|

Report from

Europe

Rebound in UK imports continued in September but

prospects less certain

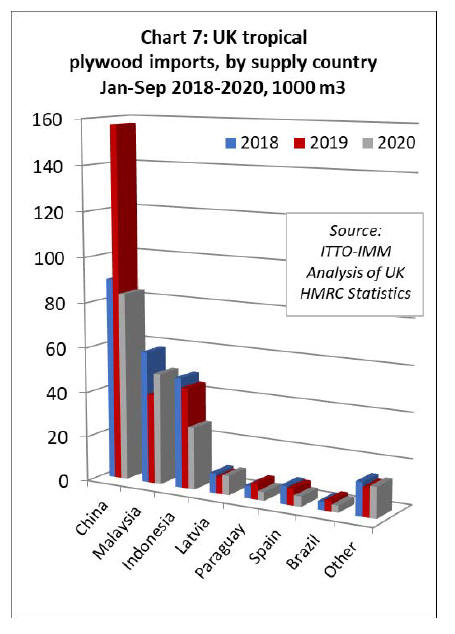

UK imports of tropical wood and wood furniture products

continued to rebound in September, with total value rising

to USD97.6 million, 30% more than the previous month

and the same level as in September 2019 (Chart 1).

UK imports strengthened significantly in the third quarter,

in line with the recovery in the broader economy and in

construction activity and the housing market as lockdown

measures eased during the period.

Prospects for the final quarter of the year are less certain,

with signs that the economic recovery is losing momentum

and the reintroduction of lockdown measures nationwide

in England from 5 November, due to last for at least four

weeks, in response to a sharp rise in COVID-19 cases.

Meanwhile, the Brexit transitional period comes to an end

on 31 December and according to the Economist,

reporting on 12th November, there is ¡°no trade deal in

sight¡±.

The Economists observes that ¡°talks are continuing, but

agreement is elusive on the most contentious issues: a

level playing-field for competition (including limits to

state aids), fisheries, and dispute resolution. Michel

Barnier, the EU negotiator, says the talks are not currently

on a path to a deal¡±.

The total value of UK imports of tropical wood and wood

furniture into the UK in the third quarter of 2020 was

USD245 million, 39% more than the second quarter of the

year.

However, import value in the third quarter of this year was

19% below the same period of 2019. Import value in the

January to September period this year was USD697

million, 27% less than the same period in 2019.

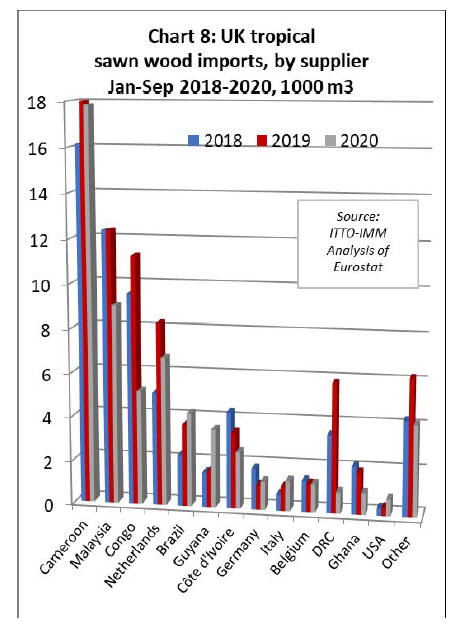

According to official UK statistics, GDP grew by 15.5% in

the third quarter as restrictions on movement eased across

June, July, August and September. Monthly GDP grew by

1.1% in September 2020, the fifth consecutive monthly

increase following a record fall of 19.5% in April 2020.

September 2020 GDP was 22.9% higher than its April

2020 low. However, it remains 8.2% below the levels seen

in February 2020, before the full impact of the COVID-19

pandemic. There was also a loss in momentum through the

third quarter of 2020 (Chart 2 above).

