4.

INDONESIA

Indonesian economy records growth

During a press conference on the Indonesian State Budget

Finance Minister, Sri Mulyani Indrawati, said economic

growth up to the third quarter of 2021 was 3.1%

approaching the government’s forecast of 3.7% to 4.5%

for the year.

SVLK promotion needs to be intensified

Indroyono Soesilo, chairman of the Association of

Indonesian Forest Concessionaires (APHI), said intensive

promotion is needed to encourage global market

acceptance of the Timber Legality Verification System

(SVLK) applied in Indonesia.

He said that Indonesia had proposed Ambassador Yuri O.

Thamrin as Executive Director of the International

Tropical Timber Organization (ITTO) which, he added

can contribute to the promotion of sustainable wood

products such those from Indonesia.

See:

https://www.antaranews.com/berita/2505549/aphi-promosiperlu-digencarkan-untuk-mendorong-keberterimaan-svlk

Indonesia exports more to US and China than EU

The Indonesian Ambassador to the European Union, Andri

Hadi, said demand for Indonesian wood products in the

European Union is less than that to the United States and

China even though Indonesia has adopted the Forest Law

Enforcement Governance and Trade (FLEGT) scheme

which aims to promote Indonesian products in the EU.

According to him Article 13 of the VPA between

Indonesia and the EU which regulates market incentives

has not been implemented by a number of EU member

states.

In response Patrick Child, speaking for the European

Commission, said that with the recognition of the Timber

Legality Verification System (SVLK) as a FLEGT license

Indonesian wood products can more easily enter the EU

market but the impact does need to be optimised.

He said the European Union wll continue cooperating with

Indonesia for the benefit of both parties regarding FLEGT

including the issue of applying due diligence on wood

products that do not have a FLEGT license.

See:

https://www.antaranews.com/berita/2505525/produk-kayuri-ke-eu-di-bawah-as-dan-china-meski-ada-skema-flegt

and

https://www.borneonews.co.id/berita/242620-produk-kayu-ri-keuni-eropa-di-bawah-as-dan-china-meski-ada-skema-flegt

In related news, Indonesia has indicated will take action if

the European Union and UK do not consistently apply the

Forest Law Enforcement, Governance and Trade (FLEGT)

regulation.

The Director General of Sustainable Forest Management

of Ministry of Environment and Forestry (KLHK), Agus

Justianto, in a statement at COP26 said "Our SVLK has

obtained a FLEGT license but the European Union is not

consistent in applying the FLEGT license system.

See:

https://www.msn.com/id-id/berita/nasional/dari-cop26-glasgow-dirjen-agus-justianto-uni-eropa-harus-konsisten-atasimplementasi-lisensi-flegt/ar-AAQtRRT?li=AAuZNMP

and

https://m.tribunnews.com/nasional/2021/11/09/dari-cop26-glasgow-dirjen-agus-justianto-uni-eropa-harus-konsisten-atasimplementasi-lisensi-flegt

SLVK a reference for sustainable commodities

The Ministry of Environment and Forestry (KLHK) said

Indonesia's Timber Legality Verification System (SVLK)

could be a reference point in efforts to promote the global

trade in certified sustainable commodities.

The Director General of Sustainable Forest Management

at the Ministry of Environment and Forestry, Agus

Justianto, said an accountable verification system that

involves multi-stakeholders along with incentives are an

option to promote trade in agricultural commodities under

the Forest, Agriculture and Commodity Trade (FACT)

Dialogue scheme.

The FACT Dialogue is a forum for a number of countries

that aims to promote trade in sustainable agricultural,

forestry and commodity products to control deforestation

and protect forests. Indonesia and the UK are co-chairs of

the FACT Dialogue which accommodates the key

producers and consumers of commodities, such as beef,

soybeans and palm oil.

Simon Sharpe, Senior Adviser - Forest Governance,

Markets and Climate (FGMC) Programme Department for

Environment Food and Rural Affairs (DEFRA) UK, is

reported to have said based on the experience of FLEGT

and SVLK Indonesia market acceptance of certified

sustainable products is still low.

See:

https://www.antaranews.com/berita/2511849/klhk-slvk-jadirujukan-bagi-promosi-komoditas-bersertifikat-lestari

and

https://investor.id/business/270187/promosi-komoditas-lestaribisa-tiru-svlk-indonesia

Innovative and sustainable Lightwood – opportunities

in international markets

Setyo Wisnu Broto, chairman of the Indonesian

Lightwood Association (ILWA) has reported export

demand for wood commodities began to increase in line

with the recovery of the global economy. He said that at

the beginning of the pandemic demand for wood in export

markets fell by around 70% compared pre- pandemic

levels.

