Japan

Wood Products Prices

Dollar Exchange Rates of 11th

January

2021

Japan Yen 103.96

Reports From Japan

Recent infection

surge puts break on recovery

A recent survey found the majority of large Japanese

companies anticipate moderate economic growth in fiscal

2021. However, those in doubt said they are not sure when

sales will return to pre-pandemic levels.

The January 2021 surge in the spread of infections has put

a brake on the early signs of recovery reported in late

2020. The December 2020 and January 2021 the third

wave of infections has become critical and the government

has announced a state of emergency in the worst affected

prefectures.

The chairman of the Japan Business Federation has urged

cooperation between the public and private sectors to slow

the spread of the corona virus.

He said 2021 will be the year of revival, the key to which

is a digital transformation of the economy pointing out that

the administrative, medical and education systems in

Japan have been slow to see the advantages of expanded

digitalization.

See:

https://japantoday.com/category/business/business-leadersvow-to-revive-pandemic-hit-economy-with-innovation

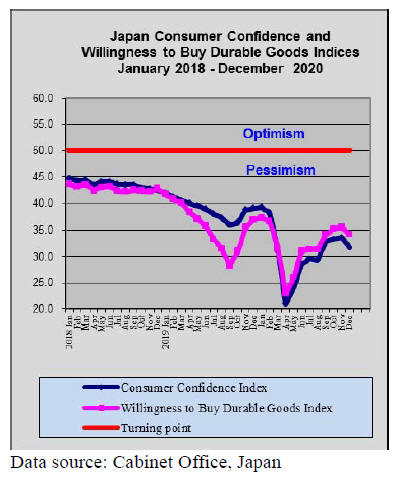

Not surprising ¨C consumer confidence falls

For the first time in four months the consumer confidence

index for December released by the Cabinet Office

declined, driven down by a resurgence of coronavirus

infections across the country.

The index of sentiment among households fell to 31.8

from 33.7 in November. The index provides an indication

of consumers expectations for the coming six months. A

reading below 50 suggests pessimists outnumber

optimists. Of concern for exporters of wood products the

index for the December index for willingness of Japanese

consumers to purchase durable goods dropped sharply

from a month earlier.

The result of the latest survey was conducted in late

December as the country began to see a third wave of

virus infections. In response to the rapid spread of

infections the government has declared a state of

emergency for 11prefectures and it went into effect on 7

January and will remain in place for a month.

Late 2020 retail sales continued the downtrend and Tokyo

consumer prices declined at the fastest rate in 10 years as

record virus cases kept shoppers at home and darken the

recovery outlook. Retail sales fell 2% in November from

the prior month, as consumers continued to cut back on

apparel purchases, the economy ministry reported Friday.

See:

https://financialpost.com/pmn/business-pmn/japans-retailsales-resume-falling-amid-virus-resurgence

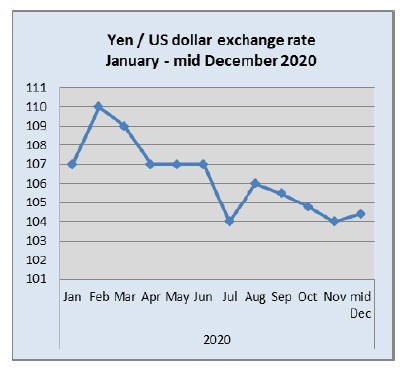

BoJ determined to stem any yen rise

The Japanese government and Bank of Japan (BoJ) have

reaffirmed they will work together to ensure the stability

of the yen after the currency recently rose to a 10-month

high of 102 against the US dollar.

Rising perceptions of risk and an uncertain economic

outlook as a third wave of corona infections spreads across

Japan could impact the exchange rate but the government

has made it clear that it will take all appropriate measures

to ensure a strengthening of the yen will not undermine the

price competitiveness of Japanese exports.

Land prices falling

Land prices in 38 of 100 commercial and residential

districts in Tokyo, Osaka, Nagoya and other cities have

been falling according to the latest land value report issued

by the Ministry of Land, Infrastructure, Transport and

Tourism. The data marked the first time since 2012 that

the number of districts seeing price declines outnumbered

areas with rising prices. Experts say the scale of the drop

is similar to that in 2008 during the global financial crisis.

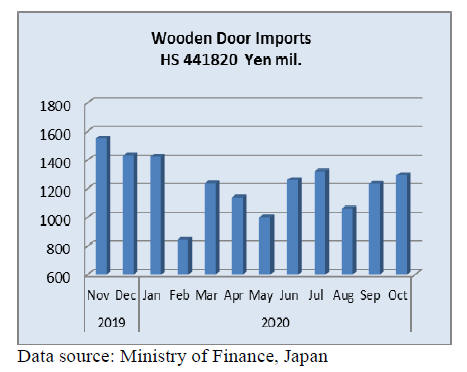

Wooden door Imports

October imports

In October 2020 two shippers accounted for 86% of

Japan¡¯s imports of wooden doors (HS 441820), China,

54% and the Philippines 32%. Year on year the value of

October 2020 imports was down 15% but month on month

the value of imports barely changed.

