4.

INDONESIA

Boosting exports to Japan

The Chargé d'affaires of the Indonesian Embassy in

Tokyo, Tri Purnajaya, said Indonesia has the opportunity

to increase exports of wood products to Japan because

Indonesian products have a good reputation in Japan.

To expand export sales the Chargé d'affaires said that the

Indonesian Embassy in Tokyo is ready to help increase

processed wood products export especially plywood.

He pointed out that exports of Indonesian wood products

to Japan in 2019 were worth around US$1.55 billion

which he estimated was around 8% of all Japan’s wood

product imports.

However, the pandemic has disrupted trade and poses a

huge challenges. In the first half of 2020 Indonesia’s wood

product exports to Japan fell around 4%.

Nevertheless, Tri Purnajaya is optimistic because demand

for wood products in Japan is still high and as the

economy recovers so will consumption.

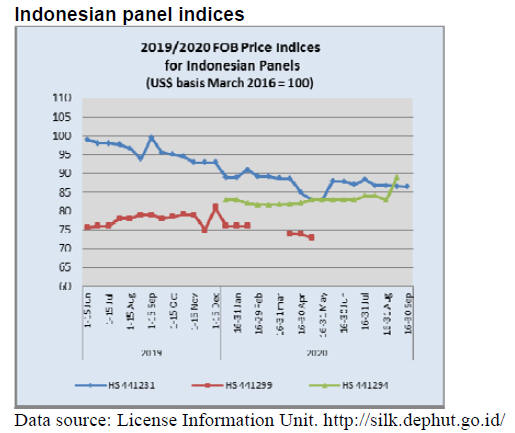

A representative of the Indonesian Wood Panel

Association (Apkindo), Handjaja, said Indonesia is a

major global plywood exporter. Plywood exports were

worth US$1.7 billion in 2019. He further said Indonesian

plywood meets the required quality standards in Japan and

is verified legal under the SVLK.

See:

https://republika.co.id/berita/qgi4fn349/ekspor-produkkayu-olahan-masih-punya-ruang-ditingkatkan

Removing obstacles in the furniture sector

The government, through the Representative Council of

Indonesia (Dewan Perwakilan Rakyat Republik

Indonesia,DPR), is committed to removing obstacles faced

by the furniture makers in securing legal wood raw

materials.

In a press statement Deputy Chairman of the DPR,

Rachmat Gobel, said "Commitment to complete work

must be the main key for all parties with their respective

main duties and functions. Thus, the investment that

comes in must be effective and produce results, not an

investment that in the long term is detrimental to

Indonesia”.

He continued, saying he had learned of the problems in a

dialogue with furniture and crafts manufacturers who

pointed out that the export potential of the national

furniture and handicraft sector could rise to US$5 billion

over the next five years provided the timber raw materials

were available.

Furniture industry representatives asked for the

elimination of a number of export regulations that

suppress their potential to maximize added value.

See:

https://ekonomi.bisnis.com/read/20200916/9/1292542/dprdorong-penyelesaian-hambatan-usaha-di-industri-mebel

Indonesia strong in South Korean Plywood Market

Indonesian plywood gained a firm market share in the

South Korean market during the first half of this year.

Apart from Indonesia and Vietnam the South Korean

plywood market is also important for Chinese plywood

producers.

Recent reports show South Korean plywood imports

reached US$391 million in the first half of which US$133

million was from Indonesia followed by Vietnam with

US$127 million.

Vietnam producers attracted an anti-dumping investigation

by South Korean authorities. In a final decision after a

nine-month investigation, South Korean regulatory

authorities issued anti-dumping duties of up to 10.65

percent for 5 years on cerain Vietnamese plywood

producers.

The decision to impose anti-dumping duties on

Vietnamese plywood requires approval from the Minister

of Strategy and Finance by the end of this year.

