|

Report from

Europe

European plywood market lucrative, but challenging

At the time of writing, the 63200-tonne dwt Konya was

unloading its cargo of plywood and other wood products at

the UK port of Tilbury. It was the first timber breakbulk

vessel out of Port Klang, Malaysia to London in years and

a sign of the times.

Some European plywood importers report that container

costs out of Asia have started to come off their pandemic

peak. Others, however, say that they are still being quoted

charges which one described as ¡®unreal¡¯. ¡°We¡¯ve recently

been offered rates for a 40ft container of US$15,000 to

US$20,000,¡± they said. ¡°That compares with US$1,500 to

US$2,000 in October 2020. It¡¯s crazy.¡±

Even those who report some softening in container rates

confirm they remain at historically high levels, hence

widespread migration to breakbulk.

The unprecedented inflation in container charges is

principally attributed to the impact of the pandemic on

trading patterns, which has left containers in the wrong

places, with major quantities stacked empty at ports in

consumer countries.

¡°Changes in consumption and shopping patterns triggered

by the pandemic, including a surge in electronic

commerce, as well as lockdown measures, have led to

increased import demand for manufactured consumer

goods, a large part of which is moved in shipping

containers,¡± stated a briefing note on the situation from

UNCTAD. ¡°Carriers, ports and shippers were all taken by

surprise. Empty boxes were left in places where they were

not needed, and repositioning was not planned for.¡±

As the global economy more generally revived when

lockdown restrictions eased, exporters in producer

countries, notably in Asia, found themselves increasingly

short of containers and prices rose accordingly. ¡°There¡¯s

also clearly been an element of profiteering at some

shipping lines,¡± said a plywood importer.

¡°The fact some are quoting container rates at half the

value of the plywood contents is not all down to

availability.¡±

Importers also point out that breakbulk is not a

straightforward alternative, particularly for those who have

not used it before. It involves more administration, the risk

of penalties if cargoes are not at port on time or in the

volumes booked and greater likelihood of product damage

in transit. While considerably cheaper than container

freight, it has also become more expensive.

¡°Breakbulk operators are seeing an opportunity to make

money and their rates have roughly doubled in the last six

months,¡± said an importer distributor.

And transport is just one of the challenges facing the

European plywood import trade. Over the last three

months, they report, global consumption has continued to

gather pace, given added impetus by government

economic stimulus measures.

At the same time production in many parts of the world

remains constrained by lack of personnel due to Covid-19

infection or isolation, plus pandemic safe work practices.

Raw material supply is also cited as an issue for some

manufacturers. Product prices have consequently

continued to climb.

¡°We¡¯re getting good margins, but obtaining product and

managing allocation, keeping your key customers covered

and reasonably happy despite the price rises, has made it

an increasingly stressful business,¡± said an importer

distributor. ¡°It¡¯s lucrative, but more challenging than at

any time we can remember.¡±

Some European importers expected plywood demand to

ease somewhat over the summer season. But, with

tourism still depressed by the pandemic, others say they¡¯re

not expecting to see the usual degree of holiday

slowdown. The general consensus is that for the time

being consumption remains on an upward curve. The

European DIY and home improvement market is cited as a

key plywood demand driver, as it has been since summer

2020.

¡°While pandemic controls are being relaxed, large

numbers of people are still working from home at least

part of the time, and that¡¯s expected to be a permanent

state of affairs for many. As a result they¡¯re spending more

on improving and enlarging their properties. Loft

conversions and garden office building are at record

levels,¡± said a UK-based importer.

¡°Spending on holidays, which was absolutely decimated in

2020, also continues to be depressed this year, leaving

more funds for investing in homes and gardens. The UK

Construction Products Association stated that in normal

times UK holiday expenditure alone exceeds £60 billion a

year. So there¡¯s a lot of surplus money around.¡±

Demand from new build is also reported to be looking

increasingly healthy, not least due to fiscal support from

governments which see construction as a key engine of

economic recovery. This is borne out by the June report

from Euroconstruct. It says that European construction

recovery is faster than expected and much of the loss in

output due to the pandemic is expected to be recovered in

2021. It forecasts average building growth in the 19

Euroconstruct countries this year to be 3.8%, following

last year¡¯s 5.8% contraction.

