US Dollar Exchange Rates of

10th

April

2021

China Yuan 6.5530

Report from China

Decline in 2020 sawnwood imports

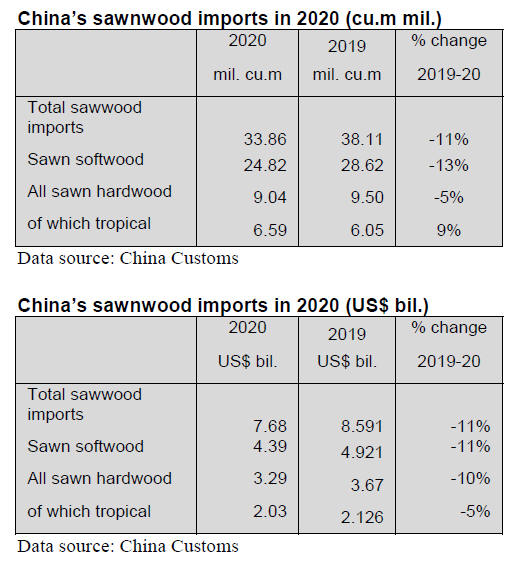

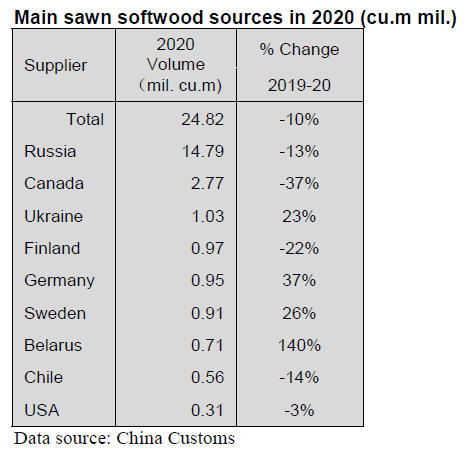

According to data from China¡¯s Customs, 2020 sawnwood

imports totalled 33.86 million cubic metres valued at

US$7.68 billion, a year on year decrease of 11% both in

volume and in value. Of total sawnwood imports, sawn

softwood imports fell 13% to 24.82 million cubic metres

accounting for 73% of the national total which was 2%

less than in 2019.

Sawn hardwood imports fell 5% to 9.04 million cubic

metres because China¡¯s sawn hardwood imports from the

top sources, Russia and Canada, fell 13% and 36%

respectively.

Of total sawn hardwood imports, tropical sawnwood

imports were 6.59 million cubic metres valued at US$2.03

billion, a year on year increase of 9% in volume but a drop

of 5% in value and accounted for about 19% of the

national total.

