4.

INDONESIA

Furniture and handicraft exports to

US and EU beat

expectations

Indonesia continues to see growth in wood product exports

to the US despite the impact of the global pandemic. The

Minister of Environment and Forestry has indicated that

exports to the US rose around 16% year on year in the

period January to October 2020.

The good performance of Indonesia’s wood products

sector is not confined to exports to the US as January to

October exports to the EU were also higher by around

10% year on year.

Indroyono Soesilo, Chairman of APHI (Asosiasi

Pengusaha Hutan Indonesia), applauded the changes in tax

and non-tax regulations introduced by the government in

order to contribute to increasing exports.

For example the government has lowered the export duty

on exports of from 15% to 5%. In addition to relaxing

tariffs, the government has adjusted regulation and duties

on processed merbau, white meranti and yellow meranti.

See:

https://foresthints.news/forestry-exports-to-us-retain-positivegrowth-despite-covid-19/

and

https://ekonomi.bisnis.com/read/20201025/9/1309487/eksporveneer-kini-hanya-dikenakan-tarif-5-persen

The Furniture and Handicraft Association has indicated

that output from the furniture sector is recovering despite

the ongoing impact on demand of the pandemic. This is in

contrast to the situation in the first quarter of the year

when orders collapsed.

Regina Kindangen from HIMKI said that the Association

members appreciated the stimulus measures provided by

the government to SMEs in the home decor and furniture

sectors.

Regina continued saying SMEs are currently experiencing

better times even though Indonesia is experiencing

economic recession as it sees consumers in the importing

countries have a high degree of willingness to spend on

furniture and handicrafts. The domestic sector should get a

boost from adoption of the Omnibus Law through which

the government intends to reduce imports of goods that

can be made domestically.

See:

https://bisnis.tempo.co/read/1400365/pandemi-globalmulai-terkendali-kinerja-ekspor-industri-mebelpulih?page_num=2

and

https://ekonomi.bisnis.com/read/20201029/257/1311072/industri-mebel-dan-kerajinan-mulai-siuman

In related news, the Ministry of Trade has set a benchmark

export price for processed meranti wood products. This

determination was made after the Ministry of Finance

amended export duties for certain dimensions of meranti.

Details are in Ministry of Trade Regulation Number 86 of

2020.

See:

https://bisnis.tempo.co/read/1399872/mendag-tetapkanharga-patokan-ekspor-kayu-olahan-meranti/full&view=ok

Panel sector hard hit by pandemic

The Indonesian Wood Panel Association (Apkindo) has

said the Indonesian wood panel industry has been is hard

hit by the impact of the pandemic and forecasts that

production this year will be down by nearly a quarter.

Panel production in the first nine months of the fell 24% to

2.35 million cubic metres. Adding to the concern of

Apkindo is the decline in export prices.

Gunawan Salim, speaking for Apkindo, noted the

pandemic and heavy rains which disrupted harvesting and

log transport drove down production levels. He suggested

the pandemic will continue to impact production and

demand throughout the second half of this year. Demand

for wood panels, especially in the traditional Japanese

market, has been trending down.

Another trade investigation may open door for

Indonesia

The US government is currently conducting an

investigation of Vietnamese wood product exports and the

Indonesian Ambassador to the US, Muhammad Lutfi, said

this was a good opportunity for Indonesian exporters to

expand market share in the US.

The Ambassador reported that the Indonesian Embassy in

Washington had created a mechanism to bring together US

importers and Indonesian exporters.

See:

https://rmco.id/baca-berita/ekonomi-bisnis/52914/indonesialirik-ekspor-kayu-ke-as

Take advantage of GSP says Minister

The extension of the Generalised System of Preferences

(GSP) facility announced by the US government in

October is expected to drive increased rattan product

exports to the US according to the Minister of Trade, Agus

Suparmanto.

Indonesian rattan product exports in the first 8 months of

this year reached US$357 million a decline of 4%

compared to the same period in 2019. The main export

markets are the US with an export share of 41% .followed

by the Netherlands (8%) and Germany (7%).

