4.

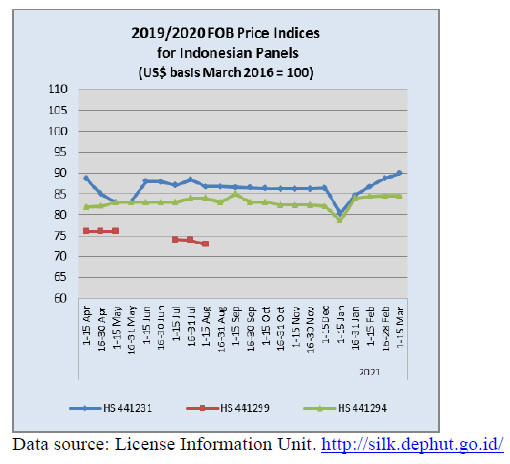

INDONESIA

Five point strategy to boost exports

The Director General of National Export Development in

the Ministry of Trade, Kasan, has said exports are one of

the components of GDP that can promote national

economic recovery. To realise this the Ministry of Trade

has developed a five point export boosting strategy:

maintaining export markets and the main products,

prioritising export-oriented small and medium enterprises

(SMEs), penetrating non-traditional markets, utilising

trade agreements and conducting regulatory reforms

particularly through the Job Creation Act.

Kasan believes emerging markets and non-traditional

markets will play an even greater role in the future. He

pointed out that emerging market countries will soon

contribute around 70% to the world economy and about

half of this will be from Asian countries.

Large potential for growth in US market

Demand for wood products in the United States is

projected to increase this year and two executives of

major exporters said their companies are optimistic there

will be a further rise in demand from the United States.

The executives said Indonesia’s market share for furniture

in the US is still small so there is a huge opportunity for

export growth. A fibreboard exporter also plans a stronger

focus on the US market this year.

See:

https://www.msn.com/id-id/berita/other/potensi-pasarcerah-sejumlah-emiten-kayu-garap-pasar-amerika-serikat/ar-BB1e2JsR?ocid=BingNewsSearch

Non-timber forest products can generate income and

lift the economy

During a recent technical guidance and capacity building

training exercise for communities in forest areas the

Minister of Environment and Forestry, Siti Nurbaya said

non-timber forest products have enormous potential and

can have a role in increasing household income, improving

local economies and preserving the forest. She said

however, NTFPs have not received much attention from

the community, especially forest farmer groups.

The Minister expressed optimism that NTFP will become

part of main stream forest utilisation in Indonesia.

Non-timber forest commodities that have the potential

include eucalyptus leaves, coffee, latex, bamboo, corn,

lemongrass, elephant grass, palm sugar, gamal, rattan,

sugar palm, cloves, resin, gaharu, sap, bark, incense,

candlenut, walnuts and honey, said the Minister.

See:

https://www.medcom.id/ekonomi/sustainability/akWLjPMKhasil-hutan-bukan-kayu-berpotensi-tingkatkan-ekonomi

Urgently expedite negotiations on international

agreements

The Indonesian President, Joko Widodo, has urged the

Ministry of Trade to quickly expedite negotiations on

international agreements between Indonesia and partner

nations. The President said this will open up new markets

such as the IA CEPA (Indonesia-Australia Comprehensive

Economic Partnership Agreement) and deals with South

Korea and the EU.

The Indonesia-Australia CEPA was signed on 4 March

2019 and took effect on 5 July 2020, after the ratification

process spanning 10 months. Meanwhile, Indonesia and

South Korea officially signed a Comprehensive Economic

Partnership Agreement 18 December. The Indonesia-

European Union Comprehensive Economic Partnership

Agreement (I-EU CEPA) negotiations are still on-going.

Plan to restore 1.2 million hectares of peat by 2024

Acting Director General of Forestry Planning and

Environmental Management in the Ministry of

Environment and Forestry (KLHK), Ruandha Agung

Sugardiman said the ministry plans to restore 1.2 million

hectares of peatland by 2024 in order to achieve

Indonesia's international commitment to achieve carbon

emission target. In addition, the Ministry of Environment

and Forestry will also carry out mangrove restoration in

nine provinces. The total area to be restored is 600.000

hectares.

