|

Report from

Europe

Encouraging signs for European furniture sector

The global significance of the European furniture sector,

and some positive signs for the sector after the turmoil

caused by the COVID pandemic, are highlighted in recent

reports in World Furniture, the trade journal of CSIL, the

Milan-based furniture market research organisation

(www.worldfurnitureonline.com).

In the editorial to the most recent edition (June 2021) of

World Furniture, Paola Govoni notes that ¡°the disruptive

consequences of the last 18 months are there for all to see.

A lot has changed on every level and some of these

developments could be here to stay.

At the time of writing there are encouraging signals in

Italy and most of Europe showing that the summer could

be the beginning of an exit-phase from the pandemic.

Major international economies have entered a recovery

path and the strengthening of the increasing trend resulted

in an upward revision of growth forecasts in many

countries¡±.

In a report on the Italian furniture sector, which while less

dominant in terms of production volume than in previous

years is still extremely influential for international

furniture design and branding, CSIL Market Researcher

Cecilia Pisa observes that "despite the disruptive effects of

Covid-19 both on the demand and supply side, the year

ended with a better outcome than expected".

According to Ms. Pisa, Italy¡¯s total furniture sales at home

and abroad were down around 10% overall in real terms in

2020, a significant decline of more than 25% in sales on

the domestic market in the first half of 2020 was followed

by a rebound in the second half of the year. Italian

companies managed to contain losses, some even

increasing sales due to ongoing investments in the

development of new products, in technological innovation

and the opening of new stores.

Ms. Pisa notes that a major driver of purchases of furniture

in Europe during the pandemic was renewed interest in

home renovation and improvement as the home "acquired

a new centrality both for living and working, becoming a

new fulcrum of our daily activities". Furthermore, money

saved in travel or entertainment expenses has been partly

invested in improving living spaces, positively influencing

consumption.

Ms. Pisa emphasised that there has been particular

attention paid to "the home office environment (ergonomic

office chairs, small desks and lighting fixtures), to the

kitchen, the comfort segments (from mattresses to

upholstery) and the outdoor furniture".

There is also a growing demand for flexible/transformable

furniture and sustainable solutions with a preference for

natural materials, formaldehyde-free products and waterbased

paints free of volatile organic compounds.

And, of course, the pandemic also led strong acceleration

in sales through e-commerce.

While focusing on the furniture sector, these comments

have wider significance for the wood sector, both due to

the scale of wood consumption by European

manufacturers and the importance of Europe as a market

for imported finished furniture, including from the tropics.

According to CSIL¡¯s own figures, with a market value of

nearly €100 billion (USD120 billion), Europe is the

second largest furniture market in the world, accounting

for around 26% of all world furniture consumption, second

only to Asia and the Pacific region (43%) and larger than

the North American market (23%).

In contrast to the North American market, the European

market is more heavily dependent on domestic production

with manufacturers in the region accounting for well over

80% of consumption.

Wood material is by far the most dominant base material

for furniture production in Europe. In those categories of

furniture for which material data is available, wood

accounted for 74% of the value of furniture production in

the EU28 in 2019, compared to 25% for metal and just 1%

for plastic furniture.

Eurostat data on actual furniture production in the EU in

2020 has yet to be published, but the Eurostat furniture

production index suggests that overall production was

down around 8% in the EU27 and 23% in the UK during

the year (Chart 1).

In the EU27, this followed on from a slight 1% fall in

2019 when production was already weakening in response

to sluggish growth of the EU economy and intense

competition in global markets, particularly from Chinese

manufacturers whose sales in the US market were being

diverted elsewhere due to the on-going trade dispute.

The Eurostat index shows that the production trend varied

widely between European countries during 2020, with

particularly large declines in the UK (-23%), Spain (-

17%), Romania (-16%), and France (-14%), and

moderately large declines in Sweden (-10%), Italy (-9%),

Netherlands (-8%), Germany (-7%), Belgium (-6%), and

Portugal (-5%). In Denmark production was stable in 2020

while in Lithuania, where there has been a lot of

investment in furniture production in recent years, notably

by IKEA, the production index actually increased 2%

during the year.

Eurostat¡¯s monthly furniture production index shows that

the decline in EU furniture manufacturing activity was

heavily concentrated during the first lockdown period in

March and April 2020, when there was a precipitous and

unprecedented fall (for example down as much as 90% on

normal levels in Italy), but that activity rose sharply

throughout the rest of the year. In 2021, the monthly index

shows that production in most countries has rebounded to

at least as high as the pre-COVID level and in some cases

- notably in Italy, Denmark and Lithuania - now exceeds

the pre-COVID level.

