Japan

Wood Products Prices

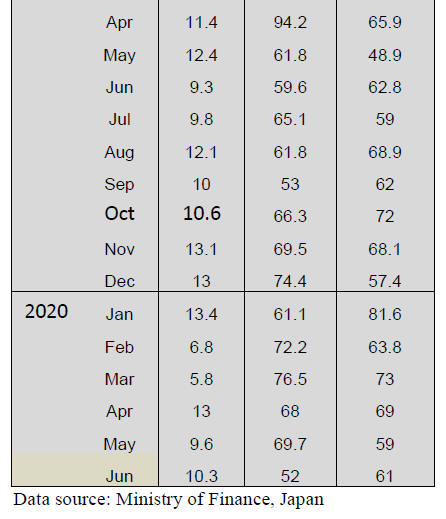

Dollar Exchange Rates of 25th

August

2020

Japan Yen 106.59

Reports From Japan

Is this the end of Abenomics?

The Japanese Prime Minister, Shinzo Abe, has resigned

and this comes just days after achieving the record as the

longest serving Japanese Prime Minister. His departure

may signal the end of the ¡®abenomics¡¯ experiment which

was designed to reverse the persistent deflation in Japan

through massive monetary easing and a 2% annual

inflation target adopted by the Bank of Japan.

Critics of ¡®abenomics¡¯ had, until Abe¡¯s resignation, been

circumspect but now there has been more open criticism of

the policy which, even, before the corona virus pandemic,

was not delivering on raising consumer spending or

company capital investment.

Even before the pandemic ¡®abenomics¡¯ failed to deliver

the domestic conditions that would drive higher growth

beyond reliance on international demand and now, as the

economy has been decimated by pandemic control

measures, Japan is paying a big price as any short-term

benefits brought by ¡®abenomics¡¯ have been wiped out.

Perhaps the greatest disappointment with ¡®abenomics¡¯ was

the elusive reforms to reshape the economy which suffers

low productivity, rigid labour market and a rapidly ageing

population.

The aim of ¡®abenomics¡¯ to encourage companies to

increase capital expenditure did not succeed but access to

cheap money allowed companies to build up cash reserves.

This policy, which is now paying off as companies have a

huge cash resource, is serving as a liquidity buffer to

survive the shock from the pandemic. The pandemic has

reassured corporations that cash is indeed king.

The priority at the moment is recovery of the economy

which will now fall on the next Prime Minister who will

be chosen by the ruling Liberal Democratic Party.

See:

https://www.nasdaq.com/articles/analysis-abenomics-failsto-deliver-as-japan-braces-for-abe-resignation-2020-08-28

Recovery not until 2022

The Japanese economy recorded its biggest decline in the

second quarter of this year and many commentators warn

that the country must be prepared for a long drawn out

recovery and a weak job market.

The Cabinet Office has suggested annual growth could fall

a further 5% for the year to March 2021.

Although recent data indicates the slowdown in

consumption and production may have slowed, it could be

until 2022 that the economy could return to levels before

the pandemic. June unemployment figures were low

compared to many other countries but analysts warn

underemployment is emerging as a problem.

Saito Taro, executive research fellow at NLI Research

Institute, predicts that the jobless rate will climb to four

percent by the end of this year.

See:

https://www.nliresearch.co.jp/en/report/detail/id=65192?site=nli

and

https://www3.nhk.or.jp/nhkworld/en/news/backstories/1258/

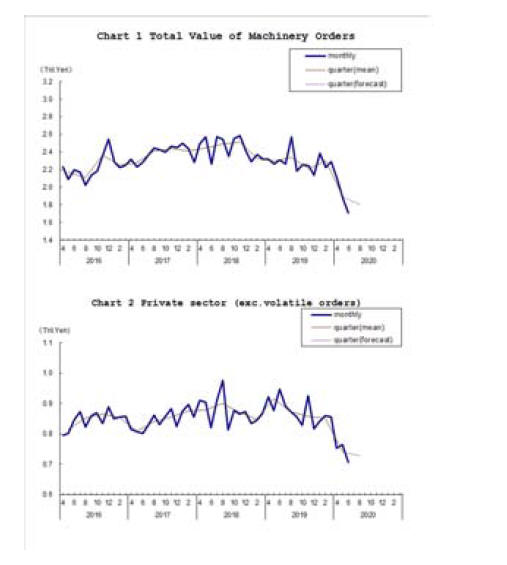

Machinery orders

The total value of machinery orders received by

manufacturers operating in Japan declined by 8.4% in June

from the previous month and in the second quarter fell by

17.7% compared with the previous quarter. Weak private

consumption and international demand took its toll on

machinery orders. Orders from overseas, an indicator of

future exports, declined 4% in the second quarter

following the fall in the first quarter.

