US Dollar Exchange Rates of

25th March

2021

China Yuan 6.5697

Report from China

Investment in housing spikes along with retail sales of

furniture

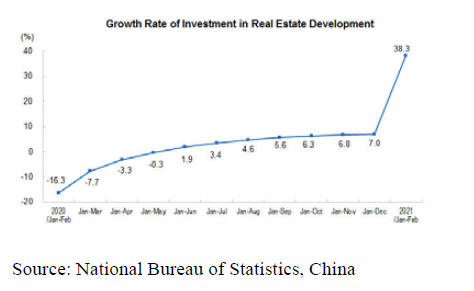

The National Bureau of Statistics has made available a

press release on real estate development and sales.

Between January to February investment in real estate

development increased 38% year on year which is around

5% higher than in January.

Residential investment expanded over 40% and household

consumption connected to housing growth also increased.

For example, consumption of building and decoration

materials rose 53% from last year and there was an almost

60% rise in sales of furniture in January 2021.

Real estate investment in the eastern region was up

32%

year on year; investment in the central region was up 52%;

investment in the western region was up 45% and

investment in the northeast region was 29%. Between

January and February the area of land purchased area by

real estate companies increased over 30%.

See:

http://www.stats.gov.cn/english/PressRelease/202103/t20210316_1814918.html

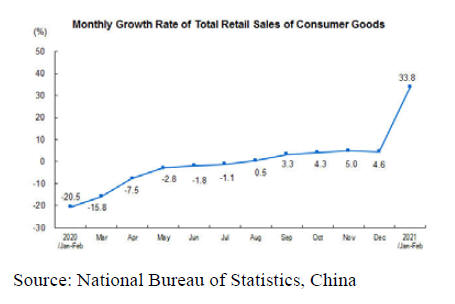

In related news, over the same period retail sales of

consumer goods increased over 30% year on year with

sales of furniture increasing almost 60%.

See:

http://www.stats.gov.cn/english/PressRelease/202103/t20210316_1814920.html

Decline in 2020 log imports

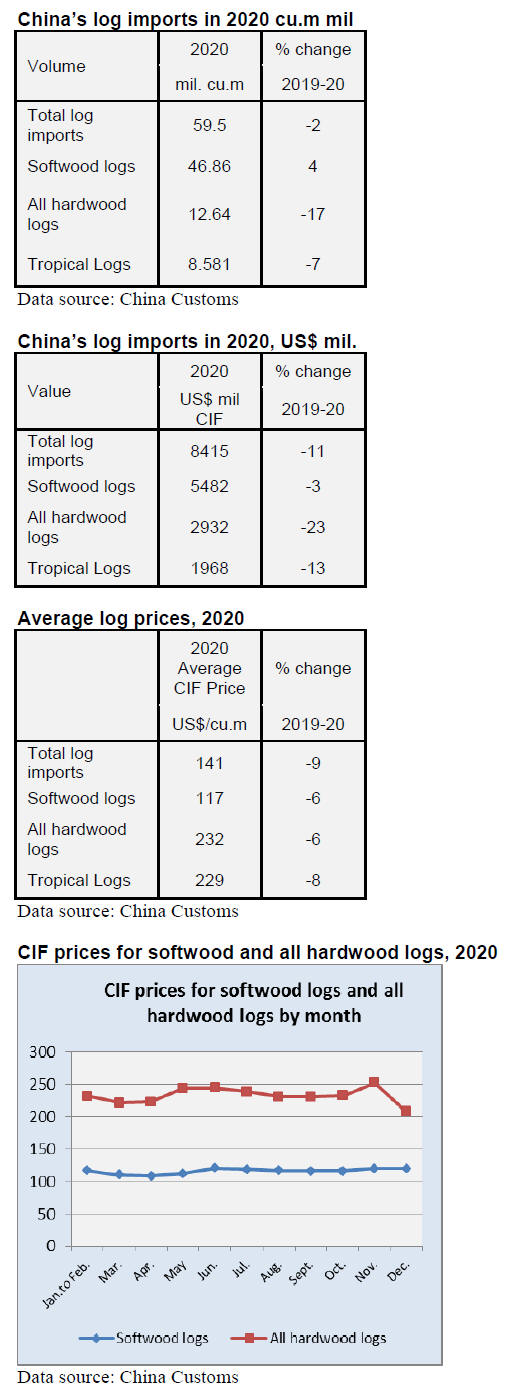

According to China Customs, log imports in 2020 totalled

59.20 million cubic metres valued at US$8.415 billion

(CIF), a year on year decline of 2% in volume and 11% in

value. The average price for imported logs was US$141

(CIF) per cubic metre, down 9% on levels in 2019.

Of total 2020 log imports,softwood log imports rose 4% to

46.86 million cubic metres, accounting for 79% of the

national total, 4% up on 2019. The average price for

imported softwood logs was US$117 (CIF) per cubic

metre, down 6% on levels in 2019.

It has been forecast that as much as 500 million

cubic

metres of European spruce will be harvested by 2024 and

most of these softwood logs will be imported by China via

the China-Europe Railway Express.

