|

Report from

Europe

EU tropical timber trade faces double dip recession

Total EU27 (i.e. excluding the UK) import value of

tropical wood and wood furniture products was US$2.48

billion between January and October last year, 12% less

than in 2019.

This is a significantly higher level of import than forecast

earlier in the year when the first waves of the COVID-19

pandemic hit the continent leading to widespread

lockdowns with severe implications for the EU27

economy and on the supply side in tropical countries.

However, with the onset of a second wave of the virus,

and signs that the EU27 is now experiencing a double dip

recession, trade may be receding once again.

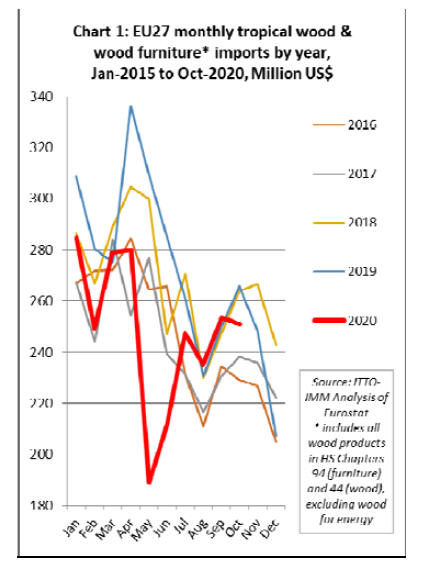

Chart 1, which shows the value of EU27 imports of

tropical wood and wood furniture products each month

during the last five years, highlights that while imports fell

sharply in May last year there was a very strong rebound

in June and July. Although imports declined again in

August, they were at a five year high for that month

(which is typically very slow during the European summer

vacation period), and then recovered well in September.

With the easing of lockdown measures from May onwards

and boosted by the introduction of large government

stimulus measures, the economy picked up across the

EU27 in the third quarter.

According to Eurostat, seasonally adjusted GDP in the

EU27 increased by 11.5% during the three month period.

The rebound was almost sufficient to offset the 11.3%

decline in EU27 GDP in the second quarter of 2020.

During this period, EU27 imports were given a boost by

the relative strength of the euro on international exchange

markets, the euro-dollar rate rising sharply from a low of

1.06 in March to 1.22 by the end of the year.

The dollar¡¯s weakness is due to political uncertainty

during and after the presidential elections and the

continuing severity of the pandemic in the United States.

Renewed signs of stress in the EU27 economy

A slight dip in EU27 tropical wood product imports in

October is more worrying as it coincides with renewed

signs of stress in the EU market in the last quarter of 2020.

The second waves of COVID infection across Europe

during the winter months have grown to be significantly

larger than the first waves last year leading to renewed and

more widespread lockdowns.

According to the Oxford ¡°stringency index¡±, which

records the strictness of ¡®lockdown style¡¯ policies to limit

the spread of COVID-19, since mid-October most of

Europe has been subject to restrictions as severe as those

imposed in the first lockdown between March and June

last year. The expectation is that these renewed measures

will be in force in most European countries at least until

mid-February and probably much longer.

Meanwhile, the relative strength of the euro is creating a

headache for the European Central Bank which has

become alarmed at the impact on export competitiveness

of EU27 manufacturers at a time when other factors are

weighing down heavily on demand.

Bloomberg Economics estimates euro-zone GDP fell 1.5%

in the last quarter of 2020, bringing the decline for 2020 as

a whole to 7%. Bloomberg Economics now expects

another 4.1% decline in eurozone GDP in the first quarter

of 2021. Two consecutive quarterly falls is the formal

definition for a recession. The Bloomberg forecast

therefore implies that Europe is in the grips of a ¡°double

dip¡± recession following the downturn already recorded in

the first two quarters of 2020.

However, there have been sizable divergences among EU

member states. Germany has benefited from its greater

reliance on manufacturing, with factories staying open

while government-mandated lockdowns shut non-essential

shops and much of the hospitality sector. Bloomberg

Economics says Europe¡¯s biggest economy probably

managed to post some growth in the fourth quarter and

may have avoided the ¡°double dip¡±. Economists polled by

Reuters in the first week of January now expect German

economic growth to come in at minus 5.1 per cent for the

whole of last year.

