|

Report from

North America

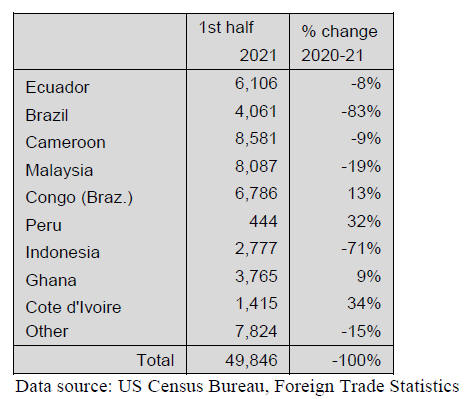

Tropical hardwood imports down sharply in June

Imports of sawn tropical hardwood fell 22% by volume in

June. The 7,763 cubic metres imported in June was

significantly lower than the volume seen in the last few

months and was down to a level comparable to that of last

winter.

Imports from the top supplying nations were all down by

an even larger percent: Cameroon down 48%, Congo

(Brazzaville) down 35%, Malaysia down 34%, and

Ecuador down 23%. Imports of aapelli and acajou

d¡¯Afrique were about half of the previous month¡¯s volume

while imports of keruing dropped by 38% and Balsa was

down 39%.

Imports of ipe and jatoba, which are no longer included in

these reported totals, both rose again in June. Ipe imports

gained 3% in June while jatoba imports grew by 24%.

Overall sawn tropical hardwood imports (not including ipe

and Jatoba) are down 37% year to date. However, if we

include those two woods, imports are actually up 16%

over 2020 so far this year.

Canadian imports of sawn tropical hardwood fell for the

second straight month in June. Imports were off 12% as

imports from Cameroon, Indonesia, and Congo

(Brazzaville) all fell by more than 30%.

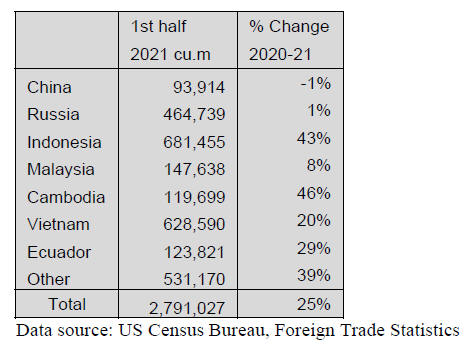

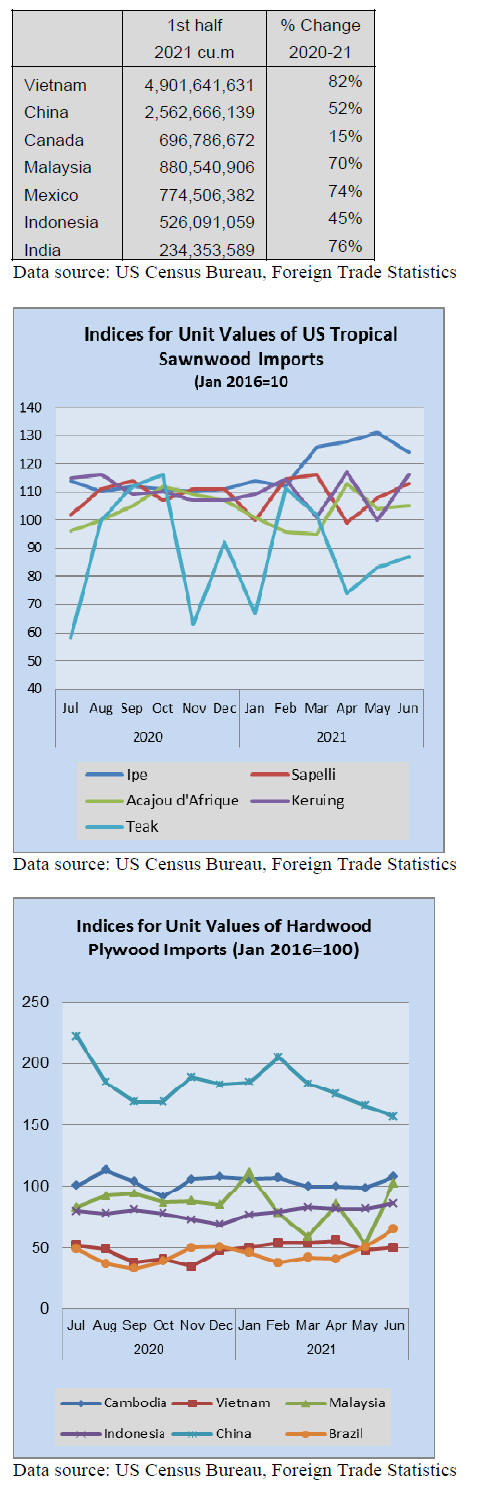

Hardwood plywood imports retreat

After a record volume in May, imports of hardwood

plywood fell back 8% in June. Despite the retreat, at

282,048 cubic metres the volume was more than 53%

higher than June 2020. The fall in volume did not lead to a

corresponding dollar loss as the amount spent rose

marginally to more than US$195 million as unit values

increased.

