Japan

Wood Products Prices

Dollar Exchange Rates of 10th

November

2020

Japan Yen 104.70

Reports From Japan

Third wave imminent

The number of coronavirus infections in Japan from July

to September was four times higher than the figure for

March to May. Although Tokyo still accounts for most of

the new cases virus hotspots are emerging in many

prefectures. It would appear that Japan is about to

experience a third wave of infections and that the numbers

of infections could exceed those in the period of the

second wave.

The Japan Medical Association has urged the government

take action before it's too late. However the Prime

Minister remains undecided on declaring a state of

emergency or reviewing the "Go To Travel" (subsidized

travel) campaign.

Manufacturers more optimistic but jobs disappearing

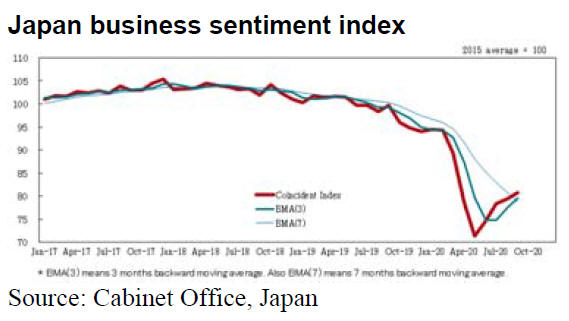

The Cabinet Office survey of business conditions in Japan

has reported an upswing leading government analysts to

talk of signs of recovery even as the country appears set

for a serious third wave. The survey also signaled that

retail sales remained sluggish and the job market

worsened. Business sentiment among Japanese

manufacturers and service-sector firms was the least

pessimistic in nine months in November.

In related news, the Japan Center for Economic

Research

has reported Japan's real gross domestic product expanded

1.1% in September from the previous month due to

increases in domestic and external demand.

Housing investments rose 1.3%, while consumer

spending

climbed 0.8%. Japan's exports increased over 5% driven

by car sales to the US.

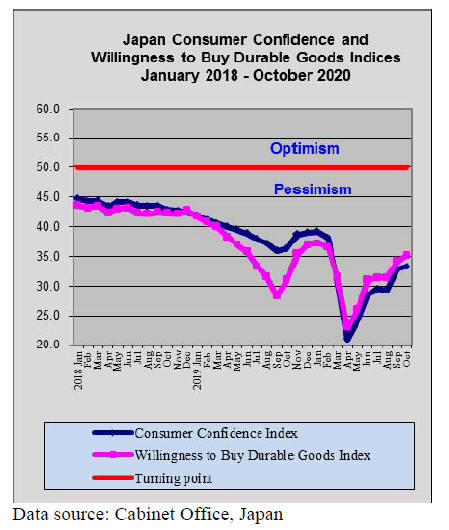

The latest data on household spending shows that there

was a 10% decline in September year on year. This

marked the fourth largest decline so this year and came as

real wages dropped for the seventh consecutive month.

The high year on year September decline was exaggerated

because in September 2019 consumers rushed to buy

goods in advance of the consumption tax increase in

October of that year which pushed up spending.

However, the economy is beginning to revive after the

worst postwar slump in the second quarter of the year as

exports have increased. The government is expected to

announce the plan for extra stimulus measures by the end

of November.

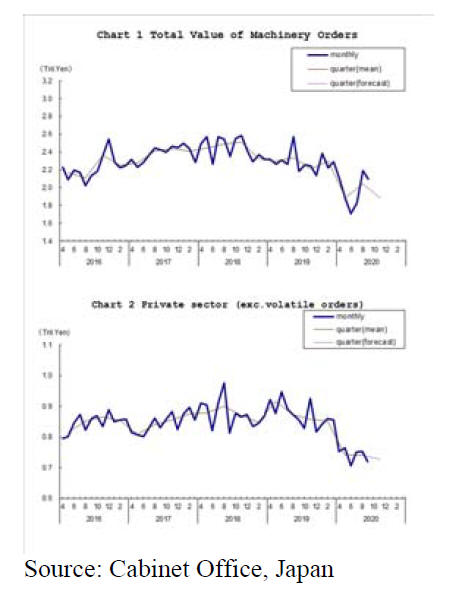

Manufacturers cut back on machinery orders

The value of orders for machinery by Japanese

manufacturers, a gauge of economic prospects, fell by

4.4% in September from the previous month.

