US Dollar Exchange Rates of

25th August

2020

China Yuan 6.8898

Report from China

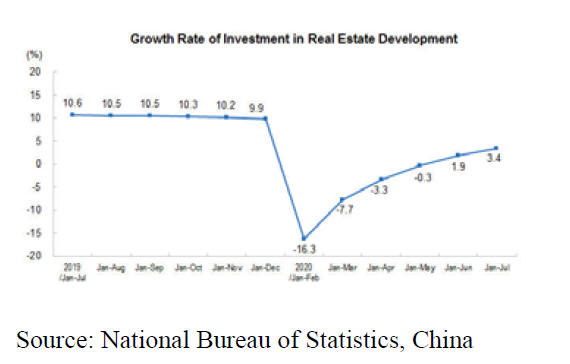

Investment in real estate

In the first seven months of this year domestic investment

in real estate increased by 3.4% year-on-year, and the

growth in investment in July continued the upward trend.

As an indicator of future prospects for the balance

of 2020

in the real estate sector the area of land purchased for

development fell slightly in July when compared to July

2019.

See:

http://www.stats.gov.cn/english/PressRelease/202008/t20200817_1783486.html

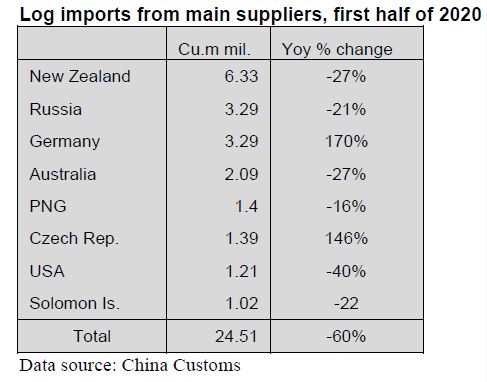

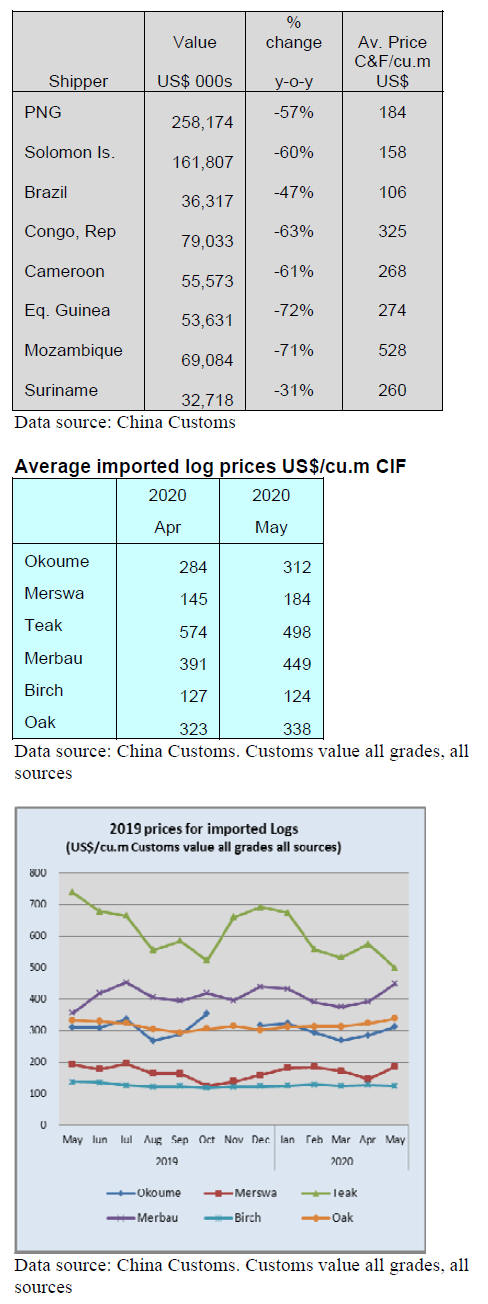

Sharp decline in China¡¯s log imports

China¡¯s log imports fell sharply in the first half of 2020 to

24.51 million cubic metres valued at US$3.558 billion,

down 60% in volume and 62% in value from the same

period of 2019.

Of total log imports, softwood log imports fell 61% to

17.64 million cubic metres, accounting for 72% of the

national total. Hardwood log imports fell 55% to 6.87

million cubic metres (28% of the national total log

imports).

