4.

INDONESIA

Shortage of containers disrupting

exports

Indroyono Soesilo, Chairman of the Association of

Indonesian Forest Concessionaires (APHI), has raised the

alarm on rapidly rising shipping costs as this is having an

impact on the export of Indonesia's wood products which

are in high demand. He noted that shipping costs vary but

it is the cost of shipping to the US that is of most concern.

According to Indroyono there solutions such as shipping

using small container ships or vessels to Singapore from

where they on forwarded to the importers. He also said it

is also possible to use small break bulk vessels for direct

export to China

See:

https://newssetup.kontan.co.id/news/kontainer-langkaekspor-produk-industri-kehutanan-nasional-terhambat

Apply health protocols in mills and factories

Acting Director General of Agro Industry in the Ministry

of Industry, Putu Juli Ardika, stated that the health

protocols applied by the wood and furniture processing

industry were well maintained when they visited wood and

furniture processing industry companies in Tangerang

saying work shift arrangements are very good and social

distancing can be achieved in large factories with fewer

workers.

Putu said through these efforts it is hoped that national

manufacturing productivity will be sustained.

See:

https://www.antaranews.com/berita/2351886/kemenperinnilai-prokes-industri-pengolahan-kayu-dan-furnitur-bagus

Indonesia reported fewer than 10,000 new coronavirus

cases and less than 1,000 deaths on 6 September. The

virus has continued to surge in some regions including in

parts of Sumatra, Kalimantan, Sulawesi and remote Papua.

Just over 11% of the population has been fully vaccinated.

Since 15 July the number of cases have fallen. The

recovery rate is also higher than new positive cases.

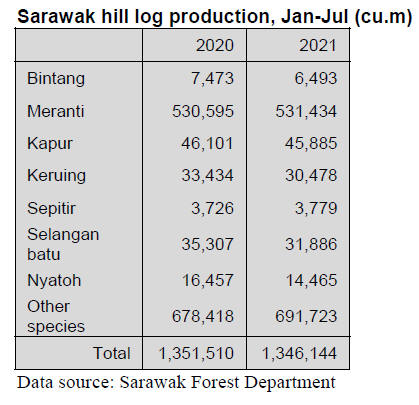

Meranti dominated log production in 2020

Statistics Indonesia (BPS) data shows that the production

of logs from companies with forest concession in

Indonesia was 5.26 million cu.m in 2020. This was down

around 15% compared to the previous year. Meranti

dominated the log production in Indonesia last year and

totaled 1,643,720 cu.m or 31% of total log production. The

production of red meranti was recorded at 653,490 cu.m

last year, about 13% of total production of logs.

The other main timbers harvested in 2020 were merbau,

acacia and keruing. The production of which was 609,710

cu.m, 500,230 cu.m and 331,440 cu.m respectively.

Over 80% of harvested logs were sold on by logging

companies with the balance being used by integrated

operations.

See:

https://databoks.katadata.co.id/datapublish/2021/08/31/merantimendominasi-produksi-kayu-bulat-indonesia-pada-2020

Indonesian furniture attracted attention at the Las

Vegas Summer Market 2021

Contemporary furniture and Indonesian rattan furniture

successfully attracted US buyers at the August Las Vegas

Summer Market 2021 and manufacturers who exhibited

managed to secure potential orders worth around Rp. 20

billion during their five-day participation in Las Vegas.

See:

https://pressrelease.kontan.co.id/release/furniturkontemporer-dan-rotan-indonesia-berjaya-di-las-vegas-summermarket-2021?page=all

Few community forest owners have ready access to

markets

The growth of community-based forest product businesses

is still very low and many owners in rural areas do not

have ready access to the markets. This was stated by Tri

Nugroho, the Program Director of MFP4

(Multistakeholder Forestry Program Phase 4). To address

this so as to improve the lives of people who depend on

forests MFP4 collaborates with an institution known as the

Market Access Player (MAP) which has can help create

links between community producers and buyers.

See:

https://republika.co.id/berita/ekonomi/pertanian/qycqak456/petani-diorong-untuk-hasilkan-komoditas-bernilai-tinggi

Minister spotlights conservation areas in logging,

pulpwood concessions

Indonesian Environment and Forestry Minister, Siti

Nurbaya, has once again pointed out the importance of

high conservation value (HCV) areas that have been

legally set aside in existing logging and pulpwood

plantation concessions covering an area of nearly 3.9

million hectares.