In related news, Indonesian’s Environment and Forestry

Minister, Siti Nurbaya, has revealed a dramatic fall in the

country’s deforestation rate during the 2019/2020 period.

The data suggest a 75% decline compared to deforestation

in the 2018/2019 period.

Deforestation of 462,500 hectares was reported in the

2018/2019 period and this dropped to just 115,500

hectares in the 2019/2020 period. These figures refer to

net deforestation.

See:

https://foresthints.news/indonesia-deforestation-rate-dropsdrastically-by-75/

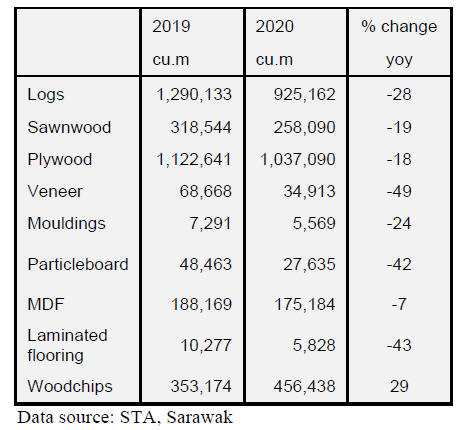

5.

MYANMAR

Myanmar news

Communication and the flow of news from Myanmar has

been disrupted. The following news summary is from

multiple sources.

Myanma Timber Enterprise (MTE) continues the

suspension of log sales.

Most shipping lines have suspended services for

the safety of staff.

There is growing concern among international

investors.

A planned online meeting between the army

appointed Investment Minister and business

associations led by the Union of Myanmar

Federation of Commerce and Industries was

cancelled because of non-participation by the

business sector.

The State Administration Council (current

military regime) has revoked the permits of major

print and online media companies. This was done

after the media reported on the killings by the

army and police.

The civil disobedience movement continues. MPs

elected on 8 November 2020 have formed what is

termed, the Committee Representing Pyidaungsu

Hluttaw (translation Committee Representing

Union Parliament) and is issuing statements on

behalf of the elected NLD-Government.

Most commercial banks are closed but they have

now been threatened, open or have license

revoked.

See:

https://www.frontiermyanmar.net/en/tax-chief-brushes-offpublic-campaign-to-starve-the-regime-of-revenue/

https://www.frontiermyanmar.net/en/nothing-is-moving-cdmfreezes-foreign-trade-raising-fears-of-shortages/

Myanmar Federations call for support

On 5 March the Myanmar Union Federations called for

international support.

Source:

https://labornotes.org/blogs/2021/03/myanmar-unionfederations-call-international-support-against-coup

The statement from the Federation reads:

“Kyae Zin (F), 19 years, Mandalay University, Mandalay,

Nyein Thu Aung (M), 19 years, Magwe Institute of

Technology, Magwe region, Arkar Moe (M), 25 years, N.

Okkalapa, Yangon, Nay Myo Aung, (M), 16 years,

Mandalay regional, Min Khant Kyaw (M), 17 years,

Sagaing region, Htet Wai Htoo (M), 17 years, Mon state.

These are some of the future of Burma shot by Min Aung

Hlaing’s military in the cities of Burma. More than 50

have been accounted for.

Some were lucky to have funerals by their families while

many have disappeared. The people’s movement against

the military regime that staged a coup has continued all

over Burma for over a month and is still continuing. More

walks of life are participating and all sectors of work are

participating.

The following are some areas where our members have

successfully demonstrated that a soldier or a military

officer cannot run each and all technical issues.

As of 5 March all spheres of energy extraction are

stopped. The Thanpayakan refinery has been stopped—the

military took away three weeks’ supply of processed fuel

(some two weeks ago)—and no reserve left.

The Nyaungdone gas production that gets about 270

million kays per day is shut down. The Ayadaw gas

production that feeds the gas to run the turbines of the

military-owned factories in WAZI township, Magwe

region, are stopped, and none of the factories are

operating. That is why they can’t print the bank notes and

bullets and so are buying the bullets and the bank notes are

printed—with Chinese words on the paper packing.

