3.

MALAYSIA

Export performance January to April

National trade statistics for the first four months of this

year illustrate the impact of the pandemic on the

performance of timber exporters. Export earnings for the

period January to April 2020 fell 10% year on year to

RM6.4 billion.

Sawnwood export volumes for January to April 2020

dropped 36% in volume year on year and by 38% in value

(399,934 cu.m and RM734.5 million). Exports of

sawnwood to the EU in April were badly affected,

dropping 65% year on year to 2,599 cu.m.

In contrast, exports of MDF in April fell just 2% to 38,366

cu m but were reported to have increased in value

compared to the previous month.

In April wood product exports to ASEAN countries fell

47% to 3,575 cu m from 6,801 cu m in the previous

month. Exports to Indonesia and the Philippines dropped

by 23% and 86% to 2,083 cu m and 438 cu m respectively.

However, Vietnam increased its buying by 16%.

While there was a recovery in plywood exports in April,

cumulative exports for January-April 2020 were down 5%

in volume year on year and by 13% year on year in value.

April exports to ASEAN and East Asia increased by

around 5% to 95,517 cu m compared to the previous

month.

April exports of mouldings increased 11% month on

month in volume and by (a surprising) 157% in value to

8,981 cu.m worth RM32.6 million.

Moulding exports for the period January to April 2020

decreased by 34% in volume and by 28% in value to

57,731 cu.m worth RM219.4 million as compared to the

corresponding period in 2019. Exports to the EU for April

were recorded at 4,006 cu.m, a decline of 40% compared

to the previous month.

Rubberwood export quota

The Ministry of Plantation Industries and Commodities

has tentatively approved the sawn rubberwood export

quota for 2020 at 50,000 cu. m.

All registered exporters are required to apply for the sawn

rubberwood quota. The approval of quotas is subject to the

current export requirement as well as MTIB control

mechanisms. From 1 July 2019 exports of finger-jointed

rubberwood products were subject to an export ban.

Paulownia considered for plantation programme

A technical committee recently met to discuss the

Government’s proposal to include paulownia as one of the

approved species in the Forest Plantation Development

Programme which will provide soft loans to eligible

companies participating in the programme.

Representatives of a company familiar with paulownia

briefed the committee on the mechanical properties of the

wood, planting and maintenance methods, seedling

propagation, pests and disease control and timber

utilisation.

