4.

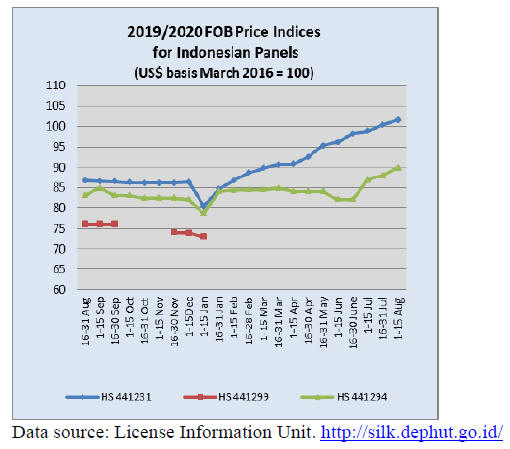

INDONESIA

Restrictions to be eased in Jakarta

As of 3 August 2021, the Indonesian Government

announced 3,496,700 confirmed cases of COVID-19 in all

34 provinces of Indonesia, with 524,142 active cases,

98,889 deaths and 2,873,669 people that have recovered

from the illness. Indonesia targets Covid-19 vaccination

for 208.3 million people and has administered the first

dose of vaccines to 23 out of 100 citizens as of 2 August

2021.

See:

https://reliefweb.int/report/indonesia/situation-updateresponse-covid-19-indonesia-3-august-2021-enid

A decision has been made to extend Covid-19 control

measures in Java and Bali but the current plan calls for a

relaxation of restrictions in some areas including Jakarta

where infection rates have slowed. Restrictions in some

areas outside Java and Bali will be extended until 23

August.

Economic recovery moving in right direction

State-owned Enterprises (SOE) Minister, Erick Thohir,

has commented that Indonesia's economic recovery is

moving in the right direction since economic growth

reached 7% in the second quarter of this year.

He argued that this was the result of strong exports,

improving household consumption and investment.

However, the Minister warned everyone must be aware

that the delta variant has a high infection rate and this

represents a considerable risk.

Recovery of exports to US

Indonesia's furniture and craft exports recorded positive

growth especially to the US market rising 35% in the first

half of 2021.

The chairman of the Indonesia's Furniture and Craft

Industry Association's (HIMKI), Abdul Sobur, said during

the first half of 2021exports of furniture and crafts were

valued at US$1.687 billion, a 35% increase year on year.

The main market was the US (50%) followed by Japan

(7%), the Netherlands (5%) Germany (4%), Belgium

(4%), Australia (3.6%) and the UK (3%).

Meanwhile, the Director of Production Forest Business in

the Ministry of Environment and Forestry (KLHK)

reported that exports of forest and wood products in the

first quarter of 2021 increased to US$3.045 billion

compared to the US$2.731 billion in 2020. In the second

quarter of 2021 exports increased 70% year on year.

Plantation and natural forest log production rises

The performance of the forestry and wood processing

sectors in the first and second quarters of 2021 improved

compared to the same periods in 2020. There was an

increase in log production, processed wood production,

NTFP production and export earnings.

Production of logs from both natural forests and plantation

forests in the second quarter of 2020 was 11.56 million

cubic metres and this rose to 12.8 million cubic metres in

the second quarter of 2021. Processed wood production in

the first quarter of 2021 increased by 6% compared to

2020 and in the second quarter it was the same as last year.

To accelerate the growth of the forestry sub-sector the

government implemented several policies including

relaxation of fiscal policy, acceleration of the

implementation of the Job Creation Law and facilitation of

financing for timber legality certification for MSMEs in

forest products and community forest industries.

See:

https://industri.kontan.co.id/news/produksi-kayu-hutanalam-dan-hutan-tanaman-meningkat-620-pada-kuartal-ii-2021

India’s decision on MDF dumping welcomed

Minister of Trade, Muhammad Lutfi, has expressed his

appreciation of the India Government’s decision to reject

the proposed anti-dumping import duty on imports of plain

medium density fibreboard with a thickness of less than 6

mm from Indonesia.

