Japan

Wood Products Prices

Dollar Exchange Rates of 10th

April

2021

Japan Yen 109.67

Reports From Japan

Vaccination roll-out for

elderly

Japan¡¯s vaccination programme began 12 April around

four months after the start of inoculations in the United

States and the United Kingdom. This delay has generated

criticism of the government¡¯s handling of vaccine

procurement.

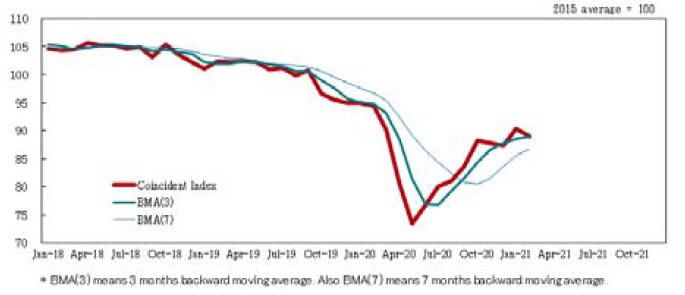

Business sentiment tilts positive

Business sentiment among large companies has been

improving and the ¡®Tankan¡¯ survey by the Bank of Japan

(BoJ) said the index for big manufacturers was positive in

March, a considerable improvement over the negative

level in the December survey.

The ¡®tankan¡¯ measures corporate sentiment by subtracting

the number of companies saying business conditions are

negative from those responding they are positive.

The March survey supports the view of the BoJ that the

economy continues to recover ¡°moderately¡±.

Despite the growing optimism among large manufactures,

small and medium sized companies are struggling and

with less take-home pay and rising uncertainty over the

direction of the pandemic retail sales are weak and fell for

the third straight month in February.

Against this background the economy looks set to have

contracted in the first quarter of 2021.

See:

https://www.fxempire.com/forecasts/article/usd-jpyfundamental-daily-forecast-data-indicates-japanese-economy-iscontracting-during-current-quarter-714517

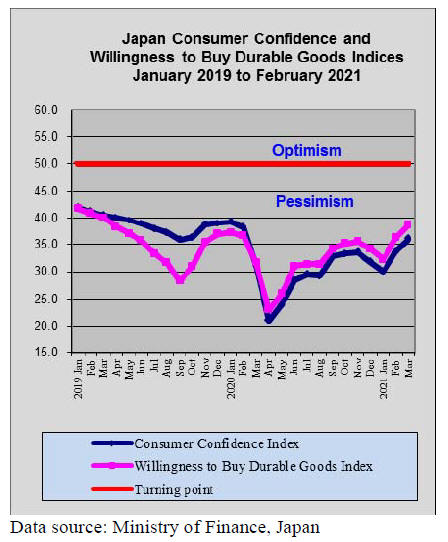

Start of vaccinations boosts consumer

sentiment

Since the beginning of 2021 consumer confidence has

been improving as has the willingness of consumers to

purchase durable goods the purchase of which is the first

to decline when times are tough. The rise in sentiment has

been put down to the beginning of the corona vaccination

programme in the country.

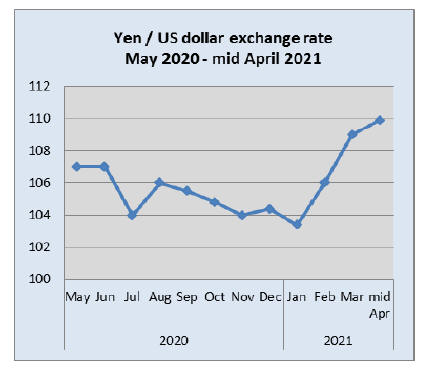

Weak yen good news for Bank of Japan

Since the beginning of this year the yen/dollar exchange

rate has been in the range 107-109 yen to the dollar. This

exchange rate is welcome news for the Bank of Japan as it

seeks to revive the export dependent economy.

The down side of the weaker yen is that the cost of

imports rises and this could further dampen domestic retail

sales which dropped a further 1.5% in February. It is

anticipated that Japan's economy contracted in the first

quarter partly due to falling consumer spending.

