4.

INDONESIA

Indonesian Ambassador visits UK

timber companies

In a bid to encourage UK timber importers to increase

their purchase of wood products from Indonesia a

delegation from the Embassy in the UK led by Indonesian

Ambassador, Desra Percaya, recently visited a number of

timber companies in the country.

During the visits the Ambassador said there is an

opportunity to gain from the UK-Indonesia FLEGT-VPA

and ensure that high-quality timbers remain firmly

established in UK industry’s supply chain.

See:

http://www.ttjonline.com/news/indonesian-ambassadorvisits-uk-timber-companies-8908227

Green Deal and Fit for 55 climate package

The European Union Ambassador to Indonesia, Vincent

Piket, in speaking with the press explained the European

Green Deal and the Fit for 55 Climate package.

In July this year the European Commission adopted a

package of proposals to make the EU's climate, energy,

land use, transport and taxation policies fit for reducing

net greenhouse gas emissions by at least 55% by 2030,

compared to 1990 levels.

Achieving these emission reductions in the next decade is

crucial to Europe becoming the world's first climateneutral

continent by 2050 and making the European Green

Deal a reality.

The Commission presented the legislative tools to deliver

on the targets agreed in the European Climate Law and

fundamentally transform the economy and society for a

fair, green and prosperous future.

The Ambassador said this would not affect trade with

Indonesia or the Comprehensive Economic Partnership

Agreement (CEPA) free trade negotiations with Indonesia.

But mentioned it is possible that there will be additional

regulations to prevent the entry into the EU of products

that damage the environment.

See:

https://ec.europa.eu/commission/presscorner/detail/en/IP_21_3541

Indonesian ‘Suar’ furniture a hit in Canada

The Indonesian Consul General in Toronto, Leonard F.

Hutabarat, was present at the inauguration of a showroom

featuring Indonesian wooden furniture especially suar

wood (also known as trembesi wood).

Suar wood is the Indonesian variety of Albizia saman, a

tree native to South America. It was introduced to

Indonesia in the mid 19th century by the Portuguese as a

plantation tree. Fast growing tree by nature, it has spread

throughout the region and is used for wood slab furniture.

The Canadian importers and showroom owner said that

Indonesia has abundant suar wood and skilled workers to

manufacture quality products. According to his assessment

suar wood furniture is in demand in Canada and the

United States.

See:

https://kemlu.go.id/toronto/id/news/14764/dorong-eksporfurniture-kayu-suar-indonesia-ke-kanada-konjen-ri-torontoresmikan-heft-home-showroom-toronto

In related news Indonesian teak products find a ready

market in Germany according to Indonesian Ambassador

to Germany, Arif Havas Oegroseno.

Products from Indonesia teak plantations are subject to the

Indonesia Timber Legality Verification System (SLVK)

recognised by the European Union.

The teak, which is produced sustainably, legally and

socially responsibly has advantages over teak from other

Southeast Asian countries, which in recent years is thought

to have suffered a reputational decline due to allegations

of over exploitation of forest land and environmental

damage due to land clearing for teak plantations said

Oegroseno.

He also pointed out that the commitment of Indonesia to

the FLEGT control system is expected to satisfy European

Union consumers that Indonesian wood products are

produced legally.

See:

https://radarsukabumi.com/dunia/kayu-jati-indonesia-jadisorotan-dunia-paling-dicari-di-jerman/

Reaction to negative NGO campaigns targeting SFM

A Member of Commission IV of the House of

Representatives, Firman Subagyo has said negative

campaigns by a number of environmental NGOs targeting

the Indonesian forestry sector could harm national

economic interests. He cited a case where pressure from

international NGOs resulted in an Indonesian company

losing its FSC certified status. Subagyo called on the

government to be firm with NGOss that interfere with

national economic interests.

See:

https://www.suara.com/bisnis/2021/07/16/142605/pemerintahdiminta-tindak-lsm-yang-halangi-ekspor-produk-alamri?page=all

Transparency in carbon projects

Indonesian Environment and Forestry Minister, Siti

Nurbaya, says efforts to trace collaboration among a

number of carbon projects in which local governments are

engaged are aimed at ensuring that the national

greenhouse gas inventory remains transparent and

credible. Local governments are legally required to report

the greenhouse gas inventory in each of their territories to

the Minister in her capacity as the country’s national focal

point to the UNFCCC.

The Minister stressed that local governments engaged in

carbon projects are obliged to immediately report to her as

well as to the Minister of Home Affairs primarily on the

legal basis for their engagement with carbon projects in

their territories.