The Indian Directorate General of Trade Remedies

(DGTR) had considered a US$22.47-258.42/cu.m duty on

Indonesian MDF products after it determined that there

were material losses in the Indian MDF Board domestic

industry.

Based on data from the Central Statistics Agency,

Indonesia's MDF exports to India slowed over the past five

years. The highest export of the Indonesian MDF to India

was in 2016 when shipments were worth US$8 million,

this drooped to a little over US$2 million in 2020.

See:

https://www.kemendag.go.id/id/newsroom/pressrelease/ekspor-fibre-board-indonesia-ke-india-bebas-bea-masukanti-dumping-1

Opportunities for greater trade with the UK

Indonesia can intensify trade relations with the UK by

improving the ease of doing business (EODB) and

reducing trade barriers according to the Head of the

Research Center for Indonesian Policy Studies (CIPS),

Felippa Ann Amanta.

In a press release Amanta said that opportunities exist for

better trade relations between Indonesia and the UK

through the Developing Country Trading Scheme (DCTS)

and the Joint Economic and Trade Committee (JETCO)

that was mutually agreed upon.

The Developing Countries Trade Scheme or DCTS

recently launched by the UK after Brexit, boosts the

prospects of Indonesia, which had inked the JETCO with

the UK, to bolster trade between both nations.

Citing the Trade Ministry’s data, Amanta pointed to the

low level of trade between Indonesia and the UK which

was only US$2.2 billion in 2020. Amanta believes that

Indonesia had huge opportunities to export a wide range of

products to the UK.

See:

https://en.antaranews.com/news/180790/improving-eodb-tostrengthen-indonesias-trade-relations-with-uk-cips

Association proposes carbon trading platform

The government has proposed the introduction of a

Carbon Tax through a revision of Law Number 6 of 1983

concerning General Provisions and Tax Procedures (RUU

KUP). It is planned that the minimum rate of tax will be

IDR75.00 per kilogram of carbon dioxide equivalent

(CO2e).

Chairman of the Association of Indonesian Forest

Concessionaires (APHI), Indroyono Soesilo,

recommended that a carbon trading mechanism should be

established so both sellers and buyers can benefit.

See:

https://www.republika.co.id/berita/qxajyc383/aphi-usulkanopsi-pengenaan-pajak-karbon

and

https://nasional.kontan.co.id/news/aphi-perusahaan-yangmencapai-target-penurunan-emisi-selayaknya-diberikan-insentif

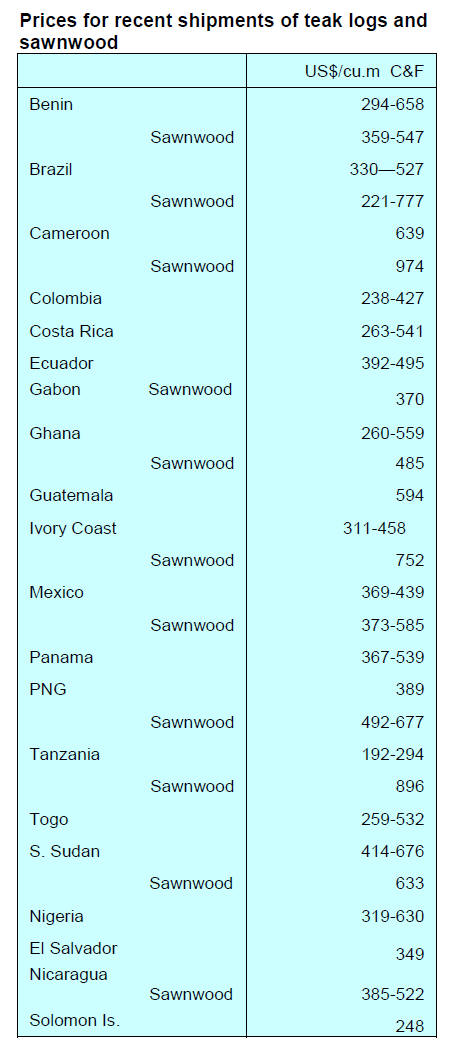

5.

