|

Report from

North America

Tropical hardwood imports hold steady - Canadian

imports rise sharply

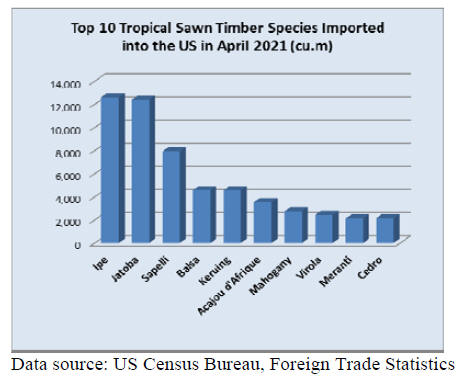

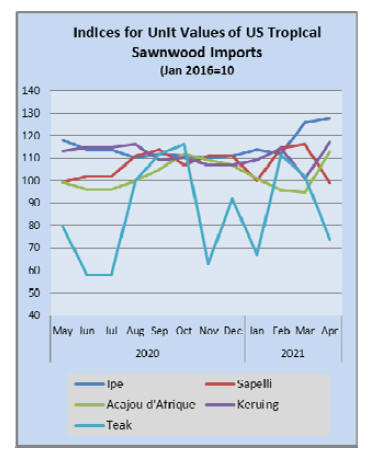

After a strong recovery in March, US imports of sawn

tropical hardwood held steady in April, falling a modest

2% from March. At 9,457 cubic metres, volume is only

slightly more than half that of last April, which saw a

spike early in the pandemic.

Additionally, last April¡¯s numbers counted ipe and jatoba

imports, which are no longer included in the totals from

the beginning of 2021. Imports from Congo (Brazzaville)

were down 66%, while imports from Ecuador and Brazil

fell 11% and 16%, respectively.

Imports this year from Brazil, by far the largest supplier of

sawn tropical hardwood to the US in 2020, are down 83%

year to date through the first four months of 2021.

However, there is no single species that is significantly

down in volume. Teak imports fell by 77% in April and

are behind 24% year to date, yet cedro fell 21% in April

but is up 67% year to date, and acajou d¡¯Afrique imports

are ahead 22% year to date despite falling 22%.

While overall year to date imports are technically down

42% through April, nearly all of that loss is due to the

adjusted statistics. If ipe and jatoba imports are included

then US imports of sawn tropical hardwood are actually up

3% year to date through April.

Meanwhile, Canadian imports of sawn tropical hardwood

soared in April, gaining 79% over March to mark the

strongest month since October 2019. Thanks to the strong

monthly numbers, imports for the year to date climbed

virtually even with 2020 totals after a weak first quarter.

Imports of mahogany rose 20% and imports of iroko rose

30%, while imports of virola, imbuia and balsa more than

doubled. Imports from Congo (Brazzaville), the

Democratic Republic of Congo, Cameroon, and Ghana

were all up sharply.

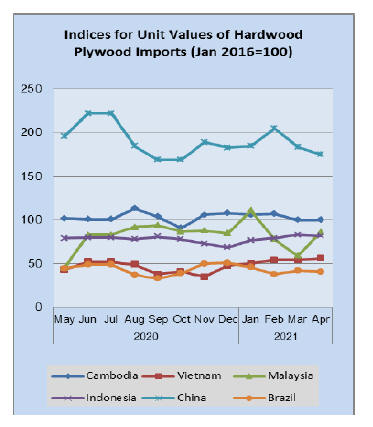

Hardwood plywood imports remain flat

The volume of US imports of hardwood plywood was

relatively unchanged for the second straight month, falling

by 1% in April. At 247,188 cubic metres, volume for the

month was 40% above that of the previous April and up

19% year to date. Imports from Russia and Vietnam were

both up by about 15% while imports from Indonesia were

down 15%.

