US Dollar Exchange Rates of

25th January

2021

China Yuan 6.4798

Report from China

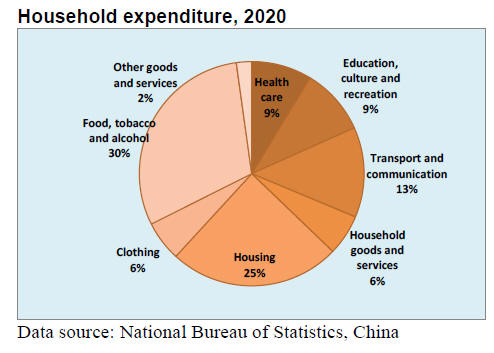

Household income and consumption rose in 2020

A press release from China¡¯s National Bureau of Statistics

says in 2020 per capita disposable income reached

RMB32,189 a nominal increase of 4.7% over the previous

year and a real increase of 2.1% after deducting price

factors. The per capita disposable income of urban

residents was RMB43,834 an increase of 3.5%.

See:

http://www.stats.gov.cn/english/PressRelease/202101/t20210119_1812523.html

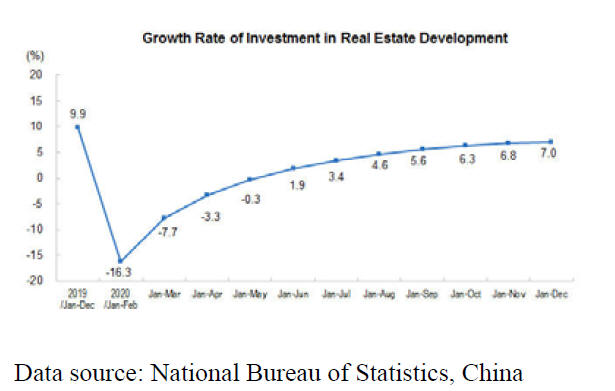

2020 real estate development

Details of national real estate development in 2020 have

been published by the National Bureau of Statistic.

Overall, 2020 investment in real estate development

increased 7% over the previous year while investment in

residential properties expanded 6.3% compared to 2019.

See:

http://www.stats.gov.cn/english/PressRelease/202101/t20210119_1812512.html

China¡¯s GDP exceeds RMB100 trillion

According to the National Bureau of Statistics the value of

China's gross domestic product rose 2.3% to RMB101.6

trillion year on year in 2020 exceeding RMB100 trillion

for the first time. That makes China the only major

economy to post growth in 2020.

The proportion of China¡¯s GDP to the world economy

grew to 17% in 2020 from 16.3% in 2019. The total value

of import and export goods rose 1.9% year on year to

RMB32.16 trillion in 2020.

Wood processing enterprises on holiday

At present, production in factories in Shandong, Jiangsu,

Guangdong and Fujian has been suspended. In order to

stagger the flow of people travelling workers have

returned to their hometown for the holidays ahead of

schedule.

The recent intensely cold weather has challenged the

power system all over the country. Some factories

experienced power failures and in order to manage the

power supply the authorities have required factories with

non-continuous production lines to close early for the

holidays.

The trade press in China has suggested around 30% of the

wood processing enterprises have been affected and in

some areas only 10% of factories are operating. For

example, the local media says wood processing factories

in Guigang City, Guangxi Zhuang Autonomous Region

shut down from 15 January.

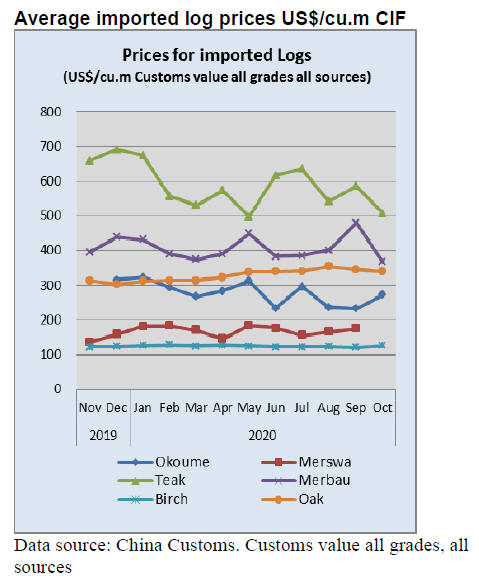

Container shortage impacting timber imports

The availability of shipping containers and disruptions to

shipping schedules is impacting the flow of wood product

imports. The shortage of shipping containers in places

where they are needed has pushed up international

shipping costs. Imports are disrupted and producer

countries are facing a challenge to get timber shipments

away.

