|

Report from

Europe

EU plywood trade cautious, but recovery faster than

expected

It¡¯s still too early to say for sure, but it¡¯s variously

estimated by European plywood importers and distributors

that the Covid-19 pandemic will slice 10-20% off their

2020 bottom line.

Trade has since seen a bounce back, varying in degree

from country to country, but companies don¡¯t expect it to

make up for the sales lost when the health crisis first hit.

Looking ahead, the sector is hopeful about continued

market recovery, although there¡¯s awariness about making

more than short-term forecasts and concern about the

economic fallout as European governments wind down

pandemic business support measures.

There is some preoccupation too about the potential

impacts on the European economy of Brexit if the UK

does come to the end of its transition period to depart the

EU on January 1 and leaves without a trade deal.

The better news, however, is that, while plywood

companies across Europe acknowledge that they¡¯ve taken

a significant hit from the pandemic, the general view is

that the contraction in trade has not in fact been as severe

as expected earlier in the year.

¡°In normal circumstances, losing a tenth to a fifth of sales

would be seen as a bit of a disaster,¡± said one importer.

¡°But if you¡¯d offered us that when we were at peak

lockdown, we¡¯d have grabbed it with both hands. At one

point we were trading at between 30 and 35% of normal

levels.¡±

This expressed the general consensus. Some companies

closed for a period late March into April. Most kept

trading, but report that they were mainly dealing with

outstanding orders.

¡°There was new business coming into the pipeline, but it

was significantly down and more hand to mouth,¡± said an

importer/distributor. ¡°Very few customers were

committing more than a few weeks ahead. We actually

kept all our staff on, but it was as much to keep

communications channels open with customers, as to

actually do business.¡±

But the worst of the crisis was, in the words of one

company, ¡®surprisingly short-lived¡¯. Business was reported

to have started recovering as early as May and picked up

from there.

¡°An indicator that things didn¡¯t turn out quite as bad as

customers expected was that we got calls in April asking

for longer payment terms, then in May they came back to

us and said that they no longer needed them,¡± said an

importer distributor.

Some businesses report that they were already back to pre-

Covid trade levels by June and that momentum continued

to build in July.

¡°Early on, part of the uptick in activity was due to delayed

supply shipments coming in and completing outstanding

orders that we¡¯d been able to fulfill before,¡± said an

importer. ¡°But new orders also started to increase.¡±

August dip in continental European plywood trade

Some plywood businesses in continental Europe said that,

after trade strengthened through June and July, it dipped

again, in some cases sharply, in August.

¡°This seems to be because people went ahead with

vacations, even if they were staycations,¡± said an importer.

¡°We anticipated once customers got back to business post

lockdown and staff returned after furlough or technical

leave, they¡¯d work through the summer period. However,

trade did slowly get back to recovery in September.¡±

The exception to this trend was the UK. ¡°We don¡¯t have

the continental summer vacation pattern, and we saw sales

continuing to accelerate through July and into August,¡±

said a UK importer.

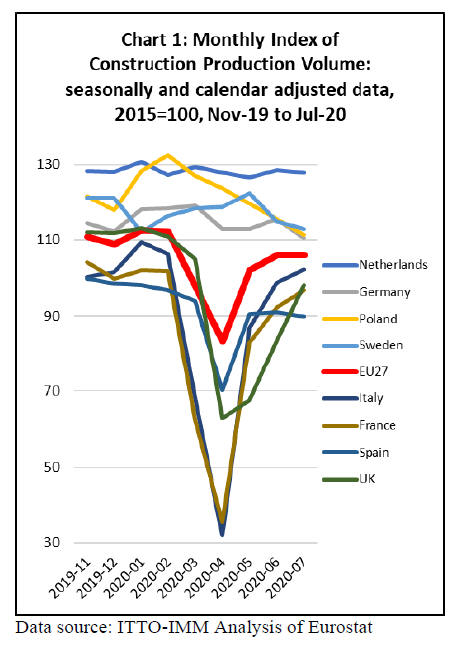

The European construction sector, the main plywood

consumer, was severely affected by the pandemic in April

but recovered strongly in most countries in the following

months. According to Eurostat figures in April EU27

construction output slumped by 15% compared to March

but made up much of the lost ground in May and June

(Chart 1).