Machinery orders are a key advance indicator for

corporate capital spending and the government uses this

key data to predict the strength of business spending in six

to nine months.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2020/2006juchue.html

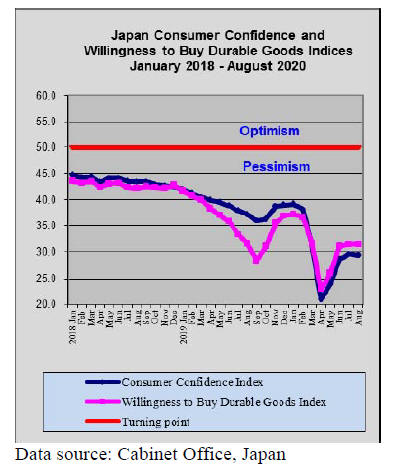

Consumer confidence stalls as corono-virus

second

wave expands

The latest Cabinet Office survey shows Japan's consumer

confidence index fell slightly in August dropping for the

first time in three months as the coronavirus crisis

continues to cloud the outlook for jobs and the economy.

See:

https://www.todayonline.com/world/japans-consumerconfidence-index-slips-august

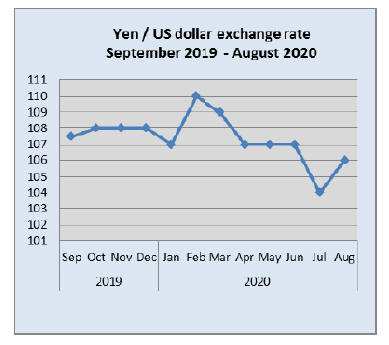

Bank of Japan holds the key to exchange

rates

The combined effect of a weakening dollar and the

resignation of the Japanese Prime Minister lifted the yen

against the US dollar but the change was short lived. What

is more likely to impact the longer term yen/dollar

exchange rate will how the policy of the Bank of Japan

may change.

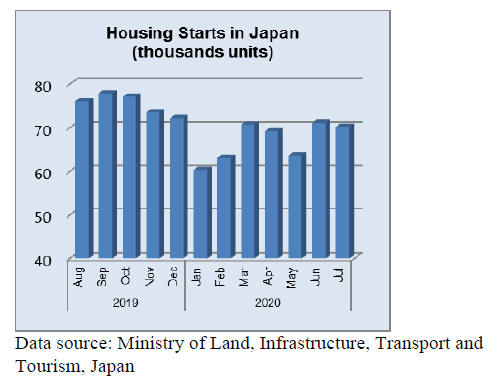

July housing starts down 11% year on year

The month end release of housing statistics shows that

July housing starts were little changed from the level seen

in June but, year on year, July starts were around 11%

down.

Import update

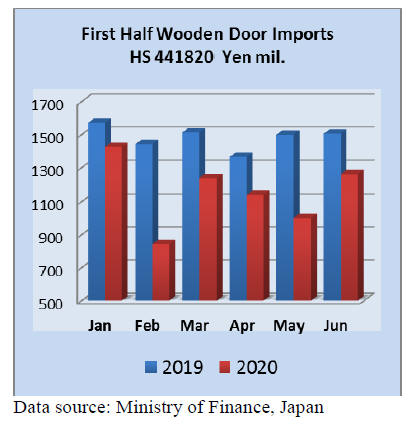

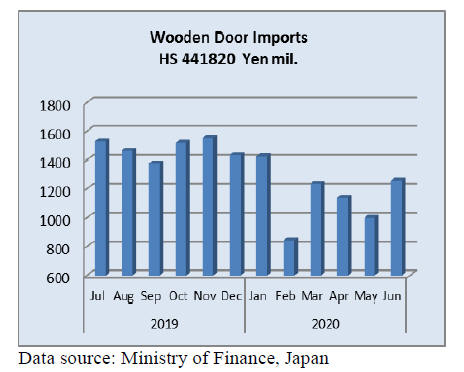

Wooden door imports

In the first half of 2020 the value of Japan¡¯s imports of

wooden doors (HS441820) were down 26% from the same

period in 2019.

