Japan

Wood Products Prices

Dollar Exchange Rates of 25th

October

2020

Japan Yen 104.85

Reports From Japan

Prime Minister makes priority trip to

Viet Nam and

Indonesia

Most newly appointed Japanese Prime Ministers make the

US their first overseas destination the cement the longstanding

strategic partnership between the two countries.

However, Japan¡¯s new PM opted to focus his first

overseas mission on Asia with visits to Vietnam and

Indonesia.

This, say analysts, was in response to the changing

geopolitical situation in the region especially with Chinese

activities in the South China Seas. The purpose was to

promote the Japanese policy of securing a ¡°a free and open

Indo-Pacific region.¡± Vietnam is central to this policy as,

like Japan, it has territorial issues with China.

The other purpose was to advance the reopening of

business travel between the two countries. In meetings

with the Indonesian President the focus was on expanding

exports and providing assistance to Indonesian efforts to

revive the economy.

See:

https://www3.nhk.or.jp/nhkworld/en/news/backstories/1340/

Stimulus supports economy

A government report in October painted a more optimistic

view of economic prospects saying strengthening demand

for electrical items and higher spending on domestic travel

is helping revive the economy but cautioned the economy

is facing severe risks due to the coronavirus pandemic and

associated control measures. The Japanese economy

suffered its worst postwar contraction in the second

quarter of this year.

In related news, the Japanese government is considering

an additional economic stimulus in an effort to boost

consumption and officials have been charged with

developing new ideas to be included in the government's

third supplementary budget for fiscal 2020.

The media anticipate that the ¡®Go-To¡¯ campaigns for

domestic tourists, through which the government subsidies

part of the costs of domestic tourist trips and dining out

will encourage consumption. In addition, some

adjustments to taxes are being considered.

Household spending declines further

The Ministry of Internal Affairs and Communications has

reported that household spending fell for an 11th

consecutive month in August as consumers struggled to

return to their pre-pandemic purchasing habits. Household

spending declined around 7% in August from a year

earlier. However, the pace of decline has slowed after

hitting a 16% high in May at the height of the lockdown.

In related news consumer prices fell for the second

consecutive month in September driven down by weak

demand. This will be a continual problem in a country

already in recession.

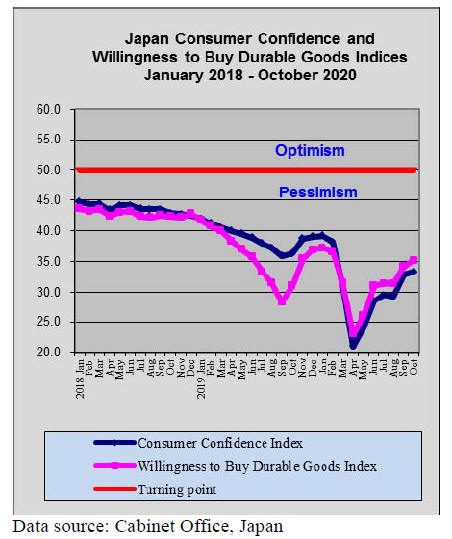

Japan's October consumer confidence marked a second

rise reflecting the early signs of economic recovery from

the disruption caused by the pandemic.

The index assessing economic expectations in the next six

months improved but the pace of recovery slowed

compared to the previous month. On willingness to buy

durable goods the index also improved on levels in

September.

Recovery in exports to China

The pace of decline in Japan¡¯s exports eased in September,

a sign that the pandemic¡¯s impact on global trade is easing.

The Ministry of Finance said value of Japan¡¯s September

exports declined 4.9% from a year earlier, much better

than the almost 15% decline in year on year exports in

August. Most of this improvement was the result of a

recovery in China but analysts warn China¡¯s growth rate

will be impacted by what is happening in the rest of the

world.

During the six months up to September exports declined

over 35%, the sharpest drop since the global financial

crisis.

The main problem for the Japanese government is that the

pandemic is making Japanese companies cautious about

hiring, improving wage growth and investment.

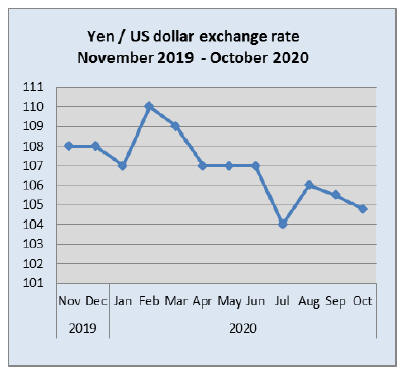

Yen/dollar steady despite rising uncertainty

Rising Covid-19 infections in the US and Europe, the

failure of the US to settle on fresh stimulus measures and

uncertainty over how the US election will turn out are

currently driving risk aversion in currency markets.