See:

https://ekonomi.bisnis.com/read/20200918/12/1293534/geservietnam-indonesia-kuasai-pasar-kayu-lapis-korsel-segini-nilainya

UK market confident on Indonesia's wood products

The Indonesian SVLK legality verification system and

FLEGT licensing makes Indonesia a low risk source of

tropical timber in the UK.

Between November 2016 to September 2020, Indonesia

reported 27,500 documents for 730,000 certified timber

shipments worth US$1 billion exported to the UK

according to the Charge d'Affaires Embassy of the

Republic of Indonesia (KBRI) London, Adam M. Tugio.

Adam said FLEGT is an important hallmark for retailers in

the UK as it ensures transparency. Today, more British

consumers are adopting ethical purchasing and demand

proof of legality for the wood products they purchase

along with assurances that the products purchased have

not resulted in deforestation.

Adam explained that British consumers appear willing to

buy certified sustainable products at a premium price. This

change in behavior has given importers hope that the

British government can provide incentives for the use of

sustainable wood by the UK timber industry.

See:

https://ekonomi.bisnis.com/read/20200924/257/1296105/pasaringgris-makin-percaya-produk-kayu-lestari-indonesia

In related news, Deputy Minister of Environment and

Forestry, Alue Dohong, in his remarks on a webinar ‘UK

Market Update for FLEGT Timber Product: Indonesia's

Timber as Sustainable Partner for UK Market’ held on 23

September said that that the SVLK won the trust of

international buyers because Indonesian wood products

come from legal sources.

In the webinar, Lord Goldsmith, UK Minister of State for

Pacific and the Environment, said that the commitment to,

and legality standards of Indonesian wood products makes

it easier for UK importers and consumers and that he

appreciates the cooperation between Indonesia and the UK

over the past two decades in developing strong compliance

standards for sustainable wood.

5.

MYANMAR

All timber

production ceased

An explosive second wave of Covid-19 infections has

shocked the country. Cases have now topped 10,000 with

226 confirmed deaths. The Ministry of Health and Sports

(MOHS) imposed strict ‘stay-at-home’ restrictions for

Yangon from 24 September.

Only businesses involved in banking and financial

services, petrol stations, food and cold storage,

pharmaceuticals, purified water distribution and

production of daily personal items have been exempted

from the order. As a result, all wood processing industries

in the area covered by the lockdown have ceased

production.

It is difficult to assess the impact on the industry and

exports. The current lockdown will be reconsidered in

early October. If the lockdown is extended for a month the

impact on the manufacturing sector and wood processors

may be severe.

The ban on foreign visitors and domestic travel has been

extended to the end of October. The ban on domestic

travel will disrupt preparations for the general election due

in a few weeks. While economic growth has not been

listed as one of the top three priorities in the ruling party’s

manifesto, politicians are paying more attention to the

private sector ahead of the upcoming November elections.

Support for workers

Officials in the Yangon Region Government are

discussing plans to provide financial assistance to workers

who cannot get to work because of the travel ban.

Workers who have made Social Security Board (SSB)

contributions will receive 40% of their wages as financial

assistance and assistance will be provided to those who

have not contributed to the SSB.

See:

https://www.mmtimes.com/news/myanmar-govt-distributecash-workers-without-social-security.html

Border trade suspended

Myanmar’s official border trade with China has

completely ceased as China has closed the Ruili crossing.

Ruili is the main border town adjacent to Muse in

Myanmar. Muse sees the busiest border trade with China

which averaged around 4.57 billion kyats (US$3.5 million)

per day before the pandemic.

Ruili, in China’s Yunnan Province, is under lockdown and

all residents are to be tested for COVID-19 after two

allegedly illegal immigrants from Myanmar tested

positive.

Reports say about 400 trucks with goods from Myanmar

are stranded in Muse and around 100 trucks are stuck in

Jiegao between the border and Ruili so traders are

searching for warehouses to temporarily store the goods.

