Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jun

2021

Japan Yen 109.68

Reports From Japan

New strategy - focus on

economic security

The government is set to approve a new growth

strategy and the domestic media anticipate the focus will

be on economic security reflecting the rising tension

between the United States and China. During a press

briefing on the strategy a government spokesperson is

quoted as saying ¡°I doubt there were growth strategies in

the past that played up economic security as a pillar like

this one does.¡±

Masaya Sasaki, Senior Economist at the Nomura Research

Institute commented that under the current situation it will

be difficult to promote free trade and the transfer of data

so Japan will shift direction.

The Japan Times reports that in the new growth

strategy

document the chapter on economic security says that

Japan:

aims to secure technological advantages by

analysing, identifying, fostering and protecting

technologies in which the country has a

competitive edge

will focus on reducing risks of supply chain

disruptions for vital products such as

semiconductors, medical items, batteries and rare

earths

pledges to prop up the competitiveness of the

chip industry

seeks to attract cutting-edge production bases to

the country

plans to build more domestic data centres to store

sensitive data within the country

The draft of the growth strategy states that the changing

international environment has prompted other nations to

make ¡°unprecedented levels of investment to secure

production bases that are vital in terms of economic

security within their home countries.¡±

The changing economic direction will require the private

sector to face issues of economic security that it

unaccustomed to. Companies will need to have tighter

control of supply chains and on raw material sourcing

which could push up costs.

See:

https://www.japantimes.co.jp/news/2021/06/10/business/economy-business/suga-economic-security/

and

https://www.cas.go.jp/jp/seisaku/seicho/seichosenryakukaigi/dai11/siryou1-1.pdf

OECD cuts growth forecast

The Organisation for Economic Co-operation and

Development (OECD) has upgraded its forecast for global

economic growth this year but cut its projection for Japan.

Japan's growth estimate for 2021 as downgraded to 2.6%

from the previous estimate of 2.7% due to the introduction

of strict virus control measures and the slow progress in

Japan's vaccination campaign compared with other OECD

countries.

Third virus emergency holding down recovery

prospects

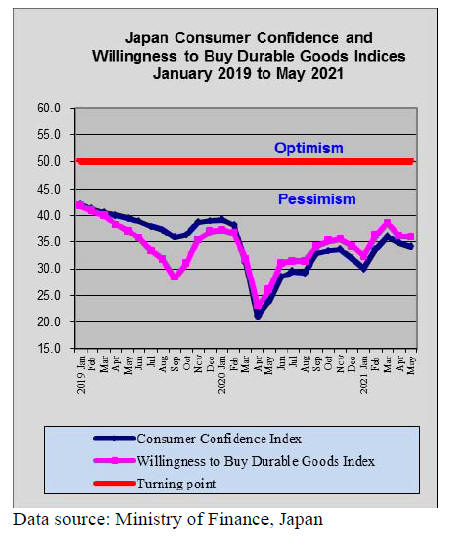

The Cabinet Office has said its latest survey shows

sentiment among large Japanese companies in the April-

June period became more pessimistic for the second

straight quarter. The confidence index, which surveys

firms capitalised at yen1 billion or more declined to minus

4.7 from minus 4.5 in the January-March period, the

second consecutive negative quarter.

The index for manufacturers turned negative for the first

time in four quarters. The index for non-manufacturers

remained negative although it improved slightly.

The report says the third virus emergency and lockdown is

having a damaging impact on the non-manufacturing

sector.

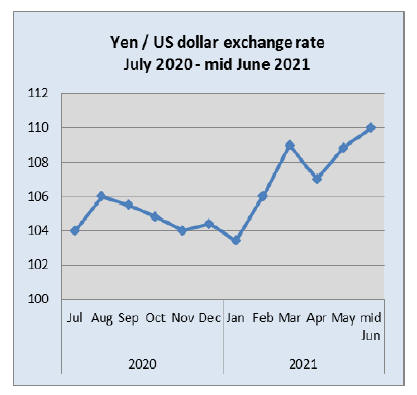

No shift in yen/dollar exchange rate

anticipated

The yen dipped slightly mid-month to below yen 109 to

the US dollar but there is unlikely to be any major shift in

exchange ratesin the short term.

The short lived strengthening of the US dollar was

triggered by a faster than expected increase in the US

consumer price index. Analysts do not foresee any major

strengthening of the dollar against the yen under the

current interest rate regime in the US.

Local governments offering (almost) free

homes

Japan's Housing and Land Survey which is conducted

every five years found there are more than 8 million empty

homes in rural Japan. Now local governments with a stock

of empty homes are making it easy for anyone willing to

come and renovate by selling them for as little as yen

50,000.

