Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Sep

2021

Japan Yen 109.29

Reports From Japan

Private sector urges government

to lift restrictions

The Japan Business Federation (Keidanren) has urged the

government to take action to restart economic and social

activities as the number of people vaccinated rises. Tokura

Masakazu, Keidanren Chairman, said the country needs

measures "to get the economy up and running again."

The private sector proposed shortening the

quarantine

period for people entering Japan to a maximum of 10 days

from 14 days currently which is under consideration.

The government is considering reducing the selfquarantine

period for vaccinated arrivals from overseas.

Currently everyone from overseas has to remain isolated

for 14 days. A 10 day quarantine is being considered

because social and economic activities must resume. The

new arrangement will apply to those inoculated with the

Pfizer, Moderna or AstraZeneca vaccines and could come

into effect at the end of September.

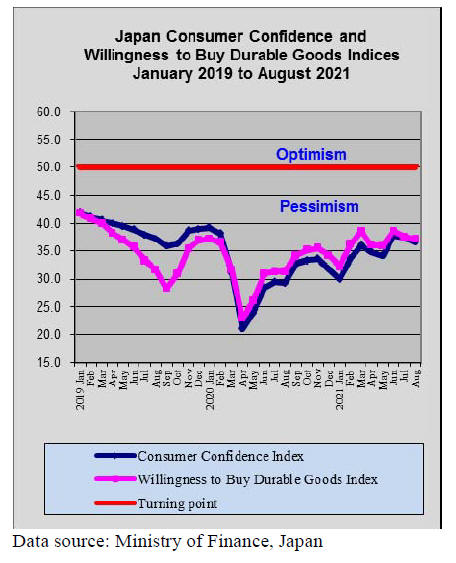

Dip in household spending

July household spending grew slower than expected as a

resurgence in COVID-19 cases undermined consumer

activity. The Japanese economy cannot shake off the

impact of the pandemic because the slow roll-out of

vaccinations means restrictions on movement must be

maintained. Household spending rose 0.7% year-on-year

in July after a 4% fall in June but the rise in July was

partly due to a sharp contraction in July last year.

See:

https://www.reuters.com/business/retail-consumer/japansjuly-household-spending-rises-less-than-expected-2021-09-07/

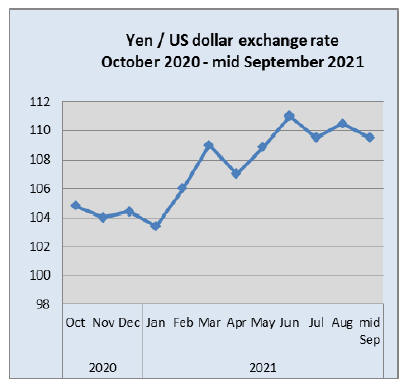

Yen/dollar exchange had short rocky ride

The US dollar/ yen exchange rate reacted to the decision

by Japan¡¯s Prime Minister, Yoshihide Suga, not to seek a

second term as prime Minister. His decision came at a

time when the Covid situation has worsened because of

the slow rollout of vaccines. The exchange rate volatility

was also impacted by recent economic data from the

United States. The US added just 235,000 jobs in August

while the unemployment rate dipped to 2.5%.

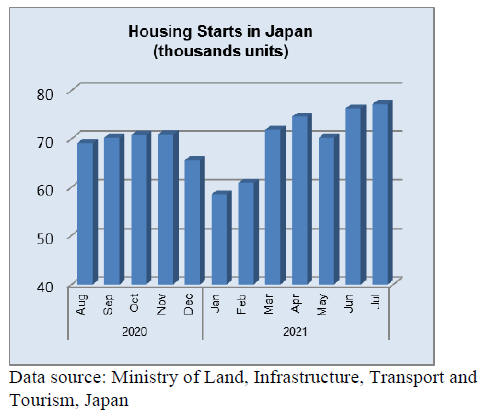

Forecast decline in housing starts

The Nomura Research Institute is forecasting a significant

drop in new housing starts across Japan by 2030.

According to the Institute¡¯s report housing starts are

forecast to drop from 950,000 units in 2018 to 730,000

units in 2025. In 2030, total housing starts are forecast to

be 630,000 units.