She emphasised that the HCV areas in logging

concessions and plantations represent an ecological last

resort. "Both these industries remain relatively stable

despite the surging pandemic and played a contributing

part at a certain level when Indonesia managed to move

out of economic recession in the second quarter of this

year," she said. Minister Nurbaya pointed out that HCV

areas are not abandoned areas as there are legal and

sustainability measures for the areas.

See:

https://foresthints.news/minister-spotlights-hcv-areas-inlogging-pulpwood-concessions/

Indonesia-Norway climate and forest partnership

terminated

On 10 September 2021 the Government of Norway

received a formal notification that the Government of

Indonesia had decided to terminate the 2010 Letter of

Intent on Cooperation on Reducing Greenhouse Gas

Emissions from Deforestation and Forest Degradation.

A press release from the Norwegian authorities reads “Our

two nations have for more than a decade collaborated on

reducing greenhouse gas emissions from deforestation and

forest degradation. During this time, Indonesia has become

a world leader in combatting tropical deforestation. A

series of progressive regulations and policies to protect the

nation’s rainforests have been put in place. The results are

impressive.

Over the last four years Indonesia has delivered massive

reductions of deforestation and peatland conversion. This

is a significant contribution to global climate change

mitigation and protection of biodiversity.

Last year, Norway announced a contribution of NOK 530

million to Indonesia for its 2016/2017 deforestation results

in line with the Letter of Intent. The contribution was

intended to be disbursed to Indonesia’s own financial

mechanism, the newly established Indonesian

Environment Fund (IEF). Recently, our two governments

have been engaged in discussions on a legal agreement for

the transfer of the results-based contribution.

Until the termination announcement discussions in this

regard were ongoing and in Norway’s view constructive

and progressing well, within the frameworks set by our

two countries’ regulatory limits. Given our commitments

in the Letter of Intent, and Indonesia’s impressive results,

we were looking forward to supporting Indonesia’s efforts

with similarly significant annual contributions in the years

to come.

The Government of Norway would like to congratulate the

Government of Indonesia with their impressive REDD+

achievements to date. We welcome the Indonesian

Government’s continued leadership on this crucial climate

action agenda, and its continued commitment to deliver on

its emission reduction targets. We have highly appreciated

our collaboration and stand ready to continue supporting –

in mutually agreeable ways – Indonesia’s efforts in

protecting its forests and peatlands”.

See:

https://www.nicfi.no/current/press-statement-the-indonesianorway-climate-and-forest-partnership/

5.

MYANMAR

Sustainable development of wood-based

industry

The recently established Development Committee for the

Wood-Based Industries has initiated a survey of exporters.

This is the first ever comprehensive survey to seek the

perspectives of all players- forest products associations

and the individual manufacturers.

The committee was formed with Deputy Minister as Chair

and Managing Director of the MTE as Secretary. The

terms of the committee are wide ranging and include raw

material sourcing, technology, taxation and regulations.

The survey covers application of HS codes, importation of

raw materials, Forest Department and the Myanma Timber

Enterprise (MTE) documentation, promoting exports of

products other than sawnwood, difficulties in investment

and taxation, market barriers, shipping procedures,

application of forest permit (legality Certificate by Forest

Department) and export licensing by the Trade

Department.

One manufacturer said, in relation to HS codes, Myanmar

and importing countries need to reconcile or synchronise

the codes. In Myanmar, the unit of quantity is either cubic

ton 1 ( cubic ton is 50 cubic-foot) or cubic metre.

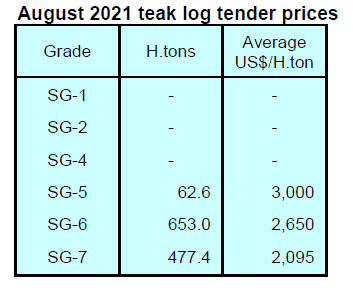

Auction of seized timber

According to Irrawaddy Online News, MTE will auction

12,500 tons of hardwood in September as it seeks to raise

hard currency. MTE said the sale includes 1,500 tons of

teak logs and 1,000 tons of sawn teak. The auction will be

held in Yangon’s Insein Township with buyers bidding

online.

