|

Report from

Europe

EU27 tropical timber imports stronger than expected

so far in 2020

Total EU27 (i.e. excluding the UK) import value of

tropical wood and wood furniture products was US$1.98

billion between January and August this year, 14% less

than in 2019. This is a significantly higher level of import

than forecast earlier in the year with the ¡°Great

Lockdown¡± having a severe impact on the wider EU27

economy and on the supply side in tropical countries.

The fact that EU27 trade in tropical wood timber products

was cooling even before the onset of the COVID-19

pandemic makes this performance even more remarkable.

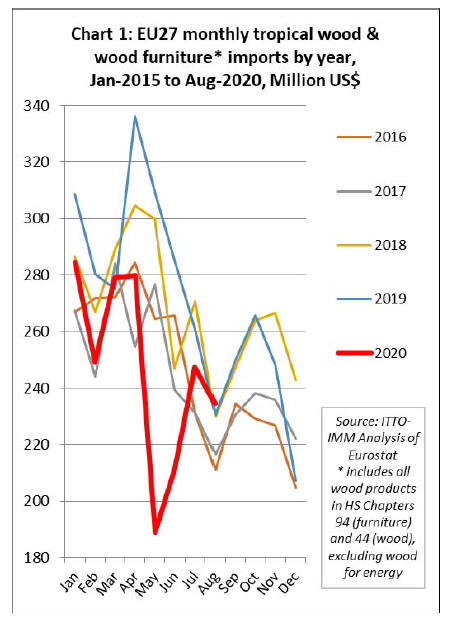

Chart 1, which shows the value of EU27 imports of

tropical wood and wood furniture products each month

during the last five years, highlights that while imports fell

sharply in May this year there was a very strong rebound

in June and July. Although imports declined again in

August, they were at a five year high for that month

(which is typically very slow during the European summer

vacation period).

The continued relative buoyancy of trade is probably

partly due to the strength of the DIY sector in the EU27

during the lockdown with many people taking the

opportunity to carry out home improvement work. In some

EU27 countries with less stringent lockdowns, such as the

Netherlands and Sweden, commercial construction and

manufacturing activity also continued, at a slower pace but

without interruption throughout the spring and summer

months.

With the easing of lockdown measures from May onwards

and boosted by the introduction of large government

stimulus measures, the economy picked up across the

EU27 in the third quarter. Official GDP figures have yet to

be published (due early November), but according to

projections by Barclays an 11.5% rebound of euro area

economic activity is expected in the third quarter, led by

Spain (17.9% q/q) and France (16.8% q/q). Barclays

projections for third quarter rebounds in Italy (12.5% q/q)

and Germany (8.2% q/q) are less dramatic but only

because the initial downturn in the second quarter was

more muted.

EU27 imports have also been given a boost by the relative

strength of the euro on international exchange markets, the

euro-dollar rate rising sharply from less than 1.10 to nearly

1.20 between May and August.

The dollar¡¯s weakness is due to uncertainty in the run up

to the presidential elections and the severity of the

pandemic in the United States.

More serious challenges emerging for the EU27

economy

However, it remains to be seen whether the recovery in

EU27 imports will be sustained as there are, once again,

serious challenges emerging for the European economy.

The relative strength of the euro is already creating a

headache for the European Central Bank which is

becoming alarmed at the impact on export competitiveness

of EU27 manufacturers at a time when other factors are

weighing down heavily on demand.

Meanwhile, the second waves of COVID infection across

Europe have grown to be larger than the first and have led

to renewed lockdowns which now threaten a final quarter

economic contraction. Assessing the impact of the new

lockdown measures is difficult because, unlike six months

ago, they are now more regional, or targeted, sectorspecific

and time¨Climited. However, they are adding to an

already uncertain economic climate.

Forward looking indicators show that economic

momentum in the EU27 is likely to get worse before it

gets better. October registered a third consecutive monthly

decline in the Euro Area Purchasing Managers Composite

Output Index, down 1.1 points to 49.4 and taking it back

into contractionary territory (any score below 50 indicates

that a majority of those surveyed recorded a decline in

purchasing).

The latest PMI data for eurozone construction is also not

encouraging. IHS Markit, who undertook the survey,

commented in their 6th October report that ¡°The PMI

results for September show that the eurozone construction

sector remained stuck in contraction as builders struggled

to secure new work amid the COVID-19 outbreak.