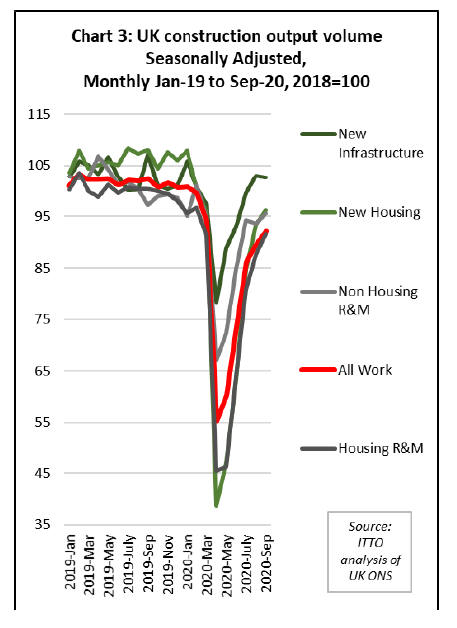

UK construction output volume rebounded strongly

between May and August this year following a record fall

of 41.2% in April. However the pace of recovery in the

sector slowed in September with growth of only 2.9%

during the month. The latest increase is being driven

primarily by new housing (Chart 3).

Despite recent recovery in the UK construction sector,

output in September was still 7.3% lower than the level in

February 2020 before the full impact of the coronavirus.

The infrastructure and private new housing sub-sectors are

the only components of construction to return to their peak

since February 2020.

On a quarterly basis, the UK construction sector grew by

41.7% in the third quarter this year following a record fall

of 35.7% in the second quarter.

UK tropical wood furniture imports gain momentum in

September

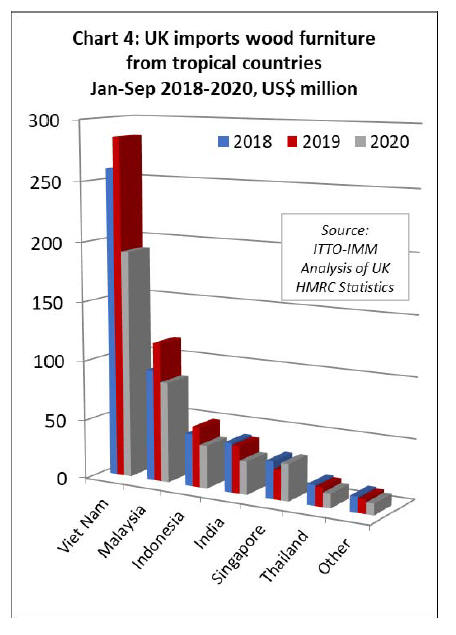

Overall UK imports of tropical wood furniture products in

the nine months to end September this year were USD392

million, 28% less than the same period in 2019. However,

imports gained momentum during September, rising to

USD55.3 million compared to USD43.9 million in August

and a low of only USD24.5 million in May during the first

lockdown period.

However, comparing the first nine months of 2020 with

the same period last year, UK imports of wood furniture

declined sharply from all the leading tropical supply

countries (Chart 4).

Imports from Vietnam were down 33% to USD191

million, imports from Malaysia fell 28% to USD84

million, imports from Indonesia declined 29% to USD36

million, imports from India fell 30% to USD28 million

and imports from Thailand were down 25% to USD12

million. In contrast, there was a 25% rise in imports from

Singapore, to USD31 million.

Recovery in value of tropical wood products

UK imports of all tropical wood products in Chapter 44 of

the Harmonised System (HS) of product codes in the

month of September were USD42 million, a significant

recovery from only USD31 million in the previous month

and well up on the historic low of only USD24 million in

June. Imports in September this year were 5% more than

in the same month of 2019.

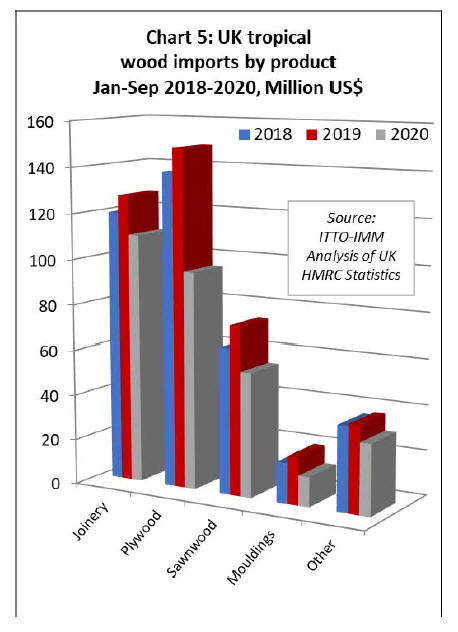

However, comparing the first nine months of 2020 with

the same period in 2019, total UK import value of tropical

wood products was, at USD305 million, 26% less than the

same period in 2019.