MYANMAR

Exporters facing tough times

Timber exporters are saying buyers in the EU have cut

back on purchases and those that continue to buy wood

products are asking for the names of company

shareholders.

Timber exporters have been facing tough trading

conditions since the February coup. First, the Trade

Department suspended the issuance of export licenses for

about three months from April to June 2021 the when

licenses began to be issued the EU announced sanctions on

the Myanma Timber Enterprise and Forest Joint Venture

Corporation, the official suppliers of teak logs to the

industry.

Myanmar’s political rights and aid crisis is worsening

Speaking to UN News, the organisation’s top aid official

in Myanmar, Acting Humanitarian and Resident

Coordinator Ramanathan Balakrishnan, described how

people have been severely impacted across the country

since the military took control in February.

“The situation in the country is characterised now by

instability and a deteriorating socio-economic and security

situation and to add to that we have a raging third wave of

COVID-19,” said Mr. Balakrishnan.

Highlighting the ongoing nature of armed resistance to

State security forces “in several ethnic minority areas”

including in the states of Shan, Chin and Kachin, the UN

official said that more than 200,000 people had been

uprooted from their homes there to date.

See:

https://news.un.org/en/story/2021/07/1096772

ASEAN envoy confirmed

A decision was taken at the 28th ASEAN Regional Forum

6 August 2021 to appointment of the Minister of Foreign

Affairs II of Brunei Darussalam to be the Special Envoy of

the ASEAN Chair on Myanmar.

The report of the ASEAN Chairman’s Statement reads:

“The Meeting discussed the recent developments in

Myanmar and expressed concern over the situation in the

country, including reports of fatalities and violence. The

Meeting also heard calls for the release of political

detainees including foreigners.

The Meeting welcomed Myanmar’s commitment to the

Five-Point Consensus adopted at the ASEAN Leaders

Meeting on 24 April 2021 and acceptance for the timely

and complete implementation of the Five-Point Consensus

namely, the immediate cessation of violence in Myanmar

and for all parties to exercise utmost restraint; constructive

dialogue among all parties concerned to commence to seek

a peaceful solution in the interests of the people; a Special

Envoy of the ASEAN Chair to facilitate mediation of the

dialogue process, with the assistance of the Secretary-

General of ASEAN; ASEAN to provide humanitarian

assistance through the ASEAN Secretary General and

assisted by the ASEAN Coordinating Centre for

Humanitarian Assistance on disaster management (AHA

Centre) and the Special Envoy and delegation to visit

Myanmar to meet with all parties concerned.

The Meeting welcomed the appointment of the Minister of

Foreign Affairs II of Brunei Darussalam to be the Special

Envoy of the ASEAN Chair on Myanmar, who will start

his work in Myanmar, including building trust and

confidence with full access to all parties concerned and

providing a clear timeline on the implementation of the

Five-Point Consensus before the ASEAN Foreign

Ministers Meeting”.

See:

https://asean.org/wp-content/uploads/2021/08/Final-Chairmans-Statement-of-the-28th-ARF.pdf

However, this appointment was immediately criticised by

Justice for Myanmar who, in a press release, stated the

ASEAN envoy is not acceptable because Brunei’s stateowned

oil company holds gas and oil licenses in the

country.