European countries like France that are more reliant on

services have been hit harder. The French central bank

reported that the economy likely contracted by 4% in the

final quarter of 2020, which would confirm a previous

estimate that the economy shrank by 9% last year.

Forward looking indicators show that economic

momentum in the EU27 is unlikely to pick up pace in the

first quarter of 2021. The IHS Markit Eurozone PMI

Composite Output Index rose from 45.3 in November to

49.1 in December.

However a score below 50 indicates that a majority of

those surveyed recorded a decline in purchasing during the

month. Services were the principal drag on economic

output, with activity here falling for a fourth successive

month in December. Manufacturing remained the principal

bright spot of eurozone economic performance, expanding

for a sixth successive month and at a faster rate than in

November.

The latest PMI data for eurozone construction is also not

encouraging. IHS Markit, who undertakes the survey,

commented in their 6th January report that ¡°Eurozone

construction companies reported a continued downturn in

activity during December, while incoming business also

fell at a solid, albeit softer pace.

Concerns surrounding the longer term impact that the

pandemic will have on the wider construction sector,

alongside a lack of new projects in both the public and

private sector being bought to tender resulted in an

extension to the pessimistic outlook held by eurozonebased

builders for a fifth month in a row¡±.

IHS Markit noted in relation to individual countries that

¡°France and Germany continued to report further declines

in construction activity, with the former signalling the

steepest fall since May. Italian firms on the other hand

registered marginal growth for the first time since

September.¡±

Most economists now predict that it will be the second

quarter that a recovery in the EU economy ultimately gets

under way. Looking positively, the bounce-back could be

sharp, at least initially, once restrictions are eased and

infections subside, as more of the population is vaccinated.

Pent-up demand could see a chunk of the hundreds of

billions of euros of consumers¡¯ involuntary savings being

unleashed. By the second half of the year, the EU¡¯s

unprecedented 1.8 trillion-euro (US$2.2 trillion) recovery

fund and multi-year budget should be supporting growth.

EU tropical wood product imports down across the

board

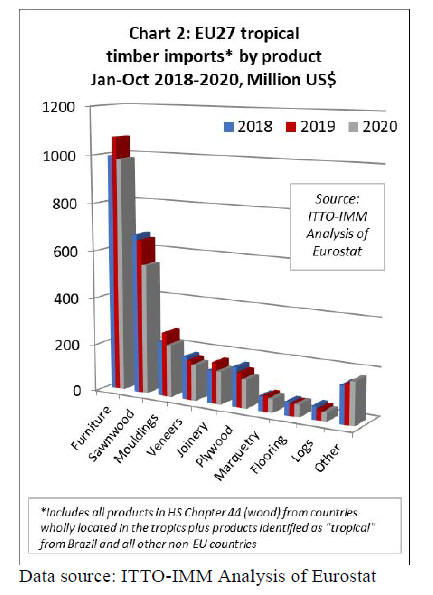

Unsurprisingly, EU27 imports of all the main tropical

wood products fell in the first ten months of 2020, but in

each case the decline was less dramatic than expected

earlier in the year when the scale of the pandemic and

associated lockdown measures were becoming apparent.

In the year to October, EU27 import value of wood

furniture from tropical countries declined 8% to US$982

million, while import value of tropical sawnwood declined

16% to US$545 million.

Tropical mouldings were down 18% to US$220 million,

veneer down 10% to US$150 million, joinery down 19%

to US$139 million, plywood down 18% to US$121

million, marquetry and ornaments down 14% to US$58

million, and logs down 21% to US$36 million.

The import value of tropical flooring actually increased

slightly, up 3% to US$52 million (Chart 2).

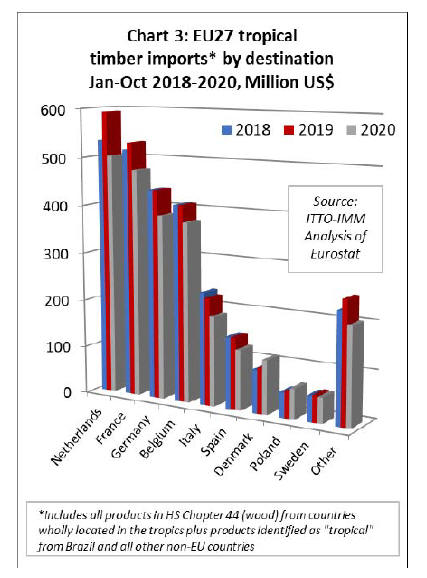

Import value fell into all six of the largest EU27

destinations for tropical wood and wood furniture products

in the first ten months of the year.