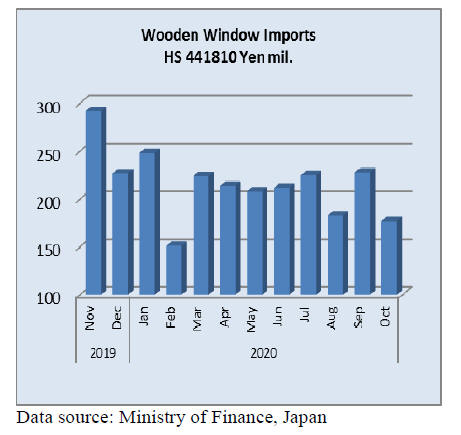

Wooden window imports

October imports

The value of October 2020 wooden window (HS441810)

imports dropped 28% year on year and month on month

imports were down 25%. Some 95% of October 2020

wooden window imports were provided by three shippers,

China (49%), the US (23%) and the Philippines (23%).

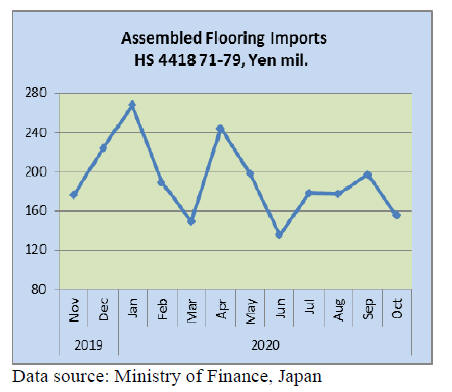

Assembled wooden flooring imports

October imports

HS441875 continued to dominate Japan¡¯s imports of

assembled flooring in October 2020 accounting for around

73% of the various categories imported most shipped from

China, Malaysia and Indonesia.

HS441879 accounted for 14% of the value of October

imports. Year on year the value of October 2020 imports

dropped a massive 41% and compared to the value of

September imports there was a 21% decline.

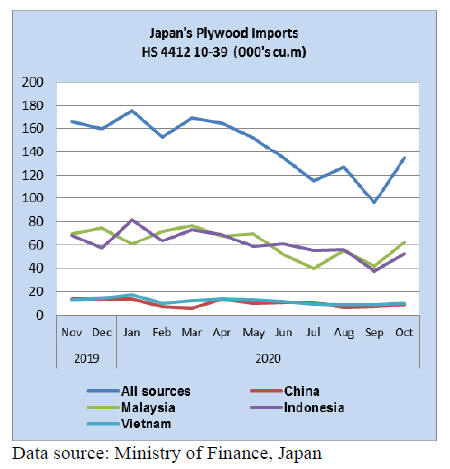

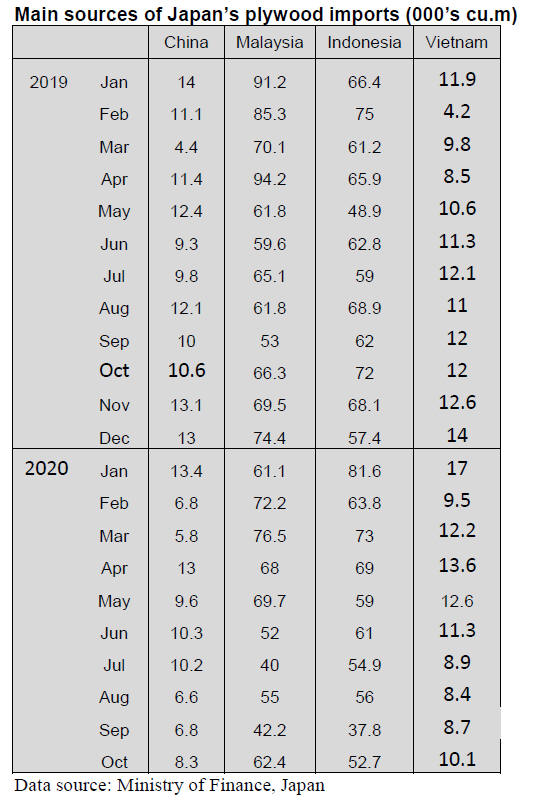

Plywood imports

October imports

Between February and July 2020 there was a steady

decline in the volume of plywood imports. Imports in

August tipped higher only to be followed by a further

decline in September. This decline was reversed in

October 2020 when the volume of imports jumped 40%

compared to a month earlier. However, year on year

October 2020 impoirt volumes were down 17%.

Year on year the main plywood suppliers to Japan saw

sharp declines in the volume of shipments except

Malaysia. October 2020 shipments from Indonesia were

down 27% year on year and there was a 20% decline in

shipments from Vietnam.

It is noteworthy that the volume of shipments from

Vietnam exceeded those from China for the 10 months to

Octber 2020. The surge in the volume of October 2020

imports benefitted all the main suppliers with Malaysia

notching up a 40% increase in shipments.

