo of the Bogor Agricultural University

(IPB University). If fires can be eliminated this will help

achieve the target of lowering greenhouse gas emissions

said the professor during a discussion at the Indonesia

Pavilion at the COP-26.

See:

https://en.antaranews.com/news/199293/law-enforcementis-tool-to-curbing-forest-fires-professor

5.

MYANMAR

Violence condemned

On November 26 a statement was released by the US State

Department, Office of the Spokesperson. The following is

the text of a joint statement signed by the governments

of Australia, Canada, New Zealand, Norway, the Republic

of Korea, the United Kingdom and the United States.

“We reiterate our grave concern over reports of ongoing

human rights violations and abuses by the Myanmar

Security Forces across the country, including credible

reports of sexual violence and torture, especially in Chin

State, Sagaing Region and Magwe Region.

In Chin State, it is reported the military has burned homes,

churches and an orphanage in Thantlang village, and has

targeted humanitarian organizations. More than 40,000

people are reported to have been displaced in Chin State

and 11,000 in Magwe Region as a result of recent

violence.

Reports of internet shutdowns and other methods of

communication in Chin State and other areas of the

country are also troubling. Communities impacted by

violence need access to information to keep themselves

safe.

We are concerned about allegations of weapons

stockpiling and attacks by the military, including shelling

and airstrikes, use of heavy weapons and the deployment

of thousands of troops accompanying what security forces

assert are counter-terrorism operations, which are

disproportionately impacting civilians. We also note our

increasing concern at armed clashes in Rakhine State in

early November”.

See:

https://www.state.gov/joint-statement-on-increasingviolence-in-myanmar/

Myanmar’s Ministry of Foreign Affairs raised strong

objections on 27 November to the ‘biased’ joint saying it

“contained sweeping and groundless accusations against

the Tatmadaw (army ) such as human rights violations

and the disproportionate use of force.”

