Japan

Wood Products Prices

Dollar Exchange Rates of 10th

March

2021

Japan Yen 108.49

Reports From Japan

Circular economy initiative

launched

The Ministry of the Environment and the Japan Business

Federation (Keidanren) announced the launch of a

¡®Partnership on Circular Economy¡¯ at the March Circular

Economy Roundtable hosted by the World Economic

Forum. This aims to bring the private sector and

government together to advance the circular economy in

Japan. The partnership is expected to evolve through

collaboration with the World Economic Forum¡¯s Circular

Economy Initiative.

See:

https://www.env.go.jp/en/headline/2502.html

Small businesses suffering badly

Business sentiment among large Japanese companies in

the January-March period turned negative for the first time

in three quarters reflecting the impact of the country¡¯s

second state of emergency declared in early January.

The index for manufacturers stood at plus 11.6, down from

plus 21.6 in the previous quarter but remained positive for

the third three-month period. The index for nonmanufacturers

was minus 7.4, dropping from plus 6.7,

turning negative for the first time in three quarters.

See:

https://www.japantimes.co.jp/news/2021/03/12/business/economy-business/negative-business-sentiment/

The situation of smaller businesses was more serious

where the index fell to minus 31.4 from minus 15.5 for the

October-December period. The index for these companies

has been negative for 28 consecutive quarters.

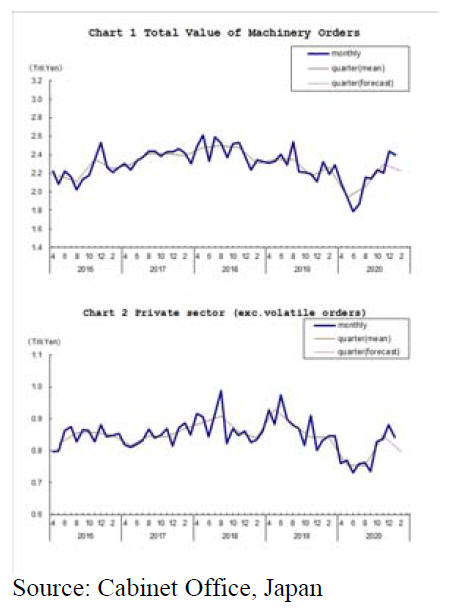

Data from the Ministry of Finance showed companies in

Japan reduced spending on plant and equipment in the

final quarter of 2020, the third consecutive quarter posting

a decline. This has raised doubts on speed at which a

recovery can be achieved.

The data shows capital spending fell almost 5% in the last

quarter 2020 compared with the same period a year earlier

and this is despite a pick-up in exports to China and the

US and this is likely to result in weaker than forecast GDP

growth.

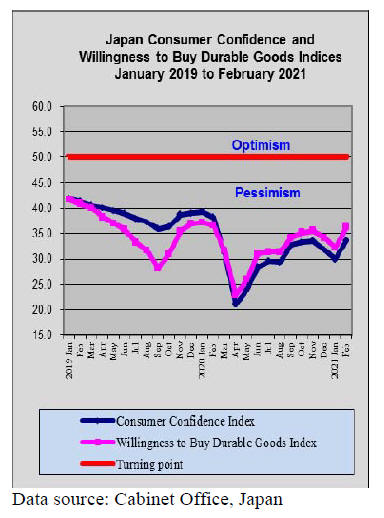

Decline in corona infections lifts consumer

sentiment

Japan's consumer confidence improved in February, the

second sharpest increase on record after the surge in June

2020 when the first state of emergency was lifted. The

Cabinet Office suggested that the main factor affecting

consumer sentiment was the steady decline in the number

of virus cases rather than whether or not the country has a

state of emergency (SoE) in effect.

The second SoE began 7 January for the Tokyo

metropolitan area and then expanded to 11 prefectures. It

has since been scaled back and now only covers the Tokyo

metropolitan region. The SoE was scheduled to end on 7

March but has been extended by two weeks amid concerns

about the recent slowing down in the decline of infections.

The Cabinet Office upgraded its assessment for the first

time in five months, saying consumer sentiment has

"remained in a severe situation but shown signs of

recovery." In January it said sentiment was "weakening."