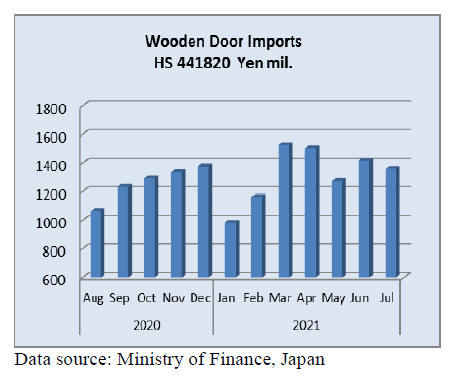

Import update

Wooden door Imports (HS441820)

China accounted for 56% of Japan¡¯s July 2021 imports of

wooden doors (HS441820) with a further 30% being

shipped to Japan from the Philippines. The only other

significant shipper in July was Indonesia which provided

an additional 6% of the total value of wooden door

imports in July.

Year on year, July 2021 imports were flat but there was a

4% decline in the value of July imports compared to June

of the same year.

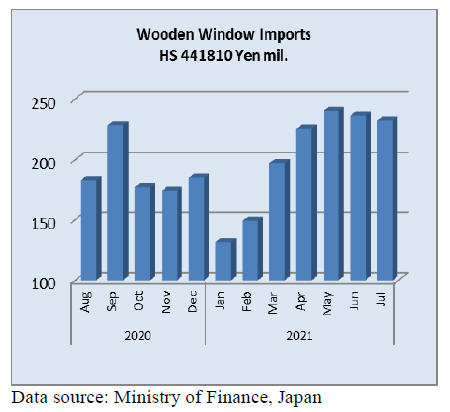

Wooden window imports (HS441810)

After peaking in May this year the value of Japan¡¯s

imports of wooden windows (HS441810) have fallen for

two consecutive months, dropping 5% month on month in

June and by 3% in July. As would be expected July 2021

imports were higher than in July 2020 but what is

significant is that the year on year rise was small.

Over 90% of Japan¡¯s imports of wooden windows came

from shippers in just three countries, China (47%), the US

(27%) and the Philippines (19%). Shippers in these three

countries dominate Japan¡¯s imports of wooden windows.

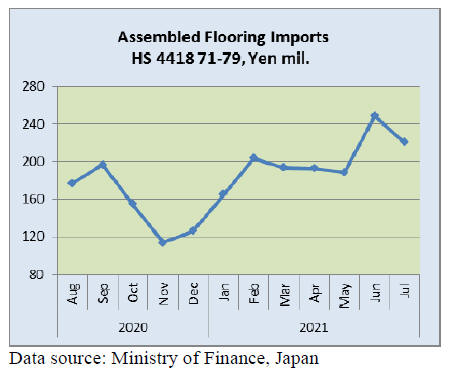

Assembled wooden flooring imports

After the steep rise in the value of assembled flooring

imports there was a correction in July. Compared to a

month earlier the value of assembled flooring imports in

July this year dropped 15%. Prior to the sharp rise in June

imports there had been three consecutive months where

the value of assembled flooring imports declined.

Year on year, the value of Japan¡¯s imports of assembled

wooden flooring (HS441871-79) in July rose 24%, but this

was from a low caused by various pandemic control

measures introduced by the Japanese government.

Imports of HS441875 acounted for most assembled

flooring imports with 45% being shipped from China.

Shippers in Vietnam continue to do well accounting for

22% of July 2021 imports.

The other major supplier was Indonesia which accounted

for 17% of the value of July 2021 imports.

