4.

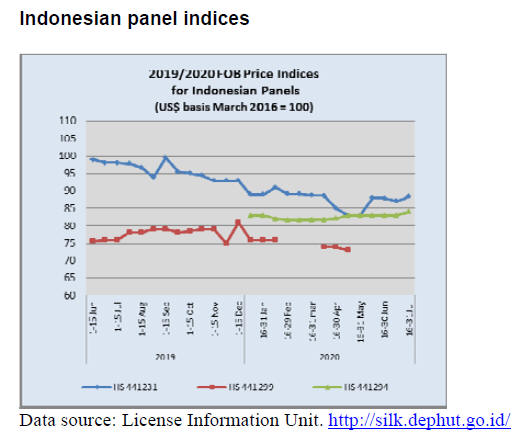

INDONESIA

Timber sector may be seeing a

recovery

Bambang Hendroyono, Secretary General in the Ministry

of Environment and Forestry, has reported that wood

product export figures for June are suggesting that the

timber sector may be at the beginning of a recovery phase

despite the impact of the global COVID-19 pandemic.

This view was supported by Indroyono Soesilo, Chairman

of the Association of Indonesian Forest Concessionaires

(APHI), who said looking at the trend there is optimism

that a year on year increase in export earnings from the

timber sector could be possible in the second half of the

year.

See:

https://foresthints.news/indonesias-forestry-exports-beginto-recover-despite-covid-19/

A boost to the overall export performance came from an

increase in exports to the US explained the Head of the

Indonesian Trade Promotion Center in Los Angeles, Bayu

Nugroho. The Ministry of Trade has reported that there

was an increase in furniture exports to the US in the first

five months of the year. When half year data becomes

available the full picture will become clear.

Furniture exports from Indonesia to the US between

January and May 2020 earned US$582 million well above

the US$385 million in the same period in 2019.

Indonesia's furniture exports to the US in 2019 were

recorded at US$1.04 billion, an increase of almost 30%

compared to the US$809 million in 2018.

See;

https://pressrelease.kontan.co.id/release/ekspor-furniturindonesia-ke-amerika-serikat-melonjak-513-di-tengah-pandemicovid-19

While overall the export performance was solid, APHI

Executive Director, Purwadi Soeprihanto, has expressed

concern that exports of Indonesian wood products to the

EU have not grown as much as anticipated. In trying to

explain this he said markets in the EU are very sensitive to

environmental considerations and product standards are

demanding.

He added that although Indonesia and the European Union

have concluded the Forest Law Enforcement, Governance

and Trade (FLEGT) Voluntary Partnership Agreement

(VPA) and Indonesia enforces its Timber Legality

Verification System (SVLK) Indonesian products have a

hard time competing with FSC labelled products. To

examine this he said that a joint audit was being conducted

between the SVLK and FSC certification schemes.

See:

https://industri.kontan.co.id/news/ini-penyebab-eksporproduk-kehutanan-indonesia-ke-uni-eropa-kurang-maksimal

https://industri.kontan.co.id/news/begini-kata-pelaku-industriproduk-kehutanan-soal-prospek-ekspor-uni-eropa

Furniture association reorientation to domestic market

The Indonesian Furniture and Crafts Industry Association

(HIMKI) is optimistic that the challenges faced by the

furniture industry will ease during the second half of the

year. Behind this view is the assumption that the Chinese

economy will improve which will lift demand for wood

products.

Looking to the future, HIMKI Secretary General, Abdul

Sobur, has indicated the second half of the year will

witness a transition period for the furniture sector.

He said the association plans to stimulate a change in the

orientation of the national furniture sector industry away

from a concentration on exports to one where the domestic

market is the main target to guard against any further

shocks to external demand.

5.

MYANMAR

Pandemic update

As of 25 July there were only 353 reported corona virus

cases in Myanmar and none required intensive care. The

testing capacity in the country has increased to around

2,000 daily. All returnees from overseas are required to

mandatory quarantine for 21 days and for a further for

seven days at home. International flights are closed until

31 August but relief flights to bring home citizens

continue.

Restrictions on business operations have undermined

company finances and resulted in many having to lay-off

workers. For mills that were able to operate, the slowdown

in orders from EU was and remains a problem and a

potential risk to the survival some companies. It appears

there is a growing sense in the domestic industry that the

timber trade in Myanmar has become overly politicalised

especially in the EU, the major market for Myanmar teak.