The construction sector was hit hardest in April in Italy,

down 53%, France, down 43%, and Spain, down 25%.

Construction in the UK also fell rapidly in April, down

40%. Although production rebounded in all these

countries in the following months, it was still down on the

long-term average in July.

In contrast, construction production in the Netherlands,

Germany, Poland and Sweden was less affected during the

first wave of the pandemic.

On the basis of current data, Euroconstruct predicts that,

after expanding 2.7% in 2019 to €1,700 billion,

construction output in its 19 European member countries

will contract 11.5% (compared to a GDP decline of 8.8%).

This will take revenue down to around €1,500 billion, the

lowest level since 2015.

Recovery is expected to set in next year, with output rising

6%, followed by 3% growth in 2022. However, the

pandemic over the 2020-22 period is forecast to cost

construction around €350 billion in lost business.

Over this year, only Portugal and Poland among

Euroconstruct countries are expected to see building sector

growth, while the smallest contractions will be in

Switzerland and Finland, down 1-2%.

Of the big five, Germany is predicted to fare best, with a

2.5% construction downturn, and the UK worst, with

output 33% lower. Building in Spain is forecast to contract

15%, France by 17.8% and Italy 11.4%.

These figures tally with comments from plywood

companies in different countries, although a number gave

a more upbeat perspective on the rate of recovery in

construction, with government investment programmes

expected to give the industry a further boost in various

countries.

¡°In two of our leading construction markets, Germany and

the Netherlands, we saw activity continuing quite robustly.

There was some slowdown, but few sites closed, and from

May onwards demand has picked up steadily,¡± said an

importer.

¡°In Germany, in particular we see strong prospects for the

industry. After a period of under investment, for which it

was criticized by the EU and UN, Germany started a

multi-billion euro infrastructure and public construction

spending programme about two years ago, and that

continues. So we¡¯re expecting good growth in the market.¡±

While construction suffered worse in France, public

investment is also expected to underpin recovery and

growth.

¡°The French government says its recovery investment

package will eventually add up to 4% of GDP, the largest

percentage spend of any European country,¡± said another

importer. ¡°It maintains that this should get GDP to pre-

Covid levels by 2022, and €7 billion is earmarked for

building renovation and increased energy efficiency.

Additionally, as part of its sustainable development

programme, France is introducing a law in 2022 whereby

timber will have to make up 50% of construction materials

used in new public buildings. In line with this, a

significant part of construction for the 2024 Paris

Olympics will be in wood.

¡± The pace of recovery in other European countries was

expected to depend on the resources governments have

available to boost their economies. ¡°The deeper their

pockets, the sooner they¡¯ll get back on track,¡± said an

importer-distributor.

Early signs of recovery in UK plywood market

While Euroconstruct forecasts the UK building sector to

suffer the steepest downturn of its member countries, bar

Ireland where contraction is predicted at 38%, a UK

importer also reported good signs of recovery from June

through August.

¡°In fact we had one of our best Julys ever, not just for

plywood, but also OSB and the range of wood panel

products, and construction contributed significantly to

that,¡± they said.

¡°Looking forward, the government has also pledged to

increase funding for public building projects and the

refrain is that we¡¯re going to build back better and

greener, which should hopefully open the door to greater

use of timber.¡±

Of other markets, the DIY and repair maintenance and

improvement sectors are both reported to have come

through the pandemic relatively strongly, and now to be

picking up well.

¡°It seems consumers turned to DIY projects during

lockdown,¡± said an importer. ¡°In addition, the money

they¡¯re not spending on holidays and going out is going

into home improvement.¡±

Of other plywood markets, furniture and joinery

manufacture seem to have taken longer to recover,

although activity is now said to be on the up. Worst

affected are reported to have been packaging, hit

especially by the general downturn in manufacturing, and

shopfitting, with retail already suffering going into

lockdown, in part from continuing growth in online

shopping, which the pandemic has further accentuated.

The hospitality sector has also been badly affected, as has

the trade exhibition industry.

