|

Report from

Europe

Half UK tropical timber trade value lost in May

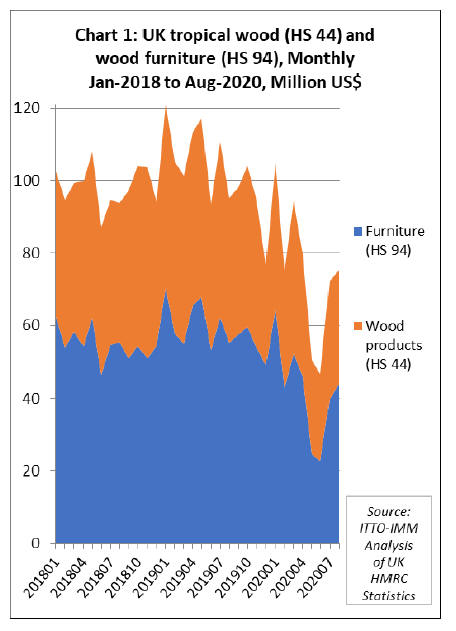

After a sharp fall in UK imports of tropical timber

products in May and June in response to the COVID-19

pandemic, imports rebounded strongly in July and made

more gains in August. However, even in August, total

imports were still down around 15% compared to the same

month the previous year (Chart 1).

A strong rebound in construction and other broader

economic measures during the summer months gave rise

to optimism that the downturn may be short-lived and the

recovery would be ¡°V-shaped¡±. More recent indications,

however, are of a ¡°tick mark¡± recovery, with the sharp fall

followed by a longer tail of recovery.

Now new lockdown measures are being imposed in the

UK with mounting concern about a second wave of the

virus which might yet overwhelm health facilities. The

withdrawal of short-term government support measures,

notably the furlough scheme designed to keep more people

in work during the first lockdown, also raises the prospect

of a spike in unemployment during the winter months.

Overall UK imports of tropical wood furniture products to

end August this year were US$337 million, 31% less than

the same period in 2019. Imports fell to only US$24.5

million in May, 60% down on imports typical for that

month in a normal year. However, tropical wood furniture

imports recovered to US$40 million in July and US$44

million in August.

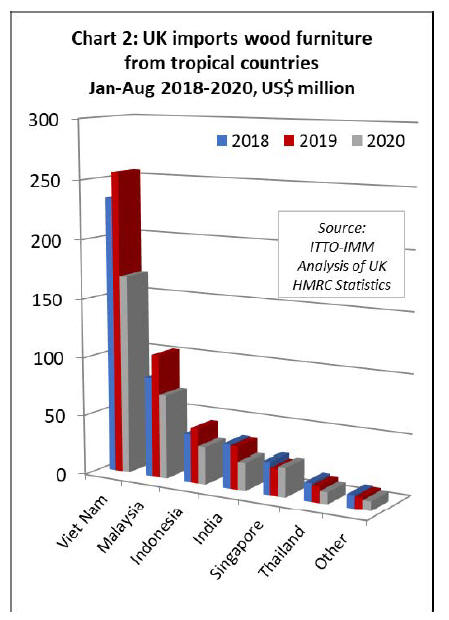

UK imports of wood furniture declined sharply from all

the leading tropical supply countries in the first eight

months of this year (Chart 2). Imports from Vietnam were

down 34% at US$168 million, imports from Malaysia fell

32% to US$71 million, imports from Indonesia declined

31% to US$31 million, and imports from India fell 34% to

US$24 million. However, there was an 8% rise in imports

from Singapore, to US$25 million.

The total value of UK imports of all tropical wood

products in Chapter 44 of the Harmonised System (HS) of

product codes to end August this year was US$262

million, 29% less than the same period in 2019.

Imports fell from US$34 million in April to US$26 million

in May and continued to slide to US$24 million in June.

They then recovered to US$33 million in July before

slipping back to US$31 million in August.