EU furniture trade surprisingly stable

While the production index gives an insight into the highly

volatile market conditions for furniture in Europe during

the COVID pandemic, the trade data seems surprisingly

stable. In terms of USD trade value, trade in 2020 was

little changed from the previous year.

This aligns with a longer term trend of relative stability, at

least when assessing annual changes in the USD dollar

value of wood furniture trade adjusted for inflation (Chart

2).

Looking from the outside, the reality is that while the

European market for wood furniture is certainly large, it

has experienced only limited growth in the last decade and

barely recovered from the large decline experienced

during the 2008-2009 financial crises.

Considering the EU27+UK as a whole, wood furniture

imports from outside the bloc were USD7.4 billion in

2020, 3% less than the previous year. This represents a

partial reversal of the gradual rising trend in import value

from USD 6.6 billion in 2016 to a decadal high of USD7.6

billion in 2019.

While imports of wood furniture into the EU27+UK have

been tending to rise in recent years, the USD value of

exports from the bloc have been sliding, a trend which has

accelerated since the start of the pandemic. In 2020,

EU27+UK exports of wood furniture to countries outside

the bloc fell 7% to USD 6.7 billion 2020. This continues a

decline in export value from a high of USD 9.17 billion in

2014 to USD7.2 billion in 2019.

Overall these trends suggest that even before the

pandemic, EU wood furniture manufacturers were

gradually losing competitiveness in global markets. The

competitive benefits of the relative weakness of the euro

against the dollar, particularly between 2015 and 2017,

and of the cost saving efforts by EU wood furniture

manufacturers in the last decade have waned.

In recent years, competition for EU-based manufacturers

has intensified from newly emerging producers in Eastern

European countries outside the EU and from Vietnam

which in the last 5 years has rapidly overtaken all other

tropical countries in the global league table of wood

furniture producing nations.

In addition to the market and logistical challenges of the

COVID pandemic, EU wood furniture manufacturers have

suffered in higher-end export markets in Asia, the CIS and

Middle East from a range of factors including diversion of

Chinese products away from the US to other markets, a

sharp fall in global equity markets towards the end of

2018, extreme weakness of the Russian rouble, and low oil

prices.

Overall, the combined effects of rising imports and

declining exports is that the slight trade surplus in

EU27+UK wood furniture trade that persisted between

2011 and 2018 became a trade deficit of USD 420 million

in 2019 rising to USD 690 million last year.

While EU27+UK furniture manufacturers have struggled

to maintain sales in external markets they remain the

dominant players in their home markets, exploiting to

good effect the benefits of close proximity and ease of

access to consumers, their depth of knowledge of fashion

trends, technical standards and distribution networks, and

their strong design skills and brands.

These long-term benefits have been reinforced by the

serious logistical problems and rising container rates

during the pandemic that have made shipment into the

region more difficult and costly.

Internal trade in wood furniture in the EU27+UK region

was USD 20.5 billion in 2020, the same level as the

previous year and only slightly less than USD 21.3 billion

in 2018 when it was at the highest level since before the

2008-2009 financial crises.

EU27+UK wooden furniture imports fell in 2020

EU27+UK imports of wooden furniture from non-EU

countries fell 3% to USD 7.4 billion in 2020 after rising

4% in 2019 (Chart 3). Imports from China, by far the

largest external supplier, decreased 3% to USD 3.66

billion in 2020, but imports from other non-tropical

countries increased 10% to USD 1.86 billion

Tropical countries, for which EU27+UK imports fell 12%

to USD 1.87 billion in 2020, were the major losers, being

particularly hard hit by supply problems and rising

shipping costs during the year.

While USD value of wood furniture imports into the

EU27+UK decreased in 2020, import tonnage actually

increased, rising 3% to 2.44 million tonnes. The decline in

unit value is likely associated with a shift in the balance of

imports away from tropical countries in favour of

increased imports from China and countries in Eastern

Europe neighbouring the EU.

This probably also implies a shift in the balance of

furniture imports to include less products for exterior

applications (which still dominate in imports from tropics)

and more products for interior applications.

In 2020, import tonnage increased by 5% from China to

1.18 million tonnes and by 13% from other non-tropical

countries to 640,000 tonnes. In contrast imports from

tropical countries fell by 11% to 560,000 tonnes (Chart 4).

