4.

INDONESIA

Indonesian furniture exports to

Canada

Statistics Canada reported 2020 imports of Indonesian

furniture increased by 21% compared to the previous year.

In the first quarter of 2021 furniture exports to Canada

increased by almost 50% compared to the same period in

2020.

Recently, the Indonesian Consul General in

Toronto, Leonard F. Hutabarat, held a virtual meeting

with Sinthusan Sivagnanam, CEO of Avanica Inc., a

Canadian company that has a wooden furniture factory in

Jepara, Central Java. The meeting was to discuss latest

developments in the export of Indonesian wooden

furniture to Canada as despite the huge potential,

Indonesia's furniture exports are still faced with a number

of challenges including the scarcity and high cost of

shipping containers.

See:

https://kemlu.go.id/portal/en/read/2580/berita/export-ofindonesian-furniture-products-to-canada-by-avanicaincorporation#

Digital services for Indonesian exporters

The Deputy Minister of Foreign Affairs, Mahendra

Siregar, expressed optimism that Indonesia companies are

on track to revive exports especially to Europe where there

is good demand for Indonesian products such as seafood,

rattan, wood products and furniture.

The Ministry of Foreign Affairs facilitates virtual business

matching between Indonesian entrepreneurs and importers

and distributors in Europe, the latest of which involved 35

Indonesian companies with business partners from

Western and Southern Europe.

Mahendra said the Ministry will continue to arrange

business meetings as they provide benefits for

entrepreneurs including Indonesian and European

MSMEs.

See:

https://www.neraca.co.id/article/147921/kemenlu-berikanlayanan-digital-bagi-eksportir-indonesia-perluas-pasar-ke-eropabarat-dan-selatan

Social forestry delivers higher incomes for

communities

The Director General of Social Forestry and

Environmental Partnership (PSKL) in the Ministry of

Environment and Forestry (KLHK), Bambang Supriyanto,

said that social forestry is having an impact on the

finances of communities living around forests.

He pointed out that the social forest programme has

generated job opportunities for over 1 million families.

According to KLHK data, as of May 2021 the social

forestry programme extended over 4.7 million hectares

distributed throughout Indonesia.

Up to June 2021 an additional 276,550 ha. have been

assigned to the programme. Bambang reported that, based

on a survey on the impact of social forestry on 103 social

forest business groups in 2020, 46% felt that their family

income had doubled and 26% said that their family income

increased 2-3 times with another 26% said the increase

was less than double.

See:

https://www.antaranews.com/berita/2216202/klhkperhutanan-sosial-berikan-dampak-nyata-untuk-masyarakat

Online sales platform for forest products

Perum Perhutani, a State-Owned Enterprise which has the

duty and authority to carry out the planning, management,

exploitation and protection of forests in its working area

has developed a platform in order to support marketing via

mobile apps. Perum Perhutani Commercial Director,

Ahmad Ibrahim, said this application will be boosted to

facilitate trade in Perhutani products making it easier for

consumers to shop.

Perhutani provides the guarantees on the quality, the origin

and the legality of the wood products it markets. Ibrahim

said Perhutani implements Sustainability Forest

Management and holds 49 FSC Controlled Wood

certificates and eight FSC FM-CoC certificates.

See:

https://www.liputan6.com/bisnis/read/4443577/perhutanikembangkan-platform-penjualan-online-pertama-untuk-produkkehutanan

Steep drop in fire hotspots

The Environment and Forestry Ministry has satellite data

showing that between January to mid-June 2021 the

number of fire hotspots representing potential forest fires

dropped substantially compared to the same period last

year.

The satellite-based evidence is derived from Terra/Aqua

(LAPAN) data in hotspots with a confidence level of more

than 80% indicating that from1 January 15 June 2021,

268 hotspots were detected, a fall from the 745 hotspots in

the same period last year.

See:

https://foresthints.news/report-details-impressive-declinesin-hotspots/

5.

MYANMAR

Rising Covid-19 infections

Residents in Maungdaw, a border town close to

Bangladesh in Rakhine State, are concerned about a new

virus outbreak in the town after three people who had

received two vaccinations tested positive.

Despite increased COVID-19 cases, including among

people who have not traveled, there is currently still no

plan to close Rakhine’s schools, said the head of the state

education office, U Tin Thein. Basic education schools

opened on 1 June in Rakhine and more than 300,000 or

almost all pupils have attended schools in the state,

according to the office. Sagaing Region has seen the

largest number of infections followed by Yangon Region

and Chin State. Clusters of infections have also been

reported in Yangon and Bago regions.