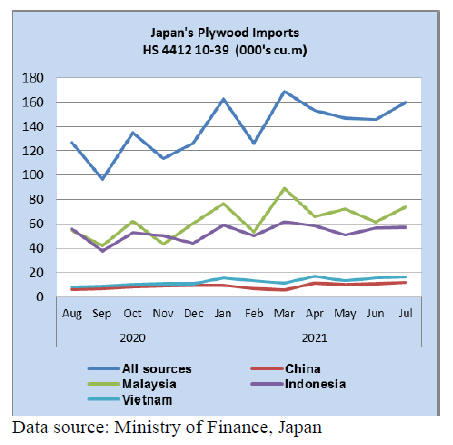

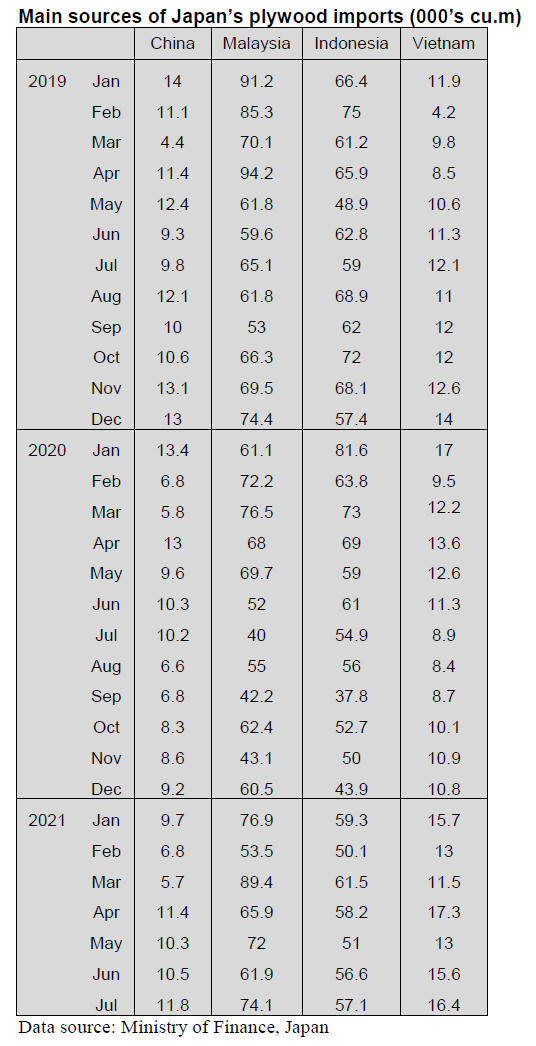

Plywood imports

While exhibiting marked swings the volume of plywood

imports during the first 7 months of 2021 has trended

higher. Import volumes are higher than in 2020 and July

2021 imort volumes were some 8% higher than in July

2019.

Year on year the volume of Japan¡¯s July imports of

plywood (HS441210-39) was up almost 40% and

compared to a month earlier the volume of plywood

imports rose almost 10%.

Of the four main shippers of plywood, Malaysia,

Indonesia China and Vietnam shipments from China rose

slightly in July compared to a month earlier, arrivals from

Malaysia also increased as they did from Vietnam but July

imports from Indonesia were at around the same level as

in June.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Log demand for the first half of the year

Demand for logs in the first half of the year is 8,155,000

cbms for lumber manufacturing (4.3% more than the same

period of last year) and 2,552,000 cbms for plywood

manufacturing (5.7% more). After imported lumber supply

decreased, domestic sawmills¡¯ activities got active so the

demand for logs of both imports and domestic increased.

For lumber manufacturing, domestic logs increased by

1.2% and imported logs increased by 16.1%.

Share of domestic logs for lumber is 76.6%, 1.6 points

down from 2020. Total demand for logs declined since

April 2020 by increased consumption tax and COVID 19

epidemic and lasted through February 2021 then tight

supply of wood products as a result of decline of imported

products became obvious so that demand for domestic

products sharply increased and domestic sawmills¡¯ log

purchase increased largely.

Since March 2021, monthly log supply for lumber was

about 1,400,000 cbms and for plywood was 400,000 cbms,

which are same number as 2019 when the demand was

active.

Total log supply for lumber in the first half of the year is

6,248,000 cbms of domestic, 1.2% more and 1,907,000

cbms of imported, 16.1% more. Imported logs increased

by 264 M cbms, a majority of North American logs so that

share of domestic logs decreased.

Log supply for plywood manufacturing during January

and June is 2,343,000 cbms of domestic, 9.3% more and

209,000 cbms of imports, 22.9% less. Share of domestic

logs increased to 91.8%, 1.1 point up from 2020.

Share of domestic logs has increased for four straight

years since 2017 and it reached 84.4% in 2020 but in

2021, if imported log supply for lumber increased over

domestic, share of domestic logs could decline for the first

time in five years.

However, in 2021, import wood products like lumber,

laminated lumber and plywood continue declining so selfsufficiency

rate of wood would increase.

Tight supply of softwood plywood

Softwood plywood manufacturers announced to raise the

sales prices of softwood to 1,100 yen per sheet delivered

since August 1 because of climbing log cost while the

sales continue active. In July, demand by both direct sales

to precutting plants and to dealers is very active and

dealers say that there is no time to build up the inventory

as the sales are so busy while allocation by the

manufacturers is limited.

For the manufacturers, the shipment exceeds the

production so June end inventory was 92,100 cbms, 4,100

cbms less that May end. Produced plywood is shipped out

immediately and the manufacturers are not able to deal

with spot orders and deliveries are delayed. Since July,

major precutting companies stopped order restrictions so

that orders for plywood increased. Smaller precutting

companies procure necessary volume of plywood from

local dealers because they are not able to buy extra volume

from the manufacturers.

The manufacturers are not able to increase the production

because of tight log supply. Log demand is active for

lumber, laminated lumber and export. Particularly in the

Western Japan, log supply is so tight that the

manufacturers need to restrict manufacture certain items

so it is practicallyproduction curtailment.