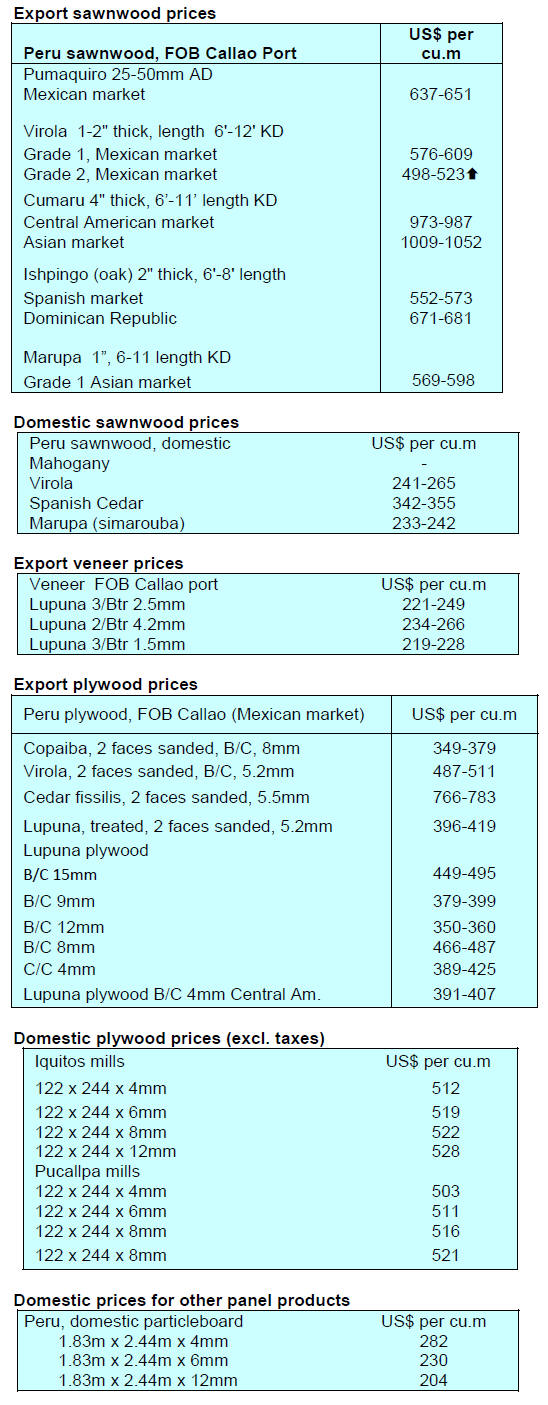

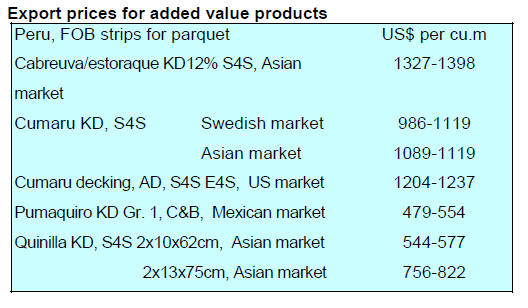

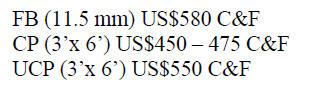

Plywood export prices

Traders based in Sarawak reported the following July

export prices:

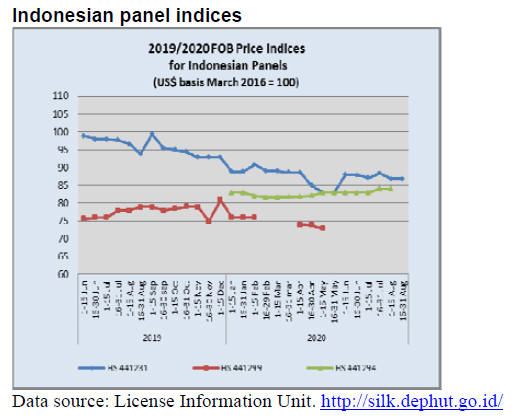

4.

INDONESIA

Furniture industry needs help to be

ready for demand

up-turn

Indonesian furniture manufacturers are optimistic that

production will be back to normal by the end of the first

quarter of 2021 but, because average production utilisation

will be stuck at around 30%, they asked the government to

provide support for the industry so that it can be ready to

take immediate advantage of the anticipated rise in

demand at the end of the first quarter 2021.

The optimism of the industry hinges on the relaunch of the

Indonesia Furniture Expo (IFEX), which is scheduled to

take place at the end of the first quarter of 2021, assuming

that a vaccine has become available. Abdul Sobur,

Secretary General of the Indonesian Furniture and Craft

Industry Association HIMKI, said last year IFEX attracted

12,000 buyers.

Despite the request for direct financial support submitted

to the Ministry of Industry, the Association has not had a

response. Because of this Sobur said the Association will

instead propose an easing of costs associated with imports

of raw materials by furniture exporters at least at this

critical time when government efforts are focused

pandemic control measures.

See:

https://ekonomi.bisnis.com/read/20200817/257/1280197/industri-furnitur-minta-stimulus-hadapi-lonjakan-permintaan-2021

Furniture entrepreneurs – firmly ‘No’ to log and raw

rattan exports

Supriyadi, General Chairman of HIMKI in Cirebon is still

strongly objecting to attempts to allow log and raw rattan

exports which, he said, would run counter to the

downstream development programme launched by the

government.

Supriyadi said he was concerned that there were people

who wanted the government to allow log and raw rattan

exports saying this is more practical and profitable than

exporting finished goods in the form of furniture and

crafts.

Supriyadi was reported as saying "We (the Association)

firmly reject the opening of the export of logs and raw

rattan materials because if it is opened the raw materials

will be exported massively as happened with rattan raw

materials several years ago."

See:

https://www.antaranews.com/berita/1678690/kalanganindustri-mebel-jangan-buka-ekspor-kran-kayu-log-dan-rotan

Trade surplus for July 2020

Indonesia recorded a trade surplus of US$3.26 billion in

July 2020 as exports improved to US$13.73 billion and

imports slowed to US$10.47 billion according to the

Central Bureau of Statistics (BPS). The BPS Head,

Suhariyanto, said the July surplus is higher month on

month and year on year.