Towards the end of October the yen strengthened

moderately, much less than could be expected during

times of growing uncertainty.

At around yen 104+ to the US dollar the yen has exhibited

remarkable stability after a turbulent first quarter.

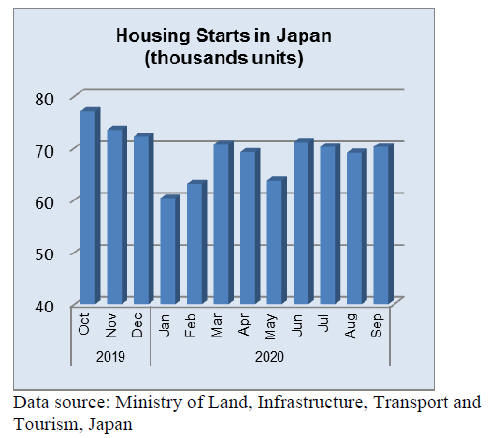

Builder¡¯s confidence dented as orders slip

Data from the Ministry of Land, Infrastructure, Transport

and Tourism shows that housing starts declined almost

10% year-on-year in September following a 9% fall in

August.

Projections of annualised starts dropped to 815,000 in

September from 819,000 in August. Data also showed that

construction orders received by the big 50 contractors fell

in September after an increase in August.

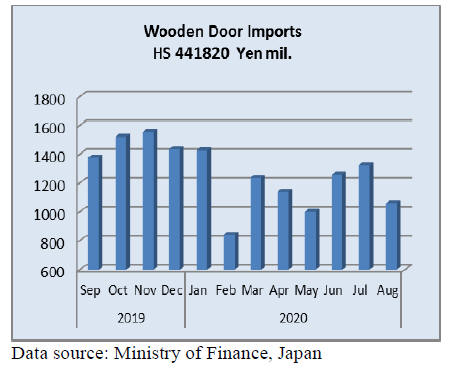

Import update

Wooden door imports

August is holiday month in Japan and construction activity

is down to about 2 weeks in the month. Given the slow

August building activity one could have expected a drop in

imports of housing components such as doors in the

preceding months but this was not apparent. However

there was a decline in the value of wooden door imports in

August.

Year on year door (HS441820) imports dropped 28% and

compared to July imports in August were down around

20%.

As in previous months the main shippers of wooden doors

to Japan were China (58% of August imports) the US 23%

and Malaysia 5%, an improvement on shipments delivered

to Japan in July.

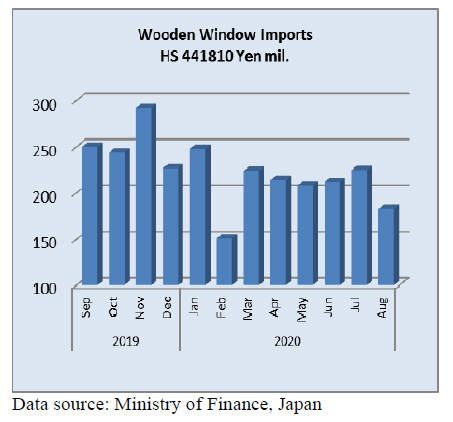

Wooden window imports

Japan¡¯s imports of wooden windows (HS441810) have

turned out to be erotic during the first 8 months of this

year.

The steady increase in the value of window imports that

began in May collapsed in August with year on year

import values falling 34% and month on month import

values declined 19%.

In August the two shippers of wooden windows to Japan,

China and the US saw market share fall to around 70%,

down from over 80% in July. The new comer, the

Philippines secured a 14% of Japan¡¯s imports.

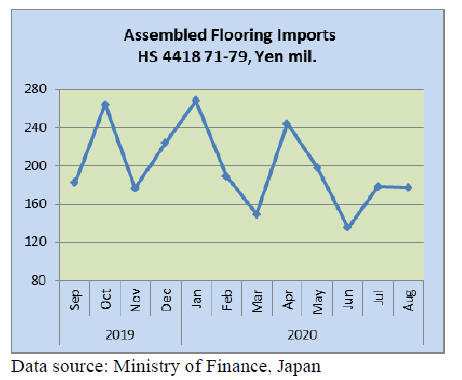

Assembled wooden flooring imports

Of the various categories of flooring imported HS 441875

accounted for 73% of August imports as it has done in past

months and was supplied mainly by shippers in China and

Vietnam.

