|

Report from

Europe

EU27 imports close to record levels

EU27 imports of tropical wood and wooden furniture

products in the first six months were at the highest level

for a decade. But perhaps surprisingly, even this has not

led to an increase in share for tropical products in the EU

market. EU27 imports from non-tropical countries have

increased even more rapidly.

In fact, the extraordinary market conditions that have

emerged during the COVID-19 pandemic have driven total

EU27 imports of wood and wooden furniture products this

year close to the record levels of 2007 and 2008, just prior

to the global financial crises.

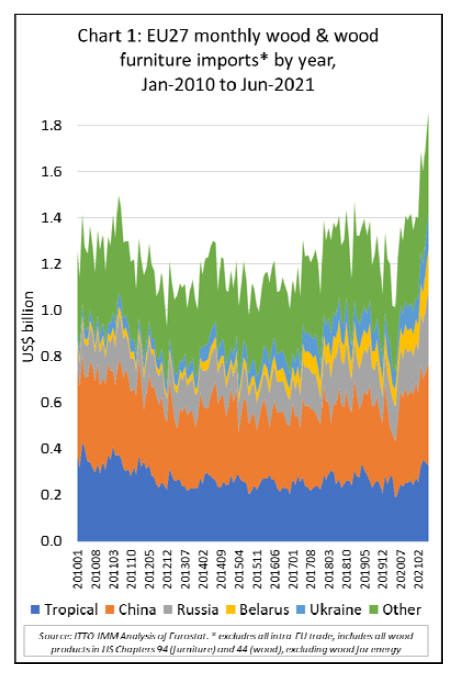

Total EU27 import value of wood and wooden furniture in

the first six months of this year was US$9.7 billion, 38%

more than in the same period in 2020. Import value of

tropical products was US$1.88 billion, 26% more than the

same period in 2020. However import value from nontropical

regions was US$7.82 billion, a 42% increase.

Imports were up by 44% from China to US$2.42 billion,

by 50% from Russia to US$1.43 billion, by 71% from

Belarus to US$810 million, and by 50% from Ukraine to

US$770 million.

Of course, the comparison to a particularly slow trading

period during the first lockdown last year makes this year's

rise seem even larger. But trade this year is unprecedented

even compared to the long-term. Total EU27 imports

were valued at US$1.86 billion in June this year, by far the

largest amount of any single month in the last decade

(Chart 1).

Monthly import values this high have only ever before

been seen in the boom years of 2007 and 2008, just before

the crash brought on by the global financial crises.

Positive signs of EU recovery

The sharp rise in the value of EU27 wood product imports

this year is partly due to rising timber product prices, the

dramatic and unprecedented increases in freight rates from

October last year, and to the arrival of a backlog of orders

delayed during the pandemic. However, it also comes at a

time when more positive signs are emerging on the

demand side as the economic recovery in the EU gains

momentum.

This trend is expected to continue as vaccination rates are

rising, lockdown measures are eased and the full effects of

NextGenerationEU, the EU¡¯s large fiscal stimulus

programme, begin to be felt.

According to the EU¡¯s ¡®Summer 2021 Economic Forecast¡¯

published in July, following a 6.0% decline in 2020, the

EU economy is now forecast to expand by 4.8% in 2021

and by 4.5% in 2022. This represents a significant upgrade

of the growth outlook compared to the ¡®Spring 2021

Economic Forecast¡¯ which the Commission presented in

May.

The contraction of EU GDP in the first quarter of this year

turned out to be marginal and milder than expected.

Upbeat survey results among consumers and businesses,

as well as data tracking mobility, suggest that a rebound in

consumption is already underway and set to strengthen in

the coming months.

There is also evidence of a beginning revival in tourism

activity, which should also benefit from the new EU

Digital COVID Certificate. Together, these factors are

expected to outweigh the temporary production input

shortages and rising costs hitting parts of the

manufacturing sector.

Economic growth rates will continue to vary across the

EU. Some Member States (e.g. Germany, Netherlands,

Sweden, Denmark, Poland) are now expected to see

economic output return to their pre-pandemic levels by the

end of 2021. Others (e.g. Spain, France, Italy, Portugal)

will take longer, but all should see their economies return

to pre-crisis levels before the end of 2022.