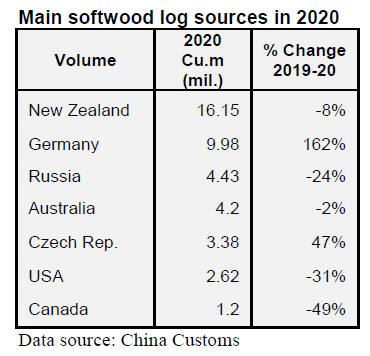

Softwood log imports from Germany soared

In 202 the volume of softwood log imports from most

countries however, from Germany, the Czech Republic

and Japan imports increased which contribute to the

overall rise increase in softwood log imports even during

the pandemic.

New Zealand was the main softwood log supplier to China

in 2020 accounting for 34% of total softwood log imports.

Softwood log imports from New Zealand totalled 16.15

million cubic metres in 2020, a year on year decline of

8%.

Germany became the second main supplier of softwood

logs imports at 9.98 million cubic metres, a year on year

increase of 162%, accounting for about 21% of the total

softwood log imports in 2020, exceeding imports from

Russia for the first time.

China¡¯s softwood log imports from the Czech Republic

and Japan in 2020 rose 47% and 23% to 3.38 million cubic

metres and 1.15 million cubic metres respectively.

Russia ranked the third supplier of China¡¯s softwood logs

imports at 4.43 million cubic metres in 2020, a year on

year decline of 24% and accounted for 9.5% of total

softwood log imports in 2020.

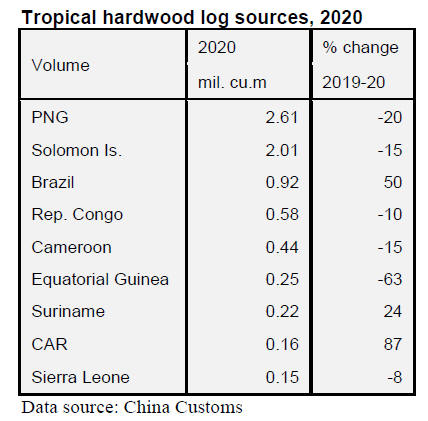

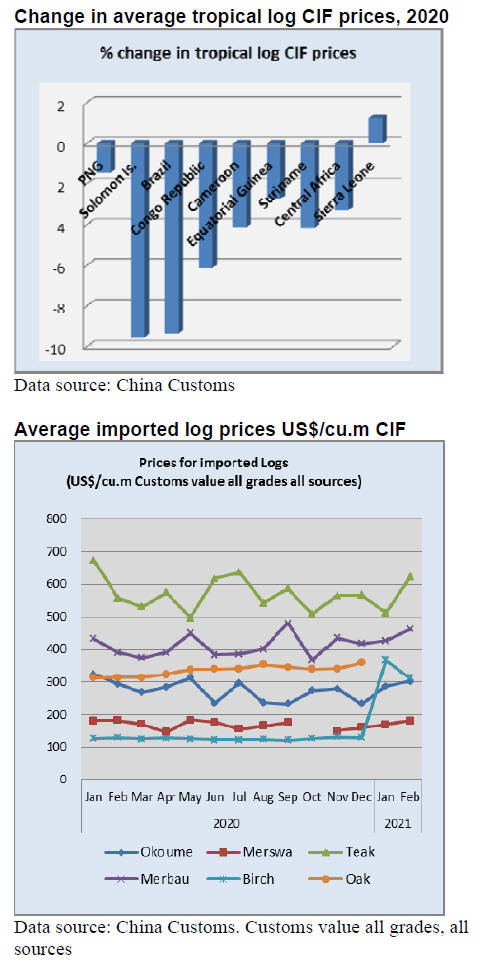

Hardwood log imports in 2020

Hardwood log imports in 2020 fell 17% to 12.64 million

cubic metres (21% of the national total log imports). The

average price for imported hardwood logs in 2020 was

US$232 (CIF) per cubic metre, down 6% on 2019. Of total

hardwood log imports, tropical log imports were 8.581

million cubic metres valued at US$2.932 billion CIF,

down 7% in volume and 13% in value from 2019 and

accounted for 14% of the national total import volume,

down 1% on 2019.

The average price for imported tropical logs was US$229

CIF per cubic metre, down 8% on levels in 2019. The

value of tropical log imports in 2020 was US$1.968 billion

CIF, reflecting a 13% decline.

Before its log export ban Myanmar was a major source of

tropical logs for China. However, China¡¯s log imports

from Myanmar in 2020 fell to just 2,490 cubic metres

valued at US$2.77 million (CIF), down 78% in volume

and 80% in value. The average price for imported logs

from Myanmar fell in 2020 to US$1,111 (CIF) per cubic

metre, down 9% over 2019.

China imported tropical logs mainly from Papua New

Guinea (30%), Solomon Islands (23%), Republic of

Congo (7%) and Cameroon (5%). Just 9 countries

supplied 86% of China¡¯s tropical log requirements in

2020.

Log imports from the main tropical suppliers, namely

PNG, Solomon, Brazil, the Republic of Congo, Cameroon,

Equatorial Guinea, Suriname and Central Africa fell 1%,

10%, 9%, 6%, 4%, 3%, 4% and 3% in 2020 respectively.

However, log imports from Sierra Leone alone rose

slightly.

|