In addition, Minister Nurbaya pointed out that the local

governments engaged in carbon projects are also to report

on policy measures taken, the extent of the management

area, the scope of activities, methodologies and the targets.

See:

https://foresthints.news/minister-tracing-local-govt-carbonprojects-to-keep-indonesias-ndc-target-on-track/

5.

MYANMAR

Exports of wood products suspended

The government procedures for monitoring exports of

wood products were suspended by Forest Department after

the government announced the closure of government

departments from in response to the recent surge in corona

infections across the country. The result of this action is

that timber exports are stalled. The Myanma Timber

Enterprise has not resumed the tender sale of logs.

The Myanmar Port Authority (MPA) issued a statement

saying port operations will continue handling incoming

international shipments.

See:

https://elevenmyanmar.com/news/yangon-internationaljetties-remain-operative-during-public-holidays

Covid-19 third wave

The number of fatalities in the third wave of coronavirus

has exceeded the combined total of Covid-19 deaths in the

first two waves of the pandemic according to the Ministry

of Health and Sports (MOHS).

A total of 3,216 people died in the first and second waves

between March last year and late May this year. Since

then, there have been 3,921 fatalities in less than two

months. The MOHS figures are widely-believed to be an

underestimate as they exclude people who died of Covid-

19 at home.

See:

https://www.irrawaddy.com/news/burma/myanmars-thirdwave-covid-19-deaths-now-exceed-fatalities-in-first-and-secondwaves.html

Heavy job losses since February coup

The International Labor Organization (ILO) has estimated

Myanmar lost 1.2 million jobs in the second quarter 2021

following the February military coup that crippled an

economy already weakened by the coronavirus pandemic.

Donglin Li, the ILO’s representative for Myanmar said in

a statement “Myanmar was already facing economic stress

with jobs and livelihoods under threat as a result of the

COVID-19 pandemic. However, the estimates show a

serious and rapid deterioration in employment in the first

half of this year on a scale that could drive many in

Myanmar into deep poverty.”

The ILO statement continued, “the political crisis has

exacerbated the severe impacts of COVID-19 and has

extensively destabilised the economy and halted an

expected economic recovery”.

The employment trends during the first half of 2021

indicated “considerable losses in both employment and

working hours,” with women estimated to have been

impacted more than men.

See:

http://www.ilo.org/global/about-theilo/newsroom/news/WCMS_814686/lang--en/index.htm

Political turmoil and third wave of COVID-19 severely

impacting the economy

Mariam Sherman, World Bank Country Director for

Myanmar, Cambodia and Lao PDR said in a statement

“The loss of jobs and income and heightened health and

food security risks are compounding the welfare

challenges faced by the poorest and most vulnerable,

including those that were already hit hardest by the

pandemic last year,”

The statement continues “Myanmar’s ongoing political

turmoil and a rapidly-rising third wave of COVID-19

cases are severely impacting an economy that had already

been weakened by the pandemic in 2020.

The economy is expected to contract around 18% in

Myanmar’s 2021 Fiscal Year (October 2020 to September

2021) with damaging implications for lives, livelihoods,

poverty and future growth, according to the latest World

Bank’s Myanmar Economic Monitor. An 18%

contraction, coming on top of weak growth in FY2020,

would mean that the country’s economy is

around 30 percent smaller than it would have been in the

absence of COVID-19 and the military takeover of

February 2021”.

See:

https://www.worldbank.org/en/news/pressrelease/2021/07/23/myanmar-economy-expected-to-contract-by-18-percent-in-fy2021-report

Desperate need for action - UN

In a statement, Tom Andrews, Special Rapporteur on the

human rights situation in Myanmar and Mary

Lawlor, Special Rapporteur on human rights

defenders, highlighted credible reports from Myanmar of

activists forced into hiding after having arrests warrants

issued against them under Section 505 (a) of the Penal

Code. The author say homes of activists were raided,

possessions seized and family members threatened and

harassed noting that many others who were unable to flee

have been arrested.

Lawyers representing those detained after the coup have

themselves been detained, as have journalists covering the

protests, the statement added.

Special Rapporteur Andrews said that the people of

Myanmar appreciate the expressions of concern from the

international community, “but what they desperately need

is action”.