This has prompted the private sector to urge the

government to take action.

Orders from US importers have also fallen and this, it is

assumed, is because of the seriousness of the virus spread

in the US and the impact on manufacturing and sales.

Orders drying up

Myantrade, under the Ministry of Commerce, surveyed

226 export companies in the country. The survey found

that 19% of companies are experiencing a decline in

orders by up to 20% while 36% said they have not

received any orders from their buyers for the next three

months.

According to the survey, more than 50% of companies

saw a drop in orders with 18% reporting orders being

cancelled. More than half of the export companies

surveyed expect further declines in orders for the next

three months.

In related news, the Ministry of Labour, Immigration and

Population said that in June more than 140,000 workers

lost their jobs due to the closure of 5,658 micro, small and

medium-sized enterprises and 270 large factories as well

as shops and restaurants.

See:

https://www.irrawaddy.com/business/businessroundup/irrawaddy-business-roundup-28.html

Support for households

To alleviate the hardship faced by households the

government will provide K40,000 to each of the 5.4

million households with irregular incomes according to U

Zaw Htay, Director-General of the Ministry of State

Counsellor Office. In remote areas pilot mobile payments

will be tested. In April, the government provided essential

food to over 4 million families and then the government

provided K15,000 to each of the 1.4 million families who

did not get the food supplies from the government.

To fund the Covid-19 Economic Relief Plan the

government is working on acquiring US$1.5 billion in

loans from international organisations such as IMF, World

Bank and the Asian Development Bank.

Thousands of jobs in tourism sector at risk

During a recent National Tourism Development

Committee’s meeting, U Tin Let, Deputy Minister of the

Ministry of Hotels and Tourism, said there is a risk that a

large number of hotels and tourism related businesses will

not survive without help. If they collapse, he said, this

could result in around 75,000 directly employed workers

and thousands of indirect workers in the sector being

without an income.

Harvesting and transport

As is normal during the rain season from May to Oct only

pre-harvest work, such as the tree markings and road

maintenance, is undertaken. This year the harvesting target

is far below the Annual Allowable Cut (AAC).

For log hauling the Myanma Timber Enterprise (MTE) is

using private operators in some areas. MTE is very

carefully working to ensure private operators comply with

harvesting rules and regulations under the eyes of

environmental watchdogs which also ensures that MTE is

transparent in its contract assignment procedure. Some

critics do not understand well the difference between the

previous private sector logging sub-contracts and the

current new system of using the private service providers.

Effectiveness of dual currency log payment system

debated

The issues of the log export ban and the dual currency

system for log sales by the Myanma Timber Enterprise

(MTE) has again been discussed in the domestic press

(The Voice Journal).

Logs sold for the manufacture of export products must be

paid for in US dollars while logs to be used to produce

items for the domestic market only can be paid for in the

local currency, the Kyat.

The recent article pointed out that the two currency

payment system appears to contradict government

regulations and, this aside, allowing payments in local

currency could exaggerate the impact of fluctuations in

exchange rates.

Commenting on the suggestion for a single payment

system an exporter said the two currency system should be

maintained because logs in the so-called ‘conflict areas’

should be only for domestic use. If these logs are not

separated from other supplies then importers would face

problems satisfying the Due Diligence Requirements in

their market.

The article also urged a discussion on reconsideration of

the log export ban which was introduced in 2014 saying

the export of non-teak logs should be allowed because

local industries are not geared up to produce exportable

items from non-teak logs and the resumption of non-teak

log exports would be beneficial for the country.

Another miller/exporter commented the log export ban is

intended to support domestic industries secure log

supplies, something that was always a problem when log

exports were allowed.

6. INDIA

Pandemic update

The Indian Ministry of Health has reported that as of 25

July there are around 1.3 million corona virus cases in the

country and 456,071 active cases. Some 849,431 people

have been treated and discharged bringing the percent

recovery to around 64%.

The government has advised against large gatherings and

has asked states and local bodies to use technology to

ensure everyone is aware of how to protect themselves.

Economy improved in June

Measures adapted to slow the spread of the virus resulted

in severe disruption of industrial production and consumer

spending during April and May but the IHS Markit

Purchasing Managers' survey for India illustrates that the

economy improved in June as restrictions were eased.