See:

https://www.validnews.id/GSP-Diharap-Geliatkan-Ekspor-Rotan-SSS

In related news the government is urging SMEs to take

advantage of the GSP facility to increase exports to the

US. The Minister of Cooperatives and SMEs, Teten

Masduki, said the extension of the GSP facility by the US

comes at a time when Indonesian SMEs need all the help

they can get.

The Ministry will assist with international certification

support including product certification by the US Food

and Drug Administration (FDA) and the US Ministry of

Agriculture. It will also offer incentives for SMEs whose

products qualify for the GSP.

See:

https://nasional.kontan.co.id/news/pemerintah-dorongumkm-manfaatkan-fasiltitas-gsp-tingkatkan-ekspor-ke-as

5.

MYANMAR

Continuing impact of

COVID-19

The economic impact of the second wave of the COVID-

19 pandemic has been more severe on Myanmar

businesses than the first wave, according to the latest

World Bank survey of the private sector. The survey, the

fourth in a series of eight planned, was conducted in

September and covered 500 firms.

Despite COVID-19, domestic investments for fiscal 2019-

20 were more than Kyat 1.88 trillion, which is around

Kyat 200 million higher than in the previous fiscal year.

Approval was given to over 130 Myanmar businesses to

invest in nine sectors during the period. The Bank report

says in fiscal 2019-20, over 23,000 jobs were created as a

result of Myanmar domestic investments.

Revenue rates for private plantation and community

forest logs

The Forest Department has announced revenue rates

(royalty fees) for the logs, posts and poles harvested from

plantations and community forests. Teak and padauk logs

attract the highest rate at 1500 Kyats (About US$1.15) per

cubic ton and for other hardwoods rates are as low as 3-

500 Kyats per cubic ton. The rate for logs from

community forestry is chargeable at double the rate for

plantation logs.

Data release in transparency push

The Ministry of Natural Resources and Environmental

Conservation (MONREC) website provides information

on the conservation, forest governance and trade data for

the past 5 years.

According to the information on the website there are

79,151 acres of private plantations, 111,490 acres of stateowned

plantations and 519,250 acres of community

forests. In addition, 1,292,486 trees have been replanted

in the past three years.

From the available data it can be roughly interpreted that

timber industries purchased logs at a value of around

US$578 million from MTE and exported products at a

value of US$882 million.

On 12 November the Myanmar Timber Enterprise sold

about 4,100 tons of Inn-Kanyin logs and the price varies

from US$500 to 735 per ton.

Japan to assist with Dawei Special Economic Zone

It has been reported that the Japanese government has

offered to participate in the development of the Dawei

Special Economic Zone (SEZ) according to U Myint San,

Vice Chair of the SEZ management committee.

Myanmar is hoping for financial and technical support

from Japan to begin construction of the long-delayed SEZ

which is expected to be one of the largest in South East

Asia and eight times larger than the Thilawa SEZ in

Yangon.

The new SEZ will be located 20 kilometres north of

Dawei, capital of Tanintharyi Region in Myanmar’s

southeast coast bordering Thailand.

Myanmar election

Myanmar peacefully concluded its general election on 8th

November and the National League for Democracy (NLD)

party secured a majority.

6. INDIA

Agricultural sector

could save the economy

The Indian economy was hit hard by the Covid-19

pandemic in the first half of 2020. Projections from the

IMF suggest India’s GDP growth is expected to contract

over 10% in 2020, one of the steepest contractions among

emerging markets.

But a revival could come from one of its ‘invisible’ and

often-least report sectors, agriculture. There is a growing

awareness in the country that this year‘s harvest will be

above average because of favourable weather and this will

put extra money into the hands of farmers and disposable

incomes.This good news is in contrast to the situation

facing companies in urban areas which are struggling to

boost their sales devastated by the pandemic.

Consumer confidence sharply down

The Reserve Bank of India’s consumer confidence survey

in September showed that for the third consecutive month

more people were pessimistic about economic prospects.

The consumer confidence index was at a record low of

49.9% in September.

The Ministry of Finance recently introduced measures

aimed at lifting consumer spending but economists have

questioned if the new measures can spur long-term

growth. One measure which could help the timber sector is

the extensive, interest free long-term loans offered by the

state governments for infrastructure spending.