See:

https://news.un.org/en/story/2021/07/1096072

6. INDIA

Inflation heats up

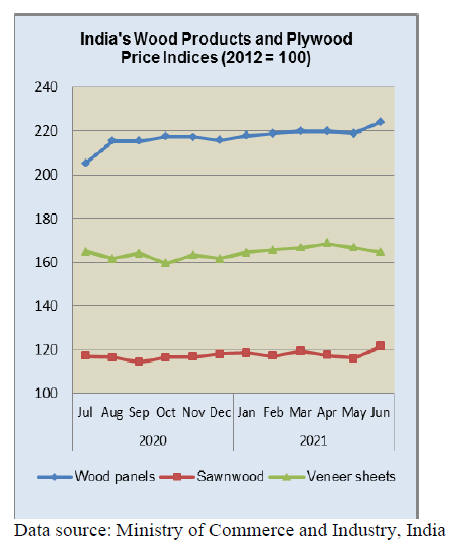

The Ministry of Commerce and Industry has reported the

official Wholesale Price Index (WPI) for ‘All

Commodities’ (Base: 2011-12=100) for June increased to

133.5 from 132.7 in May 2021.

The annual rate of inflation, based on the monthly WPI

was, year on year, 12.07% in June 2021. The higher rate of

inflation in June was primarily due to effect of a low year

on year base prices.

The index for manufactured products accounts for 64% of

the index increased. Out of the 22 groups of manufactured

products tracked 11 groups saw price increases with 8

seeing declines. The balance remained unchanged. Price

increases were recorded for wood and of products of wood

and cork but a price decline was reported for veneers.

The press release from the Ministry of Commerce and

Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Home sales remain sluggish

Home sales in the second quarter (April to June 2021) fell

sharply as potential buyers delayed investments. Sales in

Delhi NCR, Mumbai, Bangalore and Pune were especially

badly hit.

Overall, sales were down over 50% compared to the

previous quarter and it was in the Tier II and III cities that

the steepest declines were seen.

However, enquiries from potential buyers improved in

June as the rate of corona infections dropped allowing

some lock-down measures to be lifted. Analysts anticipate

a higher rate of sales in the 3 months after June supported

by stable interest rates and subsidies on stamp duty and

registration charges.

Building companies have been kept afloat during the

pandemic by government initiatives in loan restructuring

and tax rebates. This support has helped builders complete

ongoing projects but with an unsold housing stock and

weak demand house prices are under pressure.

See:

https://www.financialexpress.com/money/housing-sales-intop-8-metro-cities-fall-by-55-as-60000-units-sold-in-april-june-2021/2289978/

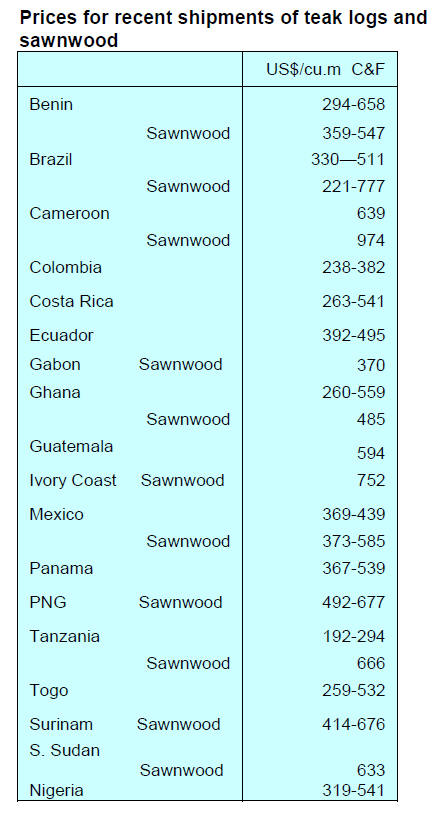

Plantation teak prices C&F Indian ports

Surging freight charges are resulting in higher landed costs

for teak shipments.