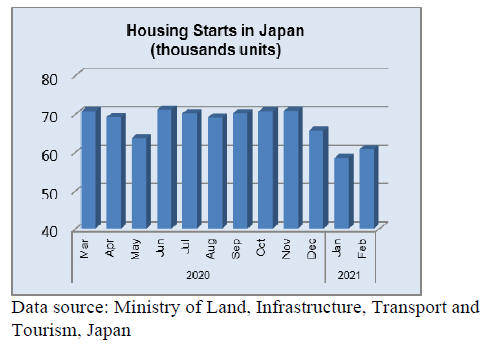

Foreign markets offer hope for house

builders

A Japan Lumber Reports survey has found orders placed

with the major builders in Japan was down 5% in

February. This marks two consecutive monthly declines.

In contrast the survey found builders of low cost homes

are doing well with order values up by 12% in February

marking ten consecutive monthly increases.

With a declining and aging population Japanese house

builders are developing straegies to maintain sales, one of

which is to nuture overseas projects.

The Japanese house builder Sekisui House has partnered

with Homes England and the UK developer Urban Splash

to build over 400 modular homes on a site in Northstowe,

Cambridgeshire, UK. This will be the first project

completed by the three-way partnership.

See:

https://www.insidehousing.co.uk/news/news/japans-biggesthouse-builder-delivers-400-modular-homes-in-homes-englandpartnership-70046

Import update

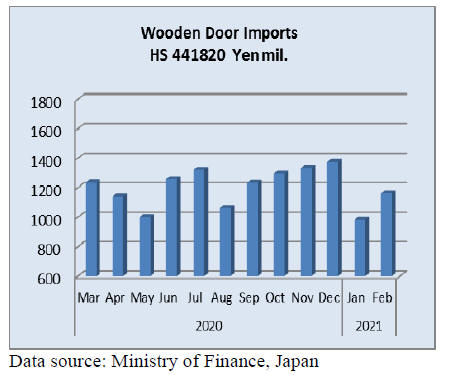

Wooden door Imports

As was the case in January 2021, China and the

Philippines dominated Japan¡¯s sources of wooden doors

(HS441820) but their combined shared of total imports

slid once more with shippers in SE Asia especially

Indonesia and Malaysia grabbing a higher market share.

China accounted for 52% of the value of February imports

of wooden doors followed by the Philippines at 29% and

Indonsia at 6%. Year on year, February imports of wooden

doors were up 38% and month on month February imports

were 18% higher.

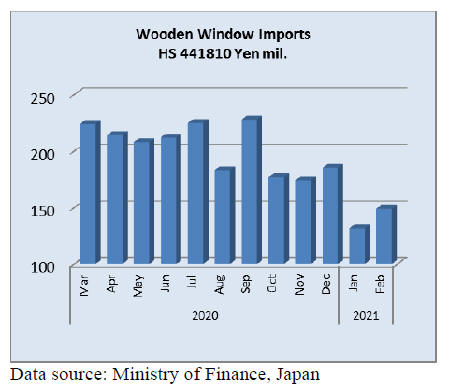

Wooden window imports

The value of February 2021 imports of wooden windows

(HS441810) was little changed from a year earlier but

compared to the value of imports in January there was a

13% increase. Three shippers, China (49%), the US (25%)

and the Philippines (23%) accounted for most of Japan¡¯s

wooden window imports in February and all saw their

share of imports rise compared to January.

Year on year February 2021 imports of wooden windows

were flat but month on month there was a 13% increase.

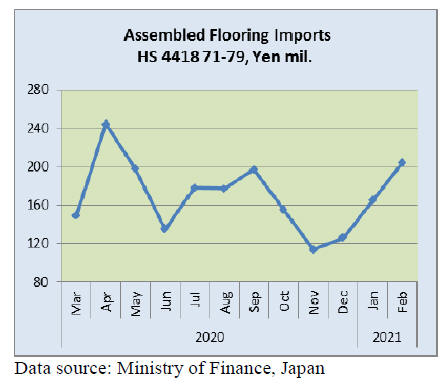

Assembled wooden flooring imports

Shipments of assembled wooden flooring (HS441871-79)

from China accounted for the largest share (70%) of

Japan¡¯s imports as they have done for several years.

In February this year shippers in Malaysia captured

the

number two spot. HS441875 continued to dominate

Japan¡¯s imports of assembled flooring in February 2021

but, as a proportion of all wooden floor arrivals in Japan,

there was a decline in this category with a corresponding

rise in imports of HS441879.