According to the Ministry of Health, Myanmar has

recorded 152,356 COVID-19 cases with 3,290 deaths

nationwide. In the border area with India the fatality rate is

reported as rising.

See:

https://www.irrawaddy.com/news/burma/vaccinatedrakhine-residents-catch-covid-19-on-myanmar-bangladeshborder.html

Third round of EU sanctions over the military coup and

subsequent repression

On 21 June 2021 the Council of the European Union

issued a press release with details of the additional

sanctions imposed on individuals and entities in Myanmar.

See:

https://www.consilium.europa.eu/en/press/pressreleases/2021/06/21/myanmar-burma-third-round-of-eusanctions-over-the-military-coup-and-subsequent-repression/

The press release says “The Council today imposed

sanctions on 8 individuals, 3 economic entities and the

War Veterans Organisation in relation to the military coup

staged in Myanmar/Burma on 1 February 2021, and the

ensuing repression against peaceful demonstrators. The

EU's restrictive measures are largely aligned with those of

major international partners.

The individuals targeted by sanctions

include ministers and deputy ministers, as well as

the attorney general, who are responsible for undermining

democracy and the rule of law and for serious human

rights violations in the country. The four entities are

either state-owned or controlled by the Myanmar Armed

Forces (Tatmadaw), contributing directly or indirectly to

the military's revenues or activities.

By targeting the gems and timber sectors these measures

are aimed at restricting the junta’s ability to profit from

Myanmar’s natural resources, while being crafted so as to

avoid undue harm to the people of Myanmar.

Restrictive measures, which now apply to a total of 43

individuals and 6 entities, include an asset freeze and a

prohibition from making funds available to the listed

individuals and entities. Additionally, a travel ban

applicable to listed persons prevents them from entering or

transiting through EU territory.

Pre-existing EU restrictive measures also remain in place.

These comprise an embargo on arms and equipment that

can be used for internal repression, an export ban on dualuse

goods for use by the military and border guard

police, export restrictions on equipment for monitoring

communications that could be used for internal repression,

and a prohibition on military training for and military

cooperation with the Tatmadaw.

The restrictive measures come in addition to the

withholding of EU financial assistance directly going to

the government and the freezing of all EU assistance that

may be seen as legitimising the junta. The EU remains a

steadfast supporter of Myanmar/Burma’s people and of the

country’s democratic transition.”

As a result of the latest EU sanctions which imposed

restrictive measures on the Myanma Timber Enterprise,

the Forest Joint Venture Corporation and the Minister of

MONREC, timber exporters have been advised to await an

evaluation of the impact of the new measures.

Recently the authorities resumed issuing export licenses

for sawnwood. The licenses had been suspended by

the State Administration Council (official name of military

government) from the beginning of April this year.

The private sector understands that exports of sawnwood

will be permitted until 31 December 2022 after which only

exports of semi-finished and finished products will be

allowed.

Although the latest EU sanctions do not refer to a ban on

EU imports of wood products from Myanmar exporters in

Myanmar and EU importers wish to seek clarification on

this issue before resuming shipments of wood products

including sawnwood.

It has been learned that a Wood-based Industries

Development Committee was formed last month with the

Deputy Minister as Chair and the Managing Director of

the Myanma Timber Enterprise as Secretary along with

private sector representatives. It is understood that the

natural forest log export ban will remain in place.

6. INDIA

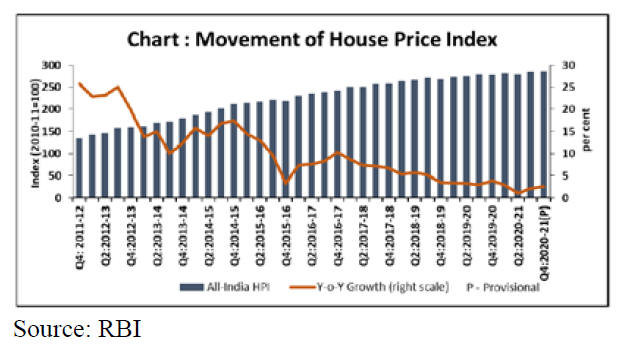

House price index

continues up

The Reserve Bank of India released its quarterly Housing

Price Index (HPI) for the period January-March 2020-21

based on transaction-level data received from housing

registration authorities in ten major cities. The HPI

increased 2.7% year-on-year in the March quarter 2020-21

compared to 3.9% growth a year ago. The cities covered

are: Ahmedabad, Bengaluru, Chennai, Delhi, Jaipur,

Kanpur, Kochi, Kolkata, Lucknow and Mumbai.

