Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Jun

2021

Japan Yen 110.89

Reports From Japan

Signs of another COVID-19

rebound in Tokyo

As the number of corona virus cases continued to decline

nationwide and the fourth wave of infections appeared to

have peaked, the Japanese government lifted the state of

emergency in all prefectures except Okinawa. However,

strict measures remain in place in seven of the nine

prefectures where the state of emergency was in place.

Behind this move was evidence that the burden on the

health care system is beginning to lessen. However, signs

of another COVID-19 rebound in Tokyo were emerging

towards month end. During a meeting at the Tokyo

Metropolitan Government infectious disease experts

warned that new cases in the capital have been increasing

steadily for two weeks, foot traffic has grown since virus

measures were loosened and highly contagious variants

are spreading rapidly.

Inflation is back for the first time in 14 months

According to the Bank of Japan (BoJ) inflation has turned

positive for the first time in 14 months driven by rising

commodity costs, especially fuel, and this has resulted in

consumer prices.

This is welcome news for the Bank but to have any

meaningful impact the rise needs to be higher and

sustained because it is far below that in most other

developed economies where interest rate hikes are being

considered. The BoJ forecasts inflation staying below its

2% target for the foreseeable future as a revival of

consumer spending is a distant dream.

In its latest assessment of the economy the BoJ has warned

that consumption was "stagnating". Despite this the Bank

kept its assessment that the economy was showing signs of

recovery thanks to strong exports. The Governor of the

BoJ said if the vaccine rollout can be speeded up there's a

chance that consumption may recover faster than

expected.

See:

https://www.japantimes.co.jp/news/2021/06/18/business/japaninflation-june/

In related news the BoJ has announced a plan to boost

funding to address climate change following decisions by

central banks in several OECD countries to address the

risks from climate change on their economies.

The BoJ said it will launch a climate change scheme this

year which will provide funds to financial institutions that

increase loans and investment for activities aimed at

combating climate change.

While details are yet to be decided the BoJ said the

scheme will be similar to its programme that offers cheap

loans to financial institutions that boost lending in sectors

considered to be growth industries.

See:

https://www.reuters.com/world/asia-pacific/boj-mayextend-pandemic-relief-scheme-keep-stimulus-intact-2021-06-17/

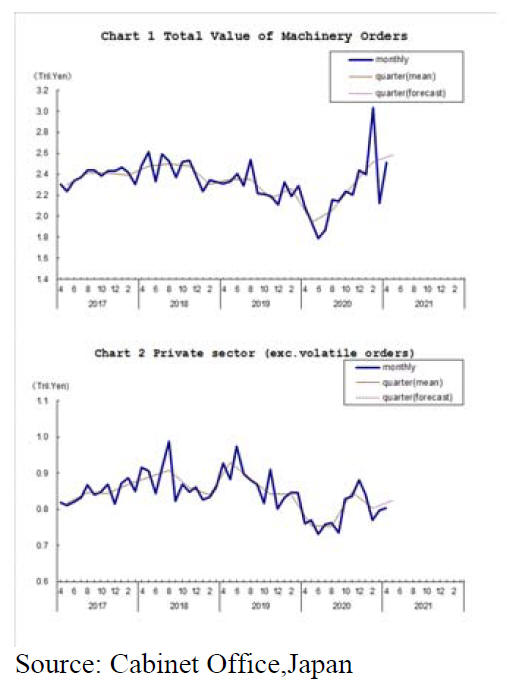

Machinery orders hint at private sector optimism

Japan's core private-sector machinery orders rose slightly

in April from the previous month. The orders, which

exclude those for ships and from electricity utilities due to

their volatility, totalled 802.9 billion yen ($7.3 billion),

according to the Cabinet Office. Machinery orders, seen as

a leading indicator of corporate capital spending, rose for

the second straight month.