See:

https://www.justiceformyanmar.org/press-releases/aseansrole-in-myanmar-further-undermined-by-brunei-business-withmilitary-and-cronies

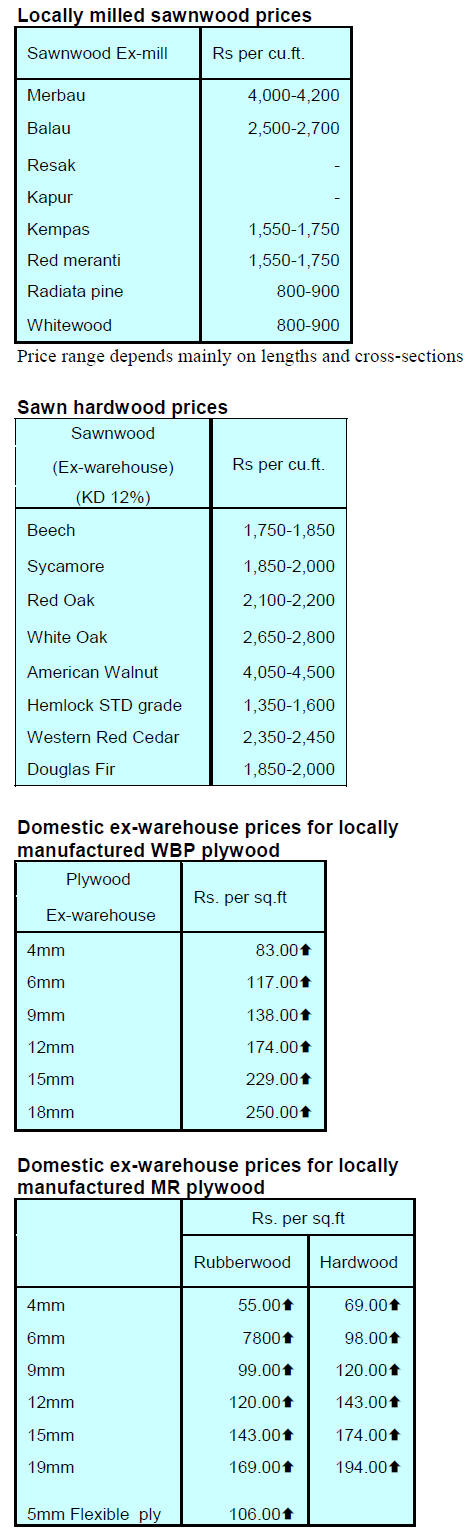

6. INDIA

Record exports

Data from the Ministry of Commerce indicates that Indian

exports have gradually grown after the first wave of the

Covid-19 disrupted global trade. Exports reached a record

high of US$35.2 billion in July this year, the highest

monthly figure in the country’s history. July 2021 exports

increased of 48% compared to July 2020 and by over 30%

compared to pre-pandemic July 2019.

Strong export demand has boosted domestic production

and the economy is showing signs of recovery. The

recovery in manufacturing has resulted in rising demand

for labour which is a welcome development after the

massive job losses during the second wave of the Covid-

19 pandemic.

