Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Oct

2021

Japan Yen 114.26

Reports From Japan

Fully vaccinated residents

expected to top 70% in

October

The government has lifted the state of emergency, the first

time since April that the entire country is not subject to

strict measure to curb the spread of the virus. The lifting

was possible as there has been a steady decline in new

infections easing of the strain on the country's medical

system.

The government plans to ease restrictions in stages to

bring back social and economic activities while also

preventing another wave of infections.

As of mid-October just over 60% of the people in Japan

have received two COVID-19 vaccine shots with 71%

having received their first shot. The proportion of fully

vaccinated residents is expected to top 70% this month.

The government plans to finish administering two vaccine

shots to all willing residents by the end of November and

it plans to begin booster shot for medical workers before

the end of this year.

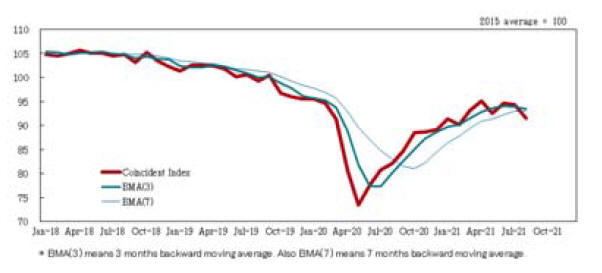

Business conditions worsened in September

The Cabinet Office index of business conditions reflecting

the state of the Japanese economy marked its sharpest fall

in 15 months in September. A government official

reported in the domestic press said that the indices for

industrial output and shipments dropped mainly because of

lower output from the auto industry, the result of a chip

shortage.

The index for retail sales also trended lower as the covid

restrictions stopped people moving around.

Conditions severe says Bank of Japan

Largely because of the drop in car exports the Bank of

Japan (BoJ) downgraded its economic assessments for five

of the country¡¯s nine regions.

In its quarterly Sakura report, the BoJ said the Japanese

economy remains in a ¡°severe¡± situation despite its

recovery trend. This assessment was released before the

state of emergency covering 19 of the country¡¯s 47

prefectures was lifted.

In the BoJ¡¯s Tankan survey for September the index for

current business conditions rose for the fifth straight

quarter at both large manufacturers and large nonmanufacturers.

But the survey also showed that large

manufacturers are cautious about their business conditions.

Medium and samall companies are experiencing extremely

tough conditions.

See:

www.japantimes.co.jp/news/2021/10/07/business/bojregional-downgrade/

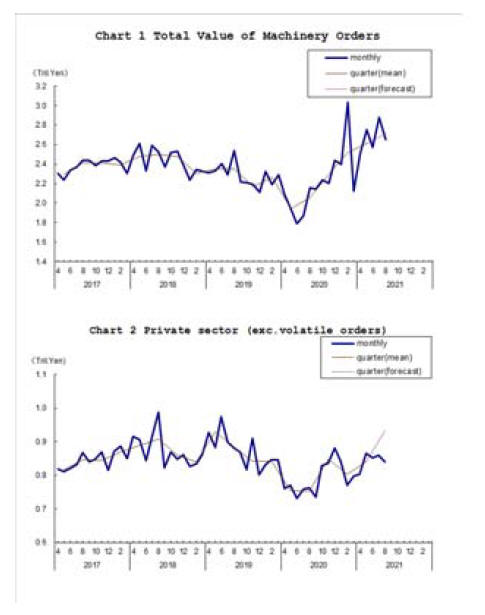

Private sector investment stalls

Private sector machinery orders by Japanese

manufacturerse declined in August from a month earlier.

The Cabinet Office downgraded its assessment for the first

time since February, saying machinery orders, which are

considered a leading indicator of corporate capital

expenditure, showed "signs of stalling in their recovery."

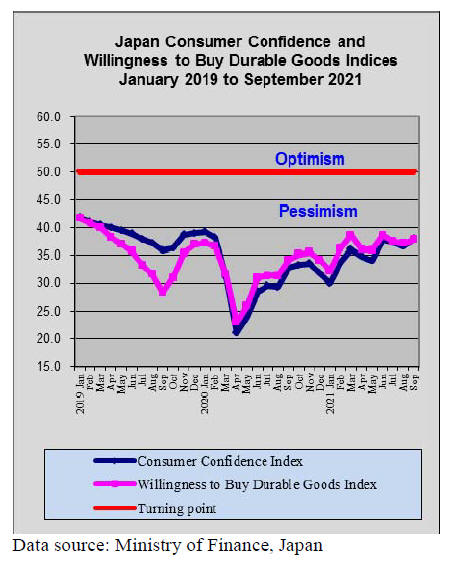

Energy costs rising, another damper on

household

spending

Household spending had been falling more sharply than

expected during the state of emergency and was

particularly impacted by curbs on holiday travel. The 3%

year-on-year decrease in spending in August was worse

than forecast and followed a 0.7% increase in July.