The faster the vaccine roll-out the earlier

consumption

will rise

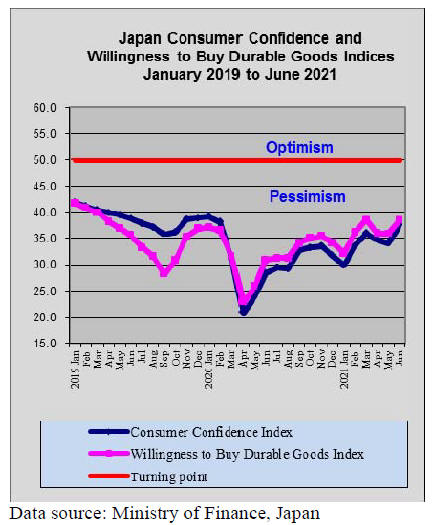

Assets held by Japanese families have been rising steadily

compared to last year and stood at a record yen1,946

trillion yen at the end of March. Households have

naturally cut back on unnecessary spending as they are

unsure what the future holds in store.The negative impact

of the pandemic on spending will only be pushed back

when the vaccine roll-out is speeded up.

Economists say people will, as in other countries,

open

wallets once the pandemic ends. While pent-up demand

may eventually support private consumption, which makes

up more than half of the economy, exporters face major

challenges from a global chip shortage and shipping

problems.

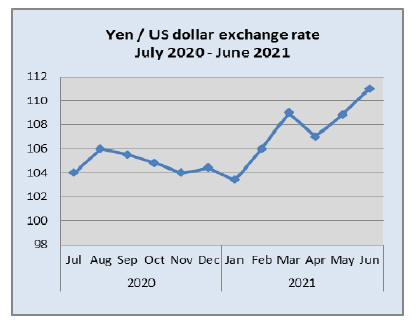

Combination of issue drives yen lower

The yen dollar exchange rate in recent days has followed

the general US dollar recovery seen with other currencies

because of the US Federal Reserve stance on inflation

along with a dip in Japan¡¯s PMI data. Sentiment was

weakened further by the outlook for the Japanese economy

revealed in the latest BoJ meeting minutes.

Towards month end the yen was at 110.9 to the US dollar,

a level not seen in two months.

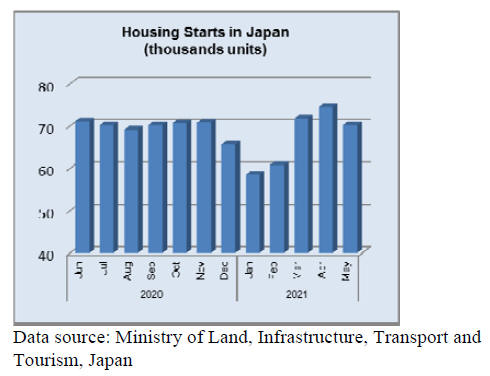

Rethinking housing priorities in Japan in

the wake of

COVID-19

With remote work likely to remain beyond the pandemic

house builders are assessing how they can adjust to better

meet the needs of those working from home.

In Japan floor space is a critical issue because of high land

costs especially in the cities so homes tend to be small and

cramped.

The pandemic, however, has scrambled the real estate

market as quarantines, states of emergencies and selfimposed

isolation prompt millions to work from home and

rethink their housing priorities.

The job placement company Biz Hits conducted a survey

and this is reported in the Japan Times. Most respondents

(85%) said they used the living room or bedroom as their

workspace which, they pointed out, was unsatisfactory.

Most said they wanted a dedicated home office space.

According to the Japan Productivity Center, while the

number of people working from home has started to fall it

still hovers around 25% of the workforce and it is the

needs of these people home builders will seeking to satisfy

through innovative use of space.

Import update

Furniture imports

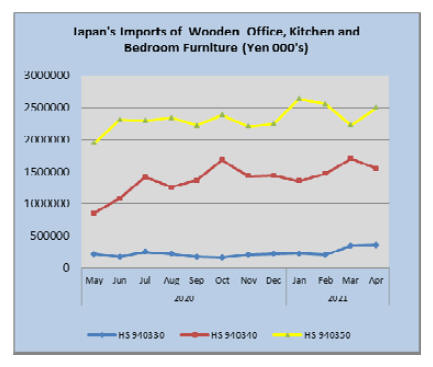

After an uptick in the value of wooden office and kitchen

furniture at the beginning of the year as the second quarter

opened there were signs of a downward correction. In

contrast, wooden bedroom furniture imports to Japan fell

in the first quarter but picked up in April.