Year on year, the value of Japan¡¯s imports of assembled

wooden flooring (HS441871-79) rose 8% and month on

month there was a 23% increase building on rises for each

month since December 2020.

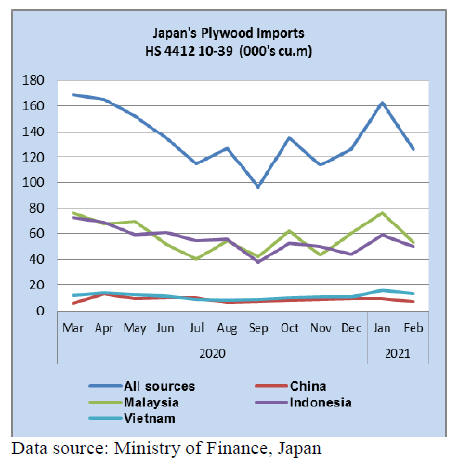

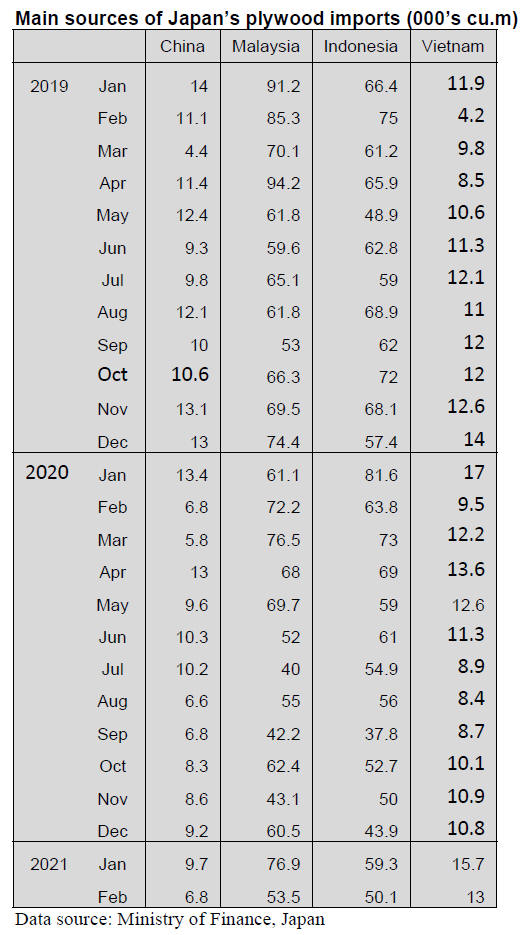

Plywood imports

After three consecutive monthly increases in the volume

of plywood imports there was a correction in February and

each of the main suppliers, Malaysia, Indonesia, Vietnam

and China saw export shipments drop.

Malaysia and Indonsesia account for most of Japan¡¯s

imports of plywood but exporters in Vietnam continue to

enjoy a sizeable share of plywood import volumes which

are now twice the volume shipped to Japan from China.

Of the various categories of plywood imports of

HS441231 accounted for 89% of February 2021 imports

with HS441234, the second highest category, accounting

for just 6%.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Sales of major house builders in February

Ordered value major eight builders in February is down by

5% and this is two straight months decline. By declaration

of the state of emergency since early January, visitors to

the house exhibition sites drooped by about 50%, which

influenced February orders. Meantime, low cost builders

continue active and three builders¡¯ order value in February

is 12% up and this is ten consecutive months increase over

the same month a year earlier.

The demand to live in suburban areas continues and

acquisition of necessary properties influences orders of

house sales.

Number of visitors to the house exhibition sites was

increasing until the declaration of the state of emergency

in last January and the orders were recovering but tide

changed again since last January.

Buyers¡¯ attitude changed. They request brochures by

website and after examining brochures at home and focus

on target then visit house exhibition site so request for

brochures by website continues busy. With this trend, time

from visiting the site and concluding the deal becomes

shorter than before.

This means declining visitors is not necessarily mean

declining sales because visitors are now more serious

potential buyers.

Low cost builders and builders of units built for sale enjoy

busy market by active demand to live in urban areas so

they say if there is property, house can be sold in no time.