Looking ahead the survey forecasts the Indian economy

could rebound in the second half of this year.

India imposed a total lockdown in March and restrictions

were gradually eased from May. There was a sharp decline

in GDP in the second quarter of this year driving a

recession in the 2020-21 financial year.

Despite the short-term shock to the economy, foreign

investment into India remained buoyant.

See:

https://www.markiteconomics.com/Public/Home/PressRelease/b8e264c35c704290af1b7ac8d4227203

and

https://economictimes.indiatimes.com/news/economy/indicators/indian-economy-set-for-post-covid-19-rebound-as-fdi-remainsbuoyant-ihsmarkit/articleshow/77127090.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Despite the overall dim prospects there is some

encouraging news. Analysts write “the monsoon has set

well and the Festival of trees is in full swing. Day by day

more people and also those in government are realising the

importance of green cover and ambitious projects have

been launched“.

After 25 years Public Works Department reverses ban

on timber in construction of buildings

The Indian Public Works Department under the Union

Housing and Urban Affairs Ministry, the government's

construction agency which undertakes major construction

projects on behalf of the Central Government as well as

the state governments, has changed its stance on the use of

timber in construction.

After 25 years the Public Works Department has reversed

the ban on use of timber in construction of buildings and

housing projects. This decision came about as the Ministry

of Environment, Forest and Climate Change pushed for

the change because this will increase demand for woodbased

products that would encourage investment and

create jobs.

The Ministry of Environment stated that as India has

committed to contributing to a carbon sink of 2.5-3 billion

MT through additional forest and tree cover by 2030,

raising the demand for forest products will give a boost to

efforts to expand forest cover.

See:

https://realty.economictimes.indiatimes.com/news/industry/cpwd-removes-ban-on-use-of-timber-in-construction-ofbuildings/76758331

Plans to expand domestic furniture production and

reduce imports

In the inaugural address at the India Global Week 2020, a

virtual conference organised in the UK with the theme of

Aatmanirbhar Bharat (translated to: self-reliant India) the

Indian Prime Minister stressed that the government’s

policy of self-reliance was key to protecting the country

from future economic shocks while remaining integrated

with the rest of the world.

As a follow-up the government has identified 20 sectors

where India can satisfy more of its domestic demand

through import substitution. One target for this approach

will be furniture.

Speaking at a Federation of Indian Chambers of

Commerce & Industry webinar the Minister of Commerce

and Industry highlighted the focus on expanding domestic

furniture production and reducing imports.

The Minsiter said the government has identified sectors

where India can not only meet its domestic needs but also

become globally competitive and become a global leader

by supplying to the world.

Reports suggest the government is considering restrictions

on imports of 371 items ranging from toys and plastic

goods to sports gear and furniture.

2020 survey – first half year housing sales plummeted

The near complete shutdown of all activity in the housing

and construction sectors as a result of the unprecedented

disruptions caused by the pandemic control measures has

had a devastating effect. The KnightFrank 2020 survey

shows that home sales plummeted in the first half of the

year.

Some companies managed to secure some business

through innovative online marketing, refundable deposits

and help for buyers seeking financing but, despite this, it

has been a disastrous period quarter for the market.

The impact of the lockdown resulted in over 80% declines

in sales and new starts in most regional markets.

Companies in Delhi, Chennai and Hyderabad reported

almost no sales in the second quarter. As restrictions are

being eased the problem has now become one of a

shortage of workers.

The Indian residential market has been sluggish for a few

years but of concern now is that affordable housing sector

is also showing signs of weakness and the share of

affordable housing in the overall market has fallen below

50% for the first time. The affordable housing segment

saw a strong expansion in 2014 and 2015 driven by the

governments promise of housing for all by 2022.

For more see:

https://content.knightfrank.com/research/2028/documents/en/india-real-estate-residential-office-h1-2020-indian-real-estateresidential-office-7302.pdf

Plantation teak

The trickle of teak imports has continued and traders

report no problems with domestic transport from the ports.

C&F rates for Indian ports from various other sources

continue within the same range as given earlier.