No trains are running.

Of all the CDM activities, the Foreign Affairs Office

personal CDM led by UN Permanent Representative U

Kyaw Myo Tun—from the UN Permanent Representative

office—5 persons in Washington D.C., 4 persons in

Geneva, 1 person in Berlin, have rocked the regime.

The U.S. government has blocked $1 billion by U.S.

Executive Order 14014.

The American Chamber, the Euro Chamber, the Italy

Myanmar Business association, the French Chamber of

Commerce, and the British Chamber of Commerce in

Myanmar have declared they will not meet with the

regime.

The World Bank has informed the regime that all

drawdowns are suspended at the moment

The Karen National Union/Kachin Independence Army

have announced that the coup is not acceptable and that it

takes away the credibility of the peace process.

Shooting with machine guns/using snipers/using planes

are their last resort.

What we request now is a harsh comprehensive sanction

that can finish off the regime and its structure.

It will hurt everybody. More the grassroots, the daily

incomeof people. And these are the people who die now

for want of change. After suffering abuse of the eco-social

system by the military over five decades, now facing death

from bullets shot by our own military in our own homes,

without external invasion, and we now call for clear-cut

international sanctions on the country.

We will suffer another five years to be rid of these military

thugs and their “we hold weapons, we can do whatever,

whenever we want” insolence, their doctrine, and practice.

And that is the only way, to rebuild Burma from scratch—

without any interference from the military.”

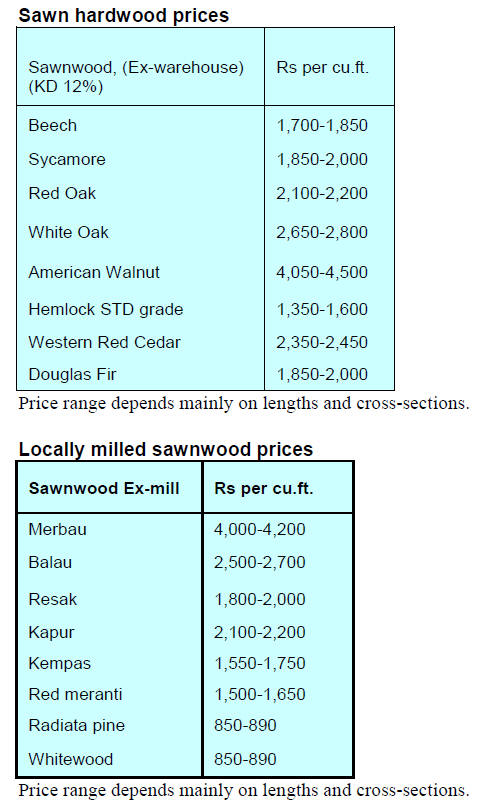

6. INDIA

India's

Manufacturing PMI

The IHS Markit India Manufacturing Purchasing

Managers’ Index (PMI) showed a decline in India’s

manufacturing activity in February 2021. The

manufacturing sector activity rose to an almost eight-year

high in January.

See:

https://www.business-standard.com/article/economypolicy/india-s-manufacturing-pmi-at-57-5-in-feb-2021-against-57-7-in-jan-121030100280_1.html

Expand timber trade with Russia

According to the Indian Foreign Secretary, Harsh Vardhan

Shringla, India and Russia should diversify their trade

beyond the traditional sectors and mention was made of

opportunites for expanded trade in wood products.

India-Russia trade amounted to US$10.11 billion in 2019-

2020 but they have agreed a bilateral trade target of

US$30 billion by 2025. To achieve this consideration is

being given to cooperation on transport and logistics, ship

building, pharmaceuticals, agro-industry products and

timber among others.

See:

https://www.india-briefing.com/news/india-russia-to-triplebilateral-trade-by-us5-billion-per-annum-21768.html/

Strong demand for bigger homes

Demand for homes in India is said to be at an all-time high

thanks to low interest rates, changes buyer preferences and

some tax cuts in various States. Home buyers have shifted

preferences to bigger homes to make ‘work-from-home’

more convenient. Niranjan Hiranandani, President,

National Real Estate Development Council (NAREDCO)

has expressed appreciation of the government initiatives

that have led to a boost in home demand.