While recovery rates will vary from country to country,

with Ireland and Hungary expected to show some further

decline in 2021, this puts the industry overall on track to

reach pre-crisis levels of activity in 2022 latest.

Besides construction, importers also report good growth

in demand from joinery, furniture manufacture, packaging

and boat building. ¡°It¡¯s pretty much across the board,¡± said

one.

So far, the import sector reports little market push back on

price. ¡°It can¡¯t last forever, and if we¡¯re not seeing some

more significant price easing in two or three months, there

may be more resistance, especially if there¡¯s any degree of

economic slowdown,¡± said one importer. ¡°So far though,

customers accept that this is a market-wide phenomenon.

They¡¯re doing good business, so they¡¯re willing to pay.¡±

Despite logistical difficulties, added to which are longer

manufacturing lead times, most importers are reported to

be ¡®well covered for purchases¡¯ over coming months.

¡°But stocks on the ground are still very short, there¡¯s little

in the way of a product buffer,¡± said an importer.

¡°Whatever comes in is delivered immediately.

Nobody is saying, why don¡¯t you hold on to our shipment

and we¡¯ll take it in four to six weeks. Customers are

waiting for vessels to arrive to receive their cargoes. They

want it straight away.¡±

In terms of source of supply, China is reported to be

keeping up with demand, albeit with longer lead times, but

prices have been rising increasingly steeply.

¡°In the first quarter increases were moderate, but in Q2

we¡¯ve seen rises of 15-20% F.O.B.,¡± said an importer.

¡°Compared to Brazilian, that¡¯s not too bad, but when you

factor in freight rates it makes quite a difference.¡± Chinese

producers are also reported to have become increasingly

assertive.

¡°Some are trying to renegotiate outstanding contracts,¡±

said an importer. ¡°For orders placed April/May they¡¯re

maybe asking for another US$15-20 per cube.

They say they¡¯re facing rising costs for raw materials,

including glues, logs and veneer.

If you don¡¯t pay, you risk the plywood not being produced

and, if you¡¯ve booked the breakbulk ship space, you then

risk incurring dead freight and demurrage charges from

the shipping line.¡± Chinese ports are also reported to be

congested with breakbulk vessels and shipping lines are

asking for surcharges to cover added waiting times.

Brazilian price inflation is attributed primarily to the

combination of the impact on manufacturing of the severe

Covid-19 situation in the country, plus huge demand from

the US construction market.

¡°For standard 18-20mm elliottis plywood we were paying

US$250-300/cu.m last October/November. Lately the

asking price from Brazil has been US$500-600/cu.m.

Basically they¡¯ve doubled up,¡± said an importer. ¡°Unless

they desperately needed a specific product, European

importers more or less stopped buying Brazilian in

March/April this year when prices reached this level.

More recently we¡¯ve heard that there have been shipping

line issues between Brazil and the US and we¡¯ve had more

spot volume offers from Brazilian producers at slightly

lower prices. Whether this is the start of a wider

downward trend remains to be seen.

Despite these shipping problems, the US remains a

booming market, the government is injecting more money

into the economy and, even at recent high price levels,

Brazilian plywood remains the cheapest Americans can

get for the quality.¡± Brazilian prices are in turn said to be

helping push up Chinese.

¡°People who used to buy volume from Brazil have been

trying to replace it from China, adding further inflationary

pressure to their products,¡± said an importer distributor.

Russian birch plywood supply is reported as tight, sold

until September, and prices have also reached new heights.

¡°Yesterday we were asked to pay £62 per board for 18mm.

At the start of last year pre- pandemic it was £17,¡± said a

UK importer.

Adding a further market challenge is the preliminary antidumping

duty imposed on Russian plywood by the EU on

June 15. This has been set at 16% DAP (delivered at

place) and will remain in place until December, when the

EU will decide on the rate going forward.

¡°This has also led more European buyers to look to Asia,

but freight rates are limiting the extent to which it¡¯s viable

to switch from Russian,¡± said an importer-distributor. But

for the cost of containers, importers thought Indonesian

producers, in particular, would be able to capitalise on the

anti-dumping duty and substitute Russian film-faced with

their products.