South Korea seeks to boost trade to support a

recovery

Myanmar and South Korea have agreed to enhance trade,

investment and energy cooperation to help ease the

COVID-19 downturn. During an online meeting of the

bilateral Joint Commission for Trade and Industrial

Cooperation it was agreed that economic ties be expanded

and infrastructure projects should proceed.

6. INDIA

Sound agro-forestry

plan but little progress

Agro-forestry practices are gaining popularity in the

country as the mix of commercial trees and crops

geneartes early sources of income some of which can be

used for tree crop maintenance.

Agro-forestry is being promoted to supply commercial

timbers such as sandalwood, agarwood and red sanders

mixed with other hardwoods such as teak, laurel

(Terminalia tomentosa), haldu (Adina cordifolia), kalam

(Mitragyna parviflora), rosewood (Dalbergia latifolia),

sissoo( D.sissoo) and other local species.

Interest is growing in the so-called ‘five storey‘ agroforestry

comprising native hardwood trees, exotics

between the hardwoods, Fruit trees, vegetables and

climbers and underground spices.

In related news, at the 10th Sustainability Summit

organised by the Confederation of Indian Industry (CII),

Union Environment Minister, Prakash Javadekar,

explained the Central government’s decision to reforest

degraded forests through public-private partnership (PPP)

mode.

The National Agro-forestry policy 2014, which emphases

farm forestry and agro forestry, has not resulted in much

progress on ground. Commentators in India say there is a

need to scale-up already-developed agro-forestry models

using indigenous species for ecological sustainability and

economic expansion as over the past 10 years timber

imports have jumped to more than US$5 billion because

domestic timber resources are limited and demand has

surged.

For more see: http://www.risiinfo.com

Government urged to boost investment

The United Nations Conference on Trade and

Development (UNCTAD) has forecast an almost 6%

decline in India’s GDP for 2020 and is urging the

government to continue measures to boost investment and

consumer spending.

The UNCTAD report ‘From Global Pandemic To

Prosperity for All: Avoiding Another Lost Decade’ says

“In the case of India, the baseline scenario is a sharp

recession in 2020 as strict lockdown measures to stem the

virus’s spread brought many productive activities to a halt

across the country,”.

