4.

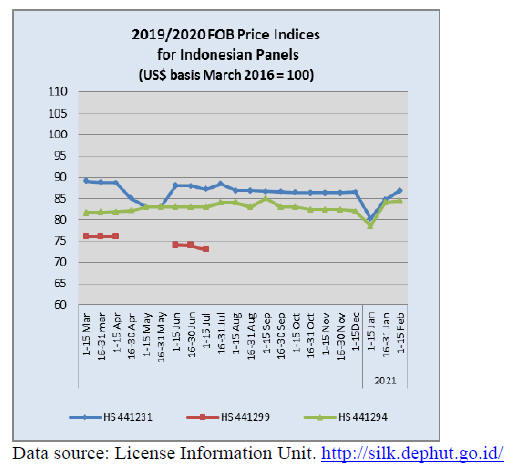

INDONESIA

International trade agreements will

help drive

economic recovery

The Indonesian economy contracted 2% year-on-year in

2020. This was at a slower pace than projected by the

government (1.7 to 2.2%) according to Suhariyanto Chief

of the Central Statistics Agency (BPS).

In related news, the Minister of Trade, Muhammad Lutfi,

said International trade agreements will drive the

economic recovery and he highlighted the efforts to raise

non-oil and gas exports to help Indonesia's battered

economy.

Existing international trade agreements include the

Regional Comprehensive Economic Partnership (RCEP),

Indonesia-Korea Comprehensive Economic Partnership

Agreement (IKCEPA), Indonesia-Pakistan Preferential

Trade Agreement (IP-PTA) and Indonesia-Australia

Comprehensive Partnership Economic Agreement (IACEPA).

Indonesia's trade balance in 2020 posted a surplus of

US$21.7 billion, the highest since 2012. However, the

large surplus was because of a sharp decline in imports. In

2020 exports fell 2.6% year-on-year while imports

plunged over 17%.

The Minister said to increase exports it will be necessary

to strengthen bilateral ties with the US and China as they

are strategic partners for Indonesia.

Between January and November 2020 Indonesia's exports

to the US rose 3.6% compared to the same period in the

previous year. Exports were dominated by garments

(19.4%), electronics (10%) and rubber products (8%).

The Minister noted that during the pandemic Indonesia

received many orders for electrical products as well as

furniture from the United State such that furniture exports

grew almost 12% to US$2.3 billion.

Indonesia's trade and investment cooperation with China is

strong because of the ASEAN-China Free Trade

Agreement (ACFTA) and the Regional Comprehensive

Economic Partnership (RCEP) schemes.

Between January and November 2020 Indonesia's exports

to China increased by almost 11% year on year and were

dominated by iron and steel (24%), minerals (21%) and

palm oil (11%).

See:

https://www.kemendag.go.id/id/newsroom/pressrelease/tingkatkan-ekspor-indonesia-terus-jalin-hubunganbilateral-dengan-as-dan-tiongkok-di-tengah-perang-dagangkedua-negara-1

Private sector optimistic on 2021 sales

A major wood products manufacturer has indicated that it

is optimistic that 2021 sales will improve as the US

economy picks up speed. The basis for this optimism also

stems from the shift of US importers away from Chinese

sources to Indonesia among others.

To take advantage of arising opportunities companies are

planning to increase production which will be good news

for employment in Indonesia.

See:

https://industri.kontan.co.id/news/integra-indocabinet-woodoptimistis-pendapatan-naik-20-di-tahun-2021

Development of industrial plantations for bioenergy

The Minister of Environment and Forestry (LHK, Siti

Nurbaya, has explained details of Indonesia's agreed

Nationally Determined Contribution (NDC) and the

agreed target for greenhouse gas (GHG) emissions. To

achieve the targets the Ministry will encourage Industrial

Plantation Forests (HTI) for Bioenergy purposes,

utilisation of micro-hydro technology, utilisation of waste

for power-gen and utilisation of geothermal resources.

Another aspect of support from the Ministry will be the

implementation of policies for the development of energy

plantation forests.

See:

https://www.jpnn.com/news/menteri-siti-dorongpengembangan-hutan-tanaman-industri-untuk-bioenergi?page=4

5.

MYANMAR

Reports from Myanmar will

resume as soon unhindered

communication with the country is possible.