According to the EU's forecast, uncertainty and risks

surrounding the growth outlook are high but remain

overall balanced. The threat posed by the spread and

emergence of variants of concern underscores the

importance of a further rapid increase in full vaccination.

Economic risks relate in particular to the response of

households and firms to changes in restrictions and the

impact of emergency policy support withdrawal.

Forward looking indicators show that economic

momentum in the EU27 has picked up since the start of

the year, although business and consumer confidence is

still quite fragile, particularly in the construction sector, a

key driver of timber demand in the region.

At 49.8 in July, the IHS Markit Eurozone Construction

Total Activity Index fell from 50.3 in June and pointed to

a marginal reduction in overall construction activity.

This marked the first fall in Eurozone construction activity

since February, with companies often linking the decline

to rising costs and raw material shortages. On a brighter

note, Eurozone construction firms remained confident that

activity will increase over the next 12 months amid

forecasts of strengthening economic conditions, improved

supplier performance and new projects.

Highest EU tropical imports since 2012

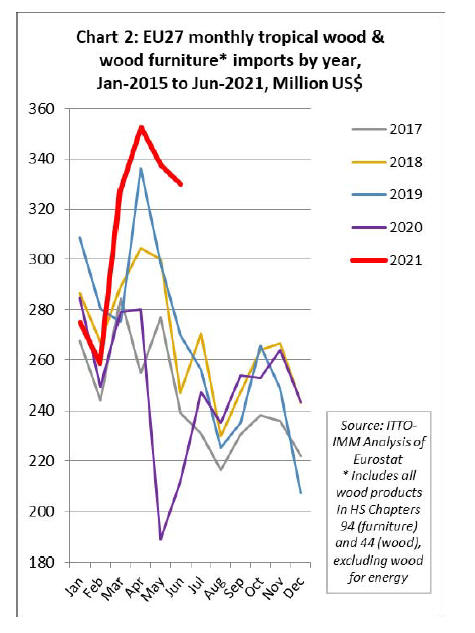

EU27 imports of tropical wood and wooden furniture

started this year slowly in January and February but surged

to US$327 million in March and then again to US$353

million in April, the highest monthly import recorded

since January 2012. Import value fell away only slightly to

US$338 million in May and US$330 million in June

(Chart 2).

The value of EU27 imports of most tropical wood

products increased in the first six months of 2021

compared to the same period in 2021. For wooden

furniture, joinery and flooring from tropical countries,

imports were higher even than in 2019 before the

pandemic.

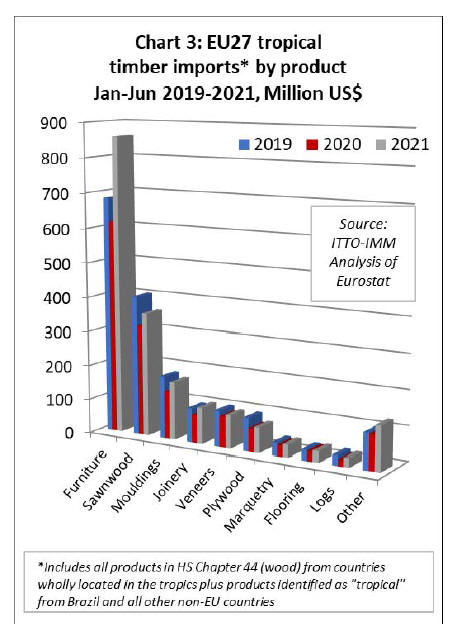

In the first 6 months of 2021, EU27 import value of

wooden furniture from tropical countries was US$859

million, 39% and 26% higher than the same period in 2020

and 2019 respectively. For tropical joinery products,

import value of US$105 in the first 6 months this year was

29% and 6% higher than the same period in 2020 and

2019 respectively.

For tropical wood flooring, import value of US$33 million

in the first 6 months this year was 15% higher than in

2020 and 5% higher than in 2019.

EU27 imports of other tropical wood products in the first

six months of 2021 were higher than the same period last

year but still down on levels achieved in 2019.

Import value of tropical sawnwood was US$358 million,

up 12% on 2020 but down 11% on 2019.