See:https://unctad.org/en/pages/PressRelease.aspx?OriginalVersionID=570

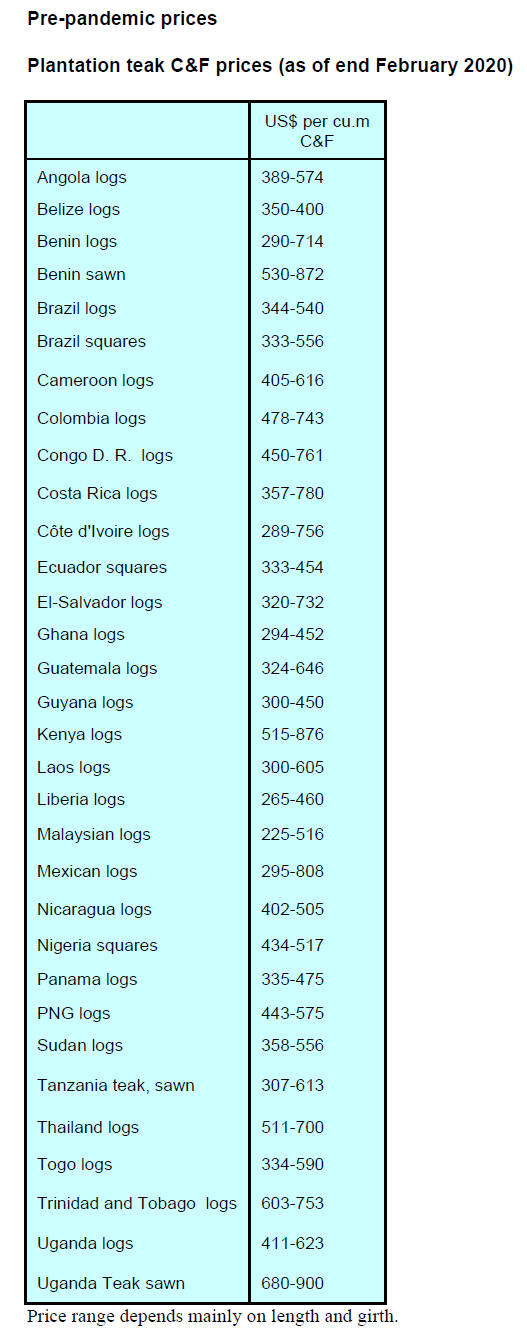

Plantation teak

Indian importers have commented that freight rates have

become more volatile as there is shortage of containers.

They anticipate this situation will prevail for some time.

Under the present circumstances it is difficult to give a

clear picture of C&F prices for imported teak.

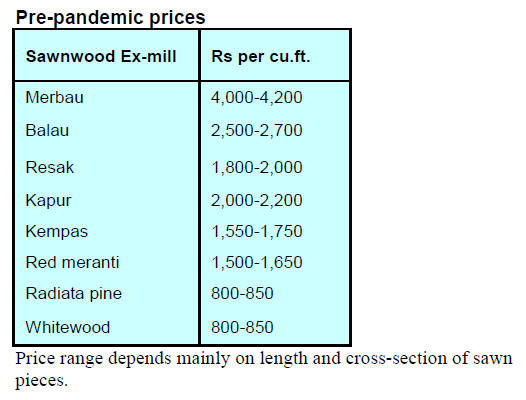

Locally milled sawnwood

There has been a modest rise in demand for hardwoods

mainly in the smaller cities in rural areas. The timber

markets in the main cities are still affected by the corona

control measures and the recent rise in infections has

disrupted the economic recovery.

The prices below do not, as yet, reflect the

increased

freight rates.

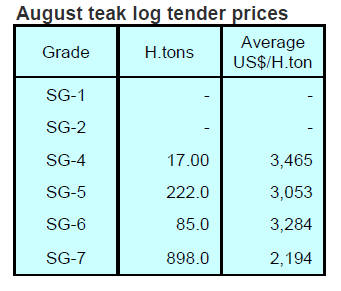

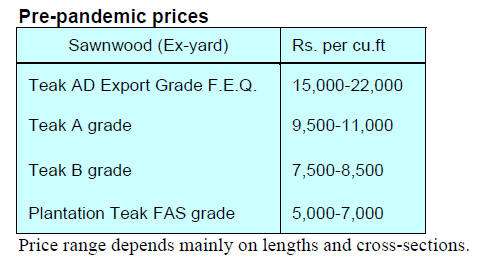

Myanmar teak

As tender prices for logs in Myanmar have been rising

Indian importers are anticipating exporters will be asking

for higher prices when shipments of teak to India resume.

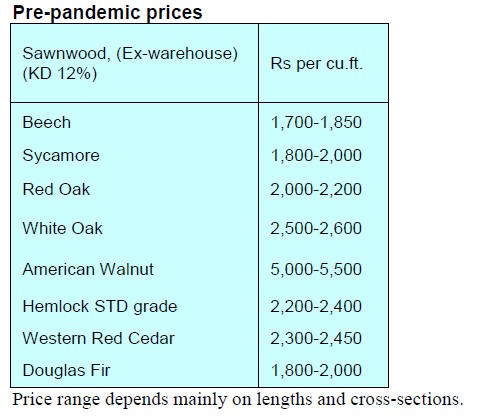

Sawn hardwood prices

A modest revival in demand was seen recently but the

pace of improvement has been very slow such that any

further rise in demand will be dependent on business

conditions stabilising.