5.

Myanmar

Another step forward as some travel

restrictions lifted

In another move to stimulate their economies, Japan and

Myanmar have agreed to relax border controls for

foreigners and long-term residents. This is particularly

important for Japanese companies which have operations

in Myanmar. The next step will be to ease restrictions and

allow short-term business travel.

See:

https://www.japantimes.co.jp/news/2020/08/25/national/japanmyanmar-reopen-borders/#.X0yziZIzbIU

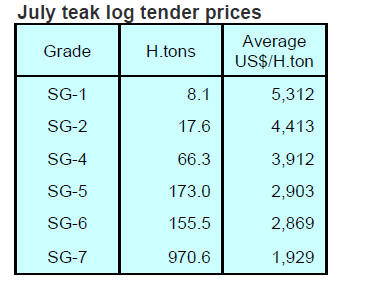

MTE Tender Sale

In the August the Myanma Timber Enterprise (MTE)

tender the MTE offer around 1,200 tons of teak lLogs and

over 5,000 tons of other hardwoods. As of 31 August the

results form the sale were not available. The August sale

was only the second since sales were suspended in March.

Covid-19 cases surge in Rakhine State

In early August it appeared that Myanmar had stemmed

the spread of the corona virus as there were only a few

infections confirmed over the past three months.

Against this background it came as a surprise when the

Ministry of Health reported new 16 cases in Rakhine

State. On 30 August the number of cases rose to 319 in

Rakhine State. The Authorities issued ‘Stay at Home’

orders for the more than 3 million people in Rakhine State.

Border Trade

Trade between Myanmar and other members of the

Association of Southeast Asian Nations (ASEAN) reached

over US$9.9 billion in the first nine months of this fiscal

year.

Between October 2019 to June 2020 Myanmar earned

over US$3.6 billion from exports to ASEAN member

states while imports from ASEAN totalled US$6.3 billion

with Thailand, Singapore and Malaysia being the main

trading partners.

In related news, the border trade with China, Thailand,

Bangladesh and India continues to flourish. The Ministry

of Commerce estimates the value of trade at 18 border

trade camps exceeded US$9.6 billion between October

2019 and August this year of which over US$6.45 billion

was exports.

6. INDIA

Impact of pandemic on housing

The pandemic has drastically altered the work style for

many and, with the prospect of ‘work from home‘ being

here to stay in many sectors, commentators on the real

estate sector see a change coming in investment

preferences in the real estate sector.

As house prices are unlikely to rise for some time and with

home loan interest rates at record lows new homebuyers

may consider first looking at larger homes and secondly

looking for homes in areas out of the main cities as they

no longer have a daily commute.

This is especially likely for IT workers who can now

abandon the formerly popular 'walk-to-work' culture to

one that focusses on the home environment.

Today, the work from home concept has become the new

driver of investment decisions by homebuyers. The focus

of the buyers is less on proximity to office but more on the

at-home comfort, amenities and affordability of the

project.

Reeza Sebastian, President, Residential Business,

Embassy Group has identified a growing interest among

Indian home buyers in gated townships which provide

security and recreation facilities. She points out that most

of the new gated townships, because they demand large

areas of land, have been established in areas with good

acceee but out of the urban areas.

See:

https://www.youtube.com/watch?v=AwtLR_9E6gM

Association appeal - Plant trees to supply industry

An appeal has emerged from some timber sector

associations for the planting of trees that are the raw

material for the wood products sector.

A large number of mills in India are dependent on

imported hardwood and softwood logs and the asociations

are asking that planting be focussed on species that can

substitute for imports.

The suggestion is that domestic species such as pali

(Palaquium ellipticum), poon (Calophylum tomentosam),

bijasal (Pterocarpus marsupium), laurel (Terminalia

tomentosa), rosewood (Dalbergia latifolia), sissoo

Dalbergia sissoo), mango (Mangifera indica), jamun

(Eugenia jambolana), neem (Azhadirachta indica), arjun

(Terminalia arjuna) and teak (Tectona grandis) should be

planted.