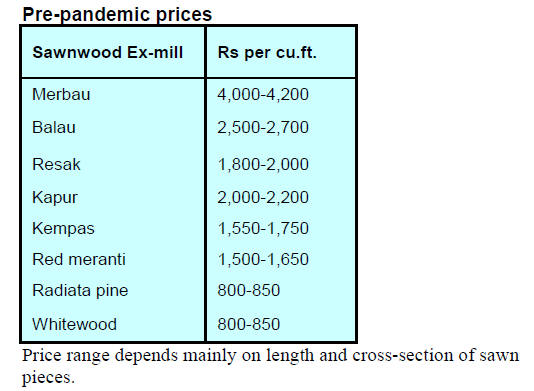

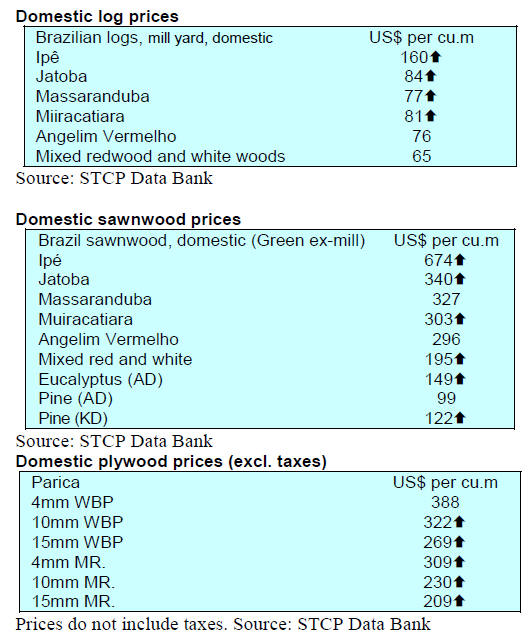

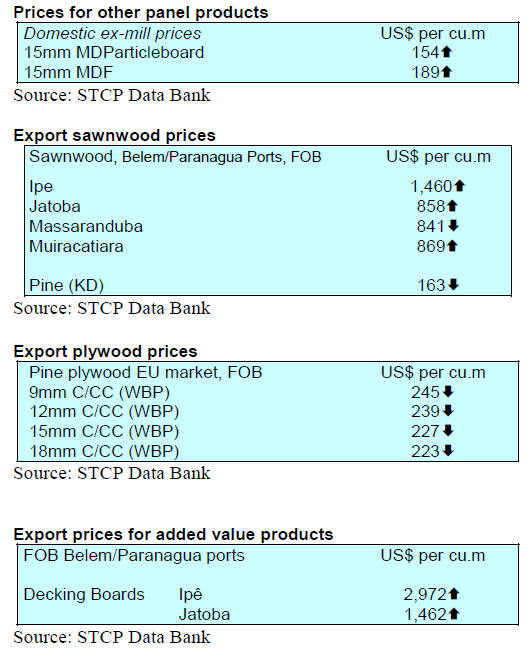

Locally sawn hardwood prices

The sawnwood markets are yet to reopen. Pre-pandemic

prices are shown below.

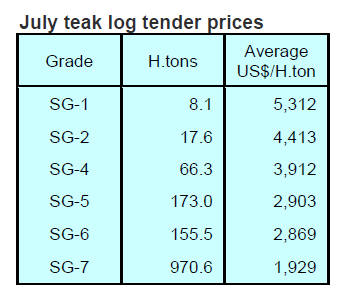

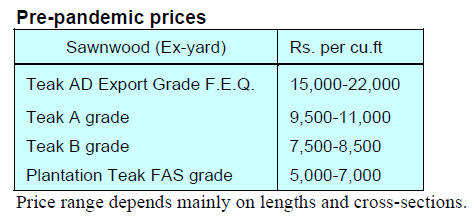

Myanmar teak prices

Teak log sales have resumed in Myanmar allowing millers

to build stocks ready for when demand in India recovers.

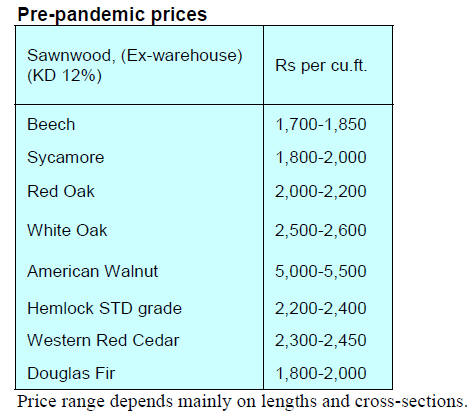

Sawn hardwood prices

Imports of timber from the US are beginning to recover

and analysts suggest there will be a growth in imports of

US hardwoods as furniture import substitution fforts take

hold. However, production at most manufacturing units is

hampered by slow demand.