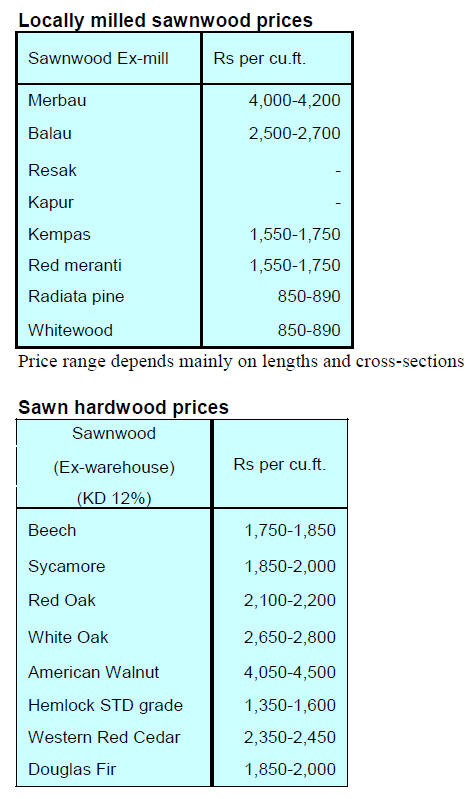

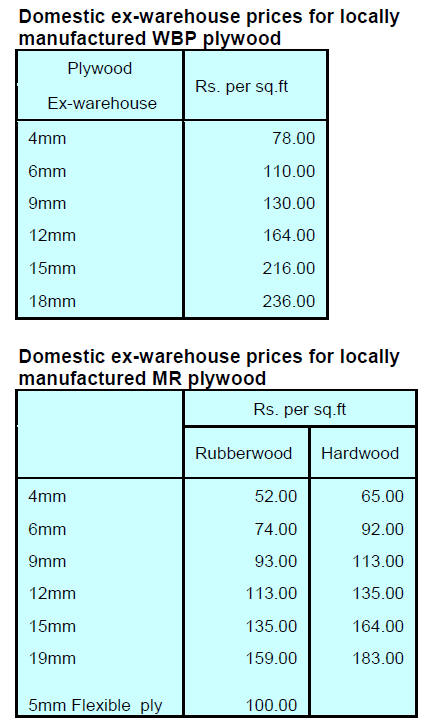

Plywood

Log availability is becoming an issue for manufacturers

and rising log costs are eating into the bottom-line of

plywood manufacturers. As the housing market is still

fairly active plywood producers will be seeking an

opportunity to raise prices.

In a press release reported in the Times Of India Century

Plyboards has said it has launched a ‘Century Promise

app’ which will provide customers with the means to

determine if they are buying genuine Century products or

fake labelled plywood. The company says this will be

achieved through an embedded QR code.

The plywood market in the country is worth over Rs

23,000 crore (US$3 mil. plus) and around 30% of this is

from the ‘organised’ sector including Century Plyboard.

The other 70% of plywood available is from smaller

producers and where counterfeit plywood is sold to

unsuspecting consumers.

See:

https://timesofindia.indiatimes.com/business/indiabusiness/century-ply-eyes-pre-covid-level-biz-injuly/articleshow/84565782.cms

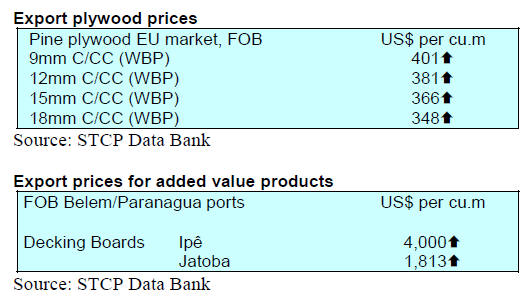

Current plywood prices are reported below.

Tree planting festival

Every year in the first week of July a week-long

celebration, Van Mahotsav, is observed. One event is the

planting of tree saplings and the Union Environment

Minister, Prakash Javadekar, urged people to plant more

and more trees to create a healthy environment.

Van Mahotsav, was first launced by a botanist who

organised the first Indian national tree plantation week in

1947. In 1950, the plantation drive was declared as a

national activity by the then Minister of Food and

Agriculture Kanaiyalal Maneklal Munshi. Later in the

same year, Munshi moved the event to the first week of

July and renamed it Van Mahotsav.

Deforestation in the country has led to a 16% loss in forest

cover over the last decade and Van Mahotsav plays a

crucial role in raising public awareness.

See:

https://www.indiatoday.in/information/story/van-mahotsav-2021-history-significance-celebrations-and-everything-you-needto-know-1821532-2021-07-01

7.

VIETNAM

Southern Vietnam under lockdown

The entire Suthern Region of Vietnam has been placed

under a two-week lockdown as confirmed Covid-19 cases

exceeded 3,000 daily at the end of July. The lockdown

order includes the Mekong Delta and Ho Chi Minh City

metropolis the country’s financial and economic hub (a

third of Vietnam’s population).

The timber industry had been doing well until mid-July

but the infection situation has become much worse.

Many companies tried to accommodate workers on-site in

order to keep factories running but this was not successful.

The likelihood is that that many factories will soon have to

close. Infections rates are rising steeply in Binh Duong,

Dong Nai and Ho Chi Minh City, localities contributing

70% of total exports.