By eight major builders, ordered value compared to the

same month a year earlier in February is 95% while low

cost three builders in February is 112%.

Higher prices of European OSB

Market prices of European OSB are climbing. Reasons are

increasing demand in Europe, higher freight by container

shortage and inflating adhesive cost. Orders to the

manufacturers are swelling and it is hard to have

production for Japan market.

Delay of shipment by container shortage is getting critical.

It is hard to secure containers. Cargoes for shipment are

accumulated at shipping ports. January scheduled cargoes

still remain at loading port in middle of February without

any containers. Containers returning from Asia are not

coming back and it needs premium freight like 50% to

have containers in tight supply.

Adhesive (MDI) supply started getting tight since last July

2020 and the prices are inflating particularly after Chinese

demand came back in last February and at the same time,

MDI plant in the U.S.A. suffered slow production by cold

waves so worldwide supply of MDI is getting tight.

European OSB manufacturers say that adhesive supply is

now based on quota and some manufacturers are down

because of shortage of adhesive. Export prices for Japan

have started climbing since middle of 2020.

South Sea logs and lumber

Both demand and supply of South Sea logs are low. The

demand decreases largely in Japan after last plywood mill

stops operation and other mills shift to use other species or

veneer so log demand practically died in Japan.

Chinese made laminated free board prices are climbing.

Demand in Japan is not so active but dealers continue to

purchase to cover dropping inventory. Tropical hardwood

lumber demand is recovering for truck body but it is

limited demand.

Serious shortage of containers

Container shortage continues worldwide. Export business

in China is very active and China looks for containers

aggressively. Normally inbound cargoes are loaded and

containers are shipped back to China but demand of empty

containers is so strong in China that it pays premium to

bring containers back without any inbound cargoes and

some empty containers bound for Japan from North

America abruptly changed to go to China.

In short, China scrapes containers at any cost now. This

influences wood products import of Japan. North

American and European suppliers are tired of low sales

prices for Japan then securing containers is another

headache so cargoes for Japan are waiting for containers at

every loading ports. This delays shipments so supply

shortage in Japan gets worse by not only supply side

reason but also shipping problem. The suppliers are

reducing offer volume for Japan with reason of container

shortage and higher freight.

Trans-shipment of container cargoes is delayed. European

cargoes for Japan normally stop at Shanghai, China or

Pusan, Korea for transshipment but this takes time because

of congestion. Containers with hemlock genban scheduled

to arrive in January held for a month in Shanghai for

transshipment and finally arrived in late February so the

genban users operate hand to mouth by the delay. Future

containers with genban are being held in Shanghai so the

supply shortage will continue.

European wood products suppliers struggle to secure

containers for Japan so shipment of lamina and structural

laminated lumber for the first quarter has been delayed.

The suppliers increase sales for European market, where

land transportation is possible so the supply for Japan

would decline more. Second quarter negotiations for

lamina and laminated lumber should start shortly but the

container shortage remains as serious problem.

Russian lumber export business has the same problem.

Export cargoes are piling up at shipping ports in the

Russian Far East so the ports refuse to bring railcars into

port. Transshipment at Pusan, Korea for Japan sea side

ports takes more than two weeks now by congestion.

Okura developed new type concrete forming panel

Okura Industrial Co., Ltd., (Kagawa prefecture) developed

new type of concrete forming panel. Concrete panel has

been imported tropical hardwood plywood but what

Okura developed is made of water proof particleboard and

domestic softwood plywood as base materials. Weight is

10% lighter than tropical hardwood concrete forming

plywood.

Particleboard has forest certificate and domestic softwood

plywood is sustainable material so the product is

environmentally friendly product. Performance of the

product is almost same as imported hardwood concrete

forming plywood.

Particleboard is 2.7 mm thick made of FSC-COC certified

rubber tree wood chip and 9 mm thick domestic cypress

plywood. This composite panel is coated with high density

polyethylene sheet. Size is 12 mm thick 900x1800 mm.

The weight per sheet is about 11 kilogram.

After the supply of concrete forming plywood from South

East Asian countries has been getting tight by declining

raw materials. This new product can be supplied stably

and the price is also stable unlike South Sea plywood,

which supply is unstable by weather and the prices

fluctuate.

|