In May MTE held three separate auctions when nearly

10,300 tons of timber was sold for around US$5 million

followed by another auction in June of more than 14,000

tons of timber. The wood sold in May and June reportedly

came from a stockpile of 200,000 tons of timber seized by

the previous elected government.

However, a retired Manager of MTE who asked not to be

identified is reported as saying “it was not logical to say

all 200,000 tons of stockpile was illegally harvested. Some

of timbers might not meet the EUTR requirement to be

legal but it was not fair to say that all is illegal”. He also

spoke of his frustration as MTE needs about US$35

million annually to pay salaries and pensions.

In related news, it is reported that the parallel National

Unity government has warned it will blacklist any bidder

and government staff involved in the timber auctions.

See:

https://www.irrawaddy.com/news/burma/myanmar-junta-toauction-over-12000-tons-of-illegal-timber.html

Foreign trade falls sharply

The Ministry of Commerce has reported Myanmar’s

export earnings were just over US$26 billion as of 20

August in the current 2020-2021 fiscal year, a drop of

nearly US$7 billion compared to the same period of last

financial year according to.

In the eight months of the current financial year to May

China topped the list of the 10 countries to which

Myanmar exported goods most.

Myanmar exported goods worth US$3,985.06 million to

China, US$2,091.81 million to Thailand, US$673.87

million to Japan, US$485.50 million to India, US$434.67

million to the US, US$261.71 million to Germany,

US$245.75 million to the UK, US$233.48 million to

Spain, US$203.72 million to the Netherlands and

US$198.29 million to South Korea according to the data

from the commerce ministry.

See:

https://elevenmyanmar.com/news/myanmars-foreign-tradevalue-declines-by-nearly-7-billion-this-year

Exporters told to convert hard currency

The Myanmar Central Bank has told exporters that they

must convert all foreign currency earnings into the

domestic currency within four months of the receipt. The

Bank stated that the earnings in foreign currency from

export which entered their bank accounts must be sold in

four months after the entry to the licensed banks with

current market price without fail.

The Bank rule came into effect the day of the

announcement. The announcement was issued under the

foreign Exchange Management Law, 49 (c).

According to Foreign Exchange Management Law section

38 (b), 42 (a) and 35, all earnings in foreign currency

received in the course of exports must be deposited in

respective local bank accounts within a limited time frame

after the goods have been loaded and shipped.

See:

https://elevenmyanmar.com/news/cbm-exporters-to-sellexport-earnings-in-their-accounts-in-four-months-after-theirentry-into

6. INDIA

Corona up date

India administered more than 180 million corona vaccines

doses in August as it continues to speed up its vaccination

programme to try and stall a third wave of infections. The

government aims to vaccinate all eligible Indians by the

end of this year.

It has been reported that India will begin using a new

COVID-19 vaccine that uses circular strands of DNA to

trigger an immune response to the corona vius. This could

be good news as the new DNA vaccine could be used

anywhere in the world when approved. The new vaccine,

ZyCoV-D is administered into the skin without an

injection and has been found 67% effective.

See:

https://www.nature.com/articles/d41586-021-02385-x

Government data showed India’s economy expanded 20%

year-on-year in the April-June quarter. During the same

period last year, India's economy shrank by 24%.

Rising freight charges to dent exports

After the record high in July 2021 Indian exports will be

affected by the shortage of shipping containers around the

world. Export competiveness could be dented as the

rapidly rising costs of shipping are passed on to

consumers.

The cost of shipping a container has more than doubled in

a few months and the Federation of Indian Exporters

Organisation (FIEO) and other private sector groups have

alerted the Central government and urged action.

India’s exports grew to US$33.1 billion in August, 45%

higher than last year, but a faster pace of increase in

imports resulted in trade deficit widening to US$13.9

billion, the highest since April.

Although exports were nearly US$2 billion lower than in

July when they hit US$35.4 billion.

See:

https://www.indiatoday.in/business/story/global-containershortage-impact-on-india-export-trade-volume-1847120-2021-08-30

Rebound in consumer confidence

Indian householder consumer confidence improved almost

3% month on month in August according to the monthly

Refinitiv-Ipsos Primary Consumer Sentiment Index

(PCSI) for India. This index takes account of consumer

attitudes on the current and future state of local

economies, personal finance situations, savings and

confidence to make large investments.