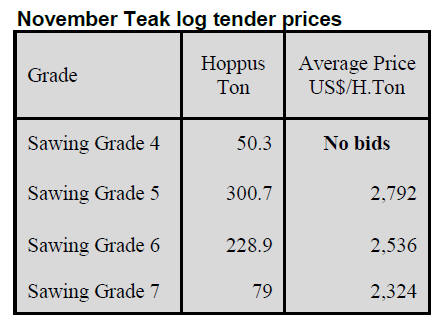

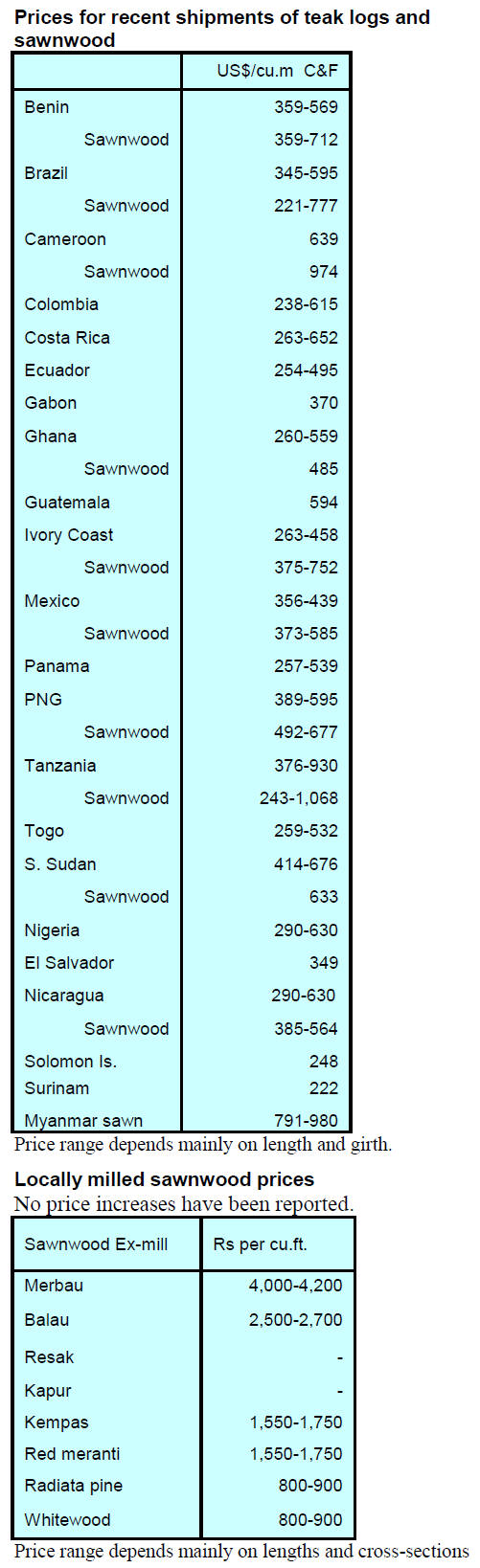

Teak log prices stable

The Myanmar Timber Enterprise (MTE) offered around

735 tons of teak logs for tender sale recently and the prices

bid were little changed from previous sales. However, all

lots of Sawing Grade 4 logs received no bids.

Generally, Sawing Grade 4 logs are processed to high

quality products for niche markets in the EU and USA.

The EU announced trade restrictions targeting the MTE in

June this year and before these became effective

manufacturers tried to stock- up on logs and have switched

to alternative markets but these markets may not require

the top quality timber from Sawing Grade 4 logs.

6. INDIA

India’s response swift and

substantial says IMF

In October the International Monetary Fund concluded

consultations on the economy with India. A recent press

statement says “India’s economy is poised for a rebound

after enduring a second wave of COVID-19 infections this

year that further constrained activity and took a heavy toll

on its people“.

New infections have fallen significantly and vaccination

rates have risen to surpass a billion doses, although a

resurgence is possible even if it seems unlikely today. The

IMF says India was among the fastest-growing economies

in the world in the decade before the pandemic which

created unprecedented challenges. The two COVID-19

waves caused health and economic crisies however, the

economy is gradually recovering.

The IMF note that the authorities’ economic response, was

swift and substantial as it included fiscal support such as

scaled-up support for vulnerable groups, monetary policy

easing, liquidity provision and accommodative financial

sector and regulatory policies.

According to the IMF growth is projected at 9.5% in the

finacial year 2021/22 and 8.5% the following year.

However, taming inflation, projected at 5.6% in

FY2021/22 will be a challenge.

See:

https://www.imf.org/en/News/Articles/2021/11/02/na111121-indias-economy-to-rebound-as-pandemic-prompts-reforms

Still a way to go to recover housing market

According to the results of a survey by Deloitte Touche

Tohmatsu India LLP (Deloitte India) the pandemic has

altered home buyer preferences. The report from Deloitte

sets out the key trends that are expected to contribute to

the revival of the Indian real estate sector.

The impact of the pandemic control measures had a very

varied impact with the hospitality and manufacturing

sectors being badly affected and since restrictions were

eased the rebound has been equally uneven.

A revival of government infrastructure projects is helping

the manufacturing and construction sectors but consumer

anxiety is holding back a recovery of the services sector.

However, a recovery is taking root as witnessed by recent

high-frequency data but there are some challenges such as

high inflation, the need for more job creation, poor wage

growth and reduced asset values and these will affect

consumer purchasing power.

Despite the anticipated rebound in 2022 output levels are

likely to remain much below the pre-pandemic GDP levels

according to the results of the survey.

The authors of the survey write “With industries showing

immense resilience through innovative ways during the

pandemic and India now gradually making its way toward

recovery, growth sustainability in 2021 will depend on

widespread vaccine deployment and effective government

measures”.

See:

https://www2.deloitte.com/global/en/insights/economy/asiapacific/india-economic-outlook-01-2021.html