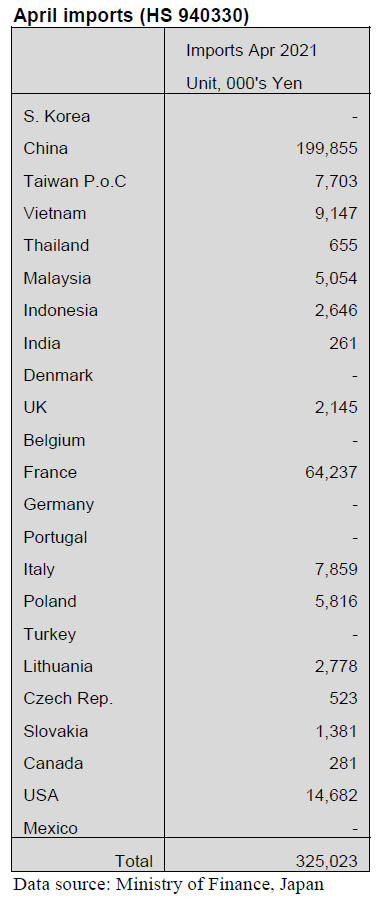

Office furniture imports (HS 940330)

Year on year the value of Japan¡¯s imports of wooden

office furniture (HS940330) in April doubled. This is more

a reflection of the low level of imports in April 2020 rather

than increased demand.

Compared to the value of imports in March there was

virtually no change in the value of imports in April.

Shipments of wooden office furniture (HS940330) from

the main suppliers China, Vietnam and those in SE Asia

were little changed from levels reported for March, the

exception being those from France. In March shippers in

France jumped into the top league of suppliers accounting

for around 30% of imports but in April arrivals from

France represented just 19% of the value of April arrivals.

Data from the Japanese Ministry of Finance shows China

was the main supplier of wooden office furniture in April

accounting for 66% of imports followed by France at 19%

and the US 4%.

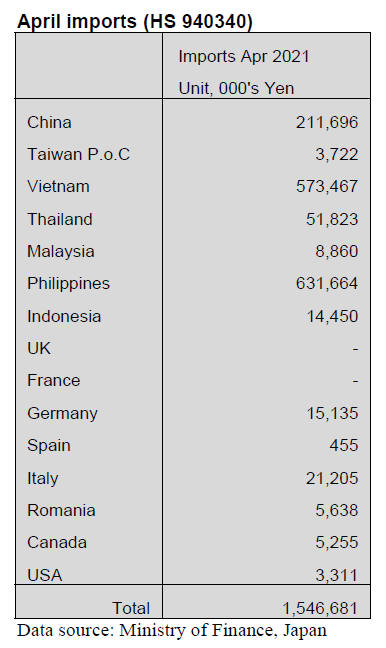

Kitchen furniture imports (HS 940340)

The steady rise in wooden kitchen furniture (HS940340)

imports came to an end in April. Compared to the value of

March imports April saw a 9% decline. Given the low

level of imports in April 2020 it is not surprising that April

2021 imports were worth over 40% more.

Shippers in the Philippines continue to dominate Japan¡¯s

wooden kitchen furniture imports accounting for around

41% of April imports but shipments from the Philippines

dropped 14% month on month.

Shipments from Vietnam were close behind those from the

Philippines accounting for 37% of April imports but this

again was a drop (7%) compare to a month earlier. The big

winners in April were exporters in China who saw exports

of wooden kitchen furniture jump by over 30%. In March

shipments of wooden kitchen furniture from Thailand

were high but in April arrivals dropped 50%.

