Japan

Wood Products Prices

Dollar Exchange Rates of 10th

February

2021

Japan Yen 104.9

Reports From Japan

Business confidence dented

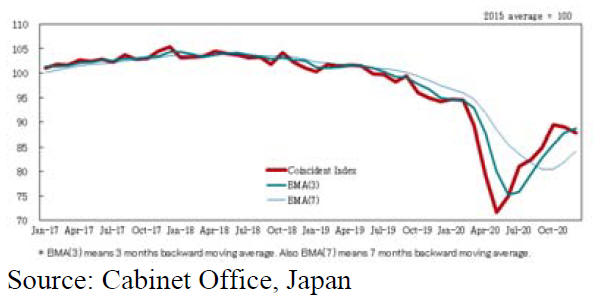

Preliminary data from the Cabinet Office shows the index

of economic conditions (coincident index, a key index

reflecting the state of the Japanese economy) fell in

December last year, the second consecutive monthly

decline.

The December drop was the biggest single monthly

decline since May 2020 when the index fell following

Japan's April 2020 state of emergency declaration. Japan is

now experiencing its 3rd state of emergency declared in

January which is now extended to mid March in those

prefectures seeing the worst pace of infections.

Tighter law to beat back spread of

infections

Under the current state of emergency the government is

asking people to refrain from non-essential trips not only

at night but also during the day and is urging companies to

work harder to support ¡®work from home¡¯. Travel between

prefectures is also discouraged.

Japan's parliament has introduced fines for people and

businesses that do not comply with restrictions imposed

during a state of emergency to prevent the spread of the

novel coronavirus.

Initially the government proposed prison sentences for

Covid-19 sufferers who refuse to be hospitalised. This was

eliminated from the final law. Covid-19 patients resisting

hospitalisation can be fined up to 500,000 yen and those

who fail to participate in epidemiological surveys by

health authorities, up to 300,000 yen. Restaurants and bars

that fail to cooperate with orders to reduce their operating

hours can be fined up to 300,000 yen.

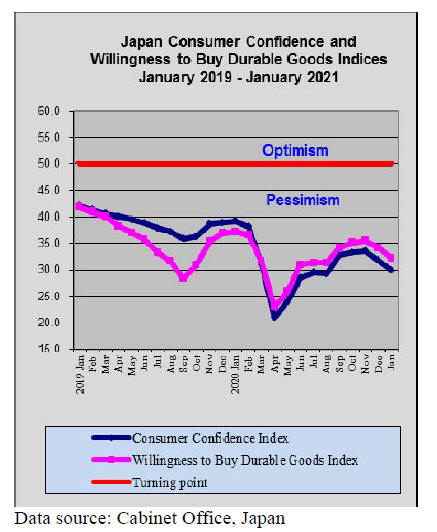

Big drop in household spending

Data from the Ministry of Internal Affairs and

Communications has revealed that in 2020 monthly

spending by Japanese households fell over 5% from the

previous year, the sharpest drop on record. The decline

was the largest since comparable data became available in

2001.

The 2020 decline in household spending was worse

than in

2014 when the consumption tax was raised. However, as

people are spending time at home as well as working from

home spending on computers and video game equipment

rose sharply last year.

It has been suggested that household spending is expected

to gradually recover in 2021 after a decline in the first

quarter due to the ongoing state of emergency. Household

spending is a key indicator of private consumption which

accounts for a sizeable slice of GDP growth.

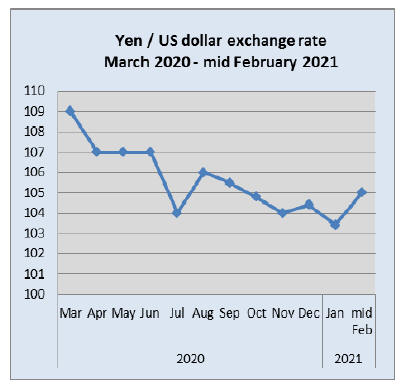

Prospect that yen will strengthen ¨C BoJ readies

In the face of a potential strengthening of the yen against

the US dollar the Bank of Japan (BoJ) is looking at ways

to signal that it will act, possibly pushing interest rates

even further below zero.