Over 80,000 sawmills and handicraft enterprises are ready

to use domesitc resources to give a boost to selfsufficiency

calls by the authourities.

Two new industrial parks for Punjab

The Punjab Cabinet has approved the construction of

industrial parks for an integrated manufacturing cluster

over 2,000 acres on land near Mattewara in Ludhiana and

at Rajpura in Patiala District. The initiative is seen as core

in accelerating industrialisation and job creation.

According to a spokesperson, the Mattewara project site

had been under active consideration of the state

government for several years and it was originally

conceived and pursued by the industries department. The

integrated manufacturing cluster near Rajpura will be

developed with the help of the National Industrial Corridor

Development Corporation on 1,000 acres of government

and panchayat (village) land.

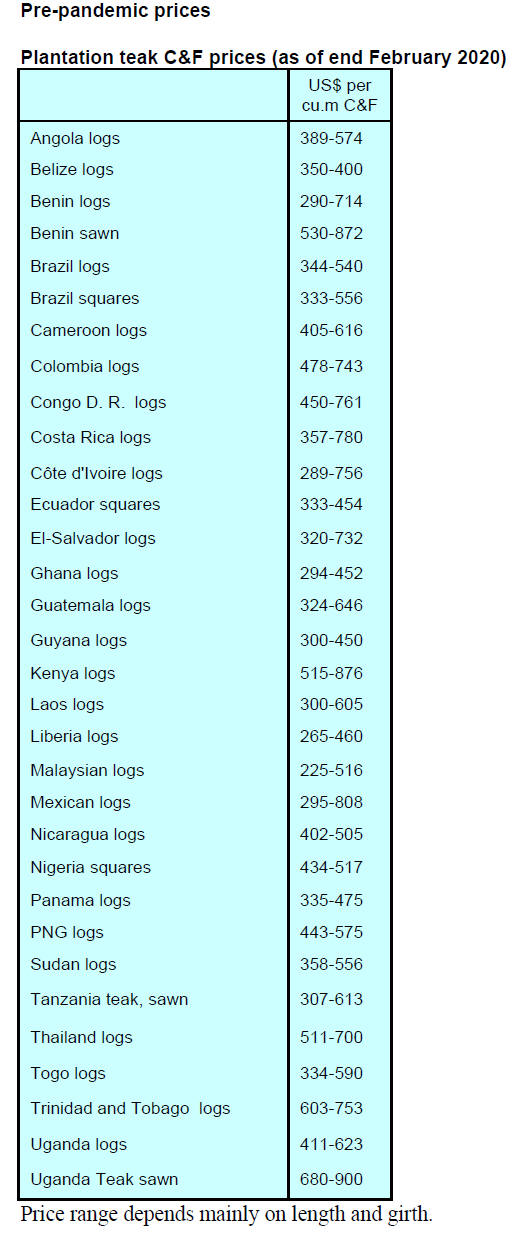

Plantation teak

Traders report the arrival at Indian ports of a few

shipments of teak logs and say more shipments are being

despatched from the supply countries. However, trading

conditions have been completely disrupted by the

lockdowns and a recovery in demand and shipments is a

long way off.

C&F prices at Indian ports from various sources have not

changed from pre-pandemic levels.

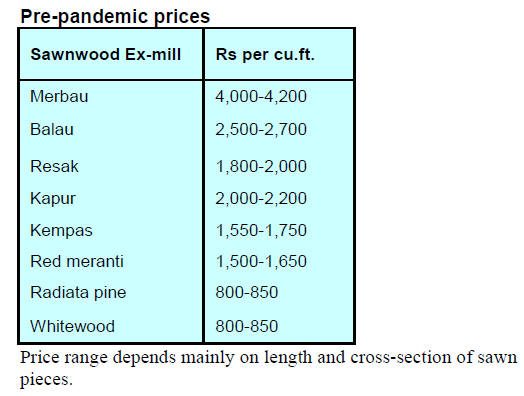

Locally milled sawnwood

While most urban markets are still locked down analysts

report there has been a modest revival of demand for

imported hardwoods in some rural areas.

