Japan

Wood Products Prices

Dollar Exchange Rates of 10th

December

2020

Japan Yen 104.02

Reports From Japan

More money to keep recovery on track

Japan's Cabinet has approved an additional economic

package worth 73.6 trillion yen (US$707 billion) to keep

the economy on a recovery track. The package includes

extensions of subsidy programmes aimed at promoting

domestic travel (currently suspended), spurring

consumption and helping companies maintain employment

as well as incentives for digitalization and carbon

reduction.The government estimates the stimulus

measures will boost Japan's GDP by around 3.6%.

To boost tourism and as a trial for the August Tokyo

Olympics, Japan plans to eventually accept small group

tours. In March a center for monitoring the health of

visitors from overseas will be established and visitors will

be required to register their passport numbers with the

center and report daily updates on their health condition

for two weeks.

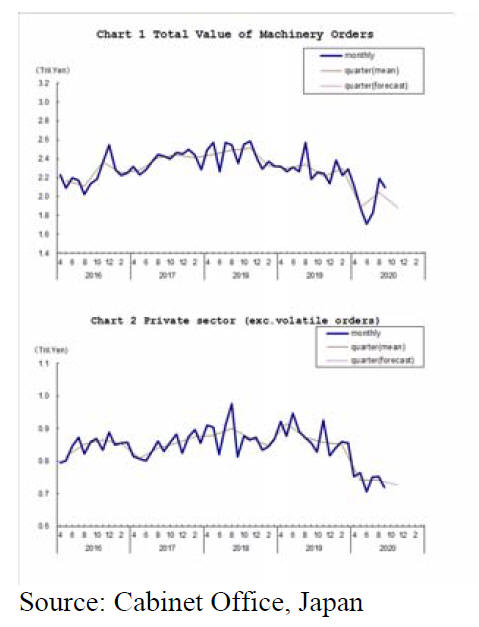

Forecast machinery orders

Orders for new machinery placed by Japanese companies

with Japanese makers are indicators of how businesses

perceive of short to medium term prospects. The latest

Cabinet Office survey of machinery orders received by

280 manufacturers operating in Japan fell by 4.4% in

September from the previous month on a seasonally

adjusted basis.

In the third quarter of this year there was an increase of

around 8% compared with the previous quarter with

October orders rising further and November orders rising

8%. There was a 22% rise in November orders from

overseas but domestic orders dropped 15% according to

the Japan Machine Tool Builders' Association.

The Cabinet Office has said for the final quarter of 2020

the value of machinery orders is forecast to decline.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2020/2009juchue.html

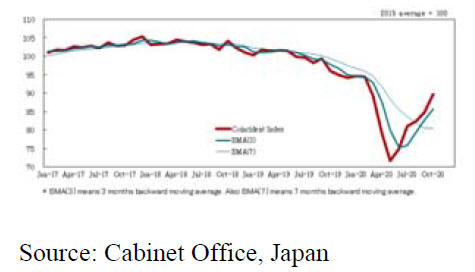

Business conditions improving says Cabinet

Office

The Cabinet Office index of business conditions for

November continued its upward trend rising 5 points from

the previous month to 89.7 against the 2015 base of 100.

The November month-on-month rise was the secondlargest

increase since records started in January 1985. The

business index reflects improvements in the Japanese

economy which has trended higher for 5 months.

See:

https://www.esri.cao.go.jp/en/stat/di/di-e.html

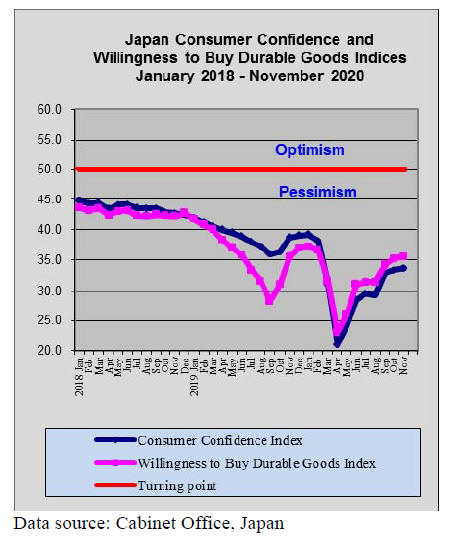

Consumer confidence up in November

Cabinet Office data shows consumer confidence in Japan

improved for the third consecutive month in November

but the pace of improvement slowed. The rapid rise in

coronavirus infections, especially towards the end of

November dented sentiment. The Cabinet Office

maintained it earlier assessment saying that consumer

confidence ¡°remains bearish but continues to show signs

of picking up.¡±

Of the four component indicators, overall livelihood and

income growth improved, while employment worsened.

The indicator on willingness to buy durable goods

remained unchanged.