Import value of joinery products was down 14% at

USD110 million, tropical plywood was down 36% at

USD95.7 million, tropical sawnwood fell 26% to

USD54.7 million, and mouldings/decking declined 38% to

USD13.1 million (Chart 5).

Signs of recovery in UK imports of wooden doors from

Indonesia

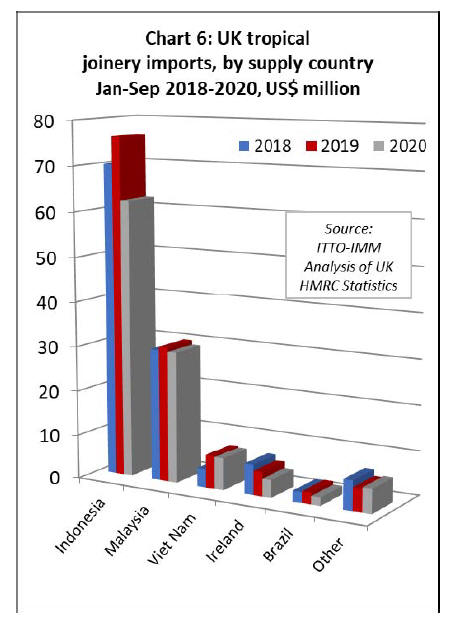

After making gains in 2019, UK imports of tropical

joinery products from Indonesia, mainly consisting of

doors, fell 19% to USD62 million in the first nine months

of this year (Chart 6). UK imports of wooden doors from

Indonesia made up ground in September after very low

imports in June, July and August.

After a strong start to the year, UK imports of

joinery

products from Malaysia and Vietnam (mainly laminated

products for kitchen and window applications) stalled

almost completely in May before recovering slowly in the

summer months and gaining momentum in September.

Total joinery imports in the first nine months were down

3% from both Malaysia and Vietnam, to USD29.4 million

and USD7.5 million respectively.

UK trade in joinery products manufactured from tropical

hardwoods in neighbouring Ireland have also fallen

dramatically this year, down 27% to USD3.9 million in the

first nine months.

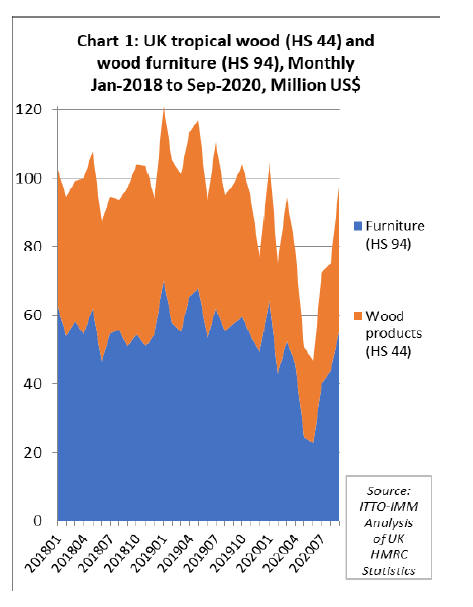

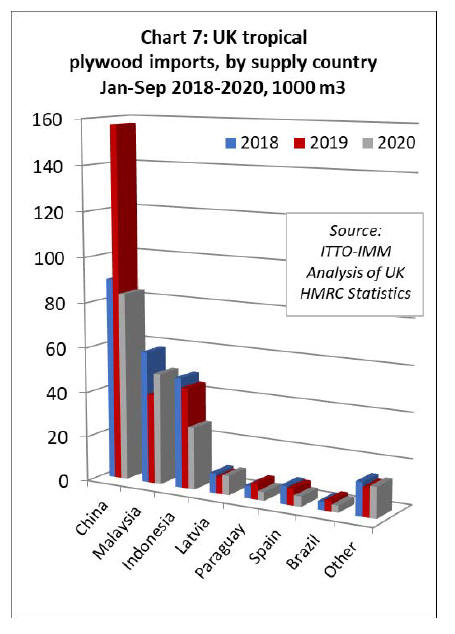

UK imports of tropical hardwood plywood from China

rising

The UK imported 83,500 cu.m of tropical hardwood faced

plywood from China in the first nine months of this year,

47% less than the same period last year (Chart 7). UK

imports of plywood from China ground to halt earlier this

year when China went into lockdown.