Shipments of assembled flooring from China accounted

for around 40% of all assembled flooring imports with a

further 16% coming from both Malaysia and Vietnam.

Year on year assembled flooring (HS441871-79) dropped

17% but month on month were unchanged from July.

Ignoring the peaks and dips in the value of imports there

has been a steady decline since the beginning of the year.

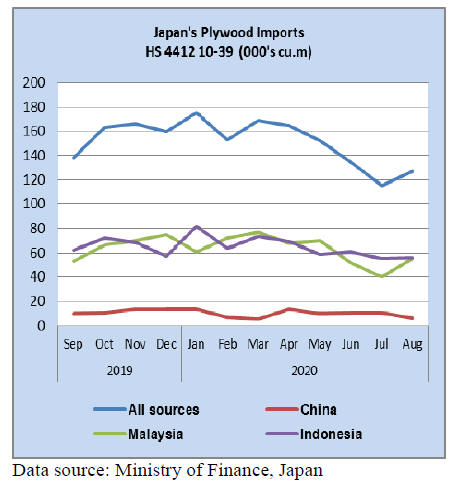

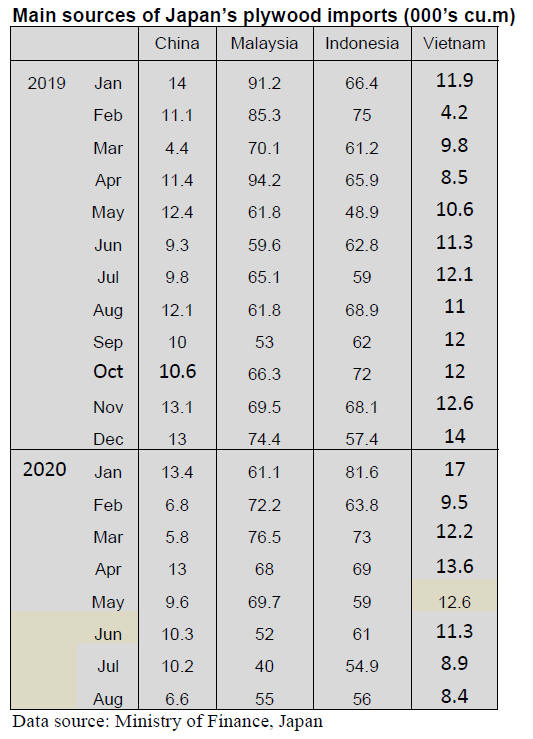

Plywood imports

After sustaining plywood shipments to Japan as the two

main shippers, Indonesia and Malaysia experienced a

decline in demand in July. In August shipments from

China dropped around 35% to just 6,600 cu.m. In contrast,

plywood shipments to Japan from both Indonesia and

Malaysia rose slightly month on month in August. But this

good news was dampened by the 18% year on year decline

in August plywood shipments to Japan. Except for July,

plywood shipments from Vietnam to Japan exceeded that

from China.

Of the various categories reported HS441231 accounted

for over 70% of imports with a further 5% each being of

HS441233 and HS441234.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

South Sea (tropical) logs and lumber

Arrivals of South Sea logs have been low but demand for

both plywood and lumber is weak, there is no shortage.

Plywood mills continue production cutback with weak

demand. Because of corona virus epidemic, large

gathering is prohibitive so many large events are

cancelled, which results in drop of demand of plywood for

stage and related facilities.

In hardwood lumber, movement of laminated free board is

stagnant. There were some spike of demand in late August

but it declined again after demand for public facilities and

reform of stores died down.

Among lumber, movement of decking lumber is active

probably because demand of suburban houses gets busy

due to work from home is becoming popular now.

Russia further tightens wood export

It is reported that the president Puchin of Russia instructed

the government to ban export of unprocessed softwood

logs and high grade hardwood totally since January 2022.

This is nothing new because export duty of Russian Far

East softwood logs is set at 80% since 2021. This was

decided back in 2018.

The objective is to promote higher processing of logs. By

this instruction of the government will come up with new

measures to restrict wood export.

The president also mentioned to stop illegal logging

strictly. System to keep track of harvest, processing and

ship-out (export) will be made to have high traceability.