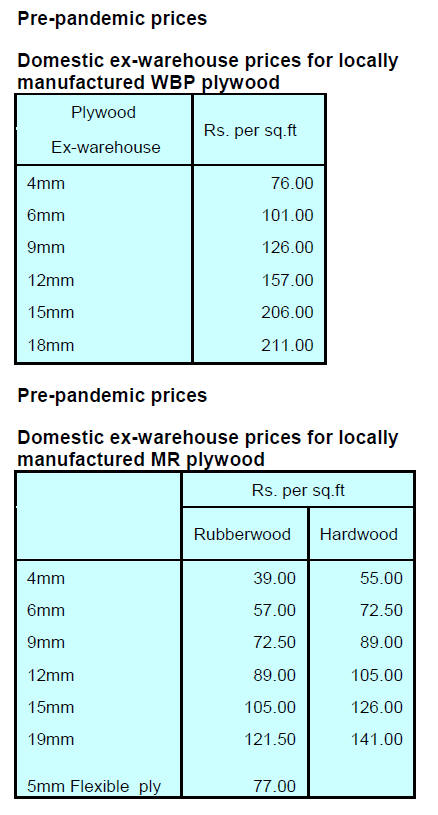

Plywood

Millers say that a rise in demand has allowed them to lift

production slightly and that sales are improving. Domestic

producers want to raise prices as production costs have

risen but with prices for imported panels falling they have

no opportunity to raise prices for panels.

7.

VIETNAM

Vietnam top exporter

of veneer and plywood

The US Globaltrade magazine has republished a story

from an Indexbox market forecast illustrating that, in value

terms, the largest hardwood veneer and plywood suppliers

to the US in 2019 were first Vietnam, China and Canada

with a combined 45% share of total imports. Other

suppliers were Indonesia, Russia, Cambodia, Malaysia,

Spain, Brazil, Ecuador, Italy and Uruguay, which together

accounted for a further 43%.

See:

https://www.globaltrademag.com/the-american-hardwoodveneer-and-plywood-market-vietnam-replaces-china-as-topforeign-supplier/

and

https://www.indexbox.io/store/us-hardwood-veneer-andplywood-market-analysis-and-forecast-to-2020/

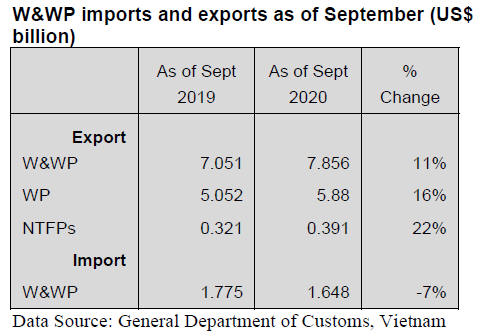

Export/import update

In spite of the pandemic by mid-2020 Vietnam’s wood and

wood product (W&WP) export earnings topped US$7.9

bil., a year-on-year growth of 11%. Wood product exports

reached US$5.9 bil., with a year-on-year growth of 16%,

while the export of NTFPs amounted to US$391 mil., 22%

up.

In total, on 15 September 2020 exports of W&WP plus

NTFPs were valued at US$8.249 billion, an increase of

12% against the same period of 2019. With this impressive

growth rate in 2020 total W&WP exports (plus NTFPs)

are expected to be over US$12 billion keeping Vietnam

amongst the top 5 global wood product exporters.

In contrast, W&WP imports into Vietnam up to September

were reported at US$1.7 billion, a year-on-year decline of

7%.

EU welcomes VNTLAS

In a September 2020 press release, Giorgio Aliberti,

Ambassador of the European Union to Vietnam

commented on the completion of the Government Decree

on the Vietnam’s Timber Legality Assurance System

(VNTLAS) which aims at implementing the annex with

the same title of the EU – Vietnam Voluntary Partnership

Agreement (VPA) on Forest Law Enforcement,

Governance and Trade (FLEGT).

