Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Sep

2021

Japan Yen 111.74

Reports From Japan

State of Emergency lifted

The government has ended the state of emergency for

Tokyo and 18 prefectures as infections have declined from

their peak. Infections in Japan have been falling since the

record of 25,876 cases on 20 August. A total of 1,147

cases were confirmed on 27 September. When lifted, this

will be the first time since April that no part of Japan was

under restrictions. Restrictions will be eased in stages with

Prefectural Governors deciding on which antivirus

measures should remain.

Japan needs to simultaneously curb the spread of COVID-

19, promote economic activity and implement reform

measures to improve the business environment according

to a recent government white paper on the economy. With

the nation struggling to contain the pandemic, it is vital to

build an economy capable of responding flexibly to

emergencies such as supply-chain disruption and climate

change, according to the white paper.

The white paper calls for practical approaches, including

the use of vaccination certificates, to revive consumption

and support corporate activities.

See:

https://english.kyodonews.net/news/2021/09/023a70c43ebdjapan-needs-resilient-economy-to-overcome-new-challengeswhite-paper.html

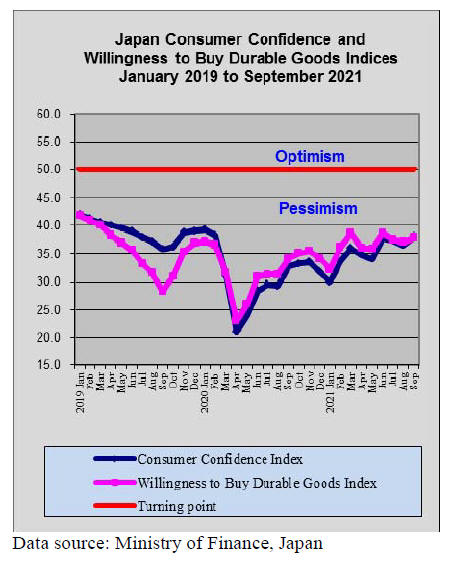

Consumer confidence gets a boost

Household spending is expected to pick up as the state of

emergency around the country has been lifted. Although a

decision on the lifting of restrictions was not announced untl late

September anticipation that this would be the case gave

consumer confidence a boost. On a more sobering note, hospitals

are readying for the next wave of infections as people begin

trying to get back to a more normal life and as commuters fill the

trains.

Despite pandemic demand for land firm

Average land prices in Japan as of 1 July fell around half a

percent from the previous year, a decline for the second

consecutive year. However, housing demand, sustained by

low-interest rates, was firm even before the pandemic

pushing up residential land prices in urban residential

areas.

See:https://www.mlit.go.jp/hakusyo/mlit/r01/hakusho/r02/pdf/English%20Summary.pdf

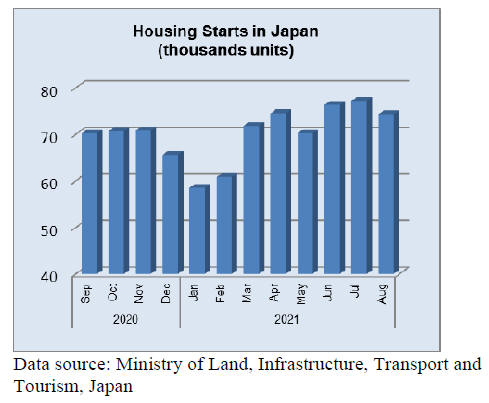

August housing starts were around 7% higher compared to

August 2020 but have now reached about the same level

as in pre-pandemic August 2019. The slight dip in August

starts compared to July is because of the holidays period.

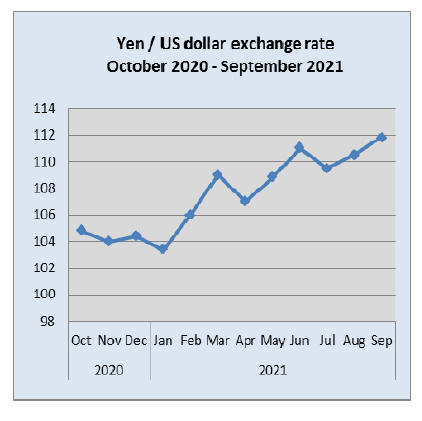

Yen tilts weaker again, exporters happy

The US dollar continued to show strength against most

major currencies in late September including the yen

Market analysts are suggesting the yen could drop to

around 112 to the dollar, a level it has not reached since

early 2020.