See:

https://www.livemint.com/news/india/consumerconfidence-improves-in-august-11628916022960.html

Demand for wood to surge in India by 2030 - new

report

There will be a substantial increase in wood consumption

in India by 2030, exacerbating an existing shortfall

between wood production and demand and increasing the

country’s reliance on wood imports, according to an ITTO

report that analyzes India’s timber market dynamics to

2030.

The report shows that, although India’s forest cover has

increased steadily for nearly two decades, timber

production is still substantially less than consumption, and

an increasingly large proportion of demand is being met

by imports. The report has three main sections. The first

reviews the development of the Indian forest sector over

the last decade, including changes in forest cover and

timber growing stock.

The second section analyses trends in India’s wood-based

industry, including the international trade of roundwood,

sawnwood, plywood, fibreboard, hoopwood, pulp and

veneer.

The third section of the report provides projections of

demand for 2021–2030, based on likely increases in

population and income, wood consumption trends, and

growth in important wood-based industries. The report

concludes with a discussion on how to improve the

accuracy of future reports.The study forecasts a jump of

nearly 70% in demand for roundwood in India in the next

decade, from 57 million cu.m in 2020 to 98 million

cu.m in 2030, driven largely by the construction sector.

Without policy change, say the authors, India will need to

rely heavily on imports to meet this surge in demand

because domestic production is restricted by the country’s

conservation-oriented forest policy.

See:

https://www.itto.int/other_technical_reports/

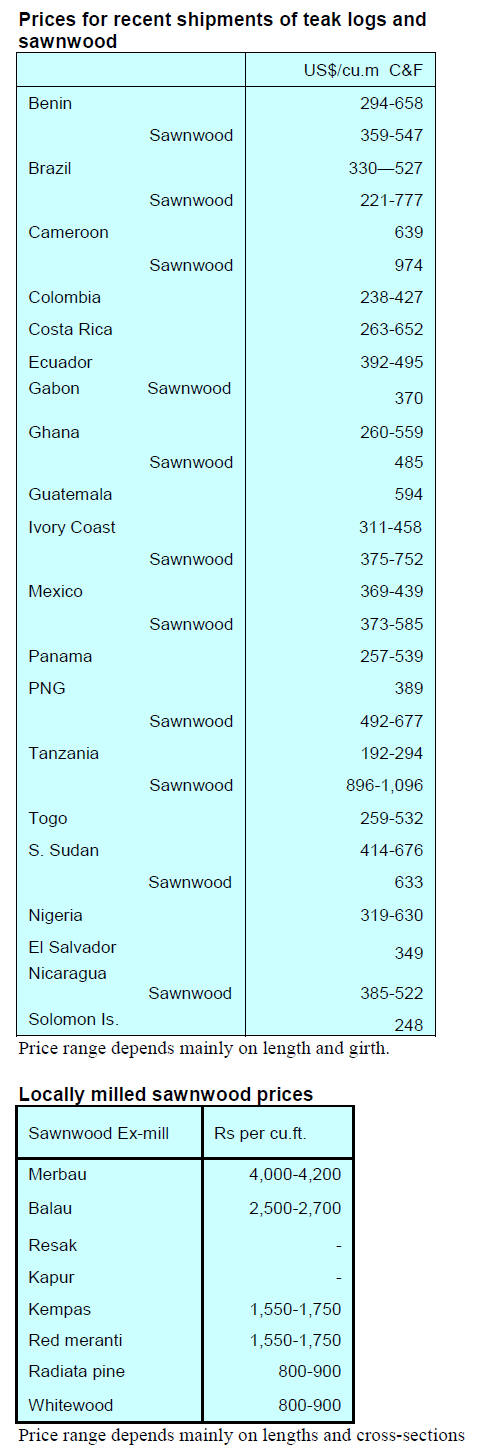

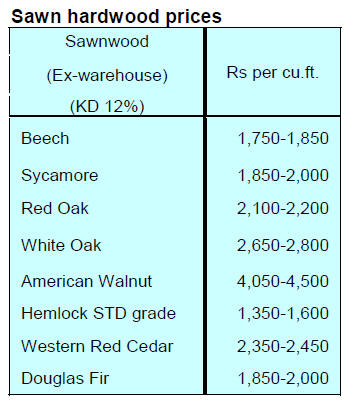

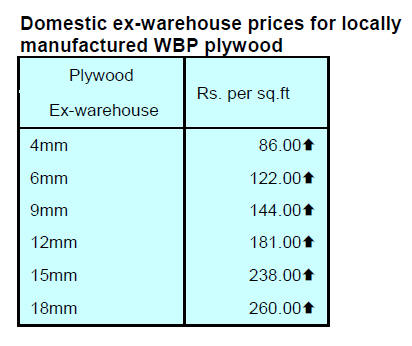

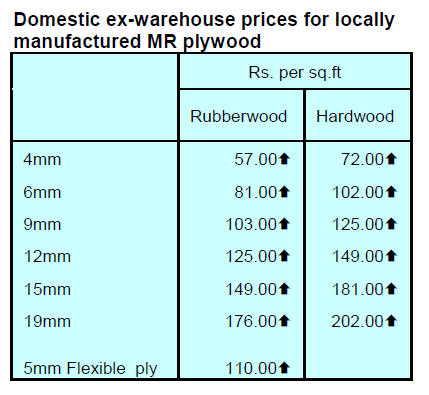

Plywood

Plywood prices have been raised once again as production

costs have jumped. MDF and particleboard manufacturers

(and to some extent, plywood makers) share the same

domestic wood raw material base and competition for raw

materials is becoming intense resulting in rapid increases

in prices.

In addition, resin costs are rising. Much of the resin and

other chemicals used in production are imported and rising

freight costs and rising global demand has pushed up

prices. Adding to the problems faced by wood based panel

makers is the shortage of workers and consequent increase

in wages.

Mills in Kerala relied on experienced workers from Assam

and mills in Maharashtra relied on workers from Orissa.

Workers from these two regions fled the cities during the

worst of the pandemic and have been slow to return.

7.

VIETNAM

Two scenarios for Vietnams’ exports in the last

months of 2021

In the first two quarters of 2021 exports of wood and wood

products from Vietnam increased but due to the pandemic

export earnings will decline in the coming months.

According to the Directorate of Customs exports of wood

and wood products in the first 7 months of 2021 reached

US$9.26 billion, a 57% increase compared to the same

period of 2020.

However, since July social distancing and restrictions on

movement in many provinces and cities in Vietnam have

impacted production. Exports of wood and wood products

in July reached nearly US$1.3 billion, some 17% down

year on year. In the first half of August export earning fell

45% compared to July.

It is possible that covid restrictions will be in place for

sometime and this will badly affect production. Covid-19

control measures affect all sector of the timber industry,

especially companies in the main wood processing centers

like Binh Duong, Dong Nai Provinces and Ho Chi Minh

City.

The response of companies to the recent lockdown has

been to reduce the number of workers and reduce or

curtail production. Some companies are trying to maintain

production at 20 - 50% of capacity in order to partially

meet orders and maintain jobs for employees. Workers

from plants that have stopped production are facing an

uncertain future.

A recent survey conducted in Ho Chi Minh City, Binh

Duong Province and Dong Nai Province by three

associations including the Handicraft and Wood

IndustryAssociation of Ho Chi Minh City (HAWA), Binh

Duong Furniture Association (BIFA) and Dong Nai Wood

and Handicraft Association (DOWA) revealed some

alarming data. By August 18.5% of association members

halted production, 46% of members reduced the capacity

and applied the “3 on-site” rule.

It was estimated that over 80% of workers in the

association member plants had temporarily lost their jobs.

A study conducted jointly by Forest Trends, VIFOREST

and the Forest Products Association of Binh Dinh

Province set out two possible scenarios for export in the

last months of this year.

In the first scenario the group assumed the decline in the

first half of Auguts will last to the end of the third quarter.

By that time the vaccination roll-out will be well

underway.

As a result export earnings will begin to recover from the

fourth quarter but would only be around 70% of the first

two quarter earnings. If accurate the gross wood product

earnings for 2021 will be US$13.55 billion.

In the second scenario the group assumed the pandemic

will not be controlled so in this case the decline in export

earnings will continue until year end such that 2021

earnings would be only US$12.69 billion.