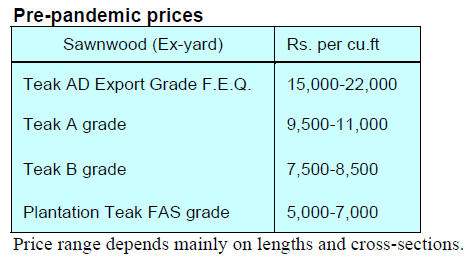

Myanmar teak

What little trade there is in Myanmar teak is being

conducted from previously landed stocks. There have been

no new arrivals from Myanmar.

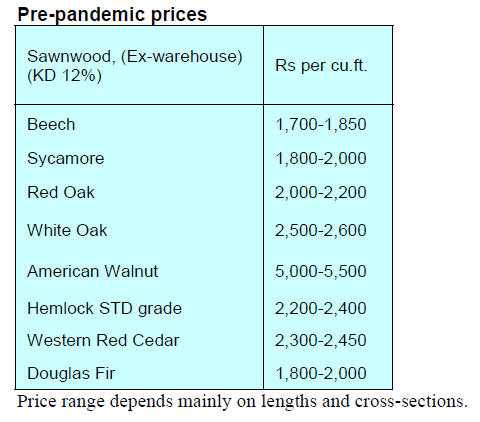

Sawn hardwood prices

Importers say they have no confidence to place orders with

overseas sawnwood shippers as what little demand there is

can be satisfied from existing stocks.

Reports suggest oak is gaining in popularity and there has

been a price rise in some areas. On the other hand, demand

for walnut has weakened.

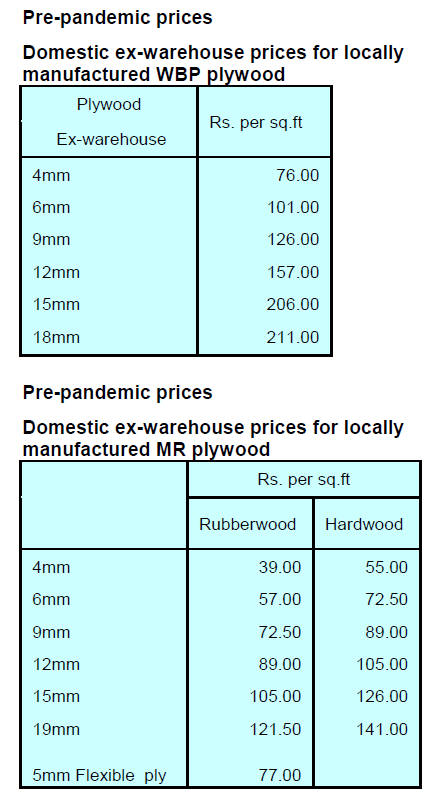

Plywood

Plywood mills are making efforts to identify domestic log

sources. In some states plans are being made to expand the

number of wood processing plants to support India’s selfsufficiency

drive.

Mills are also busy trying to automate operations as much

as possible to overcome the persistent problem of labour

shortages. Plywood prices are unchanged.

7.

VIETNAM

Stunning first half exports

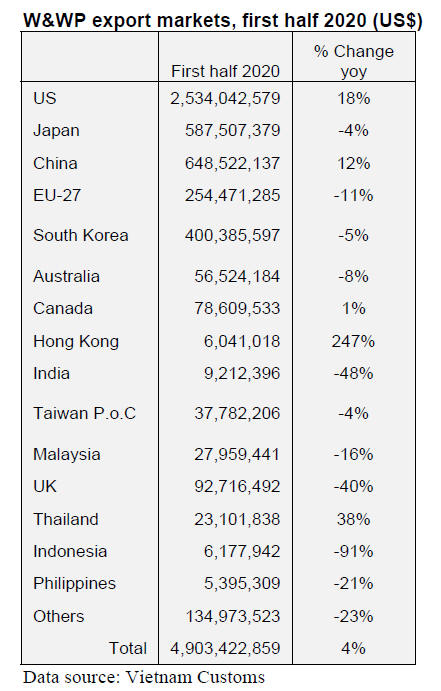

According to Vietnam Customs, at the end of June, wood

and wood product (W&WP) export revenues amounted to

US$4.903 billion, 4% up compared to the same period of

2019 and 22% higher than in May.