Continuing the trend of recent years, in 2020 there was

another significant increase in import tonnage of wood

furniture from several countries bordering the EU,

including Ukraine (+17% to 123,000 tonnes), Turkey

(+26% to 120,000 tonnes), Belarus (+20% to 115,000

tonnes), Bosnia (+4% to 68,000 tonnes), Serbia (+4% to

62,000 tonnes), and Russia (+29% to 40,000 tonnes).

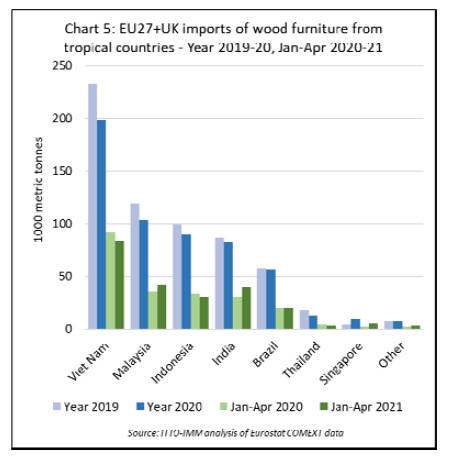

Despite a significant decline in EU27+UK imports of

wood furniture from Vietnam last year, down 15% to

198,000 tonnes, the country remained by far the largest

tropical supplier to the bloc in 2020.

Imports also declined steeply from Malaysia (-13% to

104,000 tonnes), Indonesia (-10% to 89,000 tonnes) and

Thailand (-26% to 13,000 tonnes). Imports fell less steeply

from India (-5% to 83,000 tonnes) and Brazil (-2% to

56,000 tonnes).

Imports from Singapore nearly doubled, but from a small

base to 9,000 tonnes, due to greater availability of

containers for shipment out of the country. (Chart 5).

Imports of wood furniture into the EU27+UK strengthened

considerably in the opening months of this year, but once

again tropical countries lagged behind other supply

countries.

In total, the EU27+UK imported 980,000 tonnes of wood

furniture in the first four months of 2021, 37% more than

the same period in 2020. Imports increased by 46% from

China, to 490,000 tonnes, and by 63% from other nontropical

countries to 270,000 tonnes. However, imports

from tropical countries increased by only 4%, to 230,000

tonnes.

The biggest increases in EU27+UK imports of wood

furniture from tropical countries in the first 4 months of

2021 were from India (+35% to 40,000 tonnes), Malaysia

(+18% to 42,000 tonnes) and Singapore (+175% to 5,000

tonnes). Imports from Brazil increased only marginally, by

5% to 21,000 tonnes, but imports continued to decline

from Vietnam (-9% to 84,000 tonnes) and Indonesia (-8%

to 31,000 tonnes).

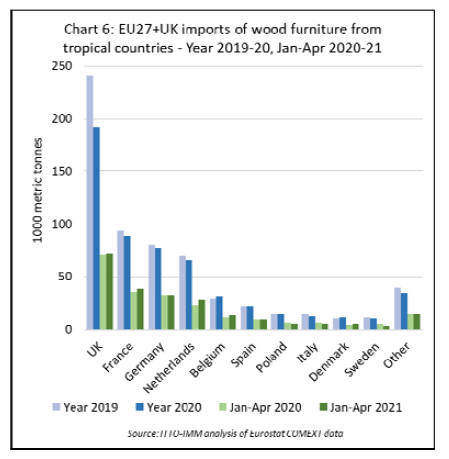

Much of the decrease in EU27+UK imports of wood

furniture from tropical countries in 2020 was concentrated

in the UK which a recorded a 20% fall to 192,000 tonnes

during the year. Imports from tropical countries fell less

dramatically into the other leading markets including

France (-5% to 89,000 tonnes), Germany (-3% to 78,000

tonnes), Netherlands (-5% to 66,000 tonnes), and Spain (-

4% to 22,000 tonnes).

Imports of furniture from tropical countries made some

gains in Belgium (+7% to 32,000 tonnes) and Poland

(+5% to 15,000 tonnes) in 2020. (Chart 6).

In the first four months of 2021, EU27+UK imports of

wood furniture from tropical countries recovered some of

the ground lost in the previous year, rising 4% to 228,000

tonnes.

A rise in imports was recorded in nearly all the leading

markets including UK (+2% to 72,000 tonnes), France

(+8% to 39,000 tonnes), Germany (+2% to 33,000 tonnes),

Netherlands (+18% to 28,000 tonnes), and Belgium

(+24% to 14,000 tonnes). Imports into Spain were level at

10,000 tonnes) while imports into Poland fell 20% to

5,000 tonnes.