The survey pointed to broad-based declines across

housing, infrastructure and commercial projects. In line

with increases in coronavirus cases, and the potential for

stricter restrictions to be imposed, a rebound in the nearterm

seems unlikely. In fact, eurozone builders remained

pessimistic about growth prospects¡±.

IMF forecasts published in October now suggest that euro

area GDP will decline 8.3% this year followed by growth

of 5.2% in 2021. Of the largest economies, prospects are

strongest in Germany, with a 6% decline forecast for this

year to be followed by 4.2% growth next year.

The French economy is forecast to fall 9.8% this year

followed by 6% growth next year. Italy's economy is

forecast to fall 10.6% this year and to rebound 5.2% next

year. Spain's economy is forecast to fall even more

drastically this year, down 12.8%, but to rebound more

strongly, by 7.2% in 2021.

Also in October, the European contractors¡¯ federation

FIEC published their annual report which forecast an 8.5%

fall in EU27 construction activity in 2020. FEIC said the

final months of 2020 would be critical for the industry as

new projects were expected to decline during the Autumn.

In a sign of the heightened uncertainty, the FIEC report

included no forecasts for next year. However, FIEC

warned that ¡°The situation might worsen in 2021 if

investments in construction, both public and private, do

not recover significantly. Moreover, due to losses in equity

during the health crisis, companies will find it difficult to

embark on new projects.¡±

EU27 tropical imports hold up reasonably well in all

sectors

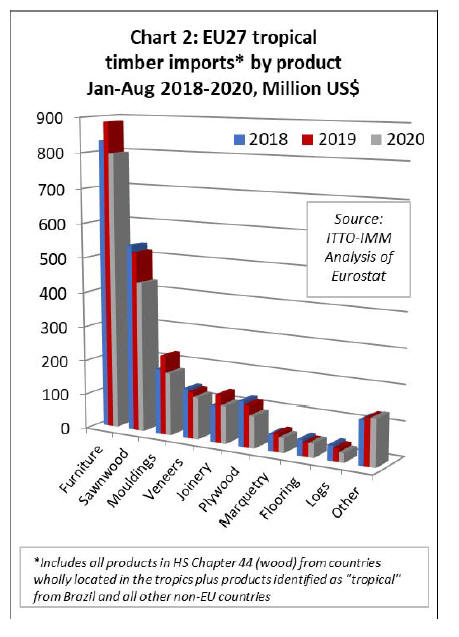

Unsurprisingly, EU27 imports of all the main tropical

wood products fell in the first eight months of this year,

but in each case the decline was less dramatic than

expected earlier in the year when the scale of the

pandemic and associated lockdown measures were

becoming apparent.

In the year to August, EU27 imports of wood furniture

from tropical countries declined 10% to US$797 million,

while imports of tropical sawnwood declined 17% to

US$432 million, tropical mouldings were down 21% to

US$179 million, veneer down 10% to US$120 million,

joinery down 21% to US$108 million, plywood down 23%

to US$93 million, marquetry and ornaments down 18% to

US$43 million, and logs down 26% to US$27 million.

Imports of tropical flooring were stable, but at a

historically low level of US$40 million (Chart 2).

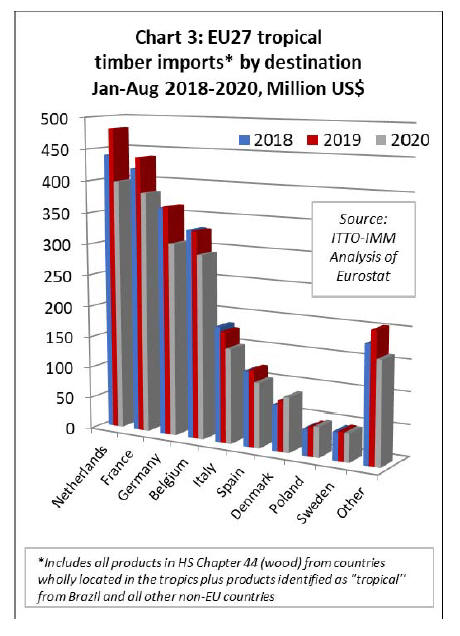

Imports fell into all six of the largest EU27 destinations

for tropical wood and wood furniture products in the first

eight months of this year.

Imports were down 17% to US$398 million in the

Netherlands, 12% in France to US$383 million, 16% in

Germany to US$306 million, 11% in Belgium to US$292

million, 15% in Italy to US$150 million, and 15% in Spain

to US$103 million.

