4.

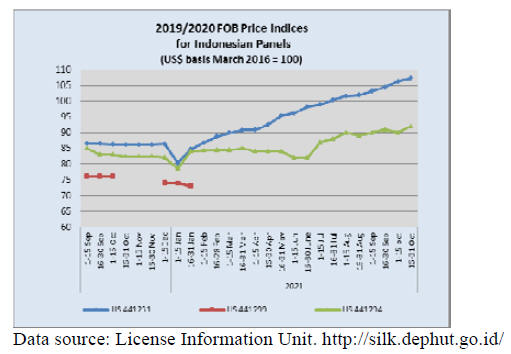

INDONESIA

Business Forum at Expo 2020

The Ministry of Environment and Forestry (KLHK) held a

business forum "Investment and the Development of

Forestry Multi-Businesses in Indonesia" and "The

Potential and Opportunities for Investment in Trading of

Forestry Products" in Dubai.

The Director General of Sustainable Forest Management,

KLHK, Agus Justianto, said that this business forum was

expected to open up opportunities and increase interest in

the Indonesian forestry and timber sectors. Agus said that

the government is expecting a 2% increase in export

earnings from the two sectors this year.

At the two events the Ministry of Environment and

Forestry introduced 12 types of Indonesian tropical woods

for export including benuang (Octomeles sumatrana Miq),

bintangur (Calophyllum spp), duabanga (Duabanga

moluccana), jabon (Antochepalus spp), matoa (Pometia

pinnata), nyatoh (Palaquium spp), nyawai (Ficus variegata

Blume), resak (Vatica spp), samama (Anthocephalus

macrophyllus), sindur (Sindora spp), gerogong and

medang (Litsea firma).

See:

https://infopublik.id/kategori/nasional-ekonomibisnis/573051/indonesia-buka-peluang-pasar-produk-kehutanandi-expo-2020-dubai

Furniture SMEs assisted with marketing to the UAE

Small and medium enterprises (SMEs) assisted by the

Ministry of Trade are participating in an Export Coaching

Programme and one SME from Semarang, Central Java

has successfully expanding furniture exports to the United

Arab Emirates (UAE).

The Director General of National Export Development at

the Ministry of Trade, Didi Sumedi, said in a statement

"Despite facing restrictions due to the ongoing pandemic,

the number of new export players is increasing. We

congratulate this company for successfully exporting to

the United Arab Emirates”. The UAE is a non-traditional

market for Indonesia but can be important as it is a hub to

enter other Middle East regions.

See:

https://www.antaranews.com/berita/2462557/ukm-binaankemendag-perluas-pasar-ekspor-furnitur-ke-uni-emirat-arab

Furniture and Craft SMEs encouraged to export

Chairman of the Indonesian Furniture and Craft Industry

Association (HIMKI), Abdul Sobur, said the Association

supports furniture and craft SMEs with exporting

emphasizing that the export market is not only for large

companies but can also be penetrated by the furniture and

craft SMEs.

He added that Indonesia has abundant raw materials for

the manufacture of wood products along with many skilled

craftsmen so this industry can become a formidable

exporter.

See:https://www.medcom.id/ekonomi/bisnis/9K5QLMPK-ukmmebel-dan-kerajinan-digenjot-tembus-pasar-ekspor

Businesses committed to sustainable peat

management

Forestry and plantation businesses in Indonesia are

committed to implementing best practices by applying

research and development results to ensure that peatlands

can be managed sustainably. Chairman of the Association

of Indonesian Forest Concessionaires (APHI) Indroyono

Soesilo said the challenges faced in peat management

include water and carbon stocks, subsidence and fire

prevention.

According to Indroyono the application of best practices

for peat management is expected to support the

availability of wood raw materials to supply the industries

in the country.

See:

https://industri.kontan.co.id/news/pengusaha-hutan-klaimmanfaatkan-hasil-litbang-untuk-kelola-lahan-gambut

Economic recovery continues

Indonesia's exports as of September 2021 reached

US$20.60 billion, according to Statistics Indonesia (BPS)

data. Meanwhile, the country's imports in September 2021

were valued at $16.23 billion indicating a surplus trade

balance in September 2021 marking the 17th successive

monthly surplus.