Punitive tariffs avoided

The Office of the US Trade Representative has said it had

determined that no tariff action against Vietnam was

warranted after its Central Bank agreed with the US

Treasury not to manipulate its currency for an export

advantage.

The statement reads: “The Office of the United States

Trade Representative today issued a formal determination

in the Vietnam Currency Section 301 investigation

reflecting the agreement reached earlier this week between

the Department of the Treasury and the State Bank of

Vietnam.

The determination finds that the Treasury-SBV agreement

provides a satisfactory resolution of the matter subject to

investigation and accordingly that no trade action is

warranted at this time. USTR, in coordination with

Treasury, will monitor Vietnam’s implementation going

forward.

See:

https://ustr.gov/sites/default/files/files/Press/Releases/Vietnam_Currency_301_Notice_FRN.pdf

Earlier this year the business community in the US urged

the Trade Office not to resort to tariffs as a remedy in its

trade disputes with Vietnam.

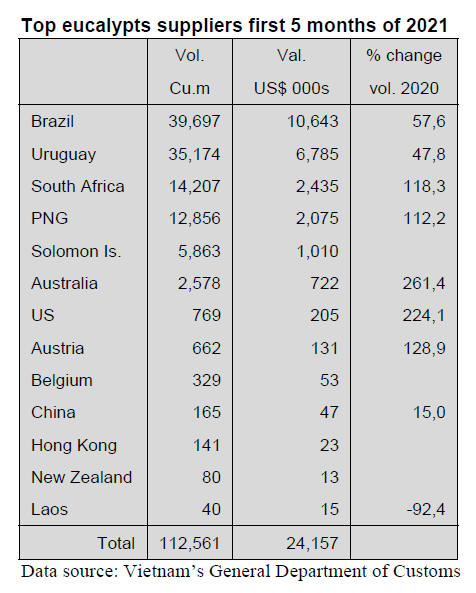

Brazil, the largest supplier of eucalypts to Vietnam

In June 2021 Vietnam's eucalypts imports were estimated

at 25,200 cu.m. worth US$5.0 million, down 0.8% in

volume and 0.4% in value compared to May 2021.

However, compared to June 2020 imports were 3 times

higher. In the first 6 months of 2021 imports of wood of

this species reached 137,800 cu.m. worth US$29.2

million, up 99% in volume and 96% in value over the

same period in 2020.

Eucalypt import from all sources in the first 5 months of

this year accounted for around 58% of total timber imports

by volume.

Brazil topped the list of eucalypt suppliers by shippingto

Vietnam 39,700 cu.m worth US$10.6 million, up 58% in

volume and 52% in value over the same period in 2020.

Value of eucalypts imports 2019 - 2021

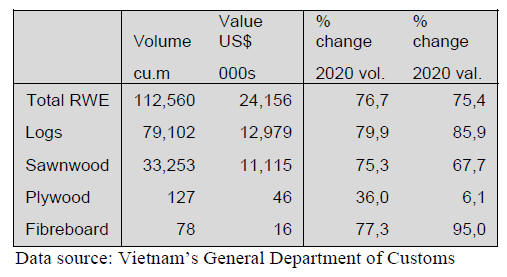

According to Vietnam’s General Department of Customs,

Vietnam's eucalypts imports in the first 5 months of 2021

eucalypts imports reached 112,600 cu.mworth US$24.2

million, up 77% in volume and 75% in value over the

same period in 2020.

Eucalypts products

In the first 5 months of 2021 imports of eucalypts logs

reached 79,100 cu.m worth US$13 million, up 80% in

volume and 86% in value over the same period in 2020.

Imports of eucalypts sawnwood reached 33,253 cu.m,

worth US$11.1 million, up 753% in volume and 68% in

value over the same period in 2020.

Prices for imported eucalyptus

In the first 5 months of 2021 the average price of imported

eucalypts US$214.6/cu.m, down 0.7% over the same

period in 2020.

In particular, the price of imports from Brazil was

US$268/cu.m, down 3.6% over the same period in 2020;

from South Africa US 171.4/cu.m, down 2.5%; from

Australia US$ 280/cu.m, down 4.0 per cent.

In contrast, the price of this wood from Uruguay reached

US 192.9/m³, up 8.0% over the same period in 2020 and

prices of eucalyptus from Papua New Guinea averaged

US$161.4/cu.m, up 12%.