The next Bank meeting will be in March but, because of

the risk of a yen rise they need to prepare now. The

problem is to balance the negative impact of rate cuts

against avoiding yen strength. The BoJ wants to alter the

general consensus that it does not have the option to cut

rates further.

Looking at the medium term many analysts are forecasting

a rise of the yen to 100 to the dollar, up from the present

104/5.

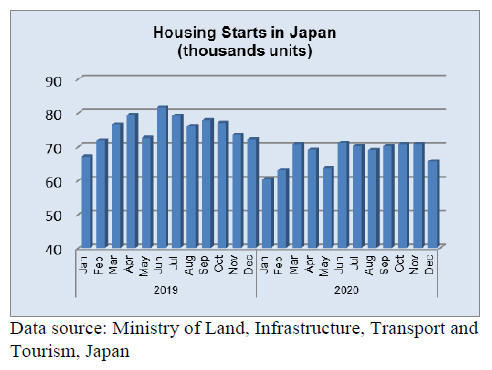

Sales of second hand homes rise

The impact of the corona pandemic on the Japanese real

estate sector has been considerable. As companies follow

the government¡¯s request for more ¡®work from home¡¯ they

are at the same to downsizing office accommodation. The

occupancy rate for office buildings in most of the main

cities in Japan has been declining and this could be a game

changer for the commercial as well as residential property

market.

Before the pandemic the pace of change in residential

housing starts in Japan was a reflection of the aging and

dwindling population. The pandemic added a new

dimension as workers found they could relocate to large

suburban homes as they no longer needed to commute. On

the one hand new home building has been falling but

demand for second hand homes has been rising.

Sales of second hand homes in Japan rose on average by

2.5% in 2020 with the biggest rise of 7% being recorded in

Kanagawa Prefecture. The average price of a second hand

home in Japan is now yen 31 million and has been rising

steadily.

The Japan Lumber Reports (JLR) has said (page 16) the

assumption for 2021 is that housing starts (new homes)

would be about 780,000-800,000 units, the COVID-19

epidemic would be under control in the second half of

2021 in Japan and the Tokyo Olympic Games would be

held as scheduled.

Radiocaesium contamination of logs in

Fukushima

undermines prices

A recent study of the impact of radiation on trees

surrounding Japan¡¯s Fukushima Daiichi nuclear power

plant has been released. The publication focuses on

radioecologjcal experience and data acquired and lessons

learned in Japan following the nuclear accident at the

Fukushima Daiichi nuclear power plant in March

2011. The research focused on radionuclide interception

by forest trees and a few agricultural crops.

The major part of Fukushima Prefecture is covered by

forest, so research projects were established in forests to

quantify the rate of reduction of the external gamma dose

rate from radiocaesium and to better understand soil

chemistry. The studies also evaluated the distribution of

radiocaesium within different components of trees (wood,

bark and leaves) to gain knowledge about the amount of

radiocaesium in timber and firewood, wild plants, fungi

and wild animals and to analyse the time trends of activity

concentrations in such products.

Approximately 70% of the territory affected by the

Fukushima Daiichi accident is covered by forest and

forests in Fukushima Prefecture consist of about 0.34

million ha. of forest plantations and 0.58 million ha. of

natural/semi natural forest.

Radiocaesium dynamics within forest ecosystems are

more complex than in agricultural land because trees are

perennial plants and forests are highly structured

ecosystems. Leaves/needles, branches, bark, forest floors

and soil surface organic layers were initially contaminated

at the time of deposition.

The report notes ¡°The important long-term contamination

pathway for trees is root uptake. Both the soil surface

organic and the mineral soil layers are sources for uptake

of radiocaesium by trees and understory species via roots

or mycelia. The above processes lead to redistribution of

radiocaesium within a forest ecosystem, eventually

forming a quasi-equilibrium steady state of the

radiocaesium activity concentrations in the tree and soil¡±.

There is a direct economic cost from this contamination as

mills in eastern Japan pay more for less contaminated logs

The additional costs were covered by TEPCO

compensation. The authors of the report say ¡°For

sustainable long-term production, remediation methods are

needed to produce wood that conforms to the standard

limits¡±.