There were hardly any deliveries from February through to

early April and UK importers were forced to live off

inventories. However imports picked up during the

summer months, rising into September with the arrival of

significant volumes under delayed contracts.

Likely due to supply problems in China, UK imports

of

plywood from Malaysia, which were in long term decline

before this year, have recovered some ground during the

pandemic period. Despite significant slowing in May,

imports from Malaysia were still up 24% at 49,500 cu.m

for the first nine months of the year.

In contrast to Malaysian plywood, UK imports of

Indonesian plywood fell 39% to 27,500 cu.m in the first

nine months of the year. In addition to supply problems

during the pandemic, Indonesian plywood has come under

very intense competitive pressure from Russian birch

plywood this year.

UK imports of tropical hardwood plywood from South

America declined in the first nine months of this year,

down 44% from Paraguay to 3,900 cu.m and down 44%

from Brazil to 3,100 cu.m.

In recent years, the UK has been importing small volumes

of tropical hardwood plywood from Latvia and Spain. In

the first nine months of 2020, imports increased 13% to

8,500 cu.m from Latvia but fell 38% to 4,600 cu.m from

Spain.

UK tropical sawn hardwood imports recover ground in

the third quarter

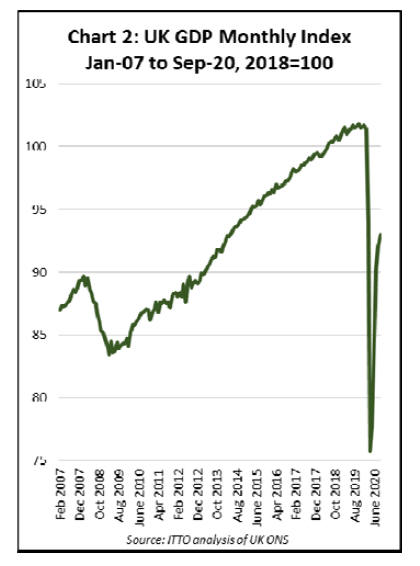

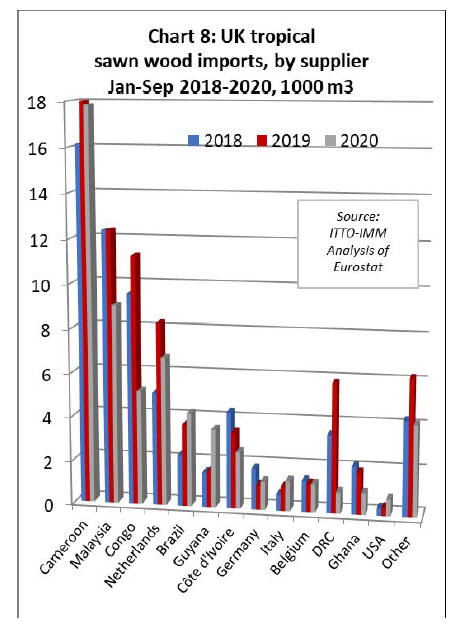

The UK is now a relatively minor market for tropical sawn

hardwood, importing less than 100,000 cu.m in each of the

last two years, making it only the fifth largest European

importer for this commodity (after Belgium, Netherlands,

France and Italy).

While the UK trade in sawn tropical hardwood fell sharply

in May and June this year, there was some recovery in the

third quarter, particularly from Cameroon and Latin

America. However imports were still down from most

major supply countries by the end of September (Chart 8).

UK imports from Cameroon, the leading supplier, declined

sharply in June this year to just below 1000 cu.m for the

month, but rebounded strongly to an average of 2600 cu.m

per month in July, August and September.

