|

Report from

North America

Economic activity flat lining

Given the reporting lag for most traditional economic

indicators, investors have turned to real-time data to assess

the US economy during the COVID-19 pandemic.

Economists at Jefferies write in a note to clients that their

in-house economic activity index has ¡®flat-lined¡¯.

Many of the Southern states are experiencing a significant

surge in coronavirus with coronavirus deaths rising in

Florida, Texas, and Arizona, even as they continue to

trend down nationally.

Regional data show particular economic weakness in

virus-hit states, where V-shaped recoveries are changing

to a W trend.

See:

https://www.axios.com/coronavirus-surge-economicrecovery-stalls-ea0303a4-81d0-47ed-94e3-def1d3884ec9.html

Falling timber supply affecting construction sector

A shortage of sawnwood is affecting the construction

industry in what is usually its busiest time of the year. All

contractors are experiencing the supply crunch which

began with the onset of COVID-19.

The pandemic caused a big decline in supply as well as a

surprising increase in demand spurred by homeowner

renovations. Slower harvesting and production cuts have

also played a role.

Many of North America¡¯s biggest sawnwood producers

have significantly lowered output during the pandemic

while laying off hundreds of employees.

US importers request flexibility on formaldehyde

audits

In a 29 June letter, Cindy Squires, Executive Director of

the International Wood Products Association, wrote to US

Environmental Protection Agency Administrator Andrew

Wheeler requesting regulatory relief for Third-Party

Certifiers under the TSCA Title VI Composite Wood

Program concerning the requirement for on-site

inspections during the COVID-19 pandemic.

This request comes after the California Air Resources

Board provided guidance on procedures to allow

flexibility for TPCs to continue their oversight on

established and approved composite wood panel producers

when on-site inspections may be impossible due to global

travel restrictions.

Squires urged EPA take quick action to provide much

needed regulatory relief to allow TPCs under the TSCA

Title VI Composite Wood Program to conduct remote

¡°on-site¡± inspections of panel producers during the

ongoing COVID-19 pandemic.

See:

https://cdn.ymaws.com/www.iwpawood.org/resource/resmgr/enews/IWPA_letter_COVID_Relief_for.pdf

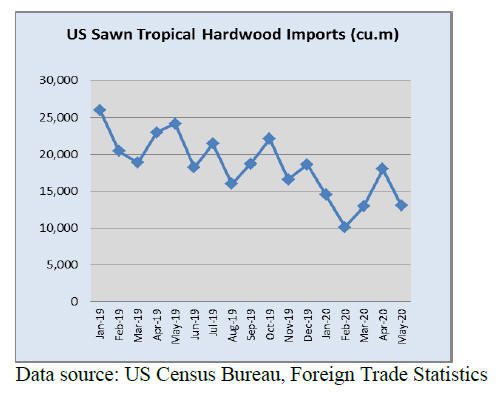

Tropical sawnwood imports sharply down

After a promising April, US imports of sawn tropical

hardwood fell by 39% in May, back to the level seen in

March. At 39,020 cubic metres, the volume of tropical

sawn hardwood imports were down more than 45% from

the previous May. Year-to-date 2020 imports are down

39%.

Imports from Indonesia were down by 55% in May but

remain a 26% head year-to-date. Imports from Brazil fell

by 21% and imports from Cameroon were off 35%.

Imports from Ecuador bounced back somewhat in May,

rising 49%, but still trail 2019 year to date by 73%

Imports of jatoba, sapelli, virola and ip¨¦ all fell sharply in

May. Virola is outpacing last year by 7% while imports of

jatoba are down 29%, sapelli is down 18%, and iIp¨¦ is

down 30%. Balsa is down a full 73% year-to-date, despite

gaining by 56% in May.

Canadian imports of tropical hardwood rose 78% in May

but were still nearly 10% lower than that of May 2019.

Imports are down 6% year-to-date.