Brexit boosts UK wooden furniture imports from China

During 2021, there are some early signs that the departure

of the UK, Europe¡¯s second largest economy, from the EU

single market and customs union at the start of the year,

may be increasing opportunities for non-EU suppliers of

wood furniture to the UK market.

The immediate impact of the pandemic on UK trade in

wood furniture was to marginally increase reliance on

imports from within the EU. In 2020, UK imports from

non-EU countries fell 9% to USD 2.4 billion while

imports from EU27 countries fell only 5% to USD 1.2

billion.

However in the first quarter of this year, immediately

following the UK¡¯s departure from the EU single market,

UK imports from outside the EU surged to over USD 800

million, nearly 40% more than the same period in 2020.

Meanwhile imports from the EU increased by only 4%.

Nearly all the gains in UK imports in the first quarter of

2021 came from China which alone accounted for 60% of

all UK imports from non-EU countries.

Consolidation and reorganisation amongst world¡¯s

largest furniture manufacturers

The global furniture sector is renowned for being

relatively fragmented, dominated in most countries by

large numbers of small and medium sized enterprises with

a relatively low degree of concentration.

But that is not say that there are no significant large

companies (IKEA immediately comes to mind) nor that

there has been no consolidation in recent years.

This is immediately apparent from the March 2021 edition

of the CSIL report on the ¡°Top 200 Furniture

Manufacturers Worldwide¡±. The report shows that the 200

largest furniture companies have a total turnover of over

USD 160 billion of which nearly USD 100 billion is

related to the furniture sector, accounting for about 20% of

world furniture production.

Together the top 200 furniture manufacturers employ

about 740,000 people and are headquartered in 30

countries. Nearly 45% of the Top 200 are headquartered in

the EU, 20% in North America, 30% in the Asia Pacific

region, and 5% in Russia, Turkey, South America, the

Middle East and Africa.

According to CSIL preliminary estimates, world furniture

production was worth about USD 422 billion in 2020, 7%

less than in 2019. The Top 200 companies appear to have

performed relatively well compared to the wider sector in

2020, with turnover falling less than 2% during the year.

This is linked to those companies¡¯ larger financial

resources which allowed quicker re-alignment of business

strategies, development of new on-line sales channels, and

repositioning of their supply chains.

According to the CSIL report, the relative performance of

the Top 200 companies has been significantly affected by

lockdown policies which have varied significantly across

countries, production segments and retail activities.

Companies have been affected to varying degrees by store

closures and delivery delays. To mitigate risk in the future,

CSIL suggest that large furniture companies will diversify

their supply bases, reduce dependence on single suppliers

and source from a wider range of locations.

CSIL note that a strategy of manufacturing location

repositioning has been accelerated in recent years, driven

by the increasing need for flexibility and to reduce the

time-to-market and minimise overall costs, including

production, tariffs, and transportation.

About half of Top 200 companies now have

manufacturing activities outside the country where their

headquarters is based. Companies that have gone furthest

in shifting part of their production activities abroad are

those headquartered in Europe (40%), followed by those in

Asia (30%) and North America (nearly 30%).

Preferred countries for investment in furniture

manufacturing by European companies are across Europe

(mostly Eastern European countries), followed by the Asia

Pacific (in particular China and Vietnam) and North

America (mainly the USA for office furniture production).

Almost all Top 200 companies headquartered in Asian

countries that have operations elsewhere have

concentrated on opening plants in other Asian countries

(notably Vietnam, Thailand and Malaysia).

However some more export-oriented manufacturers have

also opened facilities in North America (particularly

Mexico and the USA) to reduce time to market and

overcome the recent trade tensions between the US and

China (and other Asian countries).

The majority of North American companies that have

established production activities abroad have chosen to

open facilities in Mexico and to a lesser extent in the Asia

Pacific region (particularly China).

CSIL note that mergers and acquisitions (M&A) activity

has increased amongst the Top 200 companies. Around 30

M&A operations were identified between 2015 and 2016

rising to over 60 between 2017 and 2017. Much of this

activity involved US companies acquiring other US firms,

but Chinese firms were also involved in several large

investments, mostly of foreign companies and particularly

in Europe, to increase sales in some key markets and/or

expand their manufacturing capacity.

All CSIL reports can be purchased online and downloaded

from: www.worldfurnitureonline

|