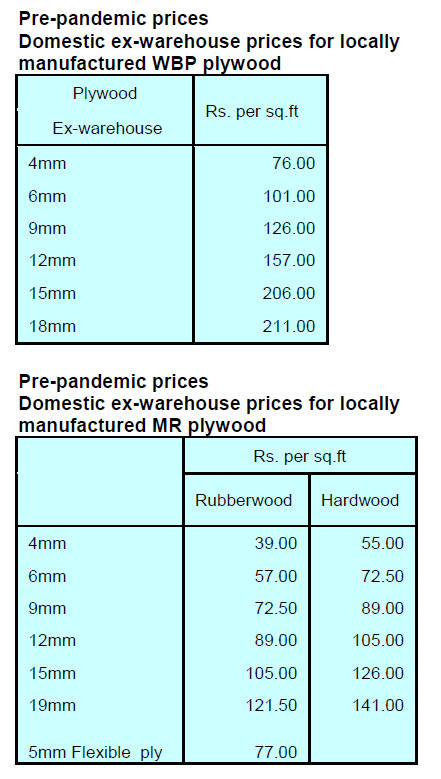

Plywood

There has been a recent focus on increasing domestic log

production and discussion have centred on how to

encourage tree planting by the States, the Central

Government, entrepreneurs and farmers. There has been

an emphasis on commercial planting of local species

which were being used but have now been depleted.

Among exotic species, eucalyptus, poplar and melia dubia

are being considered. Analysts write “if India wants to be

self-sufficient in wood products active support to increase

plantations will be necessity from the Government side.”

Although restrictions on business operations and on

domestic travel have been eased it appears many migrant

workers have not yet returned to work and this is

undermining efforts to boost industrial output.

It has been reported that in the Krishna district in Andhra

Pradesh less than 25% of workers are returning to take up

their industrial jobs which, with the weak consumer

demand has put industrial recovery at risk.

As domestic demand for plywood begins to recover the

biggest hurdle is still the availability of workers. Plywood

prices remain unchanged despite the desire of

manufacturers to lift prices.

7.

VIETNAM

Acacia plantations

at risk from fungus attack

Under the “Doi moi” (renewal policy) land tenure reform,

which provided land to farmers, along with the robust

development of wood processing in the country has been a

key driver of commercial plantation development.

Immense areas of denuded hills and barren land left after

Vietnam War have been re-greened with acacia (mostly

acacia mangium and acacia hybrid – a variety of acacia

created by cross-breeding of acacia mangium and acacia

auricuriformis).

Wood harvested from over 3 million ha. of short rotation

(4–7 years) acacia and rubberwood play a vital role in

supporting the development of wood industry sector and

improvement of farmers’ livelihood.

In recent months many plantation owners have reported

the presence of disease in the acacia plantations which, it

has been identified, is caused by a leaf fungus,

Ceratocystis manginecans.

The Vietnam Academy of Forest Science (VAFS) has

warned this fungus, if not checked, could damage all

acacia species planted in Vietnam, including acacia

mangium, acacia hybrid, acacia auricuriformis and acacia

crasicarpa. The Academy noted the damage caused to

acacia plantations in Indonesia and along with the

Vietnam Administration of Forestry (VNFOREST) is

urging local authorities to take immediate action to treat

infected acacia plantations.

VNFOREST has reported on the current outbreak

specifically mentioning the infection in Tuyen Quang,

where almost 100 ha. of plantations (2019 planting) have

withered and the infection rate is over 70%. VNFOREST

has recommended the clearing and replanting. Tuyen

Quang is not the only place experiencing infection as the

disease is scattered in many places but there are no

statistics on the extent of damage.

In long term, developing disease-tolerant varieties of

acacia and diversification of planting species rather than

acacia alone are seen as possible solutions.

Export and import update

Vietnam earned just over US$5 billion from wood product

exports in the first half of this year, up 2.4% year on year

according to the Vietnam Administration of Forestry. In

June alone export earnings topped US$900 million.