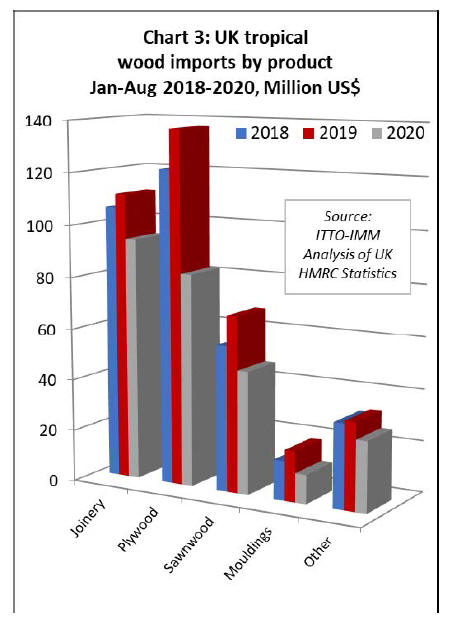

Comparing the first eight months of 2020 with the same

period in 2019, total UK import value of tropical joinery

products was down 15% at US$94.2 million, tropical

plywood was down 40% at US$82.4 million, tropical

sawnwood fell 30% to US$47.5 million, and

mouldings/decking declined 43% to US$11.2 million

(Chart 3).

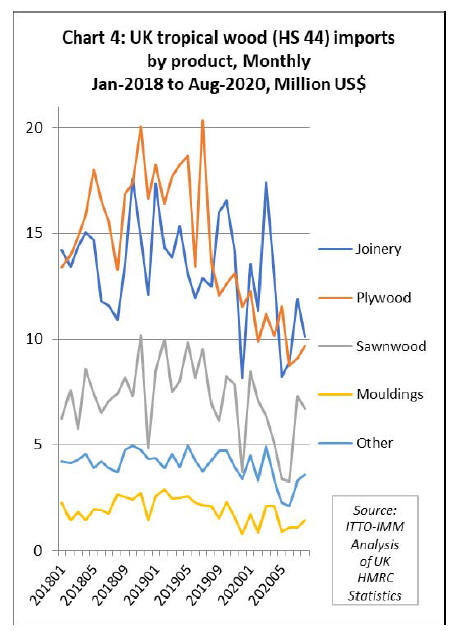

Although UK imports of all HS Chapter 44 wood products

from the tropics have fallen sharply this year, the timing of

the decline and subsequent recovery has varied by product

group (Chart 4).

For example, the decline in imports of tropical sawnwood,

which were quite buoyant before the COVID lockdown,

was short-lived and followed by a strong recovery in July

and August. In contrast, UK imports of tropical plywood

were sliding even before the lockdown and had barely

recovered by the end of August.

Indonesia loses ground in UK joinery market

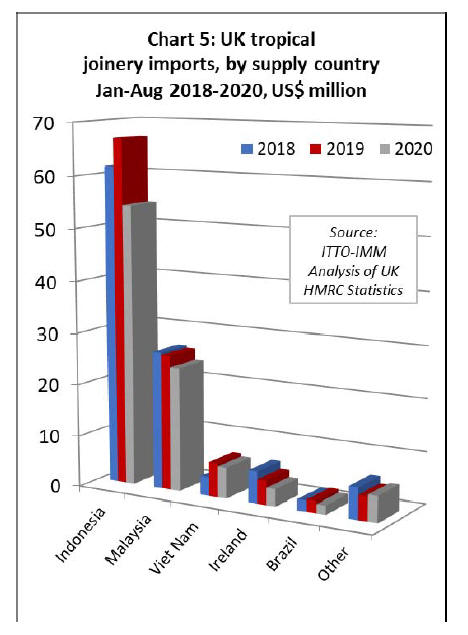

After making gains in 2019, UK imports of tropical

joinery products from Indonesia, mainly consisting of

doors, fell 19% to US$54 million in the first eight months

of this year (Chart 5).

UK imports of wooden doors from Indonesia were quite

strong in March and April but were slow between May

and August. It is not unusual for these imports to vary

widely each month, even in a normal year, and it is

therefore difficult to predict how the trade will develop for

the rest of the year.

After a strong start to the year, UK imports of joinery

products from Malaysia and Vietnam (mainly laminated

products for kitchen and window applications) stalled

almost completely in May and recovered only slowly in

the following months.

Total joinery imports in the first eight months were down

9% to US$24 from Malaysia and down 9% to US$6

million from Vietnam. UK trade in joinery products

manufactured from tropical hardwoods in neighbouring

Ireland have also fallen dramatically this year, down 29%

to US$3.3 million in the first eight months.