According to Jahangir Aziz, head of emerging markets

economics at JPMorgan “What India needs right now is

income support so that when the infection becomes more

manageable and restrictions are lifted, consumers and

businesses would have the financial stability to borrow

and invest.”

See:

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/CCS09102023E6F5FCA08F4C4BAB9F599F5D9DC754.PDF

and

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1663722

High freight rates and container shortage – Ministry in

discussion with shipping lines

India’s Ministry of Commerce recently met with

representatives of container shipping lines to discuss the

current container shortage and rising freight rates. This

comes close behind action by the US and Chinese

authorities aimed lowering record high freight rates on the

trans-Pacific route.

The Federation of Indian Export Organisations said freight

charges have increased between 30-50% on some routes

and that disruption of container movements, which caused

a shortage of capacity, was partly to blame. In the period

April-September 2020 India’s exports declined 17% while

imports fell 35%.

See:

https://www.hellenicshippingnews.com/indian-ministry-tomeet-container-shipping-lines-oct-21-amid-calls-to-addresssevere-shortage-high-rates-sources/

Government shops not to sell imported goods

The Indian Ministry of Defense is aiming to ban the sale

of thousands of imported items at its stores (Canteen

Stores Department - CSD) as part of efforts to promote

domestically manufactured goods under the

‘Aatmanirbhar Bharat’ scheme.

The CSD runs one of the largest retail store chains in India

with over 3,500 stores across the country. In a government

order in October the Ministry of Defense stated that

meetings had been held with the three Services and with

those from the CSD to advance the Atmanirbhar

Bharat, known internationally as the ‘Made in India’

movement.

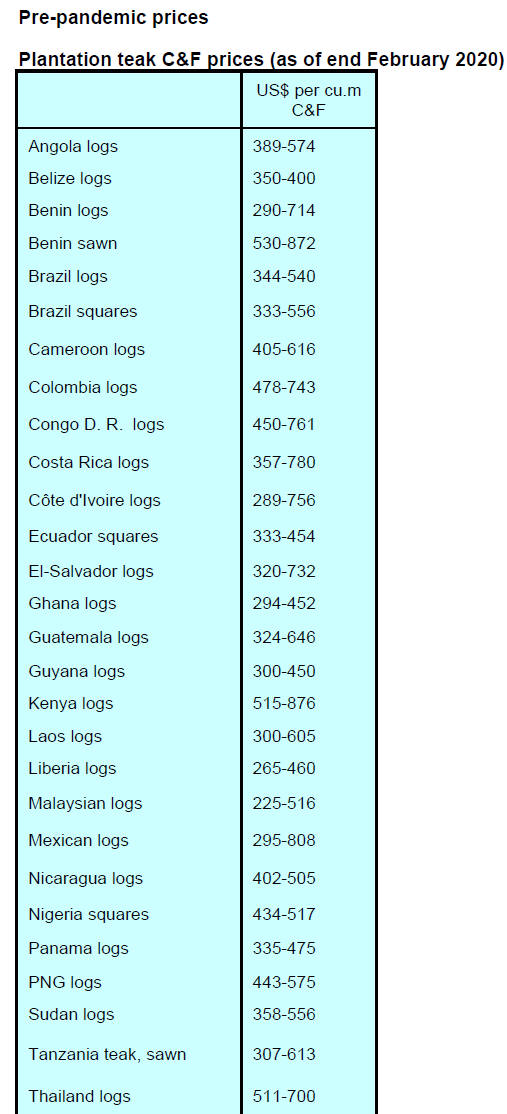

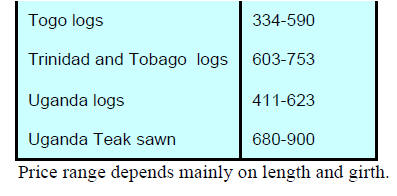

Plantation teak stocks drop pushing up prices

Retail prices for wooden furniture, particularly teak items

have risen by 10-15% over the past few months even as

demand weakened due to the impact of the pandemic

lockdown.

The Times of India quotes the president of Kandla Timber

Association as saying prior to the pandemic there were

around 5,000 containers of teak arriving at Indian ports but

this number has fallen dramatically creating a steep drop

in teak stocks.