In the July-September period orders increased almost 8%

compared to the second quarter. In the final quarter of

2020 it has been forecast that there could be a further

decline in private-sector orders.

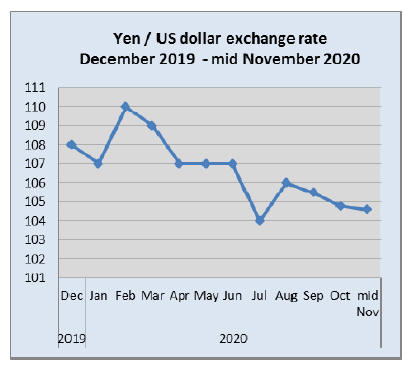

Yen steady despite uncertainty in US

election outcome

The Bank of Japan (BoJ) is monitoring foreign exchange

rates following Joe Biden¡¯s victory in the US presidential

election as there is concern that uncertainty will drive

inflows to the yen which would undermine export growth

upon which the Japanese economy is very dependent.

After Trump¡¯s surprise victory in the 2016 US presidential

election the yen strengthened drastically. This time round

there has been some inflows to the yen but there has been

only a modest strengthening to around 104 to the dollar

from about 105 prior to the US election result.

Land prices fall ¨C first drop in 3 years

According to the Land, Infrastructure, Transport and

Tourism Ministry average prices for land in Japan fell this

year the first decline in three years as the pandemic caused

a drop in demand for commercial properties.

The rapid growth in the tourism sector pushed up demand

for commercial land prior to the pandemic and average

land prices had been moving higher for the first time in 27

years since the collapse of the country¡¯s bubble economy

in the early 1990s. If the pandemic is not brought under

control in the coming months land prices may fall further.

Kengo Kuma and Associates (KKAA)

an architectural firm in Japan has designed asemi-open

and temporarily placed pavilion for events which can be

deconstructed and moved. The designers used a steel

frame as the structure¡¯s base over which CLT panels were

overlaid to create a multi-paneled façade. The CLT panels

were made from Japanese Cypress.

See:

https://www.yankodesign.com/2020/11/13/a-glitteringtimber-pavilion-in-tokyo-is-preparing-for-a-journey-back-hometo-the-hiruzen-mountains/

Import update

Furniture imports

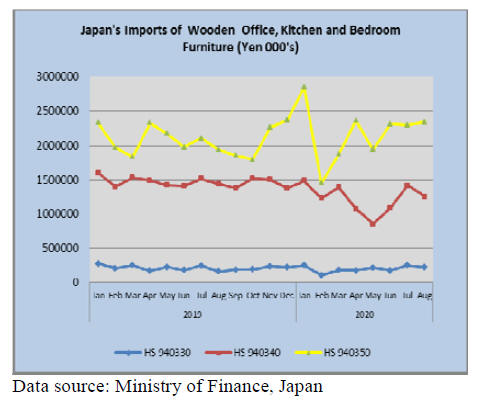

With available data on the value of furniture imports for

the first 8 months of the year it is possible to gauge the

impact of the pandemic. Imports of wooden office, kitchen

and bedroom furniture (HS940330/40/50) fell as could be

expected as economic activity was curtailed because of a

lock-down and because consumers stopped spending in the

early days of the pandemic.

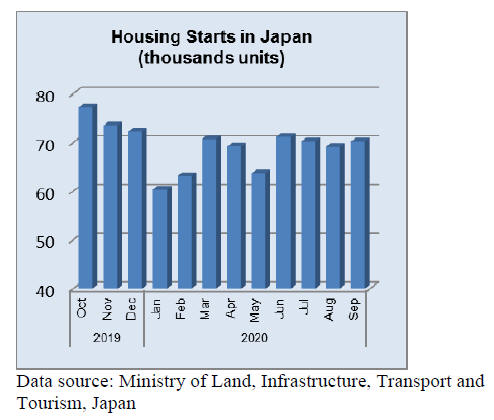

Imports of bedroom furniture recovered quickly in the

second quarter of the year but it was not until the third

quarter that imports of wooden kitchen furniture started to

recover. With the adoption of ¡®work-from-home¡¯ culture

demand for office furniture held up well and imports

increased from the end of the first quarter.