The latest data are a challenge for the new Prime Minister

Fumio Kishida as the country prepares for the late October

general election. Analysts expect consumption to rebound

in the coming months as the state of emergency has been

lifted and progress in the vaccination roll-out lifts people¡¯s

spirits.

Electricity prices in Japan jumped to a nine-month high in

mid-October as prices for oil, natural gas and coal are

starting to impact the cost of power generation. Japan

imports most of its energy needs so higher oil, gas and

coal prices will drive inflation higher.

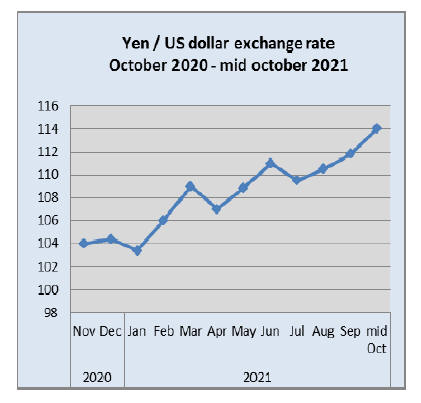

Yen at 3 year low

The yen¡¯s slipped to its lowest level in almost three years

(113.45 to the US dollar) in mid-October. This, along with

rising costs for imported energy could create a big

challenge for the government which hopes to get the

economy moving again. With Brent crude at US$85 a

barrel and rising further yen weakness is likely.

Import update

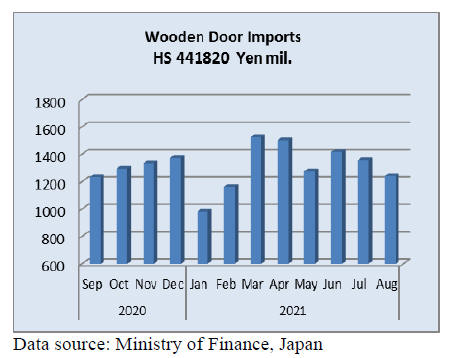

Wooden door Imports (HS441820)

Year on year, August wooden door imports (HS441820)

were 17% higher than in 2020 but still well below the

value of August 2019 imports. August marked the second

consecutive drop in the value of wooden door imports.

Compared to July, the value of August imports was almost

9% down.

China accounted for 61% of Japan¡¯s August 2021 imports

of wooden doors with a further 25% being shipped to

Japan from the Philippines. The only other significant

supplier in August was Malaysia which provided an

additional 3% of the total value of wooden door imports.

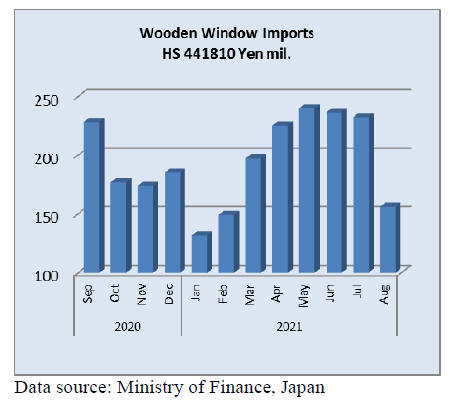

Wooden window imports (HS441810)

Data from the Ministry of Finance shows a dramatic

decline in the value of August imports of wooden

windows (HS441810). If correct August imports dropped

by almost half from a month earlier. The largest decline in

August arrivals was beacause of reduced shipments from

the US (down 90%), the Philippines (down almost 50%)

and China, the largest supplier (down 24%).

If the data is correct then the value of August

imports of

wooden windows was 15% below that in 2020 and sharply

down on the value of August 2019 imports.

Over 90% of Japan¡¯s imports of wooden windows came

from shippers in just three countries, China (54%), the

Philippines (15%) and the US (14%). Shippers in these

three countries continue to dominate Japan¡¯s imports of

wooden windows.

