US Dollar Exchange Rates of

25th February

2021

China Yuan 6.4752

Report from China

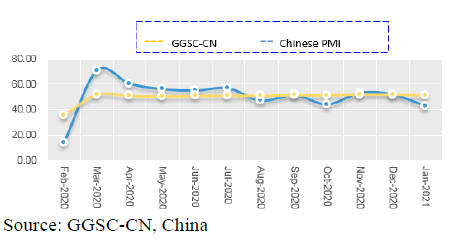

GGSC-CN Index Report (January 2021)

Inventory of raw materials increased and exports

remained weak

In January 2021, despite a rebound in corona infections

China's economy maintaineds an upward trend. The

purchasing managers index (PMI) for the manufacturing

industry is 51.3%, only slightly lower than that in the

previous month.

The index has been above 50 for seven consecutive

months. However, in January the wood sector production

and manufacturing industry continued to shrink. Although

production was the same as last month the number of new

orders declined significantly in January, the inventory of

raw materials increased and exports remained weak.

The GGSC-CN comprehensive index for January

registered 42.9% (48.4% for last January and 38.3% for

January 2019), a decline of 19% from the previous month.

The operations of the wood product enterprises

represented in the GGSC-CN index shrank from last

month.

The production index in January registered 50%, the

same

as the previous month. The new order index registered

28.6%, a drop of 31% from the previous month. The new

export order index reflecting international trade registered

35.7%, a decline of 4% from the previous month.

The main raw material inventory index registered 57%, an

increase of 17% points from the previous month.

This indicates that the raw material inventory of forest

products enterprises included in the index increased in

January from the previous month.

The employment index registered 42.9%, a drop of

7% from the previous month as companies cut back on the

workforce. The supplier delivery time index was 50%,

same as the previous month indicating that the deliver time

of raw materials from suppliers was almost the same as in

December 2020.

See:

http://www.itto-ggsc.org/site/article_detail/id/210

Canadian decision on China¡¯s plywood

In January 2021 the Canada Border Services Agency

(CBSA) terminated the dumping and subsidy investigation

in respect of certain decorative and non-structural plywood

originating in or exported from China.

The statement from the CBSA is provided below and the

source of the full determination is shown.

On 21 January 2021, pursuant to paragraph 41(1)(a) of the

Special Import Measures Act, the Canada Border Services

Agency terminated the dumping investigation in respect of

certain decorative and other non-structural plywood

originating in or exported from China by:

Celtic Co., Ltd.

Linyi Evergreen Wood Co. Ltd.

Linyi Huasheng Yongbin Wood Co., Ltd.

Pingyi Jinniu Wood Co., Ltd.

Pizhou Jiangshan Wood Co., Ltd.

Shandong Good Wood Imp. and Exp. Co., Ltd.

and

Xuzhou Shengping Imp and Exp Co., Ltd.

Similarly, on the same date, pursuant to paragraph

41(1)(a) of the Special Import Measures Act the Canada

Border Services Agency terminated the subsidy

investigation in respect of certain decorative and other

non-structural plywood originating in or exported from

China by Celtic Co., Ltd., Linyi Evergreen Wood Co.,

Ltd., Linyi Huasheng Yongbin Wood Co., Ltd., Linyi

Jiahe Wood Industry Co., Ltd., Pingyi Jinniu Wood Co.,

Ltd., Pizhou Jiangshan Wood Co., Ltd., Shandong Good

Wood Imp. and Exp. Co. Ltd., and Xuzhou Shengping

Imp and Exp Co., Ltd.

On the same date, pursuant to paragraph 41(1)(b) of the

Special Import Measures Act, the Canada Border Services

Agency made final determinations respecting the dumping

and subsiding of certain decorative and other nonstructural

plywood originating in or exported from China,

with respect to exporters for which the investigations have

not been terminated.