Total UK imports from Cameroon in the first nine months

of the year were down only 4% compared to the same

period in 2019.

In contrast to Cameroon, UK imports from other African

supply countries have been extremely slow this year,

declining sharply during the first lockdown and yet to

show any signs of recovery.

In total in the first nine months of the year, imports from

the Republic of Congo declined 54% to 5,200 cu.m,

imports were down 25% to 2,600 cu.m from Côte d'Ivoire,

down 84% to only 976 cu.m from DRC and down 48% to

985 cu.m from Ghana.

UK imports from Malaysia were 9,000 cu.m in the first

nine months of 2020, 27% less than the same period in

2019. However imports from Malaysia, having fallen to

just 315 cu.m in June (which surely must be an all-time

monthly low for this trade), had recovered to 1356 cu.m

for the month of September.

The UK imported 6,750 cu.m of tropical sawnwood

indirectly via the Netherlands in the first nine months of

2020, 19% less than during the same period last year.

However, there was significant growth in this indirect

trade in 2019 and imports so far this year are higher than

in the same period in 2018.

UK imports of sawn tropical hardwood from South

America, although still limited, have been more buoyant

this year than in 2019 despite the pandemic. Imports from

Brazil increased 14% to 4,200 cu.m in the first nine

months of 2020, with particularly good volumes arriving

in July before falling away in August and September.

UK imports from Guyana increased 113% to 3,550 cu.m

in the first nine months of the year with reasonably

consistent volume averaging around 600 cu.m arriving

each month since April. The UK is currently the only

European country importing commercial volumes of wood

from Guyana on a regular basis.

STTC Conference - tropical wood contribution to green

recovery in Europe

The core theme of the online 2020 Sustainable Tropical

Timber Coalition (STTC) Conference, due to be held

online on 19 November, will be how the sustainable

tropical timber sector can take the opportunity of and

contribute to a post-pandemic reboot of the global

economy on cleaner, greener lines.

In introducing the Conference, STTC - an alliance of

industry, business, government and NGOs dedicated to

increasing European demand for verified sustainable

tropical timber - notes that:

¡°the priorities of businesses worldwide are shifting due to

the economic uncertainties caused by the Covid-19

pandemic. Many are in survival mode. At the same time,

there is growing appreciation across industry, amongst

politicians and societies more broadly that we should not

aim simply to go back to business as usual. In line with

such strategies as the EU Green Deal and as stated among

others by the new European Green Recovery Alliance of

NGOs, businesses and politicians, the goal should be a

lower environmental impact new normal. The focus is

increasingly on establishing a sustainable circular

bioeconomy¡±.

The circular bioeconomic model will be a central STTC

Conference topic; how it operates, its benefits and how the

timber sector and the tropical timber sector in particular

can form a key component of a bioeconomic future.

Perspectives will come from circular economy specialists,

producer countries, urban authorities and bioeconomic

business innovators.

STTC Conference speakers will examine the wider effects

of the pandemic, notably, by underlining our

interdependence and vulnerability, the renewed focus it

has put on that other global crisis facing us ¨C the climate

emergency. The EU Green Deal will also be discussed,

with its pledges to support deforestation-free value chains,

restore biodiversity, eliminate net EU greenhouse gas

emissions by 2050 and boost efficient use of resources by

moving to a clean, circular economy.

The event will include presentations, panel discussions,

question and answer sessions and delegate thematic

sessions. One of the keynotes will be delivered by Lee

White, Minister of Water and Forestry in Gabon,

responsible for the implementation of the announcement

by President Ali Bongo in 2017 that all Gabonese forests

have to be certified for sustainable forest management by

2022.

Another keynote will be delivered by Hugo Schally, Head

of Sustainable production, products and consumption, DG

Environment, who is coordinating and developing the

European Commission¡¯s work on the links between trade

and environment as well as on deforestation and forest

degradation.

The STTC Conference is free of charge and takes place

online on Zoom from 09.00am to 13.00pm CET on

Thursday November 19. For registration:

See:

http://www.europeansttc.com/19-november-2020-onlineconference-holding-the-line/#tab-id-1

|