However, Indonesia's trade also experienced a deficit with

several countries the largest being with Australia,

US$529.7 million; Thailand, US$346.8 million and

Ukraine, US$247.2 million.

See:

https://en.antaranews.com/news/195673/economicrecovery-in-indonesia-continues-as-optimism-remains-high

5.

MYANMAR

Poverty, unrest and economic crisis

The World Food Programme Myanmar Country Director,

Stephen Anderson, has said the triple impact of poverty,

political unrest and the economic crisis coupled with the

rapidly spreading third wave of covid-19 the people of

Myanmar are “experiencing the most difficult times of

their lives”.

In related news, Noeleen Heyzer a former United Nations

Under-Secretary-General who had a working relationship

with Myanmar’s previous military regime has been

appointed as the new UN Special Envoy for Myanmar.

The 73 year old Singaporean succeeds Christine Schraner

Burgener.

Covid update

As of October 19, a total of more than 16 million COVID-

19 vaccines have been vaccinated in Myanmar, according

to the Ministry of Health. The ministry says 24 million

Sinopharm vaccines have been purchased from China and

12 million people with the ages between 40 and 64 will

receive the vaccine this year. The ministry said it was also

working to increase the number of vaccines available and

to coordinate the purchase of vaccines.

See:

https://elevenmyanmar.com/news/myanmar-receives-over-16-m-jabs-of-covid-19-vaccine-till-oct-19

)

ASEAN annual meeting without Myanmar

The annual ASEAN summit began on 26 October without

a representative from Myanmar after a decision to bar Min

Aung Hlaing from attending. Cambodian Prime Minister

Hun Sen, the next ASEAN chairperson said “Today,

ASEAN did not expel Myanmar from the ASEAN

framework, Myanmar abandoned its right.”

See:

https://www.irrawaddy.com/news/burma/asean-leadersvoice-disappointment-at-myanmar-junta-as-summit-proceedswithout-it.html

)

Myanmar’s border trade

The Ministry of Commerce has reported Myanmar’s trade

with neighbouring countries through land borders reached

over US$135 million in the current financial year to 15

October. Export via border gates amounted to US$60

million while its import were US$75 million. Myawady

was the main border trade point followed by Kawthoung.

According to the Ministry of Commerce the value of

timber traded through land borders was US$2.5 mil. in

2018-19, US$3.93 mil. in 2019-20 and US$4.2 mil. for the

ten months of the 2020-21 year.

See:

https://www.gnlm.com.mm/myanmars-border-tradereaches-over-135-mln-in-mini-budget-year/

)

Adani Ports pulls out

India's Adani Ports has pulled out of a plan to build a

container terminal in Myanmar. Last year Adani won the

bid to build and operate Yangon International Terminal

which it has said is an independent project fully owned

and developed by the company.

See:

https://www.reuters.com/world/india/adani-ports-sayscould-abandon-myanmar-project-if-found-violate-us-sanctions-2021-05-04

of U.S. sanctions.

6. INDIA

Optimistic view on covid situation

A panel of leading scientists appointed by the Indian

government writing in the Indian Journal of Medical

Research said India has rounded the corner as the number

of daily new covid-19 cases has almost halved the past six

weeks. They point to a new mathematical model which

suggests herd immunity has been achieved.

But other scientists say this model overestimates the

number of people infected and warn that with colder

temperatures India may well see a further wave of

infections.

Consumer confidence slowly recovering

Consumer Confidence of Urban Indians improved in

October according to the Refinitiv-Ipsos India Primary

Consumer Sentiment Index (PCSI). Amit Adarkar, CEO of

Ipsos India writes on the company website “Consumer

Confidence has improved in October and notably in the

two key areas of personal finances and investments for the

future.

This augurs well for the festival season as consumers do

not feel strapped for funds to splurge and enjoy the festival

time. Confidence around the economy has seen a minor

uptick and it’s understandable as the economy will take a

longer time to repair and recover, due to the long-term

impact of the pandemic.

Confidence in employment opportunities is, however,

downbeat and thisneeds special focus both by the

goverment and the private sector as improved job outlook

is critical to sustainability of demand.”