The full determination can be found at:

https://www.cbsaasfc.gc.ca/sima-lmsi/i-e/donp2020/donp2020-fd-eng.html

New national standard for Veneer

The national standard, GB/T 13010-2020, for wood

veneers has been released by the National Technical

Committee for Standardisation of wooden panels and this

will come into force on 1st June 2021.

This new standard is an integration and revision of two

previous standards for sliced veneer (GB/T 13010-2006)

and rotary veneer (LY/T 1599-2011).

The implementation of this new standard for veneer will

effectively regulate product quality, enterprise production

and marketing of wood veneer in China and is a

significant step towards higher technological capacity in

the sector.

See:

http://rbw.criwi.org.cn/news/?pid=406

Increased natural forest area and stocking

China now has 1.98 million hectares of natural forest

accounting for 64% of the country's forest area and more

than 83% of its forest stock.

Since the 13th Five-Year Plan, the central government has

continuously supported protection of natural forests.

RMB240 billion was spent on protecting natural forests in

China over the past five years accounting for more than

40% of the total investment in forests and grasslands from

the central government. An amount of RMB223.4 billion

was from the central government and RMB16.6 billion

from local governments.

China has achieved a net increase of 5.93 million hectares

in the area of natural forests over the past five years and a

net increase of 1.375 billion cubic metres in stocking

volume.

Rise in sales of flooring products in 2020

According to data from the China Forest Products Industry

Association annual sales of flooring products rose 1.35%

to 903 million square metres in 2020. Of the total sales of

wood and bamboo flooring was about 412 million square

metres, stone-wood-plastic-ploymer composite flooring

sales were 4.17 square metres and wood plastic flooring

sales were 74 million square metres.

However, sales of wooden and bamboo flooring fell 3% to

411.7 square metres in 2020. Sales of laminated wooden

flooring were 199 million square metres, a year on year

decline of 8%, wooden composite floors, 138 million

square metres, year on year up 9%, solid wood floors, 41

million square metres, year on year down 12%, bamboo

floors, 28.6 million square metres, year on year down 5%

and other floors, 5.1 million square metres, year on year

up 11%.

Annual sales of stone-wood-plastic-polymer floors rose

5% to 417 million square metres in 2020 with around 95%

being exported.

Annual sales of wood and plastic flooring increased about

6% to 74 million square metres in 2020. 60% are exported

and 95% are for outdoor flooring.

Main features of the flooring industry in

2020

Domestic sales of wood-bamboo flooring declined.

The differentiation of domestic marketing channels has

becoming more and more significant. Sales for

commercial facilities continued to expand driving the sales

growth of composite flooring. Sales in the retail/home

market declined affecting solid wood flooring and

laminate flooring.

The pandemic had little influence on the export of flooring

in 2020 and sales of stone-wood-plastic floors and wood

plastic flooring increased slightly.

Many enterprises increase prices for wood panels

After the Spring Festival prices for chemical raw materials

soared by more than 50% forcing wood panel makers to

raise prices. Further prices increases have been forecast.

As panel prices rise there will be a knock-on effect to

furniture makers.

As a result of the increased in production and labour costs

a number of decorative paper producers have raised the

price of panel coatings.

Shangrao wooden blinds sold well in 2020

According to Shangrao Customs (Jiangxi Province),

exports of wooden window blinds made in Shangrao City

exceeded RMB120 million in 2020, a year-on-year growth

of 23%. In the second half of 2020 exports increased by

more than 50% year on year.

Because of the pandemic control measures in the main

overseas markets people have been spending more time at

home and have turned to home improvements to relieve

stress. Shangrao Customs adapted its inspection methods

to aid enterprises with many steps being achieved online.

This greatly assisted exporters and saved them money and

time.

To ensue enterprises meet the regulatory requirements

Shangrao Customs took the initiative to conduct what it

termed "Cloud Inspection" and field operations in the

mode of "No Contact".

See:

http://www.srxww.com/html/article/1024/2021_1200543.html

|