See:

https://vietnamagriculture.nongnghiep.vn/2-scenarios-ofwood-exporting-of-vietnam-in-the-last-coming-months-of-2021-d301443.html

Enterprises starved of raw materials and workers

Timber enterprises in Binh Dinh have a huge backlog of

export orders but there is a severe shortage of workers and

raw materials and the supply chain has been disrupted.

According to Le Minh Thien, Chairman of Binh Dinh FPA

thanks to the USA, EU, UK and Australia markets

enthusiastically import furniture from the beginning of

2021 until the end of August furniture manufacturers in

Binh Dinh have exported a wide variety of products

through online channels.

However, now a number of localities in Binh Dinh

Province have to comply with the Government's Directive

16 for Covid-19 prevention and control. The restriction on

the movement of people has forced many wood processing

businesses in the area to stop operating.

He also said if this situation persists throughout September

furniture exports from Binh Dinh manufacturers will

plummet by 30-40% compared to July and the situation

will be even more severe in October.

According to the Binh Dinh FPA several large furniture

factories in Binh Dinh have implemented the ‘3 on the

spot’ system to maintain production. However, businesses

can only sustain this for a short time because the costs

incurred are too high and regular screening is costly and

time consuming.

Assuming an enterprise has 500 workers working "3 on

the spot", a test for all workers will cost about VND 70

million. In one month, four tests are required.

Implementing this ‘3 on the spot’ system creates other

problems as workers still face difficulties when going

through quarantine checkpoints. Many localities have

become too worried and applied strict measures to prevent

people from going to work in order to manage prevention

and control measures. It was not until FPA Binh Dinh

raised this with local authorities that workers could go

travel to work.

Wood processing enterprises in Binh Dinh have to face

another difficulty, the supply of raw materials. The

‘furniture capitals’ of Binh Duong and Dong Nai are now

paralysed and supply chains are broken. This has pushed

up the price of timber raw materials.

See:

https://vietnamagriculture.nongnghiep.vn/wood-enterprisestarve-of-materials-and-workers-d302066.html

Vietnams’ W&WP trade in the first 7 months of 2021

Exports

In the first 7 months of 2021 W&WP exports reached

US$9.26 billion, up 54% over the same period of 2020.

Due to the severe outbreak of Covid-19 in the major wood

processing industries of Binh Duong, Dong Nai and Ho

Chi Minh City exports in July dropped by 17% compared

to June. On the other hand imports of W&WP in the first 7

months were valued at US$1.81 billion, a year-on-year

increase of 39%.

W&WP exports to top markets in the first 7 months of

2021 are as follows:

US: US$5.72 billion, up 77.4%, accounting for

62% of Vietnam's W&WP exports;

Japan: US$0.81 billion, up 18.8%, sharing 9% of

the total W&WP exports;

China: US$0.93 billion, up 24.8%, equivalent to

10% of the total exports;

South Korea: US$0.53 billion, up 16.8%, taking

6% of the total exports;

EU: US$0.38 billion, up 34.0%, 4% of the total

value of G&SPG exports;

UK: US$0.16 billion, up 29.4%, contributing 2%

of the total exports;

Canada: US$0.15 billion, up 48.9%, about 2 per

cent of total exports.

Exports of the major W&WP including indoor/outdoor

furniture, seats, woodchip, woodpellet, veneer (peeling),

particle-board, fiber-board, plywood/finger-joint wood in

the first 7 months of 2021 increased as follows:

Furniture: US$4.33 billion, up 53% over the same

period in 2020;

Wooden seats: US$2.35 billion, up 99%;

Woodchip: US1.08 billion (8.5 million tonnes),

up 23% in volume and 17% in value;

Plywood/finger-joint wood: US$570.47 million

(1.54 million cu.m), up 43% in volume and 99%

in value;

Wood-pellet: US$241.22 million (2.14 million

tonnes), up 32% in volume and 36% in value;

Veneer (peeling): US$117.32 million (1.21

million cu.m), up 337% in volume and 185% in

value;

Fibreboard: US$36.75 million (66,860 cu.m), up

1.4% in volume and 46% in value;

Particleboard: US$6.30 million (29,870 cu. m),

up 19% in volume, but down by 3% in value.