In response to the situation in Myanmar the Programme

for the Endorsement of Forest Certification (PEFC)

included a statement on it website saying:

“At PEFC, we are extremely concerned about the recent

developments in Myanmar. In response, we are seeking

assurances from the Myanmar Forest Certification

Committee (MFCC - the national member for PEFC in

Myanmar) and the one PEFC chain of custody certified

company in the country that the rights of workers and

trade unions are not being infringed.

We also seek assurances that the revenues of the certified

forestry industry are not being used to finance human

rights violations in Myanmar.

It is of the utmost importance to us that none of the

safeguards of sustainable forest management and chain of

custody certification are violated in these challenging

times. The Secretary General and the PEFC International

Board continue to monitor the situation and will not

hesitate to take due action as required.

We have been working with stakeholders in Myanmar for

several years, supporting the country as it

moves towards the sustainable management of its forest

resources to advance equitable and sustainable

development.

MFCC is in the process of developing its national forest

certification system, in line with PEFC requirements. As

this national system is not yet endorsed by PEFC, there are

currently no PEFC sustainable forest management

certificates in the country.”

See:

https://pefc.org/news/pefc-statement-on-the-currentsituation-in-myanmar

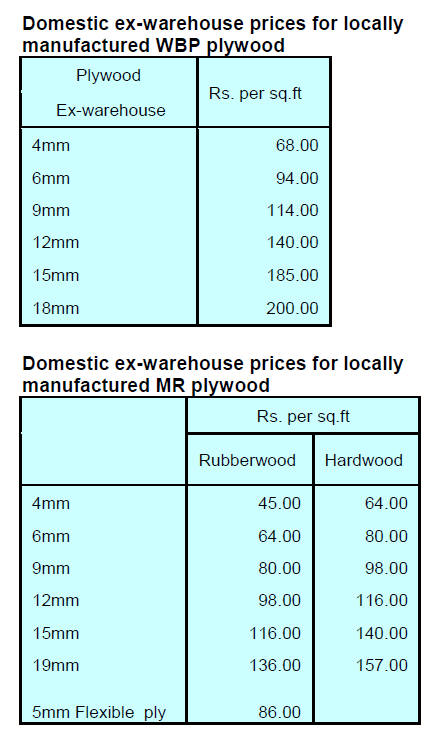

6. INDIA

Exports rise, trade

deficit narrows

India‘s Ministry of Commerce has reported January

exports increased just over 5% year-on-year to US$27

billion, lifted mainly by growth in the pharmaceutical and

engineering sectors. The trade deficit in January narrowed.

Imports in January 2021 rose 2% to US$42 billion.

Kailash Babar, writing for The Economic Times at the end

of January, reports that property registrations in the

country’s biggest real estate market, Mumbai, continue to

rise driven by the combined impact of low home loan

rates, discounts and the recent reduction in stamp duty

charges.

The number of new home registrations in January was up

over 60% year on year according to the office of the

Inspector General of Registration in Maharashtra. This is

the highest increase in January registrations 2012.

However, according to property consultants Knight Frank,

while January registrations surged real estate companies

are suffering and their stock prices have been trending

down as the real estate market remains weak. The

upcoming budget will provide a clue as where the housing

market is heading.

India 2030 – Report from CREDAI

The Confederation of Real Estate Developers’

Associations of India (CREDAI) has issued a report

entitled INDIA 2030 EXPLORING THE FUTURE

looking at growth drivers and how demographic changes

will drive the real estate sector. CREDAI represents

private real estate developers with a vision of transforming

the Indian real estate industry.

The report offers the following observations:

India’s cities will account for nearly 40% of our

population by 2030

By 2030, India’s urban population will contribute

as high as 75% of the GDP, up from 63% at

present

Delhi might overtake Tokyo as the world’s

largest urban agglomeration by 2030

India will have 68 cities with a population of

more than 1 million; up from 42 today

India’s required annual spending on infrastructure

will touch 7-8% of its GDP

The report says by 2030, 9 out of 10 Indians over the age

of 15 will be shopping online and online retailers will have

a much larger share of the retail sector.

Number of households to touch 386 million by

2030, almost 40% of Indians will be urban

residents

By 2030, residential real estate has the potential

to almost double from the current stock of 1.5

million units in key cities

Affordable housing to remain the dominant

segment; total of 10 million PMAY (U) units to

be delivered by 2020 itself.