Import value was down 15% to US$502 million in the

Netherlands, 11% in France to US$475 million, 12% in

Germany to US$384 million, 8% in Belgium to US$375

million, 16% in Italy to US$187 million, and 16% in Spain

to US$126 million.

However, import value increased in Denmark, by 19% to

US$113 million, and in Poland, by 12% to US$63 million.

Import value in Sweden declined, but by only 4% to

US$53.3 million (Chart 3 above).

EU27 wood furniture imports from Vietnam close to

last year¡¯s level

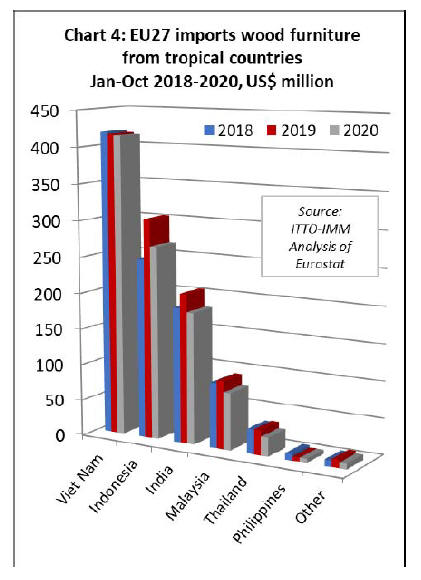

In the furniture sector in 2020, EU27 import value from

Vietnam almost matched the previous years¡¯ level in the

first ten months, down only 0.4% to US$415 million.

Imports from Indonesia were down 12% to US267 million

in the first ten months of 2020, although this compares

with a relatively strong performance in 2019 and imports

were still higher than in the same period during 2018

(Chart 4).

EU27 imports of wood furniture declined sharply from

Malaysia and Thailand in the first ten months of 2020,

respectively down 16% to US$79 million and 25% to

US$26 million. However imports from the Philippines

were more stable, falling only 2% to US$5.5 million.

EU27 imports of wood furniture from India were down

12% to US$182 million in the first ten months of 2020.

Partly due to supply side issues, imports from furniture

from India almost came to a complete halt in May last

year, but then rebounded very strongly in the third quarter

to record levels for that time of year.

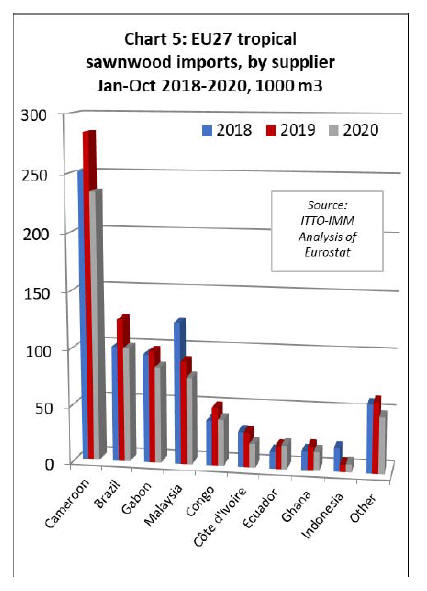

EU27 tropical sawnwood imports fall 17%

In quantity terms, EU27 imports of tropical sawnwood

declined 17% to 650,800 cu.m in the first ten months of

2020.

Imports fell sharply from all major supply countries; down

18% from Cameroon to 234,600 cu.m, 20% from Brazil to

100,300 cu.m, 14% from Gabon to 84,400 cu.m, 15%

from Malaysia to 76,400 cu.m, 20% from Congo to 40,700

cu.m, 31% from Côte d'Ivoire to 20,900 cu.m, and 22%

from Ghana to 16,400 cu.m.

However, Ecuador bucked the downward trend with EU27

imports of sawnwood from the country rising 6% to

20,700 cu.m, much destined for Denmark and likely

driven by strong demand for balsa for wind turbines.

Imports of sawnwood from Indonesia also increased

slightly, by 9% to 7,100 cu.m, but this follows a 74%

reduction in 2018 (Chart 5).

