|

Report from

North America

Private sector urges peaceful transfer of power

US business groups urged a peaceful transfer of power and

calm after a pro-Trump protest turned into a violent

insurrection in the US Capitol Building. Late in the

evening on Jan. 6th, Congress in a Joint Session

reconvened after the Capitol was secured and Vice

President Pence announced the results of the certified

electoral votes affirming a Biden/Harris win.

This ceremonial action paved the way for the inauguration

on 20 January. Concern and outrage about the violent

protest continue to reverberate in Washington and

nationwide.

The US Chamber of Commerce summed up the alarm of

the business community with this statement: ¡°The

Chamber and our members will lend all assistance

necessary to ensure a successful and peaceful transfer of

power on 20 January and to help President-elect Biden and

the new Congress address the many challenges that

confront our nation, most notably ending the pandemic

that has killed more than 360,000 Americans, imperiled

our economy, closed tens of thousands of small

businesses, and put millions out of work.¡±

See:https://www.nam.org/mobs-attack-capitol-and-the-namresponds-11638/?stream=policylegal&utm_source=link&utm_medium=social

and

https://www.nam.org/mobs-attack-capitol-and-the-namresponds-11638/?stream=policylegal&utm_source=link&utm_medium=social

and

https://www.uschamber.com/media/press-release

and

https://www.iwpawood.org/blogpost/1813919/363615/IWPAStatement-About-the-Violence-at-the-Nation-s-Capitol-Today

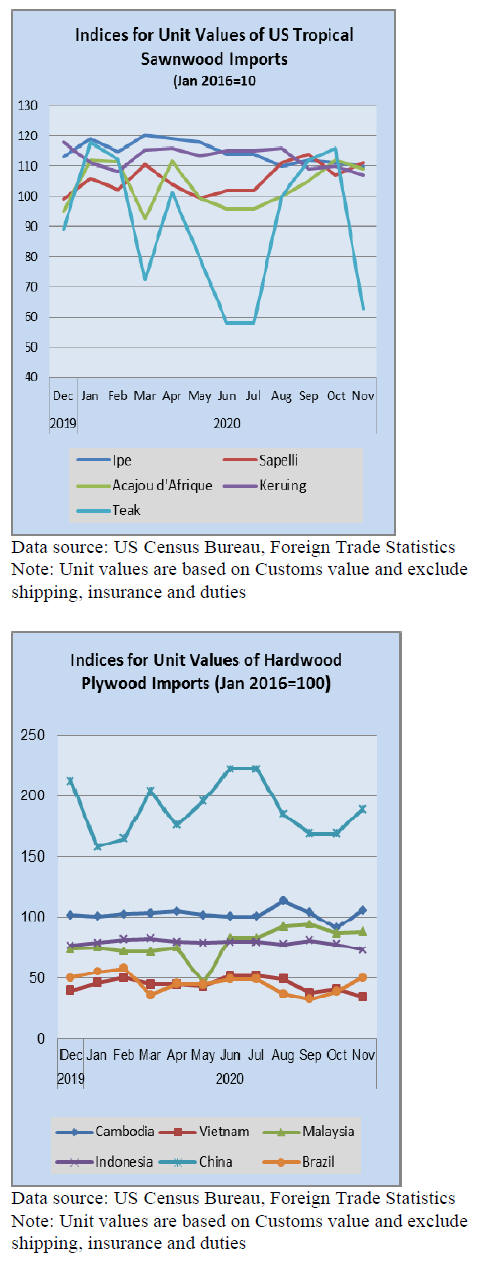

US tropical hardwood imports fall

US imports of sawn tropical hardwood fell in November.

The 12,787 cubic metres imported in November was

nearly 23% below the volume imported in November of

last year. Year to November 2020 imports were down 35%

from 2019.

Imports from Brazil rose 18% in November and imports

from Cameroon were more than double that of the

previous month. However, November imports from

Ecuador, Malaysia, Cote d¡¯Ivoire, and Congo

(Brazzaville) were all roughly half of October¡¯s numbers.