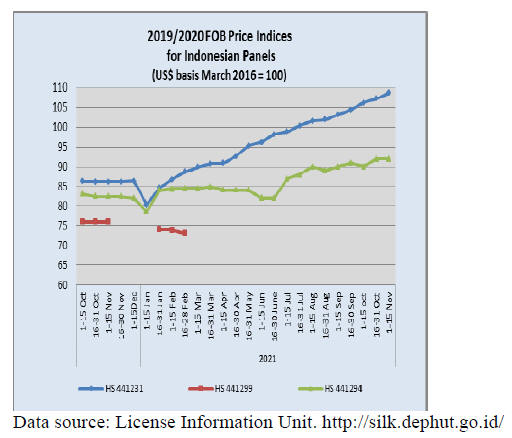

He said demand for plywood products to the United States

is currently very strong and demand in the EU markets is

also starting to rise.

However, currently exporters are facing problems due to

the scarcity of containers for shipping lightwood to some

countries. Break-bulk shipping has been tried but this is

only successful in the US said the ILWA chairman.

https://surakarta.suara.com/read/2021/11/02/201334/pandemi-covid-19-yang-berangsur-membaik-berdampak-positifke-pasar-kayu-ringan?page=2

In related news the Director General of National Export

Development, Didi Sumedi, said the Ministry of Trade is

committed to support the production and innovative

marketing of sustainable lightwood products. Through the

lightwood trade Indonesia can change its image from a

tropical wood producer to an innovative and sustainable

timber producer.

Didi gave five reasons why Indonesia's lightwood offers a

great opportunity.

First, through the SVLK, Indonesia is the only

country with the timber legality verification

system accepted by the EU FLEGT which makes

Indonesian light wood products more attractive to

consumers in European countries.

Second, the Indonesian timber industry has

moved from natural forest harvesting to

plantations.

Third, Indonesia has pioneer companies that are

able to produce innovative light wood products.

Fourth, light wood production supports the rural

economy through providing employment and

lightwood growing and sales.

Fifth, sengon and jabon (lightwood species) can

grow quickly and can be harvested within five

years.

The development of lightwood has received a boost

through cooperation between three international

organisations namely the Swiss Import Promotion

Program (SIPPO) and Fairventures Worldwide and the

German Import Promotion Program (IPD) which will

assist with the development of lightwood growing and

product development.

See:

https://pressrelease.kontan.co.id/release/kemendag-5-faktorjadikan-indonesia-lokomotif-kayu-ringaninovatif-berkelanjutandi-pasar-global?page=2

Carbon trading regulation adopted

Indonesia has passed a much-anticipated regulation that

sets a price on carbon emissions and creates a mechanism

to trade carbon. Details of Indonesia's regulation are not

yet available but based on its draft companies will be

allowed to sell carbon units if they comply with the

reporting and recording procedures for inclusion under the

Environment and Forestry Ministry's national registry.

Carbon trading will be done through a bourse in Indonesia

and levies will be charged on transactions.

See:

https://nasional.kontan.co.id/news/pemerintah-klaimcarbon-pricing-dan-pajak-karbon-bisa-tingkatkan-investasi

5.

MYANMAR

Security Council Press Statement on

Myanmar

The UN Security Council issued a press statement which

says “The members of the Security Council expressed

deep concern at further recent violence across

Myanmar. They called for an immediate cessation of

violence and to ensure the safety of civilians. The

members of the Security Council underlined the

importance of steps to improve the health and

humanitarian situation in Myanmar, including to facilitate

the equitable, safe and unhindered delivery and

distribution of COVID-19 vaccines.

They called for full, safe and unhindered humanitarian

access to all people in need, and for the full protection,

safety and security of humanitarian and medical

personnel. They underlined that vaccines should be

accessible to all and called for greater international

support to ensure the availability of COVID-19 vaccines

and to expedite their roll out.

The members of the Security Council reiterated their full

support for the Association of Southeast Asian Nations’

(ASEAN) positive and constructive role in facilitating a

peaceful solution in the interest of the people of Myanmar

and their livelihoods. The members of the Security

Council reiterated their calls for the swift and full

implementation of ASEAN’s Five Point Consensus”.

See:

https://www.un.org/press/en/2021/sc14697.doc.htm

Foreign Investment

According to the local media the Yangon Region

Investment Committee approved investments by two

foreign enterprises and two domestic businesses in the

manufacturing sector with an estimated capital of US$6.1

million and K8.64 billion respectively. This investment is

expected tp generate over 2,500 jobs.To simplify the

verification of investment projects, the Myanmar

Investment Law allows Regional and state Investment

Committees to grant permission for local and foreign

proposals where the initial investment does not exceed K6

billion (around US$5 million).