The press release continues saying "Ambassador Aliberti

trusts in Vietnam’s continued commitment to the VPA,

which entered into force last June and active pursuit of the

VPA’s objective to manage all types of forests sustainably

and provide a legal framework aimed at ensuring the

legality of the production of timber and timber products,

irrespective of whether the timber originates from within

or outside of Vietnam.

The preparation of the VNTLAS decree provided for

consultation with VPA stakeholders, including the VPA

multi-stakeholder core group in 2019 and the EU is

grateful for the opportunities for dialogue, which

continued during and beyond the VPA Joint

Implementation Committee meeting in June 2020.

The VNTLAS decree addresses important elements of the

VPA related to the import and export of timber and timber

products. It also provides the basis for an Organisation

Classification System, albeit one specific to enterprises

engaged in processing and exporting timber and thus

lacking some core elements foreseen in the VPA.

Such a system covering importer and domestic producer

organisations alike is foreseen in the VPA as a tool to

facilitate legality assurance throughout the supply chain in

Viet Nam and is a core element of the VPA.”

The press release continues, “The EU looks forward to

seeing how Vietnam will in future extend the scope to

address legality, not only at the point of import and expor,

but importantly for operators involved in harvesting,

trading and processing of domestic as well as imported

timber and for products destined to all markets”

For the full press release see:

https://eeas.europa.eu/delegations/vietnam/85283/node/85283_en

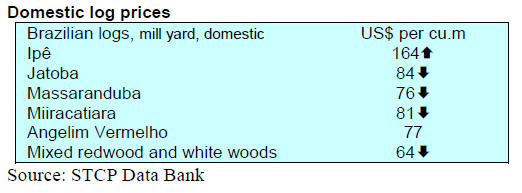

8. BRAZIL

Real strengthens against the US

dollar

Brazilian inflation measured by the Consumer Price Index

(IPCA) stood at 0.24% in August 2020, the highest value

for the month since August 2016 (0.44%). The average

commercial exchange rate ended August 2020 at

BRL5.46/US compared to the average in July 2020

(BRL5.28/USD).

However, the Brazilian real moved to a one-month high in

late September due to signs of a steady economic recovery

in the country and due to a weaker US dollar. The real rose

almost 1% to 5.246 to the dollar after data showed private

sector economic activity rose in August at its fastest pace

in seven years.

Revenue stream stabilise for furniture cluster

The Bento Gonçalves furniture cluster continues to report

improved output. The Furniture Industry Association of

Bento Gonçalves (Sindmóveis) has said the accumulated

revenue up to July this year was R$1.1 billion.

The cluster includes about 300 companies in the

municipalities of Bento Gonçalves, Monte Belo do Sul,

Pinto Bandeira and Santa Tereza. March and April 2020

were the worst months in the history of the furniture

industry in the Bento Gonçalves furniture cluster. In

contrast furniture companies in Rio Grande do Sul saw a

decline in revenues of around 6% year on year over the

same period.

As production is increased manufacturers are experiencing

delays in the delivery of raw materials and higher costs. In

addition to the demand for veneers the furniture industry

depends on prompt delivery of furniture hardware, paints

and varnishes, coatings, adhesives, paper and packaging.

Furniture industry revenues will probably improve in the

coming months but for 2020 are unlikely to match those in

2019. The performance of the furniture sector depends on

firmer internal and external demand and the speed of an

economic recovery.

IBAMA launches improved tracking system

In September IBAMA (Brazilian Institute of the

Environment and Renewable Natural Resources) launched

SINAFLOR+ which is an improved version of the former

SINAFLOR (National System for the Control of the

Origin of Forest Products) created in 2012 to guarantee

control in the management of wood, tracking it from its

origin.

According to IBAMA, in the old system the linkage

between harvested wood and the tree in the forest was

made by random sampling. In the new system

SINAFLOR+, trees for selective logging are 100%

identified by geo-referencing and all products can be

traced back to the exact point from which the log was

originally harvested. In addition to preventing fraud, the

system has an electronic signature and QR code. The new

system aims to ensure greater transparency and stricter

timber and forest products control.