See:

https://www.ipsos.com/en-in/consumer-confidence-furtherimproves-october-2021-refinitiv-ipsos-india-pcsi

Rising demand for furniture

A report by Pricewaterhouse in collaboration with IKEA

shows that as the Indian economy recovers from the

impact of COVID-19 furniture demand is rising. In the

five years up to 2019 furniture consumption was growing

close to 10% annually.

This growth was fueled by increasing urbanisation, a large

and young population and expanded middle class with

rising levels of disposable income as well as a strong

hospitality sector. However, the report also points out that

if the furniture sector is to regain its growth momentum

post COVID some serious limitations need to be

addressed.

See:

https://www.cnbctv18.com/business/india-has-potential-oftaking-furniture-exports-from-2-to-20-billion-says-expert-11017162.htm

Changes to GST being discussed

The Ministry of Finance is reportedly convening a panel to

discuss possible changes to the Goods and Services Tax

(GST). India currently taxes good and services produced

in the country at 5%, 12%, 18% and 28%, with some

essentials such as food items attracting the lowest rate and

luxury goods the highest. Wood products generally attract

an 18% GST.

The local media suggest the tax on some items may be

increased and the structure of the GST will be simplified.

See:

https://auto.economictimes.indiatimes.com/news/industry/indiamay-consider-higher-gst-and-fewer-rates/86958521