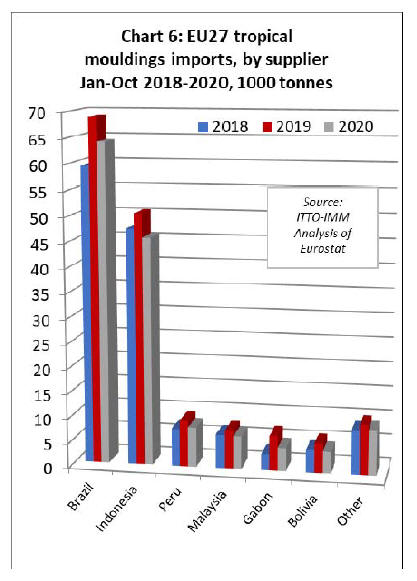

The decline in imports of tropical sawnwood in the first

ten months of 2020 was mirrored by a similar decline in

EU27 imports of tropical mouldings/decking.

Imports of this commodity were down 11% overall at

143,000 tonnes, falling 7% from Brazil to 64,200 tonnes,

9% from Indonesia to 45,800 tonnes, 15% from Peru to

8,000 tonnes, 15% from Malaysia to 6,600 tonnes, 33%

from Gabon to 4,700 tonnes, and 27% from Bolivia to

4,400 tonnes (Chart 6 above).

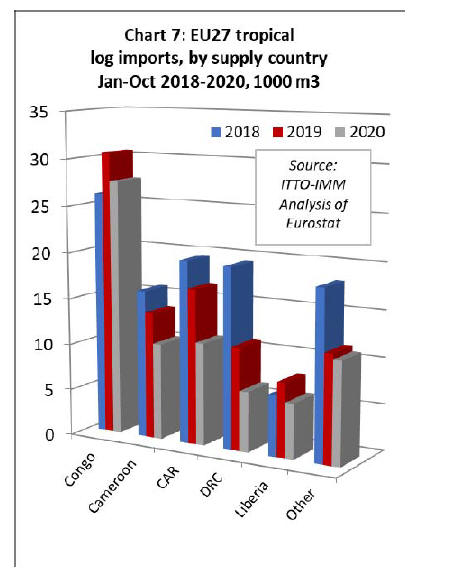

EU27 imports of tropical logs were down 21% to 72,400

cu.m in the first ten months of last year. Imports held up

reasonably well from the Republic of Congo, down only

10% to 27,600 cu.m, but fell sharply from all other leading

supply countries including Cameroon (-24% to 10,400

cu.m), Central African Republic (-34% to 11,000 cu.m),

DRC (-41% to 6,500 cu.m), and Liberia (-26% to 5,900

cu.m) (Chart 7).

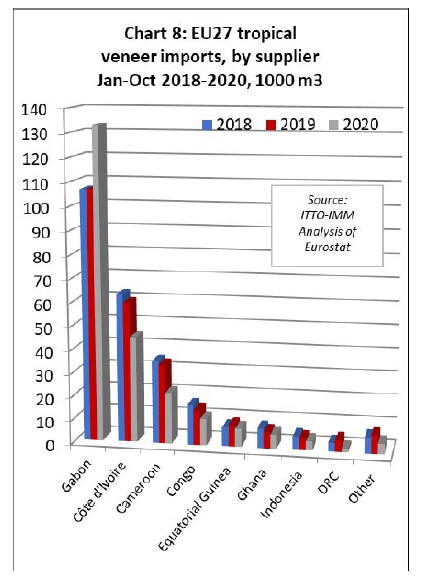

EU27 tropical veneer imports from Gabon on the rise

despite pandemic

EU27 imports of tropical veneer declined 6% to 235,000

cu.m in the first 10 months of 2020. Imports from Gabon

bucked the wider downward trend, the EU27 importing

133,100 cu.m from the country between January and

October last year, 25% more than the same period in 2019,

mainly destined for France.

Veneer imports declined from all other major tropical

suppliers, including Côte d'Ivoire (-24% to 45,200 cu.m),

Cameroon (-36% to 21,700 cu.m), Equatorial Guinea (-

16% to 7,800 cu.m), Ghana (-14% to 6,000 cu.m),

Indonesia (-24% to 3,900 cu.m) and DRC (-69% to 1,600

cu.m). (Chart 8).