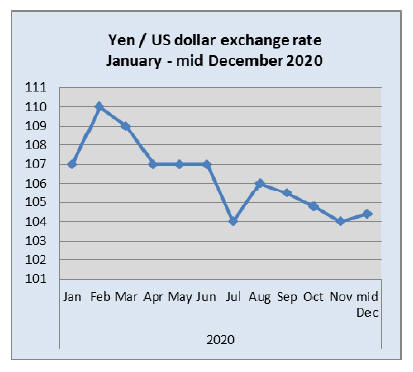

Yen holds steady against the US dollar

The yen/US dollar exchange rate has remained within a

very narrow range throughout the year. In early December

the dollar strengthened to above yen 104 as a result of

signals of a swift introduction of a corona relief package in

the US. Currently the yen remains steady at around 104 to

the dollar.

The yen/dollar exchange rate this month appears to have

been driven chiefly by stock movements rather than risk

sentiment.

Low interest rates and more time in the home

drives

interior improvements

As is happening in other countries the response of people

having to spend more time at home has been to focus on

making home more comfortable.

In Japan this has translated into spending on interior

improvements, new furniture and creation of home-office

spaces with purchases of office furniture. The current low

interest rates have provided an opportunity to finance

home improvements.

The housing market has got a boost from changes in tax

structures for home loan borrowers established to support

housing demand which has suffered due to the pandemic.

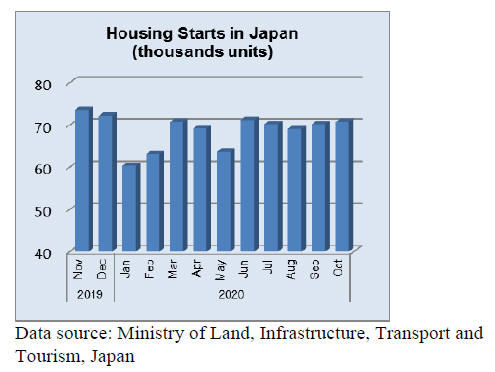

In the first nine months of 2020, housing starts in Japan

fell over 10% compared to the same period in 2019. In a

depressed market it has come as a surprise that the average

price of existing condominiums in Tokyo rose by around

4% in the third quarter of this year while the average price

of new condos fell by the same amount in sharp contrast to

the 14% increase last year.

See:

https://www.globalpropertyguide.com/news-japanshousing-market-remains-fragile-4161

Furniture imports

First 3 quarter 2020 imports

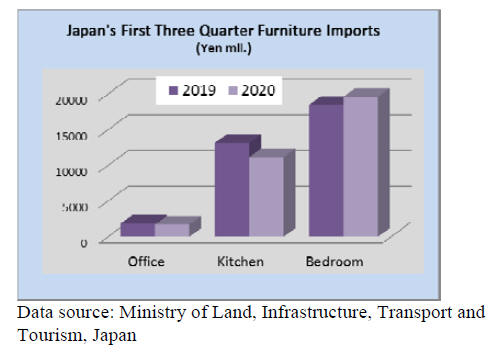

The decline in consumer spending on durable goods in the

first three quarters of this year impacted demand for

furniture but not by as much as expected. The value of

imports of wooden office furniture (HS940330) was down

8% from the same period in 2019. The lower than

expected decline could be explained by spending to adjust

home furnishing to the work-from-home style of work.

There was a much more severe decline in the value of

imports of wooden kitchen furniture (HS940340) in the

first three quarters of 2020 compared to the modest decline

in office furniture imports. The value of kitchen furniture

imports was down 15% year-on-year in the first three

quarters of 2020.

In contrast to the lower value of imports of both office and

kitchen furniture, imports of bedroom furniture

(HS940350) in the first three quarters of this year rose 6%

compared to the same period in 2019. One possible

explanation for the rise in imports/demand for bedroom

furniture is the trend among those foreseeing work-fromhome

continuing to relocate.