See:

https://www.thehansindia.com/business/housing-demand-inindia-at-all-time-high-675476

Economy gets boost from budget

The Indian economy experienced a sharper contraction in

growth than most Western economies and where these

countries cushioned the shock to their economies with

quick and massive finacial stimulus, India’s stimulus was

slow and smaller. As a result India has seen a sharp

contraction in growth over the past 12 months but the

economic policies implicit in the country’s 2021–22

Central government budget now focuses on boosting

public infrastructure and capital expenditure whose share

in GDP has increased from 1.5 per cent in 2017–18 to 2.5

per cent in the 2021–22 estimates.

The Organisation for Economic Co-operation and

Development (OECD) has projected that the Indian

economy will grow at 12.6% in Fiscal 22, the highest

among G20 countries driven by the recent stimulus

proposals. For the timber manufacturing sector the budget

is expected to boost demand and drive production higher.

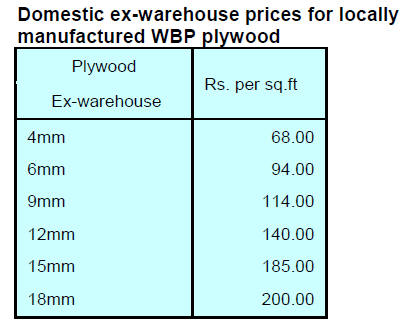

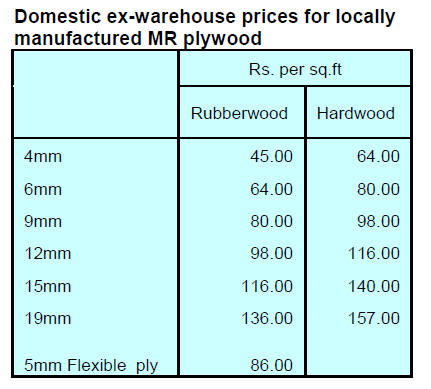

Plywood

The wood based panel sector should see sustained growth

this year. The panel sector has seen sales recover close to

pre-pandemic levels but the decorative veneer sector is

still suffering slow sales mainly because demand from the

hospitality sector remains slugish according to

PlyReporter. (February 2021 editorial).

7.

VIETNAM

US$14.5 billion from forestry exports

in 2021

Forest product exports are expected to rise to US$14.5

billion this year, up 12% against 2020. This was

announced by the Deputy Minister of Agriculture and

Rural Development, Ha Cong Tuan, in an interview with

the Lao Dong newspaper. Exports are likely to reach

US$20 billion 2025.

Over the next five years efforts will be made to sustain the

forest cover at 42%, expand markets, develop long-term

trade partnerships and promptly address trade issues for

mutual benefits in line with international commitments.

The minister mentioned that despite COVID-19 the timber

industry had a good year. Vietnam exported forest

products worth over US$13.22 billion, up 16.9% year on

year almost 6% higher than targeted. Vietnam ranks fifth

globally, second in Asia, and first in Southeast Asia in

terms of forestry exports.

He pointed out that the US, Japan, China, the EU and the

Republic of Korea are the top five importers of Vietnam’s

timber and the combined value exceeded US$11 billion or

about 90% total forestry exports last year. Vietnam has

more than 5,500 companies operating in wood and forest

product processing, which generate millions of jobs.

See:

https://vietnamnet.vn/en/business/vietnam-aims-to-earn-14-5-billion-usd-from-forestry-exports-706857.html

Revenue from forest environmental services to top

US$121 million

The Vietnam Administration of Forestry (VNFOREST)

aims to collect VND2.8 trillion (US$121.7 million) from

forest environmental services this year.

Under this policy, forest service users such as tourism

businesses or hydropower plants will have to pay

according to their use of forest resources to forest owners

which could be individuals, households, organizations or

communities.