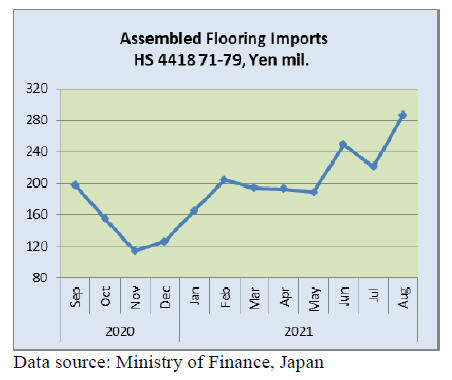

Assembled wooden flooring imports

The dip in the value of assembled flooring (HS441871-79)

in July this year no looks like a blip as imports shot up

again in August exceeding the high reported in June. Year

on year, the value of Japan¡¯s imports of assembled

wooden flooring in August this year rose 62% and they

were well up on the value of August 2019 imports.

As in pevious months imports of HS441875 was the main

category (85%) of assembled flooring imports with 42%

being shipped from China. Shippers in Vietnam continue

to do well accounting for 27% of August 2021 imports.

The other major supplier in August was Thailand.

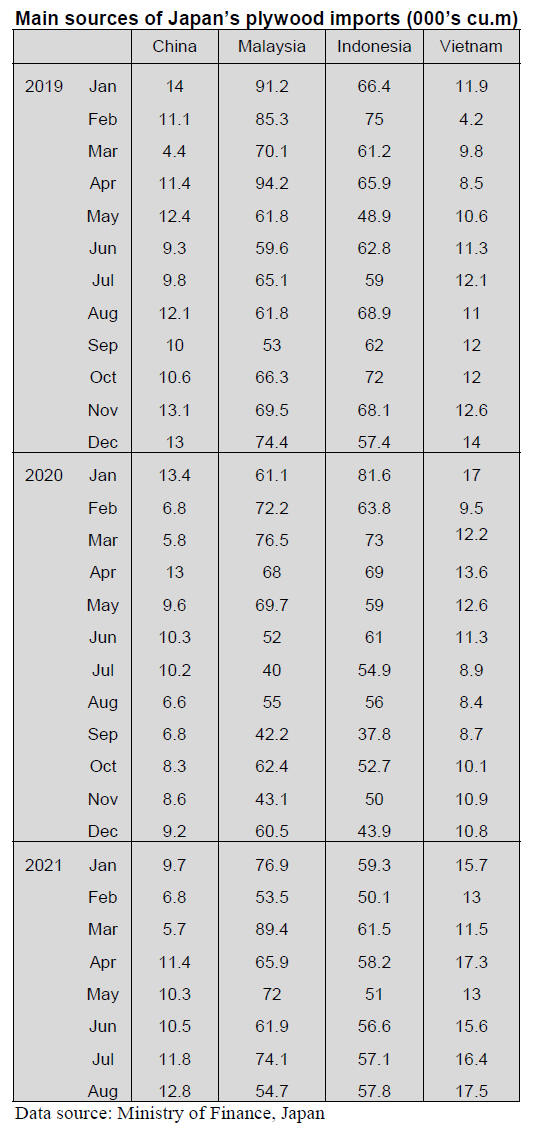

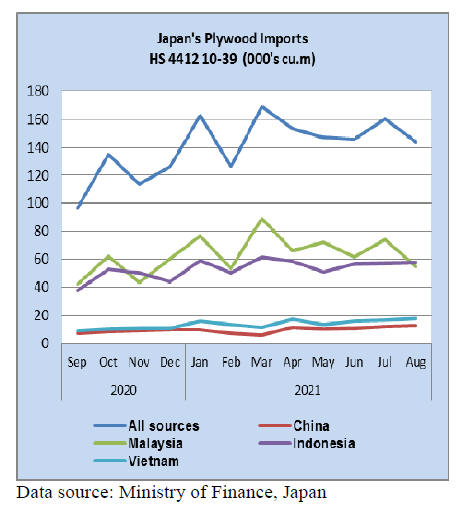

Plywood imports

Japan¡¯s plywood imports have been slipping since the

beginning of the year but the volume of August imports

was above that in August 2020 during the height of the

corona spread in Japan.

Augst 2021 imports were below that in August 2019.

