US Dollar Exchange Rates of

10th

Sep

2021

China Yuan 6.4443

Report from China

New standards for wood-based panels

Three standards for wood-based panel have recently been

approved by the National Technical Committee of Woodbased

Standardisation namely standards on Decorative

Veneer Overlaid Panels, Plywood for Combined Packing

Boxes and the Content Determination of Lead, Cadmium,

Chromium and Mercury in Wood-Based Decorative

Veneer Materials.These standards for wood-base panels

will come into force on 1 March 2022.

See:www.forestry.gov.cn/lky/2811/20210902/145526408735780.html

Formulation of standards solid wood doors

It has been reported that Zhejiang manufacturing group

and the Ningbo Institute of Standardization in Zhejiang

Province have started work on a standard for solid wood

(mortise and tenon joint) doors. The standard will provide

quality specifications for the development of solid wood

door of mortise and tenon joint structure. At present

opinions on the standard are being gathered.

Decline in China¡¯s log imports from Australia

Australia is losing around AUD1.6 billion a year after

China suspended log imports because of quarantine

problems. China¡¯s log imports from Australia in the first

half of 2021 plummeted. According to China Customs, log

imports from Australia fell to 62,855 cubic metres in the

first half of 2021 from 2,090,000 cubic metres in the first

half of 2020.

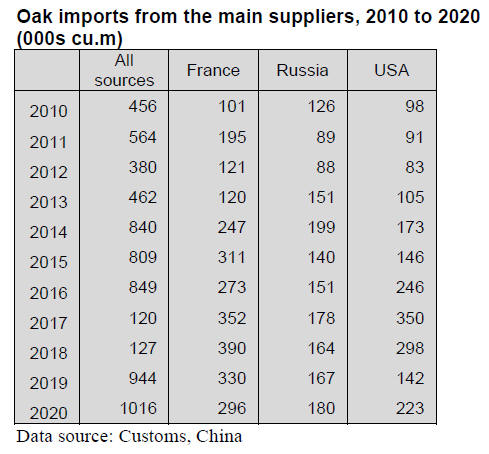

France, the largest supplier of oak imports

China Customs data shows France has been the largest

supplier of oak imports since 2014. Previously Russia was

the main supplier but Russia implemented a log export

ban. The US is also a major supplier of oak but China¡¯s

oak imports from the US have fallen in recent years due to

trade friction.

China¡¯s oak imports from France, Russia and USA rose

at

different rates in the first half of 2021 due to the

resumption of production. China¡¯s oak imports from

France rose 30% to 223,000 cu.m valued at US$86.17

million, up 56% in value. The volume of China¡¯s oak

imports from USA and Russia rose 21% and 11%

respectively in the first half of 2021.

The CIF price for imported French oak rose the most (

20%) followed by the United States, up 9%. In contrast the

CIF price for imported Russian oak fell slightly in the first

half of 2021.

The cumulative volumes of China¡¯s oak imports from

France, Russia and USA from 2010 to 2020 were 2.74

million cubic metres, 1.63 million cubic metres and 1.96

million cubic metres respectively. For the same period the

average CIF for imported oak from France was the lowest

at US$288 per cubic metre, from USA it was the highest at

US$418 per cubic metres from 2010 and 2020.

Oak is popular in China and mainly used to manufacture

furniture, flooring, casks for wine and coffins.

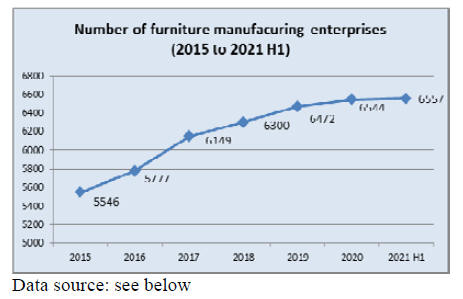

Rise in numbers of furniture makers

The numbers of furniture manufacturing enterprises in

China increased between 2015 and 2020 but the overall

growth has slowed. By 2020 the number of large furniture

manufacturing enterprises in China was 6,544. As of June

2021 the number of large furniture manufacturing

enterprises rose to 6,557.

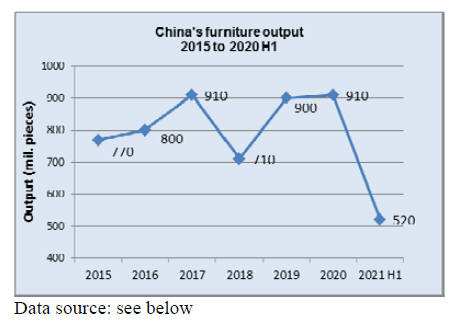

China¡¯s furniture output had been increasing between

2015 and 2017. In the first half of 2021, China's furniture

output reached 520 million pieces, up 30% from the same

period of 2020, as the country's furniture industry

recovered.

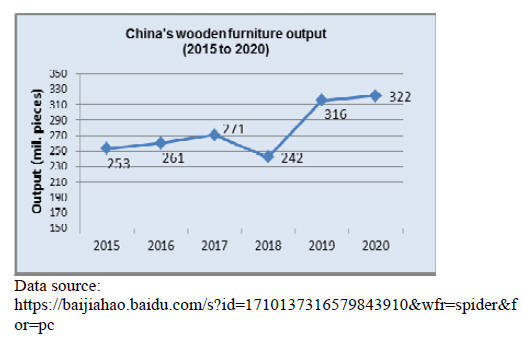

Rise in wooden furniture output

China's furniture production is divided into three

categories: metal furniture, wooden furniture and soft

furniture, accounting for 51%, 40% and 9% respectively.

Wooden furniture shows an overall growth trend from

2015 to 2020. The output of wooden furniture in China

was 322 million pieces in 2020, a year on year increase of

2%, up 27% from 2015.

|