¡°By July/August our sales into construction, which form

the biggest part of our plywood trade, were back to 90% of

normal, with furniture and joinery around 50% and

increasing,¡± said an importer. ¡°But shopfitting and

packaging were still some way behind. And the exhibition

sector, which is a significant panel products market, was

just flat and we don¡¯t see it coming back significantly even

in the first half of 2021.¡±

A UK importer distributor, however, did see some signs of

revival in shopfitting from August. Sales of wood sheet

materials for ¡®distancing screening¡¯ in hospitality and

healthcare sectors also to some extent made up for

business lost elsewhere.

Steady recovery in European plywood deliveries from

China

In terms of supply the major concern early on in the

pandemic was China. ¡°When they went into lockdown, as

far as we were concerned, they just turned off the tap,¡±

said one importer. ¡°We didn¡¯t see deliveries from

February, through to early April. We and our customers

had to live off inventories.¡±

However, through April and May, Chinese supply was

reported to have recovered steadily, and in the summer to

be back to normal. One importer reported a ¡®surge of

outstanding deliveries in July¡¯.

Increasing freight rates, up in the last couple of months

from $1,300/1,400 FEU to $2,000 are now impacting

Chinese competitiveness. In addition the strengthening of

the CNY against the dollar, plus increased veneer prices

due to the effects of bad weather on supply, are reported to

be prompting Chinese suppliers to push for 3-5% price

increases.

¡°However, there¡¯s a lot of market resistance and that could

lead to some issues with quality, with factories cutting

back on standards if they can¡¯t get price rises,¡± said an

importer. ¡°With China, you get what you pay for.¡±

Some gaps are reported to be opening up in Brazilian

supply as demand from the US construction sector

continues to grow strongly. Consequently prices are up

too.

¡°While production has continued, Brazilian through the

pandemic has been a real roller coaster,¡± said an importer.

¡°At the start in March the price for standard 20mm C+/C

dropped from US$230/cu.m FOB to $170 due to

contraction in international demand, then dipped even

lower. Now it¡¯s back to US$250-280/cu.m and it¡¯s mainly

due to an increasingly active US market.¡±

Russian plywood squeezing out Indonesian suppliers

Indonesian plywood supply is also reported to be almost

back to normal, albeit with freight rates increasing costs.

One importer, however, said they were now only buying

raw board from the country.

¡°Thinner Indonesian product is also still doing OK, and

they¡¯re strong in overlay and 2.7mm items for the caravan

industry, but, for us, they¡¯re pretty much out of the picture

in 18-21mm film-faced for construction, where Russian

dominates,¡± they said.

Russian plywood is reported to have become more

competitive overall with the rouble sliding from 77 to the

euro in June to over 90 in September.

¡°At the same time, some Russian mills have been pushing

for price rises in certain upper end qualities as they¡¯re

facing shortages of logs and quality veneers until the next

harvest season starts,¡± said an importer.

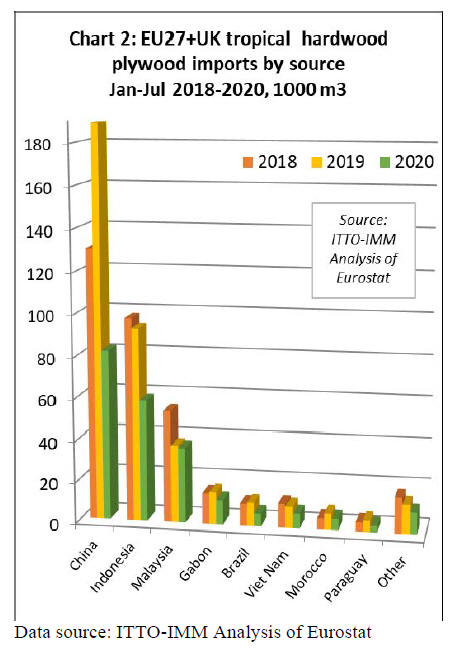

Reflecting the impact of the pandemic, analysis of

Eurostat¡¯s Comext figures show total tropical hardwood

imports into the EU27+UK were down 42.4% to 221,000

cu.m from January to July, compared with the same period

in 2019.