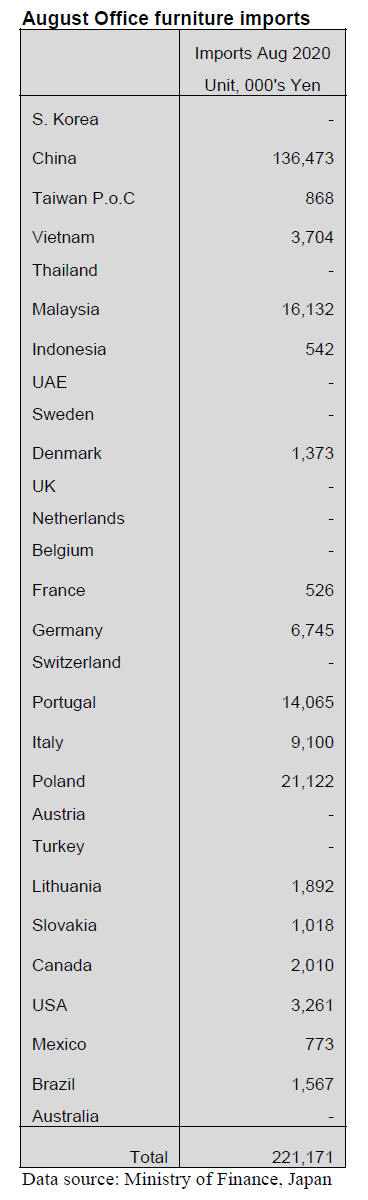

Office furniture imports (HS 940330)

The value of Japan¡¯s August imports of wooden office

furniture (HS940330) marked a correction with a 12%

month on month fall. Year on year, wooden office

furniture imports are up 45% which probably reflects the

new and well established ¡®work-from-home¡¯ culture.

For the past 5 years China, Poland and Italy have

been the

main shippers of HS 940330 but recently sourcing has

become more diversified and in August exporters in

Malaysia secured a 7% share of the value of imports, up

by a factor of x8 from July and the best performance so

far.

As was the case in previous months, China secured

the

largest share of imports at 62% followed by Poland with

an almost 11% share with Portugal and Malaysia making

up most of the balance.

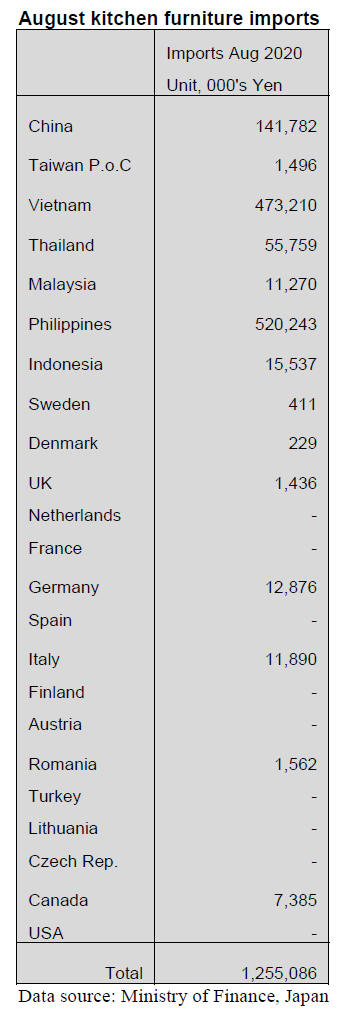

Kitchen furniture imports (HS 940340)

Three suppliers, the Philippines, Vietnam and China once

again captured the largest share of Japan¡¯s imports of

wooden kitchen furniture HS 940340 but all three saw the

value of shipments in August fall both month on month

and year on year. Japan¡¯s imports of wooden kitchen

furniture fell 13% year on year and by 11% month on

month.

Exporters in the Philippines accounted for 41% of Japan¡¯s

August imports, Vietnam 38% and China 11%. Imports

from Thailand double giving Thai shippers a 4% share of

the value of August imports.