The Times reports “the Kutch’s timber industry, India's

biggest timber production hub, is facing acute shortage of

teak wood after it resumed operations since the unlock.”

See:

http://timesofindia.indiatimes.com/articleshow/78004216.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

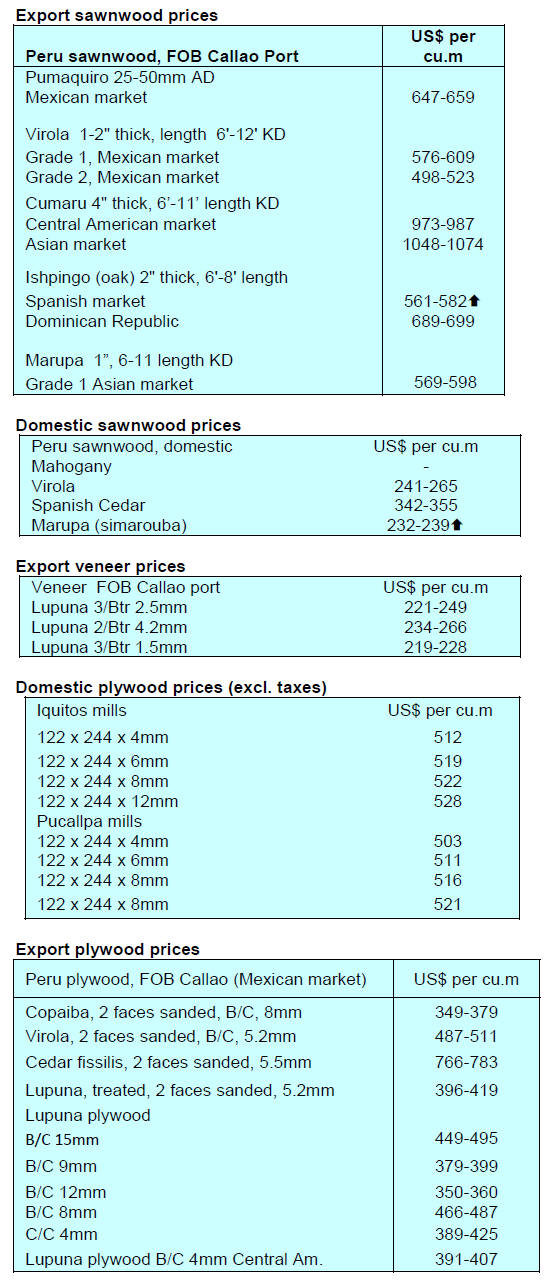

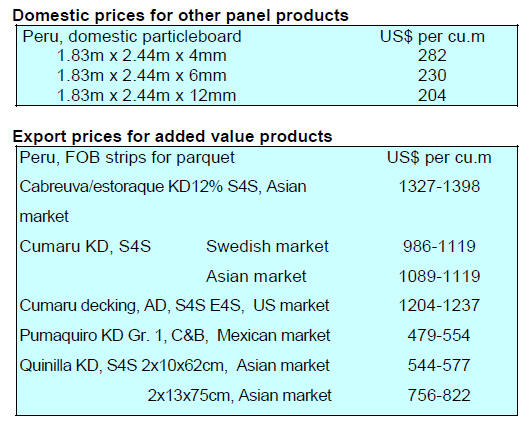

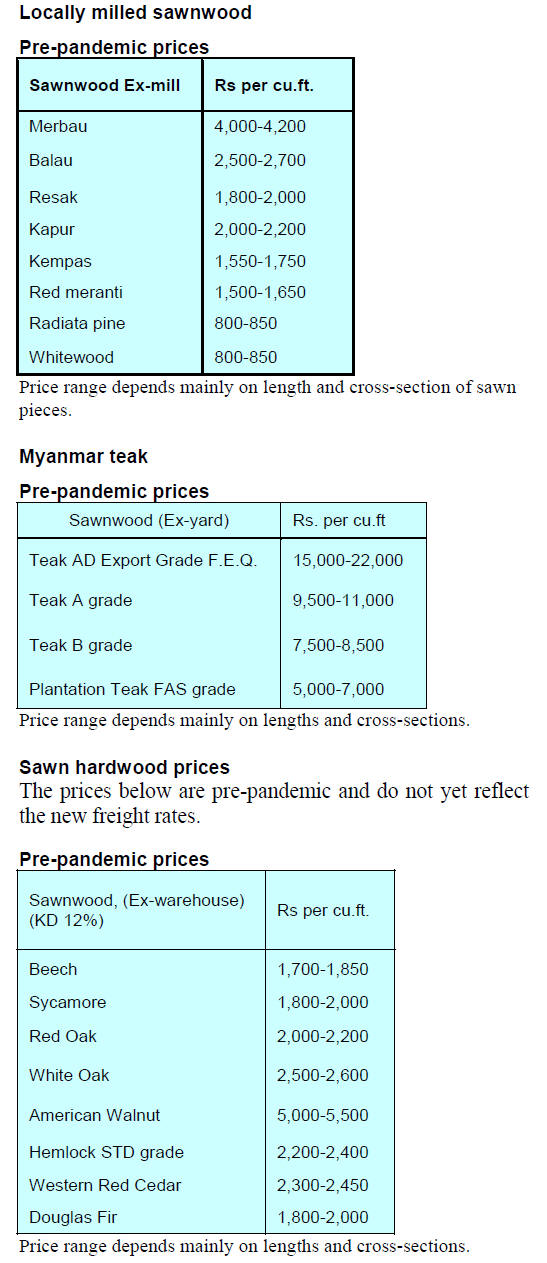

Under the present circumstances it is difficult to provide a

clear picture of plantation teak C&F prices. The price

indications below do not reflect the changing freight rates.

7.

VIETNAM

Vietnam signs

emissions reduction agreement

The Ministry of Agriculture and Rural Development

(MARD) and the World Bank (WB) - the trustee agency

of the Forest Carbon Partnership Facility (FCPF) have

signed an Emissions Reduction Purchase Agreement

(ERPA).

The FCPF will pay Vietnam US$51.5 million if the

country fully implements its commitments, under which

the north-central and central provinces of Thanh Hoá,

Nghệ An, Hà Tĩnh, Quảng Bình, Quảng Trị and Thừa

Thiên-Huế are to reduce CO2 emissions by 10.3 million

tonnes in the period 2018-2024.

MARD must periodically report on the volume of

emissions after it is confirmed by an independent

international agency after which payments will be made

for the purpose of developing sustainable forests and

forestry land management.

Deputy Minister of Agriculture and Rural Development

Hà Công Tuấn said the payment for results-based

emissions reduction is part of efforts to implement the