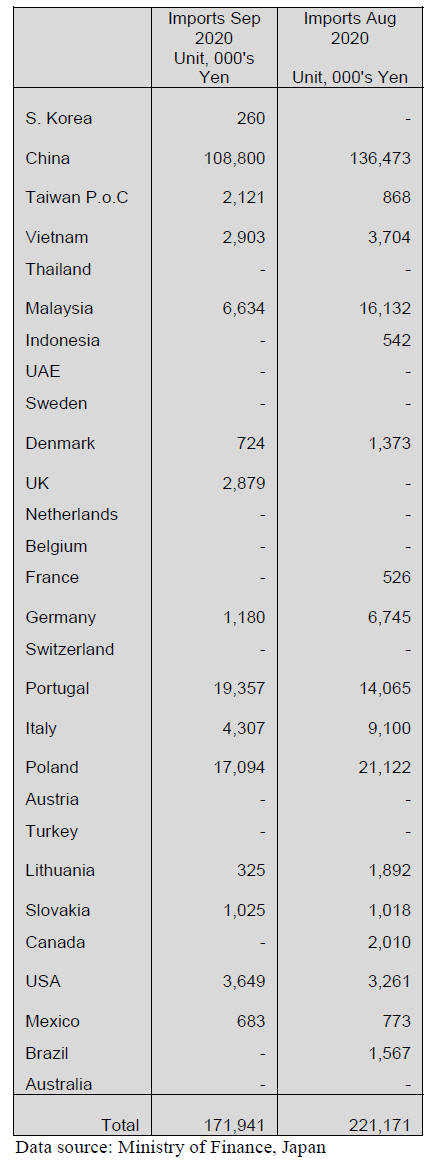

Office furniture imports (HS 940330)

September office furniture imports

Year-on-year the value of wooden office furniture imports

fell 5% but month-on-month the value of September

imports were down 22%.

The main shipper, China saw exports fall but still

accounted for 63% of all wooden office furniture imports

followed by Portugal (11% and Poland (10%). Malaysia

was within the top 20 shippers in August and September

but September exports to Japan dropped sharply.

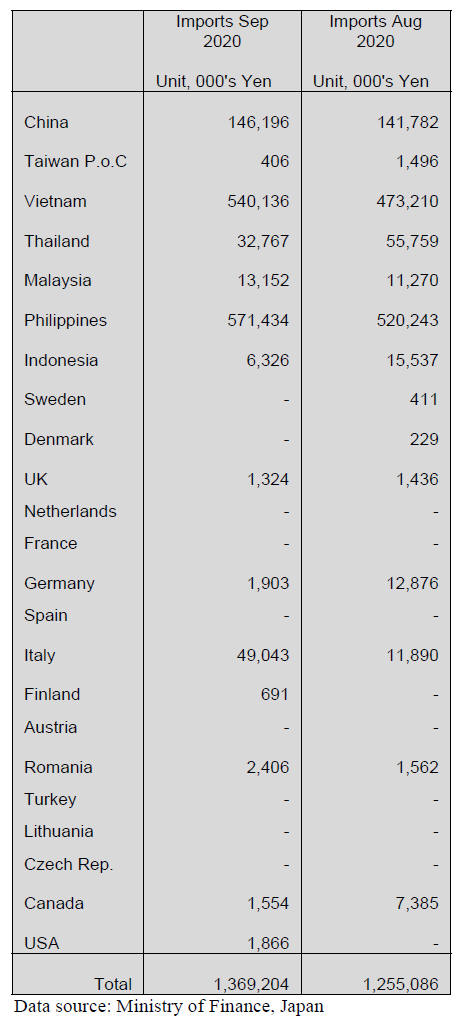

Kitchen furniture imports (HS 940340)

September kitchen furniture imports

Two suppliers, the Philippines and Vietnam accounted for

around 80% of the value of September imports of wooden

kitchen furniture into Japan. Other shippers appearing in

the top 20 were Italy (4%) and Thailand (3%).

Year-on-year, the value of September 2020 wooden

kitchen furniture imports were largely unchanged but

month-on-month there was a 9% rise in the value of

imports with exporters in Vietnam accounting for most of

the rise.

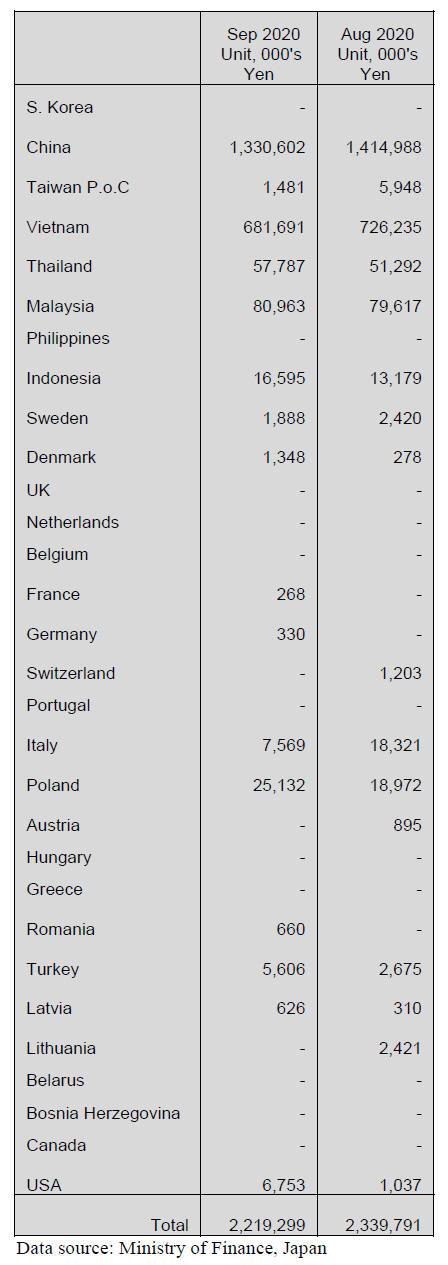

Bedroom furniture imports (HS 940350)

September bedroom furniture imports (HS 940350)

As indicated above, there was a rise in the value of

imports of wooden bedroom furniture in the first three

quarters of 2020.