SINAFLOR+ also has an integrated control panel for the

user with tools that go from history (logging permit) to

intelligent search, facilitating the management of logging

permits and pending issues by the entrepreneur. The

system has been tested since August by more than 500

trained users including members of environmental

agencies and IBAMA´s technicians and inspectors.

See:

http://aquiacontece.com.br/noticia/meioambiente/12/09/2020/sinaflor-ibama-lanca-sistema-antifraudepara-combater-o-desmatamento/155903

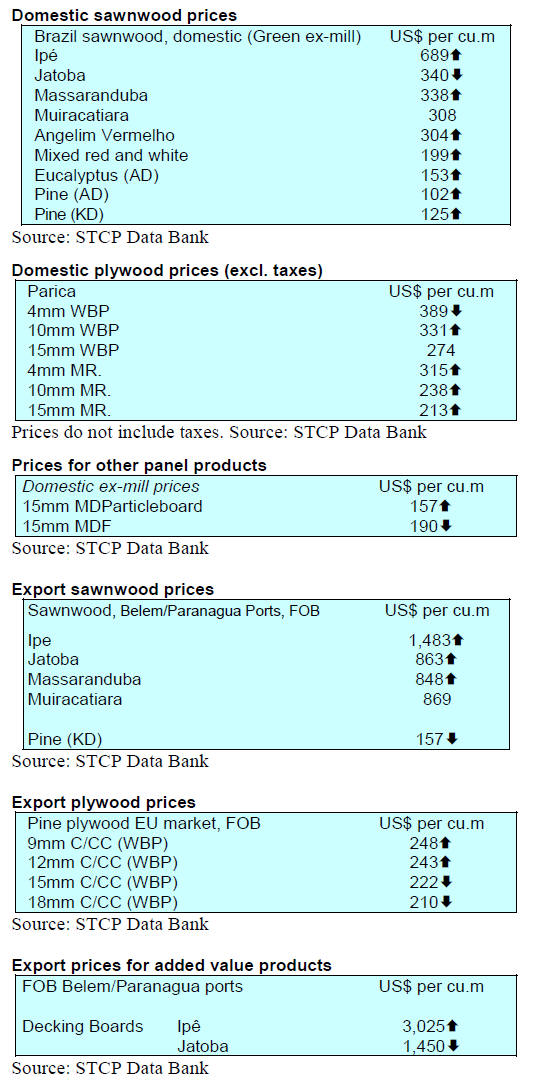

Export update

In August this year Brazilian exports of wood-based

products (except pulp and paper) increased 25.6% in value

compared to August 2019, from US$233.5 million to

US$293.1 million.

The value of pine sawnwood exports increased 36%

between August 2019 (US$35.0 million) and August 2020

(US$47.5 million). In volume terms, exports increased

56% over the same period, from 176,400 cu.m to 275,300

cu.m.

In contrast, the volume of tropical sawnwood exports

declined 11% , from 41,300 cu.m in August 2019 to

36,600 cu.m in August 2020. The value of exports

dropped but only by around 4% from US$15.3 million to

US$14.7 million over the same period.

Pine plywood exports earnings increased 52% in August

2020 in comparison with August 2019, from US$39.3

million to US$59.9 million. There was an increase in the

volume of exports but only by 38% over the same period,

from 173,900 cu.m to 239,100 cu.m signaling an

improvement in unit prices.

Brazil’s exports of tropical plywood increased around 2%

in August but the value of exports dropped almost 20%

from 5,800 cu.m (US$ 2.6 million) in August 2019 to

5,900 cu.m (US$ 2.1 million) in August 2020.

On a brighter note Brazil’s exports of wooden furniture

increased from US$47.1 million in August 2019 to

US$52.6 million in August 2020, an almost 12% rise.