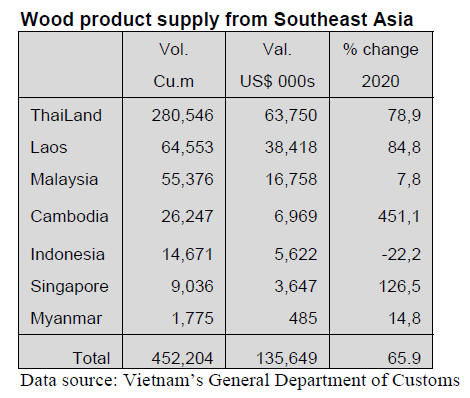

Imports Southeast Asia on rise

According to Vietnam’s General Department of Customs

imports of wood products Southeast Asian countries in

May 2021 reached 74,500 cu.m with a value of US$25.79

million, down 29% in volume and 21% in value compared

to April 2021 but up almost 100% in volume and 186% in

value over the same period in 2020.

In the first 5 months of 2021, imports of wood products

from Southeast Asia reached 452,200 cu.m valued at

US$135.65 million a year-on-year rise in volume and

value.

Key suppliers in SE Asia

In the first 5 months of 2021, imports of wood from

Thailand reached 280,550 cu.m with a value of US$63,75

million, up 79% in volume and 101% in value over the

same period in 2020.

Wood products imported from Thailand are mainly

fibreboard and particleboard, accounting for 98% of the

total imports. In the first 5 months of 2021, imports of

fibreboard from Thailand increased by 90% in volume and

107% in value over the same period in 2020 while imports

of particle-board increased by 50% in volume and 83% in

value.

In the first 5 months of 2021 imports of wood products

from Laos reached 64,5500 cu.m with a value of

US$38,42 million, up 85% in volume and 89% in value

over the same period in 2020.

Around 80% of the total wood products imported from

Laos in the first 5 months of 2021 was sawnwood and

totaled 53,7400 cu.m with a value of US$36,38 million, up

93% in volume and 88% in value over the same period in

2020.

In the first 5 months of 2021, imports of wood products

from Malaysia reached 55,3800 at a value of US$16,76

million, up 7.8% in volume and 35% in value over the

same period in 2020.

Particleboard remained the main imported wood product

from Malaysia in the first 5 months of 2021 reaching

34,070 cu.m with avalue of US$8,85 million, up 29,7% in

volume and 63,4% in value over the same period in 2020.

In the first 5 months of 2021 imports of logs from

Malaysia dropped byhalf in volume and by half in value.

On the other hand imports of sawnwood increased by

161% in volume and 10% in value, reaching 17,680 cu.m

with a value of US$6.93 million.

8. BRAZIL

Interest rate hike

In June 2021 the Central Bank of Brazil (BCB) increased

the basic interest rate (Selic) by 0.75% to 4.25% the third

consecutive monthly rate increase and is likely to raise it

by at least another 0.75% on 4 August.

Plans to vastly expand forest concessions

The Brazilian Federal Government wants to increase the

area of forest concessions granted to the private sector

from the current 1 million hectares to 4 million hectares by

the end of 2023. Nine public forest areas may be granted,

six in the Amazon and three in the Southern Region.

In 2020, the government collected R$28 million from

forest concession holders. The expectation for this year is

that revenue will rise to R$32 million.

Forest concessions are considered a priority by the

Ministry of Agriculture, Livestock and Food Supply

(MAPA) which has said the concession plan is in the

preparatory phase.

The Brazilian Forest Service has said forest concessions

usually attract small business owners from the region and

through the concession arrangement have legal security

which encourages investment.

See:

https://economia.uol.com.br/noticias/redacao/2021/07/17/governo-bolsonaro-concessoes-florestas-amazonia-meio-ambiente.htm

Lower interest rates for small businesses

The Committee on Economic Development, Industry,

Commerce and Services of the Chamber of Deputies

approved Draft Bill N° 3.605/20, which reduces the

interest rate charged to micro and small businesses during

the Covid-19 pandemic.

The Draft Bill also provides for different rates, terms and

modalities ensuring lower interest rates on loans from

official financial institutions with the aim of driving

economic recovery.

The Draft Bill requires recipients to maintain the level of

jobs and salaries and prohibits share buybacks; salary

increases, bonuses or additional benefits for its executives

and officers.

The Draft Bill will still be analysed by the Committees on

Finances and Taxation and the Constitution and Justice

and Citizenship. For the Brazilian forest sector the Ddraft

Bill is welcome as it would support small-sized

companies.