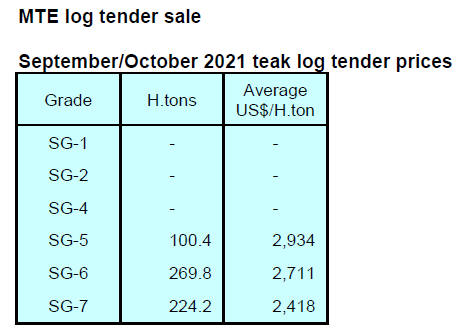

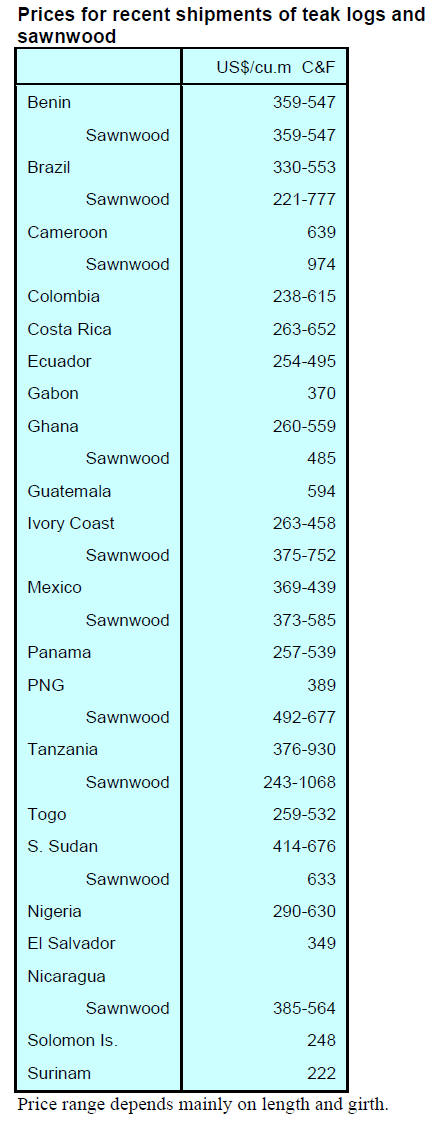

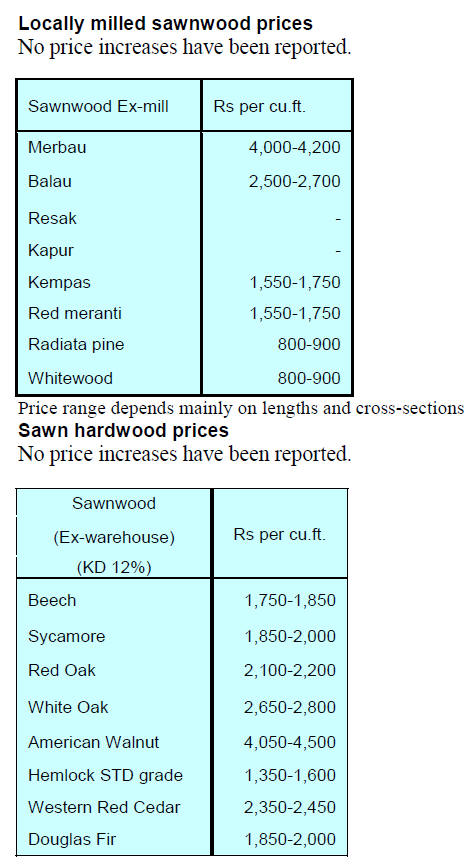

Teak logs and sawnwood

The high cost of ocean freight has caused some teak log

and sawnwood importers to ask producers to delay

shipments.

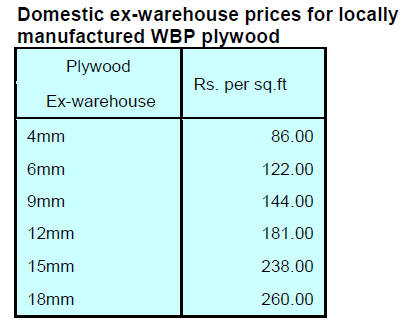

Plywood mills in the North face many

challenges

Plyreporter has a news item describing the situation in the

plywood industries in Northern India. The Plyreporter

article says manufacturers face many challenges such as

rising log prices, a decline in log quality, a slack market

along with poor payment recovery among others.

Industry analysts, says Plyreporter, think the plywood

industry in North will be facing additional challenges as

new capacity in Uttar Pradesh and South India comes on

line.

See:

https://www.plyreporter.com/tag/plywood-industries-innorth-india

7.

VIETNAM

Despite Covid W&WP exports one of the fastest

growing sectors

The latest outbreak of the Covid-19 heavily disrupted

many export-oriented industries of Vietnam, including

wood industry. W&WP exports, therefore, declined in the

last 3 months. However, in the first 9 months of 2021

W&WP exports remained one of the fastest-growing

industries, significantly contributing to the growth rate of

Vietnam’s goods production and exports.

With the pandemic now under control wood processing

enterprises are endeavoring to restore supply chains

effectively capturing market opportunities to boost

production and export of W&WP in the last months of

2021.

The accumulated W&WP exports from the beginning of

the year to October 15, 2021 accounted for US$11.5

million, up 27% over the same period in 2020. In

particular, exports of WP contributed US$8.7 billion, up

26% over the same period in 2020. Vietnam’s W&WP

export turnover of 2021 is forecasted to total at US$14

billion, year-on-year up by 13%.

Latest trade highlights

W&WP exports in the first 15 days of October 2021

reached US$397 million, up 29% compared to the first 15

days of September 2021, but down 33% compared to the

first 15 days of October 2020.

In particular, exports of WP reached US$258 million, up

41% compared to the first 15 days of September 2021 but

down 63% compared to the first 15 days of October 2020.

The accumulated W&WP export from the beginning of the

year to October 15, 2021 reached US$11.5 billion. The

export of high value-added groups of wood products (HS

94) reached US$8.7 billion, up 26% over the same period

in 2020.

W&WP export earnings in the second week of October

reached US$257.9 million, up 28% against the previous

week. WP exports, in particular, recorded at US$152.9

million were up 30% compared to the previous week.

Vietnam's imports of wood raw material in October 2021

are estimated at 462,400 cu.m, worth US$76.2 million, up

4.8% in volume and 5% in value compared to September

2021; compared to October 2020 theyt decreased by 25%

in volume and 4% in value.

In the first 10 months of 2021, imports of raw wood were

estimated at 5.552 million cu.m, worth US$1.872 billion,

up 14% in volume and 28% in value over the same period

in 2020.

Vietnam's export earnings from NTFPs in September 2021

reached US$50.23 million, down 16.5% compared to

August 2021 and down 9% compared to September 2020.

This is the first month when exports of rattan, bamboo and

other types of NTFP decreased over the same period last

year following 15 months of continued increases.