reduction of greenhouse gas emissions in line with the

Reducing Emissions from Deforestation and Forest

Degradation (REDD+) international framework.

See:

https://vietnamnews.vn/environment/803826/viet-nam-wbsign-emissions-reduction-purchase-agreement.html

Private sector commitment on development of

Vietnam’s timber industry

On 9 November 2020, in Ho Chi Minh City,

representatives of multiple associations signed the

Commitment on Sustainable and Responsible

Development of Vietnam’s Wood Industry. This

Commitment represents a comprehensive package of

actions toward sustainable and responsible development of

the wood industry sector of Vietnam.

The associations that signed the commitment were; the

Vietnam Timber & Forest Products Association and 7

affiliated associations, including the Vietnam Timber and

Forest Product Association, the Binh Duong Furniture

Association, the Handicraft and Wood Industry

Association of Dong the

Forest Products Association of Binh Dinh, the

Handicraft and Wood Industry Association of Ho Chi

Minh City, the Thanh Hoa Timber and Forest Product

Association, the Vietnam Plywood Association and the

Vietnam Wood Chips Association.

Vietnam has emerged as a major wood and wood product

producer and exporter and the private timber sector

players realise that timber legality assurance across the

entire supply chain is vital to business development. In

September this year the government issued Decree No.102

regulating the implementation of the Vietnam – EU

Agreement on Forest Law Enforcement, Governance and

Trade (VPA/FLEGT).