Some local authorities have what are called "akiya

bank"

websites listing abandoned homes. The central

government is offering financial incentives and renovation

subsidies.

See:

https://www.insider.com/japanese-government-selling-ruralhomes-cheap-akiya-banks-2021-5

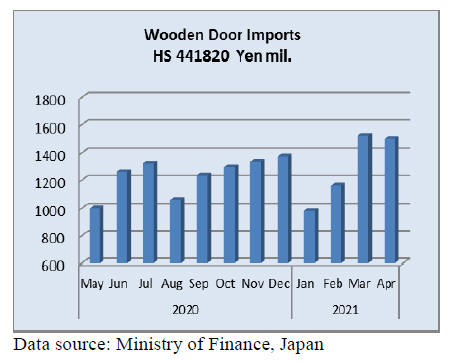

Import update

Wooden door Imports

In April 2021 manufacturers in China, the Philippines and

Indonesia provided most (92%) of Japan¡¯s wooden door

imports. Shippers in China accounted for 62% of April

door imports, the same proportion as in March. Most of

the balance was shipped from Europe and the US.

Year on year, April 2021 imports were 10% higher but

compared to the value of March imports there was a slight

decline in April.

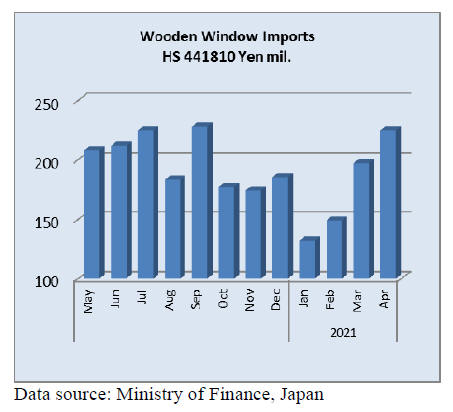

Wooden window imports

The value of Japan¡¯s wooden window (HS441810)

imports in April 2021 were some 15% higher than in

March but year on year there was a decline of around

12%.

Three shippers, China (50%), the Philippines (14%) and

the US (12%) accounted for most of Japan¡¯s wooden

window imports in March 2021. Shipments from the US

fell by half in April compared to a month earlier.

Most of the balance not provided by the top three shippers

came from the EU (17%) with Germany contributing 9%

to Japan¡¯s overall wooden window imports.

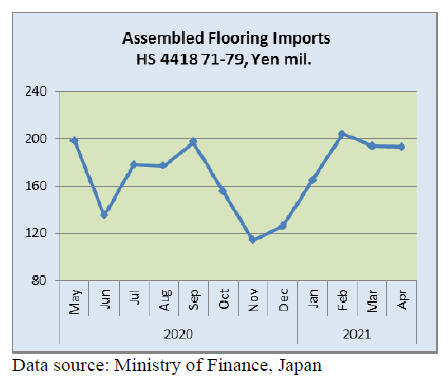

Assembled wooden flooring imports

As in previous months around 60% of flooring shipments

were of HS441875 with most coming from China and

Malaysia. The second largest category of wooden flooring

was HS441879 which accounted for just over 30% of all

wooden flooring imports. In this case, Indonesia and the

US were the main suppliers.

Year on year the value of Japan¡¯s imports of assembled

wooden flooring (HS441871-79) in April fell 20% adding

to the 7% drop in March. Month on month assembled

flooring imports in April were largely unchanged from

March figures.

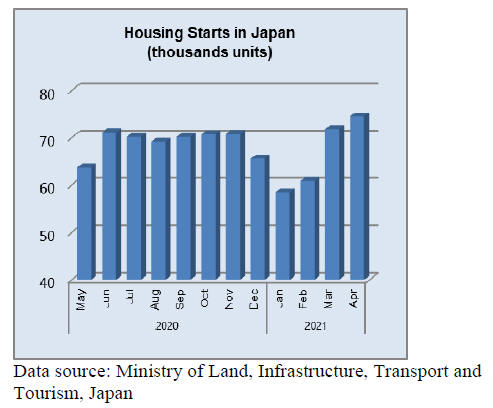

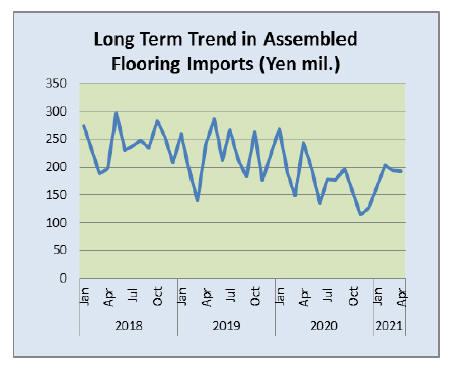

The Long term trend in assembled flooring imports is

illustrated below. In early 2020 there was a sharp

downturn as the seriousness of the corona virus infection

became clear.