Month on month, August 2021 imports were down 10%

with most of the decline being accounted for by a 25%

drop in the volume of imports from Malaysia.

Of the four main suppliers of plywood to Japan shippers in

China and Vietnam maintained their small market share in

August. Shippers in Indonesia also delivered around the

same volume in August as in July. It was shippers in

Malaysia that saw the sharp decline.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Price increase of softwood plywood

Shortage of domestic softwood plywood supply is getting

critical with brisk demand by precutting plants. Plywood

manufacturers have been running full but the

manufacturers¡¯ inventory is drying up. Because of

difficulty of getting enough logs to manufacture plywood,

the manufacturers are not able to increase the production

so delayed deliveries are now common so precutting

plants are facing difficulty of smooth operations.

The manufacturers decided to increase the sales prices of

12mm 3x6 to 1,200 yen per sheet delivered since October

1. The prices of 24 mm 3x6 panel prices are now 2,400

yen and 28 mm 3x6 are 2,800 yen. Also non-structural

softwood floor base prices are 1,050 yen, 50-70 yen up

from September.

Log procurement by plywood mills is getting more

difficult. In Western Japan, purchasing cedar and cypress

logs is struggle and the log prices stay up high and some

mills are using more imported Douglas fir logs, which

prices are high. In Eastern Japan, plywood mills face hard

competition with local sawmills and laminated lumber

mills to buy cedar and larch logs at open market. Cost of

manufacturing floor base is climbing as prices of cypress

and Hokkaido fir logs to use face and back of floor base.

Shipment of softwood plywood was more than the

production in August and inventory of structural softwood

plywood inventory was 73,100 cbms, 600 cbms less than

July end.

Delay of delivery of one to two month is becoming

normal now. Wholesalers and DIY stores also keep

chasing softwood plywood with high prices.

The market prices of 12 mm 3x6 are 1,130-1,150 yen.

With short supply, the price hike this time seems to be

accepted inn no time.

Floor manufacturers showed negative attitude to higher

prices at the beginning but imported falcate floor base

prices are up because of higher log cost then delay of

delivery by shortage of containers is critical and supply of

other plywood and floor base is also difficult so to keep

stable supply of floor, they are accepting higher domestic

softwood plywood prices.

National forest timber sales increased

By sudden demand increase of domestic wood as a result

of wood shock, the National Forest moved up timber sale

plans and the sale for April through July this year is 40%

more than the same period of 2019.

Log supply from the national forest takes about 15% of

total log demand and it is functioning as adjustment

factor. In 2020, log demand decreased by COVID 19

pandemic so the national forest sales dropped by about

30%.

System sales to particular purchasers, which takes about

70% of log sales had been around 1,800,000 cbms but in

2020, it declined to 1,640,000 cbms because there was not

enough purchasers.

In 2021, things turned around and demand for logs

sharply increased. Actually it is difficult to produce logs

in short time so the National Forest moved up timber sale

plan in each district stations.

Front loading of timber sales do not promise immediate

increase of log production but compared to private timber

harvest, National forest harvest is much quicker than

private timber harvest as it has clear and definite

management plan by the forestry agency. Actually log

supply last summer did not disrupt because increase of

national forest timber sales.

Domestic log market

In Kanto region, despite active housing starts, movement

of domestic logs is slowing since late August and

downward pressure of prices is getting stronger in

September. Green lumber and 120 mm lumber have been

weakening then 105mm square, which was firm. Is

getting softer. Only firm item is cypress sill. Dealers say

that the market should firm up in October with fall

demand.

Weakness started showing since late August and mood

changed in September and steady movement of KD 105

mm post and cypress sill is holding the market.

Bearish mood is forming by factors like sharp drop

of

North American lumber market, recovery of supply of

imported wood products and entry of new products like

poplar LVL stud.

Meantime, sawmills continue bullish and if the prices

drop, they refuse to deliver lumber to dealers but the

volume of high price lumber is declining and the dealers

need to find settling level.

Only firm item of KD 105 mm square cypress sill prices

are holding 140-150,000 yen per cbm with spot high price

of 160,000 yen. Meantime, prices of KD 105 mm cedar

square, which led the market, are getting hard to hold

130,000 yen and the maximum now is 120,000 yen. KD

cedar stud (30, 45 x 105 mm), which was front runner of

high prices, turned from firm to soft with 120,000 yen but

there are less than this prices in the market now. Cedar

post and stud pries are also softening with 120,000 yen on

105 mm lumber and 100,000 yen on 120 mm lumber.