The HPI growth showed large variation across major

cities, from an increase of 15.7% in Bengaluru to a

contraction of 3.6% in Jaipur.

See:

https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=51771

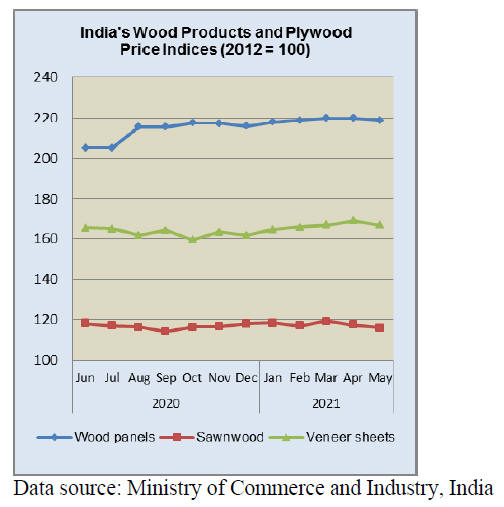

Wood product price indices rise

The Ministry of Commerce and Industry has reported the

official Wholesale Price Index (WPI) for ‘All

Commodities’ (Base: 2011-12=100) for May increased to

132.7 from 129.3 in April 2021.

The annual rate of inflation, based on the monthly WPI,

was, year on year, 12.94% in May, 2021. The high rate of

inflation in May was primarily due to effect of a low base,

the rise oil and mineral prices and a rise manufactured

product prices.

The index for manufactured products, which accounts for

64% of the index, increased. Out of the 22 groups of

manufactured products making up the index 17 increased

in May. The 4 groups for which prices declines were

reported included non- metallic mineral products; wood

and of products of wood and cork; textiles; tobacco

products. For one group there was no change.

The press release from the Ministry of Commerce and Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Industrial production and exports recovering

India's exports rose by over 4% to US$14.06 billion in the

first two weeks of June driven higher by shipments from

the engineering, gems and jewellery and petroleum

product sectors. Imports also rose nearly doubling to

US$19.59 billion during the same period.

Industry leaders in India anticipate an improvement in

domestic demand this year despite the economic setback

due to the COVID-19 pandemic as there are some signs of

a revival of economic activities as restrictions are rolled

back.

The industry has also been encouraged by a recent report

from the Reserve Bank of India in which the bank says

industrial production and exports have surged recently and

despite the second wave, goods and services tax (GST)

collection in 2021-22 so far has been better than in 2020-

21.

See:

https://www.outlookindia.com/newsscroll/industry-leadersexpect-major-uplift-in-market-sentiment-in-202122-despitepandemic-bottlenecks/2106978

7.

VIETNAM

Vietnam’s imports of wood from Europe soaring

In the first 10 days of June 2021 Vietnam’s imports of

wood products from all sources reached US$62.9 million.

According to the Center for Industry and Trade

Information (Ministry of Industry and Trade) the recently

concluded EU-Vietnam Free Trade Agreement (EVFTA)

has given a boost to the trade in wood and wood products

(W&WP) between Vietnam and EU.

The high quality, verifiable origin and zero export/import

tax on wood products imported from EU play an

increasingly important role providing raw materials for

Vietnamese enterprises.

In the first 5 months of 2021 Vietnam imported 177,590

cu.m of logs from the EU, up 21% over the same period

of 2020. Of the total volume of imported logs ash

accounted for 84% (148,850 cu.m), up 9.5% over the

same period of 2020. Imports of poplar increased sharply.

Imports of sawnwood from the EU also increased

reaching over 130,000 cu.m, up 76% over the same

period in 2020. Pine remains the most important species

imported at 49,260 cu.m.

Of the EU suppliers, imports from Belgium increased by

21%, France by 45%, Germany by 18% and Finland by

63%.

Vietnamese enterprises say imports of wood raw material

from the EU have risen because they have full order

books exports through to year end.

See: Nhập khẩu gỗ nguyên liệu từ Châu Âu tăng mạnh(msn.com)

Rising exports Canada

According to data from the General Department of

Customs, Vietnam's W&WP exports to Canada in May

2021 reached US$20.8 million, up 138% compared to

May 2020. In the first 5 months of 2021 W&WP export to

Canada amounted to US$104.3 million, up 69% over the

same period in 2020.