At present, Chinese timber traders purchasing European

spruce and American southern pine have a lot of new

orders but delivery schedules are difficult to determine.

In related news, the urgency to secure log supplies has

driven up prices in the domestic market. The trade press in

China says timber prices in Chongqing, Jiangxi and

Guangxi Provinces have been raised.

Cross-border e-commerce - a new feature of wooden

handicraft trade

Cao County is known for wooden handicraft production

and export sales with nearly 200 wooden handicraft

enterprises and workshops. At the beginning of 2020

exports from these handicraft enterprises was affected by

the pandemic which spurred an initiative on cross-border

e-commerce, business is booming and creating a beautiful

scenery.

According to the media in 2020, there were 116 crossborder

e-commerce traders with 1,100 employees and

sales RMB670 million. By way of example, YuGuang

Handicrafts Co., Ltd. in Cao County registered 10 stores

with Amazon and achieved daily sales of about

US$10,000 per store in early 2020. For 2020 the

company's sales exceeded RMB 200 million.

In order to serve the e-commerce traders training courses

have been held in Cao County involving Amazon

professionals.

China's first fully automated plywood mill comes online

On 8 January China's first fully automated plywood

production line built for Guangxi Forest Industry Group

began operation in Baise City, Guangxi Zhuang

Autonomous Region. Construction of the project started

in April 2020 and trial production had been completed by

December 2020.

The total investment was RMB250 million and the site

covers an area of nearly 9 hectares. The mill can produce

100,000 cubic metres of plywood annually.

This investment could lead the way to changing the

plywood production sector from small dispersed, laborintensive

traditional plywood manufacturing and could be

significant for the plywood supply chain.

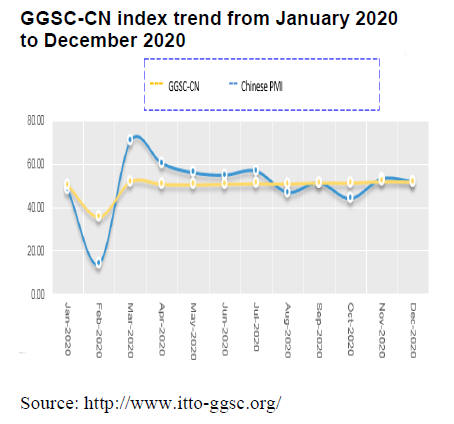

News from the GGSC -

An initiative of the Chinese private sector on building a

global green supply chain for forest products

In December 2020, despite the pandemic, domestic market

demand in China rose steadily and production and

operations of manufacturers were largely uninterrupted.

The purchasing manager index (PMI) for China's

manufacturing industry in December was 51.9%, slightly

lower than that of the previous month. The PMI has been

around 51 for six consecutive months.

The momentum for economic recovery is steady. In

December wood production and manufacturing output

expanded as domestic demand continued to recover.

However, prices for raw materials rose and the inventory

of raw materials declined and exports remained weak.

The GGSC-CN¡¯s comprehensive index for December

registered 52.0 (55.6 for last December and 55.2 for

December 2018) indicating the December operations of

the forest products enterprises represented in GGSCCN

index (major large enterprises) expanded from the

previous month. See the figure below.

Enterprises continue to face many challenges, the

main

being the impact of the global pandemic and the need to

meet new domestic environmental requirements.

Details of specific components included in deriving the

GGSC index and challenges for the Chinese timber

industries in December can be found on the GGSC website

at: http://www.itto-ggsc.org/

|