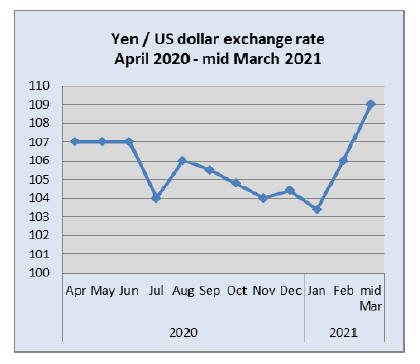

Yen at 12 month low

At 108 plus yen to the US dollar the yen is at its lowest in

12 months. The driver of the almost 5% decline in the

yen/dollar exchange rate was the surge in US stocks after

the Chairperson of the US Federal Reserve dismissed

concerns that the bank¡¯s economic support increased the

risk of spiraling inflation and insisted that the ¡®easy¡¯

monetary policy would remain in place for sometime.

At a recent Senate Banking Committee meeting the Fed

chairperson said the economic recovery was ¡°uneven and

far from complete¡±.

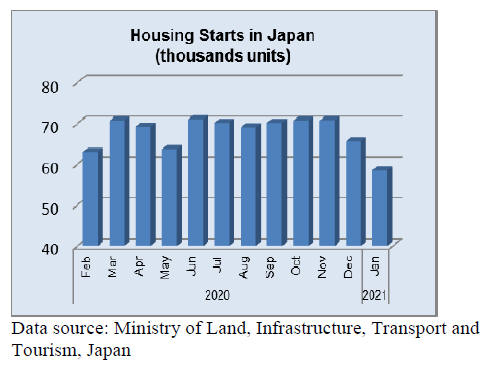

Private sector forecast for 2021 housing

The Japan Forest Products Journal sent out questionnaires

to 14 major house builders to find out how they see new

housing starts in 2021.

Average number by 14 companies is 805,000 units, 1.3%

less than 2020 with high of 835,000 and low of 774,000.

Majority commented that it is hard to predict market future

as long as COVID-19 epidemic continues but it is apparent

that consumers are seeking new life style and the move is

improving. After all, it seems safe to forecast the same as

last year with foggy future.

Total starts in 2020 were 815,340 units, 9.9% less than

2019. Despite worldwide pandemic of COVID-19 in 2020,

damage to housing market is much less than initially

forecasted with 20-30 % drop from 2019. (For more see

page 13)

Import update

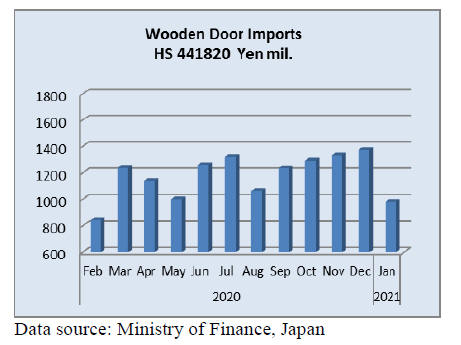

Wooden door Imports

2021 began with the two main suppliers of wooden doors,

China and the Philippines dominating imports but their

share of total wooden door imports fell to 75% from

around 80% in the previous months. Most of the lost share

went to shippers in SE Asia, notably Malaysia.

Year on year January 2021 wooden door imports

(HS441820) were down over 30% and compared to the

value of imports in December there was a 29% decline in

January. The impact of declining housing starts had a clear

impact on imports.

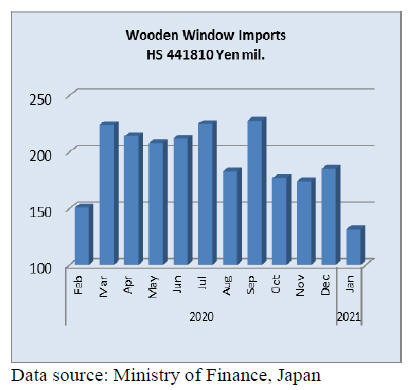

Wooden window imports

The value of January 2021 imports of wooden windows

(HS441810) fell almost 50% year on year and there was

an almost 30% decline in month on month imports. Three

shippers, China (41%), the US (15%) and the Philippines

(15%) accounted for most of Japan¡¯s wooden window

imports in January 2021 but all saw their share of imports

drop as a bigger share of imports was captured by shippers

in Sweden and South Korea.

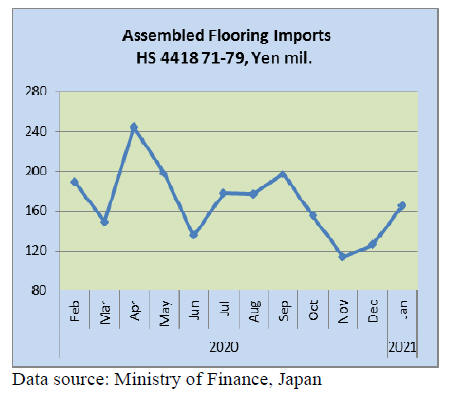

Assembled wooden flooring imports

HS441875 continued to dominate Japan¡¯s imports of assembled

flooring in January 2021 accounting for over 70% of the various

categories imported. Shippers in China accounted for over 60%

of January 2021 imports of assembled flooring followed by

Vietnam (12%). A further 10% was supplied from Malaysia and

Indonesia.