With the signing of this Commitment Vietnamese timber

enterprises have demonstrated determination to support

government efforts to sustain Vietnam’s position as a

leading producer and exporter of wood products. The

document signed commits the signatories to:

strictly comply with Decree No. 102/2020/ND-CP

Decree (VNTLAS Decree) dated September 1,

2020 of the Government on Viet Nam Timber

Legality Assurance System (VNTLAS) to assure

all activities relating to importing, exporting,

harvesting, transporting, buying, selling and

processing of wood products are legally

implemented.

support the Government of Vietnam in enhancing

inspection and supervision of imported wood,

especially tropical wood imported from

risky/non-active geographic areas set out in the

VNTLAS Decree.

request all members of the associations to strictly

comply with VNTLAS Decree; absolutely not to

use risky wood for manufacturing wood products

to meet demands from local and overseas

markets.

call on the corporate community to promote the

use of locally planted wood and wood imported

from low risk sources; priority is given to wood

harvested in certified forest.

promote the development of the domestic market

in the direction of using legally sourced wood,

enhance wood traceability, transition from risky

imported wood to locally planted wood as well as

that of wood products made of locally planted

wood and low risk imported wood.

request the Government of Viet Nam to issue a

public procurement policy towards completely

eliminating risky wood species from public

procurement, giving priority to products made of

plantation wood.

closely collaborate with related authorities to

detect, prevent and avoid commercial fraud and

investment circumvention in wood industry

sector, solicit transparent and responsible trade

and investment operations to generate higher

value for the wood sector.

call on the business community and relevant

stakeholders to join hands in building a

sustainable forestry, enhancing the protection of

natural forests, conserving biodiversity,

encouraging the expansion of certified forest and

supporting the development of improved

livelihood for forest reliant communities.

To proceed with the implementation of this Commitment,

each association will develop a road-mapped Action Plan

and allocate sufficient resources for its effective

implementation.

These Action plans will include the following

components:

(1) Collaborate with State’s authorities to propose,

counter-audit and implement related mechanisms and

policies effectively;

(2) Advocate training and provide information for

member businesses, encourage business association,

including links with tree growers and micro-business

households from wood villages;

(3) Coordinate with media and relevant stakeholders for

long-term communication campaigns aimed at improving

images of the wood industry in production, trade, markets

and products development, contribute to promote the

development of a responsible and legal Vietnamese timber

industry and a sustainable forestry sector.

The leaders of the committed associations have reiterated

their statement “WE SAY NO TO ILLEGAL TIMBER”.

As an immediate step in the implementation of the

Commitment and a joint effort to overcome the severe

damage caused by the natural disaster in the central

Vietnam in October – November this year, the signatories

have decided establish Green Vietnam Fund.

See:

https://goviet.org.vn/bai-viet/doanh-nghiep-che-bien-go-noikhong-voi-go-bat-hop-phap-9204

Export update

Vietnam’s wood and wood product exports increased

further in October 2020. In the first 10 months of 2020

export earnings from wood and wood product exports

totalled US$9.8 billion (14% up year-on-year), while

wood and wood products imports stood at US$2.0 billion

(-3% year-on-year).

At the end of October 2020 the export of wood and wood

product plus non-wood forest products from Vietnam were

valued at US$ 10.3 billion.

8. BRAZIL

Evolving Standards for wood products

The Brazilian Association for Mechanically Processed

Timber (ABIMCI) has reported significant progresses in

the standardisation of timber products.

As the coordinator of the Brazilian Wood Committee (CB-

31) of the Brazilian Association of Technical Standards

(ABNT), ABIMCI focuses on establishing minimum

performance standards for wood products with the aim of

expanding market acceptance.

In October this year technical standards for sawnwood,

wooden doors and wooden-frames were published. Rule

ABNT NBR (Brazilian Technical Standard) No.16864

consolidates an important stage in the process of

developing a standard for sawnwood which aims to

establish its greater use in civil construction, in the

packaging segment, for furniture and for general use.

The committee for wooden doors approved part 3 of

ABNT NBR 15930 that refers to wooden doors for

buildings and deals with doors with special characteristics,

including requirements for acoustic door, fire resistant and

accessibility.