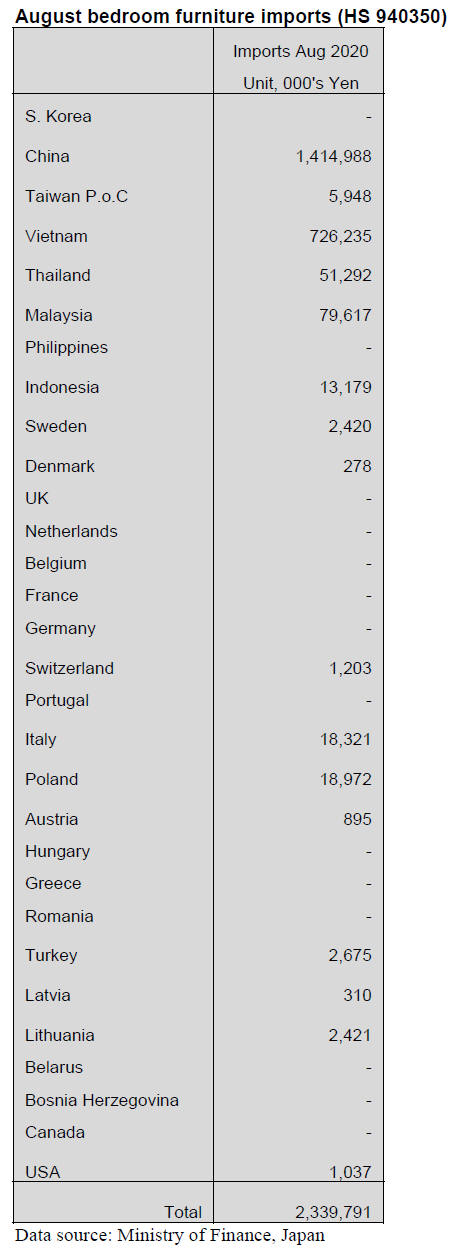

Bedroom furniture imports (HS 940350)

Year on year, the value of Japan¡¯s August imports of

wooden bedroom furniture HS 940350 was up over 20%

and there was a modest (2%) month on month increase.

Shipments from manufacturers in China and Vietnam

accounted for over 90% of August wooden bedroom

furniture imports with China providing 60%, about the

same as in July and Vietnam 31%, up on July imports. SE

Asian exporters in Malaysia and Thailand between them

secured around 5% of the value of August imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Struggling plywood mills in Malaysia and Indonesia

There are successive mill operations of Malaysian and

Indonesian plywood manufacturing plants. Climbing labor

cost puts pressure on management then plywood export

prices for Japan continue depressed then came corona

virus epidemic so they are cornered in predicament.

Shing Yang, the largest plywood manufacturers in

Sarawak, Malaysia stopped one mill¡¯s plywood

manufacturing and became veneer producing 0lant in last

July. Shing Yang produces about 40-50,000 cbms a month

of plywood by three plants, out of which 20,000 cbms are

for Japan market. Another major plywood manufacturer,

WTK closed down one of three mills.

In Indonesia, two companies stopped the operation at the

end of August. Both companies were producing about

5,000 cbms a month of .thin plywood, floor base and block

board for Japan market. Even running mills are forced to

reduce the production. Reason of stop of operations is

climbing producing cost by higher labor cost. In

Indonesia, minimum wage has been increased every year.

In last January, it was raised by 8.5% all over Indonesia.

In Malaysia, many plywood mills reply on migrant

workers from Indonesia and when the wage in Indonesia is

raised, Malaysian mills need to match the wages to have

them stay in Malaysia. Poll tax is necessary to hire

Indonesian workers in Malaysia so rising labor cost is

becoming heavy burden to plywood mills. Also log

procurement is becoming difficult not only by weather

factor but harvest restriction by environmental reasons so

log cost has been rising.

With these reasons, plywood mills in both countries suffer

deterioration of profit margin. To improve it, they have

tried to increase the export prices for Japan market but to

no avail by depressed market of Japan. In particular, the

orders from Japan decreased after the corona virus

epidemic in 2020 and the governments restrict movement

of people between countries and states in Malaysia and

Indonesia, which makes hard to secure labor force. Under

this situation, many plywood mills decided to shut-down.

Rainy season this year started in September, two months

earlier than normal years. Log cost would climb in rainy

season so there will be more mills shutting down in the

fourth quarter.

Log demand in China

World wood market got chaotic by outbreak of corona

virus and impacted import of export of wood products.

Large wood consuming country of China suffered the

same and log import in the first half of 2020 decreased but

arrivals of beetle damaged European logs are steady and

the demand recovered in the second half. Percentage of

imported logs is high from Russia and New Zealand then

European beetle damaged logs are becoming another

major source.

In 2019, logs from New Zealand are about 17-18 mil.

cbms, about 3% more than 2018 and logs from Russia are

5-6mil. cbms, 27% less. European logs are estimated about

7-8 mil. cbms, 470% more.