Central Bank of Myanmar sells more dollars

The Central Bank of Myanmar (CBM) sold US$294.8

million at its auction rate to authorised dealers in the past

eight months (Feb-Sept) 2021 according to auction

statistics.

In a bid to stabilise the local currency and control market

volatility the CBM reportedly sold about US$6.8 million

on 3 February 2021, US$12 million in April, US$24

million in May, US$12 million in June, US$39 million in

July and US$28 million in August. The current political

situation in the country means people want to hold hard

currency.

In related news after the Central Bank of Myanmar

tightened the dollar exchange rate to between 0.5% of its

reference rate by an order issued on 9 November the dollar

rate against Myanmar Kyat dropped to MMK 1,778 per

dollar.

To further strengthen the Myanmar Kyat against the US

dollar the Central Bank has reduced the margin of the

reference rate to 0.5 % from 0.8 %.The Central Bank of

Myanmar has been pumping hundreds of millions of dollar

to in an efforts to strengthened the value of the Myanmar

Kyat.

See:

https://mmbiztoday.com/dollar-rate-eases-after-centralbank-tightens-reference-rate/

)

Alternate reality -Tourism to reopen

According to the World Travel & Tourism Council in

2019 international tourism contributed about 6% to

Myanmar’s GDP. Last month the Minister for Hotels and

Tourism, Htay Aung, said the administration is finalising

plans to reopening the tourism sector to foreigners early

next year.

This move comes as the pace of COVID-19 infections has

dropped sharply. Htay Aung said although half of the

country’s hotels and guest houses have suspended

operations some 90,000 rooms are still available.

See:

https://www.mizzima.com/article/myanmar-preparescautiously-open-tourists

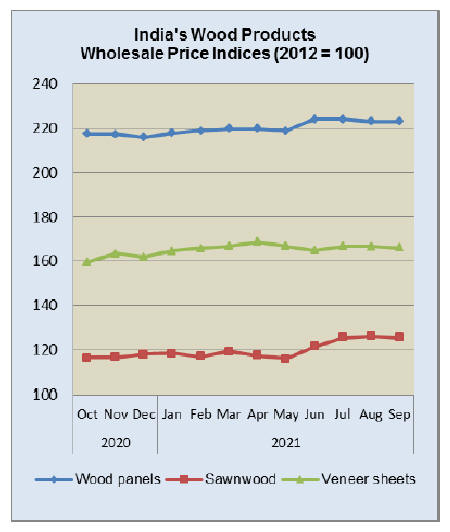

6. INDIA

Wood product price

indices unmoved despite high

inflation

The Ministry of Commerce and Industry has reported the

official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for September 2021 increased to

133.8 from 133.0 in August.

The index for manufactured products which account for

almost 65% of the overall index increased to 136.0 in

September 2021 from 135.9 for August 2021. Out of the

22 groups of manufactured products 17 saw increased

prices; 4 groups witnessed a decline and for two groups

the prices remained unchanged in September 2021 as

compared to August 2021.

The increases in prices were mainly contributed by basic

metals; food products; chemicals and chemical products;

machinery and equipment; motor vehicles, trailers, semitrailers;

and fabricated metals. The price indices for wood

products remained largely unchanged except for a slight

rise in the index for sawnwood.

The annual rate of inflation in September was almost 11%

higher over September 2020. The high rate of inflation in

September 2021 was primarily due to rise in prices of

mineral oils, basic metals, non-food articles, food

products, crude petroleum and natural gas, chemicals and

chemical products.

The press release from the Ministry of Commerce and Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