According to VNFOREST Deputy Director, Phạm Văn

Diển, forest carbon sequestration and emission reduction

services, a new feature of 2021, will add between

VND300 to 500 billion to the sector’s annual income from

environmental services. Last year the revenue from those

services stood at VNĐ 2.56 trillion, meeting 91 per cent of

the yearly target.

The revenues from forest environment services supported

226 forest management boards and 138,000 forest owners,

while creating income for 81 forestry companies and

livelihoods for more than 172,000 families in mountainous

areas, helping lift their living standards.

Revenues from forest environmental services have become

a sustainable source of finance that helps to increase the

value of the forestry sector as well as contributes to GDP

growth, according to VNFOREST.

See:

https://vietnamnews.vn/society/887213/revenues-fromforest-environmental-services-could-reach-121m-in-2021.html

Plan to plant 1 billion trees

The Ministry of Agriculture and Rural Development has

submitted a plan to the Prime Minister to plant 1 billion

trees between the 2021-2025. In 2021 alone Vietnam will

plant about 182 million trees and between 2022 and 2025

the country will plant over 200 million trees each year.

According to the Ministry, in recent years, although the

forest coverage in Vietnam has increased the quality of

natural forests has not improved, the function of protection

forests has not been fully promoted and the density of

trees to people in urban and rural areas is still low

compared to that of many other countries.

Meanwhile, the impact of climate change and natural

disasters has become increasingly complex affecting all

aspects of socio-economic life and environment and

threatening the country’s sustainable development.

Planting and protecting forests and developing trees for

environmental protection are of vital significance.

See:

https://vietnamnet.vn/en/society/project-to-plant-1-billiontrees-submitted-to-prime-minister-710087.html

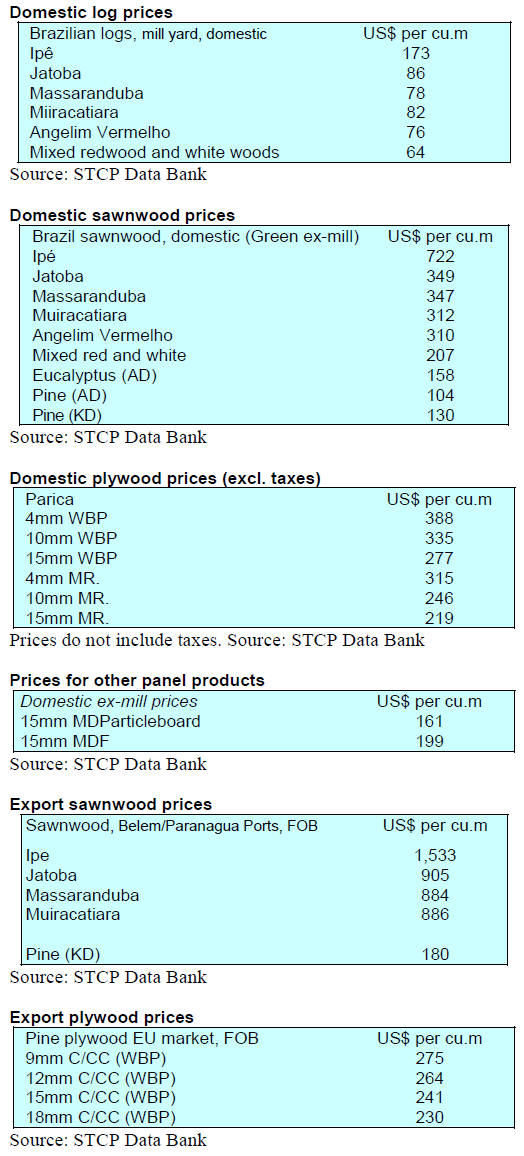

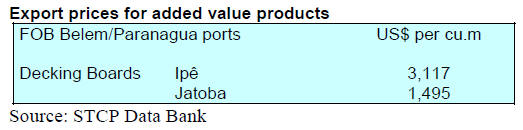

8. BRAZIL

Rising revenue from forest

concessionaires

Since 2010 the federal government collected R$102

million in forest concession fees (as of February 2021).

