|

Report from

Europe

Plywood margins are good, but supply a struggle

The good news from the majority of European hardwood

plywood importers interviewed March 2021 was that they

were making money. They reported demand ranging from

firm to booming across the market, from the construction

and DIY sector to merchants and furniture makers.

Moreover, customers were willing to pay a healthy price.

¡°If you can¡¯t make a good margin in the current climate,

you never will,¡± said one importer.

Another reported their customers ¡®accepting the real value¡¯

of plywood and timber generally. ¡°Traditionally most

view plywood as a stack it high, sell it cheap commodity,

but the market situation is such now that they¡¯re having to

pay more like its true worth¡± they said.

¡°There¡¯s strong demand and less opportunity to play

suppliers off against each other. We¡¯re experiencing less

negotiating from customers and less bad debt. It¡¯s

definitely a seller¡¯s market.¡±

The less good news for importers is the manufacturing and

supply situation. Demand is growing globally, while

output is constrained by a range of factors. Notable among

these is manufacturers either running short of staff due to

Covid-19 and still operating pandemic safe work practices

or taking time to gear up production as lockdown rules are

relaxed.

The result is extended lead times, importers only being

able to obtain a percentage of usual order volumes and

gaps in some specifications.

Manufacturers¡¯ prices also continue to climb and while, to

date, the market seems to have been able to absorb them,

some fear there is increasing danger of the market

overheating.

Soaring freight rates

The other key concern in the sector is soaring freight rates,

notably in containerized trade. With global container

distribution disrupted by the pandemic, shippers out of

Asia have been naming their price. Importers report fiveand

six-fold rises over the last six months, some even

more.

¡°I¡¯ve never known such high container rates in my entire

career,¡± said one trader. ¡°It¡¯s just not realistic or

sustainable, and at some point there has got to be an

adjustment, which could itself create market turmoil. It¡¯s

becoming quite a dangerous situation.¡±

After the first wave of the pandemic last year, European

plywood importers reported business starting to recover

from May onwards.

¡°It was slow to start with, obviously, we did a fraction of

our trade from March through May and, ultimately, we

weren¡¯t able to make up the difference. But from June-

July onwards we¡¯ve seen exponential growth ¨C it just

hasn¡¯t stopped,¡± said a UK-based importer.

¡°A lot of latent energy built up in the market during the

first pandemic lockdown and when it was relaxed that pent

up demand was unleashed. Construction projects that were

paused came back on stream and new ones started up. And

we didn¡¯t see much of a slowdown during the subsequent

lockdowns due to second and third waves of pandemic in

November and January ¨C nothing like March-April 2020.

We think that¡¯s because businesses by this time had

adapted to pandemic work practices, notably in

construction, so were able to maintain higher output

levels.¡±

In some European countries, the building sector was also

reported ¡®barely to have slowed down¡¯ through the entire

course of the pandemic and so was well placed to pick up

the pace as their wider economies emerged from

lockdown.

¡°In Germany and the Netherlands in particular we saw

only a marginal decrease in activity,¡± said one agentimporter.

Upturn in home improvement market

Some importers said they also saw the effect on sales of

the widely reported international upturn in home

improvement and refurbishment.

¡°It¡¯s been a worldwide phenomenon, people staying at

home in lockdown and on furlough have taken the

opportunity to improve their properties. Either that, or

they¡¯ve felt they¡¯ve had to adapt their houses to

living/working spaces, anticipating that, even after the

pandemic, they¡¯ll be spending at least some of the week

working from home,¡± said one importer. ¡°This has meant

more remodeling, loft conversions, extensions and also

garden office building.¡±

Within this sector, and construction more broadly, a UK

company also detected a growing preference for timber as

a natural, low environmental impact material.