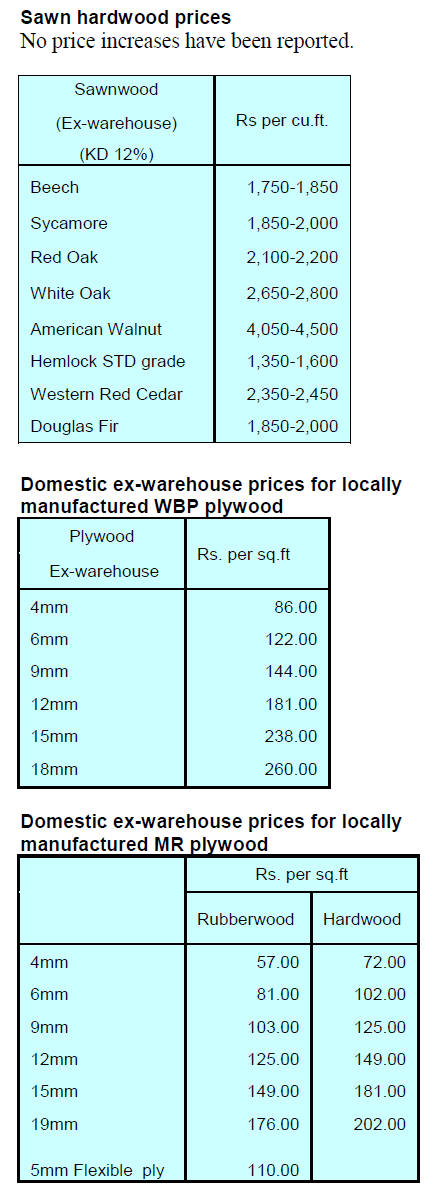

Surging raw material costs

According to Plyreporter wood raw material prices hit an

all-time high in September seriously challenging wood

product manufacturers. Millers report prices for poplar

logs have jumped by around 25% due to supply issues.

Similarly, the price of safeda (Euc.) also increased sharply

in the past six months. Traders say it is unlikely that prices

come down as supplies are limited.

Because of supply issues the industry reports a decline in

capacity utilisation with many smaller units being forced

to stop production. Associations across the country have

warned wholesale prices for finished products will have to

rise.

See:

https://www-plyreporter-com.translate.goog/article/92573/timberprices-cross-1000-big-pain-for-panelproducers?_x_tr_sl=hi&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=nui,sc

Housing developments

According to CBRE South Asia Pvt Ltd’s ‘India Market

Monitor – Q3 2021‘ report because of the combination of

an attractive mortgage regime and government incentives

housing sales jumped nearly 46% quarter on quarter to

50,000 units in the third quarter of 2021 and sales

rebounded significantly by approximately 86% year on

year. There was also a 37% rise in project launches on a

quarter on quarter basis. New launches nearly doubled

y-o-y for the year to September 2021.

See:

https://www.cbre.co.in/en/research-reports/Indiainfographic---India-Market-Monitor-Q3-2021

Uneven recovery – informal private sector still in

trouble

Estimates from the National Statistical Division suggest

the informal (unorganised) private sector in India accounts

for over half of the total value added in the economy and

employs over 80% of the total labour force.

India’s GDP in the first quarter of this year was around 9%

lower than in the same quarter pre-pandemic but high

frequency indicators suggest that parts of the economy

have now recovered to pre Covid levels. However, the

impact of policy changes and the pandemic has been felt

more by the unorganised sector. First there was the shock

to this segment following demonetisation and GST then

came covid.

There is debate on whether the various policy initiatives

led to an increase in the pace of formalisation in the

economy but in the absence of data it is difficult to make a

judgement on this.

See:

https://indianexpress.com/article/opinion/editorials/indiaeconomy-coronavirus-pandemic-mnrega-7607868/

7.

VIETNAM

Covid update

Vietnam had succeeded in keeping the virus under control

for over a year with aggressive contact tracing and

quarantine procedures but has been hit hard by the highly

contagious Delta variant creating a fourth wave of

infections that started in April.

With over 8,000 new COVID-19 cases confirmed mid-

November Vietnam’s total infections rose above 1 million.

This is testing the Vietnamese government’s plan to

reopen the economy.

Highlights of recent trade performance

Vietnam’s W&WP exports to China in October 2021 is

estimated at US$121 million raising the value over the

first 10 months of 2021 to US$1.25 billion, up 25.7%

against the same period in 2020.

Exports of bedroom furniture in October 2021 reached

US$53 million, down 77% compared to October 2020. In

the 10 months of 2021 exports of bed-room furniture

reached US$1.62 billion, up just 1.3% over the same

period in 2020.

According to statistics from Vietnam General Department

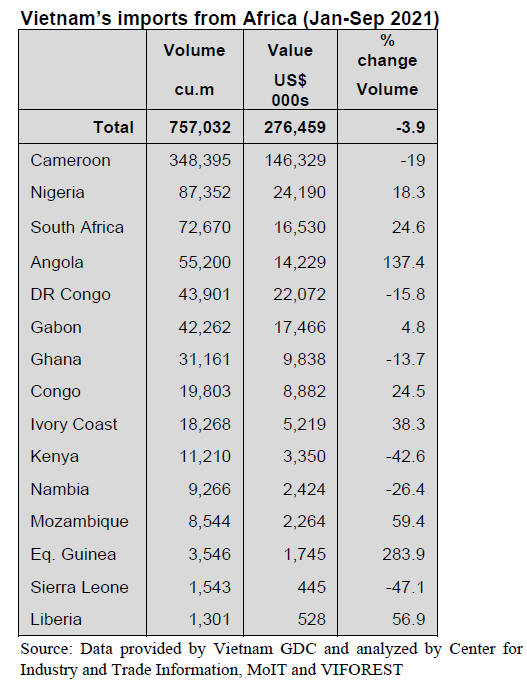

of Customs imports of logs from Africa in September

2021 reached 67,870 cu.m worth US$25.29 million, down

23.4% in volume and 23% in value compared to August

2021 and down 16% in volume and 16% in value

compared to September 2020.