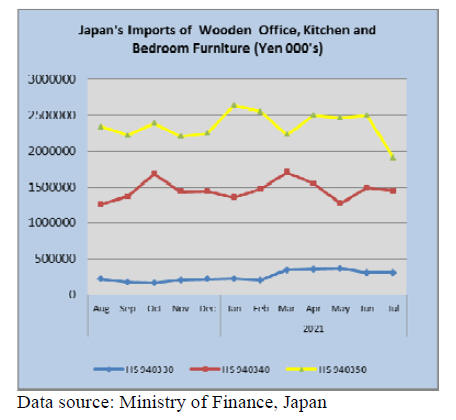

Import update

Furniture imports

Japan¡¯s imports of wooden furniture recovered in the

second half of 2020 and have continued at levels seen in in

pre-pandemic years. The country experienced a serious

forth wave of infections that has only now started to

subside but even this did not result in any noticeable

decline in the value of wooden office and kitchen furniture

imports. However, thare has been a recent correction in the

level of wooden bedromm furniture imports.

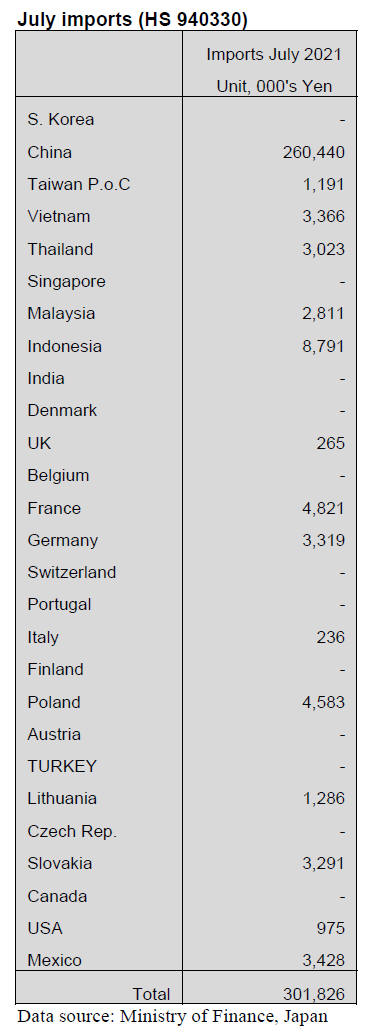

Office furniture imports (HS 940330)

Year on year, the value of imports of wooden office

furniture (HS940330) rose over 20% in July, a result of the

lower imports in 2020 during the early days of the

pandemic. Compared to the value of June imports there

was little change in July.

The top shipper of wooden office furniture in July this

year was China which saw its share of imports rise to

86%. This dented to arrivals from the other two main

suppliers Indonesia and Poland which together could only

secure a 3% share each. Compared to the value of June

imports shipments from suppliers in China jumped around

30%.

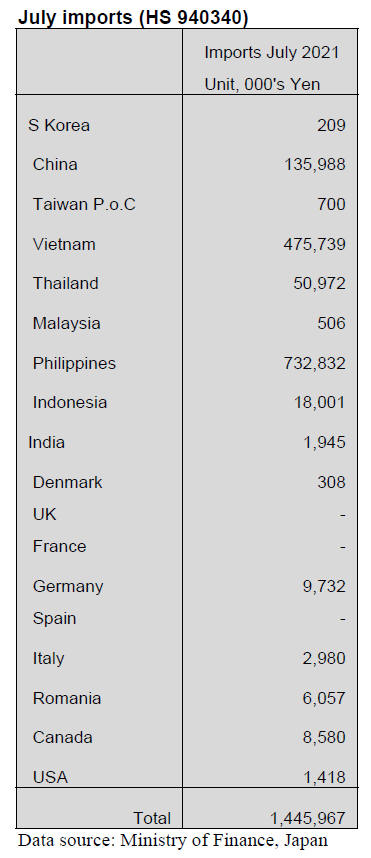

Kitchen furniture imports (HS 940340)

The value of imports of wooden kitchen furniture in July

was little changed from that in June which is bringing

down the overall third quarter imports. Over 90% of

imports of wooden kitchen furniture were from shippers in

just 3 countries, the Philippines (51% of imports),

Vietnam (33%) and China (9%).