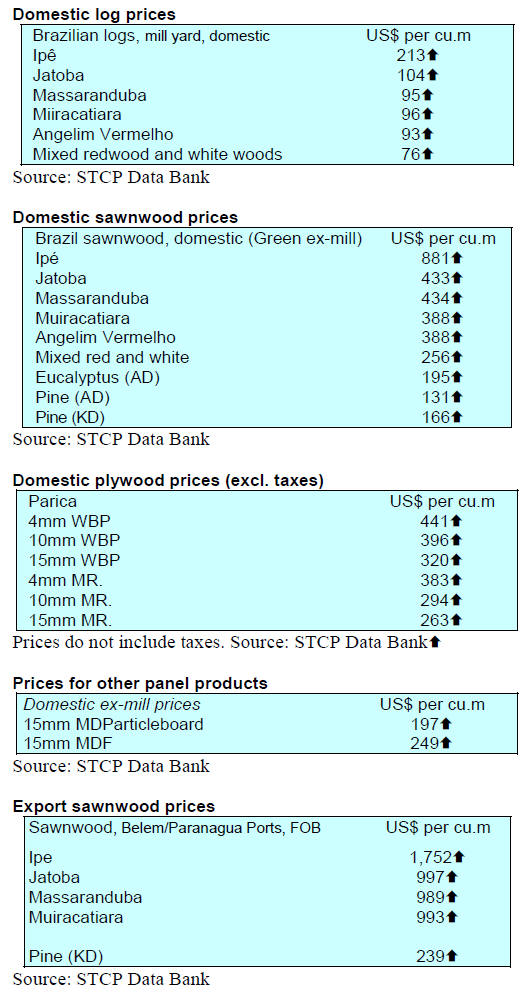

Export update

In June 2021 Brazilian exports of wood-based products

(except pulp and paper) increased 82% in value compared

to June 2020, from US$216.9 million to US$394.3

million.

Pine sawnwood exports grew 74% in value between June

2020 (US$38.4 million) and June 2021 (US$66.7 million).

In volume, exports increased 24% over the same period,

from 224,500 cu.m to 278,800 cu.m.

Tropical sawnwood exports increased 65% in volume,

from 24,200 cu.m in June 2020 to 40,000 cu.m in June

2021. In value, exports rose 53% from US$9.2 million to

US$14.1 million, over the same period.

Pine plywood exports saw an almost 300% surge in value

in June 2021 in comparison with June 2020, from US$34.8

million to US$136.9 million. In volume, exports increased

65% over the same period, from 145,800 cu.m to 239,800

cu.m.

As for tropical plywood, exports increased in volume

(36%) and in value (75%), from 3,900 cu.m (US$1.6

million) in June 2020 to 5,300 cu.m (US$2.8 million) in

June 2021.

As for wooden furniture, the export value increased from

US$38.0 million in June 2020 to US$62.4 million in June

2021, a 64% growth.

Acre – record trade surplus

Acre, one of the main timber producing States in Brazil

recorded trade surplus of US$27.1 million, exceeding by

57% the trade balance for the same period of 2020

according to the Ministry of Economy (ME).

Acre state exported US$4.5 million and imported

US$331,400 in June 2021 resulting in a trade balance of

US$4.2 million. The data show that both the value of

exports and imports in June 2021 was higher than in June

2020.

According to the ME, in the case of exports the increase

was 105%, from US$2.2 million to US$4.5 million on the

other hand imports rose 117%. Between January and June

forest products represented 51% of all products exported

by the state. The main export destinations were Peru

(24%) and the United States (12%).

9. PERU

Preventing forest fires

The National Forest and Wildlife Service (SERFOR)

announced the start of its project: “Prevention and

response to forest fires in tropical forests and forest

plantations in Peru”, financed by the International Tropical

Timber Organization (ITTO).

It is common for more than 800 forest fires to be reported

annually in Peru with many going unreported. These fires

add to green house gases, destroy habitats and decimate

the biodiversity and smoke causes health problems for the

population.

The current project seeks to contribute to the conservation

of threatened forest ecosystems in the Cajamarca,

Huánuco, Junín, Pasco and Ucayali regions. To build the

capacity for prevention the project will strengthen

monitoring systems, create early warning systems and

improve response management.

During the launch of this initiative, the project director,

Elvira Gómez, highlighted ITTO's commitment to

supporting the fight against forest fires in Peru. For her

part, ITTO's Director of Operations, Sheam Satkura,

stressed that this collaboration will mark a milestone in

this area and pointed out that "together we can contribute

to the prevention and management of forest fires at an

international and national level."