Imports of ipe rose 49% in November 2020 and are now

ahead of 2019 year on year, if only by 1%. Except for

iroko (up 133%), imports of all other hardwood sawnwood

species were trailing that of last year.

Canadian imports of tropical hardwood fell by 16% in

November and are down 17% year to November.

Hardwood plywood imports up 9%

US imports of hardwood plywood rose for the third

straight month in November 2020, gaining 9%. The

volume of 277,149 cubic metres was the highest since

May 2017. Imports from Vietnam and Russia were both

up by more than 20%.

Imports from Indonesia rose 13% in November 2020and

are ahead of 2019 by 38%. Imports from China were down

29% for the month and are now down 40% year to

November 2020. However, overall US hardwood

plywood imports were up 7% for the year to November

2020.

November bump helps veneer imports rebound

US imports of tropical hardwood veneer vaulted a much

needed 40% in November 2020 marking a third straight

month of growth.

Imports for the month were nearly 7% better than in

November 2020 marking the only month this year where

imports outpaced the previous year¡¯s total. Year to

November imports trail by nearly 30% even with the

recent improvement. Despite more than doubling in

November, year to date imports from Ghana were still

down by 57%.

Hardwood flooring imports surged

US imports of hardwood flooring grew by 18% in

November, surging to the highest level of 2020. While

imports for the month were more than 22% higher than the

previous November, imports are still down 23% year to

November.

The November gain was fueled by a 46% increase in

imports from Brazil. Imports from Brazil were now down

only 4% for the year to November after lagging much

further behind most of the year.

Imports from China and Malaysia were behind by more

than 50% up to November and dipped further in

November.

Imports of assembled flooring panels fell by 4% in

November but remain ahead 8% year to November. A

nearly 40% increase in imports from Indonesia in

November was more than offset by sharp declines in

imports from China and Vietnam. Imports from Indonesia

were up nearly 20% for the 11 months to November 2020.

US moulding imports up slightly

US imports of hardwood moulding rose 2% in October,

continuing their climb after a poor autumn. Imports were

down 14% year to November despite a rise in November.

Imports from China grew by 30% in November but

remained down by 25% for the year. Similarly, imports

from Brazil were up 21% in November but were down

48% compared to November 2019.

US wooden furniture imports surpass US$2 in

November 2020

Monthly US imports of wooden furniture surpassed US$2

billion for the first time in November. Imports rose 4%,

growing for the sixth straight month.

Despite the record growth, year to November imports were

down about 1% from last 2019 due to the impact of the

pandemic this spring.

Imports from India rose by 15% in November, while

imports from most other partners stayed fairly stable,

neither rising nor falling by more than 10%. Imports from

Vietnam rose 8% and were up 31% year to date.

This growth mirrored that of the residential furniture

market. According to the Smith Leonard Furniture Insights

report, new orders in October increased over the same

period from a year ago for the fifth straight month,

increasing 40% over October 2019.

Some 77% of Smith Leonard survey participants reported

increased orders in October. The increase in October

brought the year-to-date gain to 14%, up from 11%

reported last month. For the 10 months ended October,

orders were up for 59% of the participants.

Residential furniture manufacturers continued to report

strong order performance, though they are saying the size

of the increases has slowed.

See:

https://www.smith-leonard.com/2020/12/29/december-2020-furniture-insights/

US housing starts rise for a third-straight month

US new home construction rose more than forecast to a

nine-month high in November 2020 highlighting the

strength of a residential housing market that¡¯s been

supported by strong demand amid low interest rates.

Residential starts rose 1.2% to a 1.547 million annualised

rate from a downwardly revised 1.528 million a month

earlier according to government reports. New construction

strength was broad-based nationally.

Starts climbed in all four regions, led by a 12.9% rise in

the Northeast, according to the report, which is published

jointly by the Census Bureau and the Department of

Housing and Urban Development.

A separate report Wednesday showed that US

homebuilder confidence eased slightly in December to the

second-best level on record following the prior month¡¯s

peak.

Meanwhile, sales of existing homes turned lower in

November after five consecutive months of gains. They

fell 2.5% on a month-to-month basis to a seasonally

adjusted annualized rate of 6.69 million units, according to

the National Association of Realtors. Sales were a strong

25.8% higher from a year earlier.