¡°Surveys have shown that there¡¯s growing consumer focus

on a healthy indoor environment and the effects of

construction forms and materials on well-being, with

timber and wood structures and products shown to be

more beneficial in these areas,¡± said a spokesperson. ¡°It

makes sense that the pandemic has heightened awareness

and concern around these topics.¡±

The refurbishment market and use of timber in

construction are also expected to be given a further boost

in coming years by the EU¡¯s ¡®Renovation Wave¡¯ initiative,

launched October 2020. Forming part of the EU Green

Deal, its target is to improve housing energy performance,

helping the EU achieve carbon neutrality by 2050, while

also delivering improved home environments.

Spending on infrastructure to jumpstart growth

Another plywood importer reported benefiting from

increased infrastructure spending, notably in Germany. ¡°It

started before the pandemic, but it looks now as though

it¡¯s also being used as a tool to help jumpstart growth as

economies emerges from health crisis,¡± said a

spokesperson. ¡°In addition, the lockdown has also

facilitated projects, such as bridge and road building, as

there¡¯s been less traffic. It seems these have been brought

forward to take advantage.¡±

These comments on the building sector are supported by

latest forecasts from Euroconstruct. After contracting

7.8% in 2020 (less than forecast earlier last year), it

predicts construction in the 18-country Euroconstruct area

will grow by 4.1% this year, 3.4% in 2022 and 2.4% in

2023 to reach an annual market value of €1.73 trillion, €28

billion ahead of the pre-corona 2019 level. Residential

building is forecast to grow 4.7% this year and civil

engineering 5.2%.

Market sectors that remain depressed include shopfitting

and the exhibitions and events business. However,

merchants and distributors are reported to have offset loss

of trade here with more sales into housebuilding and

repair, maintenance and improvement markets (RMI).

¡°What have also cushioned the blow has been sales of

wood sheet materials into healthcare and retail markets for

pandemic safe-distancing and protective screening and

partitions,¡± said an importer.

After being hit hard at the start of the pandemic due to the

wider downturn in manufacturing, plywood demand from

packaging manufacturers has also improved, say some

suppliers.

Furniture production seems to be a more mixed picture.

One importer said they were experiencing ¡®robust

recovery¡¯ in demand from the sector. Another however,

reported their customers still on short time or in temporary

shutdown, with workers on furlough, although they

anticipated a robust rebound post lockdown.

¡°Furniture making seems to be less suited to online sales

as customers want to see and feel the product, so

producers have been really affected by shops being

closed,¡± they said. ¡°But they also report high levels of

inquiries, which they anticipate translating into orders

once showrooms reopen. Many consumers have saved

money in lockdown, due to not taking holidays or going

out, and furniture is one product area where they¡¯re

expected to spend it.¡±

While selling into a recovering market has been one thing,

sourcing the material in sufficient volume to meet rising

demand and ensuring prompt delivery has been another.

¡°Buying plywood and shipping it from nearly all sources

has just become very hard work, particularly since the

autumn,¡± said one importer.

SE Asian plywood manufacturers at 50% production

While Chinese hardwood plywood suppliers are reported

to have generally returned to pre-pandemic production

levels, some manufacturers in Indonesia and Malaysia

(despite EU+UK imports from the latter rising in 2020) are

reported to still to be struggling. ¡°One of our leading

Malaysian suppliers is still only at 50% of normal

production due to safe distance work practices and so

many staff being in isolation,¡± said an importer.

Another said that increased competition from US buyers

was adding to supply difficulties out of Asia. ¡°It¡¯s partly

because of the boom conditions in US construction, and

also some American buyers having diversified their supply

base away from China to other Asian producers during the

trade dispute,¡± they said.

Asian manufacturers¡¯ prices overall are reported up around

a further 10% in 2021. This is partly in response to

growing demand, in domestic as well as export markets,

but also to an extent poor weather disrupting log supply.

And, of course, adding to inflationary pressure on sales

prices are the surging freight rates from the region.

In a recent report in the UK Timber Trades Journal, a

hardwood importer reported being quoted as much

US$15,000-US$16,000 on containers out of Indonesia.

European plywood producers don¡¯t seem to have come

across those levels but are now generally facing rates of

US$7000-US$8000 from China and US$8000-9000 from

Malaysia and Indonesia.