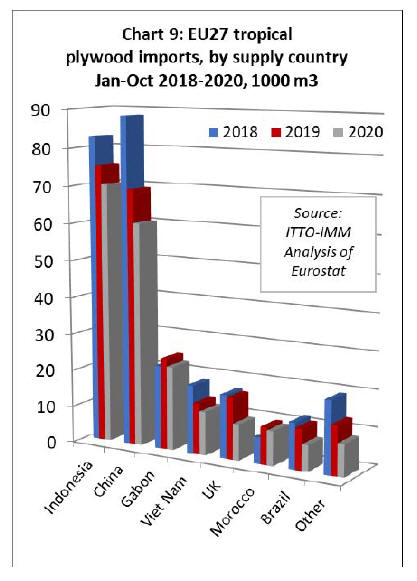

Although there were signs of an uptick in the pace of

EU27 imports of tropical hardwood faced plywood in

September and October last year, total imports of 207,000

cu.m in the first ten months were still down 15%

compared to the same period in 2019.

Imports fell from all the leading supply countries

including Indonesia (-7% to 70,200 cu.m), China (-13% to

60,400 cu.m), Gabon (-8% to 22,700 cu.m), Vietnam (-

15% to 11,700 cu.m), Morocco (-8% to 9,300 cu.m) and

Brazil (-37% to 7,000 cu.m).

EU27 imports of tropical hardwood faced plywood from

the UK ¨C a re-export since the UK has no plywood

manufacturing capacity - declined 41% to 9,700 cu.m

(Chart 9 above).

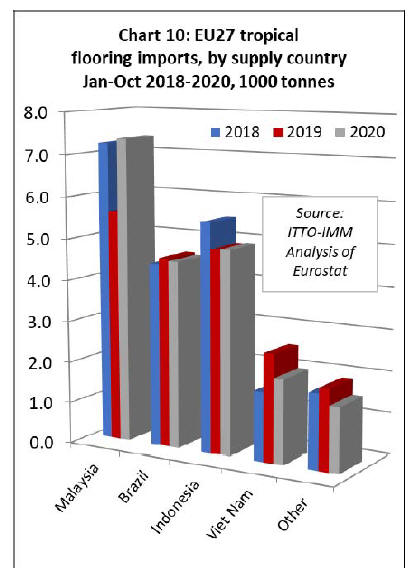

EU27 tropical flooring imports rise while other joinery

imports decline

Given the situation in the wider market, one of the least

expected trends in EU27 import data was a slight recovery

in imports of tropical flooring products in the first ten

months of last year. This follows a long period of

continuous decline. Imports increased 4% to 20,400

tonnes, with the gain due to a 31% rise in imports from

Malaysia to 7,600 tonnes, mostly destined for Belgium.

Imports from Indonesia increased slightly, by 0.4% to

4,900 tonnes and declined only moderately from Brazil,

down 1% to 4,500 tonnes. Imports from Vietnam fell more

rapidly, by 22% to 2,000 cu.m (Chart 10).

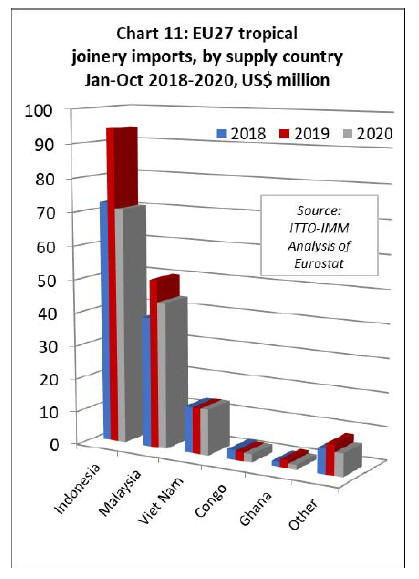

EU27 import quantity of other joinery products from

tropical countries, which mainly comprise laminated

window scantlings, kitchen tops and wood doors, declined

19% to 139,000 tonnes in the first ten months of 2020.

Imports were down 25% to 70,600 tonnes from Indonesia

and 13% to 44,000 tonnes from Malaysia. Imports from

Vietnam were static at 13,700 tonnes.

For African countries, EU27 imports of this commodity

fell 8% to 2,500 tonnes from the Republic of Congo and

were down 39% to 1,400 tonnes from Ghana. (Chart 11).

|