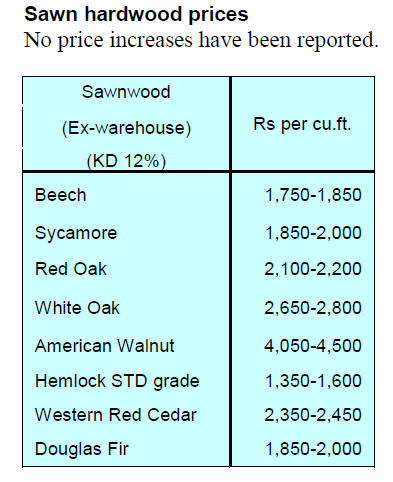

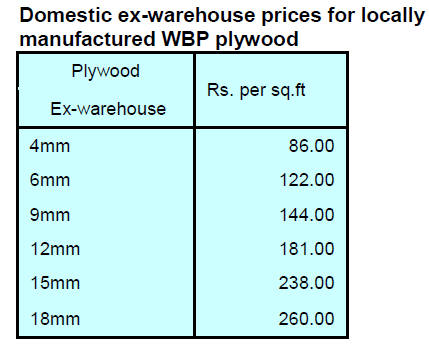

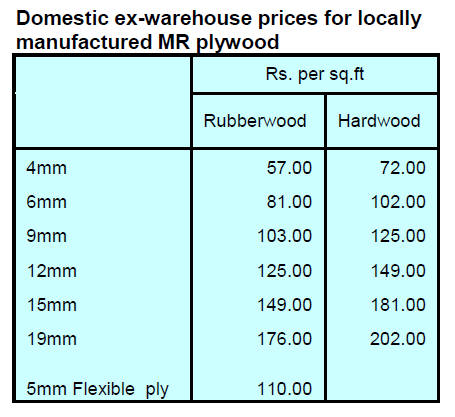

Plywood

A survey of panel retailers conducted and reported by

Plyreporter says market demand has been recovering

steadily since September despite the earlier panel price

increases. With rising costs of imported and domestic raw

materials for the panel sector further price increases

cannot be ruled out.

New ply mill gets approval

Andhra Pradesh State Investment Promotion Board (SIPB)

has approved investment proposals from five industries

worth almost US$300 million. Century Plyboards India,

one of the investors, will establish a plywood unit at

Badvel with an investment of around US$100 million and

the industrial unit is expected to generate over 2,000 jobs.

The mill will utilise eucalyptus grown by local farmers.

Vietnam's pine sawn wood.

See:

https://www.thehindubusinessline.com/news/national/apgovt-clears-5-new-industry-investments-worth-2134-cr/article37529125.ece

7.

VIETNAM

Wood and Wood Product (W&WP) trade highlights

According to the General Department of Customs W&WP

exports to Japan in October 2021 reached US$121 million,

increasing 4% compared to October 2020. In the first 10

months of 2021 W&WP exports to Japan reached US$1.16

billion, up 10.6% over the same period in 2020.

In October 2021, exports of W&WP to Germany reached

US$9.8 million, down 21% compared to October 2020,

but compared to September 2021, they increased by 60%.

The recovery in production from the end of September

2021 boosted export growth in October 2021 and in the 10

months of 2021 exports to Germany reached US$101

million, up 7% over the same period in 2020.

Imports

d imports in October 2021 are estimated at 130,800 cu.m

worth US$36.6 million, up 10.6% in terms of volume and

11.3% in value compared to September 2021.

Compared to October 2020, imports of pine sawn wood

increased by 40% in volume and 77% in value. In general,

in the first 10 months of 2021 pine wood imports reached

1.246 million cu.m worth US$300.8 million, up 75% in

volume and 98% in value over the same period in 2020.

Imports of wood from China in October 2021 reached

33,000 cu.m with a value of US$18.5 million, up 11.8% in

volume and 12% in value compared to September 2021

but down 56% in volume and 36% in value compared to

October 2020.

In the first 10 months of 2021 imports of raw wood from

China reached 892,860 cu.m with a value of US$57.08

million, up 60% in volume and up 59% in value over the

same period in 2020.

Exports starting to recover

Demand in international markets continues to grow

creating a solid foundation for recovery of the Vietnamese

furniture processing and exporting industry.

Speaking at a webinar "Strategy to revive the supply chain

of the furniture industry in Vietnam" Mary Tarnowka,

Managing Director of AmCham Vietnam said the recent

period of implementing social distancing to fight the

pandemic has been a huge challenge for businesses,

including American furniture manufacturers in Vietnam

with a large number of orders that have been affected.

The fourth quarter is a very important period for the US

market especially during the Christmas and Thanksgiving

holidays so companies are doing their best to prepare to

meet orders for these holidays.

Ms. Tarnowka also said demand for Vietnamese wood and

furniture products will continue to grow in 2022 and 2023.

However, in the next six months while orders will increase

manufacturers in Vietnam will continue to struggle to

recover 100% capacity.

“This will have a negative impact on US buyers, in

addition to the high freight rates. There are a number of

US businesses that have moved orders to China and it will

be difficult to call them back to Vietnam. It is important to

reopen quickly, resume manufacturing operations, rebuild

supply chains and promote sustainability and innovation in

the industry,” said Ms. Tarnowka.