The W&WP export growth over the first 6 months of 2020

demonstrates the strong resilience of the Vietnamese wood

industry despite the impact of COVID-19 control

measures. The US, China, Japan, South Korea and EU are

the top destinations for Vietnamese W&WP exports.

First half export up-date

As the top market the US accounted for 52% of total

export revenues or US$2.53 billion, up 18% year-on-year

in the first half. In particular, exports to the US in June

increased by 42% compared to May.

W&WP exports to China contributed 13% to total exports

at US$648.5 million, 12% higher than the same period of

2019. In June 2020, exports to China declined by 12%

month on month.

The Japanese market consumed US$587.5 million in

exports equivalent to 12% of total W&WP export revenue.

In June, export to Japan rose US$75.57 million but this

was 9% down against May.

Exports to EU-27 dropped to US$254.47 million or 5% of

the total export revenue in the first half of 2020. June

exports totaled US$39.8 million, 8% up compared to May.

W&WP shipped to South Korea in the first half of 2020

were worth US$400.38 or around 8% of all first half

exports but were down 5% over the same period of 2019.

Exports during June have been reported as US$ 56.39

million, 27% down compared to May.

W&WP export to other markets including Australia, India,

Taiwan P.o.C, Malaysia, UK, Indonesia and the

Philippines declined during the first half of 2020, while

exports to Hong Kong, Canada and Thailand grew.

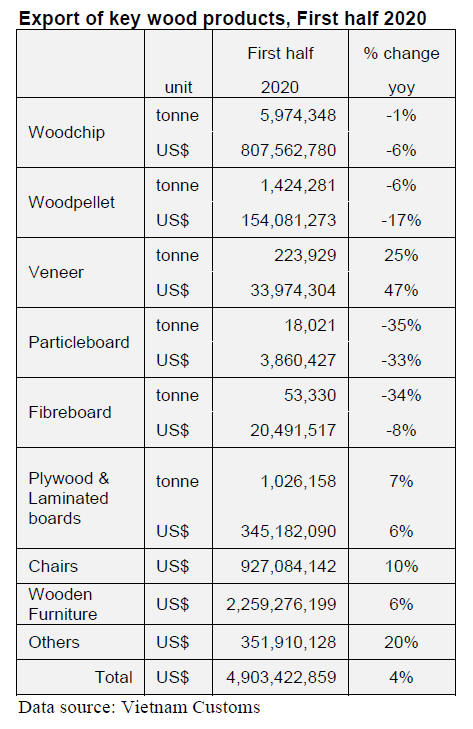

Wooden furniture, chair, woodchip, plywood/laminated

wood and wood pellets remain as the top export

commodities.

The export of these 5 commodities made up 92% of the

W&WP export revenue during the first 6 months of 2020.

Wooden furniture: The export of this group of wooden

products generated US$2,25 billion in the first half 2020,

6% higher compared to the same period of 2019 and

accounted for 46% of W&WP export earnings. Of

significance is that June exports of wooden furniture

increased 48% over the previous month.

Chairs: Chair exports alone were valued at US$0.93

billion a 10% year on year rise. In June, chair export stood

at US$203.3 million, 51% higher than that was recorded

in May.

Woodchips: The value of woodchip exports earned

US$0.81 billion, 6% down year-on-year and contributed

16% to total W&WP export earnings. Woodchip exports

in June were valued at US$88.7 million a decline of 21%

compared to the previous month.

Plywood/Laminated wood: Exports of these wood-based

panels earned at US$0.34 billion, a 6% year on year rise.

In June, plywood/laminated wood product exports fell

29% compared to May.

Wood pellets: The earning from wood pellet export

accounted for US$0.15 billion, 17% down compared to

what was achieved over first half of 2019. Wood pellet

exports accounted for just 3% of W&WP export revenues

in the first half 2020. In June woodpellet exports were

19% down compared to May.

8. BRAZIL

Concessions to be allocated in Amapá

national forest

The Ministry of Agriculture, Livestock and Supply

(MAPA) has authorised the allocation of concessions in

the Amapá National Forest (FLONA do Amapá). This was

done based on provisions in the Annual Forest Grant Plan

(PAOF) 2020 which listed the Amapá National Forest

among federal public forests available for harvesting

concessions.