Wooden furniture is Vietnam's main export to Canada. In

the first 4 months of 2021 exports of wooden furniture

accounted for 89% of the total exports of W&WP to

Canada.

In Canada, as the impact of the pandemic receded, the

housing market heated up and there are no signs of it

cooling. This is the main reason behind the surge in

wooden furniture demand in recent months. According to

data from the Statistics Agency of Canada, imports of

wooden furniture into Canada in the first 4 months of 2021

reached US$847.84 million, up 46% over the same period

in 2020.

In particular, Canada increased imports from China and

Vietnam. Imports from China reached US$326 million, up

74% and that from Vietnam reached US$152 million, an

increase of around 63% over the same period in 2020.

The rapid growth of W&WP exports from China and

Vietnam into the Canadian market presents a challenge.

From 5 May 2021 the Canadian Border Services Agency

(CBSA) decided to apply anti-dumping and anti-subsidy

duties on upholstered seats from China and Vietnam.

For Vietnam, in addition to the 7 foreign enterprises that

are subject to anti-dumping and anti-subsidy duties of

between 17.44% - 89.77%, all other exporters are subject

t o tax rate of 101.5%.

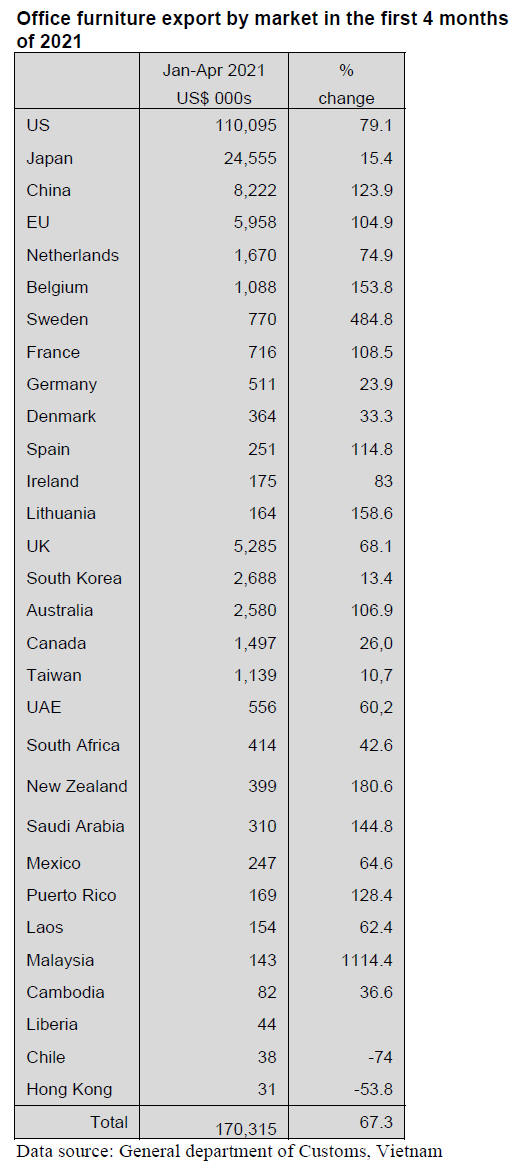

Export of office furniture rising

In May 2021 Vietnam's office furniture exports reached

US$46 million, up 96% compared to May 2020. In the

first 5 months of 2021 exports of office furniture reached

US$216 million, up 73% over the same period in 2020.

According to data from the General Department of

Customs of Vietnam exports of office furniture in April

2021 reached US$45.8 million, up 132% compared to

April 2020. In the first 4 months of 2021 office furniture

exports reached US$169.8 million, up 67% over the same

period in 2020.

From the end of April because of a resurgence of

corona

infections Vietnam’s economy slowed as enterprises cut

production and exports. Office furniture exports, however,

were the exception. The international demand for wooden

office furniture remains strong.

The US topped the list of office furniture imports from

Vietnam in the first 4 months of 2021 reaching US$110

million, up 79% over the same period in 2020.

Exports of office furniture to China, EU, Australia, New

Zealand, Saudi Arabia, Puerto Rico and Malaysia also

maintained high growth in the first 4 months of 2021.