Also the government helps investment to make higher

processing wood to small business. These measures targets

to close loop holes of illegal wood trading on border of

China, where many illegal acts or crimes are overlooked

by the Russian local governments for quick revenue.

Japan imported 105,000 cbms of softwood logs and 2,400

cbms of hardwood logs in 2019. China imported 7,553,000

cbms of Russian logs, 28% less than 2018. After Russia

bans log export totally, China needs to buy lumber instead

or look for other sources of this much logs. China bought

18,342,000 cbms of Russian lumber in 2019, which is

record high volume. This new measures will impact China

much more than Japan.

Wood demand in 2019

Total wood demand in 2019 was 81,905,000 cbms, 0.7%

less than 2018, which is the first decline in four years

since 2015. While wood demand for fuel increased by

15.1% with 10,386,000 cbms, demand of industrial wood

decreased by 2.6% with 71,269,000 cbms. For industrial

wood demand, imported wood decreased by 4.1% while

domestic wood demand is 0.5% more so that selfsufficiency

rate of industrial wood moved up by 1.0 point

at 33%.

Self-sufficiency rate of total wood including fuel wood

increased by 1.2 points at 37%. This is the highest rate in

34 years since 1985.

Decrease of industrial wood demand continued for

last

two years. In 2018, increase of fuel wood demand covered

shortfall of industrial wood demand so total wood demand

was more than 2017 but because of drop of industrial

wood demand is so much in 2019, even with increase of

fuel wood demand, total is less than 2018.

In industrial wood demand, logs for lumber manufacturing

is 1.7% less than 2018. Logs for plywood manufacturing is

4.8% less. Reason is housing starts in 2019 is 4% less than

2018. In particular, wood based units decreased by 16,075

units. In logs for both lumber and plywood manufacturing,

imported logs decreased but domestic logs increased so

the self-sufficiency rate moved up. The rate of logs for

lumber increased to 51%. Domestic logs for plywood

manufacturing increased by 4.5 points so the rate is now

45.3%.

The largest drop of industrial wood is logs for pulp and

paper manufacturing, which takes about 40% of industrial

wood. Both imported and domestic materials decreased at

31,061,000 cbms, 3.0% less. Self -sufficiency rate dropped

by 0.9 points to 15%. This hampers increase of selfsufficiency

rate of total industrial wood. Reason is

decrease of paper demand by decrease of total population

and progress of electronic devises. In 2020, paper demand

further declines by corona virus incident.

Increase of fuel wood demand is by rapid expansion of

wood biomass power generation plants. It started

increasing since 2014 and this is the first time that the volume reached

10,000,000 cbms. Imported wood for fuel in 2019 is

3,454,000 cbms, 24.6% more than 2018 while domestic

wood is 6,932,000 cbms,10.9% more.

Volume of imports is only half of domestic wood but rate

of increase of imported wood for fuel is far higher so selfsufficiency

rate dropped by 2.6 points. Majority of

imported fuel wood is wood pellet. There are 78 more

power plants, which are authorized but have not started yet

so once these start operating, 15,000,000 cbms of wood

pellet will be imported. Despite increase of domestic

wood, speed of increase of imported wood is faster so selfsufficiency

rate of fuel wood will continue declining.

Mitsui Home to build wooden condominium

Mitsui Home (Tokyo) announced that it will build five

stories wooden building as condominium in Inagi city of

Tokyo. First floor is reinforced concrete then second to

fifth floor are 2x4 wooden floor. Total floor space is about

1,140 square meters. Total units are 51.

Mitsui Home built fifth stories wooden building in 2016 as

elderly nursing home with floor space of about 10,000

square meters. It is one hour fire proof 2x4 structure.

For Inagi project, it has developed super strong bearing

wall with wall strength factor of 30 times, which is the

highest level as 2x4 building. Wall thickness is about half

of usual wall to give more inner space.

It will also use nail laminated timber for some part of

floor. NLT has been used over 100 years in North America

as structural material. Long panel is made with jointed

short lumber.

The Japan 2x4 Home Builders Association obtained the

Minister¡¯s certificate as semi fire proof structural material

so that it can be used for floor and roof. It will use 2x10 of

domestic larch for floor joist. Normally 2x4 and 2x6 are

used so this is the first time that 2x10 is used. It will use

Hokkaido wood Mitsui Real Estate group owns for interior

and other parts of the building.

|