In the first 9 months of 2021, exports of NTFPs reached

US$631.95 million, up 50% over the same period in 2020.

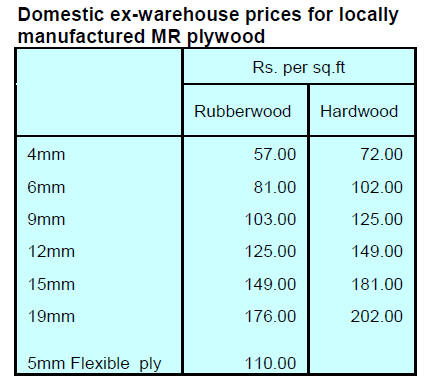

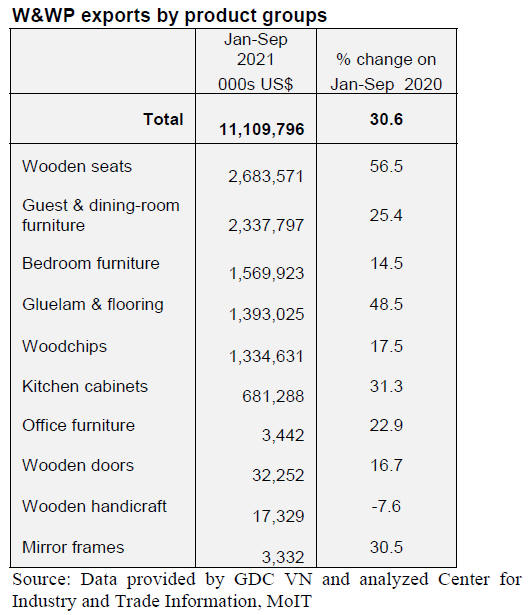

Top W&WP exported

Wooden seats have been topping W&WP groups with the

export revenue of US$2.7 billion, up 56.5% over the same

period in 2020. Next to wooden seats are guest and dining

room furniture at US$2.34 billion, up 25.4%; bedroom

furniture at US$1.57 billion, up 14.5%; glulam and

floorings US$1.4 billion, up 48.5%. See table below.

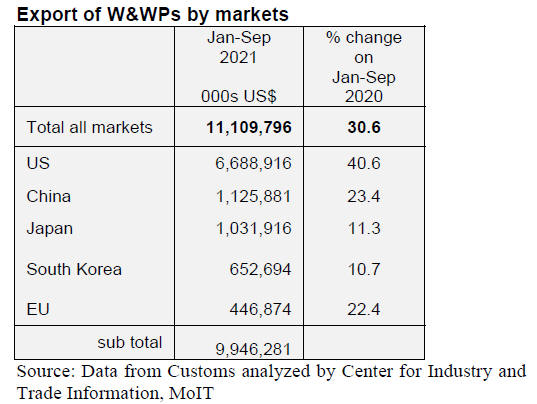

Export markets

In the first 9 months of 2021, the export turnover of

W&WPs still grew positively. The US continued as

leading the markets consuming US$6.7 billion up 41%

over the same period in 2020.

W&WP demand in the US usually increases sharply in the

last months of the year to meet the festive season demand

for wooden furniture and for the completion of

construction and housing projects. Therefore, the rapid

recovery of production is expected to accelerate Vietnam’s

W&WP exports to the US in the last months of 2021.

China was the second largest market taking US$1.1

billion, up 23% over the same period in 2020. The other

main markets are Japan (US$1 billion, up 11%); South

Korea (US$652.7 million, up 11%) and the EU (US$

446.9 million, up 22%).

The UK market is also important role consuming US$99.3

million in the first 9 months of the year and showing yearon-

year growth by 24%. Of great significance is the newly

concluded Vietnam- UK Free Trade Agreement

(UKVFTA) which benefits Vietnam’s W&WP exports to

UK through a zero duty preference.