¡°We saw an increase in Indonesian timber imports into

Europe from 2016-2019, partly due to rising consumption

generally, but we also feel to an extent due to FLEGT

licensing and the fact it has a green lane through the

EUTR,¡± said an importer. ¡°If it wasn¡¯t for the container

rates, they could potentially now have a real opportunity to

replace Russian film-faced.

With quotes on containers from Indonesia at US$13,000-

15,000, however, it isn¡¯t a viable proposition. Switching to

breakbulk on Indonesian is also problematic. To make it

feasible you need shipments of 1,000cu.m to 2,500 cu.m.

That¡¯s OK in China, but more difficult to organise in

Indonesia. Delivery to port is less reliable and you risk

incurring charges from shipping lines if cargo doesn¡¯t

show. We¡¯ve got outstanding orders from Indonesia set for

departure in June, which we¡¯re now told won¡¯t be shipped

until the end of September. We¡¯re hearing producers are

facing log shortages too.

Clients are not really interested in placing orders if they¡¯re

going to face three month delays, or possibly longer. So

Indonesia has potential to be an interesting partner for us,

but with this combination of negative factors, it isn¡¯t the

attractive option it could be. Things could change. If

container rates come down to US$7,500, the dollar doesn¡¯t

get too strong and, with the EU anti-dumping duty on

Russian in play, then Indonesia could be in business. But

there¡¯s a lot of what ifs and question marks there.¡±

Looking further ahead, some European importers

anticipate Russia¡¯s log export ban, set to come into force

in the New Year, having plywood market repercussions.

¡°It shouldn¡¯t affect production in Europe unduly, as its

Russian birch log imports are limited,¡± said an importer.

¡°But China imports huge volumes of logs from Russia in

all species, including birch. So unless the two strike a

bilateral deal, Chinese manufacturers may face a raw

materials challenge and we could see further pressure on

their production and prices.¡±

The option of plywood importers buying European

product rather than expensive imports from elsewhere has

been limited by manufacturers¡¯ capacity. ¡°European prices

have also been rising,¡± said an importer-distributor.

¡°We¡¯ve bought a little Polish recently, but pricewise,

they¡¯ve also followed the international trend.¡±

An added issue for UK businesses has been fallout from

Brexit. They report increased transport costs from

mainland Europe, with haulage companies upping rates to

offset the increased time taken by new port and customs

procedures.

There are issues too trading with Northern Ireland and

Ireland. Under the UK¡¯s EU exit deal, Northern Ireland

remains in the EU single market. That means plywood and

other timber products from the British mainland imported

into Northern Ireland have to undergo EU Timber

Regulation due diligence.

¡°Also if we ship goods to Northern Ireland for transit to

Ireland, they incur further duty, even if we¡¯ve paid duty on

them entering the British mainland,¡± said a plywood

company with sites in England and Northern Ireland.

¡°There are ways around this, but it really isn¡¯t a

satisfactory arrangement.¡±

European plywood imports rebound strongly since

September last year

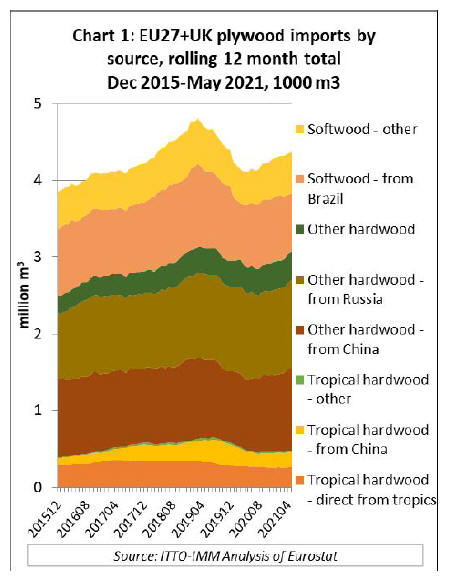

Latest analysis of Eurostat figures underlines the recent

volatile conditions in the EU and UK plywood trade. Total

EU+UK imports from outside the rose to a peak of 4.8

million cu.m in the 12 months to March 2019 before

declining sharply to a low of 4.1 million cu.m in the 12

months to March 2020.