The Brazilian Forest Service (SFB) is the managing body

for Federal Public Forests and forest concession activities.

The areas set to be allocated were subject to assessment by

the Chico Mendes Institute for Biodiversity Conservation

(ICMBio) which also provided management plans for the

areas.

ICMBio allocated approximately 58% of the total area of

Amapá FLONA for the sustainable harvesting and the

allocated area will be divided into four Forest

Management Units totalling 265,000 hectares.

Currently, there are 18 concession contracts in operation at

the federal level distributed in six national forests in the

states of Pará and Rondônia which total more than one

million hectares.

On average, four to six trees are logged per hectare and the

concessionaire can only return to the same area for

additional harvesting after 25 to 35 years.

Slide in Bento Gonçalves furniture sales bottoms-out

According to the Furniture Industry Association of Bento

Gonçalves (Sindmóveis), in the first half of 2020 Bento

Gonçalves furniture manufacturers were severely impacted

by the pandemic control measures and saw a decline in

revenues and reduced production. Revenues in the first

half of the year amounted to R$826.59 million, down

almost 3% year on year. However, this was a better

performance than furniture sales in the entire state of Rio

Grande do Sul which dipped over 10%.

While March and April 2020 were the worst months for

sales in history for the furniture industry of the Bento

Gonçalves, May and June sales started to recover

according to Sindmóveis, despite the accumulated losses

in the first half, the furniture sector seems to have

managed to stem the decline in sales. The expectation is

that the numbers will continue to improve in the second

half of this year but still finish the year negative.

Sindmóveis pointed out that the national furniture industry

has suffered more than the general average of the

processing industry. The fall in furniture manufacturing in

Brazil was 19% in the first half of 2020 when compared to

the same period in 2019 while output in manufacturing in

general fell only 12%.

One of the main problems during the first half was delays

in the delivery of raw materials due to the isolation

measures that stopped production and hampered logistics.

Export update

In July 2020 the value of Brazilian exports of wood-based

products (except pulp and paper) increased 14.8%

compared to July 2019, from US$234.1 million to

US$268.8 million.

The value of pine sawnwood exports increased 24%

between July 2019 (US$39.4 million) and July 2020

(US$48.9 million). In volume terms exports increased

38% over the same period from 199,100 cu.m to 275,200

cu.m.

In contrast the volume and value of tropical sawnwood

exports declined with a 35% drop in volumes from 47,400

cu.m in July 2019 to 30,900 cu.m in July 2020. The value,

exports fell 34% from US$18.3 million to US$ 12.0

million over the same period.

The value of pine plywood exports increased almost 57%

in July 2020 in comparison with July 2019, from US$31.7

million to US$49.6 million. The volume of exports

increased almost 58% over the same period, from 134,700

cu.m to 212,700 cu.m.

Sadly, tropical plywood exports declined in volume (-

39.3%) and in value (-39.4%), from 8,400 cu.m (US$3.3

million) in July 2019 to 5,100 cu.m (US$2.0 million) in

July 2020.

There was a slight decline in the value of wooden furniture

exports which went from US$47 million in July 2019 to

US$ 46.6 million in July 2020.

Way forward to ‘new normal’ difficult to envision

In late June 2020, FAO organised a Covid-19 Forestry

Webinar Week event. The presentations and discussions

focused on the economic, social and environmental

impacts of the crisis caused by Covid-19 and noted the

impact will be different in each country.

The participants noted quantification of the impact and the

way forward to a ‘new normal’ is still difficult foresee as

there is a great diversity of situations and a lack of

information.

In terms of the economy, recovery will depend on the

demand for Brazilian wood products both domestically

and in international markets.

Brazil’s exports of wood products are concentrated in a

few countries such as the US, China and some European

countries. Each country has a different recovery track with

less impact expected for pulp than for solid wood

products.

In the US, for example, beginning in March, there was a

sharp reduction in the construction of houses which led to

a 30% drop in the production of sawnwood. On the other

hand, in the second quarter of 2020, China increased log

imports from Brazil.

In general, export prices for solid wood products have

declined in recent months. However, the effect on the

export industry was relatively small as a result of the

currency depreciation which generated a false perception

of the impact of the pandemic on business.