After several months of declines the value of door

imports

in June moved higher compared to levels in May. Month

on month there was a 26% rise in the value of June

imports but year on year the value of imports dropped

16%.

In June the main shippers of wooden doors to Japan were

China (68% of June imports), the Philippines (13%),

followed by Indonesia and Malaysia with around 5% each.

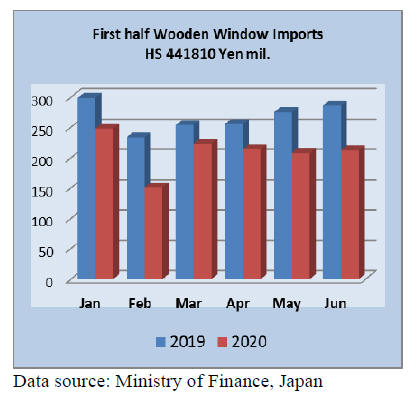

Wooden window imports

In the first half of 2020 the value of Japan¡¯s imports of

wooden windows (HS441810) was down 26% from the

same period in 2019.

The pattern of imports of wooden windows (HS441810)

mirrors that of door imports. The value of June 2020

imports of wooden windows was down 26% year on year

but was about level with the value of May imports and as

such arrested the slight decline in monthly import values

that was first seen in April.

Shipments from three supply countries made up 80% of all

June imports of wooden windows with exporters in China

accounting for over half of the total followed by the US

(15%) and the Philippines (12%). Much of the 20%

balance was sourced from shippers in Europe.

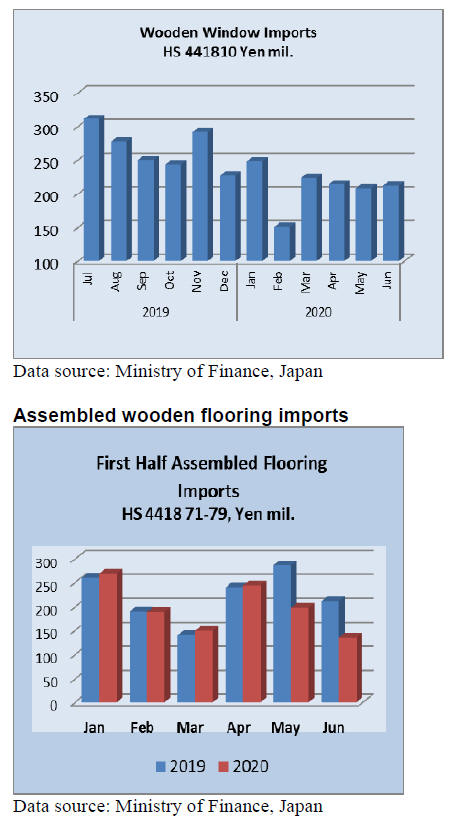

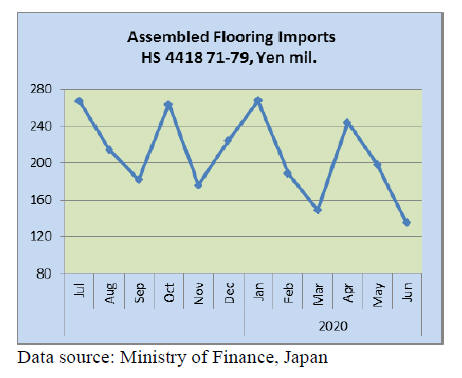

The two consecutive monthly declines (May and June)

in the

value of assembled flooring imports underlines the depressed

state of the housing market in Japan.

Year on year the value of assembled flooring imports dropped

36% in June 2020 and month on month there was a 32% decline

adding to the drop in imports seen in May.

Of the various categories of flooring imported HS 441875

accounted for over 70% of June imports as it has done in past

months and was supplied mainly by shippers in China and

Vietnam. A further 17% of imports was of HS441879 supplied

by shippers in mainly Thailand and Vietnam.