Cypress log prices soared to nearly 30,000 yen per

cbm

delivered and larch log prices in the North East climbed to

18,000 yen. Supply of North American Douglas fir logs

and Russian larch veneer is very little so that they are no

help to fill a gap of local log shortage. Present market

prices of 12 mm 3x6 softwood plywood are 1,000-1,050

yen in Tokyo market. The manufacturers increased the

prices to 1,050 yen in early July then to 1,100 yen in early

August.

With busy demand, price hike is easily accepted by the

market. August is the month when each manufacturer

stops production for about a week for regular maintenance

so the production would drop. There will be another price

hike in September with tight supply.

Supply of domestic softwood plywood is getting tighter

since middle of August. Demand continues robust while

the manufacturers¡¯ inventory stays minimum and they are

not able to increase the production because of tight log

supply and labor shortage.

With higher log cost, the manufacturers announced to

increase the sales prices of 12 mm thick 3x6 panel to

1,150 yen per sheet delivered since September 1. The

shipment in July exceeded the production so the inventory

dropped to 90.600 cbms, 1,500 cbms less than June end.

August is vacation season and majority of plywood mills

stop running for normal maintenance for about a week so

the production stops and the inventory would further drop.

Precutting plants continue the operation without taking

any vacation to catch up delayed orders so the shipment of

August will be more than the production.

Log demand is active and the supply may get tight after

Western Japan suffered heavy rain for more than a week

so log market will stay firm in coming months. Delivery of

plywood is now delayed. Precutting plants built up the

inventory since last spring but there is no surplus to loan to

other plants and even if they loan, it would be exchange

with other tight items like whitewood laminated post.

Some plants request to the customers to bring your own

plywood for precutting order despite the custom that

necessary materials procurement is precutting plants¡¯ duty.

Log procurement is competition with laminated lumber

plants, which buy cedar logs actively.

Present market prices of 12 mm 3x6 panel are 1,100 yen

per sheet delivered and new proposed prices are easily

accepted by the market as securing the volume is priority

matter now.

North American log imports

For the first half of this year, total import of North

American logs is 1,264,259 cbms, 30.8% more than the

same period of last year. Large increase of logs from B.C.,

Canada is the reason of total increase.

In the first half of last year, log demand receded by

COVID 19 epidemic and the largest log supplier in B.C.,

Mosaic Forest Management stopped log harvest so log

export for Japan decreased by 76.3% from 2019. Canadian

Douglas fir logs are mainly for plywood mills in Japan.

While Canadian log supply disrupted, plywood log

demand shifted to domestic logs so orders were not active

even when the Mosaic restarted log harvest in June last

year then the demand for Canadian logs returned after

domestic log supply gets tight and the prices have been

inflating.

Total Douglas fir is 1,201,063 cbms, 34.4% more than

2020 so the supply recovered to 2019 level but hemlock

and yellow cedar supply continues declining.

For Douglas fir log export, PLS stopped export business in

August last year and Weyerhaeuser filled a gap. Spruce

and red cedar increased but Sealaska Corporation, which

had been shipping about 60,000 cbms of high grade logs,

decided to withdraw from log business so Alaskan log

supply stops with last shipment in February 2021. There

are other minor log suppliers in Alaska but without

Sealaska, major supply stopped.

For the second half of this year, concern is expanding hot

weather and forest fires on the west coast. Particularly

Canada seems to reduce log harvest considerably so

Canadian log supply will decline toward fall.

Imports of Russian logs and lumber

For the first half of this year, import of Russian logs is

only 12,090 cbms, 65.6% less than the same period of last

year. Lumber is 238,323 cbms, 29.0% less. Normally

import of lumber increases in May and June but the supply

did not increase this year so the inventory in Japan

remains low.

In log import, whitewood is 752 cbms, 80.7% less, larch is

5,104 cbms, 72.1% less and red pine is 6,234 cbms, 51.7%

less.

Demand for logs in Japan decreased after it shifted from

logs to genban. Sawmills in Japan cannot rely on stable

supply of logs any more.

Larch logs are mainly for plywood but the demand

decreased after plywood mills in Japan use ore domestic

species. Log export duty by the Russian government is

now 80% to speed up domestic processing of logs. Since

last July, export duty on green lumber is newly imposed.

Export prices of KD red pine lumber soared but the supply

has not increased because the market prices in Japan

increased so much that the users are looking for other

items. Present CIF prices of KD red pine lumber are

US$800-900 per cbm and the market prices of quality KD

red pine taruki are 110,000 yen and of KD furring strip are

1120,000 yen in Tokyo market.