However, imports increased in Denmark, by 9% to US$86

million, and in Poland, by 5% to US$48 million. Imports

in Sweden fell but only by 2% to US$45.5 million (Chart

3).

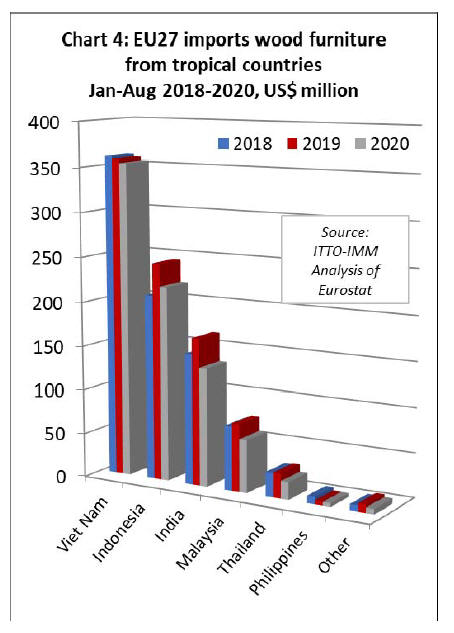

EU27 wood furniture imports from Vietnam close to

last year¡¯s level

In the furniture sector, EU27 imports from Vietnam almost

matched last years¡¯ level in the first eight months, down

only 1% to US$354 million.

Imports from Indonesia were down 10% to US220 million

in the first eight months of this year, although this

compares with a relatively strong performance in 2019 and

imports this year are still higher than in the same period

during 2018 (Chart 4).

EU27 imports of wood furniture from the other main

South East Asian suppliers declined sharply, including

Malaysia (down 22% to US$60 million), Thailand (down

29% to US$19 million, and the Philippines (down 9% to

US$4 million).

EU27 imports of wood furniture from India were down

20% to US$133 million in the first eight months. Partly

due to supply side issues, imports from furniture from

India almost came to a complete halt in May this year, but

then rebounded very strongly in July and August to record

levels for the summer months.

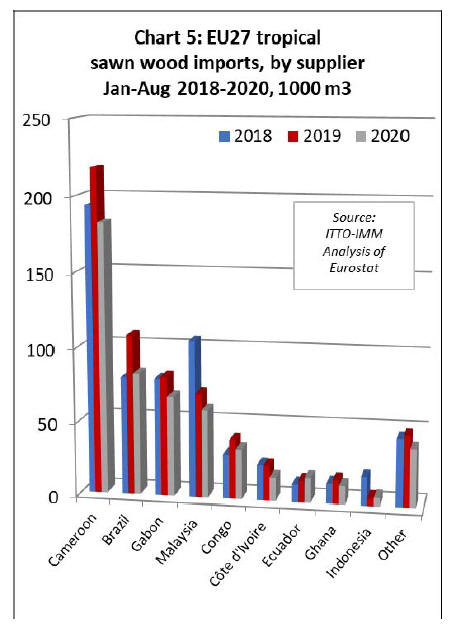

EU27 tropical sawnwood imports down sharply from

all major supply countries

EU27 imports of tropical sawnwood declined sharply from

all major supply countries in the first eight months of

2020; down 17% from Cameroon to 182,500 cu.m, 24%

from Brazil to 82,200 cu.m, 16% from Gabon to 67,900

cu.m, 15% from Malaysia to 59,600 cu.m, 16% from

Congo to 33,800 cu.m, 33% from Côte d'Ivoire to 15,800

cu.m, and 23% from Ghana to 12,200 cu.m.

However Ecuador bucked the downward trend, with EU27

imports from the country rising 15% to 16,600 cu.m, much

destined Denmark and likely driven by strong demand for

balsa for wind turbines. Imports of sawnwood from

Indonesia also increased slightly, by 11% to 5,500 cu.m,

but this follows a 74% reduction in 2018 (Chart 5).