The report says “India is home to one of the youngest

populations in the world. If directed correctly its young

working class (with a median age of 31.4 in 2030) has the

potential to achieve significant productivity gains, thereby

bolstering economic growth. However, the growth benefit

of this demographic dividend would not be automatic. A

lot depends on how well this working population can be

trained and whether enough jobs are created to employ the

new labour force additions every year”.

See:

https://credai.org/console/public/upload/4de5a183620d1ae193c813f2d20c7dec.pdf

Plywood

Century Plyboards has reported that its new veneer plant

in Gabon, operated by the Company's wholly owned

subsidiary, Century Gabon SUARL, has commenced

commercial production. The mill has a daily operating

capacity of 200 cubic metres.

See:

https://www.business-standard.com/article/newscm/century-gabon-suarl-starts-commercial-production-at-newunit-in-gabon-121020800961_1.html

7.

VIETNAM

Log and sawnwood imports

Vietnam has become a leading wood product manufacturer

with increasing imports of logs and sawnwood in terms of

volume, variety and supply sources. In the early 2000s

logs and sawnwood were imported into Vietnam from 40 -

45 countries. Today, logs and sawnwood are imported

from over 100 countries and import volumes and the

number of imported species have increased.

In 2012 the volume of logs and sawnwood imported into

Vietnam was reported at 2.4 million cu.m. In 2020, this

figure is forecast to have increased to nearly 5 million

cu.m.

Annually, Vietnamese enterprises spend about US$450

million to import logs and US$750 million on sawnwood.

In general, the average of both logs and sawnwood

imports has tended to decline gradually due to the

increasing importation of plantation timber species and

utilization of lower priced species.

The US, New Zealand, Africa (about 20 countries). EU

and Chile are the main log and sawnwood suppliers to

Vietnam accounting for over 70% of total imports in 2019.

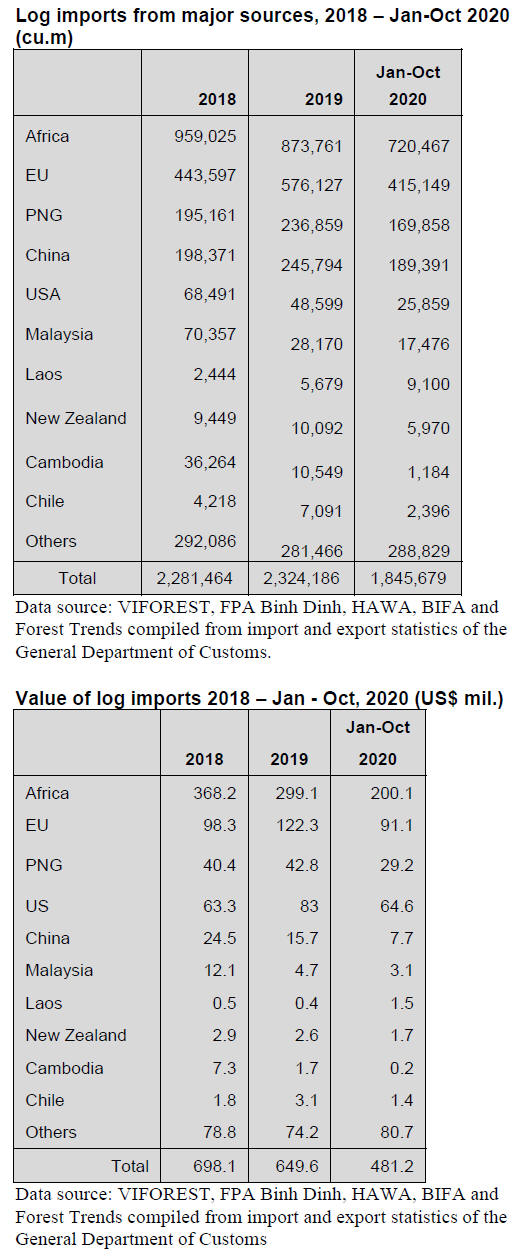

Log imports

On average, the number of countries/territories exporting

logs to Vietnam varies between 70–75 yearly. The top 5

log suppliers for Vietnam are Africa, EU, PNG, US and

China. These 5 suppliers share about 82% of the total

import in the first 10 months of 2020.

In 2019, among the countries that exported log to

Vietnam, there were 5 countries with export of over

100,000 cu.m led by Cameroon and followed by Belgium,

the US, PNG and Germany.