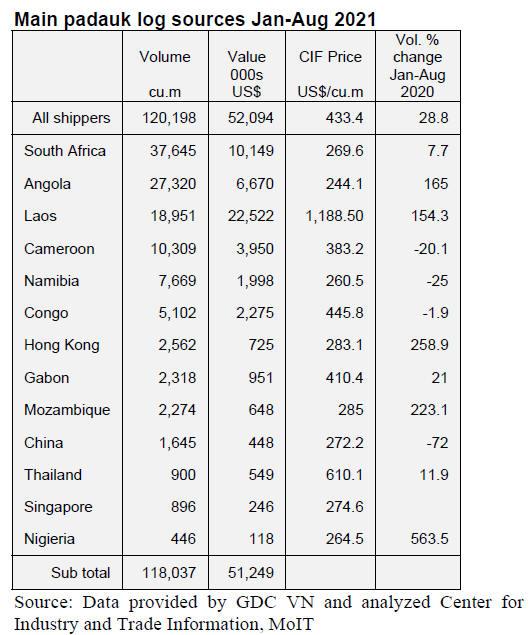

Imports of padauk

According to customs statistics the average price of

padauk logs imported into Vietnam in the first 8 months of

2021 stood at US$433.4/cu.m CIF, up 17% over the same

period in 2020.

In particular the price of padauk logs imported from

Cameroon increased by 15% over the same period in 2020

to US$383.2/cu.m while the price of padauk logs imported

from Congo increased by 12% to US$445.8/cu.m; logs via

Hong Kong rose by 12% and were priced at US$283/cu.m

while Gabon padouk log imports rose 6% and were priced

at US$410.4/cu.m CIF.

In the first 8 months of 2021, the volume of padauk

imported from South Africa, Cambodia, Laos, Hong

Kong, Gabon, Mozambique increased over the same

period in 2020, while imports from Cameroon, Namibia,

Congo etc. dropped.

8. BRAZIL

Timber exported from Mato Grosso from

sustainably

managed forests

A large part of the Amazon is within Mato Grosso State.

Between August 2019 and July 2020 the area logged for

timber purposes in Mato Grosso was equivalent to the sum

of the area logged in the six other states in the Amazon

region. In the state of Mato Grosso there are 3.8 million

hectares under sustainable forest management in cutting

cycles from 25 to 35 years.

The industrial and commercial sector based on harvests

from natural forests in Mato Grosso is at the core the

economy in 44 municipalities generating around 90,000

direct and indirect jobs.

According to International Business Centre of the

Federation of Industries of Mato Grosso State

(CIN/FIEMT) an online platform ComexStat provided by

the Foreign Trade Secretariat (SECEX) sawnwood exports

grew 73% year on year in July this year and were worth

US$1.8 million.

According to Center for Timber Producers and Exporters

of Mato Grosso State (CIPEM) 98% of the timber

exported by the state comes from sustainable forest

management areas.

In related news, IBAMA suspended the issuance of

licenses for transport and storage of tropical timber

(Document of Forest Origin, DOF) for Mato Grosso in

March 2021.

The objective of the suspension was to allow the state

governor to integrate the state systems of forest

monitoring and control with the Federal system

SINAFLOR (National System for the Control of Origin of

Forest Product).

In August 2021 the state Secretariat for the Environmental

in Mato Grosso (SEMA/MT) confirmed that the

integration between the state systems and SINAFLOR was

completed. The next step will be implementation of

verifiable traceability.

Performance of the furniture sector in 2020

According to the Brazilian Furniture Industry Association

(ABIMÓVEL) and the Brazilian Trade and Investment

Promotion Agency (Apex-Brazil) production by the

furniture industry in the country declined slightly (-1.5%)

in 2020 compared to 2019, the most recent data available.

Given the negative effects of the pandemic on production

and trade in the first half of 2020 the data confirms a

significant recovery of the sector in the second half of

2020.

Production by the furniture sector in terms of number of

items suffered a retraction of approximately 7% between

2015 and 2020 caused by the Brazilian economic crisis in

2015/2016. However, over the same period there was a

21% increase in the value of production.

It is estimated that the country saw domestic furniture

consumption of approximately 424 million items in 2020

or, in value terms, around US$13 billion at factory prices.