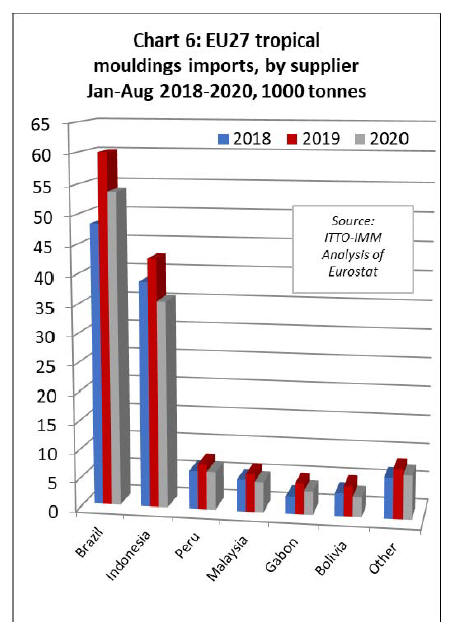

The decline in imports of tropical sawnwood in the first

eight months of 2020 was mirrored by a similar decline in

EU27 imports of tropical mouldings/decking. Imports of

this commodity were down 10% from Brazil to 53,800

tonnes, 17% from Indonesia to 35,500 tonnes, 17% from

Peru to 6,500 tonnes, 20% from Malaysia to 5,100 tonnes,

24% from Gabon to 3,900 tonnes, and 35% from Bolivia

to 3,400 tonnes (Chart 6).

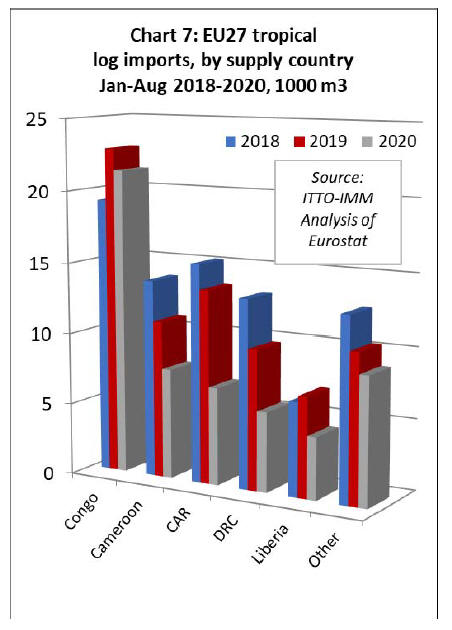

EU27 imports of tropical logs held up reasonably well

from the Republic of Congo in the first eight months of the

year, down only 7% to 21,400 cu.m, but fell sharply from

all other leading cupply countries including Cameroon (-

30% to 7,700 cu.m), Central African republic (-50% to

6,800 cu.m), DRC (-43% to 5,600 cu.m), and Liberia (-

38% to 4,300 cu.m) (Chart 7).

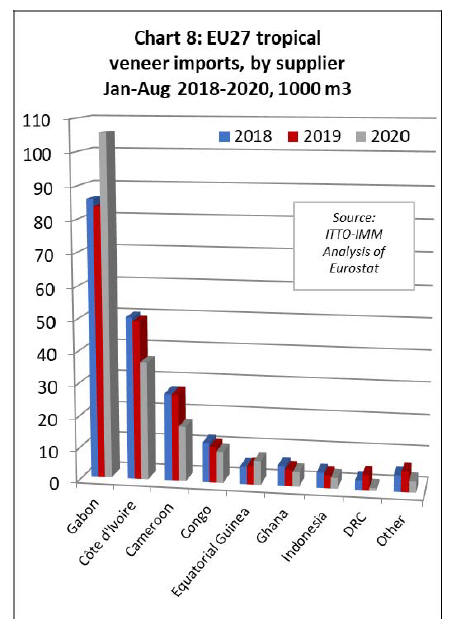

EU27 tropical veneer imports from Gabon on the rise

despite pandemic

In the veneer sector, imports from Gabon bucked the

wider downward trend in EU27 imports in the first eight

months of 2020. The EU27 imported 105,700 cu.m of

veneer from Gabon between January and August this year,

26% more than the same period in 2019, mainly destined

for France. Veneer imports also increased 32% from a

small base to 7,500 cu.m from Equatorial Guinea, in this

case destined mainly for Spain and Italy.

However, EU27 veneer imports were down 26% from

Côte d'Ivoire to 36,600 cu.m, 37% from Cameroon to

17,200 cu.m, 13% from Ghana to 4,600 cu.m, 18% from

Indonesia to 3,400 cu.m and 84% from DRC to 800 cu.m

(Chart 8).