Of total hardwood log imports, tropical log imports were

4.11 million cubic metres valued at US$956 million, down

59% in volume and 64% in value from the same period of

2019 and accounted for 60% of all hardwood log imports.

US no longer largest log supplier

The main countries supplying more than 1 million cubic

metres of logs to China in the first half of 2020 were New

Zealand, Russia, Germany, Australia, PNG, Czech Rep.,

US and Solomon Islands. Shipments of logs to China from

all main suppliers fell in the first half of the year. The

decline of more than 70% in shipments of logs from the

US was the most significant.

In the first half of the year New Zealand was the main log

supplier to China accounting for 26% of total log imports.

Imports from New Zealand totalled 6.33 million cubic

metres, down 64% from the same period of 2019.

The second ranked supplier of logs was Russia at 3.29

million cubic metres, down 56% from the same period of

2019 and accounting for about 13.5% of the national total.

The third ranked supplier of logs was Germany at 3.29

million cubic metres, down 22% from the same period of

2019 and accounting for just over 13% of the national

total. Germany has become the most important supplier of

China¡¯s log imports.

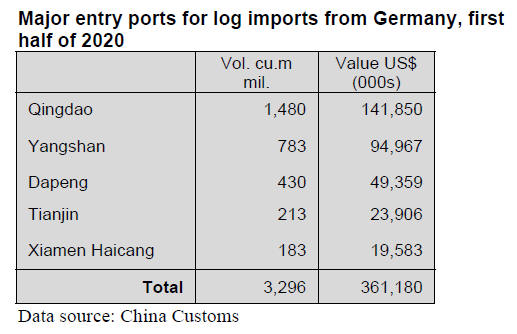

Major entry ports for log imports from

Germany

Over 90% of China¡¯s log imports from Germany in the

first half of 2020 were through Qingdao Port in Shandong

Province which handled around 45% of all log imports.

The other major entry points for logs were Yanshan in

Shanghai, Dapeng Port in Guangdong Province, Tianjin

Port and Xiamen Haicang Port in Fujian Province.

The average price for China¡¯s log imports from Germany

through Qingdao port was the lowest at US$96 per cubic

metre just below the average price for logs of US$100 per

cubic metre. Logs supplied to China from Germany

arrived via the China-Europe Railway Express.

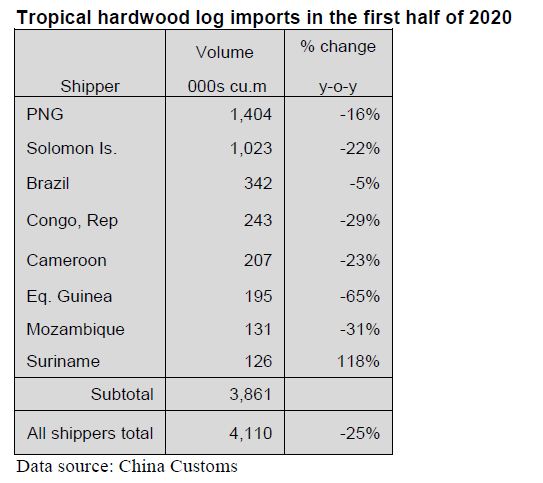

Decline in tropical hardwood log imports

Tropical log imports in the first half of 2020 amounted

4.11 million cubic metres valued at US$965 million, down

59% in volume and 64% in value over the same period of

2019 and accounted for 17% of the national total log

imports volume.

In the first half of 2020 China imported tropical logs

mainly from Papua New Guinea (34%), Solomon Islands

(25%), Brazil (8.3%), the Republic of Congo (5.9%),

Cameroon (5.0%), Equatorial Guinea (4.8%),

Mozambique (3%) and Suriname (3%). Just 8 countries

supplied nearly 90% of China¡¯s tropical log requirements

in the first half of 2020.

Tropical hardwood log imports from the main suppliers

were sharply down in the first half of 2020. Log imports

from Equatorial Guinea and Mozambique fell 70% and

69% respectively.

Before their log export bans, Laos and Myanmar were

major sources of tropical logs for China. However,

China¡¯s log imports from Laos in the first half of 2020 fell

to just 15,500 cubic metres valued at US$18 million, down

82% in volume and 83% in value.

China¡¯s log imports from Myanmar fell to just 1,300 cubic

metres valued at US$1.45 million, down 88% in volume

and 89% in value.

|