See:

https://www-pub.iaea.org/MTCD/Publications/PDF/TE-1927web.pdf

and

https://www.iaea.org/publications/14751/environmental-transferof-radionuclides-in-japan-following-the-accident-at-thefukushima-daiichi-nuclear-power-plant

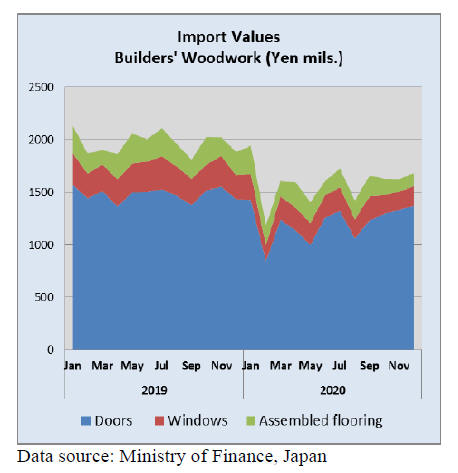

Imports of builders¡¯ woodwork

The value of Japan¡¯s imports of builders¡¯ woodwork

(HS441820, 441810 and 441871-79) declined in 2020 as

could be expected given the various restrictions on

businesses as a result of efforts to contain the spread of the

corona virus.

Compared to the value of imports in 2019 wooden door

imports in 2020 were down 18%. Imports of wooden

windows dropped 24% year on year in 2020 and the value

of imports of assembled wooden flooring dropped 20%.

The decline in year on year volumes of plywood fared a

little better dropping just 13% in 2020 compared to a year

earlier.

Looking at the data for the last two quarters of 2020 there

was an uptick in the value of wooden door imports in the

last quarter imports and a rise in the volume of plywood

imports but the final quarter of 2020 saw the value of

imports of wooden windows and assembled wooden

flooring decline.

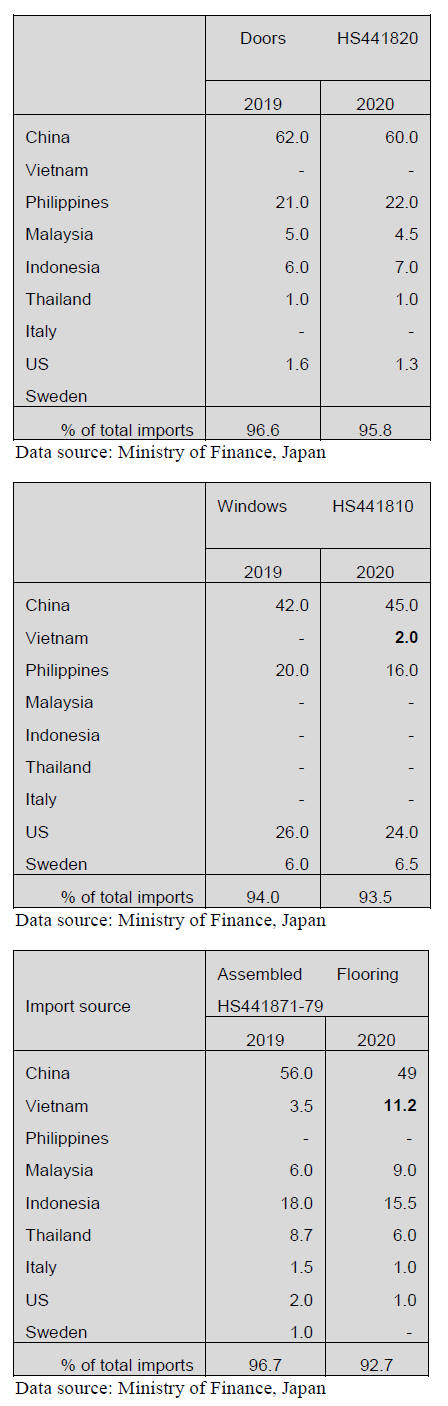

The tables below show the main suppliers of wooden

doors windows and assembled flooring to Japan along

with the respective share of that product import values in

2019 and 2020. For all three products just a handful of

suppliers account for over 90% of imports by Japan and

the majority of these shippers are in Asia.

For wooden doors (HS441820) two countries, China and

the Philippines accounted for over 80% of the value of

Japan¡¯s wooden door imports in 2019 and 2020.