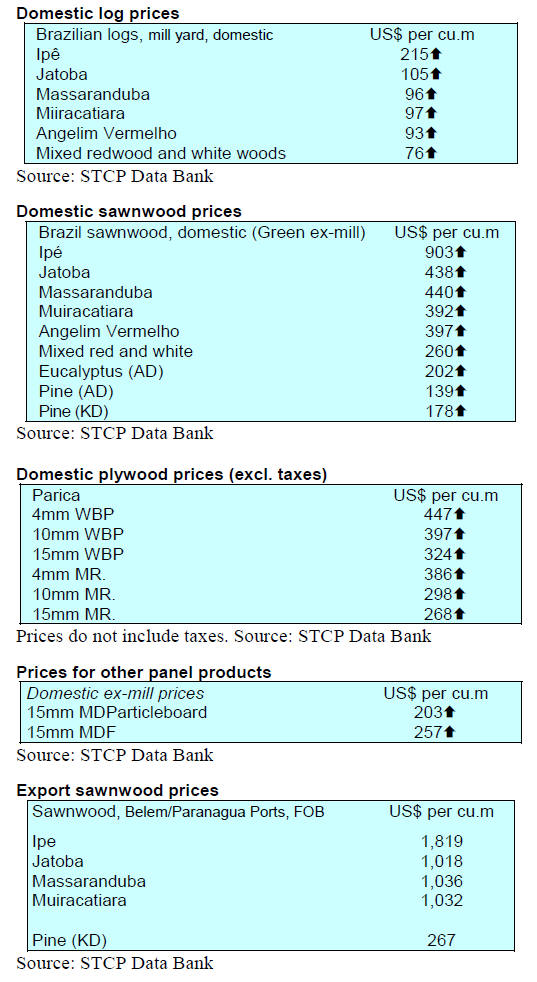

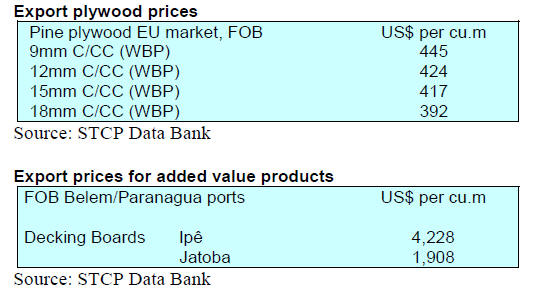

Export update

In September 2021 Brazilian exports of wood-based

products (except pulp and paper) increased 36% in value

compared to September 2020, from US$283.2 million to

US$385.8 million.

Pine sawnwood exports grew 59% in value between

September 2020 (US$51.8 million) and September 2021

(US$82.2 million). In terms of volume exports fell slightly

over the same period, from 293,700 cu.m to 293,100 cu.m.

Tropical sawnwood exports fell 10% in volume from

39,700 cu.m in September 2020 to 35,900 cu.m in

September 2021. In value, exports declined 21% from

US$15.3 million to US$12.1 million, over the same

period.

Pine plywood exports saw a 20% increase in value in

September 2021 compared to September 2020, from

US$65.9 million to US$78.8 million. In volume, exports

dropped 32% over the same period, from 233,500 cu.m to

159,100 cu.m.

As for tropical plywood, exports increased in volume by

48% and in value by 30%, from 6,100 cu.m (US$2.3

million) in September 2020 to 9,000 cu.m (US$5.3

million) in September 2021.

As for wooden furniture exports increased from US$ 51.8

million in September 2020 to US$71.9 million in

September 2021, a 39% growth.

LEAF - funding for conservation

The nine states in the Amazon received approval from the

Ministry of the Environment to join the Lowering

Emissions by Accelerating Forest Finance (LEAF),

coordinated by Emergent, a North American non-profit

organisation. Specifically, the financing is aimed at

reducing deforestation and fires, to eliminate illegal

deforestation and working to a transition to a green

economy.

The State governors are negotiating an initial funding of

R$89 million to adapt the state structures for forest

inspection among other aims. Further funding would be

sought for payment for environmental services, reduced

forest fires, reduced deforestation and lower greenhouse

gas emissions.