The amount was collected from the 15 contracts under

implementation. Forest concession allocations are

coordinated by the Brazilian Forest Service (SFB) which

falls under the Ministry of Agriculture, Livestock and

Supply.

2020 was the best year with almost R$28 million in

collections, an increase of almost 60% compared to 2019.

According to SFB, the high value collected in 2020 was

the result of measures taken to optimise payments. To

facilitate payments the SFB introduced a system allowing

payment by quarterly installments.

The SFB has also introduced measures to minimise the

financial impact caused by the Covid-19 pandemic on

forest concession contracts under its management. SFB

said that social isolation and quarantine had an negative

impact on production and trade and to take account of this

it postponed the payment due of installments to help

companies maintain jobs and remain viable.

Furthermore, SFB together with the National Bank for

Economic and Social Development offered

concessionaires emergency credit lines utilizing funds

created by the Federal Government to support small and

medium-sized companies.

E-commerce saves furniture sector

The pandemic had a negative impact on all manufacturing

sectors and between January and May 2020 retail sales

dropped over 50% compared to the same period in 2019.

However, after the initial downturn, the furniture sector

saw sales grow through e-commerce. Until recently the

furniture sector never sold much on-line with around 6%

of all sales being made by digital selling. This has now

risen to 10%.

Beginning in the second half of 2020 furniture sales

increased considerably. Out of 12 States surveyed five

reported higher than average sales with only two states

registering a decline in sales.

In terms of prices for furniture the Producer Price Index

(IPP) for the furniture industries which measures the trend

in prices “at the factory door” without taxes and freight,

indicated that from January to December 2020 there was

an average 20% increase.

Timber an important part of Acre's exports in 2020

The Amazon State of Acre is one of the main producers

and exporters of tropical timber and has the lowest

deforestation rate among all the states of the Legal

Amazon.

The value of timber exports in 2020 represented 28% of

total shipments from the State which were worth US$8

million according to the Observatory of the Permanent

Forum of Development of Acre but in 2019 exports of

timber were worth US$12 million.

The main destination for timber and wood products

exports from the State of Acre in 2020 was the United

States with 41%, followed by the Netherlands with 19%

and China with 12%. The main ports for export were

Manaus (53%) in the state of Amazonas and Paranaguá

(42%) in the state of Paraná, in the South Region of Brazil.

Furniture exports in 2020

Brazilian furniture exports ended 2020 2.5% lower year on

year according to the Brazilian Association of Furniture

Industries (ABIMÓVEL) and IEMI - Market Intelligence.

As a result, the average price of exported furniture fell

almost 7% but this drop was offset by the appreciation of

the US Dollar against the Brazilian currency.

Furniture exports to the United States stand out with a

significant share (40%) of export values, representing an

11.5% increase compared to 2019. Second in the ranking

is the United Kingdom with an 8.6% share in 2020

followed by Uruguay (7.4%), Chile (6.6%), Peru (5.1%)

and Paraguay (3.3%).