In the first half of the year Vietnam imported wood

products valued at US$1.1 billion, some 8.5% down on the

first half of 2019.

Business leaders have indicated that prospect for increased

wood product exports in the third quarter this year are not

yet certain as the effect of the pandemic on businesses in

Vietnam's key markets, the United States, the European

Union and Japan is fragile.

New investment law

On 17 June 2020 the National Assembly of Vietnam

passed the new Law on investment set to take effect 1

January 2021. This replaces Decree 118/2015/ND-CP

(Decree 118).

The New Investment Law contains notable changes that

will impact investment activities in Vietnam. Further

refinement of the regulations in the law is expected.

See:

https://www.lexology.com/library/detail.aspx?g=75ce815f-0e3f-4f5f-94f8-e719fb053ac4

8. BRAZIL

Bento Gonçalves furniture cluster

feels the pain

The Brazilian furniture sector is still feeling the negative

impact of the pandemic. According to Portal Móveis de

Valor, sector revenues in May 2020 fell in the Bento

Gonçalves, Rio Grande do Sul State furniture cluster.

Revenue for the furniture cluster in the first five months of

2020 was R$656.9 million, down 7.9% compared to the

same period last year. The recent decline comes on top of

the recent decline in cumulative earnings.

Despite the negative trend the Furniture Industry

Association of Bento Gonçalves (Sindmóveis) considers

that the May figures may be a turning point, a scenario

which can be confirmed when the June data are released.

Furniture manufacturers in Rio Grande do Sul experienced

a 14% drop in revenue between January and May this

year, compared to the same period in 2019.

The furniture sector in Brazil has been for some time

struggling to recover from the weak domestic economic

growth in 2018 and 2019. In Bento Gonçalves furniture

sales did not fall last year but stagnated in real terms.

For 2020 only January and February sales were positive

that is before the pandemic impact. Sales in March and

April were the lowest in the history of the furniture

industry.

Businesses demand sustainable agenda for Amazon

A large group of business leaders have submitted a written

statement to the Vice-Presidency and the National Council

for the Legal Amazon supporting a sustainable

development agenda and for combating deforestation in

the Amazon.

The document was signed by the CEOs of about 40

companies and business groups in the industrial,

agricultural and services sectors.

In addition four organizations: the Brazilian Business

Council for Sustainable Development (CEBDS); Brazilian

Agribusiness Association (ABAG); the Brazilian Tree

Industry (IBÁ) and the Brazilian Association of Vegetable

Oil Industries (ABIOVE) were also signatories.

In the statement the executives point out that it is desirable

that the federal government gives assurances to the

Brazilian sector that some of the actions and commitments

that are presented in the statement are adopted and

implemented. Regarding the Amazon and other Brazilian

biomes the group supports the fight against illegal

deforestation.

According to IBÁ, for the business sector that operates

within the law (in compliance with national laws), there is

no inconsistency between production and preservation and

conservation. The business sector also claims that some of

the signatory companies are already developing bioeconomy

business solutions with added-value and product

traceability.

In addition to the effective fight against illegal

deforestation the following issues are also identified as

priority areas for action:

social and economic inclusion of local

communities to ensure the preservation of forests;

minimizing environmental impacts in the use of

natural resources

seeking efficiency and productivity in the

economic activities

valuing and preserving biodiversity as an integral

part of business strategies

adoption of carbon credit trading mechanisms

shifting financing and investments to a circular

and low carbon economy

incentive packages for the economic recovery

from the effects of the Covid-19 pandemic,

conditioned to a circular and decarbonized

economy.

See:

https://iba.org/eng/business-sector-demands-action-fromthe-brazilian-government-on-the-sustainability-agenda

Export update

In June 2020, Brazilian exports of wood products (except

pulp and paper) declined 8.5% in value compared to June

2019, from US$237.0 million to US$216.9 million.

The value of June pine sawnwood exports fell 13.5%

(June 2019, US$44.4 million and June 2020, US$38.4

million). In volume terms , June exports dropped 7.5%

over the same period, from 242,800 cu.m to 224,500 cu.m.

There was a sharp drop in tropical sawnwood exports in

June, 43% in volume, from 42,300 cu.m in June 2019 to

24,200 cu.m in June 2020. In terms of value June exports

also dropped 43% year on year, from US$16.0 million to

US$.2 million.