The same opinion was voiced by Alain Cany, President of

EuroCham who acknowledged: “The time to implement

social distancing is a bad time for European businesses in

Vietnam, because this is the time when many orders are

received. While orders from Germany, France and the

Netherlands are "booming", everything in Vietnam has

stopped.”

Accordingly, businesses there are still many difficulties

and challenges such as shortage of raw materials, increases

in raw material prices, labour shortages which holds down

factory capacity. Worst of all shippers cannot find

containers.

Deputy Director of the General Department of Forestry

(Ministry of Agriculture and Rural Development) Bui

Chinh Nghia said "Vietnam's wood industry is ready to

recover and speed up after the Covid-19 pandemic" .

He said 95% of wood workers have been vaccinated

against Covid-19 with the 1st dose and 60% have received

the 2nd dose. The Ministry of Agriculture and Rural

Development is making efforts to coordinate with the

Ministry of Health to prepare 136,000 doses of the vaccine

for further vaccination of workers to gain immunity.

The labour issue he said the local People's Committees

also support enterprises in recruiting workers. Along with

that, the Government and localities have also implemented

solutions to actively support businesses in ensuring supply

chains, finding outputs, building operating models,

transportation, travel and financial problems for

enterprises to restore production.

The recovery of the timber industry will be in three phases

in which the adaptation phase will take place over three

months with employment being maintained and factories

operating. The goal of this phase is to restore 70% of the

production with sales estimated at US$900 million to

US$1.2 billion per month.

The recovery period will last for 3-6 months to prepare for

the new production season with new orders. The goal of

this phase is to restore 90% of factories and expect

revenue of US$1.2-1.4 billion per month. An acceleration

phase is expected to begin in 6 months with investment in

opportunities and growth with an expected growth rate of

15% compared to 2021.

Nguyen Hoai Bao, Deputy General Director of Scansia

Pacific Company (Dong Nai province) said that Dong Nai

province has now allowed workers to live in green areas or

if they have received one dose of the Covid-19 vaccine to

returning to work. This helps the company have more

workers and workers can also return home instead of

staying at the factory as before.

From the perspective of the association, Do Xuan Lap,

Chairman of the Vietnam Wood and Forest Products

Association, said that despite difficulties, opportunities for

Vietnam's furniture industry are still wide open.

Enterprises themselves are aware of the great opportunities

so they have been looking for ways to adapt to the new

conditions from retaining workers, finding a stable source

of raw materials to applying machinery and modern

equipment to reduce dependence on human resources and

to improve product quality.

See:

https://wtocenter.vn/chuyen-de/18379-export-of-woodfurniture-ready-to-recover-speed-up-after-the-pandemic

8. BRAZIL

Bio-economy essential for Amazon

security

The Sustainable Amazon Forum (Fórum Amazonia

Sustentável - FAS) coordinated by the Ethos Institute and

eight other organisations that make up the Organising

Committee comprises a multi-sectoral initiative aimed at

securing a sustainable Amazon.

At COP-26 a FAS document "10 points for a bioeconomy

in the Amazon," set out how to create a circular economy

and low-carbon model that keeps the forest secure,

protects local communities and effectively eliminates

deforestation.

The 10 points considered to be priorities for the region are:

Actions to combat deforestation

Land regularisation

Environmental protection and inspection

Fair and sustainable value chains

New forest economies

Social and economic inclusion of local

communities

Infrastructure and energy

Financial instruments and incentives

Business environmental impacts

Multi-sectoral governance.

According to Institute Ethos the FAS initiative is a

valuable contribution as it gives relevance to regional

voices pointing out the true priorities capable of

reconciling the preservation of biodiversity with the wellbeing

of local populations. Adding, the complex scenarios

in the Amazon demand multi-sectoral action and this

document provides ideas to advance a consensus on how

to move forward with concrete proposals for the

sustainable development of the region.

See:

http://www.madeiratotal.com.br/forum-amazoniasustentavel-lanca-nesta-quinta-na-cop26-o-documento-10-pontos-para-uma-bioeconomia-da-floresta-em-pe/

‘Green Brazil consortium’ seeking resources for the

Amazon plan

At COP-26 State Governors from Brazil launched the

‘Green Brazil Consortium’ (Consórcio Brasil Verde)

setting out how States can advance their climate agendas.

The focus of the ‘Green Brazil Consortium’ is to secure

greater technical inputs so credible proposals can be

developed to attract financing.