Imports from Indonesia, Cambodia, and Vietnam all fell

by about 10% in June but are ahead significantly year to

date from each of these countries. Overall imports of

hardwood plywood are up 25% year to date through the

first half of 2021.

Veneer imports show third straight month of strong

growth

Imports of tropical hardwood veneer continued their

strong recovery in June gaining 49% in volume from the

previous month to post its best total since August 2019.

Imports from China and Ghana both rebounded from a

dismal May while Imports from Italy grew by 44%.

Imports from India fell back 43% from a very strong May,

but still managed to outpace June 2020 imports by 75%.

The strong month pulled year to date imports ahead of

2020 for the first time this year as they are now up by 2%

through the first half of 2021.

Hardwood flooring imports strongest in more than two

years

Imports of hardwood flooring had another strong month

gaining 10% by volume in June for their best month since

May 2019. The gain was almost entirely due to a more

than doubling of imports from China in June. Despite the

gain, imports from China are still down 16% year to date.

The big month from China was tempered by drops in

imports from Malaysia (down 47%) and Indonesia (down

43%). Overall imports of hardwood flooring are ahead

41% year to date over 2020.

Imports of assembled flooring panels rose by 5% in June

on strong increases in imports from Canada (up 31%),

Indonesia (up 54%) and Thailand (up 46%). Imports from

Brazil and China were both down sharply. Imports appear

to be much stronger this year than last, but information is

incomplete currently as the U.S. government is updating

its reporting in this category. (See related story below)

USDA changes assembled flooring panels reports to

coordinate with Commerce Department

The U.S. Department of Agriculture (USDA) added two

additional categories of Assembled Flooring Panels to its

GATS imports data beginning with the data for May 2021.

The reports have added imports for Harmonised System

(HS) codes 4418790100 and 4418739000 to their reports,

increasing import total figures going back years. The two

codes represent categories that register imports ¡°not

elsewhere specified or indicated¡± (NESOI).

UDSA official Jason Carver wrote us that ¡°a number of

HS code changes implemented in 2019 (and one in 2018)

were not showing up in the GATS database but were

present in the U.S. Census trade database. Carver says the

GATS database is now up to date.

Moulding imports advance for fourth straight month

Imports of hardwood moulding were up 6% by volume in

June on strong gains from China. Imports from China rose

62%, continuing their recovery from a very weak spring.

Due to the poor first quarter, imports from China are down

60% year to date through the first half of the year.

Concersely, imports from Canada and Malaysia both fell

3% in June but are well ahead year to date, 47% and 60%

respectively. Overall imports of hardwood moulding are

up 17% year to date.

Wooden furniture imports down 2%

Imports of wooden furniture fell by 2% from May¡¯s record

but, at over US$2.2 billion in June, they are still higher

than every other month of the past 10 years and are nearly

twice that of June 2020. Imports from Mexico grew by

8%, while imports from most other countries all fell by

less than 10%, except for imports from India, which slid

20%. Overall imports are up 64% year to date through the

first half of the year.

Meanwhile, new orders for residential furniture are

continuing to see big growth, rising 47% in May 2021

over May 2020. This marks 12 straight months of yearover-

year increases, as reported by Smith Leonard in the

latest issue of Furniture Insights. Year to date, the results

remained very strong with orders up 67% over the first

five months of 2020. Orders were up for 97% for the

survey¡¯s participants year to date.

Since 2020 was not a normal year, Smith Leonard

compared the 2021 year to date results with that of their

2019 survey. This comparison showed new orders up 36%

over the first five months of 2019. These results show that

business has continued to be positive since the beginning

of the comeback from the shutdown of the economy in the

March/April 2020 time frame.

See:

https://www.woodworkingnetwork.com/news/woodworkingindustry-news/furniture-orders-47-percent-supplylabor-issuescontinue

Furniture maker MCS sues two shipping companies,

claims collusion

American home furniture manufacturer and supplier MCS

Industries has filed a US$600,000 lawsuit against Cosco

Shipping Lines and MSC Mediterranean Shipping

Company, alleging the two shippers had violated the U.S.

Shipping Act and exploited customers.

MCS says that since the beginning of the COVID-19

pandemic, shippers have colluded to manipulate the

market. MCS said the collusion was made possible

because there are now just three alliances that dominate 90

percent of the East-West trade lanes. MSC, the world's

second-largest shipper, said it was 'shocked' by the suit

and rejected claims of collusion.

MCS says a container shipped from China to the U.S.

West Coast in 2019 would have cost US$2,700. Now that

same voyage would cost more thanUS US$15,000.

Congress recently moved to give the Federal Maritime

Commission more power to investigate shipping lines.

See:

https://www.woodworkingnetwork.com/news/woodworkingindustry-news/furniture-maker-mcs-sues-two-shippingcompanies-claims-collusion

|