Biggest falls came in imports from China, down 56.6% to

82,000 cu.m. Shipments from Indonesia were 37.1% lower

at 58,000 cu.m, from Malaysia down 2.8% to 36,000 cu.m,

Gabon down 23.8% to 12,000 cu.m, Brazil down 46% to

6,000 cu.m and Vietnam down 31.7% to 7,000 cu.m

(Chart 2).

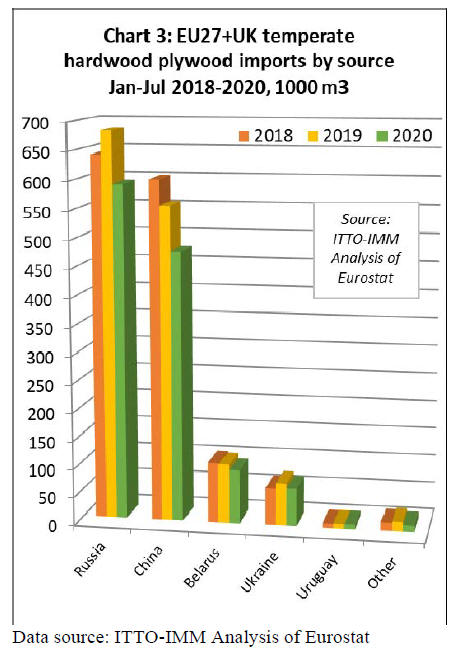

EU27+UK combined temperate hardwood plywood

imports for the period fell 13.4% to 1.25 million cu.m,

with Russian imports down 13.5% to 591,000 cu.mm,

Chinese down 14.2% to 477,000 cu.m, Belarusian down

9.1% to 95,000 cu.m and Ukrainian down 10.6% to 67,000

cu.m, while Uruguayan imports were up 0.8% at 9,000

cu.m (Chart 3).

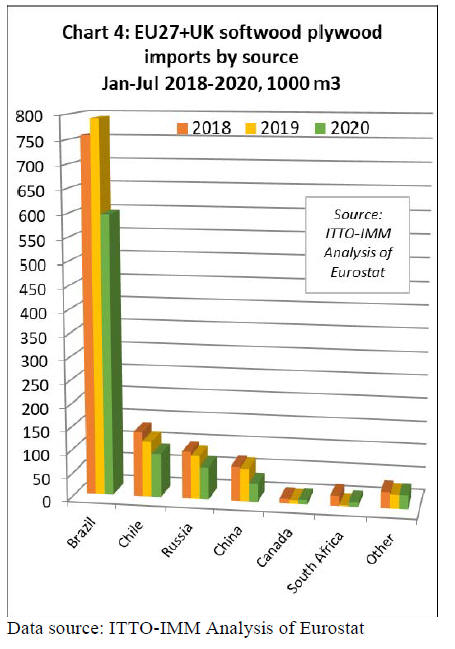

EU27+UK total softwood plywood imports over the same

period were 23.9% lower at 847,000 cu.m, with Brazilian

24.7% lower at 597,000 cu.m, Chilean down 22.1% at

93,000 cu.m, Russian down 24.7% at 70,000 cu.m and

Chinese down 44.9% at 39,000 cu.m. Imports from

Canada rose 26% to 9,500 cu.m and South African

increased 311.8% to 10,000 cu.m (Chart 4).

No-deal Brexit threatens European market confidence

Turning to Brexit, there remain fears if the UK leaves the

EU without a deal, it could further undermine European

market confidence, which is already fragile due to fresh

spikes in incidence of Covid-19 in a growing number of

countries. But late September, negotiators on both sides

were making more conciliatory noises and sounding more

positive a deal would be struck.

A leading UK importer added that, while they remained

concerned about hold ups at ports and customs as new

administrative procedures bed in in the event of a no-deal

Brexit, they were not hedging by increasing stocks.

¡°We always keep a buffer and don¡¯t anticipate we¡¯ll need

more than this,¡± they said. ¡°In addition, all our competitors

will be in the same position.¡±

Another importer said they were cautious about building

stock in case the current ¡®US demand bubble¡¯

underpinning the global market bursts. ¡°In that case prices

would drop,¡± they said.