The decline in imports predates the first Covid-19

lockdown in Europe and was due to weakening

construction sector activity and overstocking in the prepandemic

period. The rebound in construction and DIY

activity after the first lockdown period is mirrored by a

sharp rise in imports starting in September last year and

continuing until May this year (Chart 1).

Overall EU+UK plywood imports declined 2.9% to 4.3

million cu.m in 2020 but rose 5.1% from January to May

2021 compared to the same period the year before to 3.8

million cu.m. Following a fall of 11.8% in 2020,

hardwood plywood imports from the tropics in the first

five months of this year were up 11.5% to 122,000 cu.m,

while tropical hardwood plywood imports from China,

after contracting 30.3% in 2020, rose 15.3% to 72,000

cu.m.

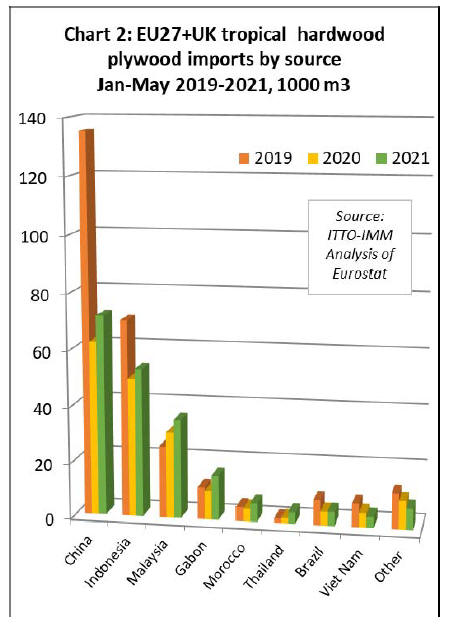

Looking at individual tropical plywood suppliers, EU and

UK imports from Indonesia from January to May 2021

were up 7% at 53,000 cu.m, from Malaysia 14.8% at

35,000 cu.m, Gabon 16% at 16,000 cu.m and Thailand

122.8% at 4,000 cu.m, while those from VietNam were

down 23.4% at 4,000 cu.m. Those from Morocco were up

43.7% at 7,000 cu.m and from Brazil 2.1% at 5,000 cu.m

(Chart 2).

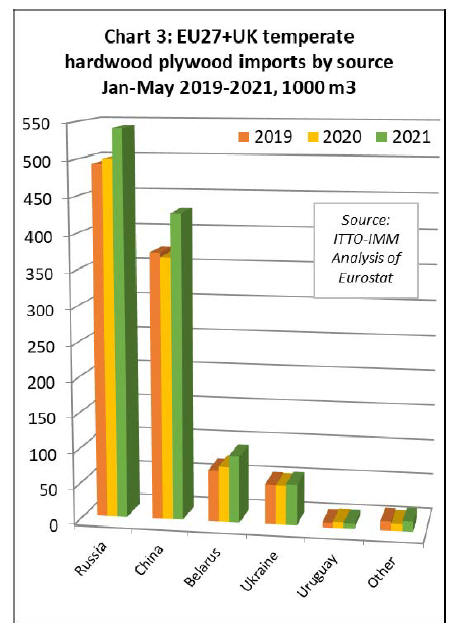

In the first five months of 2021, temperate hardwood

plywood imports from China were up 16.5% at 428,000

cu.m, while those from Russia increased 8.3% to 542,000

cu.m and from other non-tropical countries 14.7% at

172,000 cu.m (Chart 3).