Import value of tropical mouldings was US$167 million,

up 21% on 2020 but down 8% on 2019.

Import value of tropical veneer was US$95 million, 7%

more than in 2020 but 9% less than 2019.

Import value of plywood was US$73 million, up 8%

compared to 2020 but down 24% on 2019.

Import value of tropical marquetry was US$37 million,

15% more than 2020 but 2% less than 2019.

Import value of tropical logs was US$26 million, 44% up

on 2020 but 12% less than 2019 (Chart 3).

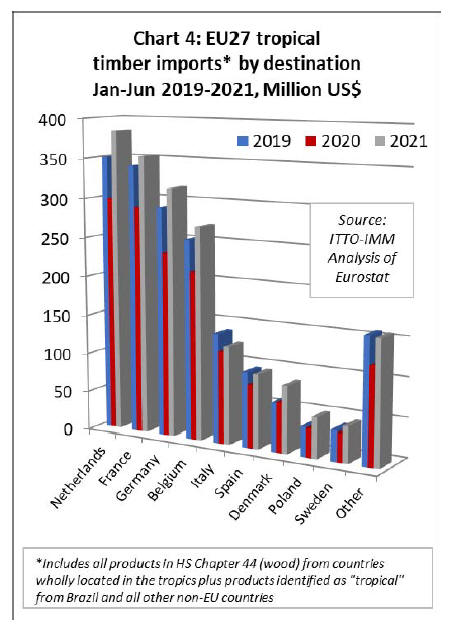

In the first six month this year, import value into all the

largest EU27 destinations for tropical wood and wooden

furniture products was higher than in the same period in

2020. Even more remarkable, of the largest markets, only

in Italy was import value in the first half of this year less

than in the same period in 2019 before the pandemic.

In the first six months of 2021, import value was up 28%

in the Netherlands to US$384 million, 22% to US$353

million in France, 35% in Germany to US$316 million,

27% in Belgium to US$270 million, 6% in Italy to

US$124 million, 18% in Spain to US$94 million, 34% to

US$85 million in Denmark, 41% in Poland to US$51

million, and 27% in Sweden to US$46 million. (Chart 4).

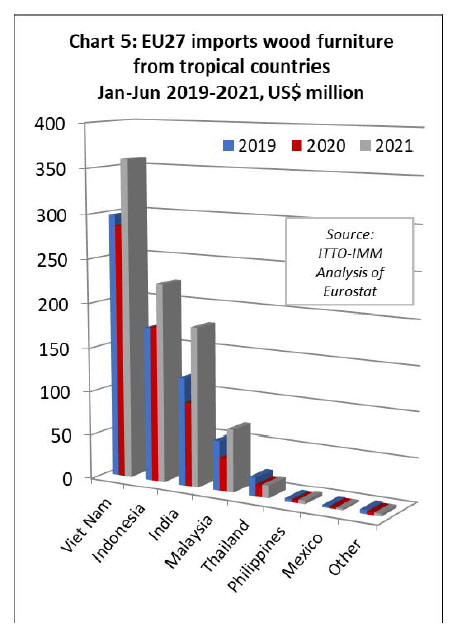

Strong recovery in EU27 wooden furniture imports

from tropical countries

After a slow start to the year, the value of EU27 wooden

furniture imports from the two largest tropical suppliers ¨C

Vietnam and Indonesia ¨C increased sharply in the second

quarter. By the end of the first 6 months, import value was

up 26% from Vietnam to US$360 million and up 28%

from Indonesia to US$224 million.

Meanwhile imports from India and Malaysia, already

strong in the first quarter this year, continued to rise

sharply in the second quarter.

After six months this year, import value from India was

US$180 million, 91% greater than the same period in

2020, while import value from Malaysia was US$71

million, a gain of 83%.

For all four leading tropical suppliers, EU27 wooden

furniture import value in the first 6 months of 2021 was

higher even than in 2019 before the pandemic (Chart 5).