See:

https://agenciapara.com.br/noticia/32316/

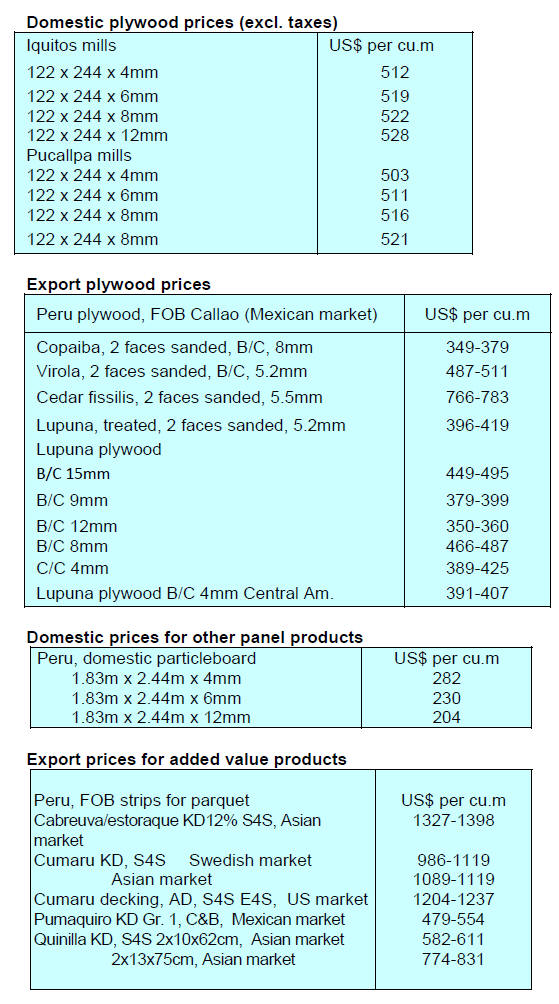

9. PERU

Composite board imports climbing

Peruvian imports of particleboard were valued at

US$112.1 million in the first 9 months of this year, a

record figure and as could be expected, a strong year-onyear

growth.

Ecuador was once again the main provider of composite

boards to Peru in the first nine months of 2021 with

shipments of US$48 million, a notable increase of 73%

(versus US$27.9 million in the same period last year).

Spain was the second ranked supplier at US$25.4 million

and an increase of 86% compared to the same period of

time in 2020.

Brazil, with a growth of 74%, was the third supplier

country with US$15.9 million; Chile followed with

US$14.3 million being the only one among the main

supplier countries that did not increase its exports to Peru

for the period January-September of this year 2021.

Training in forest fire prevention

In October the National Forest and Wildlife Service

(SERFOR) began training regional and local authorities

from Cajamarca, Pasco, Junín, Ucayali and Huánuco on

how to prevent and respond to forest fires. Participants

will develop forest fire prevention using satellite

technology and will promote inter-institutional

coordination for the implementation of strategies.

The project "Prevention and response to forest fires in

tropical forests and forest plantations in Peru" is funded by

the International Tropical Timber Organization (ITTO)

and involves a series of capacity-building events for

various authorities and key representatives of public

institutions and private companies in Cajamarca, Pasco,

Huánuco, Ucayali and Junín.

Strategy to promote forest plantations approved

SERFOR has approved the ‘Strategy for the Promotion of

Commercial Forest Plantations 2021 - 2050’ (EPPFC) the

main objective of which is to increase production and

profitability of commercial forest plantations in the

country.

The strategy includes providing appropriate conditions for

investment, improving production and processing and

marketing. Consideration is also given to the technical and

managerial capacities of those involved.

It is estimated that by 2030 there would be an annual

requirement of 144,116 hectares of land for plantations to

complement the annual production of natural forests and

satisfy domestic demand for wood products.

SERFOR identified that in the Amazon, coast and

mountains there are just over seven million hectares of

potential land for commercial forest plantations. The use

of these areas could generate a significant supply of forest

resources oriented to satisfy the growing national and

international demand and in turn provide jobs and raise the

GDP.

Satellite monitoring to halt deforestation

The Ucayali State authorities are using the ‘Platform for

Satellite Monitoring of Impacts to the Forest Heritage’

developed by SERFOR to monitor and control

deforestation.

SERFOR coordinates efforts with national, regional and

local entities to reduce the impact on the country’s natural

heritage and provides this important satellite monitoring

tool. This satellite tool analyzes information from high

resolution satellite images and has an early warning

system to alert authorities of forest incursions.