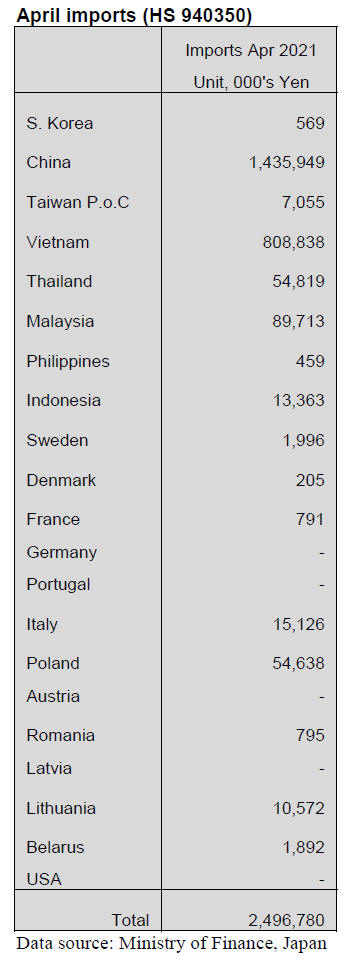

Bedroom furniture imports (HS 940350)

Year on year the value of Japan¡¯s imports of wooden

bedroom furniture rose 6% and compared to March

arrivals in April were 12% up.

The big winners in April were shippers in China who saw

a 35% increase in the value of shipments. This came at the

expense of shippers in Vietnam, Thailand and Malaysia

where shipments were well down. The value of Japan¡¯s

wooden bedroom furniture in April from Vietnam and

Thailand dropped around 10% while imports from

Malaysia were down around 30% in April.

In April shipments of wooden bedroom furniture from

China accounted for 58% of the value of Japan¡¯s total

wooden bedroom furniture imports. Shipments from

Vietnam accounted for 32%, Malaysia 4% and exporters

in Poland saw a doubling of the value of exports which

accounted for around 4% of Japan¡¯s total wooden

bedroom furniture imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Softwood plywood price hike

Softwood plywood manufacturers announced price hike

since June. New price is 1,000 yen per sheet delivered on

12 mm 3x6. The manufacturers¡¯ inventory continues low

then orders are increasing. Material log cost continues

high and adhesive prices are climbing so the

manufacturers decided to increase the prices by increasing

demand and cost push.

There was worry about demand decline when precutting

operations slow down by lack of building materials but the

orders for plywood continues active and June plywood

production is all sold out.

Inventory of structural softwood plywood by the

manufacturers at the end of April was 85,900 cbms, less

than 0.4 month then many plywood plants shutdown for

about a week during holidays in early May for

maintenance so May production dropped and the inventory

further dropped.

The dealers are trying to build up inventory in case of

supply shortage. The manufacturers ship out the products

as soon as they are made so delay of delivery started since

March.

Some wholesaler says that delivery is only 20% of what

they ordered so the business is running on hand to mouth

basis. The most concern to plywood manufacturers is

inflating production cost. Cedar log prices in the North

East are 12,000 yen per cbm delivered and in the Western

Japan are 13,000-14,000 yen.

With shortage of imported wood products, demand for

domestic cedar is getting strong and some sawmills started

using B class logs, which are normally for plywood so

further price escalation is likely all over Japan. Also

demand for larch and cypress is increasing like cedar,

which are used for face and back of plywood.

Some plywood mills increase use of North American

Douglas fir to supplement tight supplied larch and cypress

but Douglas fir supply is also tight. Adhesive prices are

also rising by worldwide demand increase for chemical

products. Present market prices of 12 mm 3x6 panel are

930-950 yen per sheet delivered so the manufacturers

increase the prices by 50-70 yen per sheet since June 1.

Russia imposes export duty on green lumber

The Russian government announced to impose export duty

on green lumber since July 1.

Green lumber means lumber with moisture content of 22%

or more. This applies to not only softwood but hardwood

lumber like oak and ash. Duty rate is 10% but minimum

prices are set like more than Euro 13 per cbm on softwood

lumber and more than Euro 15 on hardwood lumber.

There is no definite regulation to specify how to prove

moisture content.