It was only shippers in the Philippines that secured a rise

in the share of imports in July. Year on year and month on

month July 2021 import values were largely unchanged.

In June this year there were sizeable imports of

wooden

kitchen furniture from European suppliers notably

Germany and Italy but this was not maintained in July.

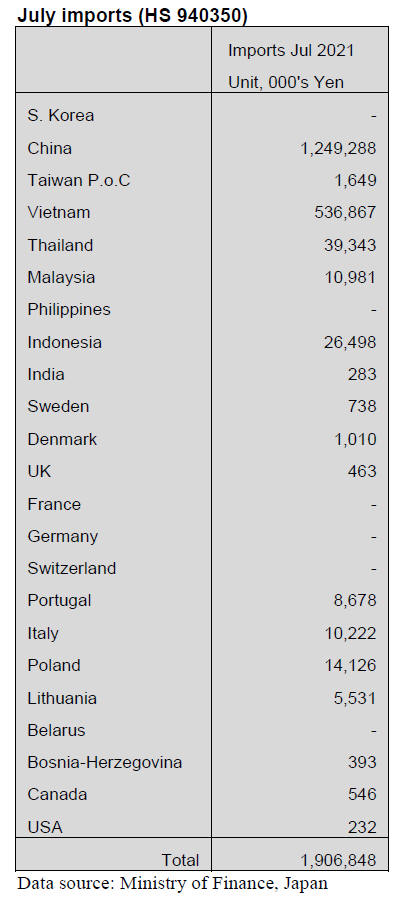

Bedroom furniture imports (HS 940350)

The value of Japan¡¯s imports of wooden bedroom

furniture plunged in July this year dropping 17% year on

year and by a massive 24% compared to the value of June

imports. The main suppliers in July were manufacturers in

China, Vietnam and Thailnd and all three saw the value of

shipments fall compared to June.

It is unlikely that the shortage of shipping containers is

behind the steep drop in the value of imports as no such

drop has been observed for other categories of furniture.

There was no similar drop in July imports in either 2019 or

2020 so the correction is likely to be due to domestic

demand changes.

In July this year the top shippers were from China (66% of

July imports) Vietnam (28%) and Thailand (2%).

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

South Sea (tropical) logs and lumber

Log production in Malaysia remains sluggish as workers

are short at logging sites and the administration offices run

on short time so log production continues slow. Log orders

from India is active. Japanese demand is decreasing for

logs with limited number of ships so even if log

production improves in producing regions, there will not

be any large increase of log demand.

Price increase on Chinese made free board is pausing now

since the dealers in Japan are cautious to make future

purchase by uncertain future market. Also the

manufacturers carry large order balance and deliveries are

now delaying. Chinese made Russian red pine lumber

prices are firm because Russia is restricting export of red

pine lumber.

Indonesian mercusii pine lumber production is affected by

decreasing number of workers by COVID 19 and shortage

of containers.

Imported wood fuel in the first half

The amount of imported wood pellet in January to June

2021 is getting higher than before. Since the amount of

wood pellet from Vietnam is over 30% up and also the

amount from Canada increased a lot at same months last

year. The total amount of imported wood pellet is 150%

more than last year.

The amount of PKS is not as much as Japanese companies

wanted but Indonesian PKS is increasing. The total

amount of imported wood pellet in January to June 2021 is

141,905 tonne, 50.4% higher than the same periods in

2020. About 3,000,000 tonne would be imported in this

year.

The imported wood pellet is from Vietnam for 712,297

tonne, 34,6% more, from Canada for 513,440tonne, 76,7%

more and from Malaysia for 80,336tonne, 13.9% less than

the same months of 2020.

Due to new biomass power generation plants in Japan,

such as Makita biomass power generation plant in

Fukuoka with power output of 75,000kw, Ichihara

biomass power generation plant in Chiba with power

output of 4,990kw and Kaita power generation plant in

Hiroshima with power output of 112,000kw are in

operation which need a lot of wood pellet.

Japan bought only 31 tonne of wood pellet in 2020, but in

this year Japan has already bought 26,967 tonne more in

2021. Nearly 4,000,000 tonne in a year by just one

American company would be imported to Japan in the

future. However, the total amount of imported PKS is

1,114,649tonne, 10.1% increased same months last year.