Domestic logs and lumber

Movement of domestic logs and lumber is pausing with

fear of price drop after the North American lumber market

is simmering down and there are some signs that import

lumber may increase in coming months but precutting

plants continue to build up inventories for fall demand

pickup and cypress sill is still short in supply and the

prices are firming.

The strongest item is 4 metre 105 mm KD cypress sill with

the prices being 100,000-140,000 yen because there is no

sign that the supply of preservative treated hemlock sill

and redwood laminated sill square increase. Not only KD

but green sill has strong demand now.

3 metre KD cedar 105 mm square has also strong demand

to replace tight supplied whitewood laminated post but

total volume of cedar is larger than cypress, the prices

have been flat for last two months at 100,000-130,000 yen.

Log supply has been steady. In the North East and

Hokkaido, log supply is still tight because of competition

with plywood mills. Tightness of log supply is easing from

Tokyo and the West. Demand for post and sill cutting logs

is very active so the prices should remain in high range.

Cypress log prices in the Western Japan are firm at

30,000-40,000 yen. Post cutting cedar log prices are

15,000-16,000 yen and the prices are very firm at Kyushu

and Northern Tokyo at 17,000-18,000 yen.

North American lumber import (Jan-Jun 2021)

Total import of North American lumber for the first half of

this year is 676,368 cbms, 10.6% less than the same period

of last year. By source, 608,100 cbms from Canada, 5.3%

less and 68,268 cbms from the U.S.A., 40.3% less. Manke

Lumber, major supplier of Douglas fir lumber stopped

production for Japan at the end of last year, which is main

reason of large decrease from the U.S.A.

However, compared to lumber supply from other regions,

decrease of North America is much smaller. European

lumber decreased by 18.2%, Russian lumber dropped by

29.0% and Chilean lumber decreased by 26.6%.

By species, SPF is 449,317 cbms, 5.2% less and Douglas

fir is 104,280 cbms, 35.1% less but others increased.

Hemlock is 78,470 cbms, 5.3% more and yellow cedar is

13,122 cbms, 24.0% more.

Export prices of SPF had kept climbing month after month

since January. The first quarter prices are US$650 per

MBM C&F. Second quarter prices are US$1,000 and third

quarter is US$1,800. With such outrageous increase,

normally the orders should decline but lumber supply for

traditional post and beam construction sharply dropped so

2x4 housing became more competitive so the purchase did

not decrease.

Meantime, supply of lumber for traditional housing did not

increase because of booming North American lumber

market and shortage of containers.

Western Forest Products, major supplier of hemlock

lumber took large orders in the first quarter to grab

Douglas fir lumber market but because of container

shortage, the shipments delayed and passed second quarter

offers. North American lumber market peaked out in late

May so supply for Japan should increase.

Wood products export for the first half of 2021

In wood products export during January and June 2021,

logs are 813,000 cbms, 27.7% more than the same period

of last year and lumber is 104,000 cbms, 40.2% more. In

particular, lumber export to the U.S.A. doubled and

exceeded the volume for China and the U.S.A. became the

top destination of lumber. Value also climbed and value of

logs is 11.4 billion yen, 50% more and lumber is 4.6

billion yen, 59.7% more.

For the first half of 2021, demand by China and the U.S.A

is strong so the export of wood products from Japan

increased considerably. If the export continues in the

second half with the same pace as the first half, annual

export volume of logs would be about.

1,600,000 cbms and lumber about 200,000 cbms, double

digit increase for two straight years. Also total value

would climbed to 50 billion yen if the second half value is

same as the first half.

By destination, in log export, China bought 678,941 cbms,

32.1% more and stayed as top buyer then Korea took

67,201 cbms, 4.6% more. Taiwan P.o.C is third with

50,704 cbms, 8.4% more. By species, cedar is top with

712,971 cbms, 28.8% more. Cypress is 93,682 cbms,

22.2% more.

In lumber export, top is the U.S.A. with 36,081 cbms,

108.7% more then China is second with 28,892 cbms,

8.9% less. Third is Philippines with 21,850 cbms, 92.2%

more. Increase of value is remarkable. Domestic demand

for logs increased and the prices soared, which pushed the

export prices. Normally it is hard to pass high cost onto

export but worldwide inflation of wood products prices

help passing high prices on export.

Average log value is 14,004 yen, 17.5% up. In particular,

cedar log prices are 13,470 yen per cbm, 21.1% up.

Lumber value is 44,416 yen, 13.9% up.

|