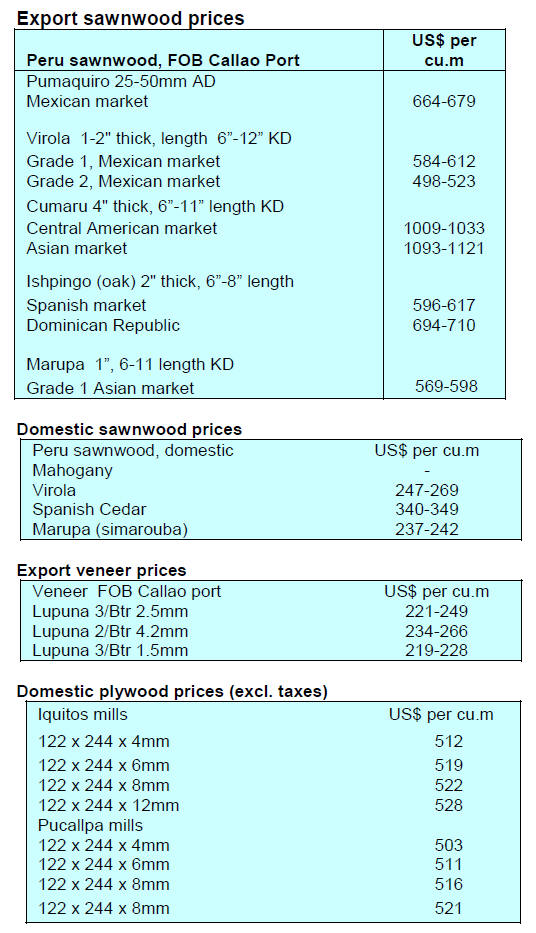

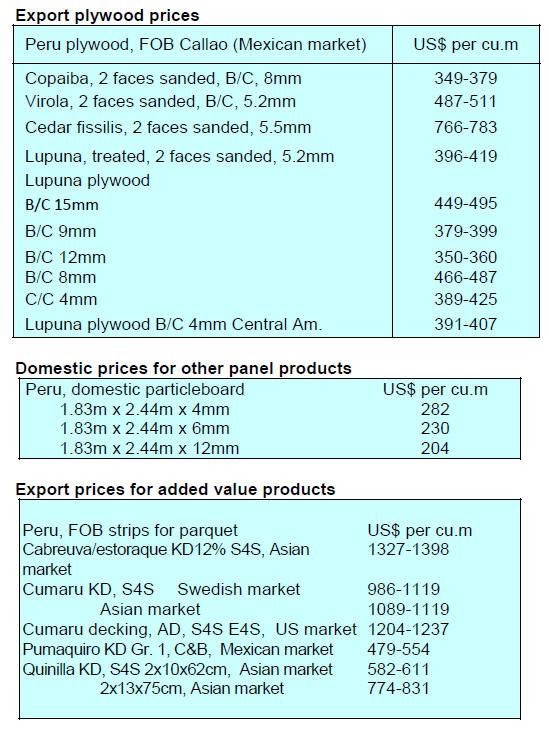

Rising exports of wood products

According to the Association of Exporters (ADEX) semimanufactured

products exported in the period January to

May 2021 increased over 80% compared to the same

period in 2020. The main market for this sub-sector

continues to be China which accounted for over 40% of

the export business. Exports to China were almost 60%

year on year. The second most important market was

France with a 27% share of total export with Denmark

accounting for a 7% share.

Veneer and plywood exports increased of 46% year on

year with Mexico accounting for almost all of this trade.

January to May 2021 exports of furniture and parts

increased almost 60% year on year with the main markets

being the United States (64% share) followed by Italy

(15%) and Chile (14%).

Economic outlook encouraging

The Peru News Agency (Andina) has reported the nation's

economy is recovering with Economy-Finance Minister,

Waldo Mendoza, pointing out that after a 30% decline in

the second quarter of 2020 GDP also fell in the third (-9%)

and fourth (-1.7%) quarters of 202 due to the pandemic.

However, GDP rose by 3.8% in the first quarter of 2021

over the same period of 2020 and was slightly up on the

same period in 2019.

Mendoza also said outlook is encouraging with year on

year growth projection at around 10% for 2021, followed

by an average of 4.5% during 2022-2024.

See:

https://andina.pe/ingles/noticia-perus-economy-movingforward-how-it-reaches-the-bicentennial-854227.aspx