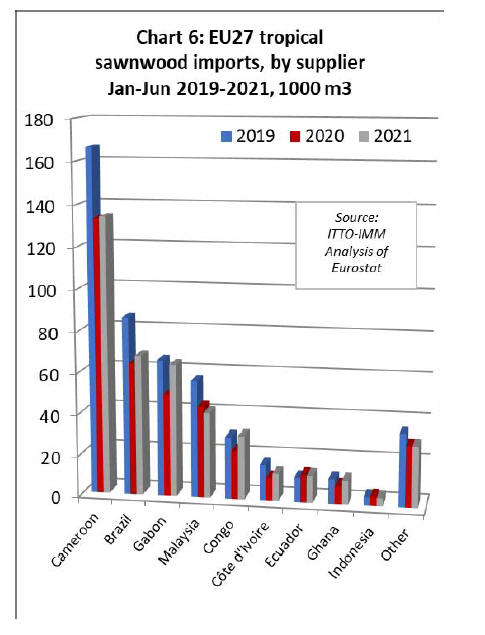

EU27 imports of sawnwood less impressive on a

volume basis

EU27 import performance of tropical sawnwood so far

this year is rather less impressive when considered on a

volume basis. Total imports of 410,000 cu.m in the first 6

months were 7.4% higher than the same period in 2020 but

still down nearly 16% compared to the same period in

2019 before the pandemic.

Imports of 134,000 cu.m of sawnwood from Cameroon in

the first 6 months this year were just 1% higher than the

same period in 2020 and still 19% down compared to

2019. Imports of 68,000 cu.m from Brazil were up 6%

compared to 2020 but down 21% compared to 2019.

Sawnwood imports from Gabon and Congo fared a little

better during the first six months of this year. Imports from

Gabon, at 64,000 cu.m, were up 29% on 2020 and down

only 3% compared to 2019. For the Congo, imports were

31,000 cu.m in the six month period, up 31% on 2020 and

2% on 2019.

Imports of sawnwood from Côte d'Ivoire were 13,500

cu.m in the first 6 months of this year, up 22% compared

to 2020 but down 23% on 2019. The long term decline in

EU27 imports of sawnwood from Malaysia continued in

the first 6 months this year, at 41,100 cu.m 6% less than

the same period in 2020 and 27% down on 2019 (Chart 6).

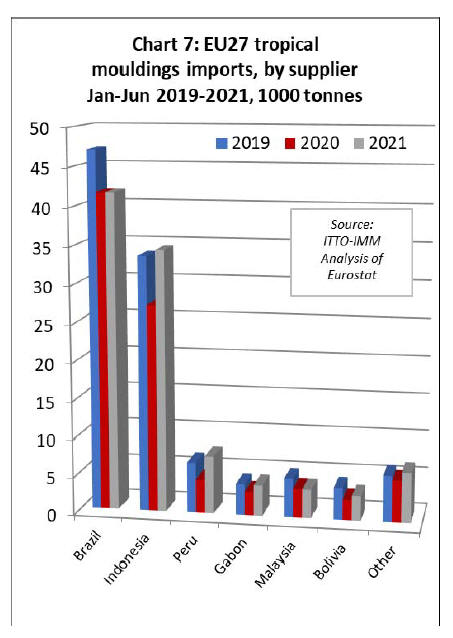

EU27 imports of tropical mouldings/decking increased

15% to 101,500 tonnes in the first half of this year

compared to last.

However import quantity was still down 5% compared to

2019. Imports of 41,600 tonnes from the largest supplier

Brazil, were unchanged on the same period last year and

12% less than in 2019.

Despite widespread reports of supply shortages for

Indonesian bangkirai decking, imports of

moulding/decking from Indonesia were 34,400 tonnes

during the first six months of 2021, 26% more than the

same period in 2020 and 2% more than in 2019.

Imports of mouldings/decking from Peru were 7,600

tonnes, 71% more than in 2020 and 14% up on 2019.

Sawnwood imports from Gabon just exceeded 4,000

tonnes in the first 6 months this year, 30% more than the

same period in 2020 but down 1% compared to 2019.

Imports from Malaysia were 3800 tonnes in the first six

months this year, 1% less than in 2020 and 22% down

compared to 2019. (Chart 7).