Removal of beetle damaged logs is priority matter in

Europe and more volume is expected in next year and on.

Despite corona virus epidemic, European supply sources

prefer to sell to China probably because of prices.

Meantime, Russian logs declined because of export duty

and logs from the U.S.A. decreased triggered by the trade

war between two countries.

In the first half of 2020, New Zealand logs decreased by

more than 25%, Russian logs decreased by more than 30%

and logs from the U.S.A. contracted by more than 45% as

both supplying countries and China suffered extreme

slowdown of economic activities to fight with corona

virus.

European logs are big relief for China but total softwood

log import in the first half of 2020 is more than 16% less

than the same period of 2019.

World market recovered after the summer and log demand

in China got active so that New Zealand radiate pine logs

for China increased both in volume and price to make up

slow first half.

Russian supply in future is uncertain after the president

Puchin mentioned to ban export of logs and semi-finished

wood products after 2022. To supplement Russian supply,

China would increase import of New Zealand radiate pine

and European beetle damaged logs.

Plywood

Tight supply of domestic softwood plywood continues and

shortage feeling is spreading. Regular orders are filled

without any problem but additional spot orders need

minimum of one week waiting for delivery. Tightness was

on particular items like thick panels but now standard

commodity item of 12 mm takes time.

In particular, in Western Japan, orders from Kyushu are

busy for restoration of typhoons and heavy rain damages

so delivery takes time but now even in Tokyo market,

orders from precutting plants are climbing so immediate

delivery is getting difficult. Market prices are tightening

and low offers are gone.

The manufacturers seek for timing to increase the

prices to

the level before the prices weakened. Distributers are

prepared to hear price hike proposal in any day.

Imported South Sea plywood in Tokyo market suffers

several short items. Record low arrivals results in rapid

decrease of port inventories. With dull movement, dealers

procured short items in distribution inventory but now

standard plywood and 12 mm concrete forming panel and

structural panel are getting tight rapidly.

Domestic logs and lumber

Log supply is increasing gradually with higher log prices

since last August but the supply is not getting enough

compared to normal years so log supply is not enough all

over Japan so log prices continue climbing in the regions

where large sawmills are like Kyushu and Northern Kanto.

Particularly in Northern Kanto, where is close to

consuming market of Tokyo, increase of log prices is

conspicuous. By higher log cost, sawmills have been

asking higher lumber sales prices so lumber sales prices

have started climbing since middle of October but log

price increase is much faster than lumber price hike.

Normally in every year, log supply increases in October

and November but low log prices since last spring, which

discouraged log suppliers so this year¡¯s log supply in fall

is much less than normal years and sawmills aggressively

procure logs. 3 meter post cutting cedar log prices in

Northern Kanto are 16,500 yen when the prices in other

regions are about 12,000-13,000 yen. 4 meter sill cutting

cypress log prices are 19,000-20,000 yen all over Japan,

which is the highest in one year.

Lumber demand is increasing particularly for nonresidential

buildings so impact of COVID-19 is not as bad

as initially feared. Since sawmills and lumber dealers have

been asking higher prices for more than a month, lumber

prices are finally firming. 3 meter KD cedar 105 mm post

prices are about 48,000 yen and 4 meter KD 105 mm sill

are about 58,000 yen.

With uncertain future market, there is no speculative

purchase with high prices. Sawmills continue to suffer

high log cost and not high enough lumber sales prices.

Honda Lumber developed water repellent plywood

Honda Lumber (Tokyo) and Meiwa Sangyo (Tokyo) have

developed new type of Vietnamese plywood for crating.

This is named ¡®water and mold block plywood for

packaging¡¯. Water repellent and anti-mold agent Sumika

Environmental Science developed are sprayed over

plywood.

Six months is assumed for period of use from

manufacturing plywood in Vietnam, shipping to Japan,

spraying process and opening of packages at the

destination.

Normally packages are covered with blue plastic sheet to

prevent from rain water but with this process, such works

are not necessary so that labor cost is saved and helps keep

cargoes inside package from getting wet even if packages

are left for long time by congestion.

This project started by request of large logistic company

and they plan to keep the inventory at major ports like

Yokohama, Moji, Nagoya and Hakata and by customers¡¯

request, the inventory will be stored at other ports like

Sendai, Osaka and Kobe.

For the time being, handling volume will be about 450

cbms a month. Initially, they are sold to the company

requested to make this product then it will start marketing

in open market since 2021.

|