Overseas investments

The government’s Foreign Investment Agency

has reported Vietnamese firms invested over US$540

million overseas in the first half of 2021, an almost three

fold rise year on year. Of the total some US$400 million

was top-up investments to existing projects.

Among the 12 fields of investment Vietnamese firms

channeled US$270 million into science-technology

projects and this accounted for 50% of all first half

investments. Wholesale and retail project attracted almost

US$150 million.

The US was the top destination for Vietnamese capital,

Cambodia ranked second followed by Canada and France.

See:

https://en.vietnamplus.vn/vietnamese-firms-overseasinvestment-rises-nearly-25fold-in-h1/203671.vnp

8. BRAZIL

Interest rate hike as inflation grows

Inflation measured by the Extended National Consumer

Price Index (IPCA) was 0.83% the highest for a May since

1996. The Central Bank raised its benchmark interest rate

by 75 basis points in May as it continues to wind down its

stimulus measures in the face of rising inflation which was

over 8% over the past 12 months.

The Bank's monetary policy committee said in a statement

it expected "another adjustment of the same magnitude or

more at its next meeting in August”.

Inflation has emerged as a central concern for policymakers

in Brazil as the economy begins to show signs of

recovery. Data for the first three months of this year

showed that GDP grew 1.2% from the previous quarter

bringing the size of the economy back to where it was

before the pandemic.

Investment in rail network to raise demand for sleepers

After months of economic decline due to pandemic 2021

prospects are improving and looking good for the

country's infrastructure and services sectors.

According to the Ministry of Infrastructure, Land and

Transport Secretariat in the coming years there will be an

expansion and renovation of the Brazilian railway network

and this will raise demand for wooden sleepers. The

Ministry’s goal is to attract more than R$40 billion in

private investments in the Brazilian railway system.

An example of where investment is required is the

construction of “Ferrogrão” (Iron-grain) railway, a project

that will run 933 kilometers between Sinop (Mato Grosso

State) and Miritituba (Pará state). This will be one of the

largest initiatives in the rail network construction.

According to projections by the Brazilian Chamber of

Construction Industry (CBIC) spending in the civil

construction sector could increase by around 4% in 2021

after falling 2.8% in 2020.

More support for small businesses

On 4 June 2021 a law (No.14.16) on the National

Programme to Support Micro and Small Businesses

(PRONAMPE) was enacted by the federal government.

This law enables the government to extend more

assistance to small and medium-sized companies affected

by the pandemic. The scheme will provide low-interest

loans, subsidised through the Operations Guarantee Fund

(Fundo Garantidor de Operações - FGO). PRONAMPE

will also create at least a R$5 billion credit line for micro

and small businesses.

This amount could rise to R$25 billion depending on the

participation of public and private banks.

In 2020 nearly half a million entrepreneurs benefited from

PRONAMPE including companies in the timber sector.

Micro-enterprises with annual sales of up to R$360,000

and small businesses with annual sales from R$360,000 to

R$4.8 million can access loans. Each loan is guaranteed by

the Federal government for up to 85%. The money can be

used for investments such as acquiring equipment or

carrying out renovations and for operating expenses such

as employee wages, paying business bills and purchasing

office supplies/goods.

