|

Report from

North America

US Bureau of Economic Analysis (BEA) news

release

Real gross domestic product (GDP) decreased at an annual

rate of 32.9 percent in the second quarter of 2020,

according to the ¡°advance¡± estimate released by the

Bureau of Economic Analysis. In the first quarter of 2020,

real GDP decreased 5.0 percent.

The full text of the release on BEA's website can be found

at:

www.bea.gov/news/2020/gross-domestic-product-2ndquarter-2020-advance-estimate-and-annual-update

The BEA says ¡°the decline in second quarter GDP

reflected the response to COVID-19, as ¡®stay-at-home¡¯

orders issued in March and April were partially lifted in

some areas of the country in May and June, and

government pandemic assistance payments were

distributed to households and businesses. This led to rapid

shifts in activity, as businesses and schools continued

remote work and consumers and businesses canceled,

restricted, or redirected their spending¡±.

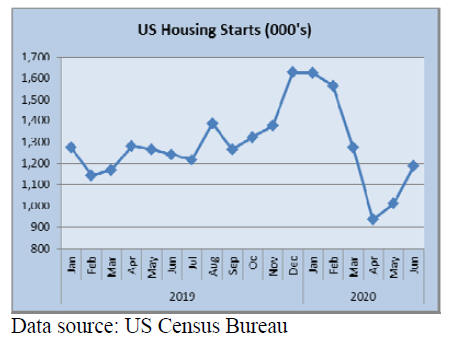

Housing starts gains in June

Led by solid single-family production, US housing starts

increased over 17% in June to a seasonally adjusted annual

rate of 1.19 million units.

The US Commerce Department announced that singlefamily

starts increased 17% to an 831,000 seasonally

adjusted annual rate, after an upward revision from the

May estimate. The multifamily sector, which includes

apartment buildings and condos, increased 17.5% to

355,000.

National Association of Home Builders Chief Economist

Robert Dietz said single-family construction expanded

from April lows due to lower inventories of new homes

but builders face challenges as costs are rising driven up

by rising sawnwood prices.

On a regional and year-to-date basis through June,

combined single-family and multifamily starts are 2.2%

higher in the Midwest, 0.2% higher in the South, 2.9%

higher in the West and 5.4% lower in the Northeast.

Overall permits increased 2.1% to a 1.24 million unit

annualised rate in June. Single-family permits increased

11.8 percent to an 834,000 unit rate. Multifamily permits

decreased 13.4% to a 407,000 pace. On a year-to-date

basis, permits are 3.4% higher in the South, 8.8% lower in

the Northeast, 2.3% lower in the Midwest and 3.9% lower

in the West.

See:

https://www.census.gov/construction/nrc/pdf/newresconst.pdf

Existing home sales - highest monthly rise in June

Sales of existing homes jumped nearly 21% in June

compared with May according to the National Association

of Realtors. This was the largest monthly gain since data

was collected and came after sharp declines over the

previous three months due to the pandemic. However,

sales were still 11% lower on an annual basis.

Each of the four major regions achieved month-on-month

growth with the West experiencing the greatest sales

recovery. Sales rose 4.3% month to month in the Northeast

and were 11.1% higher in the Midwest. In the South, sales

surged 26% monthly, and in the West sales jumped 31.9%.

This data represents contracts signed in late April and

May, that is, before much of the national economy began

to reopen and before the most recent surge in coronavirus

cases. Home sales could have been more robust had there

simply been more homes for sale. The supply of existing

homes available fell a remarkable 18% to just 1.57 million

homes at the end of June.

Cabinet sales well below last year

According to the Kitchen Cabinet Manufacturers

Association¡¯s monthly Trend of Business Survey,

participating cabinet manufacturers reported a significant

decline in cabinet sales of close to 17% for May 2020

compared to the same month in 2019. Custom sales were

down 12%, semi-custom sales decreased 23% and stock

sales decreased 14%.

See:

https://www.kcma.org/news/press-releases/may-2020-trendof-business

Looking at the month-to-month comparisons, cabinet sales

were up 10% in May 2020 compared to April. Custom

sales increased 28%; semi-custom sales increased 7% and

stock sales increased close to 9% compared to the previous

month. This is a promising trend after the significant dip in

April.

But, year-to-date cabinet sales are down 4.3%. Custom

sales dropped 6%, semi-custom sales fell 9% and stock

sales were stable.

Survey signals optimism in manufacturing

Economic activity in the US manufacturing sector grew in

June with the overall economy notching a second month of

growth after one month of contraction according to the

latest Manufacturing ISM Report on Business.

ISM Chairperson, Timothy Fiore, said ¡°The growth cycle

has returned after three straight months of COVID-19

interruptions. Demand, consumption and inputs are

reaching parity and are positioned for a demand-driven

expansion cycle as we enter the second half of the year.¡±

Of the 18 manufacturing industries ISM surveys, 13

reported growth in June, with textiles, wood products and

furniture products reporting the most growth.

One wood products executive commented to ISM that

¡°The building industry continues to defy expectations, as

we continue to rebound stronger from the previous month.

Being an essential business across most states and a surge

in DIY projects has fueled the industry forward.

While the industry will follow the greater economy, we do

believe it will be more resilient than most due to potential

migration from larger cities and an undersupplied housing

market.¡±

See:

https://www.ismworld.org/supply-management-news-andreports/reports/ism-report-on-business/pmi/june/

Consumer confidence retreats as pace of infections

rises

Consumer sentiment retreated in the first half of July due

to the increased pace of infections. The University of

Michigan's consumer-sentiment gauge snapped its twomonth

uptrend in July, an early sign that new outbreaks

are worrying consumers and an economic recovery will be

slowed.

Following the steepest two-month decline on record it is

not surprising that consumers need some time to reassess

the likely economic impact from the coronavirus on their

personal finances and on the overall economy.

The surprise decline arrived as US lawmakers debate

another fiscal stimulus bill. Congress faces mounting

pressure to pass more relief before the end of July when

the US$600 per week federal unemployment insurance

benefit will run out.

Many economists warn the disappearance of this

enormous federal stimulus, created in March, could hinder

the economic recovery and deprive millions of Americans

of a vital financial lifeline. More than 30 million people

are collecting what many recipients say is a crucial pillar

of financial support right now.

|