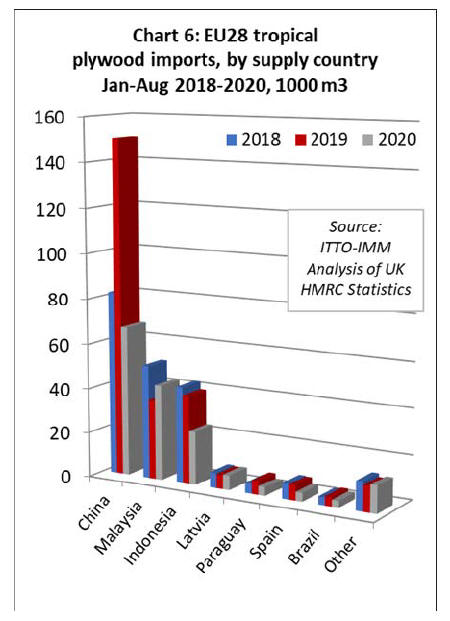

UK imports of tropical hardwood plywood from China

recover slowly

The UK imported 66,800 cu.m of tropical hardwood faced

plywood from China in the first eight months of this year,

55% less than the same period last year (Chart 6). UK

imports of plywood from China ground to halt earlier this

year when China went into lockdown.

There were hardly any deliveries from February through to

early April and UK importers were forced to live off

inventories.

UK importers report that through April and May this year

Chinese plywood supply recovered steadily. By July,

supply was back to normal and significant volumes under

delayed contracts began to arrive.

It is expected that some of the lost volume from China will

be made up later this year. On the other hand, rising

freight rates, up in the last couple of months from

US$1,300/1,400 FEU toUS $2,000, strengthening of the

CNY against the dollar, and higher raw material costs are

now impacting China¡¯s competitiveness in the plywood

market.

Likely due to supply problems in China, UK imports of

plywood from Malaysia, which have been in long term

decline, have recovered ground in 2020. Despite

significant slowing in May, imports from Malaysia were

still up 20% at 42,600 cu.m for the first eight months of

the year.

In contrast to Malaysian plywood, UK imports of

Indonesian plywood fell 40% to 23,900 cu.m in the first

eight months of the year. In addition to supply problems

during the pandemic, Indonesian plywood has come under

very intense competitive pressure from Russian birch

plywood this year. Russian plywood is reported to have

become more competitive overall, with the rouble sliding

from 77 to the euro in June to over 90 in September.

Indonesian plywood has lost share particularly in the large

market for 18-21mm film-faced for construction where

Russian birch now dominates. Although Indonesian supply

is now reported to be back to normal, albeit with freight

rates increasing costs, UK imports of Indonesian plywood

are now focused more on more niche products such as

thinner plywood and for overlay and 2.7mm items for the

caravan industry.

In recent years, the UK has been importing small volumes

of tropical hardwood faced plywood from Latvia and

Spain. In the first eight months of 2020, imports increased

4% to 6,800 cu.m from Latvia but fell 43% to 3,900 cu.m

from Spain.

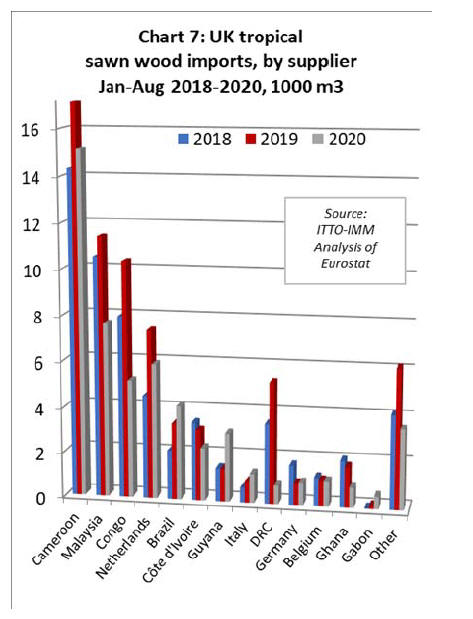

UK tropical sawn hardwood imports rising from Latin

America

The UK is now a relatively minor market for tropical sawn

hardwood, importing less than 100,000 cu.m in each of the

last two years, making it only the fifth largest European

importer for this commodity (after Belgium, Netherlands,

France and Italy).

While the UK trade in sawn tropical hardwood fell sharply

in May and June this year, there was some recovery in

July and August, particularly from Latin America.

However imports were still down from most major supply

countries by the end of August (Chart 7).

UK imports from Cameroon, the leading supplier, fell

12% to 15,100 cu.m in the eight-month period, while

imports from the Republic of Congo declined 50% to

5,200 cu.m. Of other African suppliers, imports were

down 25% to 2,300 cu.m from Côte d'Ivoire, down 85% to

only 810 cu.m from DRC and down 51% to 887 cu.m

from Ghana.