The recovery in the first quarter 2020 was short

lived and

despite the peaks and dips in the value of imports there has

been a steady decline. This is a largely a response to

falling housing starts and declining investment in

commercial property.

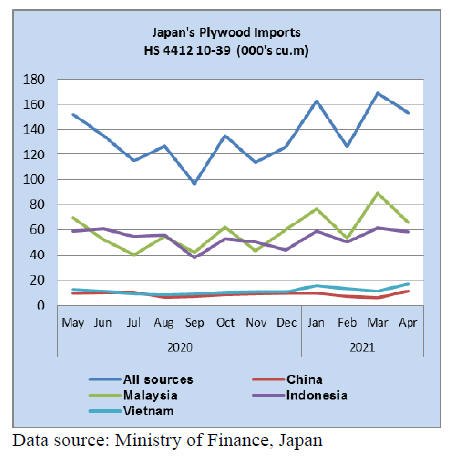

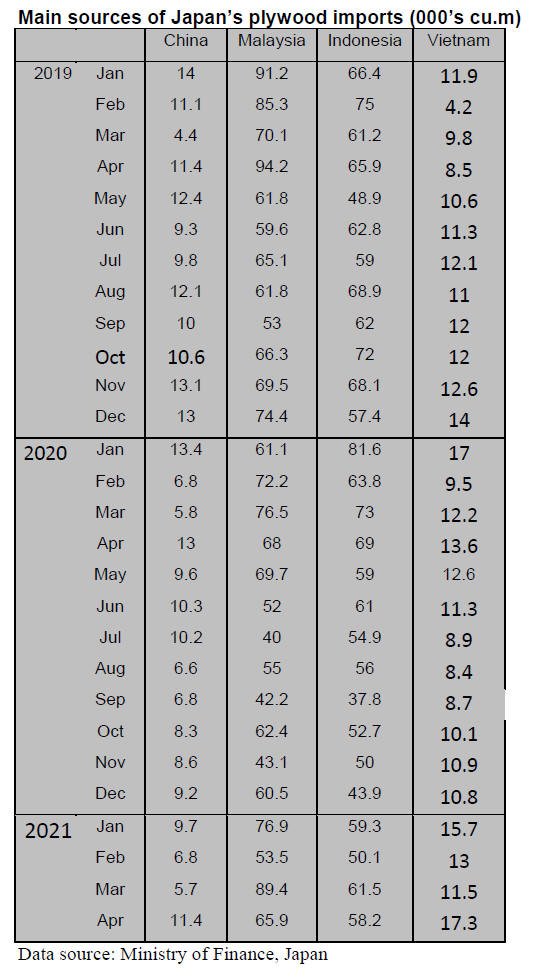

Plywood imports

Year on year the volume of April imports of plywood

(HS441210-39) was down 7% and compared to March the

volume of imports dipped almost 10%, a correction after

the peak in March.

Plywood shipments from Malaysia and Indnesia, the main

suppliers, dropped with shipments from Malaysia showing

a significant deline month on month. In contrast,

shipments from China jumped while the volume of

shipments from Vietnam remained at around the same

level as in March.

Of the various categories of plywood imports, HS441231

accounted for most of April 2021 imports with HS441234,

the second highest category.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

2021 National Forest business

The forestry Agency disclosed main subjects of 2021

national Forest business.

Planned sales of logs and timber are 4,882,000 cbms, 6%

more than 2020 but it states that there could be changes

depending on COVID 19 pandemic and supply of

imported wood products.

Business plan based on the budget is 7,163,000 cbms of

main cut (1% more) and 7,064,000 cbms of thinning (2%

more) Sales volume is 2,891,000 cbms of logs (4% more)

and 1,991,000 cbms of timber (9% more) in sales.

System sales are 1,990,000 cbms of logs (3% more)

and

20,000 cbms of timber (67% less). System sales are direct

sales to large consumers like lumber mills and plywood

manufacturers.

In 2020, because of COVID 19 pandemic, supply was

adjusted nationwide so that actual sales decreased from

initial plan on both logs and timber. In 2021, time limit of

harvest and hauling out of timber sold is off and there is

no restriction of timber harvest and extension of public

sales so this year¡¯s result should be higher than last year.