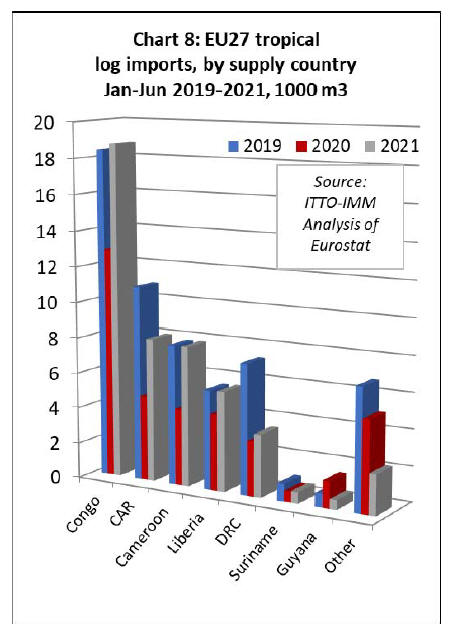

Log imports

EU27 imports of tropical logs, which have been in long

term decline and are now a shadow of their former level,

did rebound 29% to 47,000 cu.m in the first six months of

this year.

However, this is still 19% less than the same period in

2019. Imports in the first six months of 2021 from Congo

(18,800 cu.m), Cameroon (7,900 cu.m), and Liberia (5,600

cu.m) were all big increases on the same period in 2020

and close to the level of 2019 before the pandemic.

Imports in the first six months this year from CAR (8,000

cu.m) and DRC (3,500 cu.m), while significantly more

than the same period in 2020 were still well down on the

2019 level (Chart 8 above).

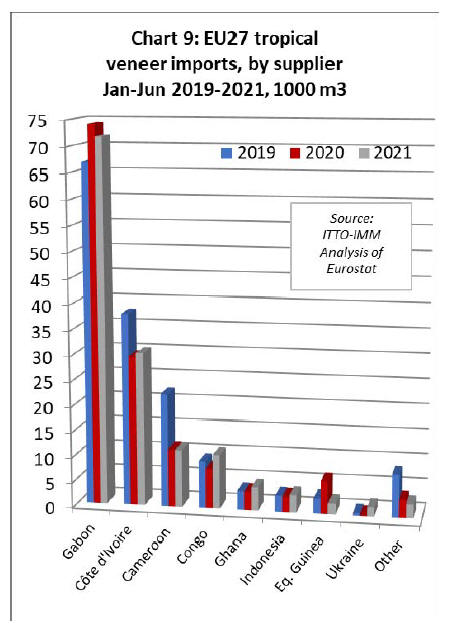

Slow EU27 imports of tropical veneer and plywood

EU27 imports of tropical veneer declined 1% to 138,900

cu.m in the first six months of this year. After a rapid rise

last year, veneer imports from Gabon declined 3% to

71,700 cu.m.

Imports were also down 1% to 11,400 cu.m from

Cameroon and 67% to 2,200 cu.m from Equatorial

Guinea. At 30,300 cu.m, veneer imports from Côte

d'Ivoire were 2% more than in 2020 but still down 20%

compared to 2019.

Larger gains were made in EU27 veneer imports from

Congo (+36% to 10,700 cu.m), Ghana (+27% to 4,700

cu.m), and Indonesia (+11% to 3,400 cu.m) (Chart 9).

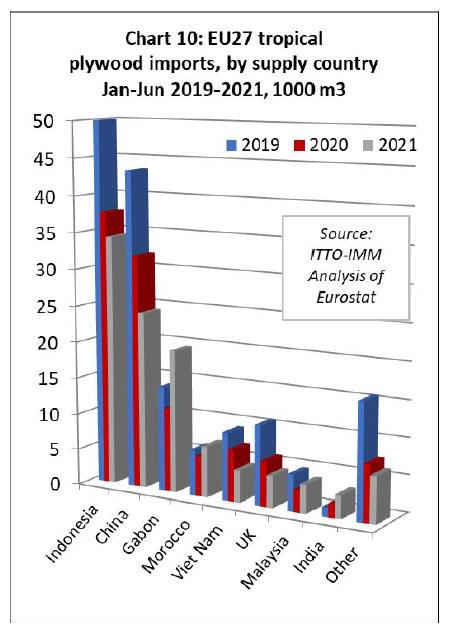

Overall the signs are that tropical hardwood plywood has

been a big loser in the competitive battle for dominance of

the EU plywood market, particularly against Russian birch

plywood. EU27 imports of tropical plywood were

107,000 cu.m in the first six months this year, that is 5%

less than the same period in 2020 and 31% down

compared to 2019.