¡°That compares with between US$1500-2000 last

October,¡± said an importer. ¡°While the market has been

absorbing price inflation recently we can¡¯t sustain this sort

of increase long term ¨C and if prices go much higher we

could be in a very difficult position.¡±

The situation has prompted many importers to switch

wholly or partly to breakbulk, citing costs out of Asia of

US$90-100/cu.m to EU and US$100-110/cu.m to UK

ports, compared with US$135-150/cu.m for containers.

However, said one, this is not necessarily a

straightforward alternative.

¡°For one thing, breakbulk shippers are now at capacity,

with services heavily booked, and they¡¯re responding to

increased demand by raising their rates,¡± they said. ¡°In

addition, you have to be shipping large volumes to make it

most cost effective, which for us is OK from China, but

more difficult from Malaysia and Indonesia. The

alternative is to piggy-back on other cargoes, which can be

complex.

Shippers also want payment the moment the vessel is

loaded, breakbulk delivery tends to be slower, then you

may find customers don¡¯t want to take this sort of volume

all at once. They wouldn¡¯t want ten containers in one go,

but perhaps ten over six weeks. Similarly, they wouldn¡¯t

want an entire break bulk load. So then you¡¯re into issues

of storage and you could find yourself financing a

shipment for three to four months. That¡¯s a drain on cash

flow you shouldn¡¯t underestimate.¡±

Risk if container rates fall quicly

Importers agree a container rate correction will have to

happen. The critical questions are when and by how much.

¡°We can¡¯t see things changing for two to three months,

then we¡¯ll be into our July/August peak buying season,

exacerbating the situation,¡± said one importer/distributor.

¡°As much a worry as freight rates continuing at current

levels, or rising further, is a sharp and sudden correction¡±

said another trader. ¡°At the moment, due to the tight and

uncertain supply situation, customers are placing forward

orders to July, August, even September.

If rates drop rapidly, some businesses could be looking

down a deep dark hole. Big stockholding importers and

distributors especially could be faced with very painful

depreciation levels. So managing stock right now is

difficult and taking long-term positions very risky.¡±

The birch plywood trade has its own issues. A rising wider

plywood market, plus raw material shortages have

prompted Russian producers to increase prices this year by

20%-25%.

¡°The mild winter impacted the harvest resulting in mills

running short of particular qualities, and now we¡¯re into

spring, the situation is expected to become even more

difficult,¡± said an importer. ¡°In addition, due to demand

for construction lumber, we¡¯ve seen some shift of harvest

from birch to pine.¡±

Underlining the stress in supply, one Ukrainian mill was

reported to be asking customers to submit orders and

specifications, then pitching one bidder against another.

Also hanging over Russian plywood is the prospect of EU

anti-dumping duty. ¡°It¡¯s creating a lot of uncertainty as we

don¡¯t know yet whether it will happen, when or how much

it might be,¡± said an importer. ¡°We¡¯ve warned customers

that we may have to put any retroactive duty on their

account and, obviously, the further ahead you buy, the

greater the risk. The result has been a rush on birch

plywood for delivery by May or June and added price

pressure.¡±

There are stresses too in the softwood plywood market.

Prices on French, Russian, Scandinavian and Chilean are

all up and delivery times are now stretching into

September/October. More recently Finnish has risen 8%

and Eastern European 20%+. Some suppliers are also

reported to be adopting hard-nosed sales tactics.

¡°One Belarusian producer has cancelled all outstanding

orders twice in the last three months and told clients they

have to pay a new price or lose their shipment,¡± said an

importer. ¡°This is previously unseen behaviour and puts a

lot of importers in a very difficult situation because they,

of course, have commitments to their customers.¡±

The sharpest price rises have come in Brazilian Elliotis,

fueled partly by curbs on production due to the pandemic,

but mainly by surging US demand. ¡°Prices have doubled

since October to US$400/cu.m. Effectively US buyers

have priced it off the European market,¡± said one importer.