The Forestry Agency says supply and demand of logs vary

by the area so it is necessary to keep watching the situation

closely and exchange information with private timber

owners and forest unions.

Plan of building new logging road is 122 kilometers (15%

less) as the Agency mainly spends budget to maintain

existing logging road system. Planned plantation is 5,400

hectares (14% less) and underbrush cleaning is 22,400

hectares (8% more). 57,400 million yen is allocated to

maintain forests for repair of flood damaged areas.

2020 wood statistics

The Ministry of Agriculture, Forestry and Fisheries

publicized 2020 wood statistics on April 30.

Total demand for logs including imports is 23,550,000

cbms, 10.6% less than 2019. This is the first time that the

volume dropped less than 24,000,000 cbms in ten years.

Domestic logs are 19,882,000 cbms, 9.1% less and

imported logs are 3,668,000 cbms, 17.8% less so domestic

share moved up by 1.3 points to 84.4%.

New housing starts in 2020 are 815,340 units, 9.9% less

than 2019. Increased consumption tax in late 2019 and

COVID 19 outbreak in 2020 are reasons of decline.

Decrease of log demand and drop of housing is almost the

same. Domestic log supply had been climbing from

bottom of 2009 with 16,620,000 cbms for last ten years the turned

downward in eleventh year. Volume of less than

20,000,000 cbms is the lowest in six years since 2014.

Reasons are decrease of logs for lumber by 9.8% from

2019 and logs for plywood also decreased by 11.6%.

By species, cedar decreased by 8.3%, cypress did by 8.9%,

larch did by 9.4% and fir declined by 21.5%.

Imported logs have decreased for four consecutive years

since 2016 and the volume dropped less than 4,000,000

cbms. By source, North American logs dropped down by

17% to 2,840,000 cbms, which takes 77% share in total

imported logs.

Logs from New Zealand decreased by 18.1%. Russian

logs did by 15.9% and South Sea logs did by 37.2%.

Among imported wood products, lumber decreased by

13%, plywood did by 13% and wood chip did by 22%.

Housing starts in 2021 are estimated about the same as

2020 so far but variable factor is supply of imported wood

products, which seem to decrease considerably so demand

shifts to domestic wood. Accordingly domestic log supply

should be up.

South Sea logs

Rainy season is over in the South East Asian countries but

there is not enough foreign workers at logging sites

because of COVID 19 outbreak. Then since last March,

India started buying logs aggressively in Malaysia and

PNG. India had been buying logs from Myanmar but due

to political confusion in Myanmar, India goes to other

supplying countries including Africa.

In Japan, there is not enough reaction to what¡¯s happening

in producing countries with limited demand and ample

inventory now. Prices of South Sea log based Chinese and

Vietnamese products such as laminated free board

continues up because raw materials cost is getting higher.

Anxiety of house builders in ¡°Wood Shock¡±

Nightmarish month of April is over for house builders.

Since late March, supply of wood building materials

became critically short and building materials market got

into real confusion. Housing starts have starter delaying

since May. House builders say this is as bad as natural

disaster and majority comments that housing starts this

year would decrease by 20-30%. Only thing house

builders can do is to secure the imported materials even

with high prices.

House builders could select any precutting plant with

desirable building materials so it has been buyer¡¯s market

all the time for years so some builders are not aware of

change of the situation until last minute while others have

been collecting information through precutting plants and

trading companies and felt the change sooner.

After the largest precutting company has started restricting

taking orders in late March, majority realized seriousness

of the situation and construction has actually started

delaying since May because of shortage of structural

materials and precutting companies started turning down

orders one after another. There are many orders without

any precutting process so these orders are pushed behind

so the situation turned to sellers¡¯ market totally.

Precutting companies are now reviewing relationship with

house builders and select builders with which they can

continue business in fair attitude.

Builders, which have been arrogant, are now dumped so

good past relationship becomes main factor to continue

business. Even local contractors, advanced contractors use

more quality domestic wood so that even when imported

materials are short, they have enough domestic wood

materials so far.

For house builders, sold houses have fixed prices for

house buyers but after they sold, precutting cost jumped

up which builders need to absorb.

Then new orders have no place to precut so

completion

time is pushed forward so builders are not able to tell

house buyers time of completion. Also delay of

construction gives grave impact to builder¡¯s finance.

Sales of detached unit built for sale have been very active

for last one year and the inventory has decreased rapidly

so that builders can sell without any discount but lack of

building materials is the same but builders with sufficient

materials would enjoy good business.