Imports from Indonesia were 34,400 cu.m, 9% less than in

2020 and 31% less than in 2019. Imports of tropical

hardwood faced plywood from China were 24,000 cu.m,

24% less than in 2020 and 44% down compared to 2019.

EU27 imports of tropical hardwood plywood from

Vietnam and indirect imports from the UK also continued

to slide in the first half of this year.

More positively, imports of tropical hardwood plywood

from Gabon and Morocco made more inroads into the

EU27 market in the first half of this year.

Imports from Gabon were 19,500 cu.m in the first six

months, 69% more than the same period in 2020 and 36%

more than in 2019. Imports from Morocco were 7,000

cu.m, 27% more than in 2020 (Chart 10).

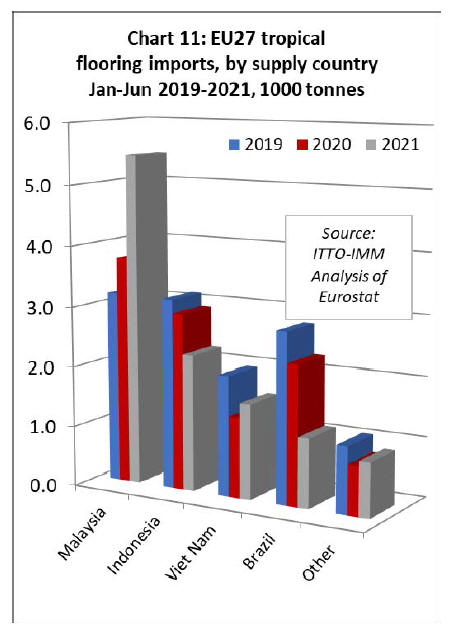

Rise in EU27 imports of tropical flooring from Malaysia

continues

EU27 imports of flooring from tropical countries were

11,300 tonnes in the first 6 months of 2021, 2% more than

in 2020 but still 7% down compared to 2019. The rise in

EU27 wood flooring imports from Malaysia, that began

last year, has continued into 2021.

Imports of 5,500 tonnes from Malaysia in the first six

months this year were 45% more than the same period in

2020 and 72% greater than in 2019.

In contrast, flooring imports from Indonesia of only 2,300

tonnes were 23% less than in 2020 and 28% down

compared to 2019. Imports from Brazil have also

continued to slide, at just 1,150 tonnes in the first six

months, 50% less than in 2020 and 59% down on 2019

(Chart 11 above).

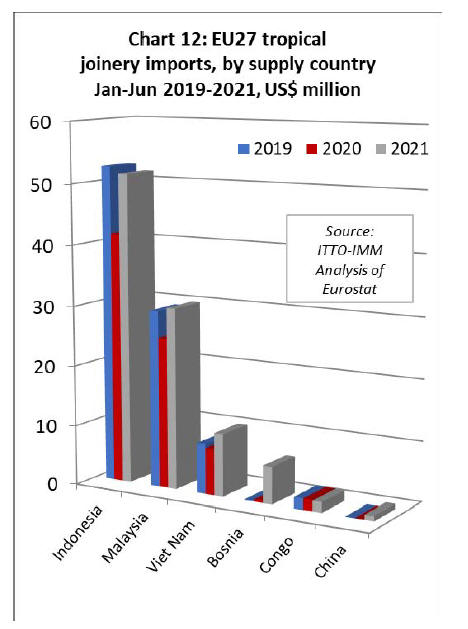

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors -

increased 29% to US$104 million in the first six months of

this year.

Imports were up 24% to US$51.5 million from Indonesia,

up 21% to US$30.1 million from Malaysia, and up 36% to

US$10.4 million from Vietnam.

This year the EU27 has also begun to import joinery

products manufactured using tropical hardwood from

Bosnia. Import value from Bosnia was US$6.2 million in

the first six months of 2021 (Chart 12 above).

|