Green lumber needs to move fast as seasonally quality

deterioration is concern so the prices are weakening.

Green cedar purlin 4 meter 90 mm square prices were

55,000 yen until September but now 52,000 yen or lower.

Survey of small contractors - (impact) of wood shock

The National Federation of Construction Worker¡¯s Unions

made survey through 270 small member contactors about

wood building materials supply because supply shortage

and higher cost put pressure on small builders. These

contractors average number of building house is only 1.7

units a year. This is the second survey after last May

survey.

About half replied that supply of building materials got

worse and the prices soared. Impact to orders is that 60%

says unchanged but 40% is struggling, which fail to

conclude the contract because of higher cost. 20% stopped

taking orders because of materials shortage. Potential

house buyers are waiting to see how long the wood shock

would last.

As to building materials supply, 51% says getting worse

since last May and 42% says unchanged. For the prices,

56% says considerable increase and 37% says small

increase. For degree of price increase compared to last

May, 41% says 10-20%, 34% 30-40% and 15% more than

50%. 5% says more than double.

For precutting cost, 29% says flat, 23% says increase of

less than 10,000 yen, 23% 10,000-20,000 yen up, 12%

20,000-30,000 yen up. 13% more than 30,000 yen up.

13% absorbs higher cost by themselves, 48% bears a part

of increase and 39% passes onto the buyers.

For outlook of wood materials procurement, 79% says

uncertain or unknown. 15% says gradual improvement and

4% says back to normal by the end of the year.

For financing, 51% says no problem, 35% says it depends

on how long this situation would last and 8% says already

has problem and 5% is having public financing. 85% says

OK until the end of the year and 15% says OK until March

next year.

Plywood

Supply tightness of domestic softwood plywood is getting

grave despite full operations of plywood mills. Demand

for both structural and non-structural continues brisk and

the manufacturers¡¯ inventory is absolute minimum.

Precutting plants¡¯ operation is now depends on how soon

plywood is delivered. Wholesalers are also frantic to

secure the volume to deal with orders from local

contractors for renovation.

Shortage would last as long as direct demand such has

precutting plants continues brisk and log shortage and

high log prices would last as long as lumber market stays

bullish so the domestic manufacturers plan to keep price

hike after October.

Higher prices and supply shrinkage continue on imported

South Sea hardwood plywood. Malaysia and Indonesia are

in rainy season now and log supply continues dropping

and plywood mills face higher container freight so C&F

prices have to go higher. Japanese buyers say that further

increase of the prices are not acceptable since future

demand is uncertain but the supplying mills do not mind

losing orders if Japan does not accept the proposed prices.

Vietnamese crating panel

Shipments of Chinese and Vietnamese panels for crating

have been delayed because of COVID 19 problem in

producing regions and confused ocean transportation. Also

the cost is being pushed up by high raw materials,

adhesives and container freight.

Market prices in Japan have been climbing since last

summer on poplar LVL and plywood. Prices of Chinese

poplar LVL are affected by busy demand for housing and

higher cost of veneer. Adhesive prices have been climbing

since last summer.

Confusion of shipping is the main problem of delayed

arrivals. Manu ships are idling and tied up at ports around

Shanghai, where labor shortage caused by COVID 19

causes slower cargo handling and transshipment so

deliveries for Japan is becoming chronic now. It takes

more than three months to arrive Japan after the cargoes

ship out manufacturing plants.

Higher cost and delayed deliveries push the market prices

up in Japan. Now 50,000 yen per cbm delivered is

common and there are offers of more than 55,000 yen.

Compared to average prices of 2019, they are 30-40%

higher now.

Vietnamese plywood production is hampered by

lockdown. The plants are ready for production but not in

operation because of raw materials supply, transportation

and movement of workers. The prices are more than 20%

higher than average prices in 2020 and it is forecasted that

the prices would further advance by another 20% toward

December.

Particularly container freight is the largest concern.

Freight on direct service from Vietnam to Japan is 20

times higher than late 2020 rate. Even with this rate, it is

hard to find enough containers. In Japan, market prices of

Vietnamese plywood B are 850-900 yen per sheet

delivered, about 60 yen higher than last spring prices.

|