In the same year there were 14 countries selling over

50,000 cu.m and 24 countries with over 10,000 cu.m.

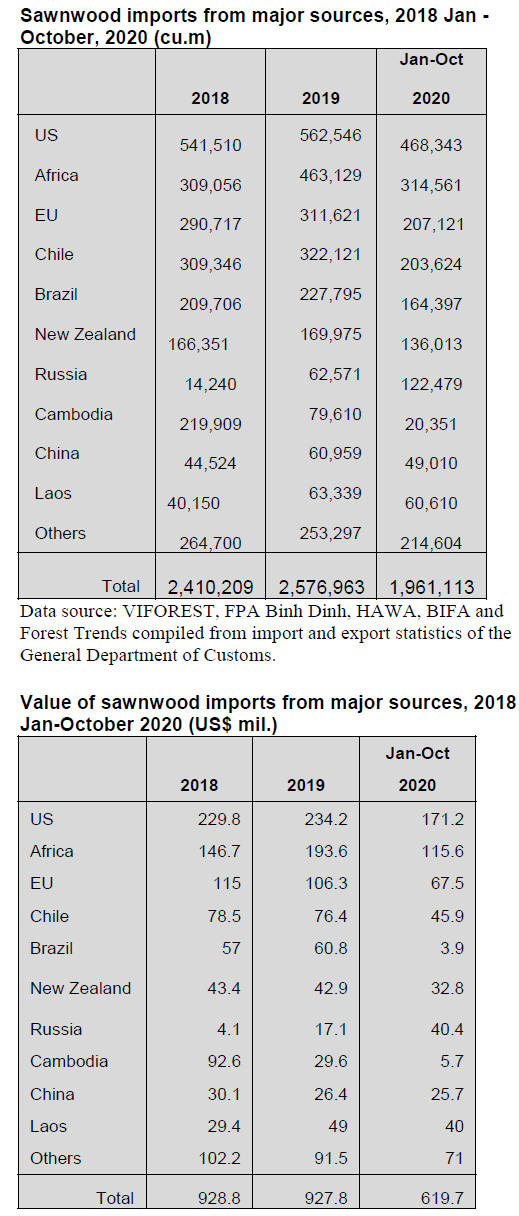

Sawnwood imports

There are approximately 100 countries exporting

sawnwood to Vietnam each year. As was the case with log

imports the number of sawnwood suppliers has not much

fluctuated in recent years.

The top suppliers of sawnwood include the US, Africa,

EU, Chile, Brazil, New Zealand, and Russia. These seven

together shared 82% of total sawnwood imported into

Vietnam in the first 10 months of 2020.

In 2019, there were 5 countries supplying of over

100,000

cu.m of sawnwood each to Vietnam, including the US,

Chile, Brazil, Cameroon and New Zealand, 11 countries

supplied over 50,000 cu.m and 32 countries supplied of

over 10,000 cu.m.

Timber species imported into Vietnam

As imports increased so did the number of source

countries and species. Data provided by the General

Department of Customs lists imported species with

scientific names. Data is available showing species

imported into Vietnam from the beginning of 2012. In

summary:

2012: 340 species were imported into Vietnam;

2013: 360 species, including 98 species imported

for the first time against 2012;

2014: 429 species with 115 new species;

2015: 460 species, including 114 new species;

2016: 515 species, including 140 new species;

2017: 615 species, including 249 new species;

2018: 651 species, including 198 new species;

2019: 418 species, including 85 new species;

First 10 months of 2020: 488 species.

Imports from Africa show the most diverse range of

species and new species are added to the list every year. In

2012, Vietnam imported only 65 species from Africa,

while in 2017 the number of species imported from this

source increased to 175 and in the first 10 months of 2020

it jumped to 122 species.

The number of species imported from Africa increased

sharply between 2012-2017 and then dropped. This

change was a reflection of the decline in the volume of

logs and sawnwood imports into Vietnam. The second

largest supplier of logs and sawnwood in 2012 was Laos

and Vietnamese importers imported about 100 species

from this source. However, by 2019, the number of

species imported from Laos declined down to 55.

Implementation of Vietnam Timber Legality Assurance

System (VNTLAS)

Following the Decree on VNTLAS, The Ministry of

Agriculture and Rural Development (MARD) issued

Decision No. 4832/QD-BNN-TCLN dated November 27,

2020 announcing the List of timber species which have

been imported into Vietnam.