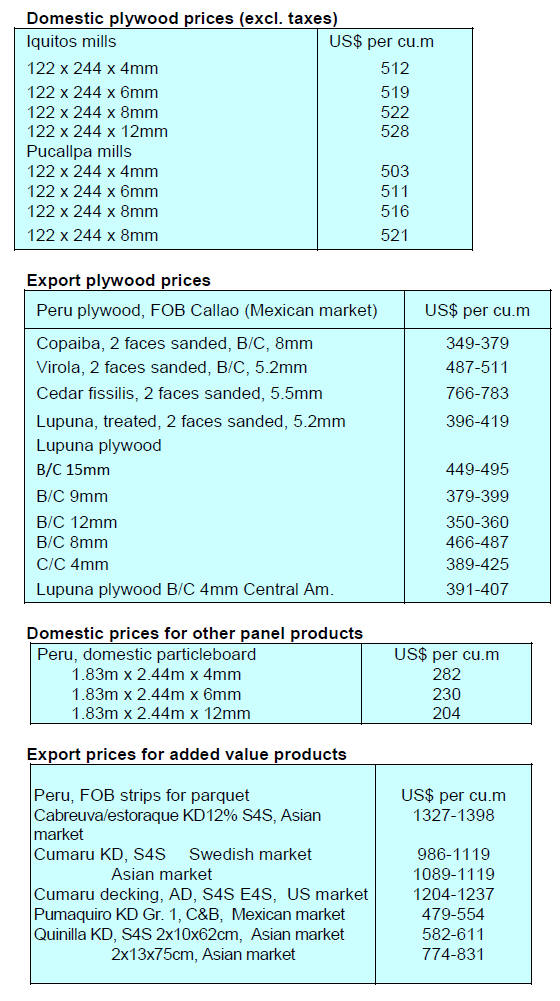

Plywood price increases

Phenol and formaldehyde prices started to rise at the end

of 2020 and they have continued to surge. Importers say

that the prices have gone up because of increased prices of

benzene and crude oil in international market.

The price increases for raw materials used to manufacture

glues and resins used in the wood based panel sector have

added to the cost of manufacturing plywood and

laminates.

At a recent meeting the All India Plywood Manufacturers

Association decided to raise plywood prices by 6% and

increase the the price of shuttering plywood by Rs. 2 per

square foot.

For more see the June 2021 issue of Ply Reporter.

Imported pine log prices jump

Sharply increased prices for imported pine logs due to firm

international demand and high freight charges have meant

that Indian manufacturers of doors and other products are

having to raise prices. As imported timber prices rise

manufacturers have decided to raise prices for finished

products.

Importers are of the opinion that pine log prices will not

come down for another 4-5 months because of strong

demand in China, USA and Europe.

7.

VIETNAM

Shipping delays as port operations slow

Shipping companies are warning that Vietnam will face a

shortage of containers in the coming weeks because of

disrupted schedules for ships returning to Asia, trucking

delays and factory closures. It has been reported that

shippers moving products out of the Cat Lai and Cai Mep

ports in Ho Chi Minh City are seeing delays of two to five

days.

The Cat Lai Terminal is heavily congested and Saigon

New Port Corporation said it has stopped taking in

refrigerated cargoes because of delayed loading. Shipping

companies have suggested exporters ship through ports

such as Tan Cang Hiep Phuoc in HCMC and Tan Cang-

Cai Mep and Tan Cang-Cai Mep Thi Vai in the

neighboring province of Ba Ria-Vung Tau.

See:

https://www.joc.com/port-news/international-ports/shippersface-growing-delays-vietnam-mulls-extending-viruslockdown_20210730.html

and

See:

https://e.vnexpress.net/news/business/companies/hcmc-portstops-receiving-bulk-cargo-amid-container-pileup-4334192.html

Vietnam wood and wood product export and import

update

Exports of wood and wood products in July 2021 reached

US$1.33 billion, up 17% compared to July 2020. In the

first 7 months of 2021 exports of wood and wood products

reached US$9.58 billion, up 55% over the same period in

2020. In particular, exports of manufactured products

reached US$7.45 billion, up 64% over the same period in

2020.

Imports of wood and wood products in July 2021 reached

US$282.7 million up 35% compared to July 2020. In the

first 7 months of 2021 imports of wood and wood products

reached US$1.83 billion, up 40% over the same period in

2020.

Exports to the Japanese market in July 2021 reached

US$128.9 million, up 26% compared to July 2020 and in

the first 7 months of 2021 exports to Japan reached

US$834.7 million, up 19% over the same period in 2020.

Exports of bedroom furniture in July 2021 are estimated at

US$196 million, little changed from July 2020 but in the

first 7 months of 2021exports of bedroom furniture were

around US$1.4 billion, up 47% year on year.

According to preliminary statistics from Customs,

Vietnam's imports of wood raw materials in July 2021

reached 25,900 cu.m, worth US$8.9 million, up 8% in

volume and 3% in value compared to July 2020. In the

first 7 months of 2021 imports of wood raw materials

reached 168,300 cu.m, worth US$ 62.8 million, up 8% in

volume and 6% in value over the same period in 2020.