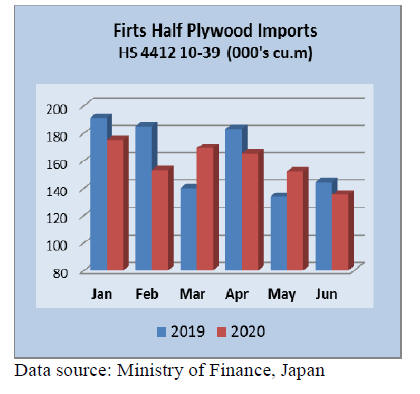

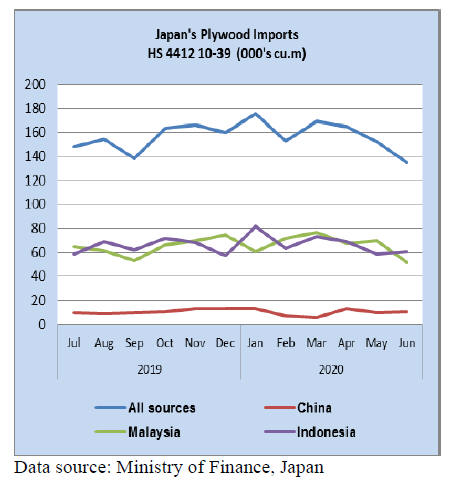

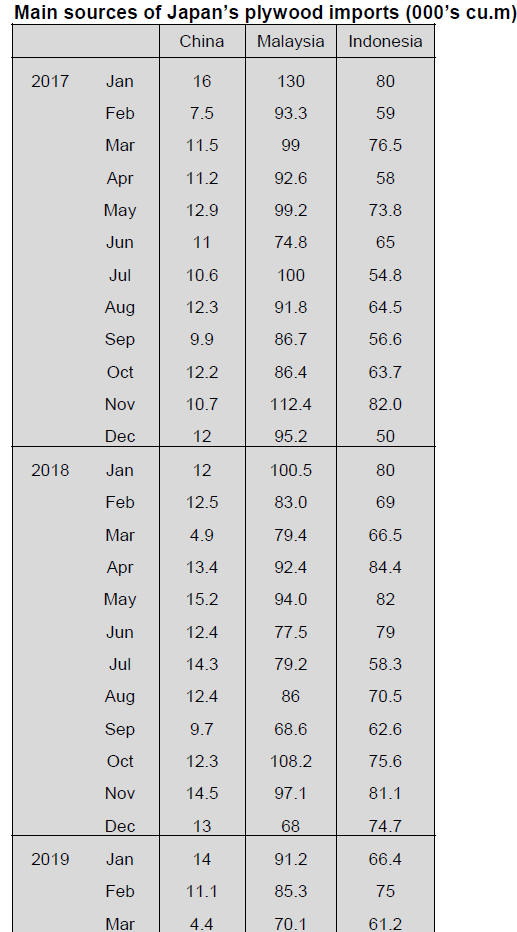

Plywood imports

There has been a steady decline in the volume of Japan¡¯s

plywood imports in the first half of 2020. Year on year the

volume of plywood imports dropped 28% in the first half

of 2020.

Indonesia and Malaysia are the top shippers of

plywood to

Japan accounting for over 80% of all plywood imports.

In June arrivals from Malaysia were down 26% compared

to May and year on year June imports were around 13%

down. In contrast, the volume of June imports from

Indonesia was around the same level as in May and were

marginally lower than in June 2019.

Plywood imports from China are small at about 10,000

cu.m monthly but was noticeable in the first half import

data is that shipments of plywood from Vietnam were for

the first time greater than from China.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Prospect of market after August

Market of building materials continues weak. New

housing starts until in June are 398,120 units, 11.4% less

than 2019. This is not so bad considering corona virus

epidemic started in early this year but many fears more

drop in coming months so dealers hesitate to procure

building materials.

Structural materials market such as beam lumber got into

price war. Softwood plywood manufacturers started

production curtailment by 20% before the market

deteriorated but count not stop price skid. Market prices

of structural softwood panel are now about 900 yen per

sheet delivered, the lowest in four years.

According to the survey made by the Japan Forest

Products Journal, orders through July are more than 90%

(for processing capacity), which is about 10% less than

2019 but considering negative factors, it is rather high

level.

This coordinates to decrease of new housing starts by

about 10% so the first half of this year was not so bad.

Major house builders¡¯ orders in last April and May drop

sizably by 30-40% because of house quarantine for

corona virus epidemic so this will lead drop of housing

starts in summer months but such builders¡¯ orders in June

recovered to only 15% less than June last year so there

are optimistic comments now.

Major builders report that number of people visiting

house exhibition sites are back to normal and large sales

campaign events also started. Order made house builders

suffered after face to face negotiations became prohibitive

by corona virus epidemic while builders, which have

ample information on web site are successful in getting

enough customers.