This list includes 322 scientific names of log and

sawnwood species imported into Vietnam with declaration

at Vietnamese Customs.

Article 6 of the VNTLAS Decree specifies the criteria for

determining the risky species imported into Vietnam,

including:

Species listed by CITES Annexes

Species attributed to Group IA, IIA: List of rare

and precious species in accordance with

Vietnam's regulations

Species imported into Vietnam for the first time

Threatened/endangered species

MARD’s Decision No. 4832 announced 51 countries of

active geographic areas. The criteria for identification of

countries of active geographic areas are provided in the

VNTLAS Decree. Log and sawnwood coming from

countries of non-active geographic areas are regarded as

risky. Based on the data provided by the General

Department of Customs of Vietnam, a large number of

major sourcing countries are attributed to non-active

geographic areas.

The VNTLAS Decree specifies that while importing log

and sawnwood classified as of risky species or from nonactive

geographic areas importers have to supplement

documents to certify timber legality. These documents

may include one of the following:

Internationally recognised certificates or national

certificates issued by the exporting countries and

recognised by Vietnam;

Logging license or other similar documents to

prove the logging legality (type of license, license

number, date of issue, issuing authority);

Documents to show that the imported timber is

allowed to be harvested (for those countries that

do not apply logging licenses).

Alternative documents (if no logging documents

are available).

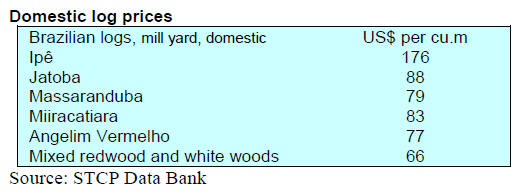

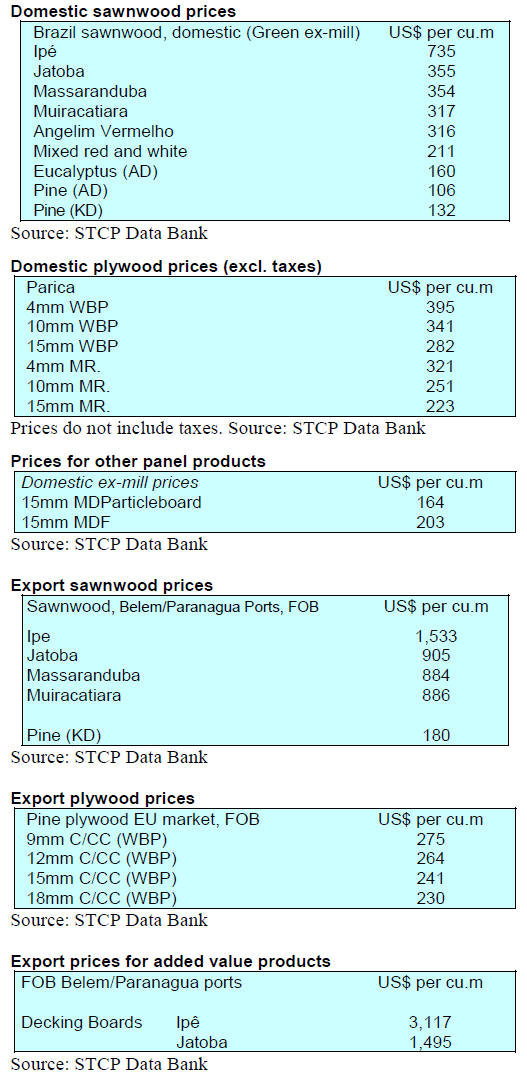

8. BRAZIL

Pará reduces deforestation in January

2021

The State Secretariat for Environment and Sustainability

(SEMAS) has, on the basis of data from the National

Institute for Space Research (INPE), reported a 90% year

on year reduction in deforestation in the State of Pará in

January 2021.

This was put down to efforts made under the Operation

“Amazônia Viva” which concluded its eighth phase in

January 2021.

The various phases of Operation “Amazônia Viva” have

protected more than 137,000 hectares with around 6,000

cubic metres of illegally harvested timber being seized

along with 87 chainsaws and 60 vehicles.