The volume from Indonesia is 918,635 tonne, 20.1% up

and Malaysia is 196,014 tonne, 20.8% down.

This is because new biomass power generation plants in

Japan prefer to use wood pellet instead of PKS. Also the

lockdown in Malaysia 2020 due to COVID-19 caused a

confusion the supply of PKS for Japan. According to a

trading company in Japan, some biomass power

generation plants consume domestic wooden pellet

because PKS is very expensive now.

North American logs

After forest fire season is over on the West Coast of the

U.S.A., FAS log prices for Japan for September shipment

are reported to be down by US$20 per M Scribner but

ocean freight continues escalating and US$100 increase in

last several weeks.

North American lumber market prices of 15 average

structural grade lumber for the first week of September are

US$395 per MBM, which stopped skidding after 15 weeks

but green Douglas fir 2x4 prices (standard & better) are

less than US$300 at US$285 per MBM FOB Portland.

Sawmills¡¯ profitability is deteriorating and many

sawmills

are curtailing the production so log purchase activities are

simmering down.

Regardless of weaker log prices, Yen¡¯s cost for sawmills

is higher because of strong ocean freight so the largest

lumber manufacturer, Chugoku Lumber raised the sales

prices on Douglas fir KD square and beam since October 1

by 10,000 yen per cbm.

Meantime, Canadian side is different with strict harvest

restriction in Southern part of Vancouver Island and

availability of logs is very difficult and export prices of

logs are inflating. Douglas fir log prices have been

advancing US$5 every month and present prices are

US$150 per cbm FAS.

Ocean freight increased by US$15 per cbm so CIF prices

are about 28,000 yen per cbm FOB truck port yard, about

2,500 yen increase. Domestic plywood mills are short of

domestic logs with soaring prices and they wish to have

Canadian Douglas fir logs even with high prices but the

importers are not able to satisfy enough.

Forestry Agency¡¯s 2022 budget request

Total of 346.2 billion yen is requested for the budget of

the Forestry Agency to perform new forest and forest

industry plan approved by the Diet in June. This is 14%

more than previous budget. 22.4 billion yen is allocated

for measures of wood industry green growth including

subsidy to deal with increasing wood processing facilities

when imported wood products are short in supply.

The main subject is green growth in forestry and forest

industry to realize carbon neutral age. 14.6 billion yen is

requested for facilities of wood processing and distribution

business and of nursery and seedlings.

In particular, wWood processing facilities are to deal with

shortage of imported wood products and domestic wood

should cover such shortage. For instance, such facilities

like processing large diameter logs to produce beam

lumber, which share of imported materials is high. 2.2

billion yen is requested for non-residential wood buildings

in which one billion is allocated for use of fire proof wood

in urban areas and another one billion is allocated for

promoting use of CLT and LVL.

147.8 billion yen is requested for forest maintenance.

Main businesses are thinning and cost saving and energy

saving of replantation after clear cutting. Building main

logging road system and improvement of existing systems.

Even if timber sales increase, log supply may not increase

with many preparations in cased of privately owned timber

but timber harvest of national forest is much quicker so it

helps solving log supply shortage problem. Actually log

supply did not disrupt during summer months this year and

many agree that increase of national forest timber sales are

the reason for smooth log supply.

Precutting market in Tokyo region

Supply of softwood plywood is extremely tight for

precutting plants. Since middle of August, delivery of

plywood is last minutes before processing and there is

increasing fear of delay of construction of houses by lack

of plywood.

Plywood mills took about ten days for regular

maintenance in August so August production is less than

normal months while precutting mills took only five days

off in August and this gap created more shortage of

supply.

Plywood mills are not able to increase the production by

tight log supply and working regulation of labor.

Precutting plants say that 12 mm panel is short as well as

thick panel like 30 mm. Wholesalers have not inventory so

only thing precutting plants can do is to beg plywood

mills.

Shortage of softwood plywood started in July. Production

and shipment in July are even with 246 M cbms so there is

no surplus at all. Assuming plywood mills carried the

inventory, the shipment in July should exceed the

production. August situation is much tighter and some

precutting plant says that delivery of orders placed two

months ago for late August delivery is seven to ten days

behind schedule.

|