In the first 9 months of 2021 wood imports from Africa

reached 757,030 cu.m at a value of US$276.46 million,

down 3.9% in volume and 2.2% in value compared to the

same period in 2020.

Declining imports of tali

Vietnam's imports of tali in October 2021 are estimated at

24,600 cu.m equivalent to US$10.3 million, up 11% in

volume and 11% in value compared to September 2021.

Compared to October 2020, it decreased by 35.7% in

volume and 32% in value.

In general, in 10 months of 2021, the imports of tali wood

are estimated at 321,000 cu.m, worth US$133.2 million,

down 8% in volume and 3% in value compared to the

same period in 2020.

In September 2021 Vietnam imported 22,200 cu.m, worth

US$9.3 million, down 38% in volume and 38% in value

compared to August 2021. Compared to September 2020

importst decreased by 24%in volume and 21% in value.

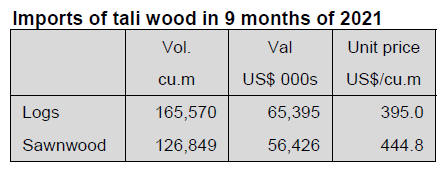

In the first 9 months of 2021, imports of tali reached

296,300 cu.m, worth US$122.9 million, down 2.5% in

volume and 3.7% in value over the same period in 2020.

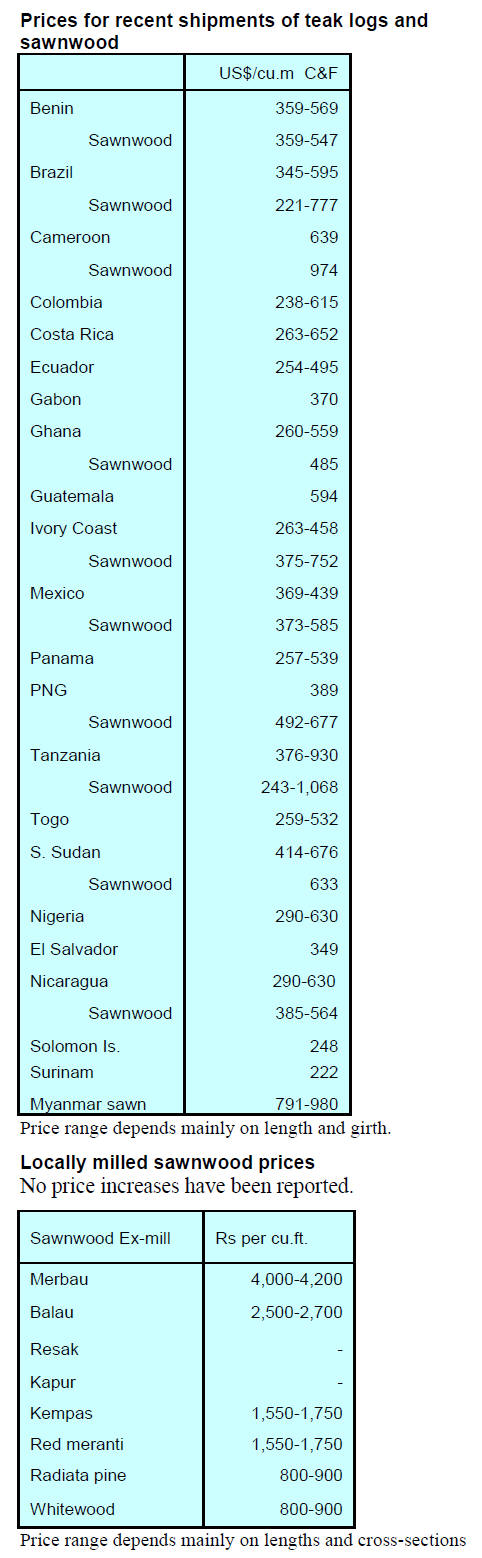

Price of imported tali

The CIF price of tali sawn wood imported into Vietnam in

September 2021 averaged US$419.7/cu.m, up 1.2%

compared to August 2021 and up 4% compared to

September 2020.