Operation “Amazônia Viva” is part of the Command and

Control programme in the State Plan “Amazônia Agora”

(Plano Estadual Amazônia Agora - PEAA) coordinated by

SEMAS. The objective is conserving the forest along with

social and economic development. Among the goals of the

plan is net zero emission of greenhouse gases by 2036. To

achieve this the plan has four pillars:

Regularise Pará” (Regulariza Pará - land and

environmental regularization)

Sustainable Lands (Territórios Sustentáveis –

support and promotion of rural producers and

degraded areas restoration)

Secure funds for the Eastern Amazon Fund

(Fundo Amazônia Oriental – fundraising for

PEAA projects)

Command and Control (Comando e Controle -

Combating environmental crimes with the State

Task Force to Combat Deforestation)

See:

https://portalamazonia.com/noticias/para-reduz-90-dodesmatamento-no-mes-de-janeiro-em-relacao-a-2020

Pandemic could not hold back Bento Gonçalves

furniture cluster

The Bento Gonçalves furniture cluster in the state of Rio

Grande do Sul reversed the decline in the performance of

the furniture sector in the first months of the Covid-19

pandemic. According to the Furniture Industry Association

of Bento Gonçalves (SINDMÓVEIS) the cluster achieved

revenues of R$2.2 billion, up 11% compared to the same

period in 2019.

Currently, companies in the Bento Gonçalves furniture

cluster account for 27% of the state's revenue generating

around R$8.2 billion in 2020, some 9% higher compared

to 2019. The recovery in sales began in the second half of

2020.

SINDMÓVEIS explains that, despite the positive

performance, losses due to the pandemic have not yet been

fully recovered. The main problems now are the high

prices and shortages of raw materials and inputs due to the

disruption of supply chains.

Even during the tough months it was possible for

manufacturers to expand employment by almost 5%. The

Bento Gonçalves furniture cluster is the main cluster in the

country in terms of number of companies and production

of furniture and parts with approximately 300

manufacturing companies located in the region.

São Bento do Sul furniture makers export to Europe

and neighbours

The furniture cluster of São Bento do Sul in the State of

Santa Catarina, one of the largest furniture producing

states in Brazil, along with the State of Rio Grande do Sul,

earned US$145 million from exports in 2020. This was

just over 20% of the total furniture exported by the entire

Brazilian industry.

2020 exports were, however, disrupted by the Covid-19

pandemic especially in the first quarter of the year when

exports to Europe and neighbouring countries fellby

around 9% compared to 2019.

In Brazil, furniture exports fell 2.8% year on year in 2020.

Among the countries that import Brazilian furniture North

America was the exception where there was an 8%

increase.

This was in contrast to imports by Europe and South

America which fell 13% and 9%, respectively in relation

to 2019. The main furniture consumers of the São Bento

do Sul cluster are the United States, France, the United

Kingdom, Canada and Spain.

For Sindusmobil (Union of Construction and Furniture

Industries of São Bento do Sul), the 2020 export

performance can be considered positive considering the

impact of the pandemic on global trade.

Federal Government improves ‘Single Foreign Trade

Portal’

The Federal Government launched a new phase of the

‘Single Foreign Trade Portal Program’ with the objective

of reducing the bureaucract impact on international trade.

The change involved reformulation of procedures,

requirements and systems applicable to international

business transactions to allow greater flexibility and

time/cost savings for traders.

According to the Secretariat of Foreign Trade (SECEX), if

the Ministry of Economy the new Single Foreign Trade

Portal will reduce costs and make better use of public

resources making them more efficient and harmonised.

In addition to these improvements, the new system using

“bConnect” technology provides an information sharing

platform using blockchain technology. The new

technology offers a model of collaboration in defining

business rules for its members.

Blockchain will be a tool adopted by Mercosur customs to

exchange information on, for instance, exporting

companies. Currently, Brazil, Argentina, Uruguay and

Paraguay are part of this initiative.