UK companies added that they were not ¡®overly anxious¡¯

either about having to undertake due diligence on imports

from the EU under the new UK Timber Regulation, which

succeeds the EUTR in the UK, if a deal is not struck.

This includes FLEGT-licensed product imported via EU

countries.

¡°We have the systems in place, and are already subjecting

Latvian plywood and OSB to due diligence, for instance,

so we don¡¯t see it as a significant additional administrative

burden,¡± said one company.

One complication is the position of Northern Ireland post

Brexit. Under the original ¡®Withdrawal Agreement¡¯

concluded by the UK and EU, it remains subject to the

EUTR, so goods shipped from the rest of the UK to

Northern Ireland would have to undergo due diligence and

be subject to the same duty as those imported into the

province from other non-EU countries.

However, under the UK government¡¯s recently proposed

Internal Market Bill, goods could be shipped to Northern

Ireland without any checks or duty, in which case those

exported from Northern Ireland to the Irish Republic

would be subject to EUTR due diligence.

¡°About 10% of our turnover comes from goods exported

to the Republic via Northern Ireland, and this uncertainty

is not helpful,¡± said a UK plywood importer. ¡°But we have

been assured, we won¡¯t be paying duty twice.¡±

Brexit deal or no Brexit deal, all UK imports from outside

the EU will be subject to the duty rates in the new UK

Global Tariff unless:

the supplier country or region has a trade deal

with the UK

a developing supplier country has Generalised

Scheme of Preference status with the UK

an open Product Quota has been registered with

the WTO.

That said, many of the duty rates will be unchanged from

those of the EU. Some will be lower.

As for quotas, this includes the EU Coniferous Plywood

Quota. According to the UK Timber Trade Federation, if

the UK strikes a trade deal with the EU, then it will

continue to take its share of this annual quota, as before. If

not, plywood from the EU will count as part of its share of

the quota.

¡°Our understanding is that the UK will have its own duty

free softwood plywood quota of around 167,000 m3

starting January 1, 2021, which is based on its usage of the

[EU] quota over the past five years,¡± said a TTF

spokesperson. ¡°If we do not sign an EU deal then

coniferous plywood from Finland, France and Sweden will

have access to the quota along with the rest of the world so

it is likely to be used up faster than before.¡±

Also in EU plywood sector news, the Dutch EUTR

Competent Authority has ordered the Netherlands

company Sakol to stop importing tropical-faced plywood

from Chinese supplier Jiangsu High Hope Arser Co. Ltd,

which it deems in breach of the Regulation.

The Environmental Investigation Agency NGO says the

move sets a precedent for the rest of the EU, and it urges

Competent Authorities in France, Belgium, Greece, and

the UK, which import similar products from China, to

follow the Dutch example.

¡°This decision is significant as it delivers a blow to the

protective cover that these global supply routes have

provided for high risk and illegal tropical timber and

shows that European authorities are rising to the challenge

posed by complex timber supply chains,¡± said EIA Forest

Campaigns Director Lisa Handy.

¡°For the EU to demonstrate it is truly a level playing field,

and if the UK does not want to become a back door for

illegal tropical timber in the region, the decision taken in

the Netherlands should trigger a domino effect across

Europe. We look forward to other authorities taking

similar actions.¡±

On the trade outlook, EU plywood companies highlight

continued downside risks in the market. These include

further increases in new cases of Covid-19 ¨C the so-called

pandemic ¡®second wave¡¯. Importers are also concerned

that unemployment will rise as governments withdraw

worker furlough support, with a consequent loss of

consumer confidence. Some expressed a worry too about

sufficient new construction work coming on stream,

despite public investment, once pandemic-delayed projects

are completed.

However, the sector is not overly downbeat. ¡°We¡¯re in a

better position now than we expected to be six months

ago, and at the moment we¡¯re seeing recovery continuing

to pick up,¡± said an importer. ¡°We¡¯re taking things week

to week, month to month, as the picture is so uncertain,

but we¡¯re cautiously optimistic.¡±

|