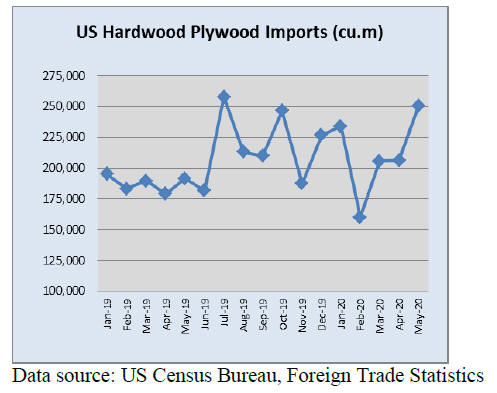

Hardwood plywood imports make gains

US imports of hardwood plywood grew by 21% in May.

Imports from Malaysia quadrupled compared to April to

record, the highest volume since May of 2010.

Imports from Indonesia were also up sharply and are

ahead year-to-date by 47%. Imports from Russia and

Vietnam grew slightly in May and are ahead by 32% and

43%, respectively, year-to-date. Total US hardwood

plywood imports are up 13% through May.

Veneer imports drop 44%

Imports of tropical hardwood veneer were down sharply in

May, falling 44%. After a promising gain in April, US

imports now lag behind 2019 year-to-date totals by 33%.

Imports from Italy, China, Ghana and Cote d¡¯Ivoire were

all down in April and are all off by more than 40% yearto-

date.

Despite falling to its slowest trade month in two years,

imports from India are down only 7% year-to-date. The

only trade partner doing better this year than last is

Cameroon, which is ahead by 128% year-to-date.

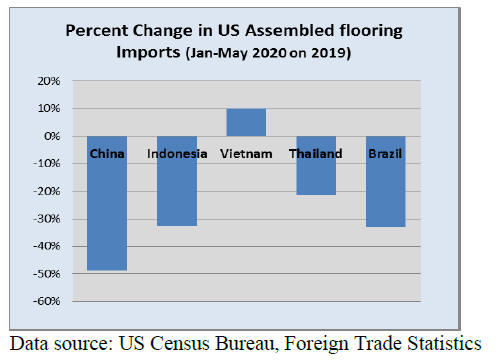

Assembled flooring imports up in May

US imports of hardwood flooring continued to slide,

falling by 3% in May. While totals were relatively flat for

the month, imports from China and Malaysia gained back

some of the market they had lost to Indonesia in recent

months.

Imports from China and Malaysia were up 51% and 90%

in May, while imports from Indonesia were down by 72%.

Still, year-to-date imports from China are down 58% and

imports from Malaysia trail by 67%, while imports from

Indonesia are up by 13% through May.

Imports of assembled flooring panels grew by 20% in May

but were still at a level nearly 30% down from May 2019.

While imports from China, Canada, and Vietnam all rose

sharply, their standing versus last year varies widely.

Imports from China are barely half that of 2019 year-todate,

imports from Canada are even with last year, and

imports from Vietnam are up 10% through May.

Moulding imports from China back to pre-crisis levels

US imports of hardwood moulding held steady in May,

falling a mere 2% from the previous month. But, much

like flooring, the sources of trade varied much more.

Imports from China rose 52%, the highest level since

September last year and slightly above May 2019.

China¡¯s gain was offset by sharp declines in imports from

Malaysia (down 80%) and Brazil (down 43%). Total

moulding imports are down 16% through May and are

down this year for all major trading partners.

Residential furniture orders continue steep decline

Residential new furniture orders in April 2020 were down

61% from April 2019 and down 52% from March,

according to the latest Smith Leonard Furniture Insights

survey of US manufacturers and distributors. As the

pandemic hit March orders were down 29% from March

2019.

The April results brought the year to date orders to a

decline of 21% after an 8% decline reported through

March.Shipments were down 50% from April 2019 and

March 2020. The April results pulled year to date

shipments down to a 15% decline.

Since shipments were not off as much as orders, it meant

that there was some shipping from stock so April stocks

dropped 8% from March. Smith Leonard officials expect

a significant decline again in the May results but not as

severe as in April.

|