Slight rise in the average prices for

sawnwood

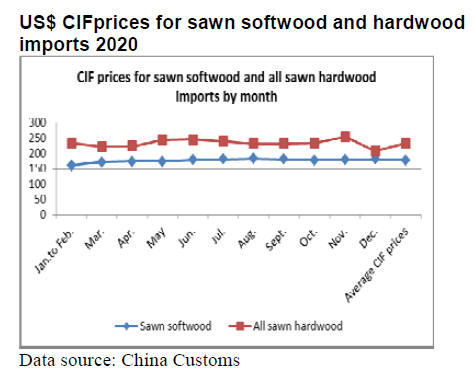

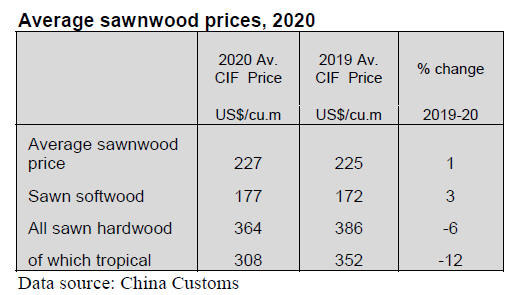

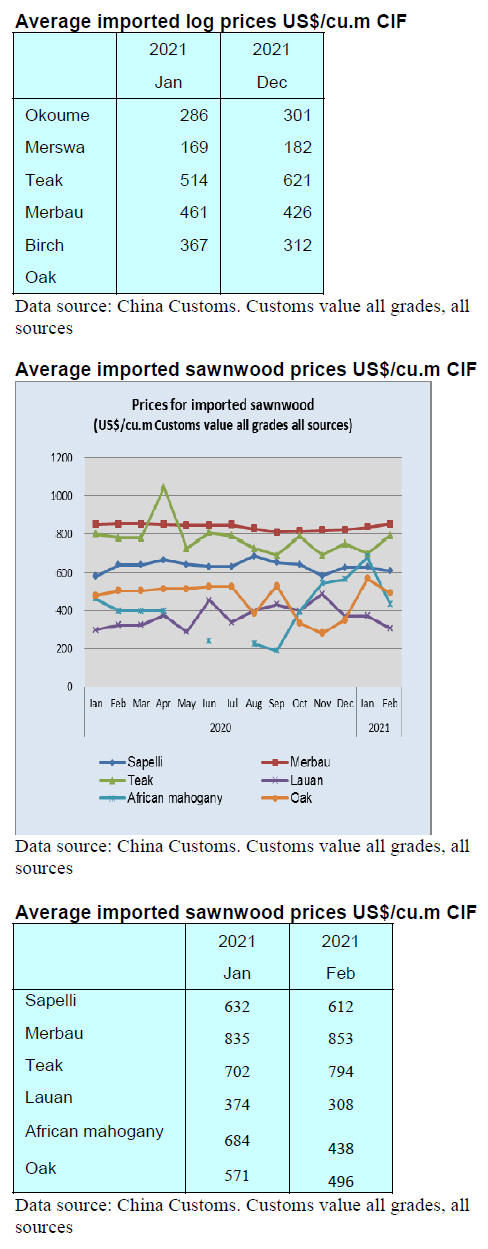

The average price for imported sawnwood in 2020 was

US$227 per cubic metre, a year on year slight rise of 1%.

The average price for imported sawn softwood was

US$177 per cubic metre, up 3% year on year.

The average price for imported sawn hardwoods was

US$364 per cubic metre, a year on year decline of 6%.

The average price for imported tropical sawnwood was

US$308 per cubic metre, down 12% year on year.

China¡¯s sawnwood imports from Belarus soared

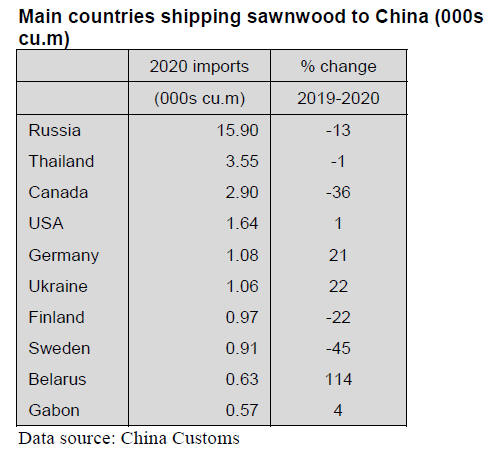

Russia still was the main sawnwood supplier to China in

2020 but China¡¯s sawnwood imports from Russia fell 13%

to 15.9 million cubic metres and accounted for 54% of the

national total, down 6% year on year. Belarus became the

fastest growing sawnwood supplier to China and

sawnwood imports from Belarus soared 114% to 630,000

cubic metres in 2020.

China¡¯s sawnwood imports from Ukraine and Germany

rose 22% and 21% to 1.06 million cubic metres and 1.08

million cubic metres respectively. China¡¯s sawnwood

imports from the USA and Gabon also increased 1% and

4% to 1.64 million cubic metres and 570,000 cubic metres

respectively in 2020.