The creation of the Consortium was promoted as a single

entity aimed at raising funds for climate action and the

generation of renewable energy. This Consortium is timely

in light of Brazil´s Nationally Determined Contributions

(NDC) commitment and marks an important step

articulation of subnational climate and socioenvironmental

governance in the country.

The priority now is for the States to draft carbon neutral

plans. As an example of the effort of Brazilian states with

carbon neutrality, the state of Mato Grosso, one of the

largest tropical timber exporting states, is working with an

environmental agenda aiming at zero carbon emissions by

2035.

See:

https://www.riotimesonline.com/brazilnews/brazil/governors-launch-green-brazil-consortium-at-cop26/

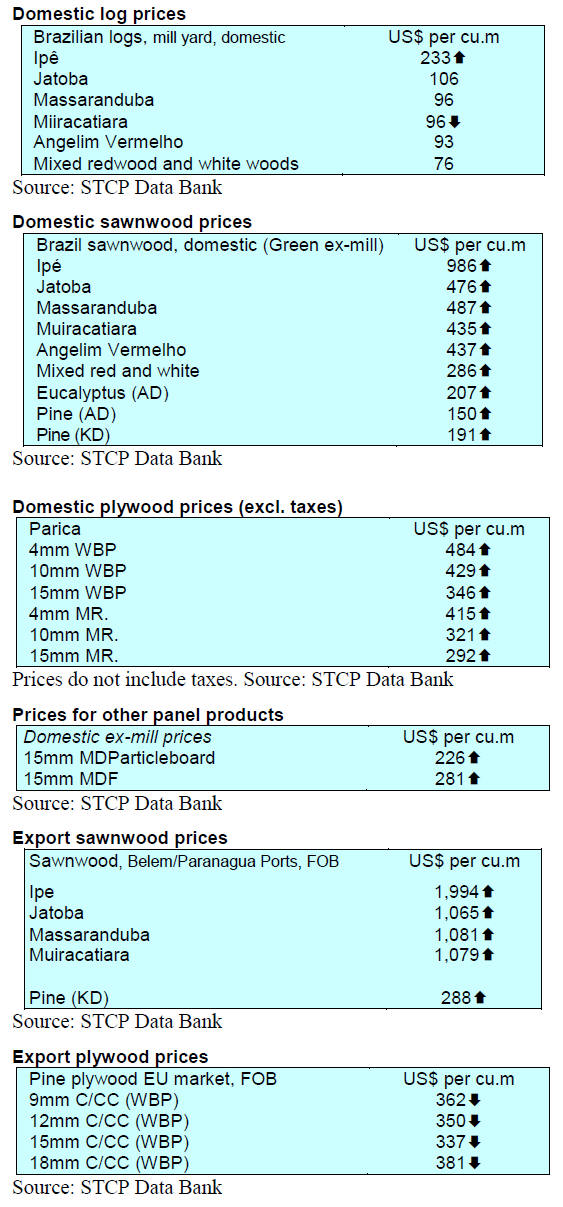

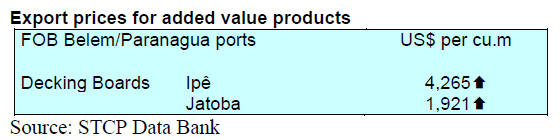

Export update

In October 2021 Brazilian exports of wood-based products

(except pulp and paper) increased 26.5% in value

compared to October 2020, from US$293.9 million to

US$372.0 million.

Pine sawnwood exports grew 58% in value between

October 2020 (US$47.1 million) and October 2021

(US$74.4 million). In volume, exports increased slightly

over the same period, from 267,900 cu.m to 268,900 cu.m.

However, tropical sawnwood export volumes fell 30%

from 40,200 cu.m in October 2020 to 28,000 cu.m in

October 2021. In value terms exports declined by the same

amount (30%) from US$15.8 million to US$11 million

over the same period.

The value of pine plywood exports saw an almost 5%

increase in October 2021 compared to October 2020 from

US$60.5 million to US$63.3 million. But in terms of

volume exports decreased 26% from 207,900 cu.m to

154,400 cu.m.

As for tropical plywood, exports increased in volume

(54.8%) and in value (124.0%), from 6,200 cu.m (US$2.5

million) in October 2020 to 9,600 cu.m (US$5.6 million)

in October 2021.