Year on year, Japan¡¯s imports of assembled wooden flooring

(HS441871-79) fell 38% but there was a 31% increase in imports

in January compared to a month earlier markig two consecutive

monthly increases.

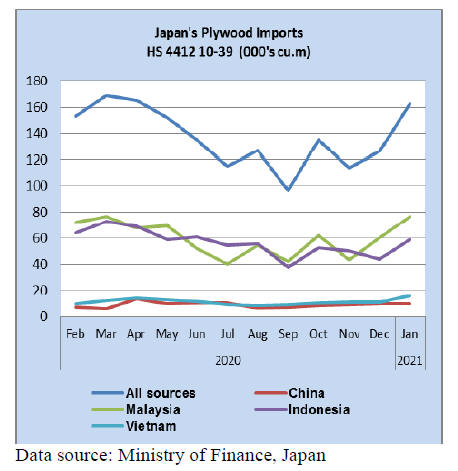

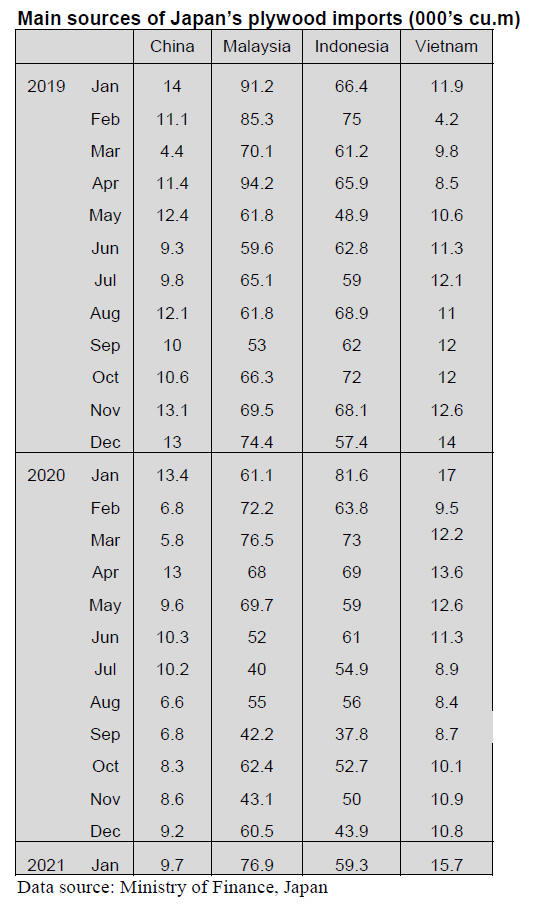

Plywood imports

The year started with a rise in the volume of plywood

imports and all of the main shippers, except China, saw

increases. Between them, Malasia and Indonsesia account

for most of Japan¡¯s imports of plywood and in January

shippers in these two countries accounted for over 80% of

all plywood (HS441210-39) imports.

The balance was supplied from Vietnam and China.

Throughout 2020 the volumes of plywood shipped from

Chian and Vietnam were about even but in January this

year there was a significant rise in shipments from

Vietnam. Of the various categories imported HS441231

accounted for over 80% of imports in January 2021.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Forecast of housing starts in 2021

The Japan Forest Products Journal sent out questionnaires

to 14 major house builders to find out how they see new

housing starts in 2021.

Average number by 14 companies is 805,000 units, 1.3%

less than 2020 with high of 835,000 and low of 774,000.

Majority commented that it is hard to predict market future

as long as COVID-19 epidemic continues but it is apparent

that consumers are seeking new life style and the move is

improving. After all, it seems safe to forecast the same as

last year with foggy future.

Total starts in 2020 are 815,340 units, 9.9% less than

2019. Despite worldwide pandemic of COVID-19 in 2020,

damage to housing market is much less than initially

forecasted with 20-30 % drop from 2019.

According to the replies from 14 companies, 2021¡¯s starts

of owner¡¯s units would be 268,500, 0.1% less than 2020.