¡°And the trend is still upward. Recently we heard

US$450/cu.m being quoted.¡±

In response to the intense demand for softwood plywood

from their regular sources, some European companies

have started opting for Chinese product instead. ¡°It¡¯s not

the same quality, but it¡¯s available and cheaper,¡± said an

agent/importer.

UK plywood trade having to deal with Brexit

In the UK, of course, the plywood trade has also had to

deal with Brexit. New customs procedures, plus having to

put all timber and wood products from the EU through

illegality risk due diligence under the new UK Timber

Regulation, were reported to have caused delivery hold

ups in January and February. However, as new processes

have bedded in, log jams seem to have eased.

Another concern for EU suppliers to the UK and UK

suppliers to the EU was the prospect of having to pay duty

twice on plywood imported from elsewhere.

Where UK companies have sales operations in EU

countries and vice versa, the solution has been to ship in

direct to the destination market. One UK company has

also been using its Northern Irish operation to supply the

EU. ¡°As Northern Ireland remains part of the EU single

market for goods, it circumvents the problem,¡± said a

company spokesperson.

Significant loss of market share for tropical hardwood

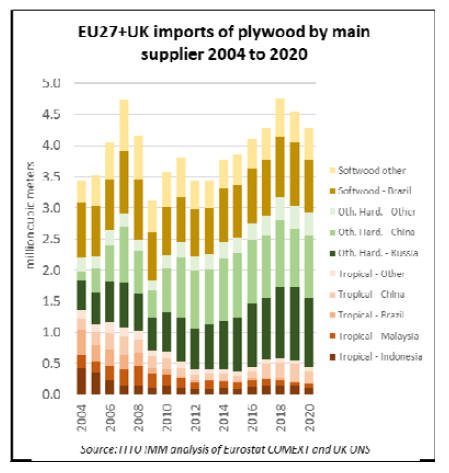

plywood

The general view is that the impact of the pandemic on

overall EU+UK plywood imports in 2020 was less than

anticipated at the start of the health crisis. The total

volume was 4.28 million cu.m, down 6%. This followed a

5% fall in 2019, but the contraction still left levels at a

historic high, with 2020 the fourth strongest year for

plywood imports into the region in the last two decades

(see Chart below).

There was, however, a significant loss of market share for

tropical hardwood plywood products, which declined 22%

to 441,000 cu.m reducing its proportion of sales from 12%

to 10%. Although imports increased 24% from Malaysia

to 72,000 cu.m, they declined from other leading supply

countries including Indonesia, down 27% to 104,000 cu.m

and China, down 31% to 187,000 cu.m.

Tropical hardwood product primarily lost share to nontropical

hardwood plywood from China, including both

mixed light hardwood (comprising mainly eucalyptus and

poplar) and birch products.

Total EU27+UK imports of non-tropical hardwood

plywood increased 1% to 2.49 million cu.m in 2020. A 6%

increase in imports from China to 998,000 cu.m offset a

5% decline in imports from Russia to 1.12 million cu.m.

EU27+UK imports of softwood plywood fell 10% to 1.35

million cu.m, mainly due to a 17% decline in imports from

Brazil to 842,000 cu.m.

Plywood supply likely a challenge throughout this year

Looking forward, the general consensus in the European

trade is that for some months, some believe right up to Q4,

the supply situation will remain challenging and, as one

importer said, ¡®selling plywood will remain easier than

sourcing it¡¯. But, they added, at some point the situation

must change.

¡°Currently everyone is buying everything they can get

hold of and price is seemingly not a consideration,¡± they

said. ¡°But what goes up must come down and we will see

a market adjustment; when the heat comes off US demand

for Elliotis, or the Brazilians face more competition in the

American market, or when plywood prices more widely

reach a point where customers start to resist, and Asian

freight rates fall, as they eventually must.

We can only hope that the correction, when it comes, is

gradual, so businesses can manage the transition to more

normal market conditions and are not left holding an

excess of overpriced stock.¡±

|