In the first 9 months of 2021 the mean import price

reached US$414.7/cu.m, up 6.4% over the same period in

2020.

In the first 9 months of 2021, imports of tali logs into

Vietnam amounted to 165,600 cu.m, worth US$65.4

million a year-on-year decline of 10% in volume and 3%

in value.

Imports of tali sawn wood reached 126,800 cu.m worth

US$56.4 million, up 12% in volume and 13% in value

over the same period in 2020.

Suppliers

In the first 9 months of 2021, Vietnam's imports of tali

from Cameroon, Congo, China, Thailand decreased

compared to the same period in 2020, while imports from

Gabon, Nigeria, Hong Kong, Laos and Cambodia

increased.

Imports of tali from Cameroon decreased by 10% in

volume and 2% in value compared to the same period in

2020, reaching 204,300 cu.m, worth US$85 million,

accounting for 69% of total imports of this wood.

Imports of tali from Congo dropped by 19% in volume

and 10% in value compared to the same period in 2020,

reaching 19,400 cu.m, worth US$10 million.

Imports from China decreased by 8.4% in volume and 6%

in value compared to the same period in 2020, reaching

7,400 cu.m, worth US$2.4 million. In addition, imports of

tali from some other markets decreased against the same

period in 2020, such as from Thailand (-27%); UAE (-

47%); Libya (-29%); Switzerland (-58%) in volume.

In contrast, imports of tali from Gabon increased by 29%

in volume and 18% in value over the same period in 2020,

reaching 27,500 cu.m, worth US$11.8 million, accounting

for 9.3% of total imports.

In addition, imports of tali wood from some other suplliers

increased sharply year-on-year in volume such as Nigeria

(+259%); Hong Kong (+299%); Laos (+297%); Cambodia

(+254%); Colombia (+39%); Angola (+75%); Kenya

(+886%).

Vietnam's wood imports from Africa declined

According to statistics provided by the Vietnam General

Department of Customs imports of wood raw materials

from Africa in September 2021 reached 67,870 cu.m with

a value of US$25.29 million, down 23% in volume and

23% in value compared to August 2021 and by 16% in

volume and 16% in value compared to September 2020.

In the first 9 months of 2021 wood imports from Africa

reached 757,030 cu.m with a value of US$276,46 million,

down 4% in volume and 2% in value over the same period

in 2020.

Wood imports from African shippers are still associated

with risks of illegality. TRAFFIC and the Vietnam

Administration of Forestry provided Customs and Forest

Protection officials with the most up-to-date information

and identification skills through a series of training

sessions and a comprehensive guidance manual.

See:

https://www.traffic.org/news/vietnamese-authoritiesteamed-up-with-traffic-to-tackle-destructive-illegal-trade-ofafrican-timber-species/

African suppliers

In September 2021 imports of wood from various sources

in Africa dropped sharply compared to August 2021 and

September 2020.

Cameroon remained the top supplier of wood raw

materials to Vietnam in September 2021 reaching 29,240

cu.m at a value of US$12.75 million, down 39% in volume

and 35% in value compared to August 2021 and decreased

by 35% in volume and 33% in value compared to

September 2020.

In the first 9 months of 2021 wood imports from

Cameroon amounted to 348,400 cu.m at a value of

US$146,33 million, down 19% in volume and 13% in

value compared to the same period in 2020.

In contrast to the above-mentioned suppliers imports of

wood from Angola in September 2021 reached 6,760 cu.m

at a value of US$2,11 million, up 354% in volume and

434% in value compared to August. In the first 9 months

of 2021 wood imports from Angola reached 55,200 cu.m

at a value of US$14,23 million, up by 137% in volume and

191% in value over the same period in 2020.

Log imports from Africa

In September 2021 imports of logs from Africa to Vietnam

reached 44,630 cu.m worth US$16.97 million, down 25%

in volume and 23% in value compared to August 2021 and

down 15% in volume and 8.5% in value compared to

September 2020.

In the first 9 months of 2021 log imports from Africa

reached 443,860 cu.m, worth US$62.20 million, down

13% in volume and 9% in value compared to the same

period in 2020.

In the first 9 months of 2021, imports of tali log reached

158,790 cu.m at a value of US$62,45 million, down 15%

in volume and 8% in value compared to the same period in

2020.

Sawnwood imports from Africa

In September 2021 sawnwood imports from Africa

accounted for 23,000 cu.m with a value of US$8,03

million, down 21% in volume and 26% in value compared

to August 2021 and down 20% in volume and 29% in

value compared to September 2020.