The depressing news continued with pine plywood exports

falling 11.5% in value in June 2020 in comparison with

June 2019, from US$39.3 million to US$34.8 million.

Exports volumes dropped slightly less (8.6%) over the

same period, from 159,500 cu.m to 145,800 cu.m.

The decline in exports was more pronounced for tropical

plywood where exports volumes fell 48% and export

values fell by 45% from 7,500 cu.m (US$2.9 million) in

June 2019 to 3,900 cu.m (US$1.6 million) in June 2020.

There was a 14% decline in wooden furniture exports in

June, US$44.3 million in June 2019 to US$38.1 million in

June 2020.

Furniture from China - almost half of total imports

Furniture exports from Brazil are not doing well this year,

mostly because of the pandemic and the consequent weak

global demand. The furniture trade balance improved in

the first half of the year with a surplus of almost 10%

compared to just 4.5% in the first half of last year.

Between January and June 2020 furniture imports dropped

over 20% to US$250 million compared to US$318 million

in the first half of 2019. However, imports from China fell

just 16% and accounted for more than 45% of total

furniture imports in the first half of the year.

The largest declines were in imports from countries that

export high-end quality furniture to Brazil such as

Germany (-45%), Italy (-39%) and France (-34%).

Overall, Brazil imported furniture from 64 countries in the

first half year with the top 10 shipping over 86% of the

total.

The Brazilian state that imports most furniture is São

Paulo, representing more than 40% of the total imported.

This is followed by Santa Catarina, Goiás but none

surpassed the growth in Ceará state where, year to June,

imports jumped from US$1.9 million in 2019 to US$4.2

million this year.

9. PERU

Forest authority operates virtually

In response to the pandemic remote working has become

the norm but those responsible for field activities and

inspections have faced major challenges. OSINFOR has

shifted operations to the virtual world with the help of the

USAID FOREST programme and the US Forest Service.

One of the first tasks was to find ways to maintain the socalled

“Operations Book for Forest Enabling Titles”.

Before the pandemic control measures this administrative

process was implemented on a face to face basis but it has

now been adapted with SERFOR to a remote system.

For some years SERFOR has operated a virtual training

platform in support of its field activities and last year the a

virtual version of some training programmes were

developed. With the resumption of business activities in

the timber sector the new virtual initiatives will be

maintained for the benefit the sector.

Peru – one of the hardest hit countries

The 199th anniversary of Peru’s independence was

marked on 28 July but there was little to celebrate as the

country faces the biggest challenge in recent history. Peru

has reported about 18,500 deaths from COVID-19 and

390,000 confirmed cases making it one of Latin America’s

hardest-hit nations just behind Brazil and Mexico and the

seventh highest globally.

The pandemic exposed weaknesses in Peru's healthcare

system which has prompted the President to announce

sweeping reforms. He also said the pandemic had exposed

serious underinvestment in healthcare.

There has been progressive improvement in economic

output since mid-May and the pace of decline in GDP has

slowed. The decline in GDP in April was -40% but May

data came in at -33%.

Everyone now hopes the worst economic impact has

ended. The slower pace of decline could be explained by

the start of Phase 1 of the Economic Reactivation Plan in

May when work restarted in the mining, construction and

commercial sectors.

Exports can revive the economy says ADEX

The president of ADEX, the exporters association, has

stressed the importance of exports in reviving the

economy saying, “although the external market is still

lagging, exports offer many opportunities if the right

strategies are designed”. He called for a streamlining of

investment processes and implementation of sectoral

economic support funds since each economic sector has its

own characteristics.

He concluded “Just as there is a government-togovernment

programme with the objective of overcoming

the obstacles of bureaucracy and corruption, we should

also seek new paths of action through a government-tocompany

programme to add public resources with the

executive capacity of companies.

See:

https://gestion.pe/economia/pacto-peru-anunciado-por-elpresidente-vizcarra-debe-convocar-a-todos-los-actores-del-paissenala-adex-nndc-noticia/

In related news, ADEX has said in March, April and May,

when pandemic isolation measures were in effect, 2,282

Peruvian companies stopped exporting. In the timber

sector those most affected were micro-enterprises as well

as 255 small companies, 8 medium-sized companies and

48 large companies. The micro and small sized enterprises

are in urgent need of assistance, said the president of

ADEX.