For the wood-frame construction standard one of the main

demands and expectations of the wood sector is in relation

to the development of the standard for wooden houses

(light wood frame).

The expectation of ABIMCI is that the national

consultation, an official stage in a process for the

preparation of a technical standard (NBR) that allows

interested parties to evaluate the proposed contents and

present suggestions/contributions will take place this year.

Operation Green Brazil extended

Operation ‘Green Brazil’ (Operação Verde Brasil) aimed

at combating illegal deforestation and forest fires in the

Amazon with support of the Armed Forces began in May

2020 and has been extended until April 2021.

The government decided to send troops to the region in

order to take action against those committing

environmental crimes. According to the Brazilian

government, R$ 400 million was allocated to the

Operation and there is unspent funds to allow the

extension.

The National Institute for Space Research (INPE) has

reported that forest fires in the Amazon in 2020 have

already exceeded those from the previous year. According

to INPE, 89,604 hot spots were detected by satellites so far

this year. In 2019, 89,176 were detected.

INPE´s deforestation alert system has reported that

deforestation in the Legal Amazon registered 964 sq. km

in Septembert his year, down 34% from September 2019.

That follows a 27% decline in July and a 21% decline in

August compared to 2019 when deforestation in the region

hit the highest level since 2008.

The alerts were made by the Real Time Deforestation

Detection System (Deter), which emits signals of changes

in forest cover for areas larger than 3 hectares, both for

areas that are fully deforested and for those in the process

of forest degradation.

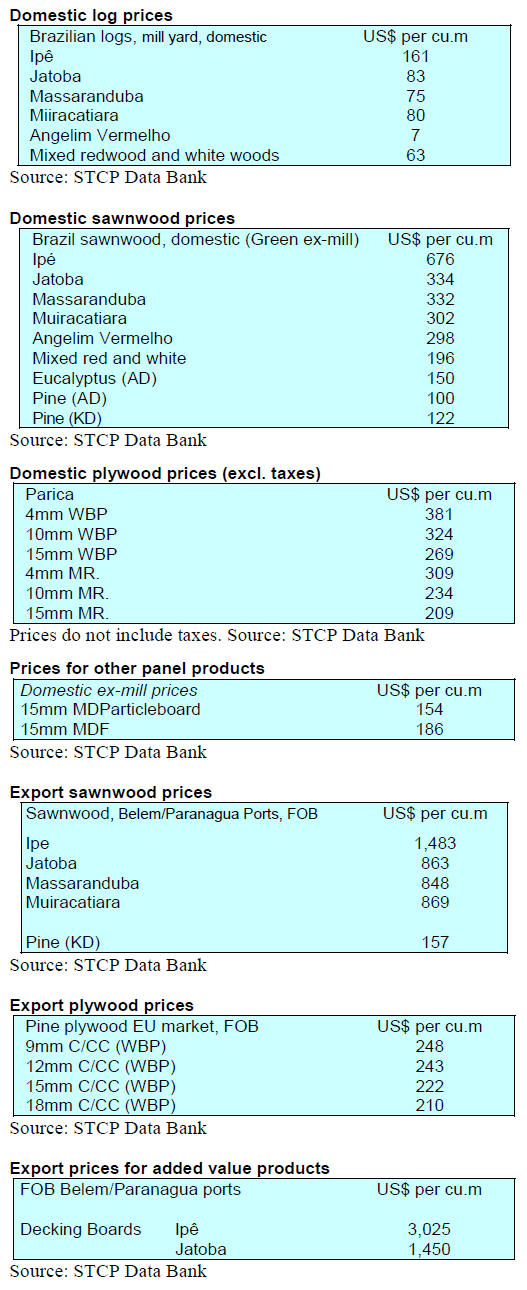

Domestic demand recovering and exports of most

wood products rising

At the beginning of the pandemic there were forecasts of

reductions in domestic demand and exports, notably of

solid wood products. The expectation was for a decline in

domestic and international demand for all forest products

throughout 2020 and into 2021.

After six months and with the pandemic affecting 30

million people, the scenario is markedly different from

that forecast. The Brazilian domestic market is already

showing signs of recovery with resumption of civil

construction and exports of most wood products have

increased.