In the first 9 months of 2021, sawnwood imports from

Africa reached 311,580 cu.m worth US$113,19 million, an

increase of 11.3% in volume and 9% in value compared to

the same period in 2020.

In September 2021, imports of sawn tali from Africa

decreased sharply compared to August 2021 and

September 2020.

However, in the first 9 months of this year imports of

sawn tali increased by 16% in volume and 16% in value

compared to the same period in 2020 reaching 108,650

cu.m with the value of US$48,73 million.

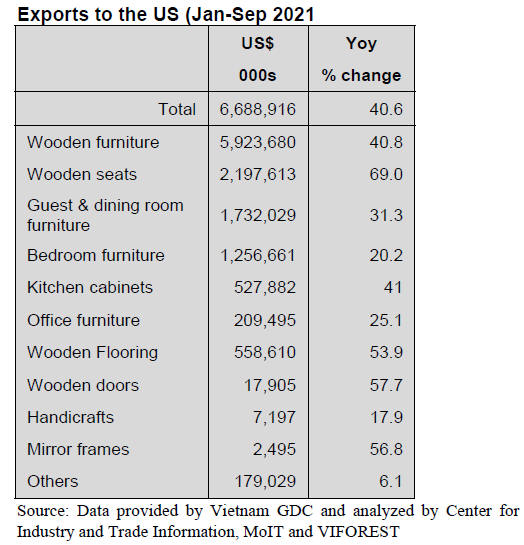

Year end rise in exports to US expected

In spite of the pandemic Vietnam’s W&WP exports to the

US in October 2021 reached US$400 million, up 14%

compared to September 2021 but down 51% compared to

October 2020.

In general, over the first 10 months of 2021 the W&WP

exports to the US amounted to US$7.1 billion, up 27%

over the same period in 2020.

For the US market wooden furniture accounted for almost

90% of the total export earnings in the first 9 months of

2021 (US$5.9 billion, up 41% over the same period in

2020).

Despite the pandemic most categories of wooden

furniture recorded gains in the first nine months of 2021.

Exports of wooden seats generated US$2.2 billion, up

69% over the same period in 2020 followed by guest and

diningroom furniture at US$1.7 billion, up 31%; bedroom

furniture at US$1.3 billion, up 20%.

Vietnam's W&WP exports to the US have declined in

the

past 3 months due to the impact of the Covid-19

pandemic. From October 2021, however wood product

exports gradually recovered.

In the last 2 months of 2021 W&WP exports are expected

to surge to meet the high demand in the US.

In the first 8 months of 2021 imports of wooden furniture

into the US from all sources reached US$16,9 billion, up

54% against the same period in 2020.

Vietnam has emerged as the largest supplier of wooden

furniture to the US shipping goods worth US$6.8 billion,

up 73% over the same period in 2020 and contributing

41% of the total value of wooden furniture imported into

the US.

Wooden seats, guest-room, dining-room and bed-room

furniture are the top wooden products Vietnam has been

exporting to US.

With the agreement of the two governments to end the

USTR investigation of Vietnam’s wood imports exports of

wooden furniture made in Vietnam to the US are expected

to increase in the years to come.

See:

https://en.vietnamplus.vn/good-prospects-for-wood-sectorsrecovery-experts/210061.vnp

8. BRAZIL

Cooperation to combat Amazon

deforestation

The National Council for the Amazon aims to coordinate

the government's actions to combat deforestation and fires

in the Amazon Region. At a meeting of the Amazon

Cooperation Treaty Organization (ACTO) the Amazon

Council emphasised that monitoring systems and decisionmaking

support are being improved in addition to the

strengthening of environmental and land regulariation

programmes.

It was also pointed out that in order to fight against

environmental crimes there was improvement in

monitoring systems, new inspectors were hired for

environmental control agencies and there was increased

engagement of public security forces such as the Federal

Police and the National Force. These measures aim to

reverse the course of rising deforestation observed in early

2021.

The Amazon Council restated its commitment to making

ACTO the reference organisation in matters of regional

cooperation, political dialogue on issues on the

international agenda relating to the Amazon.

See:

https://agenciabrasil.ebc.com.br/en/geral/noticia/2021-11/cop26-brazil-supports-intl-declaration-forest-protection

Furniture sector presents good results

Furniture production in Brazil grew 7% in August 2021

(37.6 million pieces) compared to the number produced in

July when the growth was already 9% higher compared to

June. On the other hand, apparent domestic consumption

was 36.2 million pieces in August 2021, an increase of 7%

compared to the previous month. Between January and

August 2021 there was a growth of 9% compared to the

same period of the previous year.