Export update

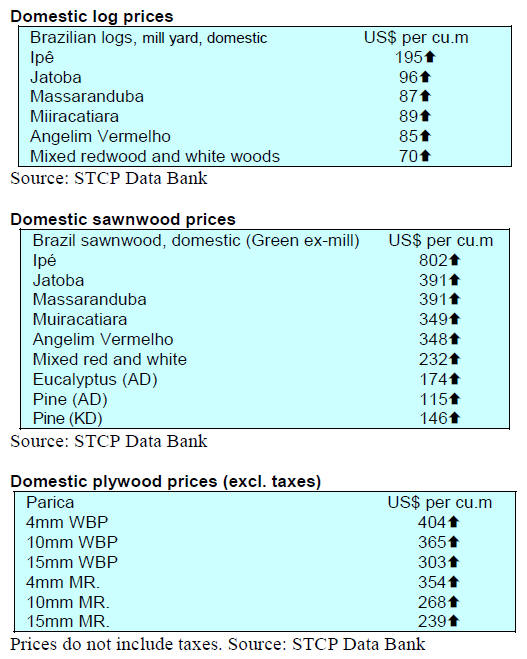

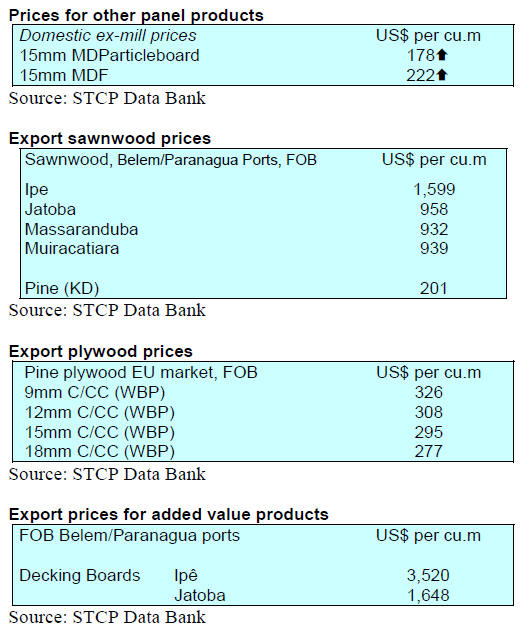

In May 2021 Brazilian exports of wood-based products

(except pulp and paper) increased 76% in value compared

to May 2020, from US$235.5 million to US$414.8

million.

Pine sawnwood exports grew 54% in value between May

2020 (US$43.2 million) and May 2021 (US$66.5 million).

In volume, exports increased almost 20% over the same

period, from 250,400 cu.m to 300,200 cu.m.

Tropical sawnwood exports increased 17% in volume

from 35,200 cu.m in May 2020 to 41,200 cu.m in May

2021. In value terms exports rose 14.5% from US$14.5

million to US$ 16.6 million, over the same period.

Demand in international markets for plywood is strong

and Brazil’s pine plywood exports increase over 200% in

value in May 2021 in comparison with May 2020, from

US$39.9 million to US$125.3 million. In terms of volume

exports increased 59% over the same period from 155,800

cu.m to 247,000 cu.m.

There was also a surge in demad for tropical plywood and

the volume of exports increased 62.5% and in value by

100% from 4,000 cu.m (US$1.6 million) in May 2020 to

6,500 cu.m (US$3.2 million) in May 2021.

As for wooden furniture export earnings jumped from

US$31.8 million in May 2020 to US$69.7 million in May

2021 an almost 120% rise.

Timber exports soaring

Brazil exported 1.18 million tonnes of wood products

between January and mid-June 2021 which represents

86% of the total shipped in 2020. In the first two weeks of

June 2021 the country exported 173,000 tonnes compared

to only 40,000 tonnes in the same period in 2020.

Furniture exports increase

After two years of decline Brazilian furniture exports

registered strong growth in the first five months of 2021.

Between January and May export earnings reached

US$385.9 million, 69% above US$228 million reported in

the same period of 2020. Despite the overall increase

among the five main importing countries, imports by Chile

stand out as the country doubled imports of Brazilian

wooden furniture.

9. PERU

Opportunities in Malaysia for timber

exporters

Agustín Palacios, Minister Counselor and Charge

d'Affaires of the Peruvian Embassy in Malaysia said

during a virtual forum, Malaysia is a major timber

exporter but is currently promoting the manufacture of

value-added products and requires additional timber raw

materials to manufacture furniture, doors, frames and

flooring. He pointed out that Malaysia could diversify its

timber raw material base with Peruvian species.

In order to promote Peruvian timbers a representative of

the Ministry of Foreign Affairs suggested Peru would

benefit from participation in Malaysia trade fairs. It was

also suggested that companies in Peru should explore ecommerce

opportunities to reach out to Malaysian

companies.

Public-private cooperation the way forward for the

forestry sector

The president of the Wood and Wood Industries

Committee of the Association of Exporters (ADEX),

Enrique Toledo, highlighted efforts by the government, the

private sector and civil society in creating opportunities

for constructive dialogue. He pointed out that it is

important to generate trust and commercial actions that

contribute to the establishment of a credible and legal

trade in sustainably harvested products from Peruvian

forests.

Exports to rebound this year - Minister

Peru’s Minister for Foreign Trade and Tourism, Claudia

Cornejo, has said that Peru's exports are expected to

recover to pre-pandemic levels by December this year.

Between January and April this year exports rose around

30% year on year. Peruvian exports totalled US$46.4

billion in 2019 but fell almost 16% in 2020 according to

the Global Business and Economy Research Center of the

Association of Exporters (Adex).

The export recovery will be driven by trade in traditional

products (minerals) and non-traditional exports including

agricultural and forest products.