In the first 6 months of 2021 imports of wood raw

materials from the US reached 374,610 cu.m, worth

US$153.72 million, down 14% in volume but up 2% in

value over the same period in 2020.

Timber enterprises implementing '3 on-site' ask for

public understanding

The South-East of Vietnam, including Binh Duong, Dong

Nai and Ho Chi Minh City together contribute over 70%

of Vietnam’s total value of wood and wood product

exports.

To avoid production disruption during the current

lockdown covering southern Vietnam many wood

processing factories have asked for permission to

implement the model of ‘3-on-site’ which means on-site

production, on-site dining and on-site overnight. They

have also asked for permission to operate a ‘1 road, 2

places’ operations. Both production models aim to avoid

the spread of coronavirus among workers.

For the ‘1 road, 2 places’ arrangement entrepreneurs must

ensure isolated production and residences in two separate

locations, with a single transport route for workers to

commute.

This pandemic production model has been functioning for

a while at small companies (less than 500 workers).

However the system has not been a total success for some

larger companies.

Wood processing enterprises which have been

implementing the ‘3 on-site’ model in the provinces of

Bình Định, Bình Dương and Đồng Nai have detected

clusters of COVID-19 cases but are asking that the

production model be allowed to continue.

The latest survey from the Bình Dương Furniture

Association (BIFA) showed that among 100 wood

enterprises which have been operating the ‘3 on-site’

model, 71 have ensured operations while 29

have been unable to avoid infection clusters.

Similarly, 60% of the 50 companies surveyed in Dồng Nai

Province said they have suspended operations because

their workers have been infected. Another 30% of

companies have been operating in an effort to fulfil

contracts.

The ‘3 on-site’ model, which involves on-site production,

dining and rest has received an enthusiastic response from

workers as it has helped maintain their incomes as well as

support production and the business.

Lê Xuân Tân, Director of Happy Furniture in Đồng Nai

Province, said his company participated in deploying the

‘3 on-site’ model under extremely strict controls from

production to accommodation.

Frequent COVID-19 tests are carried out.

Though admitting ‘3 on-site’ is quite a costly operational

model, Tân said the factory’s closure would impact

production and supply chains and mean workers would

lose their jobs.

See:

https://vietnamnews.vn/economy/999760/wood-enterprisesimplementing-3-on-site-ask-for-less-public-pressure.html

8. BRAZIL

Bank of Amazonia financing SFM

The Bank of Amazonia (BASA) is provided financing for

the implementation and maintenance of sustainable forest

management systems. According to BASA, R$66.9

million was made available in the first half of 2021 to

family farmers who are supported by the National

Program for the Strengthening of Family Agriculture

(PRONAF).

BASA points out that the main purpose of their finacing is

to promote sustainable production of agribusinesses. The

financing aims to guarantee the preservation of the

environment with small properties destined to be included

in the Permanent Preservation Area for reforestation and

agroforestry systems.

BASA considers they contribute to the UN Sustainable

Development Goals for 2030 agenda as they offer an

alternative for the restoration and use of legal reserve

areas.

In order to facilitate access to financing BASA provides a

digital platform which is already accessible in the states of

Pará, Acre, Amazonas, Rondônia, Roraima and Tocantins

states in the Amazon region.

Private preserved forests

Brazil has 498 million hectares of forests of which 98%

are natural forests and 2% are forest plantations. Of the

total area, about 55% are forests on public land and 45%

in private areas. According to Embrapa (Brazilian

Agricultural Research Corporation) out of the forests

located in private areas there are 176.8 million hectares of

natural vegetation which are preserved representing 20.5%

of the Brazilian territory.

The Rural Environmental Registry has 6.95 million rural

properties registered occupying an area of 630 million

hectares according to the Brazilian Forest Service.

Forest reserves and permanent preservation areas (APP’s)

are governed by the 2012 Brazilian Forest Code. The role

of rural producers in protecting natural vegetation is set

out in the legislation.