The most affected market by this is China, which imports

large volume of Russian hardwood lumber and also some

in Europe. In Japan market, main imports are KD lumber

but some larch lumber could be affected by this regulation.

Plywood

Movement of domestic softwood plywood is very active.

It was forecast that the demand for plywood would decline

when operations of precutting plants slow down because

of shortage of imported building materials but orders of

plywood from precutting plants remains active and dealers

are trying to build up inventory in distribution channel so

the orders are filling up of plywood manufacturers¡¯

production schedule.

The manufacturers¡¯ inventory dropped more in May

because of shutting down for maintenance and shipment is

more than production now and it takes more time for

delivery. The manufacturers asked higher prices since

June and the buyers are hastily accepting the proposal to

secure the volume.

Imported South Sea hardwood plywood supply is in

critical stage. The largest supplier in Sabah, Malaysia

stopped taking any order in May because of shortage of

log supply and workers and other suppliers¡¯ offer volume

is minimal because of log supply shortage so delayed

shipment becomes now normal.

Then since June 1, Malaysia locked down for two weeks,

which further reduce log supply. Indonesia is also

suffering log supply shortage and with brisk orders for the

North America, there is no chance that the volume for

Japan would increase.

Domestic logs and lumber

Supply shortage of imported wood products is getting

severe since last March and substituting materials are

scrambling so that the prices keep soaring without no end.

In Kanto region, prices of KD cedar 105 mm square and

stud skyrocketed to about 90,000 yen, 15,000-20,000 yen

up and of 4 meter cypress sill are 100,000 yen, 25,000-

30,000 yen up. The prices change day after day.

House builders normally set the prices for several months

but now they are asking dealers to get the necessary

volume regardless of the prices.

The domestic KD lumber prices of all type such as post,

beam, stud, purlin and brace regardless of species and

sizes are now reaching level of 100,000 yen.

Sawmills increase the production so mills are scrambling

logs. Log prices, therefore, have been soaring sharply

since last April. National average of cedar post cutting

logs are 13,000-14,000 yen but in Kyushu and Northern

Kanto, they are about 17,000 yen with spot prices of

20,000 yen.

This is the highest in forty years. 4 meter sill cutting

cypress log prices are 20,000-23,000 yen but in Kyushu,

spot prices are 30,000 yen, the highest in forty years.

Stimulated by high prices, log production is active but

rainy season is coming so log production may decrease in

June and July.

Soaring New Zealand radiate pine log prices

Export prices of New Zealand radiate pine logs are

soaring. Late May and early June shipment prices steeply

increased by US$24-25 per cbm and future increase is

certain.

Sawmills cutting radiate pine logs in Matsunaga area in

Hiroshima prefecture decided to increase the sales prices

of radiata pine lumber by 10,000 yen per cbm since

August.

Radiata pine log prices sharply jumped up since late last

year by aggressive purchase by China. February shipment

log prices of Japan increased by US$23 per cbm FOB

from January shipment, which is record high increase so

the sawmills in Japan increased the sales prices of lumber

by 5,000 yen per cbm since April and the market accepted.

However, log prices for China continue to advance to

renew the highest prices. Now the prices are US$ 188-190

per cbm C&F and in late May, US$200 offer is made.

Prices of German spruce logs, which China buys in large

volume, climbed to US$184 per cbm C&F.

Affecting such bullish Chinese purchase, log prices for

Japan for late May shipment are up by US$24-25 per cbm

FOB. Total increase since last spring is US$65. Based on

these prices, the increase in Japan would be as high as

10,000 yen per cbm.

Late June shipment log prices would be up by US$15.

Ocean freight is also escalating so it is hard to predict how

high log cost would be. Sawmills have no choice but to

accept high prices without any inventory.

Sawmills say that it is impossible to see how high log

prices climb and price increase is only solution to

minimize the loss. Cedar crating lumber prices are also up

by 3,000 yen per cbm. Sawmills need to keep increasing

lumber prices because cedar log prices also keep climbing.

|