However, the generation visiting exhibition sites are

young while aged people hesitated to go out in fear of

catching the virus. Wealthy aged generation, which is

likely to have property to put up house, is the target of

order made house builders but they quarantine at home.

Younger people may not be immediate buyers but they

are potential buyers so the builders think it is seeding time

now. In the U.S.A., major cities were lock-down to

prevent spread of corona virus so new housing starts of

1.56 million units nosedived to 930,000 in April then

after economic activities started in May, housing starts

made V shape recovery of 1.01 million in May and 1.18

million in June.

In Japan, there were no lock-down so number of new

housing starts did not drop so much compared to the

U.S.A. and as the orders are recovering after the State of

Emergency was lifted in late May, there might not be so

sharp drop.

As to building materials, dealers in Japan anticipate

further drop of the demand so procurement activities are

down so if there is no sharp drop of housing starts in

coming months, supply of the materials may get tight like

the U.S.A. where lumber market steeply climbed with

increase of housing starts because many mills curtailed

the production and the supply was tight so structural

lumber¡¯s average prices reached the record high.

It is unlikely that the same would happen in Japan but

weak materials market may bottom out and rebound on

tight supply items. Some items are over-supplied like the

European laminated lumber and the Russian lumber while

North American logs and lumber are firm and the

European lumber market is recovering.

Radiata pine logs and lumber supply this year is way

down. Log import through June was 21.0% less than 2019

and Chilean lumber import was 35.9% less. The demand

for crating is much slower than construction materials.

Japanese domestic radiate pine lumber mills¡¯ production in

April was 10-20% less than 2019 and May through July

was 30-40% less.

There are mixed views for future market and many thinks

that things are not as bad as initially feared. Others think

that there will be steep cliff ahead but nobody knows when

and how deep.

South Sea (tropical) logs

Supply of South Sea logs for the first six months of this

year is 56,700 cbms, 25.6% less than 2019. Users carry

two to three months inventory. The shipment of products

is slow. Users like plywood manufacturers are reducing

purchase of logs since orders from the customers are

declining.

Low arrival seems to continue. Suppliers¡¯ export prices of

Indonesian mercusii pine free board dropped so the

market prices in Japan declined. In every year, August is

busy season for interior repair works of schools during

summer vacation but this year is different as school

summer vacation is shortened to catch up closed period in

spring when corona virus started spreading so such works

are postponed. Demand of free board is slow as orders of

repair of shops and stores are down.

Plywood

Plywood movement continues stagnant. Down trend of

market prices seems to be bottoming as softwood plywood

manufacturers determined to stop further skidding of

market prices and imported plywood inventory is getting

low and the dealers have started cautious marketing.

Market prices of domestic softwood plywood sharply

dropped in June and early July then the manufacturers

notified dealers that they would not accept any lower

offers. The dealers are following the move of the

manufacturer since lowering sales prices does not help

move any more volume.

August is vacation month with many holidays so the

manufacturers decided to reduce the production more than

30% in hope of the prices bottoming out but future outlook

of the market is very ambiguous and the market continues

having uneasiness. Movement of imported plywood is

improving since last July.

The dealers¡¯ activities have been passive with fear of

demand retreat and price deterioration but there are many

supply short items and it is reported that shipments from

warehouses in Tokyo Bay exceeded incoming volume for

two straight months of June and July so the port inventory

is further dropping. June supply of imported plywood was

180,460 cbms, first time to dip below 200,000 cbms in

four months.

With uncertain future market, the importers made very

little purchase since April but September is interim book

closing month so that the importers try not to increase

order balance. Therefore, the arrivals seem to continue low

for coming months.

Clean-up of Aomori¡¯s dead stock logs

Local cedar logs produced in Aomori prefecture increased

as dead stock after the demand dropped by corona virus

epidemic.

There were about 60,000 cbms of logs at log yards in June

and quality deterioration was feared in warm weather.

The prefecture and the Forest Association of Aomori tried

hard to dispose of produced logs and succeeded to move

about 37,000 cbms to local LVL and lumber mills.

The prefecture decided to subsidize two third of

transportation cost of stocked logs so the Forest

Association succeeded to export 15,000 cbms of logs to

China. By these efforts, fear of quality deterioration and

resultant drop of market prices is avoided.

For log export, there are three shipments from three

different ports in Aomori prefecture. Aomori has long

experience of log export to China together with

neighboring Akita prefecture and it plans to keep looking

for more buyers in China.

|