Rental units would be 298,115, 2.8% less and units built

for sale would be 242,500, 0.9% more. In this,

condominiums would be 106,750, 1.1% less and unit built

for sale of detached units would be 133,625, 2.2% more.

Builders of unit built for sale are bullish since the business

in 2020 was good while builders of owner¡¯s units or

custom made house builders experienced slower sales after

the state of emergency was declared in April in 2020.

Builders of unit built for sale had 20-30% more orders

after May last year, which was unexpected so they need to

keep buying properties.

Builders of owners unit forecast high of 270,000 and low

of 250,000 with average of 258,500 so they think that the

starts would not be as bad as 2020. Rental units are high of

319,000 and low of 270,000 with average of 298,115.

Daito Construction is major builder of rental units and its

forecast is the lowest of 270,000, 12% less than 2020.

Daito¡¯s share of rental units is 16% and share of wooden

rental unit is 40% so Daito¡¯s forecast may be more

realistic

After COVID-19 spread, consumers¡¯ mentality has

changed. Working style is changing with remote tele work

so people are seeking place to live in suburban areas rather

than city center to avoid congested commuting traffic.

Younger people want to have working space at home so

desired management of rooms is changing.

Non-residential wooden buildings in 2020

Total floor space of non-residential wooden buildings in

2020 is 4,341,000 square meters, 11.4% less than 2019.

In 2020, Covid-19 pandemic restrained construction works

and many plans are either postponed or revised.

Also higher construction cost was expected due to the

Tokyo Olympic Games in summer of 2020, which reduced

total construction works.

Non-residential wooden buildings are 1,830,000 square

meters of offices, 2.5% less than 2019, 693,000 square

meters of stores, 22.8% less, 547,000 square meters of

factory, 12.1 % less, 848,000 square meters of warehouse,

0.4% more, 330,000 square meters of school, 17.6% more

and 696,000 square meters of hospital and clinics, 2.4%

more.

South Sea (tropical) logs and lumber

Demand for South Sea hardwood logs is stagnating as

number of log users continue to decline and even

remaining mills shift to other species or veneer instead of

logs so log import volume will drop further this year.

Chinese made laminated free board prices remain high

because high cost of Russian red pine lumber and ocean

freight and temporary shutdown of mills due to COVID-

19 so the manufacturers have no room to drop the prices.

Also Indonesian mercusii pine lumber prices are going up

by log supply shortage and container shortage. Indonesian

suppliers see that Japan accept higher prices of Chinese

made products so they propose higher prices.

Japan¡¯s wood products export in 2020

Export of both logs and lumber in 2020 exceeded 2019

and marked record high.

Strong demand by China for logs and by the U.S.A. for

lumber contributed the increase and the export prices also

climbed. According to the statistics the Ministry of

Agriculture, Forestry and Fisheries, export value of forest

products is 38 billion yen, 2.8% more than 2019.

Growth of logs and lumber export is double digit on

volume and value. While export of logs and lumber

increased, export of other products like plywood declined.

The government has been promoting export of forest

products with subsidy. Log export increased by 250,000

cbms and lumber did by 25,000 cbms. Log export to China

was 1,157,000 cbms, 210,000 cbms more than 2019.

China increased purchase of New Zealand radiate pine

logs after it stopped buying Australian logs so New

Zealand export prices increased by nearly 20% in one

year.

Japanese cedar log prices are US$5-10 lower than radiate

pine logs but climbed as New Zealand log prices increase.

Lumber export to China is almost flat with 65,000 cbms

but the export to the U.S.A. increased to 53,000 cbms.

With busy housing market in the U.S.A., demand for

exterior materials is strong and the demand for Japanese

cedar lumber seems to continue.

Vietnamese LVL manufacturer gets JAS

Vietnamese LVL manufacturer, Woodsland (Hanoi,

Vietnam) got JAS certificate on January 29 for LVL for

fixture material. This is the first JAS LVL manufacturer in

Vietnam. It will export for Japan and also markets LVL

for the Japanese industry in Vietnam for housing materials

and core of furniture and building materials.This company

also manufactures plywood, particleboard and pallet

materials.

The plant which acquired JAS certificate is one of eleven

plants Woodland has in province of Tuyen Quang.

This plant manufactures monthly 2,000 cbms of LVL for

fixture, out of which 1,700 cbms are marketed for Japan

and Japanese managing plants in Vietnam. Vietnamese

LVL plants become more competitive after TPP 11

became effective without any duty and in China, many

plants quit as they are not able to cope with tighter control

of environmental restrictions so China is now relying LVL

supply from Vietnam.

|