While demand for homes is still high, fueled in part by the

stay-at-home culture of the coronavirus pandemic, supply

is incredibly low. That is hurting sales and affordability.

See:

https://www.nar.realtor/newsroom/existing-home-salesdecrease-2-5-in-november

Canadian construction sector to rebound in 2021

The Canadian construction sector is set to rebound in 2021

after a pandemic-related dip in 2020, according to a recent

report from Vancouver-based real estate and infrastructure

advisory firm BTY Group.

Overall construction starts are projected to rebound from

C$60 billion in 2020 to C$80 billion in 2021, according to

BTY. The outlook is positive for all segments ¨C though

multifamily residential, industrial, and engineering and

roadwork will see the strongest upticks.

Infrastructure and renewables will be the top performing

sectors, driven by substantial government stimulus

spending and mega projects in BC, Quebec, and Ontario.

See:

https://www.consulting.ca/news/2050/canadianconstruction-sector-to-rebound-in-2021

USTR hearing on Vietnam¡¯s import of timber

On 28 December the Office of the US Trade

Representative (USTR) held a virtual hearing for the

Section 301 investigation concerning Vietnam¡¯s import

and use of timber that may have been illegally harvested

or traded.

The International Wood Products Association Executive

Director ,Cindy Squires, testified at the hearing that

Vietnam is important to the wood products trade both for

import and export and that damaging tariffs can be

avoided by better use of the US-Vietnam Trade and

Investment Framework Agreement.

¡°We believe this framework provides for a high-level

dialogue that can appropriately address both the subject of

this hearing as well as Vietnam¡¯s currency policies,¡±

Squires testified.

She added that tariffs could lead to a number of

unintended consequences including retaliation by Vietnam

and a loss of influence as the EU continues its trade

process with Vietnam.

The Section 301 currency investigation, along with a

separate inquiry into Vietnam¡¯s alleged use of illegal

timber in furniture and other products will determine

whether the US government imposes tariffs on Vietnamese

goods shipped to the United States. The USTR is

expected to complete its timber and currency

investigations before 20 January.

See:

https://ustr.gov/issue-areas/enforcement/section-301-investigations/section-301-vietnam

Democratic Republic of the Congo Reinstated in AGOA

Preference Program

On 22 December 2020 President Trump issued a

proclamation reinstating the Democratic Republic of the

Congo¡¯s eligibility for trade preferences under the African

Growth and Opportunity Act (AGOA) effective1 January

2021.

Goods imported from the DRC to the US entered for

consumption, or withdrawn from warehouse for

consumption are now eligible to claim preferential tariff

treatment under AGOA. The goods must meet the 35%

value-added rule and all applicable AGOA requirements.

See:

https://www.state.gov/reinstatement-of-the-democraticrepublic-of-the-congo-to-agoa/

Brazil not dumping wood mouldings but shippers in

China face problems

On December 29, the Department of Commerce

announced its final antidumping duty (AD) and

countervailing duty (CVD) determinations on wood

mouldings and millwork products from Brazil and China.

Commerce found no dumping on wood mouldings and

millwork products from Brazil and, therefore, there will be

no AD order and duty deposit requirements for imports

from Brazil.

New rates for China were outlined in decision memoranda

for China and the rates will go into effect when Commerce

publishes its AD/CVD final determinations in the Federal

Register, which usually takes between two and five

business days from the date of its final determinations.

A full list of companies with the applicable AD cash

deposit rates for wood mouldings and millwork products

from China is available in the draft Federal Register

notice.

Upon the issuance of Commerce's final determinations on

wood mouldings and millwork products, the International

Trade Commission (ITC) must make its final

determination on whether the domestic industry is injured

or threatened with injury by way of imported wood

mouldings and millwork products from Brazil and China.

If the ITC votes in the negative, no duties will be imposed,

and any duties that were previously collected will be

refunded. The ITC vote is currently scheduled for 22

January.

See:

https://files.constantcontact.com/4ea55c81401/05b537dc-80a6-4290-9acf-0cdbd3e5ee41.pdf

|