In the case of wooden windows (HS441810) China was

the main supplier in 2019 and 2020 with the Philippines

and the US accounting for most of the balance. In 2020

Vietnam emerged in the list of top 20 suppliers of wooden

windows for the first time.

Japan¡¯s imports of assembled wooden flooring

(HS441871-79 in 2019 and 2020 were dominated by

suppliers from China. Other longer term suppliers in SE

Asia such as Malaysia, Indonesia and Thailand had

growing competition from shippers in Vietnam.

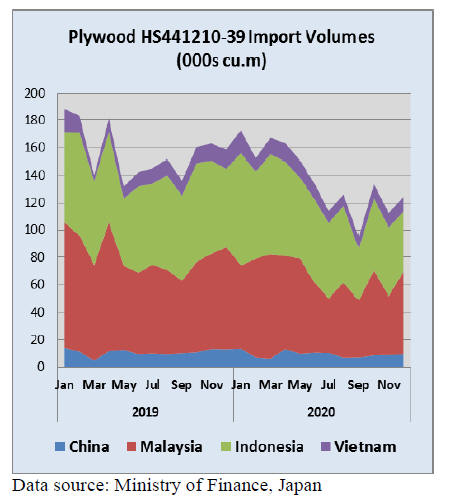

Plywood imports

Malaysia and Indonesia are Japan¡¯s traditional suppliers of

plywood and companies in Japan have had long term

relationships with suppliers in both countries.

In the past plywood imports moved up and down

depending mainly on construction spending and house

building in Japan but remained at a steady pace over the

decade up to 2018/19 when supply issues arose especially

in Malaysia. This, along with government calls for

domestic forest resources to be better utilised, began to

impact the volumes of plywood imported.

The down trend in plywood imports started to appear in

2019 and was driven further down in 2020 under the

impact of measures to control the spread of the corona

virus.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Demand projection for imported wood products in

2021

The Japan Foreign Timber General Supply and Demand

Liaison Conference made demand forecast of imported

wood products in 2021. Total is almost flat with 2020.

Total demand of imported logs and lumber is 7,310,000

cbms, 2% less than 2020.

South Sea hardwood logs would decrease largely while

logs from North America and New Zealand, lumber from

Russia and New Zealand would increase so softwood

becomes dominant products.

Assumption for 2021 is that housing starts would be

about

780,000-800,000 units, epidemic of COVID 19 would be

under control in the second half of 2021 and the Tokyo

Olympic Games would be held as scheduled.

Growth of housing starts get slower after the consumption

tax was raised to 10% in October 2019 and recovery of

wood demand is unlikely and also situation of supplying

regions continues giving no grounds of optimism. New

Zealand log prices keep climbing by active purchase by

China, North American log and lumber prices are record

high by booming housing starts and European wood prices

are escalating by busy North American market. Russian

log export is hopeless with increased export duty.

South Sea hardwood logs business is dying. Main log

supply source of PNG increased log export duty and the

last main user of tropical hardwood logs for plywood,

Daishin in Japan will close down for good in March 2021

so annual volume would be down to 20,000 cbms for

lumber manufacturing.

Prices of foreign wood products are likely to stay up high

and Japan needs to accept and if not, import volume would

decline and domestic wood is only alternative.

That the inventory dropped for six consecutive months.

Inventory of softwood plywood was 100,400 cbms, 4,900

cbms less than October. However, the shipment continues

less than the same month a year earlier so that the

manufacturers continue production curtailment to avoid

excessive supply.

Import plywood in October recovered over 180,000 cbms

but again November arrivals dropped down to 150,000

cbms. The supply from all the sources decreased.

Suppliers in South East Asian countries experience log

supply shortage and labor shortage so production increase

is difficult.

Ten big news in 2020

1. Pandemic of COVID 19

2. 10% decline of housing starts

3. Skyrocketing SPF lumber prices

4. Cancellation of major events and meetings

5. Drop of softwood plywood prices

6. Drop of domestic logs and lumber prices

7. Changing work style with remote work

8. Growth of builders of units built for sale

9. Decline of import of foreign logs

10. Withdrawal of Daishin Plywood, end of tropical

hardwood logs.

|