Rising furniture exports from Rio Grande do Sul

Furniture production in the state of Rio Grande do Sul has

started to recover after two difficult months for the sector.

Production in July increase over 40% compared to June

with the manufacture of 7.1 million pieces according to

IEMI - Market Intelligence.

For the Association of Furniture Industries of the State of

Rio Grande do Sul (Movergs) the sector's performance is

far from ideal for 2020 but, gradually, businesses are

recovering.

In July 2020, exports from Rio Grande do Sul state

increased 13%, totaling US$ 13.0 million. In August,

exports increased by 23%, totaling US$16.0 million. The

states of Santa Catarina, Rio Grande do Sul and Paraná,

together, accounted for 85% of the values exported in

August, followed by the state of São Paulo, which ranked

4th.

The United States is the main destination for furniture

exports of the state of Rio Grande do sul (22% of exports),

followed by Peru (12.3%) and Uruguay (12.2%). Exports

to Colombia and Peru in August grew 173% and 137%,

respectively compared to the previous month.

Lower forest sector exports from Acre

The state of Acre in the Amazon region is one of the

largest producers of tropical timber in Brazil and proudly

boost of the lowest rate of deforestation in the Amazon

region.

According to the Ministry of Economy, in August 2020

exports from Acre totalled US$2.42 million and imports

US$0.46 million. In the year to August exports totalled

US$23.9 million and imports, US$1.72 million. Compared

to August 2019, August 2020 exports fell 4%. The share

of forest sector exports in total August exports was 37%, a

considerable drop when compared to the same period last

year (52%).

9. PERU

Surge in January and February

sawnwood exports lifts

1st half earnings

According to the Association of Exporters (ADEX)

sawnwood exports between January and July were worth

US$12.9 around 5.5% higher than in the same period last

year. The good performance is due to firmer demand from

China.

The manager of the Extractive Industries and Services

Sector in ADEX, Lucía Rodríguez, said while the year

started well for exporters, production was seriously

disrupted in March, April and May. However, prospects

for annual sales are looking positive.

In January sawnwood sales increased around 75% year on

year and in February they were more than double the value

of February 2019 exports. However the following three

months there were declines of 20% in March, 63% in

April and 68% in May.

The main market destination for sawnwood in the first

seven months of the year were China (US$5.5 million)

followed by the Dominican Republic (US$2.7 million)

despite suffering a drop of about 39%.

The third ranked market was Mexico (US$1.8 million)

down 56% year on year. Sawnwood exports to Vietnam

which were worth US$1.2 million in the first seven

months of the year grew almost 80% year on year.

Forest operations resume but production will be lower

this year

Paralysis of timber operations due to the emergency

measures shortened the harvesting season when log

extraction is allowed.

Although some restrictions have been lifted and forest

operations have resumed it will not be possible to recover

100% of the production.

Certified forest management expands

Despite the difficult times initiatives to protect and

responsibly use tropical forests continue and FSC

certification of forest management has expanded.

This year two new areas in the Ucayali region have been

certified. To-date, the forestry companies Consolidado

Sepahua Tropical Forest SAC and Nuevo San Martín SAC

manage 313,430 hectares of certified concessions in the

country (around 30% of the total certified area). Of this

area, 295,507 hectares are destined to forest production

and 17,923 hectares are protected.

SMEs to get subsidised access CITEmadera services

The Technological Institute of Production (ITP) will offer

small and medium-sized enterprises vouchers with a value

of around US$1,200 which can be used to access the

technological services provided by the CITE network.

This is aimed at entrepreneurs who have been affected

during the State of Emergency and are in a vulnerable

situation. The services available include technical

assistance for product design and development, for

laboratory testing, productive support and training.

See:

https://www.gob.pe/en/institucion/citemadera/noticias/296398-mipymes-recibiran-vales-hasta-por-4300-soles-para-acceder-alos-servicios-del-citemadera