Acre state wood exports remain stable

Total exports from the state of Acre totalled US$3.3

million in July 2020 according to the Ministry of

Economy. Forest sector exports in July 2020 increased by

53% compared to the same month of the previous year.

In the first half of this year wood product exports from

Acre state remained stable compared to the same period in

2019. The top five markets in 2020 by export values were:

the United States (32.5%), France (20.6%), the

Netherlands (14.4%), China (12%) and Portugal (4%).

UK law to challenge exporters

Brazilian exporters are anxious to see how the British

government’s plan to introduce a law requiring companies

to ensure that imports do not contribute to

deforestation. This law aims to reduce the UK’s

deforestation footprint associated with the supply of

commodities such as soy, palm oil, beef, cocoa, pulp and

paper.

See:

http://www.madeiratotal.com.br/reino-unido-obrigaraempresas-a-rastrear-desmatamento-no-exterior/

9. PERU

Timber sector severely affected by

pandemic

The Peruvian timber sector has been severely affected by

the pandemic isolation measures and all productive sectors

including. The wood and furniture sectors are some of the

worst affected.

Export data for the first half of 2020 show that it was only

in January and February when trade was undisturbed, the

downturn began in March. The closure of borders,

confinement and other measures taken worldwide

contributed to the decline in demand for wood products.

Exports in the first half of 2020 were US$28 million a

decline of over 50% compared to the same period of 2019

(US$61 million).

The timber sector in Peru contributes just 1% to GDP but

it provides around 300 jobs for every US$1 million

exported. In 2019 the sector generated about 300,000

direct and indirect jobs.

In the first half of the year there was a decline in the

export value of all wood products such as sawnwood,

decking, wooden flooring, plywood, veneers, wooden

furniture and wooden furniture parts.

Commentators write “The Peruvian reality is not different

from other countries in the region, for example, in Brazil

there was a drop of 43%, in Chile there was a decline of

24%, in Ecuador of 20%, however, Peru registers the

sharpest decline in the region”.

Fenafor fair rescheduled for 2021

Due to the pandemic which has been affecting the majority

of timber fairs worldwide the National Forest Fair

(Fenafor) has been rescheduled for 25 - 28 November

2021.

Fenafor is the only fair for the wood sector in the country

where machinery, supplies, accessories and services for

the forestry wood and furniture industries are exhibited.

Measures proposed for survival of the timber sector

As a consequence of the pandemic timber industry

production fell drastically in the first half of the year.

What little production there utilised logs that were

harvested last year.

The Committee for the Wood and Derivatives Industry of

the National Society of Industries (SNI), chaired by

Alfredo Biasevich Barreto, presented proposals to the

government on measures that could be taken to reactivate

the sector and create the basis for medium and long-term

survival.

The Committee presented the following suggestions:

Promote an effective reactivation of the

construction sector, since this activity generates

demand for the primary and secondary

transformation of wood;

Prioritise the public purchase of products made

with Peruvian wood for schools;

Ensure flexible approval of management plans for

the forest concession harvesting;

Do not relax the traceability controls that ensure

wood raw materials are of legal origin;

Raise the drawback percentage so that wood

exports do not lose competitiveness;

Revive the Forestry Board, which has not had

meetings since May in order to once again

discuss and solve the problems that affect the

sector;

Establish the minimum area for future forest

concessions at 80,000 hectares since it has been

found that this area provides for profitable,

sustainable and successful businesses (currently,

areas can be as low as 5,000 hectares and the

maximum is 40,000 hectares).

Forest fires double that of last year

The Satellite Monitoring Unit of the National Forest and

Wildlife Service (Serfor) reported that, between January

and August 2020, 838 forest fires were detected

nationwide, 121% more than in the same period in 2019.

The most affected departments were Puno and Cusco, with

144 and 141 fires respectively; followed by Huánuco and

Junín with 73 and Ayacucho with 67.

According to Serfor one of the main causes of these fires

is the burning of agricultural residues and natural pastures.

Serfor has alerted those responsible for fires that causing

forest fires and burning the forest resources that are part of

the heritage are Very Serious Offenses according to

Section 29763 of the Forestry and Wildlife Law. The

penalties range from 10 to 5000 Tax Units (UIT) and the

Penal Code provides for prison sentences.