Of wooden furniture exports of kitchen cabinets (HS

9403.40) continued up growing over 60% compared to the

same period of the last year. Next to kitchen cabinets are

upholstered seats where exports more than doubled to

US$1.50 billion.

Imports

Vietnam imported US$1.81 billion of W&WP in the first 7

months of 2021, up 39% against the same period of 2020.

Sawnwood, logs, veneer, fibreboard, plywood, wooden

seats and furniture were the main imports.

W&WP are imported from 113 countries/territories in the

first 7 months of 2021. China, the US, Cameroon,

Thailand and Chile are 5 top sources with the supply of

US$1.12 billion, accounting for 62% of the total value of

W&WP imports into Vietnam.

China:

The value of W&WP imports from this market reached

US$667.23 million, up 71% over the same period in 2020,

accounting for 37% of the total value of imports from all

sources.

Major imports from China include plywood (US$153.08

million), Veneer (US$140.10 million), wooden seats

(US$107.03 million) and furniture (US 91.37 million).

US:

W&WP imports from the US were valued at US$189.67

million, accounting for 10.5% of total imports, up 2% in

value. The US exports mainly logs (130,370 cu.m) and

sawnwood (291,580 cu m). The US is the top sawnwood

suppliers for Vietnam.

Cameroon:

Over the first 7 months of 2021 imports from Cameroon

amounted to US$112.47 million, down 10% compared to

the same period in 2020 and contributed 6% of the total

imports. Logs (177,700 cu.m) and sawnwood (90,500

cu.m) are imported from Cameroon.

Thailand:

Imports from Thailand reached US$0.43 million in the

first 7 months of 2021, up 68%, accounting for 5% of the

imports from all sources. Particleboard (108,550 cu.m),

fibreboard (257,570 cu.m) were the key products imported

from Thailand.

Chile:

Imports were worth US$58.31 million, up 62%,

accounting for 3.2% of the total imports. Sawnwood was

the main product Vietnam imported from Chile (210,230

cu.m)

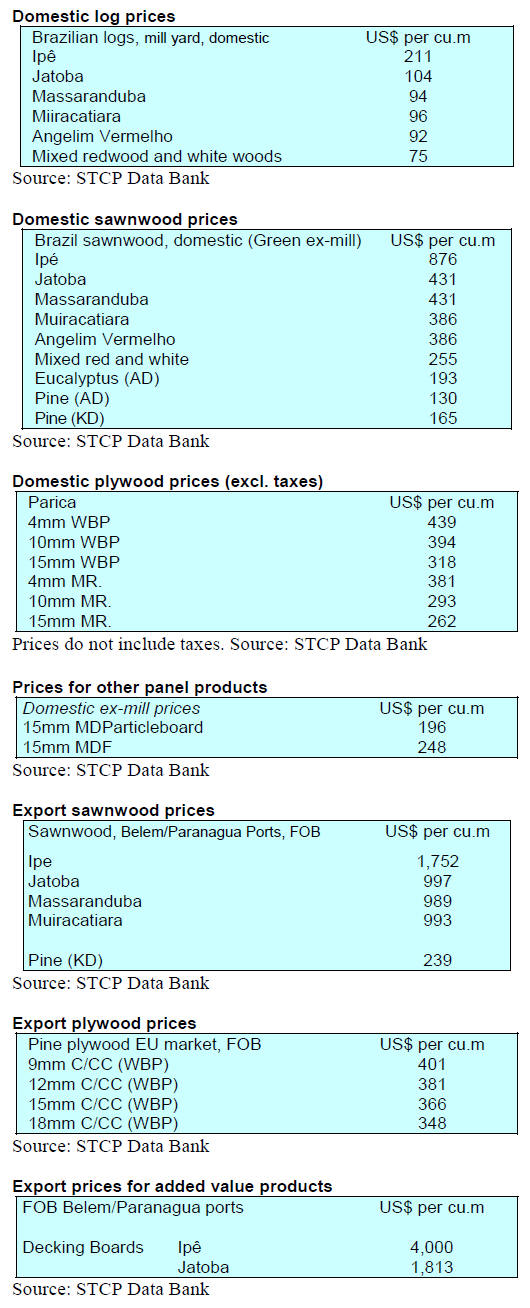

8. BRAZIL

Combating environmental crimes in the

Amazon

The Brazilian Federal Government is making efforts to

reduce the incidence of environmental crimes. The

Brazilian Institute for Environment and Renewable

Natural Resources (IBAMA) and the Chico Mendes

Institute for Biodiversity Conservation (ICMBio), the

Armed Forces and the National Public Security Force have

been working together in the Amazon region.