The value of wooden furniture exports increased from

US$57.2 million in October 2020 to US$78.1 million in

October 2021, an almost 37% increase.

Brazilian furniture exports growing

Brazil's main trading partner is the US but other markets

are also gaining in importance as opportunities for

Brazilian furniture exports in different parts of the world

expand.

In the first nine months of 2021 there was a 59% increase

in the value of furniture exports compared to the same

period in 2020. In September 2021 Brazil exported

furniture worth around US$79.6 million (FOB). All

segments showed increased exports.

The main importing countries of wooden furniture in

September were the United States followed by Chile and

the United Kingdom. Other countries such as Paraguay

and Panama, among other countries, have been attracting

the exporters attention.

See:

http://www.megamoveleiros.com.br/author/admin/

In related news, overall timber exports are on the rise. In

the first six months of the year exports were 86% of the

full year 2020 totalling 1.18 million tonnes to AgroExport.

The Santa Catarina State Association of Forestry

Companies has indicated that the expectation is that in the

second half of 2021 the average of the first half will be

maintained. Positive numbers are expected to remain until

the end of the year. A slight reduction in exports may be

caused as the price of freight remains high and shipping

containers are not readily available.

As inflation rises and the currency slips against the US

dollar there have been increases in the cost of inputs for

the industry such as for wood, paint, glue and also basic

inputs such as electricity, diesel oil and others.

The timber industry in the State is doing its best to get

around these problems. Major companies are getting

organised and together, they are carrying out the reverse

logistics of containers. In other words to fulfill the preestablished

contracts they are paying the freight for

containers to come empty.

The Paranaguá Container Terminal (TCP) is used for

exporting wood products and has a strategy to help its

customers with this problem offering customers the option

to export in break-bulk which offers a huge saving in

freight costs. The freight in this operating model is

approximately US$ 40/cu.m cheaper than the container

said the TCP.

Between January and August 2021, the terminal exported

23,118 containers, an increase of 3% over the same period

in 2020. Since the beginning of the year, TCP have

exported 25,262 units to date.

See:

https://www.portosenavios.com.br/noticias/portos-elogistica/exportacao-de-madeira-cresce-no-brasil

9. PERU

Exports to recover to pre-pandemic

levels by the end

of 2021

Peru’s wood product exports for the third quarter of this

year totalled US$86 million, 35% more than the same

period in 2020 but still far from the more than US$100

million in 2019. However, the Association of Exporters

(ADEX) and ComexPerú are projecting that that this year's

timber exports may exceed pre-pandemic levels.

Rafael Zacnich, Manager of Economic Studies at

ComexPerú, pointed out that this year wood product

export earnings could reach the levels of 2019 however, he

indicated that this does not mean a sign of recovery in

general but more evidence of the declining trend in export

earnings since the US$230 million in 2008.

He explained that the country has around 73 million

hectares of forests but with only a little more than one

million ha. certified and the risk of deforestation persists.

Against this background he commented that one of the

most critical problems is the lack of forest supervision and

control since the State allocates barely US$3.2 million

annually for that work but that the budget is often

underspent.

Erick Fisher, president of ADEX, noted that 95% of

deforestation in Peru is due to illegal logging by

subsistence farmers in the Amazon. He urged a greater

development of the ‘formal’ wood industry so that the

country can implement sustainable policies in forestry.

SERFOR roadmap to strengthen forest management

In order to strengthen strategic alliances with the Loreto

Regional Government the Executive Director of the

National Forest and Wildlife Service (SERFOR), Levin

Rojas, held a working meeting with the Regional

Governor of Loreto. The meeting focused on reducing the

gaps in the sustainable use of forest and fauna resources in

the region, identifying opportunities for improvements that

can lead to action.

Levin Rojas presented the KFW Forestry Programme

which will provide support to strengthen the capacities of

technical teams and users of forestry and wildlife services

as well as promoting greater investment in forestry

projects and review of goals to promote sustainable forest

production in the natural forests of Loreto.

International public tender for the

‘Program for the

Promotion and Sustainable Management of Forest

Production in Peru’

On 24 November 2021 a prequalification notice was

posted for an International and Open Public Service to

contract Technical Assistance Services to Support the

Implementation of the Program for the Promotion and

Sustainable Management of Forest Production in Peru.

For details see:

https://www.gtai.de/gtaien/trade/tenders/peru/consulting-services-sustainablemanagement-of-forest-production--759616