Since COVID 19 pandemic, business of restaurants, bars

and hotels has been badly damaged by the State of

Emergency declaration but housing business in 2020

dropped only by 10% or so which is lucky compared to

other business but now housing market is seriously

damaged by material shortage and the starts this year may

decrease by 20-30%, which is much worse than last year.

This is unexpected incident nobody has experienced

before.

South Sea hardwood plywood market

Market prices of 12 mm panel are climbing. In Tokyo

market, prices of 3x6 coated concrete forming panels are

about 1,430 yen per sheet delivered, 70-80 yen higher than

last month.

Export prices by the suppliers continue climbing and

future prices are as high as 1,500 yen sheet so the dealers

in Japan need to increase the sales prices to catch up future

high prices. Export prices of 12 mm panel have been

climbing by $30 every month since late last year.

General view was that once rainy season is over in March

and April, log supply increases and export prices would be

easing and low cost panel of 1,300 yen contracted in late

last year should arrive so supply shortage would be solved

so the price increase has been small like 20-30 yen at a

time but actually the suppliers in Malaysia like Shing

Yang stopped taking new orders in March to produce

order balance first.

They started taking orders in April but the volume is very

small and the prices are up byUS $30 again so JAS 3x6

coated concrete forming panel prices climbed toUS $650

per cbm C&F. The suppliers do not care about having

future orders unless offered prices are accepted so the

Japanese importers had to accept the offered prices

because the inventory is extremely low in Japan.

Local plywood manufacturers are experiencing labor

shortage because of restriction of moving people across

provinces, which influence logging and plywood mill

operations. Log prices are abnormally high at this time of

year because of aggressive purchase by India. In this

situation, the suppliers ship out mixture of old contracts

and newer high priced contracts so the importers need to

increase the prices much faster now.

Price increase by various manufacturers

Daiken Corporation

Daiken Corporation (Osaka) raised the prices of flooring

with South Sea plywood base. Others are composite floor,

insulation board. MDF manufactured in Malaysia and

New Zealand will be raised by about 15%.

Reasons of price hike are soaring South Sea hardwood

plywood, higher cost of petrochemical products and higher

cost of energy. Prices of composite floor with South Sea

hardwood plywood base and related products are up by

10% and these of composite floor for condominiums with

9 mm base are up by 15%.

Daiken¡¯s total production of floor is about 1.5 million

square meters and products for price hike is 231,000

square meters, only 15% in total floor products.

On MDF, prices of wood chip and adhesive climbed and

transportation cost soared.

Daiken has been shifting to use planted species and

domestic plywood to reduce use of South Sea hardwood

plywood and now 85% of floor is made with such

materials plus MDF, which is named ¡®E hard base¡¯

meaning eco base material. It still uses South Sea

hardwood plywood for high performance floor and sound

proof floor for condos but because of high cost of South

Sea hardwood plywood, it will continue to try using eco

base more.

Nankai Plywood

Nankai Plywood Co., Ltd. (Kagawa prefecture) announced

to increase the prices by 10-20% of all the products with

South Sea hardwood plywood base such as ceiling board,

panel for closet, 12 mm floor and 6 mm floor.

South Sea plywood supply gets tight with log supply

shortage, labor shortage by restriction with COVID 19

outbreak and the prices continue to climb by high price

dealings with busy North American market and container

shortage. Other domestic costs such as adhesive,

cardboard for packaging, trucking and labor continue

escalating.

Asahi Woodtech Corporation

Asahi Woodtech Corporation (Osaka) announced price

hike on products like composite floor since July 1. Items

of price increase are products with South Sea hardwood

plywood and lumber.

Reasons of price increase are sizable increase of South Sea

hardwood plywood and lumber, higher cost of logistics

and other materials. 10-15% price increase is for five

kinds of composite floor, 5-10% up for seven kinds of

composite floor with South Sea hardwood plywood base.

Besides flooring, products with South Sea hardwood

lumber are up by 5-10%.

Eidai

Eidai Co., Ltd. (Osaka) decided to increase the prices of

all the products listed in the catalogue. Price increase of

sound proof floor is about 15%. Other floor prices will be

up by 5-10%.

Solid wood flooring is manufactured in the subsidiary

company in Vietnam. Raw material cost is climbing and

ocean freight is up so price increase is unavoidable. Eidia

has been trying to change floor base from South Sea

plywood to domestic softwood plywood and it targets to

use domestic plywood base up to 50% by 2025.

|