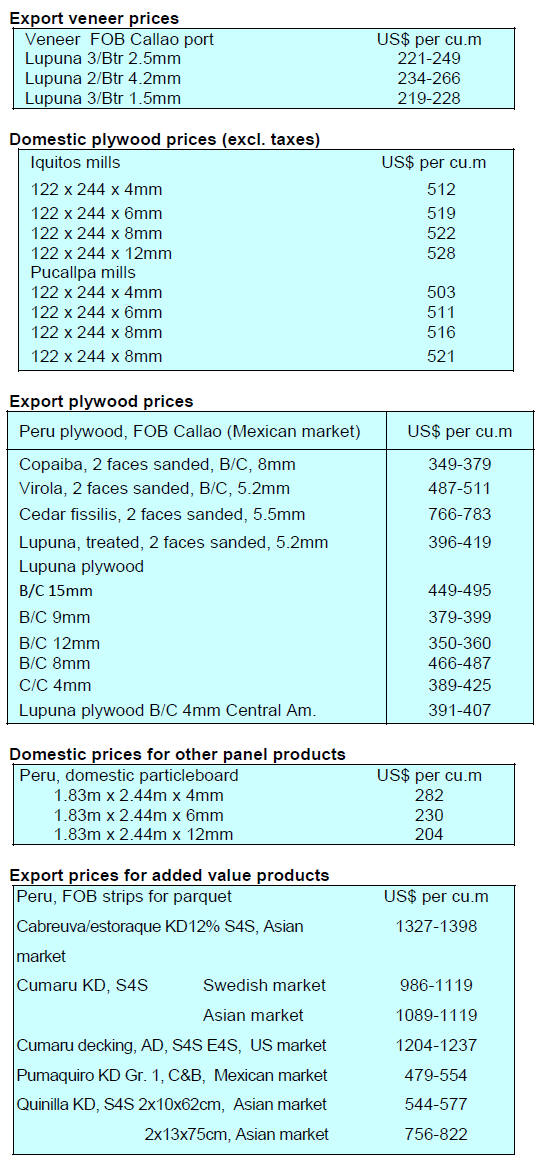

9. PERU

Disruption of harvesting in 2020

undermined exports

2020 wood product exports were the lowest in the last

decade mainly as a result of a shortage of raw material

because harvesting, which is restricted to between May

and November, was disrupted.

Looking forward to the post-pandemic time the manager

of Services and Extractive Industries of ADEX, Lucía

Rodríguez Zunino, highlighted the need to adopt new

processes for forest concessions that allow the industry to

have a secure and sustainable supply of raw materials.

He said this would encourage investment in tracking

technologies and promote the responsible and sustainable

management of Amazonian resources. He said Peru has

around 17 million hectares of permanent production

forests but only approximately 3 million hectares are

commercially utilised.

Address infrastructure to be more competitive

The Association of Exporters (ADEX) has reported

January exports (all products) totalled just over US$3,560

million, a slight contraction (-2.5%) compared to the same

month in 2020.

The president of ADEX, Erik Fischer Llanos, pointed out

that while Peruvian companies did not stop production

measures adopted in international market countries drove

down demand. He said the global outlook is still not very

clear due which generates uncertainty that undermines

private sector confidence.Fischer commented that Peru

needs to improve its international competitiveness and

addressing infrastructure (ports, airports and highways) is

essential. Also, to attract investment, there must be a

robust legal framework and strengthened state institutions.

See:

https://www.mundoempresarial.pe/actualidad/3591-exportaciones-aun-no-se-recuperan-por-confinamientos.html

Wood/plastic products from residues in Ucayali

A research group at the National Intercultural University

of the Amazon (UNIA) has been working on wood/plastic

composite technologies that could allow production of

composite material made from recycled products for use in

light construction.

The plastics recycling industry is well established

however, in Ucayali there are only recycling companies

but not companies that transform this resource. The aim of

this research is to lay the foundation for commercial wood

and plastic residue transformation into value added

products and by so doing eliminate wood and plastic

residues from the environment.

"Our initiative has been implementing a laboratory

specialized in plastic-wood compounds, which will allow

generating added value to the solid waste that currently

generates environmental pollution in the Ucayali region, in

addition to promoting the use of an environmentally

friendly material that does not contribute with

deforestation because it makes the use of wood more

efficient”, said Gilberto Domínguez Torrejón, principal

investigator in the project.

He said the group will develop a business plan for the

production and commercialisation of wood/plastic

compounds that will contribute to the development of the

Ucayali región.

Training professionals forest product tracking

The National Forest and Wildlife Service (Serfor) reported

that it is developing a training and technical assistance

programme for more than 70 professionals from 16

regions in the country who are in charge of monitoring and

verifying the legal origin of forest products.

Specialists from regional forestry authorities accessed a

new virtual platform ‘Serfor Educa’ to update their

knowledge on the correct use and filling of the forms in

the Operations Book for primary processors of timber.

The Operations Book is an important forest management

too and its proper use guarantees the legal origin and

traceability of wood products. Its use will be mandatory as

of April 1 of this year.

The regions that have participated in this training are San

Martín, Huánuco, Madre de Dios, Loreto, Ucayali,

Arequipa, Apurímac, Cajamarca, Puno, Cusco, Ica, Lima

and Áncash.