Veneer imports gain but remain uneven

The value of US imports of tropical hardwood veneer

recovered somewhat in April, rising 38% from March, but

still only reaching about 75% of the numbers of the

previous April. Year to date imports are behind 2020 by

26% as month-to-month imports remain extremely

uneven, especially from Italy.

Imports from Italy were practically zero in March but then

rose more than 20,000% in April, to a level more than

50% above that of the previous April. Yet, year to date,

imports from Italy are down 32%.

Similarly, imports from India were up 408% in April, but

are still off by 54% year to date. More consistent trade has

come from Cote d¡¯Ivoire and Ghana, which were both

down slightly in April but are ahead 86% and 29%,

respectively, year to date.

Hardwood flooring imports cool

The value of US imports of hardwood flooring fell 17% in

April, pulling back from a strong March. Despite the

decline, imports were still more than 30% higher that

April 2021 and are up 29% year to date. Imports from

Brazil fell 17% in April but remain up by 168% year to

date.

Conversely, imports from Indonesia gained 5% in April,

but are far behind last year¡¯s totals, down 74% year to

date. Imports from China are also plunging, falling 46% in

April and off by 29% year to date.

Imports of assembled flooring panels continued their rise

in April, moving up 9% from March. Imports from China

rose 65% in April while imports from Thailand rose 58%

and imports from Indonesia moved up by 24%.

Overall imports are up 48% year to date, with year to date

totals from China up 73% and totals from Indonesia and

Vietnam both more than double their totals through the

first four months of the year.

Moulding suppliers change while imports remain

steady

While the value of US imports of hardwood mouldings

remained steady in April, rising 1%, imports from Brazil

and China continued their downward path. Imports from

Brazil fell 87% in April to its lowest level in more than a

decade, while imports from China fell 58%, also to a

record low.

Imports from China are now down 49% year to date, while

imports from Brazil are behind last year 33% year to date.

The benefactors from this decline appear to be Canada,

Malaysia, and various other supplying nations. Imports

from Canada rose 5% in April and are up 30% year to

date. Imports from Malaysia rose 10% in April and are

ahead 7% year to date. Overall imports are up 10% year

to date.

US wooden furniture imports dip slightly

The value of US imports of wooden furniture fell 2% in

April. Despite the dip, the monthly total of over US$2

billion was more than 66% above that of April 2020.

While imports from most countries stayed relatively

steady, imports from Canada fell 10% in April while

imports from Indonesia grew by 17%. Overall imports are

up 45% year to date.

The US furniture market continues to roar along at a

strong pace, according to the latest Smith Leonard survey

of residential furniture manufacturers and distributors.

New orders in March 2021 were up 96% over March

2020.

However, that number may be misleading since many

businesses were partially shut down in March 2020 due to

the pandemic. A more meaningful assessment might be

that orders were 40% higher than that of March 2019, still

a very favorable comparison.

See:

https://www.smith-leonard.com/2021/05/27/may-2021-furniture-insights/

Cabinet sales slow in April

Cabinet sales have showed signs of slowing, in part due to

the labor shortage and rising home costs, according to the

Kitchen Cabinet Manufacturers Association¡¯s (KCMA)

monthly Trend of Business Survey. Overall sales

decreased 14.5% in April compared to March. Custom

sales were down 10.3%, semi-custom sales down 16.1%,

and stock sales decreased 14.2%.

Despite the pullback, 2021 sales remain strong. Overall

year to date cabinet sales are up 18.8% when compared to

the same time period in 2020. Custom sales up 22.8%,

semi-custom sales increased 22.7% and stock sales

increased 15.4%.

The April numbers skew high versus last years, as they

reflect the recovery from the height of the pandemic

lockdown. Participating cabinet manufacturers reported

an increase in overall cabinet sales of 46.8% for April

2021 compared to the same month in 2020. Custom sales

are up 65.8%, semi-custom increased 49.3%, and stock

sales increased 41.8%.

See:

https://www.kcma.org/news/pressreleases/april_2021_trend_of_busines_press_release

|