Year-on-year the value of September imports was up

20%

while month-on-month the value of imports fell 5%.

There was a strong recovery in the value of imports

following the steep drop in the first quarter of this year. In

the second and third quarters the value of imports was

consistently higher than in the same period in 2019.

Around 90% of the value of September wooden bedroom

furniture imports is accounted for by those from China

(60%) and Vietnam (31%).

Malaysia once again features as a significant shipper in

September and has maintained its share of the value of

imports to Japan at around 4%.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal

published every two weeks in English, is generously allowing the

ITTO Tropical Timber Market Report to reproduce news on the

Japanese market precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

RCEP signed

Effective date is undecided yet but early start is aimed.

Duty will be reduced step by step on 91% of industrial

products and agricultural and marine products by

participating countries. RCEP was initially proposed by

ASEAN in 2011.

Main members are Indonesia, Malaysia, Singapore, Thai,

Philippines, Vietnam, Myanmar, Laos, Cambodia, Brunei,

India, Australia, New Zealand, Korea, China and Japan.

These nations cover about 50% of global population, about

30% of global GDP and trade.

Japan has concluded Japan-ASEAN EPA or TPP 11 with

13 nations except for Korea and China so for these 13

nations, duty on wood products will not be reduced or

abolished but China and Korea are two nations with EPA

for the first time. Japan imports 151.3 billion yen of

laminated lumber, wood products for construction and

kitchen parts from China a year and 1.7 billion yen of fiber

board, particleboard and lumber from Korea.

With RCEP, duty on 30 items from China and 63 items

from Korea are either reduced or abolished but they are

minor items so there is not much influence. Duty on major

items of plywood, lumber, laminated lumber and

particleboard is unchanged from current rate.

It is agreed with China that export duty of 2% on softwood

plywood, 3% on processed wood will be abolished after

11 years since RCEP effective date. For Korea, 8% duty

on wood products like window, door, beam and piling will

be abolished after ten years. This includes precut materials

so Japanese traditional post and beam style house export

will be promoted when they become duty free.

China stops import of Australian logs

The Chinese government stopped import of Australian

logs since early November. Reason is that log fumigation

is not satisfactory but true reason is recent deteriorating

political relationship between two nations.

About 2,800,000 cbms of Australian logs are imported to

China for the first eight months of this year. Annual

import volume would be about 4,000,000 cbms, which is

fourth largest source for China behind New Zealand,

Germany and Russia. By this measure, Chinese users look

for substituting sources and the most likely source is New

Zealand then Russia and European countries and possibly

Japan.

Export prices of New Zealand radiata pine logs for China

in November are US$123-125 per cbm C&F and

December prices seem to be higher because of supply in

New Zealand would decline due to Christmas vacation.

Then the prices would be much firmer if China wants

additional volume to replace Australian log supply.

It is reported that log inventory in Shanghai is three

million cbms, which is low compared to past level with

active shipments so the Chinese log buyers will be busy

looking for substituting supply sources.

Domestic logs and lumber

It is full log harvest season now but nationwide log supply

is less than usual years. Meantime, lumber orders have

been active in October and November so sawmills are

actively purchasing logs. Therefore, logs for lumber

manufacturing are tight everywhere and the prices are

firming.

There are sawmills, which are not able to run in full

capacity because of log shortage so lumber supply is tight.

Lumber delivery to precutting plants is tight-roping.

Sawmills are hurriedly intending to increase the sales

prices.

Lumber prices are higher than last summer but not high

enough to cover high log cost. Reasons of tight log supply

are price drop in summer, demand drop of logs and

plywood mills and wood chip plants continue curtailing

the production.

Cypress is firming everywhere. Cypress log prices have

been at high level with 19,000-20,000 yen per cbm. Cedar

log prices for post cutting are unchanged at 12,000- 13,000

yen but in Kyushu and Northern Kant where large mills

are, they are as high as 15,000 yen. Lumber demand now

is the most active after corona virus epidemic started in

last spring.

3 meter KD 105 mm post prices were less than 40,000 yen

until middle of August but they are now 48,000-50,000

yen with the highest spot price of 52,000 yen.

4 meter KD cypress105mm sill prices are 58,000-61,000

yen from bottom price of 55,000 yen in last summer. 3

meter KD cypress 105 mm post prices are now 57,000-

58,000 yen by sudden increasing orders from bottom of

50,000 yen in last summer. These seem to be ceiling

prices.

|