Although there was a drop in exports for some products,

overall there was growth in the first seven months of this

year. Exports of veneers stand out although export

volumes are still small. However, other products such as

non-coniferous roundwood exports increased 23% year on

year to a record 700,000 cu.m.

International demand for wooden doors expanded over

20% with some 70% of exports going to the US. Exports

of value-added products were expected to be severely

impacted by the pandemic but this proved wrong. The

pandemic did affected exports at the beginning of the year

but the situation has changed dramatically over the past

two or three months.

Comparing August 2020 with the same month in 2019

exports of tropical plywood almost doubled, pine plywood

exports were up 45% and pine sawnwood exports

increased 68%. However, furniture exports have not yet

recovered.

This picture is totally different from that foreseen at the

beginning of the pandemic when a 30% to 40% reduction

in Brazilian exports of solid wood products was projected.

Source: Revista Referência Florestal (October, 2020)

https://www.yumpu.com/en/document/read/64591979/outubro-2020-referencia-florestal-223

Furniture exports fall even with favorable exchange

rates

With less than two months left to the end of 2020,

Brazilian furniture exports have not risen as in some other

producer countries despite the highly favourable exchange

rate which has clearly benefitted wood panel exporters. In

the case of furniture, 2020 is expected to end with export

earning at about the same level as in 2017, that is around

US$650 million.

Between January and September 2020 furniture exports

totalled US$465.2 million, 10% less than in the same

period of 2019. The main exporters are concentrated in the

southern region of the country. The states of Santa

Catarina, Rio Grande do Sul and Paraná together account

for 80% of total exports with half of this coming from

Santa Catarina.

Among the states that exported over US$1 million in the

first 9 months of the year Rio de Janeiro in the south

eastern region, showed the greatest expansion a doubling

of exports going from US$929,000 to US$1.9 million

dollars. At the other extreme is the state of Pernambuco in

the north eastern region of Brazil where exports dropped

38%.

9. PERU

Forest concessions study in the

final stage of

preparation

The National Forest and Wildlife Service (SERFOR) is in

the final stage of finalisation of its study on the

functioning and effectiveness of the timber forest

concession model from the economic, financial,

sustainability and legal perspectives so as to develop an

improved model for Peru.

It has been more than 15 years since government held

public tenders for forest concessions. Over this time more

than 800 concessions were granted covering an area of

about 10 million hectares.

For the preparation of the study, information dating back

15 years was collected on concessions in Loreto, Ucayali

and Madre de Dios. This data has been ordered, analysed

and will be reported online.

The study will make it possible to understand how the

forest structure has been impacted and what measures

must be taken in order to improve the ecological

sustainability of forest concessions.

Participation of women in the forestry sector

In order to evaluate the participation of women in the

forestry sector the National Forest and Wildlife Service

(SERFOR) reported on a study ‘Challenges of female

employment in the forestry sector: a first approximation’

prepared through cooperation with the German GIZ.

The report contains testimonies of the situations of women

who work in the forestry sector and their difficulties in

participating in this area especially in the forest use stage.

It concludes with proposals for a public policy to improve

working conditions and raise awareness among institutions

on the role of women in forestry. The report recommends

that companies would do well to recruit more women

professionals.

ADEX: forest plantation plan needed

A report by the CIEN-ADEX Global Business and

Economy Research Center indicates that the pandemic will

result in around one million jobs being lost so that it is

vital that economic activities be stimulated.

The timber sector is identified as one where economic

reactivation should be focused. According to figures from

the ADEX Data Trade Business Intelligence System in

2019 Peru exported wood products worth US$124 million

by way of contrast exports from Chile were worth over

US$5 billion despite the country having only 17 million

ha. of commercial forests.

The Center reported that over the past 50 years around ten

million hectares have been deforested in Peru with most

being the consequence agricultural expansion. The current

challenge is to fully value forest resources as they have

enormous potential.

ADEX reported that some 3 million ha. of degraded land

in Ucayali, Huánuco, San Martín, Loreto and Madre de

Dios has been abandoned by migrant farmers and ranchers

and suggested medium and long-term financing plans are

needed for the implementation of forest plantations in

these areas.