Of the various categories imported HS441231 accounted

for over 80% of imports with a further 5% each being of

HS441233 and HS441234.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

2020 Agriculture and Forestry census

The Ministry of Agriculture, Forestry and Fisheries

announced 2020 agriculture and forestry census.

This is the investigation made every five years to see

actual status of domestic agriculture and forestry in terms

of production, employment and resources. 2020 census

was made based on the replies of questionnaires made in

February 2020. Management bodies of forest industry

were 140,000 in 2010 then 87,000 in 2015 and 34,000 in

2020.

Percentage of number of timber owners with more than 20

hectares was 19.4% in 2010, 22.1% in 2015 and increased

to 32.6% in 2020. This shows increase of timberland one

owner has. Timber harvest volume by forest management

bodies was 15,621,000 cbms in 2010, 19,888,000 cbms in

2015 and 22,597,000 cbms in 2020.

Production per owner increased by introducing high

performance harvesting machines.

Size of forestland is 24,770,000 hectares and percentage of

forestland in total area is 66.4%. In forestland, 13,560,000

hectares are privately owned, 54.7%, 7,150,000 hectares

of national forest, 28.9% and 3,410,000 hectares of public

owned, 13.8%. 650,000 hectares of independent

administrative corporation.

By the areas, Hokkaido, North East and Chubu region

have heavy percentage of forestland. As to log production,

Hokkaido, North East and Kyushu are top three. Number

of forest management body is heavy in Hokkaido,

Miyazaki prefecture in Kyushu and Iwate prefecture in the

North East region.

Percentage of agricultural community reserves local

resources such as agricultural drainage, reservoir,

farmland and forestland increased since 2015. Percentage

of community to preserve forest resources increased from

22.8% in 2015 to 27.4% in 2020.

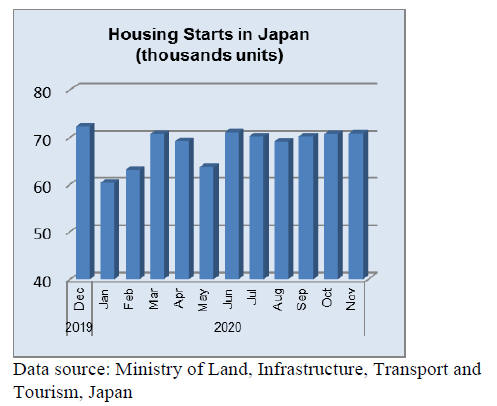

Active domestic lumber market

Domestic lumber market in Tokyo region has been firming

with active demand. As the housing starts did not drop as

much as initially feared, movement of lumber is getting

busy since late October. Sawmills are not able to increase

the production because of tight log supply. Supply of KD

cedar post, cedar stud and cypress sill and post is tight.

The prices of 3 meter KD cedar post were less than 40,000

yen in August but now they climbed to 48,000-50,000 yen.

4 meter KD cypress sill prices were 55,000 yen in August

but now they are up to 58,000-61,000 yen.

Compared to the bottom of last summer, the prices are

generally increased by 5,000-10,000 yen but sawmills

want to increase another 2,000- 3,000 yen because of high

log prices but the dealers say that the prices do not climb

despite supply shortage because total demand is about

10% less than last year so the demand has no strength to

push the prices further.

Post and sill moved actively in last two months so by order

of construction, purlin and girder should move in

December.

South Sea (tropical) logs

8,031 cbms of logs arrived in October, which is the last

shipment for Daishin Plywood, which will quit in March.

Other buyers have been using Daishin¡¯s ships to carry logs

jointly but it becomes difficult in 2021. The log importers

say that there will be two or three shipments of logs in

2021.

South Sea logs users need to switch to use veneer instead

of logs or use something other than South Sea logs.

Demand of Chinese and Indonesian made South Sea

laminated free board is very active in the market and the

suppliers plan to increase the prices.

Then container freight is climbing by supply shortage and

nobody know how high it would climb so the importers

are in a hurry to import as soon as possible. However,

demand at end users is not real active so if arrivals come

together, there would be over-supply.

North American logs

Export prices of Douglas fir logs of December shipment

for Japan are reported to stay unchanged after North

American lumber market prices plunged. Log market

prices in North American are firm and unchanged from

November.

Export prices are not so profitable for the suppliers but the

export prices for Japan increased successively for four

months from August to November. Compared to the

bottom of last July, the increase is US$140 per M Scribner

or by 17.1%.

Meantime, Douglas fir lumber prices in Japan are up by 5-

6% or 3,000 yen per cbm after the largest manufacturer

made price hike on square and other standard lumber but

the prices of the main product of KD beam remain

unchanged due to competition with European redwood

laminated beam.

The supplier considers protection of Japan market. Two

years ago, Douglas fir log FAS prices for Japan climbed

over US$1,000, which resulted in drop out of the second

largest Douglas fir lumber manufacturer in Japan. This is

bitter experience for the log supplier.

|