In June this year the Federal Government announced a

new operation called the Samaúma Operation which will

specifically address illegal deforestation. The operation is

being conducted in 26 municipalities in the States of Pará,

Amazônia, Rondônia and Mato Grosso, which together

account for around 70% of environmental offenses in the

Legal Amazon.

The Samaúma Operation is coordinated by the National

Council of the Legal Amazon (CNAL), chaired by the

Vice President. This operation can authorise the use of the

Armed Forces in indigenous lands, federal environmental

conservation units, federal land areas in general and upon

request of State Governors in areas of the states covered

by the operation.

Partnership to promote development of the timber

sector

The state of Mato Grosso is one of the main tropical

timber producing states in Brazil and the Timber Industry

Union of Northern Mato Grosso State (SINDUSMAD) in

partnership with the National Service for Industrial

Training (SENAI) is to offer training courses for its

employees aimed at further the development of the timber

sector. According to SENAI companies should benefit

from improved productivity and competitiveness.

Improving world economy lifts timber exports

Driven by the economic recovery in the world's largest

economies exports from Paraná State totalled US$1.8

billion in July, 11% more compared than in July 2020.

Between January and July this year exports from Paraná

have grown 14% year on year.

Wood products are one of the main products exported

from the state and earnings reached US$1.1 billion

according to the Foreign Trade Secretariat, Ministry of

Economy. The strong recovery in developed economies

explains the more than doubling of furniture exports.

Almost 60% of the wood products exported from Paraná

State are for the US market.

The appreciation of the US dollar against the Brazilian

currency favors exports making the Brazilian product

more competitive in international markets. Brazilian

furniture exports closed the first half of 2021 with a 72%

increase compared to the same period in 2020. The main

importers were the US followed by Chile and the United

Kingdom. Furniture manufacturers in Brazil have been

adopting ‘green’ manufacturing using sustainably

produced timber along with recycled wood.

9. PERU

Osinfor improves information system

The Forest Resources and Wildlife Supervision Agency

(Osinfor) has made changes to its Management

Information System (SIGO sfc v3.0) to provide more

information on the use of natural resources.

With the technical support of USAID and the United

States Forest Service this new version of the SIGO sfc

contains improved internal management for the inspection

processes and is expanded to include additional public

entities to strengthen traceability. The traceability report

provides detailed information on the location of the site,

expiration of permits, management plan, species and

approved volume among other items. It also covers

supervision, auditing and training.

The manager of the Forest Program of USAID and the

United States Forest Service, Victor Miyakawa, welcomed

Osinfor's initiative to continuously improve its processes

as he considers these improvements in the SIGO sfc will

provide key information to boost the competitiveness in

the forest sector.

US company in violation of Lacey Act

A US company has pleaded guilty in the District of

Columbia to violating the Lacey Act. The company

admitted that it failed to exercise due care when it

imported timber from the Peruvian Amazon. The court

imposed a fine of US$5,000 and ordered a US$200,000 in

restitution to the Ministry of Environment of Peru.

Peru issues documents to establish the chain of custody

and ensure that any timber harvested or transported is

legal. The Agency for Supervision of Forest Resources

and Wildlife (OSINFOR) audits harvest sites to ensure

legal compliance.

OSINFOR makes its findings available on SIGO, an opensource

website maintained by the Peruvian government.

Importers are able to check SIGO to determine if there

have been any irregularities regarding specific harvest

permits.

The Trade Enforcement Group of Homeland Security

Investigations in Houston and CBP conducted the

investigation with assistance from Peruvian authorities.

Trial Attorneys Patrick Duggan and Ryan Connors of the

Environmental Crimes Section of the Environment and

Natural Resources Division prosecuted the case.

See:

https://www.justice.gov/opa/pr/us-corporation-sentencedimporting-illegally-sourced-wood-amazon