In terms of value the furniture industry earned around

R$8.2 billion in August representing an increase of 9%

over the previous month. For the year to August the

increase was 42%. The average production cost of

furniture was R$219 per piece in August, an increase of

2% over July and 14% for the year to August.

Behind the increased production cost was scarcity of

inputs, rising logistics costs, exchange rates and inflation.

See:

http://www.megamoveleiros.com.br/producao-de-moveisem-agosto-apresentou-volume-similar-aos-bons-numeros-dejaneiro-de-2021/

App will help identify illegal timber logged in Brazil

An app called “Madeira de Lei“ (hardwood) has been

designed to help control and preventthe illegal trade of

high-value timber from the Amazon Region which

currently represent around 13% of Brazilian exports

according to the Federal Police.

The app, which will be used by police officers in Brazil

and abroad, will help the identification of exported timber

allowing the cross-checking of the wood sample with a

database created by the Federal Police. The system relies

on photographic images.

The Federal Police say that illegally harvested or traded

timber identified by the app will not be returned to Brazil.

From now on it will be possible to hold the importer of

illegal timber responsible in the courts of importing

country.

The launch of the “Madeira de Lei” Project was held in

Brasília where diplomats and police officers from several

countries, including the USA, France, Netherlands,

Belgium, Germany, Italy, China, Portugal and also the

United Kingdom participated.

Brazil signs the Forest Deal at COP26

Along with more than one hundred countries Brazil signed

the ‘Forest Deal’ an agreement that intends to eliminate

deforestation in the world by 2030. The agreement is

considered one of the most important within the context of

the 2021 United Nations Conference on Climate Change

(COP26).

Also, Brazil will attempt to achieve zero illegal

deforestation in the country by 2028-30. The plan put

forward by Brazil involves a steady controlled reduction in

forest destruction by 15% per year between 2022 and 2024

increasing to 40% between 2025 and 2026 until reaching

zero deforestation in 2028.

See:

https://www.bbc.com/news/science-environment-59088498

9. PERU

Growth forecast raised again

During a seminar organised by Universidad del Pacifico

the Central Reserve Bank (BCR) Governor, Julio Velarde,

projected that the Peruvian economy would grow around

13% year on year this year thanks to the policies

implemented for a rapid recovery of the country's

production sectors adding "If the production level reached

in August is maintained economic growth this year would

be impressive".

The previous growth projection by the Central Reserve

Bank was 11.9% after having raised it in September from

a level of 10.7%.

See:

https://andina.pe/ingles/noticia-peru-2021-gdp-growthforecast-raised-to-132-869112.aspx

Valuing forests

At a forum “Wood and finishes for sustainability in

construction” organised by the Association of Exporters

(ADEX), the Commission for the Promotion of Exports

and Tourism (PromPerú) and WWF Peru the president of

the Association of Exporters (ADEX), Erik Fischer

Llanos, said the Amazon is an infinite resource of which

the most abundant is wood and that advantage should be

used in a responsible and sustainable way.

The Ambassador of the European Union in Peru, Gaspar

Frontini, commented that in order to take advantage of the

enormous potential of the Peruvian Amazon all the

opportunities for development and social inclusion offered

by the forestry sector must be valued taking account of

sustainable and responsible management of timber

resources so as to avoiding their degradation. For this

reason, he considered it necessary to promote the

sustainable management of wood. However, he was

concerned about the high degree of deforestation.

The Director of PromPerú's Export Promotion Directorate,

Mario Ocharan, highlighted the responsible operations

conducted by ‘formal’ companies in Peru.

Egypt - a potential market for construction products

During a virtual forum "Profile of the construction

materials market in Egypt" Giancarlo Pedraza Ruiz Head

of the consular section of the Peruvian embassy in Egypt

said development of large-scale infrastructure and

numerous urban projects in a population of 105 million

drive the growth of the construction sector in Egypt which

constitutes a great commercial opportunity for Peru’s

wood product exporters.

Products made with Peruvian wood, which are

characterisd by their high quality, durability and optimal

presentation –and environmental certificates would have

an opportunity in Egypt, however, the president of the

ADEX Wood and Wood Industries Committee, Enrique

Toledo Gonzales-Polar, pointed out the importance of

reducing tariff barriers.

Boosting the forestry sector depends on sticking with

forestry legislation

The statement above was the opinion of Javier Rivera,

General Manager of the main reforestation company in the

country. He added the authorities need to understand the

long term nature of planation investments. He said current

government regulations do not encourage reforestation

because such investments will only yield a return in more

than 14 years for exotic species and more than 30 years for

native species (such as cedar and mahogany).

He proposed investors be assured of legal security for 30

to 40 years without which investments by the private

sector will be small.