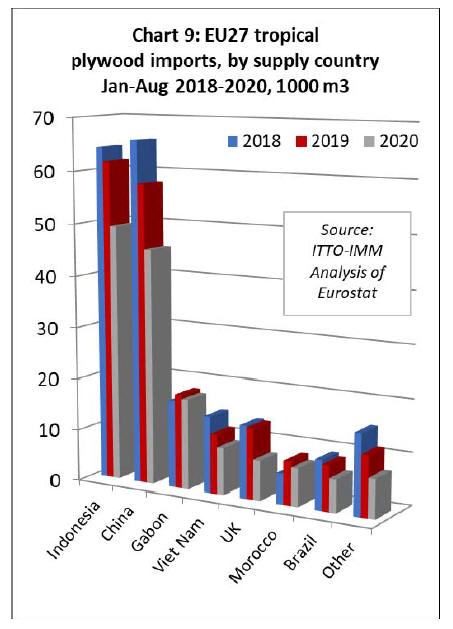

EU27 imports of tropical hardwood faced plywood were

down from all the leading supply countries in the first

eight months of 2020. Imports fell 20% to 49,400 cu.m

from Indonesia, 22% to 45,300 cu.m from China, 4% to

17,400 cu.m from Gabon, 21% to 9,000 cu.m from

Vietnam, 14% to 7,200 cu.m from Morocco and 28% to

6,300 cu.m from Brazil. (Chart 9).

EU27 imports of tropical hardwood faced plywood from

the UK ¨C a re-export since the UK has no plywood

manufacturing capacity - declined 44% to 7,600 cu.m.

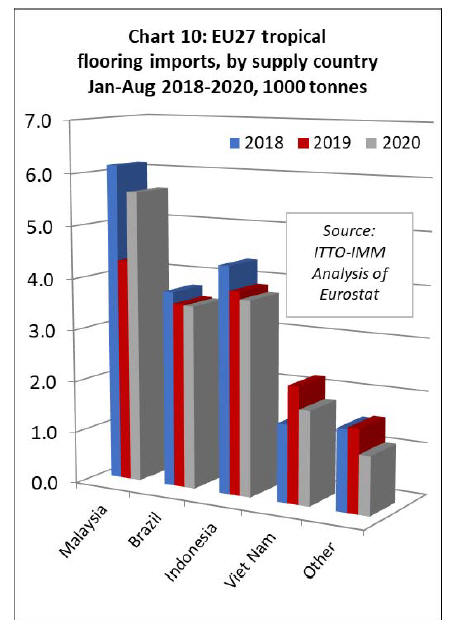

EU27 tropical flooring imports rise while other joinery

imports decline

Given the situation in the wider market, one of the least

expected trends in EU27 import data is a slight recovery in

imports of tropical flooring products in the first eight

months of this year after a long and persistent period of

decline (Chart 10).

Imports were up 2% to 15,900 tonnes, with the gain due to

a 31% rise in imports from Malaysia to 5,600 tonnes,

mostly destined for Belgium.

Imports declined only moderately from Brazil, down 1%

to 3,500 tonnes, and Indonesia, down 4% to 3,800 tonnes.

Imports from Vietnam fell more rapidly, by 19% to 1,800

cu.m.

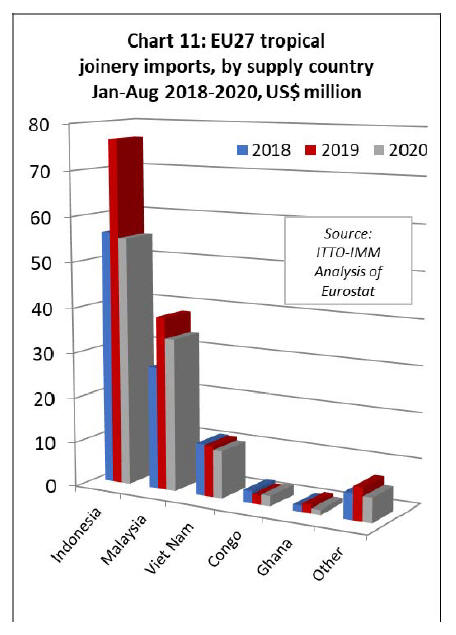

EU27 imports of other joinery products from tropical

countries, which mainly comprise laminated window

scantlings, kitchen tops and wood doors, declined from all

three of the main supply countries in the first eight months

of 2020.

Imports from Indonesia were down 28% to 55,000 tonnes,

12% from Malaysia to 33,800 tonnes, and 7% from

Vietnam to 10,600 tonnes. For African countries, EU27

imports of this commodity increased from the Republic of

Congo, by 12% to 2,300 tonnes, but fell from Ghana, by

40% to 1,100 tonnes. (Chart 11).

|