While UK imports of African hardwoods suffered severely

during the COVID lockdown this year, there is some

optimism that trade will recover well in coming months.

Recent market discussions at the London Hardwood Club

suggested that trade in the favoured African species

(dominated by sapele in the UK) is ¡°now at normal

levels¡±.

It was also noted that UK is ¡°well stocked but not

overstocked¡± in African hardwoods. However, sapele is

currently being traded at unsustainable price levels, below

replacement cost.

UK imports from Malaysia were 7,700 cu.m in the first

eight months of 2020, 33% less than the same period in

2019. Indirect imports into the UK via the Netherlands

were down 20%, at 5,900 cu.m, after significant growth

last year.

However imports from Brazil increased 23% to 4,200

cu.m in the first eight months of 2020, with particularly

good growth during the summer months after lockdown.

Imports from Guyana also increased, rising 107% to 3,000

cu.m in the first eight months of the year.

Economic forecasts in the UK becoming a little more

optimistic

The latest October report of the EY Item Club, a leading

UK economic forecasting body, is slightly more optimistic

than the previous report in July. According to the Club, the

UK economy may have grown by as much as 17% in the

three months to the end of September. This compares to

their earlier prediction of only 12% growth.

However the Club believes slower growth may follow,

with a fall to 1% or less predicted for the final three

months of this year. The end of the furlough scheme,

under which workers had part of their salary paid by the

government, will mean higher unemployment and sluggish

growth, said the forecasters.

"The UK economy has done well to recover faster than

expected so far," said Howard Archer, chief economic

adviser to the EY Item Club. "Consumer spending has

bounced back strongly, while housing sector activity has

also seen a pick-up, in part thanks to the stamp duty

holiday."

That said, the UK economy is now predicted to regain its

pre-pandemic size in the second half of 2023. Back in

July, the EY Item Club did not expect that to happen until

late 2024.

However, there is a high level of uncertainty surrounding

this forecast. While a vaccine is likely to help the

economy, the downside risks are significant. Factors that

could weigh down growth include a drop in consumer

spending, more lockdown measures, a spike in

unemployment and slow Brexit negotiations between the

UK and the EU.

On the last point, the Club's estimates assume a simple

free trade agreement with the EU by the end of the year.

Without an agreement, growth of 4.8% is forecast in 2021,

down from 6%, while growth in 2022 would be cut to

2.6% from 2.9%.

More positive, particularly for having a more direct

bearing on timber demand, is that the latest data on

purchasing managers sentiment in the construction sector

from IHS Markit and UK Chartered Institute of

Procurement and Supply (CIPS) signals another sharp

increase in UK construction activity at the end of the third

quarter.

The expansion came amid the sharpest rise in new UK

construction business since before the pandemic-induced

lockdown, with firms increasing their purchasing activity

at the quickest pace for nearly five years.

The headline seasonally adjusted IHS Markit/CIPS UK

Construction Total Activity Index registered 56.8 in

September, up from 54.6 in August. Any figure above 50.0

indicates growth of total construction output. The latest

reading pointed to a reacceleration in the rate of activity

growth and a sharp increase overall.

Underlying data revealed varied results across the three

monitored sub-sectors. The strongest performing category

was home building, where firms registered a sharp

expansion in activity for the fourth month running. Work

undertaken on commercial projects also rose strongly,

increasing at quickest pace for over two years. Meanwhile,

civil engineering activity fell for the second month

running and at the sharpest rate since May.

Looking forward, confidence towards the 12-month

business outlook in UK construction was the strongest

since February. Optimism was supported by expectations

of a sustained rise in new work.

Commenting on the latest PMI data, Duncan Brock, Group

Director at CIPS said "UK Construction took off in

September, soaring ahead of both the manufacturing and

service sectors in terms of output growth and recording the

fastest rise in purchasing activity since October 2015.

Fuelled by the easing of lockdown measures, new orders

rose for the fourth month in a row and at the quickest pace

since the beginning of the year before the pandemic

struck¡±.

While Mr Brock was concerned about the potential impact

on employment as ¡°government support schemes are

winding down¡± he suggested that ¡°for now, builders are

stocking up for Brexit and Covid-19 preparations, so

purchasing remains strong in spite of longer delivery times

and some shortages¡±.

|