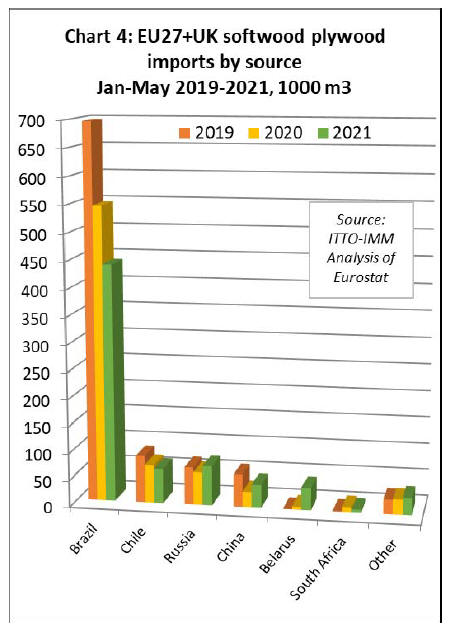

Underlining the European shift away from Brazil due to

the rise in prices triggered by US demand, Brazilian

softwood plywood imports dropped 19.5% from January

to May 2021 to 439,000 cu.m.

Softwood plywood imports from other countries were up

28.6% to 261,000 cu.m, with those from China ahead

48.7% at 43,000 cu.m (Chart 4).

Heat expected to come off the plywood trade in second

half of 2021

The outlook for the broader marketplace according to

European plywood importers is for little change from

current trading conditions over the next few months. But,

with some qualifications, there¡¯s a feeling the heat could

start to come off the trade heading into Q1 2022 and

possibly sooner.

¡°We¡¯re seeing raw materials costs across all industries, not

just wood products, at unprecedented levels due to the

combination of recovering demand and continuing

production restrictions due to the pandemic,¡± said an

importer.

¡°Estimates are that this has pushed the cost of building the

average home in Europe up 25%, for instance. So families

who previously were looking at spending €400,000-

€500,000 on a house are now having to find €500,000-

600,000. That¡¯s going to have repercussions in financing

and beyond the medium term it¡¯s not sustainable. Add in

government stimulus measures winding down and we

wouldn¡¯t be surprised to see a slowdown early in the New

Year.¡±

Another importer distributor generally agreed. ¡°The

unknown factor is the course of the pandemic. It may yet

put more pressure on prices and logistics,¡± they said.

¡°But there are signs of the market anticipating supply and

demand moving more into line and prices coming off their

peak.

Our customers are generally bought up for the next three

months and business is increasingly hand to mouth. From

October there¡¯s more hesitancy, as people don¡¯t want to

commit that far ahead, then see prices fall and have to

write off expensive stock.

There is already talk of price corrections in Brazilian and

Russian. The hope is, of course, that we get a gradual

adjustment, rather than prices that have doubled over the

last 18 months, halving overnight. That could really

destabilise the market. We¡¯ll just have to wait and see and,

in the meantime, keep business tight, keep customer

communications open and not over commit.¡±

Private sector confronts Paris Olympic Committee on

exclusion of tropical timber ¨C the story continues

In the April 16-30 2021 ITTO Market Report mention was

made of an open letter signed by several tropical timber

trade and industry associations sent to the Paris Olympic

Committee (SOLIDEO) Executive Director General

Nicolas Ferrand protesting the ¡°Cahier de Prescriptions

d¡±Excellence Environnementale¡± (Environmental

Excellence Prescription) which prohibits the use of

tropical timber in works related to the Olympics.

The letter can be found at:

https://www.atibt.org/files/upload/news/Courrier_SOLIDEO_VEn.pdf

The ATIBT, in its News Flash of 30 July, has made

available the response received from SOLIDEO which

effectively dismisses the argument put forward by the

organisations that presented the request for a review of the

decision to exclude tropical timber for construction of

Olympic facilities.

The response from SOLDEO can be seen at:

https://www.atibt.org/files/upload/news/SOLIDEO/SOLIDEO_answer.pdf

The ATIBT writes ¡°ATIBT and the signatories of the

letter will continue their actions to defend the use of

sustainable and ethical construction products. We

therefore reiterate our request for a meeting with the

SOLIDEO teams to find now a solution that would satisfy

the integration of this abundant and sustainable supply into

the construction of the infrastructure of the Paris 2024

Summer Olympic Games.

In this sense, leading companies involved in the

construction of the Olympic Village have expressed their

regret at not being able to offer tropical and boreal wood

products that meet technical, aesthetic and ecological

requirements.

ATIBT is currently exchanging with the authorities of

various wood-producing countries in the tropical regions

(Cameroon, Gabon, Republic of Congo, Malaysia) in

order to organise a diplomatic mission to France¡±.

|