State of Paraná achieves record furniture exports

The furniture industries in Paraná reached a historic high

export performance in the first half of 2021. Furniture

exports in the first half of 2021 rose 105% in value

compared to the same period last year. According to the

Ministry of Economy exports were destined mainly to

Chile, USA, Argentina, Uruguay and Peru. The challenge

now is to sustain this level of exports.

The biggest surprise was that industries in Paraná state

could achieve this as they never featured prominently in

furniture exports. This performance was achieved despite

the pandemic, increased costs and high freight charges.

At present a major concern for Brazilian furniture

exporters a possible weakening of the US dollar and

growing competition from other countries.

Even though furniture exports are rising manufacturers

have been affected by rising raw material and component

costs which are largely imported. Currently, Paraná State

is the third largest furniture producer in Brazil, behind

Santa Catarina and Rio Grande do Sul, which together

account for 80% of the country's furniture exports.

Exports of wood-based panels jump

Data from the Ministry of Economy shows that exports of

wood-based panels increased 29% in the first six months

in 2021 compared to the same period of the previous year.

In terms of export volume the increase was 11%.

In value terms wood based panel exports totalled US$185

million compared to the US$142.9 million exported in the

first six months of 2020.

9. PERU

Corona update

The number of citizens in Peru infected with COVID-19

rose to 2,130,018 as of 11 August according to the

Ministry of Health. A total of 15,625,510 vaccine doses

have been administered and 6,532,449 people have

received two doses. The Deputy Minister of Health said

“if progress is made according to the vaccination schedule,

100 percent of the population would be protected before

the end of the year”.

The Council of Ministers agreed to extend the state of

health emergency due to the COVID-19 pandemic for 180

days.

See:

https://reliefweb.int/report/peru/bolet-n-semanal-redhumanitaria-nacional-rhn-5-de-agosto-de-2021-o-1-n-29

and

https://andina.pe/ingles/noticia-peru-coronavirus-cases-total-2130018-6532449-citizens-fully-vaccinated-857424.aspx

More funds to reactivate the forestry sector

The Ministry of Economy and Finance has authorised the

transfer of US$4.4 million to be used to reactivate and

finance activities aimed at strengthening the

competitiveness and sustainable use of forest resources

and wildlife in Ucayali, Loreto and Madre de Dios.

Details are found in Supreme Decree No. 186-2021-EF

published in the Official Gazette El Peruano. Ucayali will

be entitled to around US$1.3 million, a 23% increase on

the original budget. While the transfers to Madre de Dios

and Loreto are considerably higher.

The official gazette says the priority activities are related

to the granting of access rights to forest and wildlife

resources; prevention, control and surveillance of activities

that threaten forest resources and wild fauna; the

generation, administration and dissemination of forest and

wildlife information and community forest management.

The budget line for these disbursements is the

"Competitiveness and Sustainable Use of Forest Resources

and Wild Fauna”.

Better determination of contribution of forestry sector

to economy

As part of the implementation of the Forest Satellite

Account professionals from the National Forest and

Wildlife Service (SERFOR) and the National Institute of

Statistics and Informatics (INEI) recently exchange views

with experts from Costa Rica to learn about the experience

of creating environmental accounts.

This exposure was arranged thanks to a joint initiative of

Peru, Costa Rica and Germany and is part of the work to

develop the Forest Satellite Account, a key tool that will

allow to demonstrate the importance of the forest and

wildlife sector in the national economy.

It was reported that work is being done in Peru on the

construction of a nationwide map of vegetation cover

according to the standards established by the System of

Environmental and Economic Accounts - SCAE to

determine the stock, increase or reduction of the

vegetation cover of the country.

For a year, SERFOR and INEI have developed the

Peruvian Forest Satellite Account with the technical

support of professionals from the Central Bank of Costa

Rica, the Ministry of Environment and Energy and the

National Forest Financing Fund of the Republic of Costa

Rica.