Decline in sawn softwood imports from Russia

and

Canada

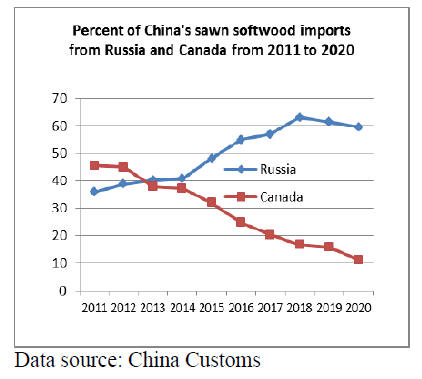

According to China Customs sawn softwood imports from

Russia and Canada, the two main sources of China¡¯s sawn

softwood imports, fell sharply in 2020 dropping 13% and

37% respectively.

However, the volume of China¡¯s sawn softwood imports

from Russia still accounts for 60% of the national total,

which has been the case for 6 consecutive years. The

market share of China¡¯s sawn softwood imports from

Canada has declined steadily since 2014.

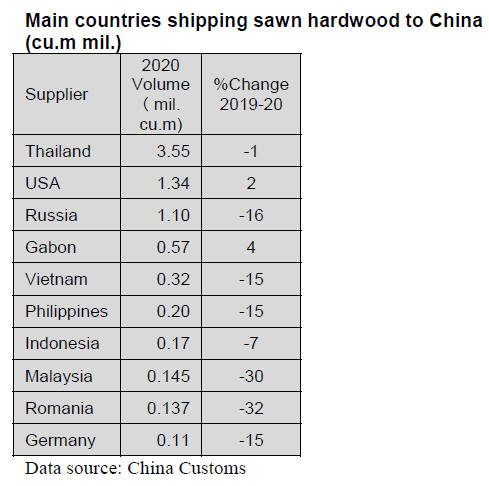

Slight rise in sawn hardwood imports from

the US

China¡¯s 2020 sawn hardwood imports from most of the

main sources declined in 2020 with imports from Romania

and Malaysia falling 32% and 30% respectively. However,

China¡¯s sawn hardwood imports from the US and Gabon

rose slightly, 2% and 4% to 1.34 million cubic metres and

570, 000 cubic metere in 2020 respectively.

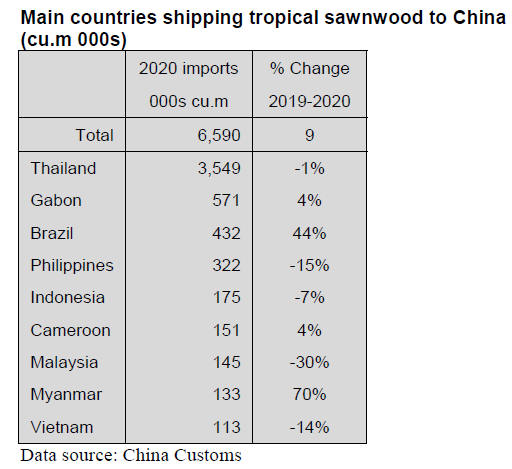

Rise in China¡¯s tropical sawnwood imports

Tropical sawnwood imports in 2020 were 6.59 million

cubic metres valued at US$2.03 billion, a year on year

increase of 9% in volume but drop of 4% in value and

accounted for about 19% of the national total.

Thailand still is the main source of tropical sawnwood for

China and 2020 tropical sawnwood imports from Thailand

totalled 3.55 million cubic metres, a year on year decline

in volume of 1%. Thailand¡¯s market share of tropical

sawnwood imports to China was 54% but this was down

5% year on year.

Nine countries supplied 85% of China¡¯s tropical

sawnwood requirements in 2020, namely Thailand (54%),

Gabon (8.7%), Brazil (6.5%), Philippines (4.9%),

Indonesia (2.6%), Cameroon (2.3%), Malaysia (2.2%),

Myanmar (2.0%) and Vietnam (1.7%). Tropical

sawnwood imports from Myanmar and Brazil rose 70%

and 44% year on year respectively but imports from

Malaysia, Philippines and Vietnam fell 30%, 15% and

14% year on year respectively.

|