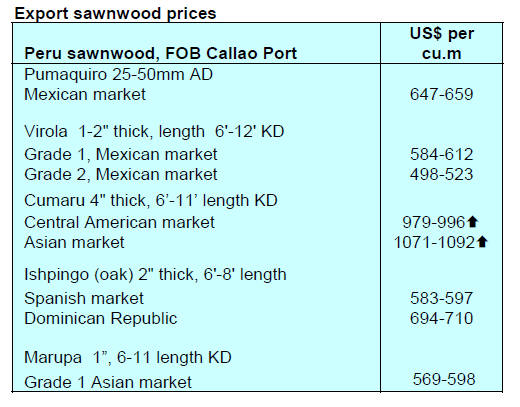

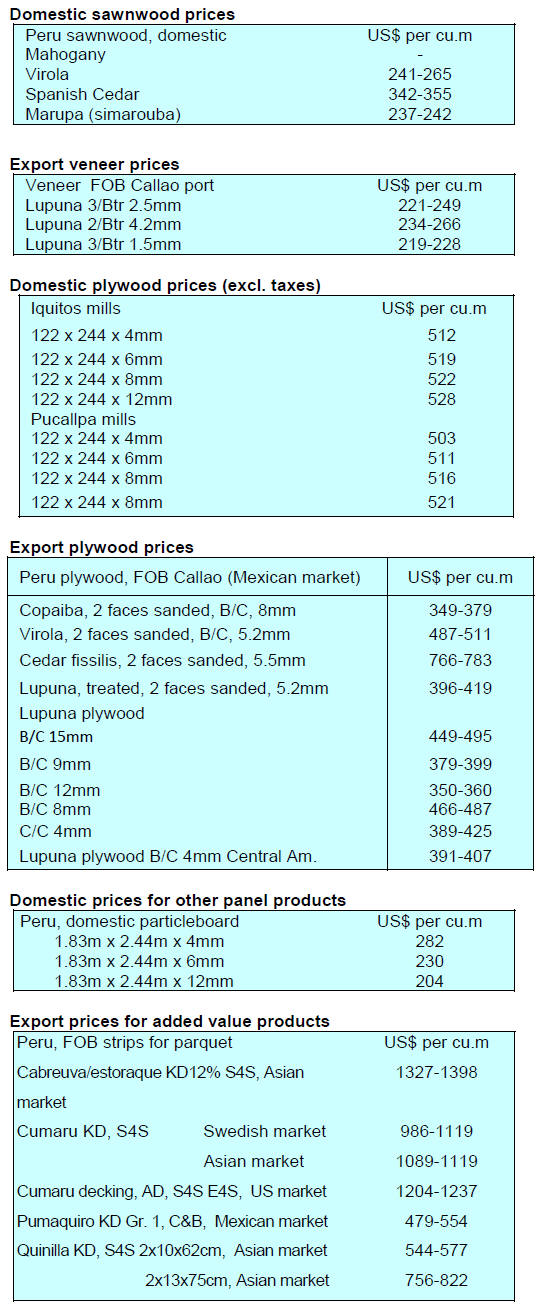

9. PERU

Wood product exports dismal in 2020

The Association of Exporters (ADEX) has reported that

2020 wood product exports totaled US$94.1 million FOB.

This represented an almost 25% decline on the US$124

million exported in 2019.

During 2020 semi-manufactured products accounted for

59% of total wood product export earnings but this was

almost 60% below that of 2019. A further 27% of earnings

came from sawnwood exports (down 8.5% year on year).

Veneer and plywood export earnings, while small, also

declined compared to 2019.

Of the US$94.1 million exported during 2020 China was

the main market taking 40% of all exports.

But exports to China dropped 24% in 2020. Mexico was

the second market at 9.5% but here there was a 35%

decline in export earnings. Other market included the

United States and France. Exports to the US were down

25% year on year and for France there was a 30% decline.

Training for community forest management

At the end of January the National Forest and Wildlife

Service (SERFOR) conducted an Intercultural Training

Program for Trainers in Community Forest Management

(PIFFMFC) the aim of which was to contribute to the

development and strengthening of technical capacity in

indigenous communities in respect of sustainable

management of forest resources.

This was conducted within the framework of the Ucayali

Indigenous Forest Conservation Project (PCBIU) and was

intended to help native communities access greater

benefits from forestry and ensure the sustainability of

forest resources to secure their livelihood.

The project will work with representatives of native

communities in the provinces of Coronel Portillo and

Atalaya.

Agrarian insurance for forestry activities

Congress recently approved a law that modifies laws

28939 and 29148 so as to make provisions for the

Guarantee Fund for the Field and Agricultural Insurance

(Fogasa) to cover forestry activities.

2020 deforestation

The National Forest and Wildlife Service (SERFOR)

reported that satellite monitoring detected 500 instances of

deforestation covering an area of more than 20,000

hectares of forests nationwide during 2020. Cases of

illegal logging and forest fires were recorded.

The satellite monitoring system was launched around 12

months ago and realtime reports are sent to the various

national and regional entities for action.